Deck 12: Managerial Accounting and Costvolumeprofit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 12: Managerial Accounting and Costvolumeprofit Analysis

1

Knowledge about the behavior pattern of a cost is important to understanding the effect on net income of a change in sales volume because as sales volume changes:

A) net income will change proportionately.

B) the effect on net income will depend on the behavior pattern of various costs.

C) fixed costs will rise proportionately.

D) variable costs will not change.

A) net income will change proportionately.

B) the effect on net income will depend on the behavior pattern of various costs.

C) fixed costs will rise proportionately.

D) variable costs will not change.

B

2

Simplifying assumptions made when using cost behavior pattern data include:

A) relevant range and liquidity.

B) fixed activity and linearity.

C) relevant range and linearity.

D) activity range and variability.

A) relevant range and liquidity.

B) fixed activity and linearity.

C) relevant range and linearity.

D) activity range and variability.

C

3

Managerial accounting can best be described as:

A) the preparation and distribution of the financial statements.

B) the preparation and distribution of the corporate tax return.

C) the preparation and use of accounting information within the organization.

D) meeting the requirements of generally accepted accounting principles.

A) the preparation and distribution of the financial statements.

B) the preparation and distribution of the corporate tax return.

C) the preparation and use of accounting information within the organization.

D) meeting the requirements of generally accepted accounting principles.

C

4

Managerial accounting supports the management process most significantly by:

A) measuring and reporting financial results after the fact.

B) determining the goals and objectives of the entity.

C) providing estimates of financial results for various plans.

D) establishing operating policies to be followed during a period of time.

A) measuring and reporting financial results after the fact.

B) determining the goals and objectives of the entity.

C) providing estimates of financial results for various plans.

D) establishing operating policies to be followed during a period of time.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements does not describe a characteristic of management accounting?

A) Management accounting must conform to GAAP.

B) Approximate amounts rather than accurate amounts or refined estimates are often used in management accounting.

C) Management accounting places a great deal of emphasis on the future.

D) Management accounting is more concerned with units of the organization rather than with the organization as a whole.

A) Management accounting must conform to GAAP.

B) Approximate amounts rather than accurate amounts or refined estimates are often used in management accounting.

C) Management accounting places a great deal of emphasis on the future.

D) Management accounting is more concerned with units of the organization rather than with the organization as a whole.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Cost behavior refers to:

A) costs that are both good and bad.

B) costs that increase at a quicker rate than others.

C) costs that decrease at a quicker rate than others.

D) costs that are variable or fixed.

E) None of these.

A) costs that are both good and bad.

B) costs that increase at a quicker rate than others.

C) costs that decrease at a quicker rate than others.

D) costs that are variable or fixed.

E) None of these.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

Performance analysis in the planning and control cycle relates to the act of:

A) planning.

B) managing.

C) controlling.

D) revising plans.

A) planning.

B) managing.

C) controlling.

D) revising plans.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

The formula for expressing the total of a fixed, variable, or mixed cost at any level of activity is:

A) total cost = fixed cost + (variable rate * volume of activity).

B) total cost = fixed cost * volume of activity.

C) total cost = fixed cost * variable rate.

D) total cost = fixed cost - variable cost.

A) total cost = fixed cost + (variable rate * volume of activity).

B) total cost = fixed cost * volume of activity.

C) total cost = fixed cost * variable rate.

D) total cost = fixed cost - variable cost.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following activities is not part of the management planning and control cycle:

A) data collection and performance feedback.

B) implementation of plans.

C) providing information to investors and creditors.

D) revisiting plans.

A) data collection and performance feedback.

B) implementation of plans.

C) providing information to investors and creditors.

D) revisiting plans.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

Activities included in a generally accepted definition of management accounting include:

A) planning, organizing, controlling.

B) planning, operating, reporting.

C) preparing, operating, creating.

D) preparing, organizing, converting.

A) planning, organizing, controlling.

B) planning, operating, reporting.

C) preparing, operating, creating.

D) preparing, organizing, converting.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

As the total volume of activity changes:

A) the total of variable costs changes.

B) the total of fixed costs changes.

C) variable costs per unit change.

D) fixed costs per unit stay the same.

A) the total of variable costs changes.

B) the total of fixed costs changes.

C) variable costs per unit change.

D) fixed costs per unit stay the same.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

Expressing fixed costs on a per unit basis of activity is misleading because:

A) total fixed costs decrease as activity decreases.

B) total fixed costs increase as activity increases.

C) fixed cost per unit increase as activity increases.

D) fixed cost per unit decrease as activity increases.

A) total fixed costs decrease as activity decreases.

B) total fixed costs increase as activity increases.

C) fixed cost per unit increase as activity increases.

D) fixed cost per unit decrease as activity increases.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is another term for mixed costs?

A) Semifixed costs.

B) Semivariable costs.

C) Component costs.

D) None of these.

A) Semifixed costs.

B) Semivariable costs.

C) Component costs.

D) None of these.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

As the level of activity increases:

A) fixed cost per unit increase.

B) variable cost per unit increase.

C) variable cost per unit decrease.

D) fixed cost per unit decrease.

A) fixed cost per unit increase.

B) variable cost per unit increase.

C) variable cost per unit decrease.

D) fixed cost per unit decrease.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

When a cost formula is used to describe a mixed (semi-variable) cost behavior pattern, total costs are expected to increase and per unit costs are expected to:

A) increase as the level of activity increases.

B) decrease as the level of activity decreases.

C) decrease as the level of activity increases.

D) remain constant as the level of activity increases.

A) increase as the level of activity increases.

B) decrease as the level of activity decreases.

C) decrease as the level of activity increases.

D) remain constant as the level of activity increases.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

Managerial accounting, as opposed to financial accounting, is primarily concerned with:

A) preparing the current balance sheet of the company.

B) present and future planning and control.

C) providing information to investors and creditors.

D) historical results of operations.

A) preparing the current balance sheet of the company.

B) present and future planning and control.

C) providing information to investors and creditors.

D) historical results of operations.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

When the cost behavior pattern has been identified as fixed at a certain volume of activity:

A) any change in volume will probably cause the cost to change.

B) it is appropriate to express the cost on a per unit of activity basis.

C) the total cost will not change even if the volume of activity changes substantially.

D) the total cost may change if the volume of activity changes substantially.

A) any change in volume will probably cause the cost to change.

B) it is appropriate to express the cost on a per unit of activity basis.

C) the total cost will not change even if the volume of activity changes substantially.

D) the total cost may change if the volume of activity changes substantially.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

The relevant range concept refers to:

A) a firm's range of profitability.

B) a firm's range of sales.

C) a firm's range of rates of return.

D) a firm's range of activity.

A) a firm's range of profitability.

B) a firm's range of sales.

C) a firm's range of rates of return.

D) a firm's range of activity.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

Managerial accounting, as compared to financial accounting:

A) must conform to GAAP.

B) places a great deal of emphasis on historical transactions.

C) uses frequent and prompt control reports.

D) focuses on information prepared for the investors and creditors.

A) must conform to GAAP.

B) places a great deal of emphasis on historical transactions.

C) uses frequent and prompt control reports.

D) focuses on information prepared for the investors and creditors.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

Management accounting is:

A) a highly technical subject that people in personnel or engineering should not be expected to understand.

B) performed by individuals who seldom work with people in other functional areas of the organization.

C) the principal activity involved in determining the goals and objectives of the entity.

D) an activity that gets involved with virtually all of the other functional areas of the organization.

A) a highly technical subject that people in personnel or engineering should not be expected to understand.

B) performed by individuals who seldom work with people in other functional areas of the organization.

C) the principal activity involved in determining the goals and objectives of the entity.

D) an activity that gets involved with virtually all of the other functional areas of the organization.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

A 10% change in a firm's revenues is likely to result in a change of more than 10% in the firm's operating income because:

A) not all of the firm's costs will change in proportion to the revenue change.

B) the firm has financial leverage.

C) the contribution margin ratio will change in proportion to the revenue change.

D) only fixed expenses will change in proportion to the revenue change.

A) not all of the firm's costs will change in proportion to the revenue change.

B) the firm has financial leverage.

C) the contribution margin ratio will change in proportion to the revenue change.

D) only fixed expenses will change in proportion to the revenue change.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

What percentage of the contribution margin is profit on units sold in excess of the break-even point?

A) It's 50% to the contribution margin ratio.

B) It's equal to the variable cost ratio.

C) It's equal of the gross profit ratio.

D) It's 100%.

A) It's 50% to the contribution margin ratio.

B) It's equal to the variable cost ratio.

C) It's equal of the gross profit ratio.

D) It's 100%.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

The contribution margin format income statement is organized by:

A) responsibility centers.

B) functional classifications.

C) sales territories.

D) cost behavior classifications.

A) responsibility centers.

B) functional classifications.

C) sales territories.

D) cost behavior classifications.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

The contribution margin format income statement:

A) results in a larger amount of operating income than the traditional income statement format.

B) uses a behavior pattern classification for costs rather than a functional cost classification approach.

C) is most frequently used for financial statement reporting purposes.

D) emphasizes that all costs change in proportion to any change in revenues.

A) results in a larger amount of operating income than the traditional income statement format.

B) uses a behavior pattern classification for costs rather than a functional cost classification approach.

C) is most frequently used for financial statement reporting purposes.

D) emphasizes that all costs change in proportion to any change in revenues.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

An example of a cost that is likely to have a variable behavior pattern is:

A) sales force salaries.

B) depreciation of production equipment.

C) salaries of production supervisors.

D) production labor wages.

A) sales force salaries.

B) depreciation of production equipment.

C) salaries of production supervisors.

D) production labor wages.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

The concept of operating leverage refers to which of the following?

A) Operating income changes proportionately more than revenues for any given change in activity level.

B) Operating income changes proportionately less than revenues for any given change in activity level.

C) Operating income changes proportionately more than income for any given change in activity level.

D) Operating income changes proportionately less than income for any given change in activity level.

A) Operating income changes proportionately more than revenues for any given change in activity level.

B) Operating income changes proportionately less than revenues for any given change in activity level.

C) Operating income changes proportionately more than income for any given change in activity level.

D) Operating income changes proportionately less than income for any given change in activity level.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

The cost of a single unit of production in excess of the break-even point in units is:

A) its fixed cost and variable cost.

B) its fixed cost only.

C) its variable cost only.

D) None of these.

A) its fixed cost and variable cost.

B) its fixed cost only.

C) its variable cost only.

D) None of these.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

The scattergram allows cost-volume relationships to be visually scanned for outlier observations that should be:

A) included in the calculation of the cost formula of a mixed cost.

B) ignored in the calculation of the cost formula of a mixed cost.

C) included in the calculation of the fixed cost component of the mixed cost.

D) included in the calculation of the variable rate component of the mixed cost.

A) included in the calculation of the cost formula of a mixed cost.

B) ignored in the calculation of the cost formula of a mixed cost.

C) included in the calculation of the fixed cost component of the mixed cost.

D) included in the calculation of the variable rate component of the mixed cost.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

The cost formula for monthly customer order processing cost has been established as $100 + $0.15 per order. It is expected that 5,600 orders will be processed in May and 6,400 in June. Total order processing costs for May and June combined will be estimated to be:

A) $940.

B) $1,060.

C) $2,000.

D) $2,500.

A) $940.

B) $1,060.

C) $2,000.

D) $2,500.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

An example of a cost likely to have a mixed behavior pattern is:

A) sales force commission.

B) raw material cost.

C) depreciation of production equipment.

D) electricity cost for the manufacturing plant.

A) sales force commission.

B) raw material cost.

C) depreciation of production equipment.

D) electricity cost for the manufacturing plant.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following terms do not appear on the contribution margin format income statement:

A) gross profit.

B) contribution margin.

C) operating income.

D) variable expenses.

A) gross profit.

B) contribution margin.

C) operating income.

D) variable expenses.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

When the firm's activity requires it to operate at a level above the upper boundary of the relevant range, fixed expenses are likely to:

A) increase.

B) decrease.

C) remain the same.

D) be eliminated.

A) increase.

B) decrease.

C) remain the same.

D) be eliminated.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

As the level of activity decreases:

A) fixed cost per unit decrease.

B) variable cost per unit decrease.

C) fixed cost remains constant in total.

D) variable cost remains constant in total.

A) fixed cost per unit decrease.

B) variable cost per unit decrease.

C) fixed cost remains constant in total.

D) variable cost remains constant in total.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

An income statement organized by cost behavior does not include:

A) operating income.

B) gross profit.

C) contribution margin.

D) revenues.

A) operating income.

B) gross profit.

C) contribution margin.

D) revenues.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

To which function of management is CVP analysis most applicable?

A) Planning.

B) Organizing.

C) Directing.

D) Controlling.

A) Planning.

B) Organizing.

C) Directing.

D) Controlling.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

Operating income using the contribution margin format income statement is calculated as:

A) revenue - variable expenses = contribution margin - fixed expenses.

B) revenue - variable expenses = gross profit - fixed expenses.

C) revenue - cost of goods sold = contribution margin - fixed expenses.

D) revenue - cost of goods sold = contribution margin - operating expenses.

A) revenue - variable expenses = contribution margin - fixed expenses.

B) revenue - variable expenses = gross profit - fixed expenses.

C) revenue - cost of goods sold = contribution margin - fixed expenses.

D) revenue - cost of goods sold = contribution margin - operating expenses.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

An example of a cost likely to have a fixed behavior pattern is:

A) sales force commission.

B) production labor wages.

C) advertising cost.

D) electricity cost for packaging equipment.

A) sales force commission.

B) production labor wages.

C) advertising cost.

D) electricity cost for packaging equipment.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is the correct calculation for the contribution margin ratio?

A) Sales revenue divided by variable costs.

B) Sales revenue divided by contribution margin.

C) Contribution margin divided by sales revenue.

D) Contribution margin divided by variable costs.

A) Sales revenue divided by variable costs.

B) Sales revenue divided by contribution margin.

C) Contribution margin divided by sales revenue.

D) Contribution margin divided by variable costs.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

The term "relevant range" refers to:

A) the range of activity where costs will fluctuate.

B) the range of activity where fixed costs change as activity changes.

C) the range of activity where total variable cost remains constant as activity changes.

D) the range of activity where cost relationships are valid.

A) the range of activity where costs will fluctuate.

B) the range of activity where fixed costs change as activity changes.

C) the range of activity where total variable cost remains constant as activity changes.

D) the range of activity where cost relationships are valid.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

When the high-low method of estimating a cost behavior pattern is used:

A) cost and volume data must be reviewed for outliers.

B) the direct result of the high-low calculations is the fixed expense amount.

C) the highest and lowest sales price and volume amounts are used in the calculation.

D) the resulting cost formula will explain total cost accurately for every value between the high and low volumes.

A) cost and volume data must be reviewed for outliers.

B) the direct result of the high-low calculations is the fixed expense amount.

C) the highest and lowest sales price and volume amounts are used in the calculation.

D) the resulting cost formula will explain total cost accurately for every value between the high and low volumes.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

A firm's products have an average contribution margin ratio of 40%, which will be maintained for the next month even though fixed expenses are expected to rise by $20,000. In order to keep operating income for the month from being affected, revenues will have to increase by:

A) $8,000.

B) $12,000.

C) $20,000.

D) $50,000.

A) $8,000.

B) $12,000.

C) $20,000.

D) $50,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

XYZ Company incurred the following costs for the month of August when it observed an activity level of 10,000 units.  During October, the activity level was 16,000 units, and the total costs incurred were $150,000.

During October, the activity level was 16,000 units, and the total costs incurred were $150,000.

a. Calculate the variable costs, fixed costs, and mixed costs incurred during October.

b. Use the high-low method to calculate the cost formula for mixed costs.

c. If the activity level were expected to be 13,800 units for the month of December, what amount of total costs would be expected?

During October, the activity level was 16,000 units, and the total costs incurred were $150,000.

During October, the activity level was 16,000 units, and the total costs incurred were $150,000.a. Calculate the variable costs, fixed costs, and mixed costs incurred during October.

b. Use the high-low method to calculate the cost formula for mixed costs.

c. If the activity level were expected to be 13,800 units for the month of December, what amount of total costs would be expected?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

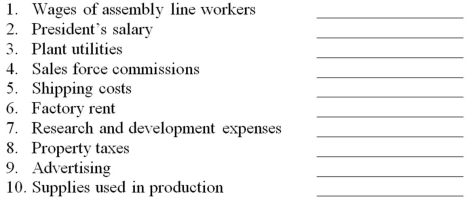

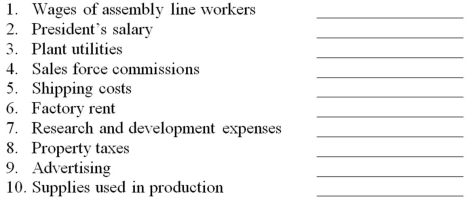

For each of the following costs, identify the cost behavior as variable, mixed, or fixed:

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

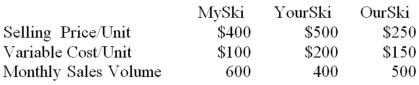

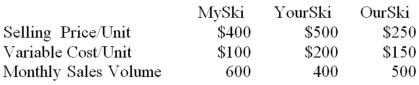

Obed Corp., makes three models of high performance cross country ski machines. Current operating data are summarized below:  Fixed expenses per month total $185,820

Fixed expenses per month total $185,820

(a) Calculate the contribution margin ratio for each product.

(b) Calculate the firm's overall contribution margin ratio.

(c) Calculate the firm's break-even point in sales dollar.

(d) Calculate the firm's operating income.

(e) Management is considering the elimination of the OurSki model due to low sales volume. As a result, total fixed expenses can be reduced by $60,000 per month. Assuming that this change would not affect the other models, would you recommend the elimination of the OurSki model?

Fixed expenses per month total $185,820

Fixed expenses per month total $185,820(a) Calculate the contribution margin ratio for each product.

(b) Calculate the firm's overall contribution margin ratio.

(c) Calculate the firm's break-even point in sales dollar.

(d) Calculate the firm's operating income.

(e) Management is considering the elimination of the OurSki model due to low sales volume. As a result, total fixed expenses can be reduced by $60,000 per month. Assuming that this change would not affect the other models, would you recommend the elimination of the OurSki model?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

Preppy Co. makes and sells a single product. The current selling price is $30 per unit. Variable costs are $21 per unit, and fixed expenses total $90,000 per month. Sales volume for July totaled 12,000 units.

a. Calculate the operating income for July.

b. Calculate the break-even point in units sold and total revenues.

c. Management is considering the use of automated production equipment. If this were done, variable costs would drop to $15.00 per unit, but fixed expenses would increase to $100,000 per month.

(1.) Calculate operating income at a volume of 12,000 units per month with the new cost structure.

(2.) Calculate the break-even point in units with the new cost structure.

a. Calculate the operating income for July.

b. Calculate the break-even point in units sold and total revenues.

c. Management is considering the use of automated production equipment. If this were done, variable costs would drop to $15.00 per unit, but fixed expenses would increase to $100,000 per month.

(1.) Calculate operating income at a volume of 12,000 units per month with the new cost structure.

(2.) Calculate the break-even point in units with the new cost structure.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

The contribution margin ratio always decreases when the:

A) break-even point decreases.

B) fixed expenses increase.

C) selling price increases and the variable costs remain constant.

D) variable cost increase and the selling price remains constant.

A) break-even point decreases.

B) fixed expenses increase.

C) selling price increases and the variable costs remain constant.

D) variable cost increase and the selling price remains constant.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

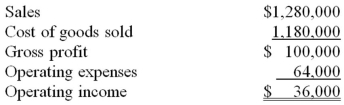

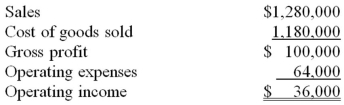

Presented below is the income statement for Ackee Food Center for the month of July:  Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 15 percent.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 15 percent.

(a.) Rearrange the above income statement to the contribution margin format.

(b.) If sales increase by 10 percent, what will be the firm's operating income?

(c.) Calculate the amount of revenue required for Ackee's Food Center to break even.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 15 percent.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 15 percent.(a.) Rearrange the above income statement to the contribution margin format.

(b.) If sales increase by 10 percent, what will be the firm's operating income?

(c.) Calculate the amount of revenue required for Ackee's Food Center to break even.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

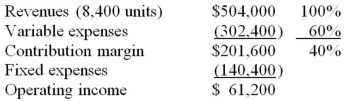

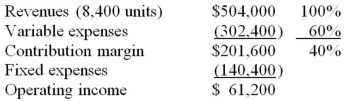

Brazen, Inc. produces sound amplifiers for electric guitars. The firm's income statement showed the following:  An automated machine has been developed that can produce several components of the amplifiers. If the machine is purchased, fixed expenses will increase to $315,000 per year. The firm's production capacity will increase, which is expected to result in a 25 percent increase in sales volume. It is also estimated that the variable expense ratio will be reduced to half of what it is now.

An automated machine has been developed that can produce several components of the amplifiers. If the machine is purchased, fixed expenses will increase to $315,000 per year. The firm's production capacity will increase, which is expected to result in a 25 percent increase in sales volume. It is also estimated that the variable expense ratio will be reduced to half of what it is now.

(a.) Calculate the firm's current contribution margin per unit and break-even point in units.

(b.) Calculate the firm's contribution margin per unit and break-even point in terms of units if the new machine is purchased.

(c.) Calculate the firm's operating income assuming that the new machine is purchased.

(d.) Do you believe that management of Brazen, Inc. should purchase the new machine? Explain your answer.

An automated machine has been developed that can produce several components of the amplifiers. If the machine is purchased, fixed expenses will increase to $315,000 per year. The firm's production capacity will increase, which is expected to result in a 25 percent increase in sales volume. It is also estimated that the variable expense ratio will be reduced to half of what it is now.

An automated machine has been developed that can produce several components of the amplifiers. If the machine is purchased, fixed expenses will increase to $315,000 per year. The firm's production capacity will increase, which is expected to result in a 25 percent increase in sales volume. It is also estimated that the variable expense ratio will be reduced to half of what it is now.(a.) Calculate the firm's current contribution margin per unit and break-even point in units.

(b.) Calculate the firm's contribution margin per unit and break-even point in terms of units if the new machine is purchased.

(c.) Calculate the firm's operating income assuming that the new machine is purchased.

(d.) Do you believe that management of Brazen, Inc. should purchase the new machine? Explain your answer.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

If fixed costs were increased by $9,000 and the contribution margin ratio remained at 30 percent, then sales must increase by _________ in order to cover the additional fixed expenses.

A) $27,000

B) $30,000

C) $33,000

D) $54,000

A) $27,000

B) $30,000

C) $33,000

D) $54,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

ABU Co. has several products, each with a different contribution margin ratio. If the same number of units were sold in July as in June, but the sales mix changed:

A) operating income would be the same in June and July.

B) fixed expenses in July would be in a different relevant range than in June.

C) the company's overall contribution margin ratio would be the same in June and July.

D) total contribution margin in July would be different from that in June.

A) operating income would be the same in June and July.

B) fixed expenses in July would be in a different relevant range than in June.

C) the company's overall contribution margin ratio would be the same in June and July.

D) total contribution margin in July would be different from that in June.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

A management decision that would have a long term influence on the operating leverage of a firm would be:

A) increasing the advertising budget.

B) substituting robots for hourly paid production workers.

C) increasing prices in proportion to raw material cost increases.

D) having a season-end sale of seasonal products.

A) increasing the advertising budget.

B) substituting robots for hourly paid production workers.

C) increasing prices in proportion to raw material cost increases.

D) having a season-end sale of seasonal products.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

Management of ABC Company is considering new production robotics to replace some current manual labor operations for one of their product lines. ABC's current cost structure for this product line consists of variable expenses of $40 per unit and fixed expenses totaling $86,400 per month. If the robotics were installed, variable expenses would drop to $28 per unit, but fixed expenses would increase to $135,600 per month.

(a.) Define the term indifference point.

(b.) Calculate the indifference point between the alternative cost structures for ABC Company's product line.

(c.) Explain how ABC's management would use the indifference point in the decision to replace the manual operations with the new production robotics.

(a.) Define the term indifference point.

(b.) Calculate the indifference point between the alternative cost structures for ABC Company's product line.

(c.) Explain how ABC's management would use the indifference point in the decision to replace the manual operations with the new production robotics.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

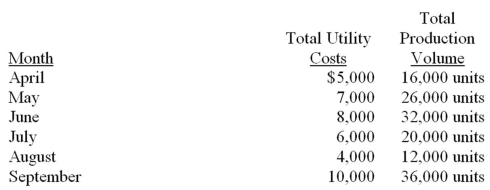

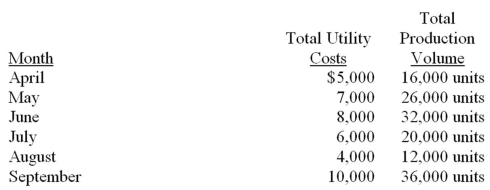

During the months of April through September, the following total utility costs were paid at various production volumes:  a. Use the high-low method to calculate the cost formula utility costs.

a. Use the high-low method to calculate the cost formula utility costs.

b. If the production volume were expected to be 22,000 units for the month of November, what amount of total costs would be expected?

a. Use the high-low method to calculate the cost formula utility costs.

a. Use the high-low method to calculate the cost formula utility costs.b. If the production volume were expected to be 22,000 units for the month of November, what amount of total costs would be expected?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

Each of a company's two product lines has a different contribution margin ratio. If the company's total sales remain the same but the sales mix shifts toward selling more of the product with the higher contribution ratio, which of the following is true?

A) Operating income will increase.

B) The average contribution margin ratio will increase.

C) The break-even point will decrease.

D) All of these are true.

A) Operating income will increase.

B) The average contribution margin ratio will increase.

C) The break-even point will decrease.

D) All of these are true.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

Each of a company's several product lines has a different contribution margin ratio. Total sales in 2014 were 20% higher than total sales in 2013. Total contribution margin for 2014 will be:

A) the same as it was in 2013, regardless of changes in sales mix.

B) 20% higher than it was in 2013, regardless of changes in sales mix.

C) more than 20% higher than it was in 2013, if the sales mix changes and proportionately more high contribution margin ratio products are sold in 2014 than in 2013.

D) less than 20% higher than it was in 2013, if the sales mix changes and proportionately more high contribution margin ratio products are sold in 2014 than in 2013.

A) the same as it was in 2013, regardless of changes in sales mix.

B) 20% higher than it was in 2013, regardless of changes in sales mix.

C) more than 20% higher than it was in 2013, if the sales mix changes and proportionately more high contribution margin ratio products are sold in 2014 than in 2013.

D) less than 20% higher than it was in 2013, if the sales mix changes and proportionately more high contribution margin ratio products are sold in 2014 than in 2013.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

A firm has revenues of $120,000, a contribution margin ratio of 30%, and fixed expenses that total $56,000. If revenues increase $20,000, then:

A) operating income will increase by $6000.

B) operating income will be 0.

C) fixed expenses will increase $8000.

D) the contribution margin ratio will increase by 1/8.

A) operating income will increase by $6000.

B) operating income will be 0.

C) fixed expenses will increase $8000.

D) the contribution margin ratio will increase by 1/8.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

Krultz Corp. has annual revenues of $760,000, an average contribution margin ratio of 30 percent, and fixed expenses of $75,000.

(a.) Management is considering adding a new product to the company's product line. The new item will have $21 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio.

(b.) If the new product adds an additional $36,000 to Krultz's fixed expenses, how many units of the new product must be sold to break even on the new product?

(c.) If 12,000 units of the new product could be sold at a price of $32 per unit, and the company's other business did not change, calculate Krultz's total operating income and average contribution margin ratio.

(a.) Management is considering adding a new product to the company's product line. The new item will have $21 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio.

(b.) If the new product adds an additional $36,000 to Krultz's fixed expenses, how many units of the new product must be sold to break even on the new product?

(c.) If 12,000 units of the new product could be sold at a price of $32 per unit, and the company's other business did not change, calculate Krultz's total operating income and average contribution margin ratio.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

Presented below is the income statement for Kettridge's Farm for the month of April:  Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 40%.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 40%.

(a.) Rearrange the income statement to the contribution margin format.

(b.) If sales increase by 10 percent, what will be the firm's operating income?

(c.) Calculate the amount of revenue required for Kettridge's Farm to break even.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 40%.

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 40%.(a.) Rearrange the income statement to the contribution margin format.

(b.) If sales increase by 10 percent, what will be the firm's operating income?

(c.) Calculate the amount of revenue required for Kettridge's Farm to break even.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck