Deck 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/137

Play

Full screen (f)

Deck 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module

1

Revenue can be recognized either when it is earned, collection has occurred, or collection is reasonably certain to occur.

False

2

The SEC scrutinizes reported earnings numbers to assess the quality of earnings and to detect any potential for earnings management.

True

3

If a company does not have any discontinued operations to list on its income statement, the labels should still be there with a zero balance noted.

False

4

A segment must pass all of the tests in order for it to be considered a reportable segment. These tests include the revenue, profit, and asset tests.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

5

There is no prescribed income statement format under IFRS whereas U.S. GAAP requires the use of the single- step or the multiple-step format.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

6

Under U.S. GAAP or IFRS, a company can either report its comprehensive income or loss under present net income and comprehensive income in a single continuous performance statement or report it in a separate but consecutive financial statement.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

7

U.S. GAAP and IFRS companies commonly measure and report net income and comprehensive income.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

8

The most common way in which to prepare the statement of cash flows is the indirect method, which is encouraged by FASB.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

9

Systematic and rational allocation is used to recognize revenue.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

10

The information contained in the statement of cash flows allows external users to assess a company's risk, liquidity, financial flexibility, and operating capability.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

11

Gains or losses associated with derivative financial instruments would be included in income from continuing operations.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

12

A company does not have to disclose information about the sale of a discontinued component in the notes to its financial statements until the actual sale has occurred.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

13

When a company classifies a component as held for sale, it must report the component on its balance sheet at the lower of its book value or its fair value minus costs to sell.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

14

When a parent company owns a majority of the common shares of a subsidiary company but not 100% of them, the parent company will consolidate all of the subsidiary's revenues and expenses into its financial statements.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

15

To compute earnings per share the denominator is net income attributable to common shareholders less any preferred stock dividends for the period.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

16

The amount of money that can be distributed to shareholders as a return of capital, without being a return on capital, is the capital financial concept.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

17

Interperiod tax allocation involves apportioning a corporation's total income tax expense for a period to the various components of its net income and other comprehensive income items.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

18

Together with the cash flow statement, the income statement enables the investors to determine the rate of return the company is generating relative to the amount of capital invested.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

19

Any disposal of a large number of long-lived assets can appropriately be reported in the income statement as results from discontinued operations.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

20

Companies with lower coverage ratios have a greater risk and a lower financial flexibility.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

21

On December 31, 2015, the net assets of Martinez Manufacturing amounted to $40,000. Net income calculated by using the financial capital maintenance concept amounted to $12,000. During the year, additional common stock was issued for $8,000, and $5,000 of dividends was paid. The net assets at January 1, 2015, amounted to

A) $31,000.

B) $37,000.

C) $20,000.

D) $25,000.

A) $31,000.

B) $37,000.

C) $20,000.

D) $25,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

22

Who is the income statement designed to inform?

A) creditors

B) investors

C) lenders

D) The income statement is designed to inform all of these users.

A) creditors

B) investors

C) lenders

D) The income statement is designed to inform all of these users.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

23

In distinguishing between revenues and gains, which of the following statements is false?

A) More gains than revenues are beyond the entity's control.

B) Gains are associated more with peripheral, nonoperating activities than are revenues.

C) GAAP does not provide precise distinctions between revenues and gains.

D) Revenues are reported net rather than gross) more often than gains.

A) More gains than revenues are beyond the entity's control.

B) Gains are associated more with peripheral, nonoperating activities than are revenues.

C) GAAP does not provide precise distinctions between revenues and gains.

D) Revenues are reported net rather than gross) more often than gains.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following expenses is an example of expense recognition under the immediate recognition principle?

A) sales commissions

B) depreciation

C) management salaries

D) transportation-out

A) sales commissions

B) depreciation

C) management salaries

D) transportation-out

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

25

The income statement is an important financial statement for all of the following reasons, except

A) the income statement helps shareholders evaluate management's operating effectiveness.

B) past income statements can be useful indicators in predicting current and future cash dividend payments as well as future stock prices.

C) the income statement provides useful information concerning the corporation's ability to generate sufficient cash flows from operations for use in payment of its operating obligations.

D) the income statement reports the amount of net cash inflows resulting from operating, financing, and investing activities to users.

A) the income statement helps shareholders evaluate management's operating effectiveness.

B) past income statements can be useful indicators in predicting current and future cash dividend payments as well as future stock prices.

C) the income statement provides useful information concerning the corporation's ability to generate sufficient cash flows from operations for use in payment of its operating obligations.

D) the income statement reports the amount of net cash inflows resulting from operating, financing, and investing activities to users.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

26

In general, revenue is recognized

A) during the production process.

B) upon completion of the production process.

C) when cash is received.

D) when goods are sold or services are rendered.

A) during the production process.

B) upon completion of the production process.

C) when cash is received.

D) when goods are sold or services are rendered.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

27

Operating capability refers to

A) the ability of a company to adapt to unexpected needs and opportunities.

B) the uncertainty or unpredictability of the future results of a company.

C) a measure of overall company performance.

D) a company's ability to maintain a given level of operations.

A) the ability of a company to adapt to unexpected needs and opportunities.

B) the uncertainty or unpredictability of the future results of a company.

C) a measure of overall company performance.

D) a company's ability to maintain a given level of operations.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

28

Revenue is recognized when:

A) it has been earned and is realized or realizable

B) a company has satisfied its performance obligation to the customer

C) a seller collects cash from a customer

D) a company bills the customer for the goods that have been delivered or the services performed.

A) it has been earned and is realized or realizable

B) a company has satisfied its performance obligation to the customer

C) a seller collects cash from a customer

D) a company bills the customer for the goods that have been delivered or the services performed.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

29

Examples of matching expenses against revenues using the association of cause and effect include all of the following except

A) insurance costs.

B) transportation costs for delivery of goods to customers.

C) costs of products sold.

D) sales commissions.

A) insurance costs.

B) transportation costs for delivery of goods to customers.

C) costs of products sold.

D) sales commissions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

30

The income statement reports

A) revenues and expenses for a given point in time.

B) revenues and expenses for a specific date.

C) revenues, expenses, gains and losses for a specified period of time.

D) revenues, expenses, gains and losses for a specific date.

A) revenues and expenses for a given point in time.

B) revenues and expenses for a specific date.

C) revenues, expenses, gains and losses for a specified period of time.

D) revenues, expenses, gains and losses for a specific date.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is helpful to report separately?

A) expenses that vary with volume of activity

B) expenses that are discretionary

C) expenses that depend on other economic factors

D) All of these answer choice present elements that are helpful to report separately.

A) expenses that vary with volume of activity

B) expenses that are discretionary

C) expenses that depend on other economic factors

D) All of these answer choice present elements that are helpful to report separately.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

32

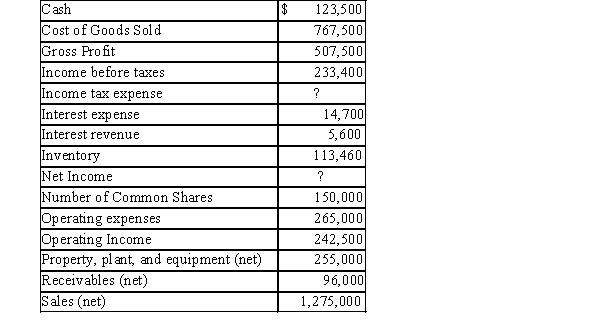

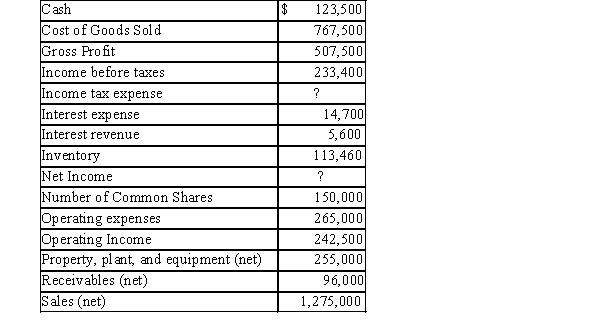

Below is a list of account balances for Fraggle Company:  What is Fraggle Company's net income, assuming a 30% tax rate?

What is Fraggle Company's net income, assuming a 30% tax rate?

A) $163,380

B) $233,400

C) $242,500

D) None of these answer choices is correct.

What is Fraggle Company's net income, assuming a 30% tax rate?

What is Fraggle Company's net income, assuming a 30% tax rate?A) $163,380

B) $233,400

C) $242,500

D) None of these answer choices is correct.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

33

The major components of the income statement are listed below: A = revenues

B = income from continuing operations C = earnings per share

D = results from discontinued operations E = operating income

In what sequence do they normally appear on the income statement?

A) B-A-E-D-C

B) E-B-A-C-D

C) A-E-B-D-C

D) B-D-C-D-E

B = income from continuing operations C = earnings per share

D = results from discontinued operations E = operating income

In what sequence do they normally appear on the income statement?

A) B-A-E-D-C

B) E-B-A-C-D

C) A-E-B-D-C

D) B-D-C-D-E

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

34

Depreciation is an example of which expense recognition principle?

A) association of cause and effect

B) systematic and rational allocation

C) cost recovery

D) immediate recognition

A) association of cause and effect

B) systematic and rational allocation

C) cost recovery

D) immediate recognition

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not a purpose of the income statement?

A) used to evaluate management's performance

B) predicts the company's future assets and liabilities

C) used to compare performance against other companies

D) assesses the company's risk

A) used to evaluate management's performance

B) predicts the company's future assets and liabilities

C) used to compare performance against other companies

D) assesses the company's risk

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not recognized by the FASB as an expense recognition principle that properly matches expenses against revenues?

A) immediate recognition

B) systematic and rational allocation

C) cash payment

D) association of cause and effect

A) immediate recognition

B) systematic and rational allocation

C) cash payment

D) association of cause and effect

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

37

The income statement helps users

A) assess the company's risk.

B) review the impact of economic factors affecting the company.

C) compare and contrast performance against a competitor.

D) All of these answer choices are ways in which the income statement helps users.

A) assess the company's risk.

B) review the impact of economic factors affecting the company.

C) compare and contrast performance against a competitor.

D) All of these answer choices are ways in which the income statement helps users.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

38

In accrual accounting, net income is defined as

A) Revenues − Expenses + Gains + Losses

B) Revenues − Expenses

C) Revenues − Expenses + Gains − Losses

D) increase in net assets from nonowner transactions

A) Revenues − Expenses + Gains + Losses

B) Revenues − Expenses

C) Revenues − Expenses + Gains − Losses

D) increase in net assets from nonowner transactions

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

39

A company is not required to follow a specific format in making the disclosures for its segments but the FASB encourages the most useful format for its specific circumstances.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

40

Georgio Company began 2015 with net assets of $80,000. Net income calculated by using the capital maintenance concept was $21,000. During 2015, owners contributed $26,000 of new capital. By year-end, the net assets totaled $78,000. Dividends to the owners during 2015 were

A) $49,000.

B) $28,000.

C) $23,000.

D) $2,000.

A) $49,000.

B) $28,000.

C) $23,000.

D) $2,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

41

When an entity reports on a sale of a component of the business

A) any income or loss from operations of the component should be reported in the income from continuing operations section, but any gain or loss on the sale of the component should be presented below the income from continuing operations section.

B) current operating income or loss of the component and any gain or loss on sale of the component should be presented in a separate section of the income statement.

C) any gain or loss on the sale should always be presented as a component of other comprehensive income.

D) all information related to the sold component should be reported solely in the footnotes accompanying the financial statements.

A) any income or loss from operations of the component should be reported in the income from continuing operations section, but any gain or loss on the sale of the component should be presented below the income from continuing operations section.

B) current operating income or loss of the component and any gain or loss on sale of the component should be presented in a separate section of the income statement.

C) any gain or loss on the sale should always be presented as a component of other comprehensive income.

D) all information related to the sold component should be reported solely in the footnotes accompanying the financial statements.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

42

In 2014, Dallas Company had sales of $600,000; cost of sales of $430,000; interest expense of $12,000; and a gain on the sale of a component of $52,000; For its income statement, Dallas uses the single-step format and the all- inclusive concept. What was Dallas's reported pretax income from continuing operations?

A) $150,000

B) $170,000

C) $158,000

D) $118,000

A) $150,000

B) $170,000

C) $158,000

D) $118,000

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not used as a caption if there is nothing to report?

A) income from continuing operations

B) results from discontinued operations

C) interest expense

D) income taxes

A) income from continuing operations

B) results from discontinued operations

C) interest expense

D) income taxes

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not a component of the income statement?

A) unusual gains and losses

B) net income

C) income taxes

D) accumulated other comprehensive income

A) unusual gains and losses

B) net income

C) income taxes

D) accumulated other comprehensive income

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following are components of the income statement?

A) revenues

B) results from discontinued operations

C) income from continuing operations

D) all of these

A) revenues

B) results from discontinued operations

C) income from continuing operations

D) all of these

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

46

Intraperiod tax allocation

A) is used to allocate a company's total income tax expense to the components of net income and comprehensive income.

B) involves temporary timing) differences between financial and taxable incomes.

C) requires allocation of deferred taxes across accounting periods.

D) results from differences between tax regulations and the principles followed to determine financial income.

A) is used to allocate a company's total income tax expense to the components of net income and comprehensive income.

B) involves temporary timing) differences between financial and taxable incomes.

C) requires allocation of deferred taxes across accounting periods.

D) results from differences between tax regulations and the principles followed to determine financial income.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

47

A company that discontinues and disposes of an operation component) should include the gain or loss on sale in the income statement as an)

A) prior-period adjustment.

B) a component of other comprehensive income.

C) an amount that is reported after income from continuing operations but before net income.

D) bulk sale of fixed assets included in income from continuing operations.

A) prior-period adjustment.

B) a component of other comprehensive income.

C) an amount that is reported after income from continuing operations but before net income.

D) bulk sale of fixed assets included in income from continuing operations.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

48

Which is least likely to be classified as a sale of a component?

A) sale by a communications company of its radio stations, but none of its television stations

B) sale by a food distributor of its wholesale supermarket division while maintaining its wholesale fast-food restaurants division

C) sale by an apparel manufacturer of a woolen suit manufacturing plant in order to concentrate on the manufacture of suits from synthetic products

D) sale by a meat-packing company of its entire) 20% interest in a professional football team

A) sale by a communications company of its radio stations, but none of its television stations

B) sale by a food distributor of its wholesale supermarket division while maintaining its wholesale fast-food restaurants division

C) sale by an apparel manufacturer of a woolen suit manufacturing plant in order to concentrate on the manufacture of suits from synthetic products

D) sale by a meat-packing company of its entire) 20% interest in a professional football team

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

49

Gregory Company is disposing of a component of its company. The net loss from the sale is estimated to be $600,000. Included in the $600,000 is termination pay of $100,000, which is directly associated with the decision to dispose of the component; and net losses from component asset write-downs of $400,000. Ignoring taxes, Gregory's income statement should report a loss on sale of a business component of

A) $100,000

B) $400,000

C) $500,000

D) $600,000

A) $100,000

B) $400,000

C) $500,000

D) $600,000

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

50

The subtotal, gross profit, will be disclosed on

A) a multiple-step income statement.

B) both multiple-step and single-step income statements.

C) neither multiple-step nor single-step income statements.

D) a single-step income statement.

A) a multiple-step income statement.

B) both multiple-step and single-step income statements.

C) neither multiple-step nor single-step income statements.

D) a single-step income statement.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

51

Intraperiod tax allocation requires a corporation's total income tax expense to be allocated to all of the following except

A) any items of other comprehensive income.

B) other revenues and expenses.

C) discontinued operations.

D) prior-period adjustments.

A) any items of other comprehensive income.

B) other revenues and expenses.

C) discontinued operations.

D) prior-period adjustments.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following would appear after the heading of operating income?

A) cost of goods sold

B) other operating income items gains or losses)

C) operating expenses

D) unusual gains or losses

A) cost of goods sold

B) other operating income items gains or losses)

C) operating expenses

D) unusual gains or losses

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

53

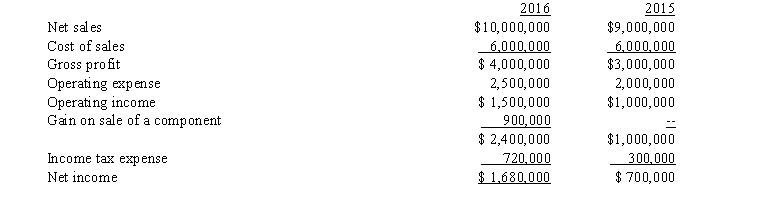

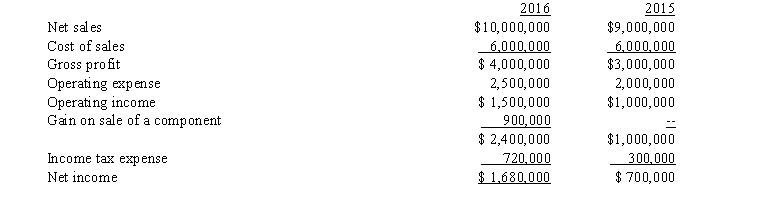

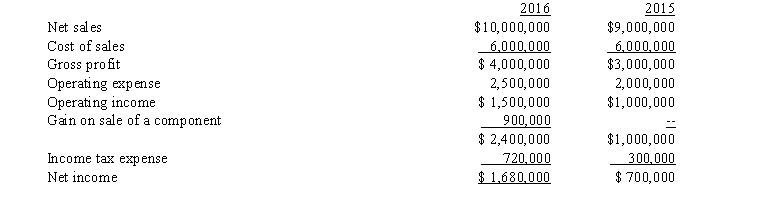

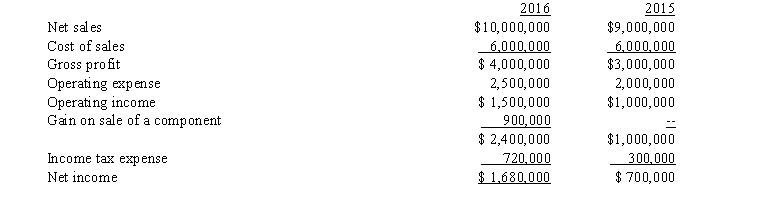

Exhibit 5-1

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015: On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report under the caption "Discontinued Operations" for 2016 and 2015, respectively,

A) income of $140,000 and a loss of $280,000.

B) income of $140,000 and a loss of $0.

C) income of $200,000 and a loss of $400,000.

D) a loss of $700,000 and a loss of $400,000.

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report under the caption "Discontinued Operations" for 2016 and 2015, respectively,

A) income of $140,000 and a loss of $280,000.

B) income of $140,000 and a loss of $0.

C) income of $200,000 and a loss of $400,000.

D) a loss of $700,000 and a loss of $400,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

54

Nelly Company sold its cattle ranching component on June 30, 2016, for a gain of $1,000,000. From January through June, the component had sustained operating income of $300,000. The income tax rate is 35%. How should Nelly report the income and the sale on its income statement?

A) as $300,000 operating income and a $1,000,000 gain on sale of component

B) as a $1,300,000 gain in operating income

C) as a net of tax gain of $845,000 after income from continuing operations

D) as $195,000 operating income and a $650,000 gain on sale of the component

A) as $300,000 operating income and a $1,000,000 gain on sale of component

B) as a $1,300,000 gain in operating income

C) as a net of tax gain of $845,000 after income from continuing operations

D) as $195,000 operating income and a $650,000 gain on sale of the component

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is a required disclosure in the income statement when reporting the sale of a component of the business?

A) The gain or loss on sale should be reported as a component of other comprehensive income

B) Both the results of operations of the discontinued component and also the gain or loss on the sale should be reported as components of other comprehensive income.

C) Earnings per share from both income from continuing operations and net income should be disclosed on the face of the income statement.

D) Revenue and expenses applicable to the discontinued operations should be disclosed in the income statement.

A) The gain or loss on sale should be reported as a component of other comprehensive income

B) Both the results of operations of the discontinued component and also the gain or loss on the sale should be reported as components of other comprehensive income.

C) Earnings per share from both income from continuing operations and net income should be disclosed on the face of the income statement.

D) Revenue and expenses applicable to the discontinued operations should be disclosed in the income statement.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 5-1

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015: On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report income from continuing operations after income taxes for 2016 and 2015, respectively, amounting to

A) $1,540,000 and $700,000.

B) $1,540,000 and $980,000.

C) $1,680,000 and $700,000.

D) $1,680,000 and $980,000.

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report income from continuing operations after income taxes for 2016 and 2015, respectively, amounting to

A) $1,540,000 and $700,000.

B) $1,540,000 and $980,000.

C) $1,680,000 and $700,000.

D) $1,680,000 and $980,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

57

The gross profit of Larry Company for 2015 is $300,000, cost of goods manufactured is $400,000, the beginning inventories of goods in process and finished goods are $28,000 and $35,000, respectively, and the ending inventories of goods in process and finished goods are $50,000 and $70,000, respectively. The cost of goods sold of Larry Company for 2015 must have been

A) $378,000.

B) $265,000.

C) $278,000.

D) $365,000.

A) $378,000.

B) $265,000.

C) $278,000.

D) $365,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

58

All of the following are included in the computation of cost of goods sold except

A) freight-out.

B) purchase returns and allowances.

C) beginning finished goods inventory.

D) freight-in.

A) freight-out.

B) purchase returns and allowances.

C) beginning finished goods inventory.

D) freight-in.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

59

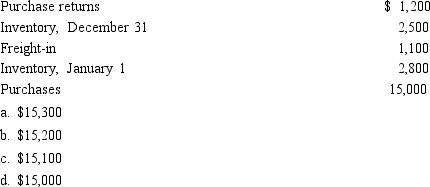

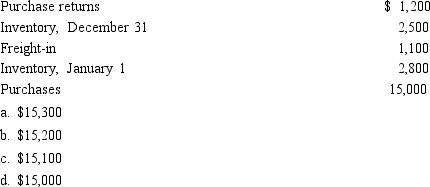

Using the information below in the computation of cost of goods sold, what would be the appropriate amount of Purchases? Purchase returns $ 1,200

Inventory, December 31 2,500

Cost of goods sold 10,500

Purchases ?

Inventory, January 1 2,500

Freight-in 1,500

A) $10,800

B) $11,200

C) $ 9,700

D) $10,200

Inventory, December 31 2,500

Cost of goods sold 10,500

Purchases ?

Inventory, January 1 2,500

Freight-in 1,500

A) $10,800

B) $11,200

C) $ 9,700

D) $10,200

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

60

From the following information, compute cost of goods sold.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

61

The statement of cash flows is least likely to help external users assess

A) a company's ability to generate positive future cash flows.

B) the amount of a company's future accrual-based sales revenue.

C) a company's ability to meet its obligations and pay dividends.

D) a company's need for external financing.

A) a company's ability to generate positive future cash flows.

B) the amount of a company's future accrual-based sales revenue.

C) a company's ability to meet its obligations and pay dividends.

D) a company's need for external financing.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

62

Differences that currently exist between IFRS and U.S. GAAP with regard to the presentation of information on the income statement include all of the following except

A) different acceptable terminology relating to revenue items.

B) depreciation measures differ when equipment has been revalued.

C) different performance measures such as EBITDA are permitted under IFRS.

D) differences resulting because IFRS does not require the use of accrual accounting under the historical cost framework.

A) different acceptable terminology relating to revenue items.

B) depreciation measures differ when equipment has been revalued.

C) different performance measures such as EBITDA are permitted under IFRS.

D) differences resulting because IFRS does not require the use of accrual accounting under the historical cost framework.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

63

Comprehensive income consists of

A) operating income + other income and losses.

B) net income + other adjustments to retained earnings.

C) net income + other comprehensive income.

D) other comprehensive income + unrealized changes in the value of available-for-sale securities.

A) operating income + other income and losses.

B) net income + other adjustments to retained earnings.

C) net income + other comprehensive income.

D) other comprehensive income + unrealized changes in the value of available-for-sale securities.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

64

IFRS reporting requires all of the following items except

A) earnings per share disclosure.

B) comprehensive income disclosure in a statement of shareholders' equity.

C) disclosure of the results of discontinued operations.

D) operating expenses disclosure.

A) earnings per share disclosure.

B) comprehensive income disclosure in a statement of shareholders' equity.

C) disclosure of the results of discontinued operations.

D) operating expenses disclosure.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

65

The primary purpose of a company's statement of cash flows is to provide information about the company's

A) operations.

B) dividend policy.

C) financing and investing activities.

D) cash receipts and cash payments during the period.

A) operations.

B) dividend policy.

C) financing and investing activities.

D) cash receipts and cash payments during the period.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

66

The numerator in the earnings per share calculation is

A) only the amount available to common shareholders.

B) net income attributable to common shareholders.

C) net income minus declared preferred stock dividends.

D) All of these answer choices are correct.

A) only the amount available to common shareholders.

B) net income attributable to common shareholders.

C) net income minus declared preferred stock dividends.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

67

Earnings per share is an important disclosure because

A) it provides information relevant to the common shareholders.

B) net income disclosed in the financial statements can fluctuate based upon management's intentions.

C) it forces common and preferred shareholders to read the financial statements.

D) it uses net income.

A) it provides information relevant to the common shareholders.

B) net income disclosed in the financial statements can fluctuate based upon management's intentions.

C) it forces common and preferred shareholders to read the financial statements.

D) it uses net income.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is included in comprehensive income?

A) gains and losses associated with derivative financial instruments that hedge future cash flows

B) translation adjustments from converting foreign statements into U.S. dollars

C) unrealized gains or losses associated with fair value of available-for-sale securities

D) All of these answer choices are included in comprehensive income.

A) gains and losses associated with derivative financial instruments that hedge future cash flows

B) translation adjustments from converting foreign statements into U.S. dollars

C) unrealized gains or losses associated with fair value of available-for-sale securities

D) All of these answer choices are included in comprehensive income.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

69

IFRS content in the income statement is similar to U.S. GAAP in all of the following areas except the disclosure of

A) revenues.

B) finance costs.

C) comprehensive income disclosure in a statement of shareholders' equity.

D) tax expense.

A) revenues.

B) finance costs.

C) comprehensive income disclosure in a statement of shareholders' equity.

D) tax expense.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

70

Comprehensive income includes the following changes in equity in a company during a period except

A) transactions with nonowners.

B) events relating to nonowner sources.

C) circumstances relating to nonowner sources.

D) distributions to owners.

A) transactions with nonowners.

B) events relating to nonowner sources.

C) circumstances relating to nonowner sources.

D) distributions to owners.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following sections will not appear in the statement of cash flows?

A) operating activities

B) investing activities

C) financing activities

D) selling activities

A) operating activities

B) investing activities

C) financing activities

D) selling activities

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

72

How should the gain or loss that is considered infrequent be disclosed?

A) separately in the income statement immediately after income from continuing operations

B) on a net-of-tax basis in the income statement immediately after income from continuing operations

C) as an contingency item in the footnotes

D) separately in the income statement as a component of income from continuing operations

A) separately in the income statement immediately after income from continuing operations

B) on a net-of-tax basis in the income statement immediately after income from continuing operations

C) as an contingency item in the footnotes

D) separately in the income statement as a component of income from continuing operations

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is not considered part of comprehensive income?

A) translation adjustments from financial statement conversions

B) gains and losses on derivative financial instruments

C) gains and losses associated with the sale of a business component

D) gain and losses associated with adjustments to pension plan assets and liabilities

A) translation adjustments from financial statement conversions

B) gains and losses on derivative financial instruments

C) gains and losses associated with the sale of a business component

D) gain and losses associated with adjustments to pension plan assets and liabilities

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

74

Lester Company reported the following information for the year ended December 31, 2015: Net income $1,000,000

Preferred dividends declared and paid 160,000

Common dividends declared and paid 90,000

Average common shares outstanding 100,000 Ending market price per share 35

Net sales 3,100,000

What was Lester's earnings per share for 2015?

A) $8.40

B) $10.00

C) $7.50

D) $31.00

Preferred dividends declared and paid 160,000

Common dividends declared and paid 90,000

Average common shares outstanding 100,000 Ending market price per share 35

Net sales 3,100,000

What was Lester's earnings per share for 2015?

A) $8.40

B) $10.00

C) $7.50

D) $31.00

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is required to be disclosed, pursuant to GAAP?

A) operating income or loss from discontinued component reported on the income statement

B) a description of facts and circumstances leading up to the sale of a discontinued component within the notes of the financial statements

C) all gains or losses from sale of the component reported on the income statement or in the footnotes

D) All of these answer choices are correct.

A) operating income or loss from discontinued component reported on the income statement

B) a description of facts and circumstances leading up to the sale of a discontinued component within the notes of the financial statements

C) all gains or losses from sale of the component reported on the income statement or in the footnotes

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

76

Comprehensive income is an important concept in accounting because it represents

A) all changes in equity.

B) changes in equity from nonowner sources.

C) changes in liabilities minus assets.

D) the impact on equity of all transactions.

A) all changes in equity.

B) changes in equity from nonowner sources.

C) changes in liabilities minus assets.

D) the impact on equity of all transactions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

77

When is a company not required to report comprehensive income?

A) when it has a net operating loss

B) when it has no other comprehensive income items

C) when it has no liability items

D) when it has no prior period adjustments

A) when it has a net operating loss

B) when it has no other comprehensive income items

C) when it has no liability items

D) when it has no prior period adjustments

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is not part of other comprehensive income?

A) unrealized changes in the value of trading securities

B) certain pension plan gains, losses, and prior service cost adjustments

C) certain gains and losses in derivatives

D) currency translation adjustments

A) unrealized changes in the value of trading securities

B) certain pension plan gains, losses, and prior service cost adjustments

C) certain gains and losses in derivatives

D) currency translation adjustments

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is an acceptable way of reporting a company's comprehensive income?

A) on the face of the income statement only

B) in a separate, consecutive, statement of comprehensive income only

C) in the statement of changes in shareholders' equity only

D) both a and b are acceptable

A) on the face of the income statement only

B) in a separate, consecutive, statement of comprehensive income only

C) in the statement of changes in shareholders' equity only

D) both a and b are acceptable

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

80

Morgan Company reported the following information for the year ended December 31, 2015: Net income $ 600,000

Preferred dividends declared and paid 60,000

Common dividends declared and paid 90,000

Average common shares outstanding 90,000 Ending market price per share 45

Net sales 5,100,000

What was Morgan's earnings per share for 2015?

A) $6.67

B) $6.00

C) $5.11

D) $0.15

Preferred dividends declared and paid 60,000

Common dividends declared and paid 90,000

Average common shares outstanding 90,000 Ending market price per share 45

Net sales 5,100,000

What was Morgan's earnings per share for 2015?

A) $6.67

B) $6.00

C) $5.11

D) $0.15

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck