Deck 12: Partnerships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/161

Play

Full screen (f)

Deck 12: Partnerships

1

Which of the following is specified in the articles of partnership?

A) procedures for withdrawal of assets by the partners

B) procedures for distribution of dividends

C) methods for valuation of the assets

D) selection of an appropriate depreciation method

A) procedures for withdrawal of assets by the partners

B) procedures for distribution of dividends

C) methods for valuation of the assets

D) selection of an appropriate depreciation method

A

2

A partnership is a ________.

A) firm listed on a stock exchange, in which no owner owns a controlling majority of equity

B) business with two or more owners that is not organized as a corporation

C) corporation in which the owners have limited liability for the organization's liabilities

D) private firm in which all owners have equal ownership and limited liability in the event of a bankruptcy

A) firm listed on a stock exchange, in which no owner owns a controlling majority of equity

B) business with two or more owners that is not organized as a corporation

C) corporation in which the owners have limited liability for the organization's liabilities

D) private firm in which all owners have equal ownership and limited liability in the event of a bankruptcy

B

3

The articles of partnership is a written contract between partners that specifies the name, location, and nature of the business; the identifying characteristics of each partner; and the method of sharing profits and losses among the partners.

True

4

A partnership is a business with two or more owners that is legally organized as a corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is true of a written partnership agreement?

A) It is an agreement in which the partners hold a direct agreement with the registration body, and the registration body acts as an interlocutor between the partners.

B) It is an informal agreement between the partners and is not legally binding.

C) It is a legally-binding agreement between the owners which explains the procedures for liquidating the partnership.

D) It is a legally-binding agreement between the proprietors and the stock exchange where it is listed regarding the profit sharing between the owners.

A) It is an agreement in which the partners hold a direct agreement with the registration body, and the registration body acts as an interlocutor between the partners.

B) It is an informal agreement between the partners and is not legally binding.

C) It is a legally-binding agreement between the owners which explains the procedures for liquidating the partnership.

D) It is a legally-binding agreement between the proprietors and the stock exchange where it is listed regarding the profit sharing between the owners.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following will result in the dissolution of a partnership?

A) admission of a new partner

B) purchase of plant assets for the business

C) contribution of an asset by an existing partner

D) a partner's withdrawal of cash from the partnership

A) admission of a new partner

B) purchase of plant assets for the business

C) contribution of an asset by an existing partner

D) a partner's withdrawal of cash from the partnership

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

7

The income of a limited liability company cannot be taxed to the members as though they were partners.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

8

In a partnership, when a partner contributes a particular asset to the firm, he or she is considered to be the sole owner of the asset.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

9

A written partnership agreement is also known as the articles of partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

10

Mutual agency means that any partner can legally bind the other partners and the partnership to business contracts within the scope of the businesses regular operations.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

11

In a general partnership, each partner has limited personal liability for the debts of the business.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

12

In a general partnership, if one partner cannot pay his or her part of the debts, the other partner or partners must pay the total.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

13

An S corporation pays no corporate income tax.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

14

In a limited liability partnership, each partner is not personally liable for the malpractice or negligence committed by another partner.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a characteristic of a partnership?

A) Partnerships pay corporate income taxes.

B) Partnerships are listed on a stock exchange.

C) Partnerships are organized as corporations.

D) Partners have co-ownership of the partnership's assets.

A) Partnerships pay corporate income taxes.

B) Partnerships are listed on a stock exchange.

C) Partnerships are organized as corporations.

D) Partners have co-ownership of the partnership's assets.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

16

The addition of a new partner to a firm does not dissolve the old partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

17

In a general partnership, the partners have unlimited personal liability for the debts of the business.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

18

An S corporation is a corporation with 100 or fewer stockholders that can elect to be taxed as a partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

19

In a partnership, the income is taxed at the partnership level as well as at the personal level of the owners.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is true of a partnership?

A) All partnership firms are public firms.

B) Partnership firms have a limited life.

C) The owners of the partnership have limited liabilities for the partnership's debts.

D) The maximum loss an owner of a partnership can incur is the invested amount.

A) All partnership firms are public firms.

B) Partnership firms have a limited life.

C) The owners of the partnership have limited liabilities for the partnership's debts.

D) The maximum loss an owner of a partnership can incur is the invested amount.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following businesses is most likely to be organized as an LLP?

A) a bookstore run by two partners

B) an international retail chain

C) an accounting firm run by two partners

D) a stationery store owned by an individual

A) a bookstore run by two partners

B) an international retail chain

C) an accounting firm run by two partners

D) a stationery store owned by an individual

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is true of a general partnership?

A) Each partner has all the privileges and risks of ownership.

B) The income of a general partnership is subject to double taxation.

C) Each partner's liability is limited to their contributed capital.

D) When a general partner contributes a particular asset to the firm, he or she is considered the sole owner of the asset.

A) Each partner has all the privileges and risks of ownership.

B) The income of a general partnership is subject to double taxation.

C) Each partner's liability is limited to their contributed capital.

D) When a general partner contributes a particular asset to the firm, he or she is considered the sole owner of the asset.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is an advantage of a partnership?

A) Partnerships are less expensive to organize than corporations.

B) The owners of a partnership are generally exempted from personal income taxes.

C) The owners who contribute an asset to the partnership retain absolute claim on the asset.

D) Partnerships have a higher cost of financial distress than those of a corporation.

A) Partnerships are less expensive to organize than corporations.

B) The owners of a partnership are generally exempted from personal income taxes.

C) The owners who contribute an asset to the partnership retain absolute claim on the asset.

D) Partnerships have a higher cost of financial distress than those of a corporation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following types of business organizations pay business income taxes?

A) S Corporations

B) sole proprietorships

C) general partnerships

D) C Corporations

A) S Corporations

B) sole proprietorships

C) general partnerships

D) C Corporations

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is an additional feature of a limited liability partnership compared to a limited partnership?

A) It has a general partner who does not participate in the day-to-day operations of the partnership.

B) It limits the personal liability of limited partners to their contribution in the business.

C) It restricts the general partner from taking high-risk projects.

D) It protects each partner from any malpractice or negligence of another partner's actions.

A) It has a general partner who does not participate in the day-to-day operations of the partnership.

B) It limits the personal liability of limited partners to their contribution in the business.

C) It restricts the general partner from taking high-risk projects.

D) It protects each partner from any malpractice or negligence of another partner's actions.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is true of limited partners in a limited partnership?

A) They have limited liability for the debts of the business but their potential for profits is unlimited.

B) They usually have first claim to profits and losses made by the business.

C) They assume the same operational duties as that of the general partner.

D) They have to assume a liability beyond their contribution in the business in the event of a bankruptcy.

A) They have limited liability for the debts of the business but their potential for profits is unlimited.

B) They usually have first claim to profits and losses made by the business.

C) They assume the same operational duties as that of the general partner.

D) They have to assume a liability beyond their contribution in the business in the event of a bankruptcy.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

27

In a ________, each partner is not personally liable for the malpractice committed by another partner.

A) general partnership

B) limited liability partnership

C) limited partnership

D) sole proprietorship

A) general partnership

B) limited liability partnership

C) limited partnership

D) sole proprietorship

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

28

In which of the following ways does a limited partnership differ from a general partnership?

A) In a limited partnership, the general partner has an unlimited personal liability in the partnership; whereas in a general partnership, all partners have same level of personal liability.

B) In a limited partnership, all the partners make an equal contribution to the daily operations; whereas in a general partnership, the general partner assumes a greater responsibility of the operation.

C) In a limited partnership, there will be only one class of partners named limited partners; whereas in a general partnership, there will be only one class of partners named general partners.

D) In a limited partnership, each partner is not personally liable for the malpractice committed by another partner; whereas in a general partnership, only the general partner is personally liable for the malpractice committed by another partner.

A) In a limited partnership, the general partner has an unlimited personal liability in the partnership; whereas in a general partnership, all partners have same level of personal liability.

B) In a limited partnership, all the partners make an equal contribution to the daily operations; whereas in a general partnership, the general partner assumes a greater responsibility of the operation.

C) In a limited partnership, there will be only one class of partners named limited partners; whereas in a general partnership, there will be only one class of partners named general partners.

D) In a limited partnership, each partner is not personally liable for the malpractice committed by another partner; whereas in a general partnership, only the general partner is personally liable for the malpractice committed by another partner.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

29

A ________ is a form of business organization that combines the advantages of both a partnership and a corporation.

A) limited liability company

B) limited liability partnership

C) C Corporation

D) general partnership

A) limited liability company

B) limited liability partnership

C) C Corporation

D) general partnership

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is true of the assets of a partnership?

A) The partner who is more actively involved in the daily business affairs is considered to be the sole owner of the partnership's assets.

B) Any new assets purchased by the partnership are jointly owned by each partner.

C) When a partner contributes a particular asset to the firm, he is considered to be the sole owner of the asset.

D) In case of liquidation of assets, the partners must be paid based on the profit sharing ratio of the partnership.

A) The partner who is more actively involved in the daily business affairs is considered to be the sole owner of the partnership's assets.

B) Any new assets purchased by the partnership are jointly owned by each partner.

C) When a partner contributes a particular asset to the firm, he is considered to be the sole owner of the asset.

D) In case of liquidation of assets, the partners must be paid based on the profit sharing ratio of the partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

31

A general partner in a limited partnership ________.

A) has less personal liability for the debts of the business than the limited partners

B) is the majority shareholder and is not involved in the daily business activities

C) has unlimited personal liability in the partnership

D) is the first owner to receive a share of profits and losses

A) has less personal liability for the debts of the business than the limited partners

B) is the majority shareholder and is not involved in the daily business activities

C) has unlimited personal liability in the partnership

D) is the first owner to receive a share of profits and losses

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

32

In comparison to a corporation, the owners of a general partnership ________.

A) have limited claim on the profits generated by the business

B) are restricted from dissolving the business without prior notice to the SEC

C) have an unlimited personal liability for the debts of the business

D) are taxed at two levels

A) have limited claim on the profits generated by the business

B) are restricted from dissolving the business without prior notice to the SEC

C) have an unlimited personal liability for the debts of the business

D) are taxed at two levels

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

33

In a partnership, mutual agency means that ________.

A) the addition of a new partner does not dissolve the old partnership; there is a mutual exchange of ownership with the exiting partner

B) every partner must contribute the same amount of capital

C) the agency problem between the principal and agents are mutual and are neutralized

D) any partner can bind the business to a contract within the scope of its regular business operations

A) the addition of a new partner does not dissolve the old partnership; there is a mutual exchange of ownership with the exiting partner

B) every partner must contribute the same amount of capital

C) the agency problem between the principal and agents are mutual and are neutralized

D) any partner can bind the business to a contract within the scope of its regular business operations

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is an advantage of a limited liability company compared to a partnership?

A) Unlike a partnership, the members of a limited liability company cannot participate actively in management of the business.

B) Unlike a partnership, the members of a limited liability company are not personally liable for the business's debts.

C) Unlike a partnership, the members of a limited liability company are taxed at the business level and are double-taxed.

D) Unlike a partnership, the members of a limited liability company do not need to file articles of organization with the state.

A) Unlike a partnership, the members of a limited liability company cannot participate actively in management of the business.

B) Unlike a partnership, the members of a limited liability company are not personally liable for the business's debts.

C) Unlike a partnership, the members of a limited liability company are taxed at the business level and are double-taxed.

D) Unlike a partnership, the members of a limited liability company do not need to file articles of organization with the state.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

35

A firm has two partners: Jim and Bill. Jim owns 60% of the partnership and Bill owns 40%. In which of the following transactions will the partnership be held responsible for an individual partners' actions?

A) Jim signs a contract as a guarantor for Bill's personal loan.

B) Jim buys a laptop on credit for personal use.

C) Bill signs a contract to buy furniture for official use in the partnership.

D) Bill defaults on payment of his personal credit card bill.

A) Jim signs a contract as a guarantor for Bill's personal loan.

B) Jim buys a laptop on credit for personal use.

C) Bill signs a contract to buy furniture for official use in the partnership.

D) Bill defaults on payment of his personal credit card bill.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is true of a limited liability company?

A) A limited liability company is not obligated to file the articles of organization with the state.

B) The owners of a limited liability company are personally liable for the business's debts.

C) A limited liability company can elect not to pay business income tax.

D) The owners of a limited liability company cannot participate actively in management of the business.

A) A limited liability company is not obligated to file the articles of organization with the state.

B) The owners of a limited liability company are personally liable for the business's debts.

C) A limited liability company can elect not to pay business income tax.

D) The owners of a limited liability company cannot participate actively in management of the business.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is an advantage of a limited liability company compared to a corporation?

A) Unlike a corporation, the members of a limited liability company are personally liable for the business's debts.

B) Unlike a corporation, the members of a limited liability company need not file articles of organization with the state.

C) Unlike a corporation, the members of a limited liability company cannot participate actively in management of the business.

D) Unlike a corporation, the members of a limited liability company are taxed at the individual level only.

A) Unlike a corporation, the members of a limited liability company are personally liable for the business's debts.

B) Unlike a corporation, the members of a limited liability company need not file articles of organization with the state.

C) Unlike a corporation, the members of a limited liability company cannot participate actively in management of the business.

D) Unlike a corporation, the members of a limited liability company are taxed at the individual level only.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

38

A(n) ________ must carry large insurance policies to protect the public in case the partnership is found guilty of malpractice.

A) general partnership

B) S Corporation

C) limited liability partnership

D) C Corporation

A) general partnership

B) S Corporation

C) limited liability partnership

D) C Corporation

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is a disadvantage of partnership firms?

A) They cannot be dissolved without the permission of the SEC.

B) They are taxed at multiple levels: corporate level and individual level.

C) They have more difficulty in raising capital as compared to a sole proprietorship.

D) They have mutual agency which creates personal obligations for each partner.

A) They cannot be dissolved without the permission of the SEC.

B) They are taxed at multiple levels: corporate level and individual level.

C) They have more difficulty in raising capital as compared to a sole proprietorship.

D) They have mutual agency which creates personal obligations for each partner.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

40

In which of the following types of business organizations do the owners have unlimited personal liabilities for the business's debts?

A) general partnerships

B) S Corporations

C) C Corporations

D) limited liability companies

A) general partnerships

B) S Corporations

C) C Corporations

D) limited liability companies

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

41

The financial statements of a partnership are similar to the statements of a sole proprietorship in all aspects.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

42

Tim and Michelle have decided to form a partnership with a 60/40 partnership interest ratio. Tim contributes $7,500 cash and $1,500 in merchandise inventory. While journalizing this transaction ________.

A) Tim, Capital will be debited for $9,000

B) Tim, Capital will be credited for $9,000

C) Tim, Capital will be credited for $6,000 and Michelle, Capital will be credited for $4,500

D) Tim, Capital will be debited for $6,000 and Michelle, Capital will be debited for $4,500

A) Tim, Capital will be debited for $9,000

B) Tim, Capital will be credited for $9,000

C) Tim, Capital will be credited for $6,000 and Michelle, Capital will be credited for $4,500

D) Tim, Capital will be debited for $6,000 and Michelle, Capital will be debited for $4,500

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

43

Steve owns 64% and Mark owns 36% of a partnership business. They purchase equipment with a suggested value of $9,600. The current market value of the equipment at the time of purchase was $9,100. At the time of the balance sheet preparation, depreciation of $160 was recorded. Based on the information provided, which of the following is true of the partnership balance sheet?

A) The Equipment account will be debited at $9,100 on the date of purchase.

B) The Equipment account will be debited at $8,940 on the date of purchase.

C) The Equipment account will be debited at $9,600 on the date of purchase.

D) The Equipment account will be debited at $9,440 on the date of purchase.

A) The Equipment account will be debited at $9,100 on the date of purchase.

B) The Equipment account will be debited at $8,940 on the date of purchase.

C) The Equipment account will be debited at $9,600 on the date of purchase.

D) The Equipment account will be debited at $9,440 on the date of purchase.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

44

A partnership records the partners' contributions at their ________.

A) current market value

B) historical value

C) net realizable value

D) average value

A) current market value

B) historical value

C) net realizable value

D) average value

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is true of a partnership balance sheet?

A) Unlike a corporation's balance sheet, it includes all income statement account information.

B) It excludes any current liabilities.

C) It reports a separate capital account for each partner.

D) It details the interest expenses of the business.

A) Unlike a corporation's balance sheet, it includes all income statement account information.

B) It excludes any current liabilities.

C) It reports a separate capital account for each partner.

D) It details the interest expenses of the business.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

46

A(n) ________ does not require any permission from the state to be set up.

A) LLC

B) partnership

C) S Corporation

D) C Corporation

A) LLC

B) partnership

C) S Corporation

D) C Corporation

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

47

Edwin and Darren have decided to form a partnership. Edwin contributes $80,000 cash and merchandise inventory with a current market value of $17,000. Darren contributes $2,400 cash and office furniture with a current market value of $3,200. When journalizing this transaction ________.

A) Office Furniture will be debited for $1,070

B) Office Furniture will be credited for $3,200

C) Office Furniture will be debited for $3,200

D) Office Furniture will be credited for $1,070

A) Office Furniture will be debited for $1,070

B) Office Furniture will be credited for $3,200

C) Office Furniture will be debited for $3,200

D) Office Furniture will be credited for $1,070

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

48

An asset received from a partner as a contribution is recorded at its historical cost.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

49

Sasha and Michelle form a partnership. Sasha contributes $13,000 cash and merchandise inventory with a current market value of $3,000. While journalizing this transaction ________.

A) Merchandise Inventory will be credited for $3,000

B) Merchandise Inventory will be debited for $3,000

C) Merchandise Inventory will be credited for $2,200

D) Merchandise Inventory will be debited for $2,200

A) Merchandise Inventory will be credited for $3,000

B) Merchandise Inventory will be debited for $3,000

C) Merchandise Inventory will be credited for $2,200

D) Merchandise Inventory will be debited for $2,200

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

50

Andy and Ian formed a partnership on April 1, 2017. Andy contributes equipment to the business that originally cost $82,000 and on which accumulated depreciation of $16,000 has been recorded. The current market value of the equipment is $74,000. The value of the equipment recorded in the partnership journal is ________.

A) $66,000

B) $74,000

C) $58,000

D) $82,000

A) $66,000

B) $74,000

C) $58,000

D) $82,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

51

In a partnership balance sheet, each partner's assets, liabilities, and equity will be shown separately.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

52

The statement of partners' equity shows the changes in each partner's capital account for a specific period of time.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

53

Rodriguez and Ying start a partnership on July 1, 2017. Rodriguez contributes $4,100 cash, furniture with a current market value of $55,000, and computer equipment. The computer equipment originally cost $48,000 in 2015, with recorded accumulated depreciation of $28,000. The current market value of the computer equipment is $17,000. At what value should the computer equipment be recorded in the accounting records of the partnership?

A) $48,000

B) $17,000

C) $20,000

D) $28,000

A) $48,000

B) $17,000

C) $20,000

D) $28,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

54

In their business partnership, George has an ownership interest of 59% and Ben has an ownership interest of 41%. In the current year, they purchase equipment for $10,100. In order to finance the equipment purchase, George makes a contribution of $7,400 and Ben makes a contribution of $2,700 to the partnership. Based on the information provided, which of the following is true regarding the partnership balance sheet?

A) Both George, Capital and Ben, Capital will increase by $10,100.

B) George, Capital will increase by $7,400 and Ben, Capital will increase by $2,700.

C) George, Capital will increase by $10,100 and Ben, Capital will remain unchanged.

D) George, Capital will increase by $5,959 and Ben, Capital will increase by $4,141.

A) Both George, Capital and Ben, Capital will increase by $10,100.

B) George, Capital will increase by $7,400 and Ben, Capital will increase by $2,700.

C) George, Capital will increase by $10,100 and Ben, Capital will remain unchanged.

D) George, Capital will increase by $5,959 and Ben, Capital will increase by $4,141.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is true of a partnership balance sheet?

A) Each partner's assets will be shown separately.

B) Each partner's liabilities will be shown separately.

C) Each partner's equity will be shown separately.

D) Each partner's assets, liabilities, and equity will be shown separately.

A) Each partner's assets will be shown separately.

B) Each partner's liabilities will be shown separately.

C) Each partner's equity will be shown separately.

D) Each partner's assets, liabilities, and equity will be shown separately.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

56

Jack holds an ownership interest of 63% and Teresa holds an ownership interest of 37% in the J and T Partnership. This year, in order to further develop the business, Jack contributes an additional $6,800 and Teresa contributes an additional $3,200 to the partnership. Which of the following is true of this scenario?

A) Either the total contribution of $10,000 or the contribution in relationship to the ownership interest ratio will be recorded.

B) Only the total contribution of $10,000 will be recorded.

C) Individual contribution of $6,800 by Jack and $3,200 by Teresa will be recorded.

D) 63% of Jack's contribution and 37% of Teresa's contribution will be recorded.

A) Either the total contribution of $10,000 or the contribution in relationship to the ownership interest ratio will be recorded.

B) Only the total contribution of $10,000 will be recorded.

C) Individual contribution of $6,800 by Jack and $3,200 by Teresa will be recorded.

D) 63% of Jack's contribution and 37% of Teresa's contribution will be recorded.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

57

If a partner's capital account is credited with the amount that he or she contributed in cash, which of the following financial statements will be affected?

A) the withdrawal statement

B) the bank reconciliation statement

C) the statement of partners' equity

D) the interest payment schedule

A) the withdrawal statement

B) the bank reconciliation statement

C) the statement of partners' equity

D) the interest payment schedule

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

58

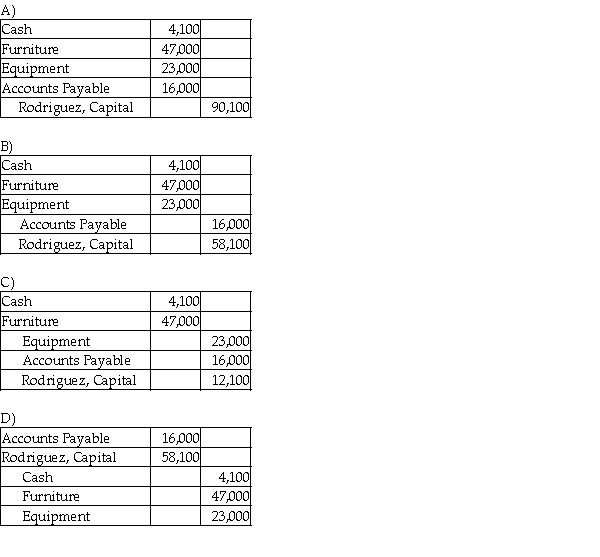

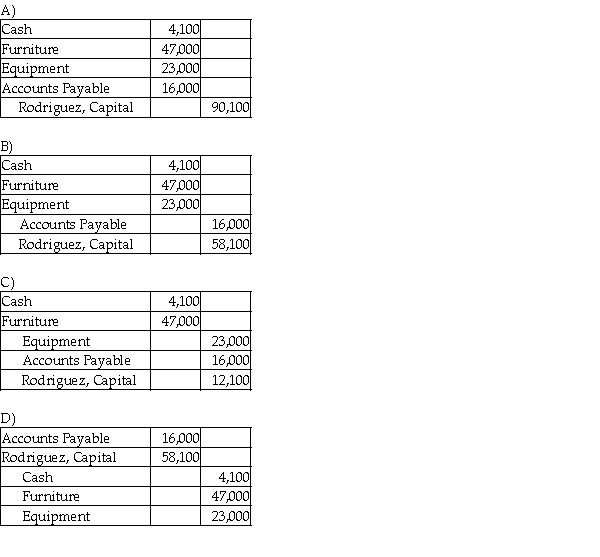

Rodriguez and Ying start a partnership on July 1, 2017. Rodriguez contributes $4,100 cash, furniture with a current market value of $47,000, accounts payables with a current market value of $16,000 and equipment with a current market value of $23,000. Which of the following is the correct journal entry to record Rodriquez's partnership investment?

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

59

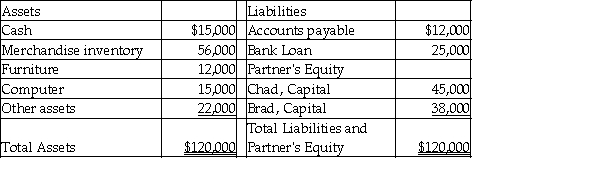

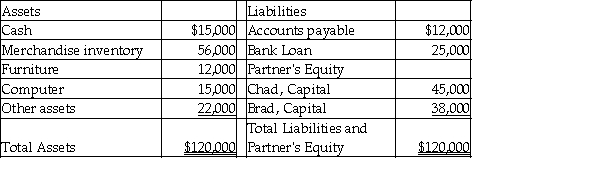

The balance sheet of Incrad Clothes, LLC, as of December 31, 2017 is presented below.  Which of the following statements is true regarding Incrad's balance sheet?

Which of the following statements is true regarding Incrad's balance sheet?

A) The computer was purchased at a cost less than $15,000.

B) The bank loan of $25,000 should be considered part of the Partner's Equity.

C) Brad and Chad have limited liabilities for the partnership's debts because it is a limited liability company.

D) The current market value of the furniture is $12,000.

Which of the following statements is true regarding Incrad's balance sheet?

Which of the following statements is true regarding Incrad's balance sheet?A) The computer was purchased at a cost less than $15,000.

B) The bank loan of $25,000 should be considered part of the Partner's Equity.

C) Brad and Chad have limited liabilities for the partnership's debts because it is a limited liability company.

D) The current market value of the furniture is $12,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

60

Profits and losses in a partnership must be shared based on each partner's capital balances.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

61

Albert, Billy, and Cathy share profits and losses of their partnership in a 1:6:3, ratio respectively. If the net income is $60,000, calculate Billy's share of the profits.

A) $12,000

B) $18,000

C) $36,000

D) $6,000

A) $12,000

B) $18,000

C) $36,000

D) $6,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

62

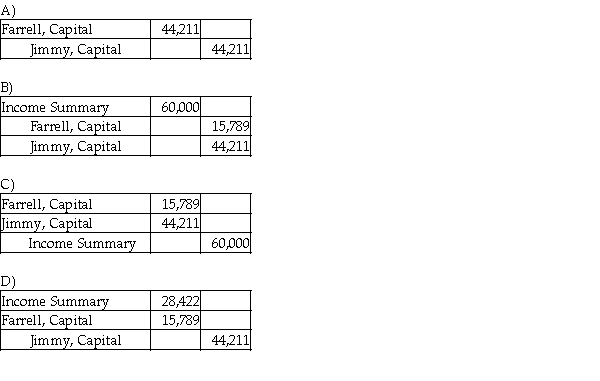

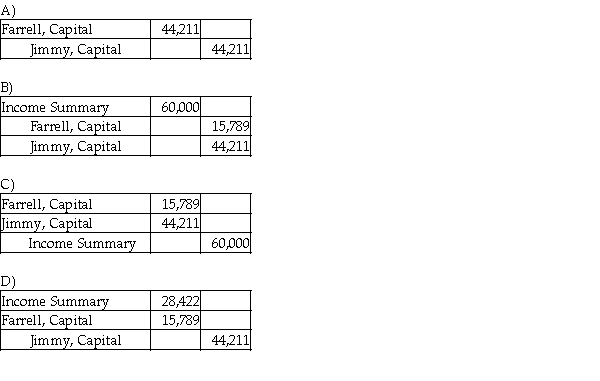

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimmy contributes $140,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2017 is $60,000. Which of the following is the correct journal entry to record the allocation of profit?

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

63

Andre, Beau, and Caroline share profits and losses of their partnership in a 3:3:7 ratio respectively. If the net income is $900,000, calculate Caroline's share of the profits.

A) $207,692

B) $484,615

C) $161,538

D) $69,231

A) $207,692

B) $484,615

C) $161,538

D) $69,231

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

64

David, Chris and John formed a partnership on July 31, 2017. They decided to share profits equally, but inserted a clause in the partnership agreement where any losses would be allocated in the ratio of 4:3:2, respectively. For the year ended December 31, 2017, the firm earned a net income of $47,000. However, for the year ended December 31, 2018, the firm incurred a loss of $65,000. Assuming that John had an initial capital contribution of $36,000 and made no withdrawals, what is the balance of John's Capital account as of December 31, 2018? (Assume that none of the partners made any further contributions to their capital accounts.)

A) $37,222

B) $36,000

C) $51,667

D) $34,778

A) $37,222

B) $36,000

C) $51,667

D) $34,778

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

65

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $30,000 and Jimmy contributes $140,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2017 is $40,000. Which of the following amounts should be credited to Jimmy's capital account?

A) $70,000

B) $40,000

C) $32,941

D) $7,059

A) $70,000

B) $40,000

C) $32,941

D) $7,059

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

66

Alex, Brad, and Carl are partners. The profit and rule sharing rule between them is 4:3:2 in alphabetical order. The partnership incurs a net loss of $120,000. Before preparing the closing journal entry the ________.

A) Income Summary account will have a debit balance of $120,000

B) Alex, Capital account will have a debit balance of $53,333

C) Alex, Capital account will have a credit balance of $53,333

D) Carl, Capital account will have a debit balance of $26,667

A) Income Summary account will have a debit balance of $120,000

B) Alex, Capital account will have a debit balance of $53,333

C) Alex, Capital account will have a credit balance of $53,333

D) Carl, Capital account will have a debit balance of $26,667

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

67

The net income (loss) allocated to each partner should always equal the total net income (loss) of the partnership.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

68

Felix and Ian allocate 2/5 of their partnership's profits and losses to Felix and 3/5 to Ian. The net income of the firm is $20,000. The journal entry to close the Income Summary will include ________.

A) credit to Ian, Capital for $12,000

B) debit to Felix, Capital for $12,000

C) debit to Felix, Capital for $8,000

D) credit to Income Summary for $20,000

A) credit to Ian, Capital for $12,000

B) debit to Felix, Capital for $12,000

C) debit to Felix, Capital for $8,000

D) credit to Income Summary for $20,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

69

Adam, Bill, and Charlie are partners. The profit and loss sharing rule between them is 3:6:2, with Bill receiving the largest share and Adam receiving the smallest. The partnership incurs a net loss of $70,000. While closing the Income Summary ________.

A) Income Summary will be debited for $70,000

B) Adam, Capital will be debited for $19,091

C) Adam, Capital will be credited for $38,182

D) Charlie, Capital will be credited for $38,182

A) Income Summary will be debited for $70,000

B) Adam, Capital will be debited for $19,091

C) Adam, Capital will be credited for $38,182

D) Charlie, Capital will be credited for $38,182

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

70

Like a sole proprietorship statement of owner's equity, the statement of partners' equity will show all the partners' capital accounts as one account.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

71

The withdrawal accounts of a partnership are closed at the end of the period, as they are for a sole proprietorship.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is true of partnerships?

A) If the partners have no partnership agreement specifying how to divide profits and losses, then they share profits and losses equally.

B) It is legally required to share the profit and losses equally, irrespective of the partnership agreement.

C) The stated ratio of profit sharing needs to be approved by the SEC.

D) The profit sharing is always based on each partner's capital balances and any losses will be shared equally.

A) If the partners have no partnership agreement specifying how to divide profits and losses, then they share profits and losses equally.

B) It is legally required to share the profit and losses equally, irrespective of the partnership agreement.

C) The stated ratio of profit sharing needs to be approved by the SEC.

D) The profit sharing is always based on each partner's capital balances and any losses will be shared equally.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

73

Keith and Jim formed a partnership, with the partners sharing profits and losses equally. The partnership incurs a net loss of $5,000 for the year. The entry to close the net loss will ________.

A) debit Income Summary by $5,000

B) decrease Keith, Capital by $2,500

C) increase Jim, Capital by $2,500

D) decrease Jim, Capital by $5,000

A) debit Income Summary by $5,000

B) decrease Keith, Capital by $2,500

C) increase Jim, Capital by $2,500

D) decrease Jim, Capital by $5,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

74

Albert, Billy, and Cathy share profits and losses of their partnership as 1:4:3, respectively. If the net income is $30,000, calculate Albert's share of the profits.

A) $7,500

B) $11,250

C) $15,000

D) $3,750

A) $7,500

B) $11,250

C) $15,000

D) $3,750

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

75

Bob and Bill allocate 2/3 of their partnership's profits and losses to Bob and 1/3 to Bill. The net income of the firm is $20,000. The journal entry to close the Income Summary will include ________.

A) credit to Income Summary for $13,333

B) debit to Bob, Capital for $6,667

C) credit to Bob, Capital for $13,333

D) credit to Income Summary for $20,000

A) credit to Income Summary for $13,333

B) debit to Bob, Capital for $6,667

C) credit to Bob, Capital for $13,333

D) credit to Income Summary for $20,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

76

Adam, Bill, and Charlie are partners. The profit and loss sharing rule between them is 2:5:3, with Bill getting the largest share and Adam receiving the smallest. The partnership incurs a net loss of $21,000. While closing the Income Summary ________.

A) Income Summary will be credited for $6,300

B) Adam, Capital will be debited for $6,300

C) Adam, Capital will be credited for $6,300

D) Charlie, Capital will be debited for $6,300

A) Income Summary will be credited for $6,300

B) Adam, Capital will be debited for $6,300

C) Adam, Capital will be credited for $6,300

D) Charlie, Capital will be debited for $6,300

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

77

Steve and Roger allocate 2/3 of their partnership's profits and losses to Steve and 1/3 to Roger. If the net income of the firm is $30,000, calculate the share of Roger's net income.

A) $20,000

B) $10,000

C) $30,000

D) $25,000

A) $20,000

B) $10,000

C) $30,000

D) $25,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

78

If the partnership agreement specifies a method for sharing profits but not losses, then losses are shared the same way as profits.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

79

Dana and Emile allocate 2/3 of their partnership's profits and losses to Dana and 1/3 to Emile. The net income of the firm is $40,000. The journal entry to close the Income Summary will include a ________.

A) credit to Income Summary for $26,667

B) debit to Dana, Capital for $13,333

C) credit to Emile, Capital for $26,667

D) debit to Income Summary for $40,000

A) credit to Income Summary for $26,667

B) debit to Dana, Capital for $13,333

C) credit to Emile, Capital for $26,667

D) debit to Income Summary for $40,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

80

Bill and Bob share profits of their partnership in the ratio of 6:1 respectively. If the net income of the firm is $29,000, calculate the share of Bill's net income.

A) $20,714

B) $4,143

C) $29,000

D) $24,857

A) $20,714

B) $4,143

C) $29,000

D) $24,857

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck