Deck 1: Accounting and the Business Environment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/197

Play

Full screen (f)

Deck 1: Accounting and the Business Environment

1

The primary objective of financial reporting is to provide information useful for making investment and lending decisions.

True

2

Business owners use accounting information to set goals, evaluate progress toward those goals, and make adjustments when needed.

True

3

Any person or business to whom a business owes money is called the business's creditor.

True

4

Managerial accounting focuses on information for external decision makers.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

5

The field of accounting that focuses on providing information for internal decision makers is ________.

A) managerial accounting

B) financial accounting

C) nonmonetary accounting

D) governmental accounting

A) managerial accounting

B) financial accounting

C) nonmonetary accounting

D) governmental accounting

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

6

Accounting is the information system that measures business activities, processes the information into reports, and communicates the results to decision makers.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

7

Financial accounting focuses on information for decision makers outside of the business, such as creditors and taxing authorities.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

8

Different users of accounting information focus on the information they need to make the best choices.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

9

Critical thinking and judgment skills are not necessary for accountants because technology has made the activities routine.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

10

The field of accounting that focuses on providing information for external decision makers is ________.

A) managerial accounting

B) financial accounting

C) cost accounting

D) nonmonetary accounting

A) managerial accounting

B) financial accounting

C) cost accounting

D) nonmonetary accounting

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

11

A creditor is any person who has an ownership interest in a business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

12

Outside investors would ordinarily use managerial accounting information to decide whether or not to invest in a business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

13

Accounting is referred to as the language of business because it is the method of communicating business information to decision makers.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

14

A creditor is a person who owes money to the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

15

Managerial accounting provides information to ________.

A) internal decision makers

B) outside investors and lenders

C) creditors

D) taxing authorities

A) internal decision makers

B) outside investors and lenders

C) creditors

D) taxing authorities

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

16

Accounting starts with economic activities that accountants review and evaluate using critical thinking and judgment to create useful information that helps individuals make good decisions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an external user of a business's financial information?

A) customers

B) cost accountant

C) company manager

D) the board of directors

A) customers

B) cost accountant

C) company manager

D) the board of directors

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following users would rely on managerial accounting information for decision-making purposes?

A) potential investors

B) creditors

C) customers

D) company managers

A) potential investors

B) creditors

C) customers

D) company managers

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

19

Local, state, and federal governments use accounting information to calculate income taxes.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

20

Investors primarily use managerial accounting information for decision-making purposes.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

21

Certified Public Accountants are licensed professional accountants who serve the general public.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

22

The Financial Accounting Standards Board is a U.S. governmental agency that oversees the creation and governance of accounting standards.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

23

As per the economic entity assumption, an organization and its owners should be seen as the same entity.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

24

In a sole proprietorship, the owner is personally liable for the debts of the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

25

GAAP refer to guidelines for accounting information in the United States. The acronym GAAP in this statement refers to ________.

A) Globally Accepted and Accurate Policies

B) Global Accommodation Accounting Principles

C) Generally Accredited Accounting Policies

D) Generally Accepted Accounting Principles

A) Globally Accepted and Accurate Policies

B) Global Accommodation Accounting Principles

C) Generally Accredited Accounting Policies

D) Generally Accepted Accounting Principles

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

26

The most that the owner of a sole proprietorship can lose, as a result of business debts or lawsuits, is the amount he/she has invested in the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

27

The formation of a partnership firm requires a minimum of ________.

A) four partners

B) three partners

C) one partner

D) two partners

A) four partners

B) three partners

C) one partner

D) two partners

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following organizations is responsible for the creation and governance of accounting standards in the United States?

A) Financial Accounting Standards Board

B) Institute of Management Accountants

C) American Institute of Certified Public Accountants

D) Securities and Exchange Commission

A) Financial Accounting Standards Board

B) Institute of Management Accountants

C) American Institute of Certified Public Accountants

D) Securities and Exchange Commission

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

29

The guidelines for accounting information are called Generally Accepted Accounting Principles (GAAP).

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

30

A corporation pays income taxes on its earnings.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

31

A business can be organized as a sole proprietorship, partnership, corporation, or limited-liability company (LLC).

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

32

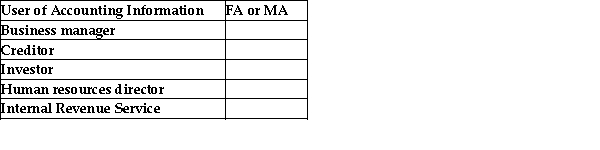

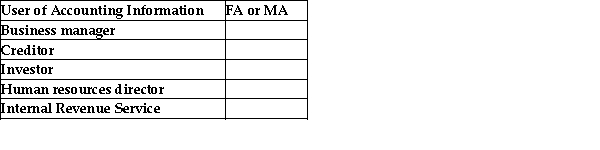

For each user of accounting information, identify if the user would use financial accounting (FA) or managerial accounting (MA).

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

33

________ are professional accountants who serve the general public, not one particular company.

A) Certified public accountants

B) Certified financial accountants

C) Audit accountants

D) Controllers

A) Certified public accountants

B) Certified financial accountants

C) Audit accountants

D) Controllers

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

34

A partnership is not taxed. Instead individual partners pay taxes on their share of the earnings.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

35

Members of a limited-liability company (LLC) are not personally liable for the debts of the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

36

Financial analysts perform reviews of companies to ensure compliance to rules and regulations.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

37

In a corporation, the stockholders are personally liable for the debts of the company.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

38

What are Generally Accepted Accounting Principles (GAAP)? Which entity is currently responsible for determining GAAP?

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

39

In a limited-liability company (LLC), the members are personally liable for the debts of the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a major reason why corporate ownership is popular in the United States?

A) Stockholders have limited liability for the debts of the corporation.

B) Most corporations are small- or medium-sized.

C) The life of a corporation is limited by the death of the owner.

D) A corporation is usually managed by the owners.

A) Stockholders have limited liability for the debts of the corporation.

B) Most corporations are small- or medium-sized.

C) The life of a corporation is limited by the death of the owner.

D) A corporation is usually managed by the owners.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

41

Caleb Brown has been the sole owner of a bicycle sales and repair shop for several years. Which of the following business types would limit Caleb's personal liability exposure to the entity's debts?

A) partnership

B) limited-liability company

C) sole proprietorship

D) limited-liability partnership

A) partnership

B) limited-liability company

C) sole proprietorship

D) limited-liability partnership

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

42

David has decided to open an auto-detailing business. He will pick up an automobile from the client, take it to his parents' garage, detail it, and return it to the client. If he does all of the work himself and takes no legal steps to form a special organization, which type of business organization, in effect, has he chosen?

A) a limited-liability company

B) a partnership

C) a corporation

D) a sole proprietorship

A) a limited-liability company

B) a partnership

C) a corporation

D) a sole proprietorship

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

43

Johnson Company purchased land for $70,000. The president of Johnson Company believes that the land is actually worth $75,000. The land can be recorded at $75,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

44

Since cost is a reliable measure, the cost principle holds that the accounting records should continue reporting an asset at its historical cost over its useful life.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is a characteristic of a corporation?

A) A corporation is owned by stockholders.

B) Lenders of a corporation do not have the right to claim the corporation's assets to satisfy their obligations.

C) All shares of a corporation must be held by a single individual.

D) Each stockholder has the authority to commit the corporation to a binding contract through his/her actions.

A) A corporation is owned by stockholders.

B) Lenders of a corporation do not have the right to claim the corporation's assets to satisfy their obligations.

C) All shares of a corporation must be held by a single individual.

D) Each stockholder has the authority to commit the corporation to a binding contract through his/her actions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is true of a sole proprietorship?

A) A sole proprietorship joins two or more individuals as co-owners.

B) The sole proprietor is personally liable for the liabilities of the business.

C) A sole proprietorship is taxed separately from the owner.

D) A sole proprietorship has to pay business income taxes.

A) A sole proprietorship joins two or more individuals as co-owners.

B) The sole proprietor is personally liable for the liabilities of the business.

C) A sole proprietorship is taxed separately from the owner.

D) A sole proprietorship has to pay business income taxes.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is true of a corporation?

A) Corporations pay the same variety of taxes as other forms of business.

B) Although a corporation is a separate legal entity, it cannot be sued.

C) Any stockholder of a corporation can commit the corporation to a binding contract.

D) The owners of a corporation are called stockholders.

A) Corporations pay the same variety of taxes as other forms of business.

B) Although a corporation is a separate legal entity, it cannot be sued.

C) Any stockholder of a corporation can commit the corporation to a binding contract.

D) The owners of a corporation are called stockholders.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

48

Corporations pay their own income tax on corporate income. Stockholders pay personal income tax on the dividends received from corporations. This is an example of ________.

A) double taxation

B) indefinite life

C) personal liability

D) a limited-liability company

A) double taxation

B) indefinite life

C) personal liability

D) a limited-liability company

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is a characteristic of a limited-liability company (LLC)?

A) An LLC's life is terminated at any member's choice or death.

B) Each member of an LLC is liable only for his or her own actions.

C) An LLC must have more than five members.

D) The income of members from an LLC is not taxed.

A) An LLC's life is terminated at any member's choice or death.

B) Each member of an LLC is liable only for his or her own actions.

C) An LLC must have more than five members.

D) The income of members from an LLC is not taxed.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

50

Lorna Smith decided to start her own CPA practice as a professional corporation, Smith CPA PC. Her corporation purchased an office building for $35,000 that her real estate agent said was worth $50,000 in the current market. The corporation recorded the building as a $50,000 asset because Lorna believes that is the real value of the building. Which of the following concepts or principles of accounting is being violated?

A) cost principle

B) economic entity assumption

C) monetary unit assumption

D) going concern assumption

A) cost principle

B) economic entity assumption

C) monetary unit assumption

D) going concern assumption

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

51

Thirty years ago, Star Grocer Corporation purchased a building for its grocery store for $30,000. Based on inflation estimates, the amount of the building has been adjusted in the accounting records. The building is now reported at $75,000 in Star Grocer's financial statements. Which of the following concepts or principles of accounting is being violated?

A) going concern assumption

B) revenue realization concept

C) economic entity assumption

D) cost principle

A) going concern assumption

B) revenue realization concept

C) economic entity assumption

D) cost principle

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

52

The sole proprietorship form of business ________.

A) enjoys an indefinite life

B) has limited liability for the business's debts

C) is a common form of organization for small businesses

D) is a separate taxable entity from its owner

A) enjoys an indefinite life

B) has limited liability for the business's debts

C) is a common form of organization for small businesses

D) is a separate taxable entity from its owner

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

53

A corporation has which of the following sets of characteristics?

A) subject to personal liability, not a separate taxable entity, terminates at the stockholder's death

B) not taxed, two or more owners, an alternative organizational form to partnerships

C) taxed on earnings, subject to personal liability, used primarily by professional organizations

D) one or more stockholders, indefinite life, no personal liability

A) subject to personal liability, not a separate taxable entity, terminates at the stockholder's death

B) not taxed, two or more owners, an alternative organizational form to partnerships

C) taxed on earnings, subject to personal liability, used primarily by professional organizations

D) one or more stockholders, indefinite life, no personal liability

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

54

According to the ________, acquired assets should be recorded at the amount actually paid rather than at the estimated market value.

A) going concern assumption

B) economic entity concept

C) cost principle

D) monetary unit assumption

A) going concern assumption

B) economic entity concept

C) cost principle

D) monetary unit assumption

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is true of the corporate form of business?

A) A corporation is organized understate law as a separate legal entity.

B) Changes in the ownership of stock has a negative effect on the continuity of the corporation.

C) Any stockholder may commit the corporation to a contract.

D) It is easy for stockholders to lodge an effective protest against management.

A) A corporation is organized understate law as a separate legal entity.

B) Changes in the ownership of stock has a negative effect on the continuity of the corporation.

C) Any stockholder may commit the corporation to a contract.

D) It is easy for stockholders to lodge an effective protest against management.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

56

In a limited-liability company, the ________.

A) members are personally liable to pay the entity's debts

B) business pays income tax on earnings

C) members are liable for each other's actions

D) members pay income tax on their share of earnings

A) members are personally liable to pay the entity's debts

B) business pays income tax on earnings

C) members are liable for each other's actions

D) members pay income tax on their share of earnings

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

57

Ten years ago a corporation purchased a building for $100,000. At that time, the corporation felt that the business was worth $125,000. The current market value of the business is $500,000. The building has been assessed at $475,000 for property tax purposes. At which amount should the corporation record the building in its accounting records?

A) $100,000

B) $125,000

C) $475,000

D) $500,000

A) $100,000

B) $125,000

C) $475,000

D) $500,000

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

58

Joshua Thomas Corporation manufactures and retails computer hardware. The president of the corporation bought a new car as a gift for his daughter and paid for it using cash from the business. Since the corporation paid for the car, it was recorded in its books as an asset. Which of the following concepts or principles of accounting did the corporation violate?

A) monetary unit assumption

B) economic entity assumption

C) cost principle

D) going concern assumption

A) monetary unit assumption

B) economic entity assumption

C) cost principle

D) going concern assumption

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

59

The ultimate control of the corporation rests with the ________.

A) board of directors

B) stockholders

C) chairperson

D) chief operating officer

A) board of directors

B) stockholders

C) chairperson

D) chief operating officer

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

60

The taxable income of a sole proprietorship is ________.

A) combined with the personal income of the proprietor

B) not combined with the proprietor's personal income

C) not taxable

D) handled similarly to that of a corporation

A) combined with the personal income of the proprietor

B) not combined with the proprietor's personal income

C) not taxable

D) handled similarly to that of a corporation

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

61

An examination of a company's financial statements and records is called an audit.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

62

As per the ________, the entity will remain in operation for the foreseeable future.

A) economic entity concept

B) monetary unit assumption

C) going concern assumption

D) cost principle

A) economic entity concept

B) monetary unit assumption

C) going concern assumption

D) cost principle

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

63

The Public Company Accounting Oversight Board (PCAOB) was created ________.

A) by the Sarbanes-Oxley Act (SOX)

B) to perform audits of public companies

C) to make restitution to investors who were defrauded by the issuance of fraudulent financial reports

D) to require auditors to take responsibility for the accuracy and completeness of financial reports

A) by the Sarbanes-Oxley Act (SOX)

B) to perform audits of public companies

C) to make restitution to investors who were defrauded by the issuance of fraudulent financial reports

D) to require auditors to take responsibility for the accuracy and completeness of financial reports

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is the correct accounting equation?

A) Assets + Liabilities = Equity

B) Assets = Liabilities + Equity

C) Assets + Revenues = Equity

D) Assets + Revenues = Liabilities + Expenses

A) Assets + Liabilities = Equity

B) Assets = Liabilities + Equity

C) Assets + Revenues = Equity

D) Assets + Revenues = Liabilities + Expenses

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

65

The Public Company Accounting Oversight Board is a watchdog agency that monitors the work of independent accountants who audit public companies.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

66

A business purchases a building for $250,000. The current market value is $375,000. The assessment value is $325,000. What value should the building be recorded at, and which accounting principle supports your answer?

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements, regarding International Financial Reporting Standards (IFRS), is correct?

A) International Financial Reporting Standards are issued by the Financial Accounting Standards Board.

B) The Securities and Exchange Commission is the private organization that oversees the creation and governance of International Financial Reporting Standards.

C) International Financial Reporting Standards represent a set of global accounting standards that are generally more specific and based less on principle than U.S. Generally Accepted Accounting Principles.

D) Companies who are incorporated in or do significant business in another country might be required to publish financial statements using International Financial Reporting Standards.

A) International Financial Reporting Standards are issued by the Financial Accounting Standards Board.

B) The Securities and Exchange Commission is the private organization that oversees the creation and governance of International Financial Reporting Standards.

C) International Financial Reporting Standards represent a set of global accounting standards that are generally more specific and based less on principle than U.S. Generally Accepted Accounting Principles.

D) Companies who are incorporated in or do significant business in another country might be required to publish financial statements using International Financial Reporting Standards.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

68

Under the going concern principle, accountants must provide proof that the business will remain in operations long enough to use existing resources for their intended purpose.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following organizations requires publicly owned companies to be audited by independent accountants (CPAs)?

A) Securities and Exchange Commission (SEC)

B) Public Company Accounting Oversight Board (PCAOB)

C) Financial Accounting Standards Board (FASB)

D) American Institute of Certified Public Accountants (AICPA)

A) Securities and Exchange Commission (SEC)

B) Public Company Accounting Oversight Board (PCAOB)

C) Financial Accounting Standards Board (FASB)

D) American Institute of Certified Public Accountants (AICPA)

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

70

International Financial Reporting Standards are comparatively more specific and more rule-based than U.S. GAAP.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

71

The left side of the accounting equation measures the amount that the business owes to creditors and to the stockholders.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

72

The total amount of assets a business possesses may or may not be equal to the total of liabilities and equity of the business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

73

Genity Company records business transactions in dollars and disregards changes in the value of a dollar over time. Which of the following accounting assumptions does this represent?

A) economic entity assumption

B) going concern assumption

C) accounting period assumption

D) monetary unit assumption

A) economic entity assumption

B) going concern assumption

C) accounting period assumption

D) monetary unit assumption

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

74

A publicly traded company in the United States does not come under Securities and Exchange Commission regulations as long as it follows the rules of GAAP.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

75

International Financial Reporting Standards (IFRS) is the main U.S. accounting rule book and is currently created and governed by the Financial Accounting Standards Board.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

76

The Sarbanes-Oxley Act (SOX) requires companies to review internal control and take responsibility for the accuracy and completeness of their financial reports.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

77

The equity of Autumn Company is $130,000 and the total liabilities are $40,000. The total assets are ________.

A) $260,000

B) $80,000

C) $90,000

D) $170,000

A) $260,000

B) $80,000

C) $90,000

D) $170,000

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

78

International Financial Reporting Standards ________ U.S. Generally Accepted Accounting Principles.

A) are the same as

B) are generally less specific than

C) are based less on principle than

D) leave less room for professional judgment than

A) are the same as

B) are generally less specific than

C) are based less on principle than

D) leave less room for professional judgment than

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

79

The Sarbanes-Oxley Act (SOX) ________.

A) requires independent accountants to take responsibility for the accuracy and completeness of the financial reports

B) created the SEC

C) ensures that financial scandals will no longer occur

D) requires companies to take responsibility for the accuracy and completeness of their financial reports

A) requires independent accountants to take responsibility for the accuracy and completeness of the financial reports

B) created the SEC

C) ensures that financial scandals will no longer occur

D) requires companies to take responsibility for the accuracy and completeness of their financial reports

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

80

Accountants assume that the dollar's purchasing power is stable.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck