Deck 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:

1

Why would a company use a separate payroll cash account?

A) Provides for better internal control

B) Ease of account reconciliation

C) Determine whether or not the employee has cashed their check

D) All of the above are correct.

A) Provides for better internal control

B) Ease of account reconciliation

C) Determine whether or not the employee has cashed their check

D) All of the above are correct.

D

2

The information needed to make the journal entries to record the wages and salaries expense comes from:

A) form W-2.

B) form W-4.

C) the payroll register.

D) form 941.

A) form W-2.

B) form W-4.

C) the payroll register.

D) form 941.

C

3

Which of the following statements is true?

A) Payroll Tax Expense increases on the debit side of the account.

B) FICA-OASDI Payable is a Liability.

C) Payroll Tax Expense has a debit normal balance.

D) All of these answers are correct.

A) Payroll Tax Expense increases on the debit side of the account.

B) FICA-OASDI Payable is a Liability.

C) Payroll Tax Expense has a debit normal balance.

D) All of these answers are correct.

D

4

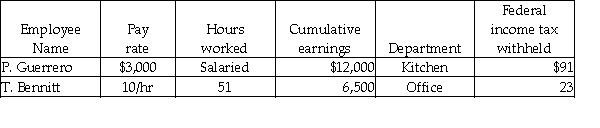

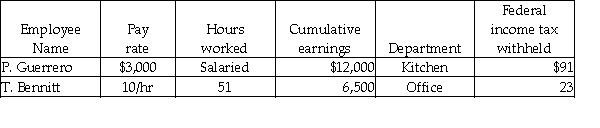

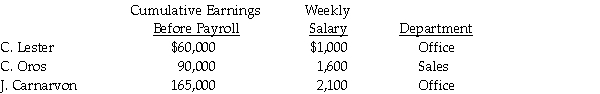

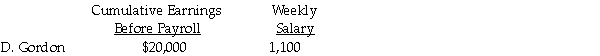

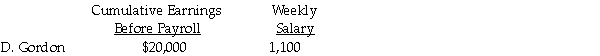

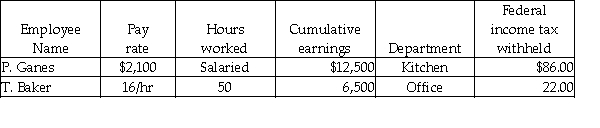

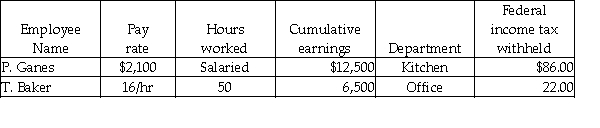

Gail's Bakery had the following information before the pay period ending June 30:

Assume: Each hourly employee is paid 1½ times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Employee Wage Expense?

A) Debit $565

B) Credit $565

C) Debit $510

D) Credit $510

Assume: Each hourly employee is paid 1½ times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Employee Wage Expense?

A) Debit $565

B) Credit $565

C) Debit $510

D) Credit $510

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

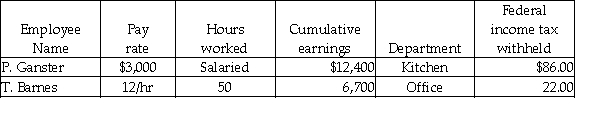

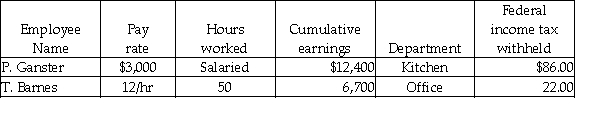

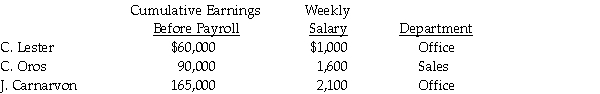

Grammy's Bakery had the following information before the pay period ending June 30:  Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

A) Debit $12,400

B) Credit $12,400

C) Debit $3,000

D) Credit $3,000

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

A) Debit $12,400

B) Credit $12,400

C) Debit $3,000

D) Credit $3,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

The account for Payroll Tax Expense includes all of the following except:

A) federal unemployment taxes.

B) FICA taxes (OASDI and Medicare) paid by the employer for the latest payroll period.

C) state unemployment taxes.

D) federal income tax.

A) federal unemployment taxes.

B) FICA taxes (OASDI and Medicare) paid by the employer for the latest payroll period.

C) state unemployment taxes.

D) federal income tax.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

The entry to record the payroll tax expense would include:

A) a credit to Federal Income Taxes Payable.

B) a debit to Pre-paid Tax Expense.

C) a credit to FICA (OASDI and Medicare) Taxes Payable.

D) a credit to Wages Payable.

A) a credit to Federal Income Taxes Payable.

B) a debit to Pre-paid Tax Expense.

C) a credit to FICA (OASDI and Medicare) Taxes Payable.

D) a credit to Wages Payable.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

What is debited if State Unemployment Tax Payable (SUTA) is credited?

A) Payroll Tax Expense

B) SUTA Tax Payable

C) Pre-paid Payroll Taxes

D) Salaries Expense

A) Payroll Tax Expense

B) SUTA Tax Payable

C) Pre-paid Payroll Taxes

D) Salaries Expense

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

Wages and Salaries Payable would be used to record:

A) gross earnings of the employees paid.

B) net earnings of the employees not paid.

C) straight-time pay only.

D) the paid portion of the earnings.

A) gross earnings of the employees paid.

B) net earnings of the employees not paid.

C) straight-time pay only.

D) the paid portion of the earnings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

Form SS-4 is:

A) completed to obtain an EIN.

B) submitted to summarize the W-2 forms to the Social Security Administration.

C) submitted quarterly to pay FIT and FICA taxes.

D) submitted annually to pay unemployment taxes.

A) completed to obtain an EIN.

B) submitted to summarize the W-2 forms to the Social Security Administration.

C) submitted quarterly to pay FIT and FICA taxes.

D) submitted annually to pay unemployment taxes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

The entry to record employer's total FICA, SUTA, and FUTA tax would include:

A) a debit to Payroll Tax Expense.

B) a credit to Payroll Tax Expense.

C) a credit to Accounts Payable.

D) a debit to Payroll Tax Payable.

A) a debit to Payroll Tax Expense.

B) a credit to Payroll Tax Expense.

C) a credit to Accounts Payable.

D) a debit to Payroll Tax Payable.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

The look-back period is used to determine whether:

A) a business should make its Form 941 tax deposits on a monthly or semiweekly basis.

B) an employer will use Form 940.

C) an employer has sent the W-2s to their employees on timely basis.

D) an employer must pay back taxes.

A) a business should make its Form 941 tax deposits on a monthly or semiweekly basis.

B) an employer will use Form 940.

C) an employer has sent the W-2s to their employees on timely basis.

D) an employer must pay back taxes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is false?

A) Payroll Tax Expense is an expense account.

B) FICA-OASDI Payable increases on the credit side of the account.

C) Payroll Tax Expense increases on the debit side of the account.

D) FUTA Tax Payable increases on the debit side of the account.

A) Payroll Tax Expense is an expense account.

B) FICA-OASDI Payable increases on the credit side of the account.

C) Payroll Tax Expense increases on the debit side of the account.

D) FUTA Tax Payable increases on the debit side of the account.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

Cash - Payroll Checking is a(n):

A) contra-asset.

B) liability.

C) asset.

D) expense.

A) contra-asset.

B) liability.

C) asset.

D) expense.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

The debit amount to Payroll Tax Expense represents:

A) the employer's portion of the payroll taxes.

B) the employees' portion of the payroll taxes.

C) the employer's and employees' portion of the payroll taxes.

D) None of the above is correct.

A) the employer's portion of the payroll taxes.

B) the employees' portion of the payroll taxes.

C) the employer's and employees' portion of the payroll taxes.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

The Wages and Salaries Expense account would be used to record:

A) net earnings for the office workers.

B) the amount for payroll tax.

C) gross earnings for the office workers.

D) a debit for the amount of net pay owed to the office workers.

A) net earnings for the office workers.

B) the amount for payroll tax.

C) gross earnings for the office workers.

D) a debit for the amount of net pay owed to the office workers.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

What type of account is Payroll Tax Expense?

A) Asset

B) Pre-paid liability

C) Contra-revenue

D) Expense

A) Asset

B) Pre-paid liability

C) Contra-revenue

D) Expense

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

What type of an account is Wages and Salaries Payable?

A) Asset

B) Liability

C) Contra-liability

D) Expense

A) Asset

B) Liability

C) Contra-liability

D) Expense

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

When a business starts, what must it obtain that identifies itself to the government?

A) State Employment Number

B) Federal Unemployment Number

C) Employer Identification Number

D) A look-back period

A) State Employment Number

B) Federal Unemployment Number

C) Employer Identification Number

D) A look-back period

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

A monthly depositor:

A) is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day).

B) is determined by the amount of Form 941 taxes that they paid in the look-back-period.

C) will remain a monthly depositor, once classified, for one year at which time they will be reevaluated.

D) All of the above answers are correct.

A) is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day).

B) is determined by the amount of Form 941 taxes that they paid in the look-back-period.

C) will remain a monthly depositor, once classified, for one year at which time they will be reevaluated.

D) All of the above answers are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

The payroll tax expense is recorded quarterly only.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

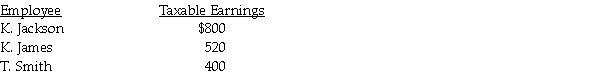

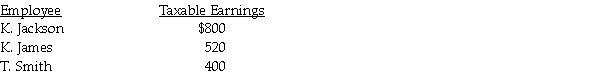

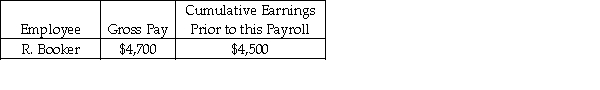

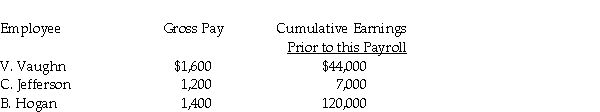

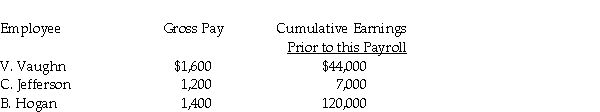

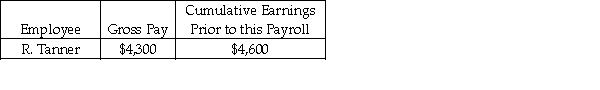

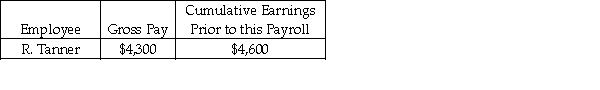

Using the information below, determine the amount of the payroll tax expense for B. Hope Company's first payroll of the year. In your answer list the amounts for FICA (OASDI and Medicare), SUTA, and FUTA.  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 5.0% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 5.0% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

The balance in the Wages and Salaries Expense account is equal to the amount of cash paid to the employees.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

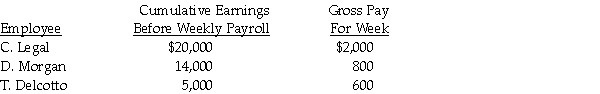

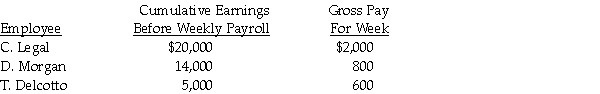

Record in the general journal the payroll tax entry for the week ended August 31. Use the following information gathered to make the entry.  a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b) Federal Unemployment is 0.8% on a limit of $7,000

c) State Unemployment is 2% on a limit of $7,000

a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%b) Federal Unemployment is 0.8% on a limit of $7,000

c) State Unemployment is 2% on a limit of $7,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

A company must pay Form 941 taxes electronically if:

A) they do business in multiple states.

B) they pay more than $2,500 in a given quarter.

C) they pay less than $2,500 in a given quarter.

D) The company would never have to pay electronically.

A) they do business in multiple states.

B) they pay more than $2,500 in a given quarter.

C) they pay less than $2,500 in a given quarter.

D) The company would never have to pay electronically.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

A banking day is any day that the bank is open to the public for business.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

There is no limit on the amount of taxes paid for SUTA.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

If Wages and Salaries Payable is debited, what account would most likely be credited?

A) Cash

B) Pre-Paid Payroll Expense

C) Payroll Expense

D) SUTA Payable

A) Cash

B) Pre-Paid Payroll Expense

C) Payroll Expense

D) SUTA Payable

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

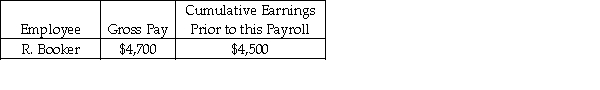

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:  Assume the following:

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Federal income tax is 15% of gross pay.

c) Each employee pays $20 per week for medical insurance.

Assume the following:

Assume the following:a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Federal income tax is 15% of gross pay.

c) Each employee pays $20 per week for medical insurance.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

FICA taxes are levied only on employees.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

Payroll information for Kinzer's Interior Decorating for the first week in October is as follows:  Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Assume the following tax rates: Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Taxable earnings subject to Federal and State Unemployment taxes: $5,000Assume the following tax rates:

Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Required: Prepare the employer's payroll tax entry for Kinzer for the first week of October.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

FIT Payable has a credit normal balance.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Jefferson Tutoring had the following payroll information on February 28:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

A) a debit to Payroll Tax Expense in the amount of $429.55.

B) a credit to FUTA Payable for $20.00.

C) a credit to SUTA Payable for $50.00.

D) All of the above are correct.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

A) a debit to Payroll Tax Expense in the amount of $429.55.

B) a credit to FUTA Payable for $20.00.

C) a credit to SUTA Payable for $50.00.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

Sweeney's Recording Studio payroll records show the following information:  Assume the following:

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

Assume the following:

Assume the following:a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Mike's Door Service's payroll data for the second week of June included the following:  Taxable earnings for state unemployment taxes: $2,000

Taxable earnings for state unemployment taxes: $2,000

Assume the following tax rates:

FICA-OASDI 6.2%

FICA-Medicare 1.45%

State unemployment 1.5%

Federal unemployment 0.06%

Required: Prepare the payroll tax expense entry for Mike's for the second week of June.

Taxable earnings for state unemployment taxes: $2,000

Taxable earnings for state unemployment taxes: $2,000Assume the following tax rates:

FICA-OASDI 6.2%

FICA-Medicare 1.45%

State unemployment 1.5%

Federal unemployment 0.06%

Required: Prepare the payroll tax expense entry for Mike's for the second week of June.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

An employer must always use a calendar year for payroll purposes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

Wages and Salaries Expense is:

A) equal to net pay.

B) equal to gross pay.

C) equal to the employer's taxes.

D) equal to wages and salaries paid in cash.

A) equal to net pay.

B) equal to gross pay.

C) equal to the employer's taxes.

D) equal to wages and salaries paid in cash.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

What liability account is reduced when the employees are paid?

A) Payroll Taxes Payable

B) Federal Income Taxes Payable

C) Wages and Salaries Payable

D) Wages and Salaries Expense

A) Payroll Taxes Payable

B) Federal Income Taxes Payable

C) Wages and Salaries Payable

D) Wages and Salaries Expense

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

Mid-West Tutoring had the following payroll information on January 31:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Federal Income Tax Withheld $900; State Income Tax Withheld $300.

Using the information above, the journal entry to record the employee's payroll expense would include:

A) a debit to Payroll Tax Expense in the amount of $4,300.

B) a debit to Wages and Salaries Expense in the amount of $4,300.

C) a credit to Cash in the amount of $4,300.

D) a credit to FUTA Payable for $120.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Federal Income Tax Withheld $900; State Income Tax Withheld $300.

Using the information above, the journal entry to record the employee's payroll expense would include:

A) a debit to Payroll Tax Expense in the amount of $4,300.

B) a debit to Wages and Salaries Expense in the amount of $4,300.

C) a credit to Cash in the amount of $4,300.

D) a credit to FUTA Payable for $120.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

A calendar quarter is made up of:

A) 4 months.

B) 13 weeks.

C) 5 weeks.

D) however many weeks are needed to complete the month.

A) 4 months.

B) 13 weeks.

C) 5 weeks.

D) however many weeks are needed to complete the month.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employees' FICA-OASDI.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employees' FICA-OASDI.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employees' FICA-Medicare.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employees' FICA-Medicare.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

The entry to record the payment of taxes withheld from employees and FICA taxes would be to:

A) credit Cash; debit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

B) debit Cash; credit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

C) credit Cash; credit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

D) None of these answers is correct.

A) credit Cash; debit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

B) debit Cash; credit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

C) credit Cash; credit FICA-OASDI Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

The payment of FUTA would include:

A) a debit to FUTA Payable.

B) a credit to FUTA Payable.

C) a debit to cash.

D) a credit to FUTA Expense.

A) a debit to FUTA Payable.

B) a credit to FUTA Payable.

C) a debit to cash.

D) a credit to FUTA Expense.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

Which form is used to report FICA taxes for the employer and employee, and also federal income taxes for the employee?

A) Form 941

B) Form 944

C) Form 940

D) Form W-2

A) Form 941

B) Form 944

C) Form 940

D) Form W-2

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total federal income tax.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total federal income tax.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

Businesses will make their payroll tax deposits based on payroll taxes collected.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

Which taxes are considered 941 taxes?

A) FICA, FUTA, and SUTA

B) FICA and SIT

C) FICA, FIT, and Workers' Compensation

D) None of these answers is correct.

A) FICA, FUTA, and SUTA

B) FICA and SIT

C) FICA, FIT, and Workers' Compensation

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total overtime earnings.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total overtime earnings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

The employer records deductions from the employee's paycheck:

A) as debits to expense accounts.

B) as credits to liability accounts until paid.

C) as debits to asset accounts until paid.

D) as debits to the cash account.

A) as debits to expense accounts.

B) as credits to liability accounts until paid.

C) as debits to asset accounts until paid.

D) as debits to the cash account.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total regular earnings.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total regular earnings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

The form used for the annual federal unemployment taxes is Form 941.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

Why are the employee deductions recorded as payables on the employer's books?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

Form 941 is filed:

A) monthly.

B) annually.

C) weekly.

D) quarterly.

A) monthly.

B) annually.

C) weekly.

D) quarterly.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Why are all of the employer payroll taxes listed in separate payable accounts?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

Form 941 taxes include OASDI, Medicare, and federal unemployment tax.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total state income tax.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total state income tax.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total gross earnings.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total gross earnings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

The same deposit rules apply to employers based on the amount collected and owed by that employer for payroll taxes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

Grammy's Bakery had the following information for the pay period ending June 30:  Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) Debit $4

B) Credit $4

C) Debit $23

D) Credit $23

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) Debit $4

B) Credit $4

C) Debit $23

D) Credit $23

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

Information to prepare W-2 forms can be obtained from the current payroll register.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employer's payroll taxes.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the employer's payroll taxes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

Which form is sent to the Social Security Administration along with the W-2s? It reports total wages, FICA tax withheld, etc., for the previous year.

A) Form W-2

B) Form W-3

C) Form SS-4

D) Form 940

A) Form W-2

B) Form W-3

C) Form SS-4

D) Form 940

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

A deposit must be made when filing the W-2 form.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the net pay for the employees' paychecks.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the net pay for the employees' paychecks.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

The correct journal entry to record the payment of SUTA is:

A) debit SUTA Expense; credit Cash.

B) debit Cash; credit SUTA Expense.

C) debit Cash; credit SUTA Payable.

D) debit SUTA Payable; credit Cash.

A) debit SUTA Expense; credit Cash.

B) debit Cash; credit SUTA Expense.

C) debit Cash; credit SUTA Payable.

D) debit SUTA Payable; credit Cash.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

How often is a Form 940 filed?

A) Monthly

B) Annually

C) Weekly

D) Quarterly

A) Monthly

B) Annually

C) Weekly

D) Quarterly

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

The W-2 is the Wage and Tax Statement.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

FUTA taxes are paid:

A) by the end of January of the following year if the amount owed is less than $500.

B) by the end of the month following the end of the calendar quarter if the amount owed is more than $500.

C) at the same time as the Form 941 taxes.

D) Both A and B are correct.

A) by the end of January of the following year if the amount owed is less than $500.

B) by the end of the month following the end of the calendar quarter if the amount owed is more than $500.

C) at the same time as the Form 941 taxes.

D) Both A and B are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

Which form contains information about gross earnings and is given to the employee by January 31?

A) Form W-2

B) Form W-3

C) Form 941

D) Form W-4E

A) Form W-2

B) Form W-3

C) Form 941

D) Form W-4E

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

The employer pays the same amount as the employee for Federal Unemployment taxes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

Prepare the general journal entry to record the payroll.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

The following amounts are an expense to the company:

A) FICA-OASDI Payable.

B) FUTA Payable.

C) SUTA Payable.

D) All of the above are correct.

A) FICA-OASDI Payable.

B) FUTA Payable.

C) SUTA Payable.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following does NOT apply to both a W-2 and a W-3?

A) Reports the total amount of wages, tips and compensation paid to the employee

B) Reports the total OASDI and Medicare taxes withheld

C) Sent to the Social Security Administration

D) Employees use both forms to prepare their personal tax returns.

A) Reports the total amount of wages, tips and compensation paid to the employee

B) Reports the total OASDI and Medicare taxes withheld

C) Sent to the Social Security Administration

D) Employees use both forms to prepare their personal tax returns.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

The employer's annual Federal Unemployment Tax Return is:

A) Form 940.

B) Form 941.

C) Form W-6.

D) Form 8109.

A) Form 940.

B) Form 941.

C) Form W-6.

D) Form 8109.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

If an employer owes less than $2,500 for FICA (OASDI and Medicare) and FIT, they can submit:

A) Form 941.

B) Form 940.

C) Form W-2.

D) Form W-3.

A) Form 941.

B) Form 940.

C) Form W-2.

D) Form W-3.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

Prepare the general journal entry to record the employer's payroll tax expense.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total deductions for the employees' paychecks.

Assume:

Assume:FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

Compute the total deductions for the employees' paychecks.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

The correct journal entry to record the payment of FUTA is to:

A) debit Cash; credit FUTA Payable.

B) debit FUTA Expense; credit Cash.

C) debit FUTA Payable; credit Cash.

D) debit Cash; credit FUTA Expense.

A) debit Cash; credit FUTA Payable.

B) debit FUTA Expense; credit Cash.

C) debit FUTA Payable; credit Cash.

D) debit Cash; credit FUTA Expense.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck