Deck 4: Market Outcomes and Tax Incidence

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/170

Play

Full screen (f)

Deck 4: Market Outcomes and Tax Incidence

1

The difference between the willingness to pay for a good and the amount that is paid to get it is also known as

A) consumer expenditure.

B) surplus spending.

C) consumer benefit.

D) producer profit.

E) consumer surplus.

A) consumer expenditure.

B) surplus spending.

C) consumer benefit.

D) producer profit.

E) consumer surplus.

E

2

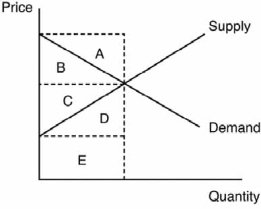

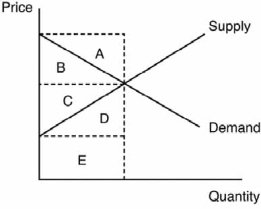

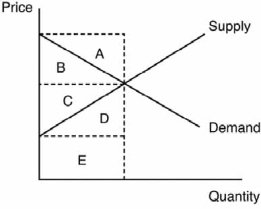

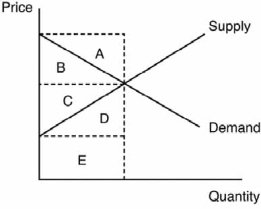

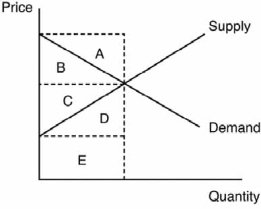

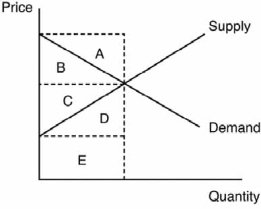

Use the following graph to answer the next questions.

In the figure, which area represents the producer surplus?

A) area A

B) area B

C) area C

D) area D

E) area E

In the figure, which area represents the producer surplus?

A) area A

B) area B

C) area C

D) area D

E) area E

C

3

Use the following graph to answer the next questions.

In the figure, which region represents the consumer surplus?

A) area A

B) area B

C) area C

D) area D

E) area E

In the figure, which region represents the consumer surplus?

A) area A

B) area B

C) area C

D) area D

E) area E

B

4

Use the following graph to answer the next questions.

-In the figure, which combination of areas represents the social welfare?

A) A + D

B) B + C

C) D + E

D) A + B

E) C + D

-In the figure, which combination of areas represents the social welfare?

A) A + D

B) B + C

C) D + E

D) A + B

E) C + D

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

5

All else held constant, an increase in the price of a good would necessarily

A) increase social welfare.

B) decrease producer surplus.

C) decrease consumer surplus.

D) increase consumer surplus.

E) increase the supply of the good.

A) increase social welfare.

B) decrease producer surplus.

C) decrease consumer surplus.

D) increase consumer surplus.

E) increase the supply of the good.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

6

For a given good, a consumer's willingness to pay is, by definition, the

A) same as the seller's willingness to sell.

B) amount of cash the consumer has on hand for purchase of the good.

C) amount the consumer offers at the start of a negotiation.

D) intensity of the consumer's desire for the good.

E) maximum price the consumer would pay for the good.

A) same as the seller's willingness to sell.

B) amount of cash the consumer has on hand for purchase of the good.

C) amount the consumer offers at the start of a negotiation.

D) intensity of the consumer's desire for the good.

E) maximum price the consumer would pay for the good.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

7

The difference between the willingness to sell a good and the price a producer receives is also known as

A) producer profit.

B) producer surplus.

C) consumer waste.

D) tax revenue.

E) producer benefit.

A) producer profit.

B) producer surplus.

C) consumer waste.

D) tax revenue.

E) producer benefit.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

8

Jung is willing to pay $85 for a new jacket that sells for $70. Eddie is willing to pay $65 for that same jacket. What is the total consumer surplus for Jung and Eddie?

A) $30

B) $15

C) $20

D) $25

E) $155

A) $30

B) $15

C) $20

D) $25

E) $155

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

9

Holding all else constant, when the price of a good decreases

A) producer surplus increases.

B) consumer surplus increases.

C) both consumer surplus and producer surplus increase.

D) consumer surplus decreases.

E) both consumer surplus and producer surplus decrease.

A) producer surplus increases.

B) consumer surplus increases.

C) both consumer surplus and producer surplus increase.

D) consumer surplus decreases.

E) both consumer surplus and producer surplus decrease.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

10

Another name for a consumer's willingness to pay is the

A) limiting cost.

B) expense cap.

C) hidden budget.

D) reservation price.

E) maximum outlay.

A) limiting cost.

B) expense cap.

C) hidden budget.

D) reservation price.

E) maximum outlay.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

11

All else held constant, a decrease in the price of a good would necessarily

A) increase social welfare.

B) decrease producer surplus.

C) decrease consumer surplus.

D) increase demand for the good.

E) increase producer surplus.

A) increase social welfare.

B) decrease producer surplus.

C) decrease consumer surplus.

D) increase demand for the good.

E) increase producer surplus.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

12

Producer surplus is the difference between

A) supply and demand.

B) the price the producer receives and the willingness to sell a good.

C) the willingness to pay for a good and the willingness to sell a good.

D) the willingness to pay for a good and the amount that is paid to get it.

E) the price paid for a good and the amount of the good produced.

A) supply and demand.

B) the price the producer receives and the willingness to sell a good.

C) the willingness to pay for a good and the willingness to sell a good.

D) the willingness to pay for a good and the amount that is paid to get it.

E) the price paid for a good and the amount of the good produced.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

13

When the price of a good increases and all else is held constant

A) both consumer surplus and producer surplus decrease.

B) both consumer surplus and producer surplus increase.

C) consumer surplus decreases.

D) producer surplus decreases.

E) producer surplus increases.

A) both consumer surplus and producer surplus decrease.

B) both consumer surplus and producer surplus increase.

C) consumer surplus decreases.

D) producer surplus decreases.

E) producer surplus increases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

14

Priscilla is willing to pay $65 for a new pair of shoes. Pandora is willing to pay $50 for the same shoes. The shoes have a price of $45. What is the total consumer surplus for Priscilla and Pandora?

A) $15

B) $20

C) $5

D) $25

E) $35

A) $15

B) $20

C) $5

D) $25

E) $35

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

15

Holding all else constant, when the price of a good increases

A) consumer surplus increases.

B) producer surplus decreases.

C) both producer surplus and consumer surplus increase.

D) both consumer surplus and producer surplus decrease.

E) consumer surplus decreases.

A) consumer surplus increases.

B) producer surplus decreases.

C) both producer surplus and consumer surplus increase.

D) both consumer surplus and producer surplus decrease.

E) consumer surplus decreases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

16

Consumer surplus is defined as the

A) difference between the willingness to pay for a good and the willingness to sell it.

B) total revenue earned from producing and selling some good.

C) difference between the willingness to pay for a good and the price paid to get it.

D) quantity of units that consumers want to buy at the market price.

E) difference between the price the seller receives and the willingness to sell it.

A) difference between the willingness to pay for a good and the willingness to sell it.

B) total revenue earned from producing and selling some good.

C) difference between the willingness to pay for a good and the price paid to get it.

D) quantity of units that consumers want to buy at the market price.

E) difference between the price the seller receives and the willingness to sell it.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

17

When the price of a good decreases and all else is held constant

A) producer surplus increases.

B) both consumer surplus and producer surplus decrease.

C) both consumer surplus and producer surplus increase.

D) producer surplus decreases.

E) consumer surplus decreases.

A) producer surplus increases.

B) both consumer surplus and producer surplus decrease.

C) both consumer surplus and producer surplus increase.

D) producer surplus decreases.

E) consumer surplus decreases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

18

Producer surplus is defined as the

A) difference between the willingness to pay for a good and the willingness to sell it.

B) difference between the price the seller receives and the willingness to sell it.

C) difference between the willingness to pay for a good and the price paid to get it.

D) quantity of units that consumers want to buy at the market price.

E) total revenue earned from producing and selling some good.

A) difference between the willingness to pay for a good and the willingness to sell it.

B) difference between the price the seller receives and the willingness to sell it.

C) difference between the willingness to pay for a good and the price paid to get it.

D) quantity of units that consumers want to buy at the market price.

E) total revenue earned from producing and selling some good.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

19

Consider the market for socks. The current price of a pair of plain white socks is $5.00. Two consumers, Igor and Samir, are willing to pay $7.25 and $8.00, respectively, for a pair of plain white socks. Two sock manufacturers are willing to sell plain white socks for as little as $4.00 and $4.15 per pair. How much is total consumer surplus in this market?

A) $2.25

B) $3.00

C) $0.75

D) $5.25

E) $15.25

A) $2.25

B) $3.00

C) $0.75

D) $5.25

E) $15.25

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

20

Consumer surplus is the difference between

A) supply and demand.

B) the price the producer receives and the willingness to sell a good.

C) the willingness to pay for a good and the willingness to sell a good.

D) the willingness to pay for a good and the amount that is paid to get it.

E) the price paid for a good and the amount of the good produced.

A) supply and demand.

B) the price the producer receives and the willingness to sell a good.

C) the willingness to pay for a good and the willingness to sell a good.

D) the willingness to pay for a good and the amount that is paid to get it.

E) the price paid for a good and the amount of the good produced.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

21

The price-quantity combination found where the supply and demand curves intersect is a unique combination that is efficient because

A) producers can sell as much as they want.

B) total surplus is maximized.

C) tax revenue is sufficient to pay for government services.

D) consumers can buy as much as they want.

E) new products are being introduced.

A) producers can sell as much as they want.

B) total surplus is maximized.

C) tax revenue is sufficient to pay for government services.

D) consumers can buy as much as they want.

E) new products are being introduced.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is concerned with efficiency rather than equity?

A) It is not fair to tax the income earned by the wealthy at higher rates than the poor.

B) Excise taxes on tobacco products affect low-income families the most and should be reduced.

C) Our income tax system should be more progressive than it is now.

D) Taxes cause distortions in markets and reduce social welfare.

E) The best type of income tax is a flat tax because it treats everyone the same.

A) It is not fair to tax the income earned by the wealthy at higher rates than the poor.

B) Excise taxes on tobacco products affect low-income families the most and should be reduced.

C) Our income tax system should be more progressive than it is now.

D) Taxes cause distortions in markets and reduce social welfare.

E) The best type of income tax is a flat tax because it treats everyone the same.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

23

Consumer surplus plus producer surplus equals

A) deadweight loss.

B) economic profit.

C) social welfare.

D) tax revenue.

E) market distortions.

A) deadweight loss.

B) economic profit.

C) social welfare.

D) tax revenue.

E) market distortions.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

24

When looking at a supply and demand graph, you would find consumer surplus

A) above the demand curve and below the supply curve.

B) below the demand curve and above market price.

C) to the right of equilibrium quantity and above market price.

D) above the demand curve and above the supply curve.

E) below market price and above the supply curve.

A) above the demand curve and below the supply curve.

B) below the demand curve and above market price.

C) to the right of equilibrium quantity and above market price.

D) above the demand curve and above the supply curve.

E) below market price and above the supply curve.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

25

When looking at a graph, the area above the supply curve and below market price is defined as

A) consumer surplus.

B) producer surplus.

C) producer benefit.

D) business profit.

E) tax revenue.

A) consumer surplus.

B) producer surplus.

C) producer benefit.

D) business profit.

E) tax revenue.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

26

LDT Products, Inc., designs and sells flannel jackets. The company is willing to sell a men's flannel jacket for as little as $45. Its main competitor is MK Outriggers, which is willing to sell the same men's flannel jacket for as little as $40. The current market price of that type of jacket is $57. What is the total producer surplus for the two firms?

A) $95

B) $12

C) $17

D) $29

E) $5

A) $95

B) $12

C) $17

D) $29

E) $5

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

27

Another name for social welfare is

A) total surplus.

B) combined equity.

C) collective good.

D) common benefit.

E) net per-capita gain.

A) total surplus.

B) combined equity.

C) collective good.

D) common benefit.

E) net per-capita gain.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

28

Sammy's Bakery and Presley's Sweetshop both sell cupcakes. The market price of one chocolate cupcake is $2.50. Sammy's is willing to sell a cupcake for as little as $1.65; Presley's is willing to sell a cupcake for as little as $1.75. What is the total producer surplus for the two firms?

A) $0.75

B) $1.60

C) $0.85

D) $2.50

E) $3.40

A) $0.75

B) $1.60

C) $0.85

D) $2.50

E) $3.40

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

29

A market has reached an efficient outcome when

A) producers are able to produce and sell as much as they like.

B) total surplus is minimized.

C) producer surplus is greater than consumer surplus.

D) consumers are able to purchase as much as they like.

E) total surplus is maximized.

A) producers are able to produce and sell as much as they like.

B) total surplus is minimized.

C) producer surplus is greater than consumer surplus.

D) consumers are able to purchase as much as they like.

E) total surplus is maximized.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

30

Social welfare i.e., the sum of producer and consumer surplus) is maximized when

A) the government taxes most goods and services.

B) very few consumers and producers exist within a market.

C) the market reaches its equilibrium price and quantity.

D) supply and demand are perfectly inelastic.

E) the government imposes price controls.

A) the government taxes most goods and services.

B) very few consumers and producers exist within a market.

C) the market reaches its equilibrium price and quantity.

D) supply and demand are perfectly inelastic.

E) the government imposes price controls.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

31

Consider the market for socks. The current price of a pair of plain white socks is $5.00. Two consumers, Jeff and Samir, are willing to pay $7.25 and $8.00, respectively, for a pair of plain white socks. Two sock manufacturers are willing to sell plain white socks for as little as $4.00 and $4.15 per pair. What is the total producer and consumer surplus i.e., social welfare) in this market?

A) $7.10

B) $5.25

C) $1.85

D) $23.40

E) $4.50

A) $7.10

B) $5.25

C) $1.85

D) $23.40

E) $4.50

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is concerned with efficiency rather than equity?

A) Sales taxes on food are regressive and should be eliminated.

B) Income taxes should be raised on low-income families so that everyone pays.

C) The United States should implement a wealth tax on upper-income households.

D) Excise taxes tend to raise prices for consumers.

E) The overall tax system in the United States should be much more progressive.

A) Sales taxes on food are regressive and should be eliminated.

B) Income taxes should be raised on low-income families so that everyone pays.

C) The United States should implement a wealth tax on upper-income households.

D) Excise taxes tend to raise prices for consumers.

E) The overall tax system in the United States should be much more progressive.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

33

When looking at a supply and demand graph, you would find producer surplus

A) above the demand curve and below the supply curve.

B) below the demand curve and above market price.

C) to the right of equilibrium quantity and above market price.

D) above the demand curve and above the supply curve.

E) below market price and above the supply curve.

A) above the demand curve and below the supply curve.

B) below the demand curve and above market price.

C) to the right of equilibrium quantity and above market price.

D) above the demand curve and above the supply curve.

E) below market price and above the supply curve.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

34

What happens to the amount of consumer surplus and producer surplus when the supply of scarves suddenly declines shifts left)?

A) Producer surplus declines and consumer surplus is unchanged.

B) Consumer surplus declines and producer surplus is unchanged.

C) Consumer surplus declines and producer surplus declines.

D) Consumer surplus is unchanged and producer surplus is unchanged.

E) Producer surplus increases and consumer surplus increases.

A) Producer surplus declines and consumer surplus is unchanged.

B) Consumer surplus declines and producer surplus is unchanged.

C) Consumer surplus declines and producer surplus declines.

D) Consumer surplus is unchanged and producer surplus is unchanged.

E) Producer surplus increases and consumer surplus increases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

35

For a given good, a seller's willingness to sell is, by definition, the

A) minimum price the seller would accept for the good.

B) amount of cash the seller needs to cover cash flow requirements.

C) amount the seller asks for at the start of a negotiation.

D) intensity of the seller's personal attachment to the good.

E) same as the consumer's willingness to pay.

A) minimum price the seller would accept for the good.

B) amount of cash the seller needs to cover cash flow requirements.

C) amount the seller asks for at the start of a negotiation.

D) intensity of the seller's personal attachment to the good.

E) same as the consumer's willingness to pay.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

36

Questions about the equity of a tax are concerned mostly with

A) efficiency.

B) tax revenue.

C) fairness.

D) deadweight loss.

E) elasticity.

A) efficiency.

B) tax revenue.

C) fairness.

D) deadweight loss.

E) elasticity.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

37

When looking at a graph, the area under the demand curve and above market price is defined as

A) tax revenue.

B) spending surplus.

C) consumer benefit.

D) producer surplus.

E) consumer surplus.

A) tax revenue.

B) spending surplus.

C) consumer benefit.

D) producer surplus.

E) consumer surplus.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

38

Producer surplus is depicted by the area

A) above market price and below the supply curve.

B) between the supply curve and the demand curve.

C) below market price and above the supply curve.

D) above market price and below the demand curve.

E) above the demand curve and below the supply curve.

A) above market price and below the supply curve.

B) between the supply curve and the demand curve.

C) below market price and above the supply curve.

D) above market price and below the demand curve.

E) above the demand curve and below the supply curve.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

39

Social welfare is measured as the sum of

A) tax revenue and deadweight loss.

B) deadweight loss and consumer surplus.

C) producer surplus and tax revenue.

D) consumer surplus and tax revenue.

E) consumer surplus and producer surplus.

A) tax revenue and deadweight loss.

B) deadweight loss and consumer surplus.

C) producer surplus and tax revenue.

D) consumer surplus and tax revenue.

E) consumer surplus and producer surplus.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

40

Consider the market for socks. The current price of a pair of plain white socks is $5.00. Two consumers, Igor and Samir, are willing to pay $7.25 and $8.00, respectively, for a pair of plain white socks. Two sock manufacturers are willing to sell plain white socks for as little as $4.00 and $4.15 per pair. What is the total producer surplus in this market?

A) $0.15

B) $8.15

C) $0.85

D) $1.00

E) $1.85

A) $0.15

B) $8.15

C) $0.85

D) $1.00

E) $1.85

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

A tax on apples would cause apple growers to suffer because

A) consumer surplus would decrease.

B) the government would collect revenue from the tax.

C) consumers would pay higher prices.

D) producer surplus would increase.

E) revenues and profits from growing apples would decrease.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

A tax on apples would cause apple growers to suffer because

A) consumer surplus would decrease.

B) the government would collect revenue from the tax.

C) consumers would pay higher prices.

D) producer surplus would increase.

E) revenues and profits from growing apples would decrease.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus i.e., social welfare) in this market after the tax is imposed?

A) A + B + C + E + F + G

B) A + E

C) A + B + C + E

D) F + G

E) B + C + F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus i.e., social welfare) in this market after the tax is imposed?

A) A + B + C + E + F + G

B) A + E

C) A + B + C + E

D) F + G

E) B + C + F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

Which party is responsible for paying this tax out of pocket?

A) consumers

B) producers

C) both consumers and producers

D) some consumers and some producers, but not all consumers and producers

E) some consumers and no producers

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

Which party is responsible for paying this tax out of pocket?

A) consumers

B) producers

C) both consumers and producers

D) some consumers and some producers, but not all consumers and producers

E) some consumers and no producers

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-A tax on consumers would cause the______ curve(s) to shift to the ______.

A) demand; right

B) supply; left

C) supply and demand; left

D) supply and demand; right

E) demand; left

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-A tax on consumers would cause the______ curve(s) to shift to the ______.

A) demand; right

B) supply; left

C) supply and demand; left

D) supply and demand; right

E) demand; left

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the amount of consumer surplus lost due to the tax?

A) A + F

B) B + C

C) A

D) A + B + F

E) B + F

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the amount of consumer surplus lost due to the tax?

A) A + F

B) B + C

C) A

D) A + B + F

E) B + F

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the revenue collected from this tax?

A) A + B + F

B) B + C

C) F + G

D) E

E) A + E

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the revenue collected from this tax?

A) A + B + F

B) B + C

C) F + G

D) E

E) A + E

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the total cost to society, in terms of lost social welfare, created as a result of the tax?

A) B + C + F + G

B) A + B + F

C) C + E + G

D) A + B + C + E

E) F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the total cost to society, in terms of lost social welfare, created as a result of the tax?

A) B + C + F + G

B) A + B + F

C) C + E + G

D) A + B + C + E

E) F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the amount of producer surplus lost due to the tax?

A) G

B) A + B + C + E

C) C

D) C + G

E) B + F

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the amount of producer surplus lost due to the tax?

A) G

B) A + B + C + E

C) C

D) C + G

E) B + F

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

It is said that taxes drive a wedge between prices. This statement is true because taxes cause

A) both consumer and producer prices to increase.

B) the consumer price to increase but leave producer prices unchanged.

C) both consumer and producer prices to decrease.

D) the consumer price to decrease and the producer price to increase.

E) the consumer price to increase and the producer price to decrease.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

It is said that taxes drive a wedge between prices. This statement is true because taxes cause

A) both consumer and producer prices to increase.

B) the consumer price to increase but leave producer prices unchanged.

C) both consumer and producer prices to decrease.

D) the consumer price to decrease and the producer price to increase.

E) the consumer price to increase and the producer price to decrease.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

50

A tax on apples would cause consumers to suffer because

A) consumer surplus would increase.

B) the price of apples would increase and fewer apples would be purchased.

C) revenues for apple growers would decrease.

D) the government would collect revenue from the tax.

E) producer surplus would decrease.

A) consumer surplus would increase.

B) the price of apples would increase and fewer apples would be purchased.

C) revenues for apple growers would decrease.

D) the government would collect revenue from the tax.

E) producer surplus would decrease.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the deadweight loss created as a result of the tax?

A) A + B + C + E + F + G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the deadweight loss created as a result of the tax?

A) A + B + C + E + F + G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

52

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

The difference between the price consumers pay and the price sellers receive after a tax is imposed is equal to the

A) loss of social welfare from the tax.

B) dollar amount of the tax.

C) deadweight loss from the tax.

D) revenue from the tax.

E) lost profit from the tax.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

The difference between the price consumers pay and the price sellers receive after a tax is imposed is equal to the

A) loss of social welfare from the tax.

B) dollar amount of the tax.

C) deadweight loss from the tax.

D) revenue from the tax.

E) lost profit from the tax.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

53

"When a good is divided up, it is important that everyone get an equal share." This statement emphasizes

A) maximum surplus.

B) efficiency.

C) aggregation.

D) equity.

E) total welfare.

A) maximum surplus.

B) efficiency.

C) aggregation.

D) equity.

E) total welfare.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent consumer surplus before the tax is imposed?

A) A + B + F

B) A

C) C + G + E

D) B + C

E) F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent consumer surplus before the tax is imposed?

A) A + B + F

B) A

C) C + G + E

D) B + C

E) F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is concerned with equity rather than efficiency?

A) Imposing a tax on a good reduces the incentive to buy that good.

B) The burden of a new sales tax typically increases prices.

C) Deadweight loss is the lost social welfare from a tax.

D) Tax rates on middle-class households are too high and should be reduced.

E) Taxes cause producers and consumers to lose surplus.

A) Imposing a tax on a good reduces the incentive to buy that good.

B) The burden of a new sales tax typically increases prices.

C) Deadweight loss is the lost social welfare from a tax.

D) Tax rates on middle-class households are too high and should be reduced.

E) Taxes cause producers and consumers to lose surplus.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

In most cases, taxes reduce economic efficiency because

A) they lower prices for consumers and cause firms to suffer.

B) they increase firms' profits at the expense of consumers.

C) taxes are perceived as unfair by some taxpayers.

D) the government often spends tax revenues on programs that some voters don't like.

E) they reduce consumer surplus and producer surplus.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

In most cases, taxes reduce economic efficiency because

A) they lower prices for consumers and cause firms to suffer.

B) they increase firms' profits at the expense of consumers.

C) taxes are perceived as unfair by some taxpayers.

D) the government often spends tax revenues on programs that some voters don't like.

E) they reduce consumer surplus and producer surplus.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

57

"When a good is divided up, it is important that none of the good go to waste." This statement emphasizes

A) fairness.

B) zero surplus.

C) efficiency.

D) equity.

E) equal welfare.

A) fairness.

B) zero surplus.

C) efficiency.

D) equity.

E) equal welfare.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus i.e., social welfare) in this market before the tax is imposed?

A) A + B + C + E + F+ G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus i.e., social welfare) in this market before the tax is imposed?

A) A + B + C + E + F+ G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is concerned with equity rather than efficiency?

A) Almost all taxes create some amount of deadweight loss.

B) Excise taxes tend to raise prices for consumers and reduce sales for firms.

C) Tax rates on the wealthy are too low and should be raised.

D) The incidence of a tax does not depend on who actually pays it.

E) Taxes generate revenues that governments spend on services.

A) Almost all taxes create some amount of deadweight loss.

B) Excise taxes tend to raise prices for consumers and reduce sales for firms.

C) Tax rates on the wealthy are too low and should be raised.

D) The incidence of a tax does not depend on who actually pays it.

E) Taxes generate revenues that governments spend on services.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information to answer the next questions.

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the total lost consumer and producer surplus i.e., social welfare) as a result of the tax?

A) A + B + C + E + F + G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

The following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent the total lost consumer and producer surplus i.e., social welfare) as a result of the tax?

A) A + B + C + E + F + G

B) A + C

C) A + B + C + E

D) F + G

E) B + C + F + G

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

61

If a tax causes the supply curve to shift, we know that the tax is paid out of pocket by

A) consumers.

B) producers.

C) the government.

D) both producers and consumers.

E) consumer, producers, and the government.

A) consumers.

B) producers.

C) the government.

D) both producers and consumers.

E) consumer, producers, and the government.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

62

A tax that is applied to one specific good or service is (an)_______ tax.

A) sales

B) general local option sales

C) property

D) excise

E) wealth

A) sales

B) general local option sales

C) property

D) excise

E) wealth

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

63

When a tax is imposed, consumer surplus and producer surplus are reallocated to

A) social welfare.

B) tax revenue and deadweight loss.

C) tax revenue.

D) deadweight loss.

E) government spending on public services.

A) social welfare.

B) tax revenue and deadweight loss.

C) tax revenue.

D) deadweight loss.

E) government spending on public services.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

64

When a tax is imposed on some good, what happens to the amount of the good bought and sold?

A) It increases.

B) It decreases.

C) It decreases, but only if the tax is imposed on producers.

D) It decreases, but only if the tax is imposed on consumers.

E) It increases, but only if the tax is imposed on consumers.

A) It increases.

B) It decreases.

C) It decreases, but only if the tax is imposed on producers.

D) It decreases, but only if the tax is imposed on consumers.

E) It increases, but only if the tax is imposed on consumers.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

65

Taxes will almost always cause consumer prices to increase. How much they increase depends on

A) how often the government collects the tax.

B) the amount of the tax.

C) who pays the tax out of pocket.

D) who is legally obligated to pay the tax.

E) the elasticities of supply and demand.

A) how often the government collects the tax.

B) the amount of the tax.

C) who pays the tax out of pocket.

D) who is legally obligated to pay the tax.

E) the elasticities of supply and demand.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

66

When a tax is imposed on some good, what usually happens to consumer and producer surplus?

A) They both increase.

B) They both fall to zero.

C) They both decrease.

D) Consumer surplus increases and producer surplus decreases.

E) Consumer surplus decreases and producer surplus increases.

A) They both increase.

B) They both fall to zero.

C) They both decrease.

D) Consumer surplus increases and producer surplus decreases.

E) Consumer surplus decreases and producer surplus increases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

67

A tax on milk would likely cause a decrease in the

A) price consumers pay for milk.

B) price of products made from milk.

C) amount of milk sold.

D) revenues from the milk tax.

E) deadweight loss from the milk tax.

A) price consumers pay for milk.

B) price of products made from milk.

C) amount of milk sold.

D) revenues from the milk tax.

E) deadweight loss from the milk tax.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

68

The incidence of a tax reflects

A) who pays the tax out of pocket.

B) how much tax revenue the tax generates.

C) who bears the burden of the tax.

D) how the tax revenue from the tax is spent.

E) government efficiency in providing goods and services.

A) who pays the tax out of pocket.

B) how much tax revenue the tax generates.

C) who bears the burden of the tax.

D) how the tax revenue from the tax is spent.

E) government efficiency in providing goods and services.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

69

A tax on milk would likely cause an increase in the

A) price consumers pay for milk.

B) price producers receive for milk.

C) amount of milk sold.

D) revenues earned from selling milk.

E) profits earned by selling milk.

A) price consumers pay for milk.

B) price producers receive for milk.

C) amount of milk sold.

D) revenues earned from selling milk.

E) profits earned by selling milk.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

70

Taxes almost always cause producer prices to decrease. How much they decrease depends on

A) the elasticities of supply and demand.

B) the amount of the tax.

C) who is legally obligated to pay the tax.

D) who pays the tax out of pocket.

E) how often the government collects the tax.

A) the elasticities of supply and demand.

B) the amount of the tax.

C) who is legally obligated to pay the tax.

D) who pays the tax out of pocket.

E) how often the government collects the tax.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

71

A tax on consumers of a good would shift the ______curve down and cause the price paid by consumers to_____ .

A) supply; increase

B) demand; decrease, then return to its original level

C) supply; decrease

D) demand; increase

E) supply; increase, then return to its original level

A) supply; increase

B) demand; decrease, then return to its original level

C) supply; decrease

D) demand; increase

E) supply; increase, then return to its original level

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

72

A tax on producers would cause the _____curve(s) to shift to the______ .

A) demand; left

B) supply and demand; left

C) supply; left

D) supply; right

E) supply and demand; right

A) demand; left

B) supply and demand; left

C) supply; left

D) supply; right

E) supply and demand; right

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

73

After a tax is imposed, the price paid by consumers _____and the price received by producers _______.

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

E) is unaffected; is unaffected

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

E) is unaffected; is unaffected

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

74

Excise taxes are taxes that are

A) applied to all goods and activities.

B) usually applied to inferior goods.

C) usually applied to income and capital gains.

D) never applied to goods or activities.

E) applied to a particular good or activity.

A) applied to all goods and activities.

B) usually applied to inferior goods.

C) usually applied to income and capital gains.

D) never applied to goods or activities.

E) applied to a particular good or activity.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

75

The incidence of a tax is unrelated to

A) how responsive producers are to the tax.

B) how responsive consumers are to the tax.

C) the elasticity of supply.

D) the elasticity of demand.

E) who pays the tax out of pocket.

A) how responsive producers are to the tax.

B) how responsive consumers are to the tax.

C) the elasticity of supply.

D) the elasticity of demand.

E) who pays the tax out of pocket.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

76

A tax on apples would cause the price paid by consumers to_______ and the price received by producers to ______.

A) increase; increase

B) increase; decrease

C) decrease; increase, then decrease

D) decrease; decrease

E) increase, then decrease; increase

A) increase; increase

B) increase; decrease

C) decrease; increase, then decrease

D) decrease; decrease

E) increase, then decrease; increase

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

77

For any type of tax the government imposes

A) supply plus demand equals market price.

B) tax revenue plus deadweight loss equals total lost social welfare.

C) tax revenue plus market price equals deadweight loss.

D) deadweight loss plus economic distortion equals tax revenue.

E) total lost social welfare plus tax revenue equals deadweight loss.

A) supply plus demand equals market price.

B) tax revenue plus deadweight loss equals total lost social welfare.

C) tax revenue plus market price equals deadweight loss.

D) deadweight loss plus economic distortion equals tax revenue.

E) total lost social welfare plus tax revenue equals deadweight loss.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

78

When a tax is imposed on some good, what tends to happen to consumer prices and producer prices?

A) Consumer prices decrease and producer prices increase.

B) Consumer prices increase and producer prices decrease.

C) Consumer prices increase and producer prices increase.

D) Consumer prices decrease and producer prices decrease.

E) Consumer prices and producer prices converge at the same point.

A) Consumer prices decrease and producer prices increase.

B) Consumer prices increase and producer prices decrease.

C) Consumer prices increase and producer prices increase.

D) Consumer prices decrease and producer prices decrease.

E) Consumer prices and producer prices converge at the same point.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

79

When a tax is imposed on some good, the lost consumer surplus and producer surplus both typically end up as

A) additional revenues for firms.

B) lower prices for consumers.

C) more units of output bought and sold.

D) increased social welfare.

E) tax revenue and deadweight loss.

A) additional revenues for firms.

B) lower prices for consumers.

C) more units of output bought and sold.

D) increased social welfare.

E) tax revenue and deadweight loss.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

80

Excise taxes are popular sources of revenue for governments because

A) they have very high levels of deadweight loss.

B) they are easy to understand.

C) consumers are rarely aware that they are paying them.

D) they are very stable sources of revenue.

E) they require very little paperwork.

A) they have very high levels of deadweight loss.

B) they are easy to understand.

C) consumers are rarely aware that they are paying them.

D) they are very stable sources of revenue.

E) they require very little paperwork.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck