Deck 30: Other Significant Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 30: Other Significant Liabilities

1

Marin Company sells 9,000 units of its product in 2018 for $500 each. The selling price includes a one-year warranty on parts. It is expected that 3% of the units will be defective and that repair costs will average $50 per unit. In the year of sale, warranty contracts are honored on 180 units for a total cost of $9,000.

What amount should Marin Company report as Warranty Expense in its 2018 income statement?

A) $4,500.

B) $9,000.

C) $13,500.

D) $67,500.

What amount should Marin Company report as Warranty Expense in its 2018 income statement?

A) $4,500.

B) $9,000.

C) $13,500.

D) $67,500.

C

2

The accounting for warranty cost is based on the expense recognition principle, which requires that the estimated cost of honoring warranty contracts should be recognized as an expense

A) when the product is brought in for repairs.

B) in the period in which the product was sold.

C) at the end of the warranty period.

D) only if the repairs are expected to be made within one year.

A) when the product is brought in for repairs.

B) in the period in which the product was sold.

C) at the end of the warranty period.

D) only if the repairs are expected to be made within one year.

B

3

A contingent liability is a liability that may occur if some future event takes place.

True

4

When vacation benefits are paid, Vacation Benefits Expense is debited.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

Disclosure of a contingent liability is usually made

A) parenthetically, in the body of the balance sheet.

B) parenthetically, in the body of the income statement.

C) in a note to the financial statements.

D) in the management discussion section of the financial statements.

A) parenthetically, in the body of the balance sheet.

B) parenthetically, in the body of the income statement.

C) in a note to the financial statements.

D) in the management discussion section of the financial statements.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

The accounting for warranty costs is based on the

A) going concern principle.

B) expense recognition principle.

C) conservatism principle.

D) full disclosure principle.

A) going concern principle.

B) expense recognition principle.

C) conservatism principle.

D) full disclosure principle.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Warranty expenses are reported on the income statement as

A) administrative expenses.

B) part of cost of goods sold.

C) contra-revenues.

D) selling expenses.

A) administrative expenses.

B) part of cost of goods sold.

C) contra-revenues.

D) selling expenses.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

If a liability is dependent on a future event, it is called a

A) potential liability.

B) hypothetical liability.

C) probabilistic liability.

D) contingent liability.

A) potential liability.

B) hypothetical liability.

C) probabilistic liability.

D) contingent liability.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Repair costs incurred in honoring warranty contracts should be debited to Warranty Liability.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following items would not be identified if a contingent liability were disclosed in a financial statement note?

A) The nature of the item

B) The expected outcome of the future event

C) A numerical probability of the expected loss

D) The amount of the contingency, if known

A) The nature of the item

B) The expected outcome of the future event

C) A numerical probability of the expected loss

D) The amount of the contingency, if known

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

Marin Company sells 9,000 units of its product in 2018 for $500 each. The selling price includes a one-year warranty on parts. It is expected that 3% of the units will be defective and that repair costs will average $50 per unit. In the year of sale, warranty contracts are honored on 180 units for a total cost of $9,000.

What amount will be reported on Marin Company's balance sheet as Warranty Liability on December 31, 2018?

A) $9,000.

B) $13,500.

C) $4,500.

D) Cannot be determined.

What amount will be reported on Marin Company's balance sheet as Warranty Liability on December 31, 2018?

A) $9,000.

B) $13,500.

C) $4,500.

D) Cannot be determined.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

The renting of an apartment is an example of a finance lease.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

A capital lease requires the lessee to record the lease as a purchase of an asset.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

An operating lease transfers substantial control of the asset to the lessee.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Postretirement benefits are accounted for on a cash basis.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

Contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will actually occur.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

In a defined contribution plan, an employer only recognizes pension expense for the amount that the employer is required to contribute under the plan.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

In concept, the estimating of Warranty Expense when products are sold under warranty is similar to the estimating of Bad Debts Expense based on credit sales.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

If a contingent liability is reasonably estimable and it is reasonably possible that the contingency will occur, the contingent liability

A) should be recorded in the accounts.

B) should be disclosed in the notes accompanying the financial statements.

C) should not be recorded or disclosed in the notes until the contingency actually happens.

D) must be paid for the amount estimated.

A) should be recorded in the accounts.

B) should be disclosed in the notes accompanying the financial statements.

C) should not be recorded or disclosed in the notes until the contingency actually happens.

D) must be paid for the amount estimated.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

A contingency that is remote

A) should be disclosed in the financial statements.

B) must be accrued as a loss.

C) does not need to be disclosed.

D) is recorded as a contingent liability.

A) should be disclosed in the financial statements.

B) must be accrued as a loss.

C) does not need to be disclosed.

D) is recorded as a contingent liability.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

An employer's estimated cost for postretirement benefits for its employees should be

A) recognized as an expense when paid.

B) recognized as an expense during the employees' work years.

C) recognized as an expense during the employees' retirement years.

D) charged to the goodwill account because providing employees with benefits generates employee goodwill.

A) recognized as an expense when paid.

B) recognized as an expense during the employees' work years.

C) recognized as an expense during the employees' retirement years.

D) charged to the goodwill account because providing employees with benefits generates employee goodwill.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

If the present value of future lease payments equals or exceeds 90% of the fair value of the leased property, the

A) conditions are met for the lease to be considered a finance lease.

B) lease is uneconomical and should not be entered into.

C) lease may be classified as an operating lease.

D) recording of a lease liability is optional-that is, the off-balance sheet approach can be elected.

A) conditions are met for the lease to be considered a finance lease.

B) lease is uneconomical and should not be entered into.

C) lease may be classified as an operating lease.

D) recording of a lease liability is optional-that is, the off-balance sheet approach can be elected.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

A lease may be classified as an ______________ lease or as a ____________ lease.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

Match the items below by entering the appropriate code letter in the space provided.

A. Finance lease

B. Contingent liability

C. Operating lease

D. Defined-benefit plan

E. Defined-contribution plan

____ 1. A contractual arrangement that gives the lessee temporary use of property.

____ 2. The cash paid by the employer to the pension plan is defined.

____ 3. A contractual arrangement which is in effect a purchase of property.

____ 4. A pension plan where employee receipts after retirement are defined.

____ 5. A potential liability that may become an actual liability in the future.

A. Finance lease

B. Contingent liability

C. Operating lease

D. Defined-benefit plan

E. Defined-contribution plan

____ 1. A contractual arrangement that gives the lessee temporary use of property.

____ 2. The cash paid by the employer to the pension plan is defined.

____ 3. A contractual arrangement which is in effect a purchase of property.

____ 4. A pension plan where employee receipts after retirement are defined.

____ 5. A potential liability that may become an actual liability in the future.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

In a lease contract,

A) the owner of the property is called the lessee.

B) the presence of a bargain purchase option indicates that it is a finance lease.

C) the renter of the property is called the lessor.

D) there is always a transfer of ownership at the end of the lease term.

A) the owner of the property is called the lessee.

B) the presence of a bargain purchase option indicates that it is a finance lease.

C) the renter of the property is called the lessor.

D) there is always a transfer of ownership at the end of the lease term.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements concerning leases is true?

A) Finance leases are favored by lessees.

B) The appearance of the account, Right-of-Use Asset, on the balance sheet, signifies an operating lease.

C) The portion of a lease liability expected to be paid in the next year is reported as a current liability.

D) Present value is irrelevant in accounting for leases.

A) Finance leases are favored by lessees.

B) The appearance of the account, Right-of-Use Asset, on the balance sheet, signifies an operating lease.

C) The portion of a lease liability expected to be paid in the next year is reported as a current liability.

D) Present value is irrelevant in accounting for leases.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a condition which would require the recording of a lease contract as a finance lease?

A) The lease transfers ownership of the property to the lessee.

B) The lease contains a bargain purchase option.

C) The lease term is less than 75% of the economic life of the leased property.

D) The present value of the lease payments equals or exceeds 90% of the fair value of the leased property.

A) The lease transfers ownership of the property to the lessee.

B) The lease contains a bargain purchase option.

C) The lease term is less than 75% of the economic life of the leased property.

D) The present value of the lease payments equals or exceeds 90% of the fair value of the leased property.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

The paid absence that is most commonly accrued is

A) voting leave.

B) vacation time.

C) maternity leave.

D) disability leave.

A) voting leave.

B) vacation time.

C) maternity leave.

D) disability leave.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

Roberts Company is preparing monthly adjusting entries at December 31. An analysis reveals the following:

1. During December, Roberts Company sold 3,000 units of a product that carries a 60-day warranty. The sales for this product totaled $100,000. The company expects 4% of the units to need repair under the warranty and it estimates that the average repair cost per unit will be $20.

2. The company has been sued by a disgruntled employee. Legal counsel believes that it is reasonably possible that the company will have to pay $200,000 in damages.

3. The company has been named as one of several defendants in a $400,000 damage suit. Legal counsel believes it is unlikely that the company will have to pay any damages.

4. Employees earn vacation pay at a rate of 1 day per month. During December, ten employees qualify for vacation pay. Their average daily wage is $80 per employee.

Instructions

Prepare adjusting entries, if required, for each of the four items.

1. During December, Roberts Company sold 3,000 units of a product that carries a 60-day warranty. The sales for this product totaled $100,000. The company expects 4% of the units to need repair under the warranty and it estimates that the average repair cost per unit will be $20.

2. The company has been sued by a disgruntled employee. Legal counsel believes that it is reasonably possible that the company will have to pay $200,000 in damages.

3. The company has been named as one of several defendants in a $400,000 damage suit. Legal counsel believes it is unlikely that the company will have to pay any damages.

4. Employees earn vacation pay at a rate of 1 day per month. During December, ten employees qualify for vacation pay. Their average daily wage is $80 per employee.

Instructions

Prepare adjusting entries, if required, for each of the four items.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

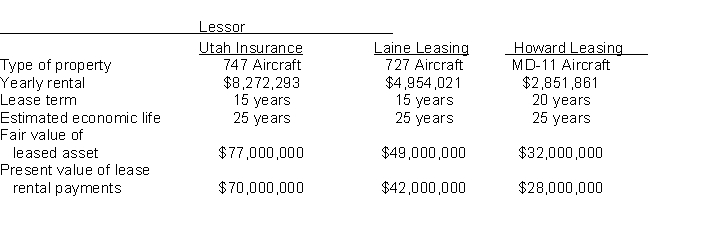

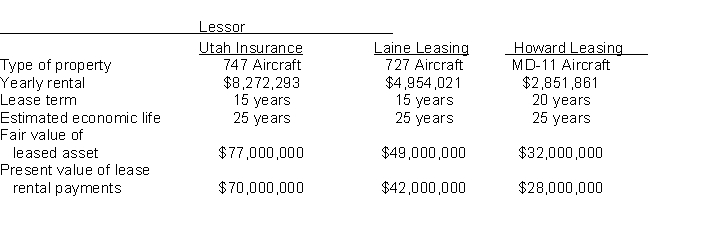

Presented below are three different aircraft lease transactions that occurred for Western Airways in 2017. All the leases start on January 1, 2017. In no case does Western receive title to the aircraft during or at the end of the lease period; nor is there a bargain purchase option.

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2017?

(c) How should the lease transaction with Laine Leasing be recorded in 2017?

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2017?

(c) How should the lease transaction with Laine Leasing be recorded in 2017?

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Sandra Sikes sells exercise machines for home use. The machines carry a 2-year warranty. Past experience indicates that 5% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is $40 for labor and $50 for parts per unit. During 2018, 3,000 exercise machines were sold at an average price of $800. During the year, 95 of the machines that were sold were repaired at the average price per unit.

Instructions

(a) Prepare the journal entry to record the repairs made under warranty.

(b) Prepare the journal entry to record the estimated warranty expense for the year.

Instructions

(a) Prepare the journal entry to record the repairs made under warranty.

(b) Prepare the journal entry to record the estimated warranty expense for the year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Larson Company has twenty employees who each earn $120 per day. If they accumulate vacation time at the rate of 1.5 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is

A) $240.

B) $2,400.

C) $3,600.

D) $360.

A) $240.

B) $2,400.

C) $3,600.

D) $360.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Postretirement benefits consist of payments by employers to retired employees for

A) health care and life insurance only.

B) health care and pensions only.

C) life insurance and pensions only.

D) health care, life insurance, and pensions.

A) health care and life insurance only.

B) health care and pensions only.

C) life insurance and pensions only.

D) health care, life insurance, and pensions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

A lease where the intent is temporary use of the property by the lessee with continued ownership of the property by the lessor is called

A) off-balance sheet financing.

B) an operating lease.

C) a finance lease.

D) a purchase of property.

A) off-balance sheet financing.

B) an operating lease.

C) a finance lease.

D) a purchase of property.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

A contingent liability should be recorded in the accounts if it is ________________ that the contingency will occur and the amount is ________________.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

Sam Myers sells televisions with a 2-year warranty. Past experience indicates that 2% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is estimated to be $75 per unit. During 2018, 9,000 units were sold at an average price of $400. During the year, repairs were made on 50 units at a cost of $3,900.

Instructions

Prepare journal entries to record the repairs made under warranty and estimated warranty expense for the year.

Instructions

Prepare journal entries to record the repairs made under warranty and estimated warranty expense for the year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

In a finance lease, the amount capitalized is the

A) sum of the lease payments over the life of the lease.

B) fair value of the leased asset on the date the lease is signed.

C) present value of the future lease payments.

D) future value of the asset as of the lease termination date.

A) sum of the lease payments over the life of the lease.

B) fair value of the leased asset on the date the lease is signed.

C) present value of the future lease payments.

D) future value of the asset as of the lease termination date.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

Hutton Cape Company, which prepares annual financial statements, is preparing adjusting entries on December 31. Analysis indicates the following:

1. The company is the defendant in an employee discrimination lawsuit involving $50,000 of damages. Legal counsel believes it is unlikely that the company will have to pay any damages.

2. Employees are entitled to one day's vacation for each month worked. The company employs 50 people who earn $120 per day and 30 who earn $160 per day. All employees worked the entire year.

3. The company is a defendant in a $500,000 product liability lawsuit. Legal counsel believes that the company probably will have to pay the amount requested.

4. The company has a defined benefit pension plan in which total pension expense for December is $50,000. The company funds one half of the expense and records a liability or the balance due.

Instructions

Prepare any adjusting entries necessary at the end of the year.

1. The company is the defendant in an employee discrimination lawsuit involving $50,000 of damages. Legal counsel believes it is unlikely that the company will have to pay any damages.

2. Employees are entitled to one day's vacation for each month worked. The company employs 50 people who earn $120 per day and 30 who earn $160 per day. All employees worked the entire year.

3. The company is a defendant in a $500,000 product liability lawsuit. Legal counsel believes that the company probably will have to pay the amount requested.

4. The company has a defined benefit pension plan in which total pension expense for December is $50,000. The company funds one half of the expense and records a liability or the balance due.

Instructions

Prepare any adjusting entries necessary at the end of the year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

40

Match between columns

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck