Deck 10: Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 10: Statement of Cash Flows

1

Which statement is correct?

A)If the reported net income is consistently close to or less than cash from operating activities, the company's net income or earnings are said to be of a "low quality."

B)If net income is consistently more than cash from operating activities, the company's net income or earnings are said to be of a "high quality."

C)One way to evaluate earnings quality is to compare the company's net income with cash from operating activities, because accrual income are less subject to managerial bias compared with cash flows .

D)If the reported net income is consistently close to or less than cash from operating activities, the company's net income or earnings are said to be of a "high quality."

A)If the reported net income is consistently close to or less than cash from operating activities, the company's net income or earnings are said to be of a "low quality."

B)If net income is consistently more than cash from operating activities, the company's net income or earnings are said to be of a "high quality."

C)One way to evaluate earnings quality is to compare the company's net income with cash from operating activities, because accrual income are less subject to managerial bias compared with cash flows .

D)If the reported net income is consistently close to or less than cash from operating activities, the company's net income or earnings are said to be of a "high quality."

D

2

Discuss how the cash flow statement helps evaluate a company's quality of earnings.

One way to evaluate earnings quality is to compare the company's net income with cash from operating activities, because cash flows are less subject to managerial bias compared with accrual income. If the reported net income is consistently close to or less than cash from operating activities, the company's net income or earnings are said to be of a "high quality." If net income is consistently more than cash from operating activities, further investigation is needed to ascertain why the reported net income is not matched by an increase in cash.

3

Which statement is correct?

A)Managers are more interested in the net income than the cash generated by the company.

B)Under GAAP, only the income statement is required by investors, creditors and managers.

C)All companies must have a treasury department to manage their cash resources.

D)The cash flow statement shows the capacity of the company to sustain its operations.

A)Managers are more interested in the net income than the cash generated by the company.

B)Under GAAP, only the income statement is required by investors, creditors and managers.

C)All companies must have a treasury department to manage their cash resources.

D)The cash flow statement shows the capacity of the company to sustain its operations.

D

4

What is included in "cash and cash equivalents"?

A)Cash on hand.

B)Term deposits maturing in 180 days.

C)Treasury bills maturing in 120 days.

D)Bonds of a publicly traded company that mature in one year.

A)Cash on hand.

B)Term deposits maturing in 180 days.

C)Treasury bills maturing in 120 days.

D)Bonds of a publicly traded company that mature in one year.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

Which statement about "cash and cash equivalents" is correct?

A)Exchanges of "cash and cash equivalents" for items that are not "cash and cash equivalents" result in cash flows for the cash flow statement.

B)Changes in the composition of "cash and cash equivalents" is considered a cash flow for purposes of the cash flow statement.

C)Changes in the composition of "cash and cash equivalents" is considered an operating activity on the cash flow statement.

D)Cash equivalents include investment in long-term bonds.

A)Exchanges of "cash and cash equivalents" for items that are not "cash and cash equivalents" result in cash flows for the cash flow statement.

B)Changes in the composition of "cash and cash equivalents" is considered a cash flow for purposes of the cash flow statement.

C)Changes in the composition of "cash and cash equivalents" is considered an operating activity on the cash flow statement.

D)Cash equivalents include investment in long-term bonds.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

Define cash and cash equivalents.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

Why are "cash and cash equivalents" treated as a single unit on the cash flow statement?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

Describe the options available for reporting investments at FVPL regarding their impact on the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

List three reasons why the statement of cash flows is a useful component of an enterprise's financial statements.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

What is cash management?

A)Cash management includes the investment of excess cash in cash equivalents.

B)Cash management excludes the investment of excess cash in cash equivalents.

C)Cash management includes the investment of excess cash in equipment.

D)Cash management includes the investment of excess cash in joint ventures.

A)Cash management includes the investment of excess cash in cash equivalents.

B)Cash management excludes the investment of excess cash in cash equivalents.

C)Cash management includes the investment of excess cash in equipment.

D)Cash management includes the investment of excess cash in joint ventures.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

What criterion is required for a "cash equivalent"?

A)Convertibility into cash or insignificant risk of change in value.

B)Insignificant risk of change in value.

C)Convertibility into cash and insignificant risk of change in value.

D)Convertibility into cash.

A)Convertibility into cash or insignificant risk of change in value.

B)Insignificant risk of change in value.

C)Convertibility into cash and insignificant risk of change in value.

D)Convertibility into cash.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

Which statement is correct?

A)An investment in a security at FVPL must be classified as a cash equivalent.

B)An investment in a security at amortized cost must be classified as cash equivalent.

C)An investment in a security held to meet short-term cash commitments must be classified as a cash equivalent .

D)An investment in a security at FVOCI must be classified as a cash equivalent.

A)An investment in a security at FVPL must be classified as a cash equivalent.

B)An investment in a security at amortized cost must be classified as cash equivalent.

C)An investment in a security held to meet short-term cash commitments must be classified as a cash equivalent .

D)An investment in a security at FVOCI must be classified as a cash equivalent.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

What guidance does IFRS provide with respect to reporting bank overdrafts on the statement of cash flows?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Which category is used on the cash flow statement?

A)Non-current.

B)Operating.

C)Non-operating.

D)Discontinued.

A)Non-current.

B)Operating.

C)Non-operating.

D)Discontinued.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

To provide information useful to decision makers, IAS 1 requires companies to report cash inflows and outflows using standardized categories. Which one of the following is not one of these standardized categories?

A)Operations

B)Properties

C)Investments

D)Financing

A)Operations

B)Properties

C)Investments

D)Financing

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement about "cash and cash equivalents" is correct?

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)Changes in the composition of "cash and cash equivalents" are considered a financing activity on the cash flow statement.

C)Changes in the composition of "cash and cash equivalents" are considered a cash flow for purposes of the cash flow statement.

D)The definition for "cash and cash equivalents" used on the balance sheet is the same as the definition for "cash and cash equivalents" used on the cash flow statement.

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)Changes in the composition of "cash and cash equivalents" are considered a financing activity on the cash flow statement.

C)Changes in the composition of "cash and cash equivalents" are considered a cash flow for purposes of the cash flow statement.

D)The definition for "cash and cash equivalents" used on the balance sheet is the same as the definition for "cash and cash equivalents" used on the cash flow statement.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

If a company has gaps between the change in cash and the net income for the year:

A)the income statement provides sufficient explanation for the sources of these changes.

B)the financial statement notes provide explanation for the sources of these changes.

C)the statement of cash flow provides explanation of the sources of these changes.

D)the statement of cash flow and balance sheet provide explanation for these changes.

A)the income statement provides sufficient explanation for the sources of these changes.

B)the financial statement notes provide explanation for the sources of these changes.

C)the statement of cash flow provides explanation of the sources of these changes.

D)the statement of cash flow and balance sheet provide explanation for these changes.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

What is included in "cash and cash equivalents"?

A)Cash restricted for plant expansion.

B)Term deposits maturing in 180 days.

C)Treasury bills maturing in 120 days.

D)U.S. dollar chequing account.

A)Cash restricted for plant expansion.

B)Term deposits maturing in 180 days.

C)Treasury bills maturing in 120 days.

D)U.S. dollar chequing account.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is correct?

A)Net income equals the cash generated by the company's operations.

B)Net income seldom reflects the change in cash during the period.

C)Net income is the most important metric to measure the financial performance of a company.

D)Cash flow is the most important metric to measure the financial performance of a company.

A)Net income equals the cash generated by the company's operations.

B)Net income seldom reflects the change in cash during the period.

C)Net income is the most important metric to measure the financial performance of a company.

D)Cash flow is the most important metric to measure the financial performance of a company.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is a financing activity?

A)Collection of accounts receivable.

B)Collection of loans receivable

C)Receipt of bank loan.

D)Sale of a machine.

A)Collection of accounts receivable.

B)Collection of loans receivable

C)Receipt of bank loan.

D)Sale of a machine.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

Explain how the following transactions should be reported in the statement of cash flows, assuming the indirect method is used to determine cash flows from operating activities. Identify all available options. If not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. The purchase of a $100,000, 45-day Treasury bill classified at FVPL.

2. Amortization of the discount on bonds payable in the amount of $20,000.

1. The purchase of a $100,000, 45-day Treasury bill classified at FVPL.

2. Amortization of the discount on bonds payable in the amount of $20,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

What are operating activities?

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities involving changes in the size and composition of the contributed equity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities involving changes in the size and composition of the contributed equity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

What is not a "non-cash" transaction?

A)Exchange of land with another company.

B)Conversion of preferred shares.

C)Payment of cash dividends.

D)Payment of stock dividends.

A)Exchange of land with another company.

B)Conversion of preferred shares.

C)Payment of cash dividends.

D)Payment of stock dividends.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

What are the two distinct components to investing activities?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

Which item will be presented on the "investing section" of the cash flow statement?

A)Proceeds from sale of sale of inventory.

B)Net investment in property, plant and equipment.

C)Proceeds from sale of equipment.

D)Proceeds from sale of preferred shares.

A)Proceeds from sale of sale of inventory.

B)Net investment in property, plant and equipment.

C)Proceeds from sale of equipment.

D)Proceeds from sale of preferred shares.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

Explain the options for recording interest and dividends received and interest and dividends paid on the cash flow statement according to IAS 7.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

Crete Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Crete's activities for the year ended December 31, 2021 included the following:

• Income tax expense for the year was $30,000.

• Sold an investment at FVOCI for $45,000. The original cost of the investment was $52,000.

• Depreciation expense for the year was $19,000.

• Sales for the year were $1,030,000.

• Selling and administration expenses for the year totaled $240,000.

• Mamie's cost of goods sold in 2021 was $315,000.

• Interest expense for the period was $12,000. The interest payable account increased $5,000.

• Accounts payable increased $20,000 in 2021.

• Accounts receivable decreased $36,000 in 2021.

• Mamie's inventory increased $13,000 during the year.

• Dividends were not declared during the year; however, the dividends payable account decreased $5,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

• Income tax expense for the year was $30,000.

• Sold an investment at FVOCI for $45,000. The original cost of the investment was $52,000.

• Depreciation expense for the year was $19,000.

• Sales for the year were $1,030,000.

• Selling and administration expenses for the year totaled $240,000.

• Mamie's cost of goods sold in 2021 was $315,000.

• Interest expense for the period was $12,000. The interest payable account increased $5,000.

• Accounts payable increased $20,000 in 2021.

• Accounts receivable decreased $36,000 in 2021.

• Mamie's inventory increased $13,000 during the year.

• Dividends were not declared during the year; however, the dividends payable account decreased $5,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

What are investing activities?

A)Activities that do not involve cash.

B)Activities involving the acquisition and disposal of long-term assets and other investments.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities involving changes in the size and composition of the equity's borrowings.

A)Activities that do not involve cash.

B)Activities involving the acquisition and disposal of long-term assets and other investments.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities involving changes in the size and composition of the equity's borrowings.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

Briefly describe non-cash transactions and how they are reported on the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

Recon Cile Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Recon Cile's activities for the year ended December 31, 2021 included the following:

• Sold a investment at FVPL for $16,000. The book value of this investment, which was held for trading purposes was $13,000.

• Purchased an investment at FVOCI for $20,000.

• Borrowed $25,000 from the bank for investment purposes.

• Sold equipment for $21,000 that originally cost $45,000. The net book value of this item at time of sale was $25,000.

• Purchased inventory costing $4,000 for cash.

• Received $6,000 in interest and $2,500 in dividends on sundry investments.

• Acquired the right to use a forklift costing $22,000 under lease agreement.

• Acquired land and buildings valued at $400,000 by issuing ordinary shares.

• Bought $300,000 in bonds at a discount, paying $285,000 cash. The investment was classified at amortized cost.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Sold a investment at FVPL for $16,000. The book value of this investment, which was held for trading purposes was $13,000.

• Purchased an investment at FVOCI for $20,000.

• Borrowed $25,000 from the bank for investment purposes.

• Sold equipment for $21,000 that originally cost $45,000. The net book value of this item at time of sale was $25,000.

• Purchased inventory costing $4,000 for cash.

• Received $6,000 in interest and $2,500 in dividends on sundry investments.

• Acquired the right to use a forklift costing $22,000 under lease agreement.

• Acquired land and buildings valued at $400,000 by issuing ordinary shares.

• Bought $300,000 in bonds at a discount, paying $285,000 cash. The investment was classified at amortized cost.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

What is an investing activity?

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities involving changes in the size and composition of the contributed equity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities involving changes in the size and composition of the contributed equity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

Mamie K. Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Mamie's activities for the year ended December 31, 2021 included the following:

• Income tax expense for the year was $36,000.

• Sales for the year were $730,000.

• Accounts payable decreased $20,000 in 2021.

• Selling and administration expenses for the year totaled $140,000.

• Accounts receivable increased $6,000 in 2021.

• Mamie's cost of goods sold in 2021 was $315,000.

• Mamie's inventory decreased $13,000 during the year.

• Interest expense for the period was $17,000. The interest payable account increased $5,000.

• Dividends were not declared during the year; however, the dividends payable account decreased $2,000.

• Sold an Investment at FVOCI for $45,000. The original cost of the investment was $52,000.

• Depreciation expense for the year was $19,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

• Income tax expense for the year was $36,000.

• Sales for the year were $730,000.

• Accounts payable decreased $20,000 in 2021.

• Selling and administration expenses for the year totaled $140,000.

• Accounts receivable increased $6,000 in 2021.

• Mamie's cost of goods sold in 2021 was $315,000.

• Mamie's inventory decreased $13,000 during the year.

• Interest expense for the period was $17,000. The interest payable account increased $5,000.

• Dividends were not declared during the year; however, the dividends payable account decreased $2,000.

• Sold an Investment at FVOCI for $45,000. The original cost of the investment was $52,000.

• Depreciation expense for the year was $19,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is an operating activity?

A)Receipt of customer deposit.

B)Proceeds from mortgage issue.

C)Purchase of land.

D)Redemption of preferred shares.

A)Receipt of customer deposit.

B)Proceeds from mortgage issue.

C)Purchase of land.

D)Redemption of preferred shares.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Explain how the following transactions should be reported in the statement of cash flows, assuming the indirect method is used to determine cash flows from operating activities. Identify all available options. If not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. Income tax expense of $30,000. The income tax payable account increased $7,000, while the deferred income tax liability account decreased $9,000.

2. Cash dividend of $40,000 declared. The dividends payable account increases $25,000.

1. Income tax expense of $30,000. The income tax payable account increased $7,000, while the deferred income tax liability account decreased $9,000.

2. Cash dividend of $40,000 declared. The dividends payable account increases $25,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

Which statement is correct according to IAS 7?

A)An enterprise must classify the receipt of interest and dividends received as an operating activity.

B)An enterprise must classify the receipt of interest and dividends received as an investing activity.

C)An enterprise may choose to report the payment of interest and dividends as either an operating or a financing activity.

D)An enterprise must choose to report the payment of interest and dividends as an operating activity.

A)An enterprise must classify the receipt of interest and dividends received as an operating activity.

B)An enterprise must classify the receipt of interest and dividends received as an investing activity.

C)An enterprise may choose to report the payment of interest and dividends as either an operating or a financing activity.

D)An enterprise must choose to report the payment of interest and dividends as an operating activity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Investing involves buying and selling debt and equity securities. What two categories of investing do not appear in the investing section of the cash flow statement?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

What are financing activities?

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities that result in changes in the size and composition of the contributed equity and borrowings of the entity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

A)Activities involving the acquisition and disposal of long-term assets.

B)Activities that result in changes in the size and composition of the contributed equity and borrowings of the entity.

C)Activities involving the principal revenue-producing activities of the entity.

D)Activities that do not involve cash.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is an investing activity?

A)Payment of salaries.

B)Purchase of inventory.

C)Sale of an investment at FVPL

D)Collection of loan receivable.

A)Payment of salaries.

B)Purchase of inventory.

C)Sale of an investment at FVPL

D)Collection of loan receivable.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Tub Time Corp.'s policy is to report all cash flows arising from interest and dividends in the operating activities section. Tub Time's activities for the year ended December 31, 2021 included the following:

• 2021's net income after taxes totaled $220,000.

• Declared and issued a stock dividend valued at $40,000.

• Accounts receivable decreased $44,000 in 2021.

• Sold a investment at FVPL for $13,000. The book value was $11,000. (Assume this investment at FVPL was held for trading purposes.)

• Interest revenue for the period was $6,000. The interest receivable account decreased $4,000.

• Declared a $10,000 dividend payable. The dividends payable account decreased $19,000 in 2021.

• Sold an investment at FVOCI for $9,000. The original cost of the investment was $14,000.

• Tub Time recorded a $15,000 goodwill impairment loss during the year.

• Depreciation expense for the year was $14,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

b. Identify how the activities listed above that are not operating activities would be required in the statement of cash flows.

• 2021's net income after taxes totaled $220,000.

• Declared and issued a stock dividend valued at $40,000.

• Accounts receivable decreased $44,000 in 2021.

• Sold a investment at FVPL for $13,000. The book value was $11,000. (Assume this investment at FVPL was held for trading purposes.)

• Interest revenue for the period was $6,000. The interest receivable account decreased $4,000.

• Declared a $10,000 dividend payable. The dividends payable account decreased $19,000 in 2021.

• Sold an investment at FVOCI for $9,000. The original cost of the investment was $14,000.

• Tub Time recorded a $15,000 goodwill impairment loss during the year.

• Depreciation expense for the year was $14,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

b. Identify how the activities listed above that are not operating activities would be required in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

What are the options for recording interest and dividends received and interest and dividends paid on the cash flow statement according to Accounting Standards for Private Enterprises (ASPE)?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Angela's Angels Corp.'s policy is to report all cash inflows from interest and dividends in the investing section and cash outflows arising from interest and dividends in the financing section. Angela's activities for the year ended December 31, 2019 included the following:

• Declared and issued a stock dividend valued at $15,000.

• Issued $300,000 in ordinary shares.

• Accounts payable decreased $38,000 during the year.

• Paid $910,000 to repurchase bonds. The book value of the bonds was $1,000,000.

• Made a $25,000 principal payment on a bank loan.

• Interest expense for the period was $12,000. The interest payable account increased $2,000.

• Declared a $12,000 cash dividend payable on January 15, 2020.

• Acquired the right to use an automobile valued at $30,000 under a lease agreement.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Declared and issued a stock dividend valued at $15,000.

• Issued $300,000 in ordinary shares.

• Accounts payable decreased $38,000 during the year.

• Paid $910,000 to repurchase bonds. The book value of the bonds was $1,000,000.

• Made a $25,000 principal payment on a bank loan.

• Interest expense for the period was $12,000. The interest payable account increased $2,000.

• Declared a $12,000 cash dividend payable on January 15, 2020.

• Acquired the right to use an automobile valued at $30,000 under a lease agreement.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

Complete the following:

a. List the three primary sources of information required to prepare a statement of cash flows.

b. A company may report its accounts receivable at the gross amount less an allowance for bad debts. Contrast the direct and indirect methods of adjusting for accounts receivable reported at the gross amount.

c. Briefly discuss how cash flows arising from the purchase and sale of treasury shares are reported on the statement of cash flows.

d. Briefly discuss how other comprehensive income is reported on the statement of cash flows.

e. Briefly discuss how cash flows arising from investments in associates are reported on the statement of cash flows.

f. Briefly discuss the alternatives for reporting discontinued operations in the statement of cash flows.

a. List the three primary sources of information required to prepare a statement of cash flows.

b. A company may report its accounts receivable at the gross amount less an allowance for bad debts. Contrast the direct and indirect methods of adjusting for accounts receivable reported at the gross amount.

c. Briefly discuss how cash flows arising from the purchase and sale of treasury shares are reported on the statement of cash flows.

d. Briefly discuss how other comprehensive income is reported on the statement of cash flows.

e. Briefly discuss how cash flows arising from investments in associates are reported on the statement of cash flows.

f. Briefly discuss the alternatives for reporting discontinued operations in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

Hoboken's activities for the year ended December 31, 2021 included the following: • Sold an investment at FVPL for $12,000. The investment was held for trading purposes. The book value was $10,000.

• Sold an Investment at FVOCI for $8,000. The original cost of the investment was $9,000.

Using the direct method, how much would be presented as cash flow from operations for the investment at FVPL investment?

A)Proceeds from sale of am investment at FVPL in the amount of 12,000.

B)Disposal of an investment at FVPL investment in the amount 10,000.

C)Gain on sale of an investment at FVPL investment in the amount 2,000.

D)Loss on sale of an investment at FVPL investment in the amount 2,000.

• Sold an Investment at FVOCI for $8,000. The original cost of the investment was $9,000.

Using the direct method, how much would be presented as cash flow from operations for the investment at FVPL investment?

A)Proceeds from sale of am investment at FVPL in the amount of 12,000.

B)Disposal of an investment at FVPL investment in the amount 10,000.

C)Gain on sale of an investment at FVPL investment in the amount 2,000.

D)Loss on sale of an investment at FVPL investment in the amount 2,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

The Company's activities for the year ended December 31, 2021 included the following: • Income tax expense for the year was $30,000.

• Sales for the year were $650,000.

• Accounts payable decreased $10,000 in 2021.

• Selling and administration expenses for the year totaled $200,000.

• Accounts receivable increased $20,000 in 2021.

• The Company's cost of goods sold in 2021 was $325,000.

• The Company's inventory increased $15,000 during the year.

• Depreciation expense for the year was $13,000.

What is the net cash payments to suppliers under the direct method?

A)$307,000

B)$-315,000

C)$320,000

D)-$350,000

• Sales for the year were $650,000.

• Accounts payable decreased $10,000 in 2021.

• Selling and administration expenses for the year totaled $200,000.

• Accounts receivable increased $20,000 in 2021.

• The Company's cost of goods sold in 2021 was $325,000.

• The Company's inventory increased $15,000 during the year.

• Depreciation expense for the year was $13,000.

What is the net cash payments to suppliers under the direct method?

A)$307,000

B)$-315,000

C)$320,000

D)-$350,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

Select transactions of SimBis Accounting Inc. (SAI)are listed below. SAI uses the indirect method to determine cash flows from operating activities.

1. SAI purchases a $200,000, 45-day Treasury bill and classified it at FVPL.

2. SAI amortizes $32,000 of the discount on bonds payable.

3. At year-end SAI increases its allowance for bad debts by $10,000.

4. SAI's income tax expense totaled $40,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $8,000.

5. SAI acquires the right to use equipment valued at $80,000 under a lease agreement.

6. SAI declares and distributes a stock dividend valued at $33,000.

7. SAI declares a cash dividend of $30,000. The dividends payable account increases $15,000.

8. SAI's comprehensive income for the year totaled $200,000 consisting of $150,000 net income and $50,000 other comprehensive income.

9. SAI sells an investment at amortized cost for $22,000. The investment's amortized cost is $20,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. SAI purchases a $200,000, 45-day Treasury bill and classified it at FVPL.

2. SAI amortizes $32,000 of the discount on bonds payable.

3. At year-end SAI increases its allowance for bad debts by $10,000.

4. SAI's income tax expense totaled $40,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $8,000.

5. SAI acquires the right to use equipment valued at $80,000 under a lease agreement.

6. SAI declares and distributes a stock dividend valued at $33,000.

7. SAI declares a cash dividend of $30,000. The dividends payable account increases $15,000.

8. SAI's comprehensive income for the year totaled $200,000 consisting of $150,000 net income and $50,000 other comprehensive income.

9. SAI sells an investment at amortized cost for $22,000. The investment's amortized cost is $20,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

Sherya Inc.'s policy is to report all cash flows arising from interest and dividends in the operating section. Sherya's activities for the year ended December 31, 2021 included the following:

• Interest expense for the period was $10,000. The interest payable account decreased $4,000.

• Made a $110,000 principal payment on a bank loan.

• Declared a $15,000 cash dividend payable on January 15, 2022.

• Declared and issued a stock dividend valued at $50,000.

• Paid $55,000 to repurchase ordinary shares and cancelled them. The book value was $40,000.

• Accounts payable increased $23,000 during the year.

• Issued $1,500,000 in bonds. The cash proceeds were $1,380,000.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Interest expense for the period was $10,000. The interest payable account decreased $4,000.

• Made a $110,000 principal payment on a bank loan.

• Declared a $15,000 cash dividend payable on January 15, 2022.

• Declared and issued a stock dividend valued at $50,000.

• Paid $55,000 to repurchase ordinary shares and cancelled them. The book value was $40,000.

• Accounts payable increased $23,000 during the year.

• Issued $1,500,000 in bonds. The cash proceeds were $1,380,000.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

The opening balance in the land account for Adara Corp for fiscal 2020 was $500,000; the closing balance was $610,000. During the year land costing $130,000 was given to a creditor in full settlement of a $152,000 loan. The fair value of the land at the time of the exchange was $152,000. The company also purchased a separate parcel of land for cash during the year.

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions (e.g., the gain or loss on exchange of land for loan, etc.).

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

c. Why does the IASB require that companies classify cash flows as arising from operations, investing, or financing activities?

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions (e.g., the gain or loss on exchange of land for loan, etc.).

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

c. Why does the IASB require that companies classify cash flows as arising from operations, investing, or financing activities?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

A company's activities for the year ended December 31, 2021 included the following: • Declared and issued a stock dividend valued at $50,000.

• Paid $975,000 to repurchase bonds at amortized cost. The book value of the bonds was $1,000,000.

• Made a $20,000 principal payment on a bank loan.

How much will be presented as cash flow from financing activities?

A)$955,000

B)-$975,000

C)$980,000

D)-$995,000

• Paid $975,000 to repurchase bonds at amortized cost. The book value of the bonds was $1,000,000.

• Made a $20,000 principal payment on a bank loan.

How much will be presented as cash flow from financing activities?

A)$955,000

B)-$975,000

C)$980,000

D)-$995,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

The opening balance in the computer account for Adara Corp for fiscal 2020 was $100,000; the closing balance was $107,000. The corresponding balances in the accumulated depreciation accounts were $63,000 and $67,500. During the year Adara scrapped a computer originally costing $13,000 having a remaining net book value of $3,500 and purchased a replacement machine for cash.

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions.

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions.

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

Explain how the following transactions should be reported in the statement of cash flows, assuming the indirect method is used to determine cash flows from operating activities. Identify all available options. If not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. An increase in allowance for bad debts by $18,000.

2. A principal payment of $35,000 on a lease liability subsequent to the commencement date of the lease.

1. An increase in allowance for bad debts by $18,000.

2. A principal payment of $35,000 on a lease liability subsequent to the commencement date of the lease.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

Select transactions of Irene Accounting Inc. (IAI)are listed below. IAI uses the indirect method to determine cash flows from operating activities.

1. IAI sells an investment at amortized cost for $28,000. The investment's book value is $20,000.

2. IAI's income tax expense totaled $30,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $18,000.

3. IAI declares a cash dividend of $3,000. The dividends payable account increases $1,000.

4. At year-end IAI increases its allowance for bad debts by $15,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. IAI sells an investment at amortized cost for $28,000. The investment's book value is $20,000.

2. IAI's income tax expense totaled $30,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $18,000.

3. IAI declares a cash dividend of $3,000. The dividends payable account increases $1,000.

4. At year-end IAI increases its allowance for bad debts by $15,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

A company's activities for the year ended December 31, 2021 included the following: • Sold an investment at FVPL for $10,000. The investment was held for trading purposes. The book value was $15,000.

• Sold an Investment at FVOCI for $10,000. The original cost was $5,000.

Using the indirect method, how much would be presented as cash flow from operating activities?

A)Proceeds from disposal in the amount of 10,000.

B)Proceeds from disposal in the amount of 20,000.

C)Loss on sale in the amount 5,000.

D)Adjustment of $5,000 on loss on sale of the investment at FVPL, an adjustment of $(5,000)on the recycled gain on sale on the investment at FVOCI, and +$10,000 inflow from the sales proceeds of the investment at FVPL.

• Sold an Investment at FVOCI for $10,000. The original cost was $5,000.

Using the indirect method, how much would be presented as cash flow from operating activities?

A)Proceeds from disposal in the amount of 10,000.

B)Proceeds from disposal in the amount of 20,000.

C)Loss on sale in the amount 5,000.

D)Adjustment of $5,000 on loss on sale of the investment at FVPL, an adjustment of $(5,000)on the recycled gain on sale on the investment at FVOCI, and +$10,000 inflow from the sales proceeds of the investment at FVPL.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

The activities for the year ended December 31, 2021 included the following: • 2021's net income after taxes totaled $125,000.

• Accounts receivable increased $32,000

• Recorded a $10,000 goodwill impairment loss during the year

• Inventory decreased $8,000

How much would be presented as cash flow from operations?

A)$85,000

B)$111,000

C)$127,000

D)$135,000

• Accounts receivable increased $32,000

• Recorded a $10,000 goodwill impairment loss during the year

• Inventory decreased $8,000

How much would be presented as cash flow from operations?

A)$85,000

B)$111,000

C)$127,000

D)$135,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

Jamie Bleay Law Ltd.'s policy is to report all cash inflows from interest and dividends in the investing section and cash outflows arising from interest and dividends in the financing section. Jamie Bleay Law's activities for the year ended December 31, 2019 included the following:

• Sold a investment at FVPL for $11,000. The book value of this investment, which was held to meet short-term cash commitments, was $11,000.

• Sold an investment at FVOCI for $14,000. The book value and original cost of the investment was $14,000.

• Borrowed $120,000 from the bank for investment purposes.

• Sold equipment for $26,000 that originally cost $20,000. The net book value of this item at time of sale was $14,000.

• Received $9,000 in interest and $7,000 in dividends on sundry investments.

• Paid $4,000 interest on the investment loan.

• Acquired land and buildings valued at $700,000 by paying $200,000 cash and issuing ordinary shares for the balance.

• Bought $550,000 in bonds at a premium, paying $560,000 cash. The investment was classified at amortized cost.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Sold a investment at FVPL for $11,000. The book value of this investment, which was held to meet short-term cash commitments, was $11,000.

• Sold an investment at FVOCI for $14,000. The book value and original cost of the investment was $14,000.

• Borrowed $120,000 from the bank for investment purposes.

• Sold equipment for $26,000 that originally cost $20,000. The net book value of this item at time of sale was $14,000.

• Received $9,000 in interest and $7,000 in dividends on sundry investments.

• Paid $4,000 interest on the investment loan.

• Acquired land and buildings valued at $700,000 by paying $200,000 cash and issuing ordinary shares for the balance.

• Bought $550,000 in bonds at a premium, paying $560,000 cash. The investment was classified at amortized cost.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

The Company's activities for the year ended December 31, 2021 included the following: • Income tax expense for the year was $30,000.

• Sales for the year were $650,000.

• Accounts payable decreased $10,000 in 2021.

• Selling and administration expenses for the year totaled $200,000.

• Accounts receivable increased $20,000 in 2021.

• The Company's cost of goods sold in 2021 was $325,000.

• The Company's inventory decreased $15,000 during the year.

What is the cash receipts from customers under the direct method?

A)$110,000

B)$320,000

C)$670,000

D)$630,000

• Sales for the year were $650,000.

• Accounts payable decreased $10,000 in 2021.

• Selling and administration expenses for the year totaled $200,000.

• Accounts receivable increased $20,000 in 2021.

• The Company's cost of goods sold in 2021 was $325,000.

• The Company's inventory decreased $15,000 during the year.

What is the cash receipts from customers under the direct method?

A)$110,000

B)$320,000

C)$670,000

D)$630,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following:

a. What are the similarities and differences between the direct and indirect methods of preparing the statement of cash flows?

b. In practice, which method of preparation is used for the statement of cash flows and why?

c. Is the indirect method of presenting the statement of cash flows required by the IASB?

d. Briefly discuss how unrealized gains and losses arising from an investments at FVPL that are held for trading purposes are reported on the statement of cash flows.

a. What are the similarities and differences between the direct and indirect methods of preparing the statement of cash flows?

b. In practice, which method of preparation is used for the statement of cash flows and why?

c. Is the indirect method of presenting the statement of cash flows required by the IASB?

d. Briefly discuss how unrealized gains and losses arising from an investments at FVPL that are held for trading purposes are reported on the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

On January 1, 2020, Adara acquired the right to use equipment under a lease agreement. The lease calls for fifteen annual payments of $10,000 due at the beginning of the year. Adara must return the equipment to the lessor at the end of the lease. The January 1, 2020 payment was made as agreed. The implicit rate in the lease is 7%; the present value of the lease payments is $97,455.

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions (e.g., depreciation and the accrual of interest at year-end).

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

Required:

a. Prepare the underlying journal entries to record the foregoing transactions and record events stemming from the transactions (e.g., depreciation and the accrual of interest at year-end).

b. For each entry identify the cash flow effects, if any, under both the direct and indirect methods of presentation and classify the cash flow according to its nature.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

Which is a correct statement?

A)The direct method of presentation for the cash flow statement must be used under ASPE.

B)The direct method of presentation for the cash flow statement must be used under IFRS.

C)The statement of cash flows explains the change between opening and closing cash.

D)The "cash" balance on the cash flow statement does not have to be equal to the "cash" balance amount on the balance sheet.

A)The direct method of presentation for the cash flow statement must be used under ASPE.

B)The direct method of presentation for the cash flow statement must be used under IFRS.

C)The statement of cash flows explains the change between opening and closing cash.

D)The "cash" balance on the cash flow statement does not have to be equal to the "cash" balance amount on the balance sheet.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Suzanne Inc.'s policy is to report all cash flows arising from interest and dividends in the operating activities section. The activities for the year ended December 31, 2021 included the following: • Interest revenue for the period was $12,000. The interest receivable account decreased $3,000.

• Sold an Investment at FVOCI for $10,000. The original cost was $5,000.

Using the indirect method, how much would be presented as cash flow from operating activities?

A)Proceeds from disposal in the amount of 10,000 + Interest received in the amount of 12,000.

B)Proceeds from disposal in the amount of 10,000 + Interest received in the amount of 15,000.

C)Gain on sale in the amount 5,000 + Interest received in the amount of 12,000.

D)Adjustment to Net Income of -5,000 for the recycled gain on sale of the investment at FVOCI + Interest cash flow of +15,000.

• Sold an Investment at FVOCI for $10,000. The original cost was $5,000.

Using the indirect method, how much would be presented as cash flow from operating activities?

A)Proceeds from disposal in the amount of 10,000 + Interest received in the amount of 12,000.

B)Proceeds from disposal in the amount of 10,000 + Interest received in the amount of 15,000.

C)Gain on sale in the amount 5,000 + Interest received in the amount of 12,000.

D)Adjustment to Net Income of -5,000 for the recycled gain on sale of the investment at FVOCI + Interest cash flow of +15,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

Select transactions of June Bowen Inc. (JBI)are listed below. JBI uses the indirect method to determine cash flows from operating activities.

1. JBI amortizes $12,000 of the discount on bonds payable.

2. At year-end JBI increases its allowance for bad debts by $18,000.

3. JBI's income tax expense totaled $50,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $8,000.

4. JBI makes a principal payment of $25,000 on a lease liability subsequent to the commencement date.

5. JBI declares and distributes a stock dividend valued at $33,000.

6. JBI declares a cash dividend of $30,000. The dividends payable account increases $10,000.

7. JBI sells a n investment at amortized cost for $28,000. The investment's book value is $20,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

1. JBI amortizes $12,000 of the discount on bonds payable.

2. At year-end JBI increases its allowance for bad debts by $18,000.

3. JBI's income tax expense totaled $50,000. Its income tax payable account increased $5,000, while its deferred income tax liability account decreased $8,000.

4. JBI makes a principal payment of $25,000 on a lease liability subsequent to the commencement date.

5. JBI declares and distributes a stock dividend valued at $33,000.

6. JBI declares a cash dividend of $30,000. The dividends payable account increases $10,000.

7. JBI sells a n investment at amortized cost for $28,000. The investment's book value is $20,000.

Required:

Discuss how the activities listed above would be reported in the statement of cash flows. For items with multiple reporting options, identify all available options. For items not reported on the statement of cash flows, indicate the disclosure requirements, if any.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

Which statement is correct?

A)Cash flows are grouped by operating, investing and financing activities.

B)Cash inflows and outflows are netted against each other.

C)Net interest received or paid can be offset in the cash flow statement.

D)Income tax paid does not need to be disclosed.

A)Cash flows are grouped by operating, investing and financing activities.

B)Cash inflows and outflows are netted against each other.

C)Net interest received or paid can be offset in the cash flow statement.

D)Income tax paid does not need to be disclosed.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Boboto Inc.'s policy is to report all cash flows arising from interest and dividends in the operating section. Boboto's activities for the year ended December 31, 2021 included the following:

• Declared and issued a stock dividend valued at $50,000.

• Paid $46,000 to repurchase ordinary shares and cancelled them. The book value was $33,000.

• Accounts payable decreased $23,000 during the year.

• Issued $1,500,000 in bonds. The cash proceeds were $1,410,000.

• Interest expense for the period was $10,000. The interest payable account decreased $4,000.

• Made a $75,000 principal payment on a bank loan.

• Declared a $15,000 cash dividend payable on January 15, 2022.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Declared and issued a stock dividend valued at $50,000.

• Paid $46,000 to repurchase ordinary shares and cancelled them. The book value was $33,000.

• Accounts payable decreased $23,000 during the year.

• Issued $1,500,000 in bonds. The cash proceeds were $1,410,000.

• Interest expense for the period was $10,000. The interest payable account decreased $4,000.

• Made a $75,000 principal payment on a bank loan.

• Declared a $15,000 cash dividend payable on January 15, 2022.

Required:

a. Prepare the cash flows from financing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not financing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

Katie Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Katie's activities for the year ended December 31, 2021 included the following:

• Income tax expense for the year was $30,000.

• Sales for the year were $1,030,000.

• Accounts payable decreased $20,000 in 2021.

• Selling and administration expenses for the year totaled $240,000.

• Accounts receivable decreased $36,000 in 2021.

• Mamie's cost of goods sold in 2021 was $315,000.

• Mamie's inventory increased $13,000 during the year.

• Interest expense for the period was $12,000. The interest payable account increased $5,000.

• Dividends were not declared during the year; however, the dividends payable account increased $5,000.

• Sold an investment at FVOCI for $45,000. The original cost was $52,000.

• Depreciation expense for the year was $19,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

• Income tax expense for the year was $30,000.

• Sales for the year were $1,030,000.

• Accounts payable decreased $20,000 in 2021.

• Selling and administration expenses for the year totaled $240,000.

• Accounts receivable decreased $36,000 in 2021.

• Mamie's cost of goods sold in 2021 was $315,000.

• Mamie's inventory increased $13,000 during the year.

• Interest expense for the period was $12,000. The interest payable account increased $5,000.

• Dividends were not declared during the year; however, the dividends payable account increased $5,000.

• Sold an investment at FVOCI for $45,000. The original cost was $52,000.

• Depreciation expense for the year was $19,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b. Identify how the activities listed above that are not operating activities would be reported in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement is true?

A)Stock splits and dividends are non-cash transactions. They are not recorded on the SCF.

B)Cash flows from the purchase and sale of treasury shares are reported as an investing activity.

C)OCI is normally reported in the financing section of the SCF.

D)Cash flows from discontinued operations would never be reported in the investing section of the SCF regardless of their nature.

A)Stock splits and dividends are non-cash transactions. They are not recorded on the SCF.

B)Cash flows from the purchase and sale of treasury shares are reported as an investing activity.

C)OCI is normally reported in the financing section of the SCF.

D)Cash flows from discontinued operations would never be reported in the investing section of the SCF regardless of their nature.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Rusabh Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Rusabh's activities for the year ended December 31, 2021 included the following:

• Sold an investment at FVPL for $16,000. The book value of this investment, which was held for trading purposes, was $13,000.

• Purchased an investment at FVOCI for $51,000.

• Borrowed $100,000 from the bank for investment purposes.

• Sold equipment for $23,000 that originally cost $55,000. The net book value of this item at time of sale was $35,000.

• Purchased inventory costing $84,000 for cash.

• Received $8,000 in interest and 5,500 in dividends on sundry investments.

• Acquired the right to use forklift costing $32,000 under a lease agreement.

• Acquired land and buildings valued at $100,000 by issuing ordinary shares.

• Bought $400,000 in bonds at a discount, paying $375,000 cash.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Sold an investment at FVPL for $16,000. The book value of this investment, which was held for trading purposes, was $13,000.

• Purchased an investment at FVOCI for $51,000.

• Borrowed $100,000 from the bank for investment purposes.

• Sold equipment for $23,000 that originally cost $55,000. The net book value of this item at time of sale was $35,000.

• Purchased inventory costing $84,000 for cash.

• Received $8,000 in interest and 5,500 in dividends on sundry investments.

• Acquired the right to use forklift costing $32,000 under a lease agreement.

• Acquired land and buildings valued at $100,000 by issuing ordinary shares.

• Bought $400,000 in bonds at a discount, paying $375,000 cash.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

ABC Inc.'s policy is to report all cash flows arising from interest and dividends in the operating activities section. Tub Time's activities for the year ended December 31, 2020 included the following:

• Net income after taxes totaled $400,000.

• The company recorded a $4000 goodwill impairment loss during the year.

• Depreciation expense for the year was $24,000.

• Declared and issued a stock dividend valued at $10,000.

• Accounts receivable increased $33,000 in the year.

• Sold an investment at FVPL for $23,000. The book value was $18,000. The investment was held for trading purposes

• Interest revenue for the period was $6,000. The interest receivable account decreased $4,000.

• Declared a $10,000 dividend payable. The dividends payable account decreased $19,000 in the year.

• Sold an investment at FVOCI for $19,000. The original cost was $14,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

b. Identify how the activities listed above that are not operating activities would be required in the statement of cash flows.

• Net income after taxes totaled $400,000.

• The company recorded a $4000 goodwill impairment loss during the year.

• Depreciation expense for the year was $24,000.

• Declared and issued a stock dividend valued at $10,000.

• Accounts receivable increased $33,000 in the year.

• Sold an investment at FVPL for $23,000. The book value was $18,000. The investment was held for trading purposes

• Interest revenue for the period was $6,000. The interest receivable account decreased $4,000.

• Declared a $10,000 dividend payable. The dividends payable account decreased $19,000 in the year.

• Sold an investment at FVOCI for $19,000. The original cost was $14,000.

Required:

a. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

b. Identify how the activities listed above that are not operating activities would be required in the statement of cash flows.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

How are cash flows from discontinued operations shown in the statement of cash flows?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

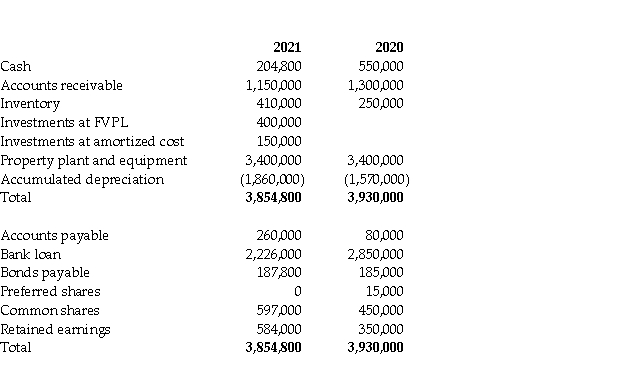

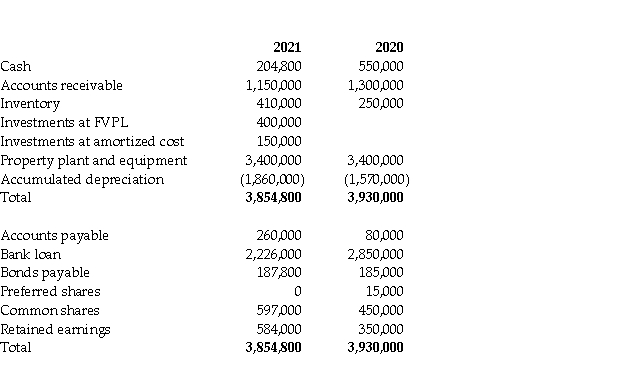

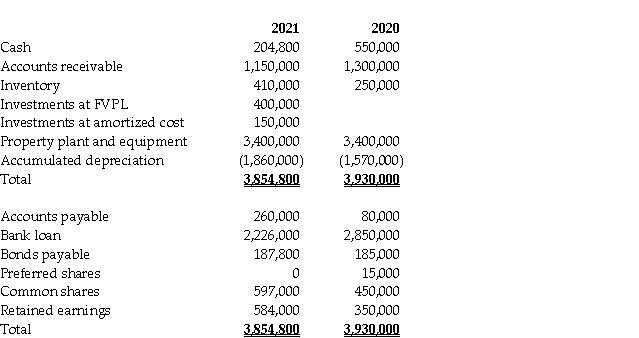

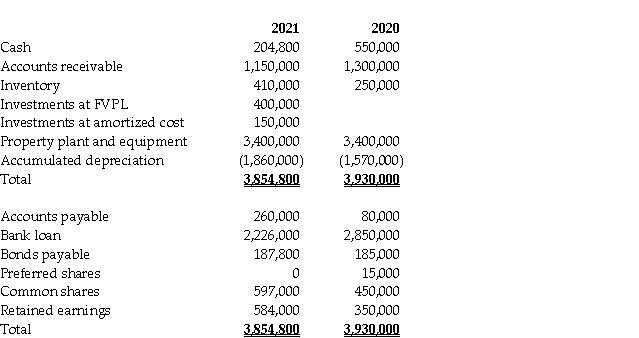

Financial information for Fesone Inc.'s balance sheet for fiscal 2020 and 2021 follows:  Additional information:

Additional information:

1. Preferred shares were converted to common shares during the year at their book value.

2. The face value of the bonds is $200,000; they pay a coupon rate of 6% per annum. The effective interest rate of interest is 8% per annum. They are reported at amortized cost.

3. Net income was $290,000.

4. There was an ordinary stock dividend valued at $12,000 and cash dividends were also paid.

5. Interest expense for the year was $130,000. Income tax expense was $116,000.

6. Fesone arranged for a $200,000 bank loan to finance the purchase of the investments at amortized cost.

7. Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities, respectively.

8. The investment at FVPL is held to meet short-term cash commitments.

Required:

a. Prepare a statement of cash flows for the year ended December 31, 2021 using the indirect method.

b. Discuss how the transaction(s)above that are not reported on the statement of cash flows are reported in the financial statements.

Additional information:

Additional information:1. Preferred shares were converted to common shares during the year at their book value.

2. The face value of the bonds is $200,000; they pay a coupon rate of 6% per annum. The effective interest rate of interest is 8% per annum. They are reported at amortized cost.

3. Net income was $290,000.

4. There was an ordinary stock dividend valued at $12,000 and cash dividends were also paid.

5. Interest expense for the year was $130,000. Income tax expense was $116,000.

6. Fesone arranged for a $200,000 bank loan to finance the purchase of the investments at amortized cost.

7. Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities, respectively.

8. The investment at FVPL is held to meet short-term cash commitments.

Required:

a. Prepare a statement of cash flows for the year ended December 31, 2021 using the indirect method.

b. Discuss how the transaction(s)above that are not reported on the statement of cash flows are reported in the financial statements.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

Provide a summary of presentation and disclosure requirements relating to the statement of cash flows.

Summary of presentation and disclosure requirements relating to the statement of cash flows.

Presentation:

Disclosure:

Summary of presentation and disclosure requirements relating to the statement of cash flows.

Presentation:

Disclosure:

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

Soorya Law Ltd.'s policy is to report all cash inflows from interest and dividends in the investing section and cash outflows arising from interest and dividends in the financing section. Soorya Law's activities for the year ended December 31, 2019 included the following:

• Sold an investment at FVPL for $11,000. The book value of this investment, which was held to meet short-term cash commitments, was $11,000.

• Sold an investment at FVOCI for $27,000. The cost of the investment was $27,000.

• Borrowed $120,000 from the bank for investment purposes.

• Sold equipment for $63,000 that originally cost $80,000. The net book value of this item at time of sale was $54,000.

• Received $5,000 in interest and $5,000 in dividends on sundry investments.

• Paid $4,000 interest on the investment loan.

• Acquired land and buildings valued at $450,000 by paying $150,000 cash and issuing ordinary shares for the balance.

• Bought $350,000 in bonds at a premium, paying $305,000 cash.

Required:

a. Prepare the cash flows from investing activities section of the statement of cash flows.

b. Identify how the activities listed above that are not investing activities would be reported in the statement of cash flows assuming that the statement is prepared using the indirect method.

• Sold an investment at FVPL for $11,000. The book value of this investment, which was held to meet short-term cash commitments, was $11,000.