Deck 9: Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

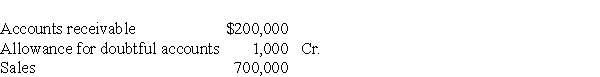

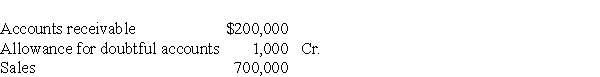

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 9: Receivables

1

The credit department should have no access to cash.

True

2

All of the following duties should be performed by a credit department except:

A)handle cash receipts and payments.

B)review applicant's income and credit history.

C)monitor customer payment records.

D)evaluate customers who apply for credit.

A)handle cash receipts and payments.

B)review applicant's income and credit history.

C)monitor customer payment records.

D)evaluate customers who apply for credit.

A

3

The allowance for doubtful accounts is a contra account to accounts receivable and has a normal credit balance.

True

4

A record that contains the details by customer or vendor of the individual account balances would be called a:

A)control account.

B)subsidiary ledger.

C)journal.

D)liability account.

A)control account.

B)subsidiary ledger.

C)journal.

D)liability account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

One method of establishing control over collections of accounts receivable is to:

A)allow no one but the bookkeeper to handle cash.

B)designate an authorized cheque signer.

C)set up a petty cash fund.

D)establish a bank lock box.

A)allow no one but the bookkeeper to handle cash.

B)designate an authorized cheque signer.

C)set up a petty cash fund.

D)establish a bank lock box.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

Receivables are classified as current assets when they are due within two years.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

Under the allowance method, the recovery of an account previously written off results in an increase in income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

Describe two common events that create receivables and provide the generic names of the two parties involved in a credit transaction.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

Selling on credit creates both a benefit and a cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

Under the allowance method of accounting for uncollectible accounts, the entry to write off an account that is determined to be uncollectible includes a debit to bad-debt expense.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

A bookkeeper should not be allowed to handle cash.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

One method of establishing internal control over receivables is to establish a bank lock box.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

The allowance for doubtful accounts is a contra account to cash.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

Bad-debt expense is a contra asset account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

Under the allowance method, the entry to write off an account that has been deemed uncollectible has an impact on the net income of the firm.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

The percent-of-sales method for estimating uncollectibles is also known as the income statement approach.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

The accounts receivable account in the general ledger serves as a control account because it summarizes the total of the receivables from all customers.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a benefit of selling on credit?

A)Revenues are increased by making sales to a wider range of customers.

B)Expenses are reduced by making sales to a wide range of customers.

C)Some customers do not pay, creating an expense.

D)Cash is received sooner.

A)Revenues are increased by making sales to a wider range of customers.

B)Expenses are reduced by making sales to a wide range of customers.

C)Some customers do not pay, creating an expense.

D)Cash is received sooner.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is included in the category Other receivables?

A)Loans to employees

B)Accounts receivables

C)Notes receivables

D)Investments

A)Loans to employees

B)Accounts receivables

C)Notes receivables

D)Investments

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

A critical element of internal control over collections of accounts receivable is:

A)the separation of cash-handling and cash-accounting duties.

B)setting up a petty cash account.

C)using a cheque-writing machine.

D)depositing the cash from the cash register on a daily basis.

A)the separation of cash-handling and cash-accounting duties.

B)setting up a petty cash account.

C)using a cheque-writing machine.

D)depositing the cash from the cash register on a daily basis.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

Aging-of-accounts receivable and percent-of-accounts receivable are both considered income-statement approaches in estimating uncollectible accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

The balance sheet of Rogers Company reports: accounts receivable (less allowance for doubtful accounts of $25,700), $695,500. Therefore Rogers Company's gross accounts receivable must be $721,200.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

The current credit balance in allowance for doubtful accounts is $1,150. Management estimates that 2% of net credit sales of $100,000 will be uncollectible. Based on the foregoing data, what is the bad-debt expense balance on the income statement?

A)$2,000

B)$850

C)$3,150

D)$2,850

A)$2,000

B)$850

C)$3,150

D)$2,850

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

It is normal to have a debit balance in the allowance for doubtful accounts account after adjusting journal entries at the end of the year.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

The current debit balance in allowance for doubtful accounts is $150. Management estimates that 2% of net credit sales of $100,000 will be uncollectible. Based on the foregoing data, what is the bad-debt expense balance on the income statement?

A)$2,150

B)$1,850

C)$3,150

D)$2,000

A)$2,150

B)$1,850

C)$3,150

D)$2,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

It is possible to have a debit balance in the allowance for doubtful accounts account before adjusting journal entries at the end of the year.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

The balance sheet reports accounts receivable at:

A)lower-of-cost-or-market.

B)historical cost.

C)fair value.

D)market value.

A)lower-of-cost-or-market.

B)historical cost.

C)fair value.

D)market value.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

When using the allowance method, the entry to write off an accounts receivable has no effect on income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

Allowance for doubtful accounts has a credit balance of $900 at the end of the current year (prior to adjustment). An analysis of the aged accounts in the customers' ledger indicates uncollectible accounts of $16,000. The adjusting entry would require a debit to:

A)bad-debt expense for $15,100.

B)bad-debt expense for $16,900.

C)allowance for doubtful accounts for $15,100.

D)allowance for doubtful accounts for $16,900.

A)bad-debt expense for $15,100.

B)bad-debt expense for $16,900.

C)allowance for doubtful accounts for $15,100.

D)allowance for doubtful accounts for $16,900.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

If the allowance method of accounting for doubtful receivables is used, what account is credited in the entry to write off a customer's account as uncollectible?

A)allowance for doubtful accounts

B)accounts receivable

C)bad-debt expense

D)sales returns and allowances

A)allowance for doubtful accounts

B)accounts receivable

C)bad-debt expense

D)sales returns and allowances

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

Allowance for doubtful accounts has a debit balance of $980 at the end of the current year (prior to adjustment). An analysis of the accounts in the customers' ledger indicates uncollectible accounts of $16,000. The adjusting entry would require a credit to:

A)bad-debt expense for $16,980.

B)allowance for doubtful accounts for $16,980.

C)allowance for doubtful accounts for $15,020.

D)accounts receivable accounts for $15,020.

A)bad-debt expense for $16,980.

B)allowance for doubtful accounts for $16,980.

C)allowance for doubtful accounts for $15,020.

D)accounts receivable accounts for $15,020.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

Allowance for doubtful accounts has a debit balance of $980 at the end of the current year (prior to adjustment). Net credit sales for the current period amount to $950,000 and 2.5% is estimated to be uncollectible. The adjusting entry would require a debit to:

A)bad-debt expense for $23,750.

B)allowance for doubtful accounts for $24,730.

C)allowance for doubtful accounts for $22,770.

D)accounts receivable accounts for $23,750.

A)bad-debt expense for $23,750.

B)allowance for doubtful accounts for $24,730.

C)allowance for doubtful accounts for $22,770.

D)accounts receivable accounts for $23,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

The current credit balance in allowance for doubtful accounts is $150. Management estimates that 2.5% of net credit sales of $105,000 will be uncollectible. Based on the foregoing data, what is the bad-debt expense balance on the income statement?

A)$2,775

B)$2,475

C)$2,650

D)$2,625

A)$2,775

B)$2,475

C)$2,650

D)$2,625

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

Allowance for doubtful accounts has a debit balance of $980 at the end of the current year (prior to adjustment). Net credit sales for the current period amount to $900,000 and 2.5% is estimated to be uncollectible. The adjusting entry would require a credit to:

A)bad-debt expense for $23,480.

B)allowance for doubtful accounts for $21,520.

C)allowance for doubtful accounts for $22,500.

D)accounts receivable accounts for $22,500.

A)bad-debt expense for $23,480.

B)allowance for doubtful accounts for $21,520.

C)allowance for doubtful accounts for $22,500.

D)accounts receivable accounts for $22,500.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

Under the income-statement approach (percent-of-sales approach), the entry to accrue bad-debt expense involves:

A)a debit to allowance for doubtful accounts and a credit to bad-debt expense.

B)a debit to bad-debt expense and a credit to allowance for doubtful accounts.

C)a debit to bad-debt expense and a credit to accounts receivable.

D)a debit to allowance for doubtful accounts and a credit to accounts receivable.

A)a debit to allowance for doubtful accounts and a credit to bad-debt expense.

B)a debit to bad-debt expense and a credit to allowance for doubtful accounts.

C)a debit to bad-debt expense and a credit to accounts receivable.

D)a debit to allowance for doubtful accounts and a credit to accounts receivable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

The current debit balance in allowance for doubtful accounts is $465. Management estimates that 3% of net credit sales of $205,000 will be uncollectible. Based on the foregoing data, what is the allowance for doubtful accounts balance on the balance sheet?

A)$6,150

B)$6,615

C)$5,685

D)$465

A)$6,150

B)$6,615

C)$5,685

D)$465

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

Accounts receivable may be presented on the balance sheet without the contra account: allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

Mandy Smith's account was written off last year. She owed City Company $5,000. Using the allowance method, the journal entry to reinstate her account involves:

A)a debit to Smith's account receivable and a credit to bad-debt expense.

B)a debit to allowance for doubtful accounts and a credit to Smith's account receivable.

C)a debit to bad-debt expense and a credit to Smith's account receivable.

D)a debit to Smith's account receivable and a credit to allowance for doubtful accounts.

A)a debit to Smith's account receivable and a credit to bad-debt expense.

B)a debit to allowance for doubtful accounts and a credit to Smith's account receivable.

C)a debit to bad-debt expense and a credit to Smith's account receivable.

D)a debit to Smith's account receivable and a credit to allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

Mandy Smith's account was written off last year. She owed City Company $5,000. Using the allowance method, the journal entry to receive the cash after her account has been reinstated involves:

A)a debit to cash and a credit to Smith's account receivable.

B)a debit to allowance for doubtful accounts and a credit to Smith's account receivable.

C)a debit to cash and a credit to bad-debt expense.

D)a debit to Smith's account receivable and a credit to allowance for doubtful accounts.

A)a debit to cash and a credit to Smith's account receivable.

B)a debit to allowance for doubtful accounts and a credit to Smith's account receivable.

C)a debit to cash and a credit to bad-debt expense.

D)a debit to Smith's account receivable and a credit to allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

You are informed that Warren Hodges, one of your customers, has declared bankruptcy. Hodges has an account with your company with a current balance of $2,300. Using the allowance method, the entry to write off the uncollectible account involves:

A)a debit to allowance for doubtful accounts and a credit to the Hodges's account receivable.

B)a debit to Hodges's account receivable and a credit to bad-debt expense.

C)a debit to bad-debt expense and a credit to Hodges's account receivable.

D)a debit to Hodges's account receivable and a credit to allowance for doubtful accounts.

A)a debit to allowance for doubtful accounts and a credit to the Hodges's account receivable.

B)a debit to Hodges's account receivable and a credit to bad-debt expense.

C)a debit to bad-debt expense and a credit to Hodges's account receivable.

D)a debit to Hodges's account receivable and a credit to allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be aged as follows: 3% for 1-30 days; 5% for 31-60 days; 8% for 61-90 days; and 20% for over 90 days. The adjusting entry to record bad-debt expense for the year is:

A)

B)

C)

D)

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be aged as follows: 3% for 1-30 days; 5% for 31-60 days; 8% for 61-90 days; and 20% for over 90 days. The adjusting entry to record bad-debt expense for the year is:

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be 0.6% of net credit sales. The balance in allowance for doubtful accounts after the adjusting entry for uncollectible accounts will be:

A)$7,880.

B)$4,680.

C)$1,480.

D)$3,200.

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be 0.6% of net credit sales. The balance in allowance for doubtful accounts after the adjusting entry for uncollectible accounts will be:

A)$7,880.

B)$4,680.

C)$1,480.

D)$3,200.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be aged as follows: 2.5% for 1-30 days; 4.5% for 31-60 days; 7.5% for 61-90 days; and 22.5% for over 90 days. After the adjustment for uncollectible accounts is made, the net realizable value of the accounts receivable will be:

A)$157,840.

B)$161,040.

C)$170,000.

D)$164,240.

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be aged as follows: 2.5% for 1-30 days; 4.5% for 31-60 days; 7.5% for 61-90 days; and 22.5% for over 90 days. After the adjustment for uncollectible accounts is made, the net realizable value of the accounts receivable will be:

A)$157,840.

B)$161,040.

C)$170,000.

D)$164,240.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

Under the allowance method, if uncollectible account write-offs during the year exceed the allowance amount, the balance in allowance for doubtful accounts at year end prior to adjustment:

A)will be zero.

B)should be deducted from accounts receivable.

C)will be a debit.

D)should be adjusted by debiting it to bring the balance back to zero.

A)will be zero.

B)should be deducted from accounts receivable.

C)will be a debit.

D)should be adjusted by debiting it to bring the balance back to zero.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

Lester Company uses the allowance method and estimates its bad-debt expense based on aging the receivables. Before the adjusting entry, the allowance for doubtful accounts had a $425 debit balance. Based on aged receivables, Lester estimates that $3,700 will probably prove uncollectible. What is the amount of the adjusting journal entry that Lester should make?

A)$3,700

B)$3,275

C)$4,125

D)$425

A)$3,700

B)$3,275

C)$4,125

D)$425

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

Accounts receivable has a debit balance of $5,000, and the allowance for doubtful accounts has a credit balance of $440. A specific account of $160 is written off. What is the amount of net receivables after the write-off?

A)$4,840

B)$4,400

C)$4,560

D)$5,000

A)$4,840

B)$4,400

C)$4,560

D)$5,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

The current credit balance in allowance for doubtful accounts before adjustment is $658. An aging schedule reveals $3,500 of uncollectible accounts. The ending balance in allowance for doubtful accounts should be:

A)$3,500.

B)$2,842.

C)$4,158.

D)$658.

A)$3,500.

B)$2,842.

C)$4,158.

D)$658.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

Table 9-1

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the percent-of-sales method to be 3% of net credit sales, the bad-debt expense for 2019 would be:

A)$2,850.

B)$3,450.

C)$2,250.

D)$600.

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the percent-of-sales method to be 3% of net credit sales, the bad-debt expense for 2019 would be:

A)$2,850.

B)$3,450.

C)$2,250.

D)$600.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

The allowance for doubtful accounts has a current debit balance of $2,550. Bad-debt expense is estimated to be 3% of net credit sales. If net credit sales were $250,000, which of the following would be part of the adjusting entry for bad-debt expense?

A)Debit allowance for doubtful accounts for $7,500.

B)Credit allowance for doubtful accounts for $4,950.

C)Debit bad-debt expense for $7,500.

D)Debit bad-debt expense for $10,050.

A)Debit allowance for doubtful accounts for $7,500.

B)Credit allowance for doubtful accounts for $4,950.

C)Debit bad-debt expense for $7,500.

D)Debit bad-debt expense for $10,050.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be aged as follows: 2% for 1-30 days; 4% for 31-60 days; 10% for 61-90 days; and 25% for over 90 days. The balance in allowance for doubtful accounts after the adjusting entry for uncollectible accounts will be:

A)$12,280.

B)$6,000.

C)$5,880.

D)$9,220.

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the aging-of-accounts-receivable method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be aged as follows: 2% for 1-30 days; 4% for 31-60 days; 10% for 61-90 days; and 25% for over 90 days. The balance in allowance for doubtful accounts after the adjusting entry for uncollectible accounts will be:

A)$12,280.

B)$6,000.

C)$5,880.

D)$9,220.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be 1.3% of net credit sales. After the adjustment for uncollectible accounts is made, the net realizable value of accounts receivable will be:

A)$156,660.

B)$170,000.

C)$159,860.

D)$163,060.

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Refer to Table 9-5. Assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that bad-debt expense will be 1.3% of net credit sales. After the adjustment for uncollectible accounts is made, the net realizable value of accounts receivable will be:

A)$156,660.

B)$170,000.

C)$159,860.

D)$163,060.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

When a note matures, the payee should record:

A)unearned revenue.

B)interest revenue.

C)interest expense.

D)note expense.

A)unearned revenue.

B)interest revenue.

C)interest expense.

D)note expense.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

Fresh Dairy Company uses the allowance method and estimates uncollectible accounts based on a percent of sales. Net credit sales represent 75% of total sales. Total sales for 2019 were $840,000. Historically, 1/2 of 1% of net credit sales have been uncollectible. At December 31, 2019, the balance in allowance for doubtful accounts is a $120 credit. What is the balance in bad-debt expense after the adjusting entry is made?

A)$3,030

B)$4,200

C)$3,150

D)$3,270

A)$3,030

B)$4,200

C)$3,150

D)$3,270

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

Eyewear Unlimited has accounts receivable of $16,000 and an allowance for doubtful accounts with a credit balance of $1,700 before a specific account of $60 is written off. What were net accounts receivable before and after the write-off?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

The current credit balance in allowance for doubtful accounts before adjustment is $658. An aging schedule reveals $3,500 of uncollectible accounts. The journal entry for estimated uncollectible accounts should be prepared for:

A)$658.

B)$3,500.

C)$4,158.

D)$2,842.

A)$658.

B)$3,500.

C)$4,158.

D)$2,842.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

Using the balance-sheet approach to estimate uncollectibles, accounts that are 90 days old are:

A)more likely to be collected than accounts 30 days old.

B)equally likely to be collected as accounts 360 days old.

C)less likely to be collected than accounts 30 days old.

D)less likely to be collected than accounts 360 days old.

A)more likely to be collected than accounts 30 days old.

B)equally likely to be collected as accounts 360 days old.

C)less likely to be collected than accounts 30 days old.

D)less likely to be collected than accounts 360 days old.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

Table 9-5

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Referring to Table 9-5, assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be 1.75% of net credit sales. The adjusting entry to record bad-debt expense for the year is:

A)

B)

C)

D)

The Ritchie Company gathered the following information pertaining to its year ended December 31, 2019, prior to any adjustments:

Aging of accounts receivable at December 31, 2019:

-Referring to Table 9-5, assume Ritchie uses the percent-of-sales method for estimating uncollectible accounts. Ritchie estimates that uncollectible accounts will be 1.75% of net credit sales. The adjusting entry to record bad-debt expense for the year is:

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

Table 9-1

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the aging of receivables method to be $3,040, the bad-debt expense for 2019 would be:

A)$3,640.

B)$2,440.

C)$3,040.

D)$600.

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the aging of receivables method to be $3,040, the bad-debt expense for 2019 would be:

A)$3,640.

B)$2,440.

C)$3,040.

D)$600.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

Sports Shop reports net accounts receivables on its December 31, 2019, balance sheet at $105,460. The allowance for doubtful accounts has a normal balance of $3,200 after adjustment. What is the ending balance in the accounts receivable account?

A)$102,260

B)$105,460

C)$108,660

D)$99,060

A)$102,260

B)$105,460

C)$108,660

D)$99,060

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

Table 9-1

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the aging of receivables to be $3,450, the amount of net accounts receivable after adjusting entries for 2019 would be:

A)$13,950.

B)$15,150.

C)$17,400.

D)$22,550.

Ringo Company had the following information relating to net credit sales for 2019:

-Referring to Table 9-1, if uncollectible accounts are determined by the aging of receivables to be $3,450, the amount of net accounts receivable after adjusting entries for 2019 would be:

A)$13,950.

B)$15,150.

C)$17,400.

D)$22,550.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

Table 9-11 Mark's Sales

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the bad debts expense?

A)$2,300

B)$5,400

C)$6,400

D)$2,700

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the bad debts expense?

A)$2,300

B)$5,400

C)$6,400

D)$2,700

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

Table 9-10 Armadillo Camera Shop

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the balance of the allowance for uncollectible accounts after adjustment?

A)$7,000

B)$3,450

C)$2,850

D)$2,250

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the balance of the allowance for uncollectible accounts after adjustment?

A)$7,000

B)$3,450

C)$2,850

D)$2,250

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

Table 9-11 Mark's Sales

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the aging method, and calculated an amount of $1,600 as their estimate of uncollectible accounts. At the end of the year, what was the balance in the uncollectible account expense?

A)$2,300

B)$5,400

C)$4,300

D)$2,700

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the aging method, and calculated an amount of $1,600 as their estimate of uncollectible accounts. At the end of the year, what was the balance in the uncollectible account expense?

A)$2,300

B)$5,400

C)$4,300

D)$2,700

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

Table 9-11 Mark's Sales

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the allowance account?

A)$2,300

B)$1,700

C)$6,400

D)$2,700

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the allowance account?

A)$2,300

B)$1,700

C)$6,400

D)$2,700

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

Table 9-10 Armadillo Camera Shop

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the amount of bad debts expense?

A)$7,000

B)$2,250

C)$3,450

D)$2,850

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the amount of bad debts expense?

A)$7,000

B)$2,250

C)$3,450

D)$2,850

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

Table 9-11 Mark's Sales

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the aging method, and calculated an amount of $1,600 as their estimate of uncollectible accounts. At the end of the year, what was the balance in the allowance account?

A)$1,600

B)$1,700

C)$6,400

D)$2,700

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the aging method, and calculated an amount of $1,600 as their estimate of uncollectible accounts. At the end of the year, what was the balance in the allowance account?

A)$1,600

B)$1,700

C)$6,400

D)$2,700

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

Table 9-10 Armadillo Camera Shop

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the balance of the allowance for uncollectible accounts after adjustment?

A)$2,850

B)$3,450

C)$7,000

D)$2,250

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the aging-of-accounts-receivable method. Management estimates that $2,850 of accounts receivable will be uncollectible. Which of the following will be the balance of the allowance for uncollectible accounts after adjustment?

A)$2,850

B)$3,450

C)$7,000

D)$2,250

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

Record entries for the following transactions for Riviera Company. Riviera Company maintains an allowance account.

a)Sold merchandise on account to Carver Company, $2,800.

b)Sold merchandise on account to Gwinett Company, $1,670.

c)Write off both the Carver Company and the Gwinett Company accounts.

d)Carver Company unexpectedly paid off its account in full.

a)Sold merchandise on account to Carver Company, $2,800.

b)Sold merchandise on account to Gwinett Company, $1,670.

c)Write off both the Carver Company and the Gwinett Company accounts.

d)Carver Company unexpectedly paid off its account in full.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

Prepare journal entries for the following independent situations.

a)The allowance for doubtful accounts has a $525 debit balance prior to adjustment. An aging schedule prepared on December 31 reveals uncollectible accounts of $7,600.

b)The allowance for doubtful accounts has a $500 credit balance prior to adjustment. An aging schedule prepared on December 31 reveals uncollectible accounts of $7,800.

c)The allowance for doubtful accounts has a $700 credit balance prior to adjustment. Net credit sales during the year are $260,000 and 4% are estimated to be uncollectible.

d)The allowance for doubtful accounts has a $800 credit balance prior to adjustment. Net credit sales during the year are $270,000 and 3.5% are estimated to be uncollectible receivable.

a)The allowance for doubtful accounts has a $525 debit balance prior to adjustment. An aging schedule prepared on December 31 reveals uncollectible accounts of $7,600.

b)The allowance for doubtful accounts has a $500 credit balance prior to adjustment. An aging schedule prepared on December 31 reveals uncollectible accounts of $7,800.

c)The allowance for doubtful accounts has a $700 credit balance prior to adjustment. Net credit sales during the year are $260,000 and 4% are estimated to be uncollectible.

d)The allowance for doubtful accounts has a $800 credit balance prior to adjustment. Net credit sales during the year are $270,000 and 3.5% are estimated to be uncollectible receivable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

Based on liquidity, which item would appear after accounts receivable in the Current Asset section of the Balance Sheet?

A)inventory

B)cash

C)short-term (marketable)investments

D)Property, Plant, and Equipment

A)inventory

B)cash

C)short-term (marketable)investments

D)Property, Plant, and Equipment

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

Compute the ending balance in the allowance for doubtful accounts after the adjusting entries have been prepared for the following independent situations.

a)Credit balance in allowance for doubtful accounts is $500 before adjustment. An aging schedule indicates $3,500 of accounts receivables are uncollectible.

b)Debit balance in allowance for doubtful accounts is $700 before adjustment. An aging schedule indicates $4,300 of accounts receivables are uncollectible.

c)Credit balance in allowance for doubtful accounts is $500 before adjustment. Net credit sales for the current year are $325,000 and 1% is considered uncollectible.

d)Debit balance in allowance for doubtful accounts is $700 before adjustment. Net credit sales for the current year are $350,000 and 1.25% is considered uncollectible.

a)Credit balance in allowance for doubtful accounts is $500 before adjustment. An aging schedule indicates $3,500 of accounts receivables are uncollectible.

b)Debit balance in allowance for doubtful accounts is $700 before adjustment. An aging schedule indicates $4,300 of accounts receivables are uncollectible.

c)Credit balance in allowance for doubtful accounts is $500 before adjustment. Net credit sales for the current year are $325,000 and 1% is considered uncollectible.

d)Debit balance in allowance for doubtful accounts is $700 before adjustment. Net credit sales for the current year are $350,000 and 1.25% is considered uncollectible.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

Table 9-10 Armadillo Camera Shop

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of bad debts expense?

A)$7,000

B)$3,450

C)$2,250

D)$2,850

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of bad debts expense?

A)$7,000

B)$3,450

C)$2,250

D)$2,850

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

On December 31, 2019, Rainbow Appliances has $275,000 in accounts receivable and an allowance account with a debit balance of $320. Current period net credit sales were $780,000, and cash sales were $68,000.

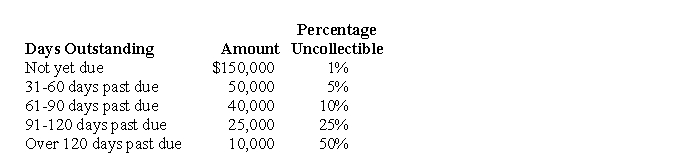

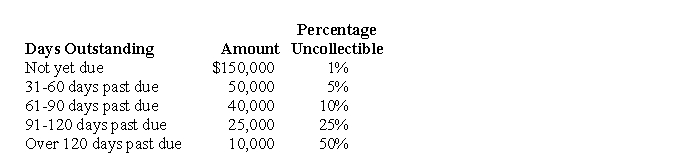

a)Rainbow Appliances performs an aging schedule, and the results are summarized below, along with the appropriate percentages that Rainbow applies to the categories shown. Assuming Rainbow uses the aging approach of accounting for uncollectible accounts, prepare the adjusting entry required at the end of the accounting period.

Assuming Rainbow uses the aging approach of accounting for uncollectible accounts, prepare the adjusting entry required at the end of the accounting period.

b)Assume now Rainbow uses the percent-of-sales method of accounting for uncollectible accounts. If historical data indicate that approximately 3% of net credit sales are uncollectible, what is the amount of bad-debt expense and what is the balance in the allowance for doubtful accounts after adjustment?

a)Rainbow Appliances performs an aging schedule, and the results are summarized below, along with the appropriate percentages that Rainbow applies to the categories shown.

Assuming Rainbow uses the aging approach of accounting for uncollectible accounts, prepare the adjusting entry required at the end of the accounting period.

Assuming Rainbow uses the aging approach of accounting for uncollectible accounts, prepare the adjusting entry required at the end of the accounting period.b)Assume now Rainbow uses the percent-of-sales method of accounting for uncollectible accounts. If historical data indicate that approximately 3% of net credit sales are uncollectible, what is the amount of bad-debt expense and what is the balance in the allowance for doubtful accounts after adjustment?

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

Table 9-11 Mark's Sales

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the accounts receivable?

A)$10,300

B)$3,700

C)$14,000

D)$21,300

At the beginning of 2019, Mark's sales had the following ledger balances:

During the year there were $450,000 of credit sales, $460,000 of collections, and $3,700

of write-offs.

-Refer to Table 9-11. At the end of the year, Mark's adjusted for uncollectible account expense using the percent-of-sales method, and applied a rate, based on past history, of 1.2%. At the end of the year, what was the balance in the accounts receivable?

A)$10,300

B)$3,700

C)$14,000

D)$21,300

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following entries would be used to account for uncollectible receivables using the allowance method?

A)Allowance for uncollectible accounts is debited and Bad debts expense is credited.

B)Bad debts expense is debited and Allowance for uncollectible accounts is credited.

C)Bad debts expense is debited and Accounts receivable is credited.

D)Accounts receivable is debited and Bad debts expense is credited.

A)Allowance for uncollectible accounts is debited and Bad debts expense is credited.

B)Bad debts expense is debited and Allowance for uncollectible accounts is credited.

C)Bad debts expense is debited and Accounts receivable is credited.

D)Accounts receivable is debited and Bad debts expense is credited.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

Table 9-10 Armadillo Camera Shop

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of net accounts receivable after adjustment?

A)$16,550

B)$17,750

C)$17,150

D)$13,000

The following information is from the 2019 records of Armadillo Camera Shop:

-Refer to Table 9-10. Bad debts expense is estimated by the percent-of-sales method. Management estimates that 3% of net credit sales will be uncollectible. Which of the following will be the amount of net accounts receivable after adjustment?

A)$16,550

B)$17,750

C)$17,150

D)$13,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

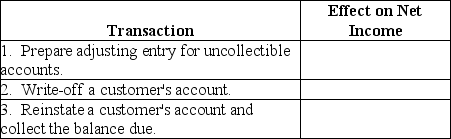

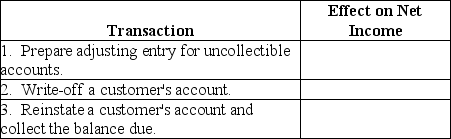

State the effect on net income of each of the following independent transactions. State your answer as: increase, decrease, or no effect.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

Munich Company's total sales for the year amounted to $100,000, of which 60 percent was on credit. The unadjusted trial balance showed accounts receivable of $20,000, and the allowance for doubtful accounts reflected a $800 credit balance (before the write-off of a bad account of $500). Munich uses 3% of accounts receivable as an estimate of bad-debt expense. Calculate the bad-debt expense for the year for Munich Company.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

Compute net accounts receivable for the following independent situations.

a)Accounts receivable has a balance of $16,000. The allowance for doubtful accounts has a credit balance prior to adjustment of $350. An aging schedule prepared on December 31 reveals $1,250 of uncollectible accounts.

b)Accounts receivable has a balance of $17,500. The allowance for doubtful accounts has a debit balance prior to adjustment of $560. An aging schedule prepared on December 31 reveals $1,500 of uncollectible accounts.

c)Accounts receivable has a balance of $15,500. The allowance for doubtful accounts has a debit balance prior to adjustment of $760. Net credit sales for the year are $35,000 and 3.5% of net credit sales are deemed uncollectible.

d)Accounts receivable has a balance of $20,200. The allowance for doubtful accounts has a credit balance prior to adjustment of $460. Net credit sales for the year are $35,000 and 4.5% of net credit sales are deemed uncollectible.

a)Accounts receivable has a balance of $16,000. The allowance for doubtful accounts has a credit balance prior to adjustment of $350. An aging schedule prepared on December 31 reveals $1,250 of uncollectible accounts.

b)Accounts receivable has a balance of $17,500. The allowance for doubtful accounts has a debit balance prior to adjustment of $560. An aging schedule prepared on December 31 reveals $1,500 of uncollectible accounts.

c)Accounts receivable has a balance of $15,500. The allowance for doubtful accounts has a debit balance prior to adjustment of $760. Net credit sales for the year are $35,000 and 3.5% of net credit sales are deemed uncollectible.

d)Accounts receivable has a balance of $20,200. The allowance for doubtful accounts has a credit balance prior to adjustment of $460. Net credit sales for the year are $35,000 and 4.5% of net credit sales are deemed uncollectible.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

On December 31, 2019, the unadjusted trial balance of Tarzwell Services showed the following balances:  The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense.

The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense.

a)Provide the entry for the write-off.

b)If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019.

c)Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense.

The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense.

The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense.a)Provide the entry for the write-off.

b)If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019.

c)Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck