Deck 5: Relevant Information and Decision-Making: Marketing Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/194

Play

Full screen (f)

Deck 5: Relevant Information and Decision-Making: Marketing Decisions

1

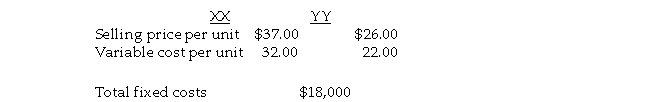

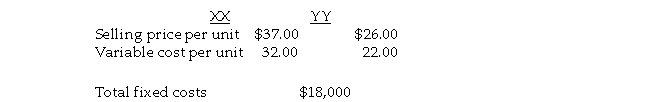

James Corporation manufactures two products, XX and YY. The following information was gathered:  If James Corporation could produce and sell either 10,000 units of XX or 5,000 units of YY at full capacity, it should produce and sell:

If James Corporation could produce and sell either 10,000 units of XX or 5,000 units of YY at full capacity, it should produce and sell:

A) 10,000 units of XX and none of YY

B) either XX or YY because James is indifferent to whether XX or YY is produced

C) 5,000 units of YY and none of XX

D) 3,000 units of YY and 6,000 units of XX

If James Corporation could produce and sell either 10,000 units of XX or 5,000 units of YY at full capacity, it should produce and sell:

If James Corporation could produce and sell either 10,000 units of XX or 5,000 units of YY at full capacity, it should produce and sell:A) 10,000 units of XX and none of YY

B) either XX or YY because James is indifferent to whether XX or YY is produced

C) 5,000 units of YY and none of XX

D) 3,000 units of YY and 6,000 units of XX

A

2

Emergency Manufacturing is considering producing a new product. Emergency Manufacturing expects that it will sell 2,000 units over the product's expected 4- year life. Variable production costs and variable selling costs are estimated at $42 and $16 per unit, respectively. Annual fixed production and fixed selling costs are estimated at $15,000 and $5,000, respectively. Research and development costs are estimated at $184,000. If the product sells for $200 per unit, the expected profit over the entire product life cycle is:

A) $20,000

B) $(40,000)

C) $204,000

D) None of these answers is correct.

A) $20,000

B) $(40,000)

C) $204,000

D) None of these answers is correct.

A

3

A small appliance manufacturer is deciding whether to accept or reject a special order for 1,000 units. There is sufficient capacity available for the order. is relevant for this decision.

A) The depreciation on assembly equipment

B) The parts for the order

C) The supervisor's salary

D) All of these answers are correct.

A) The depreciation on assembly equipment

B) The parts for the order

C) The supervisor's salary

D) All of these answers are correct.

B

4

Which of the statements below is false regarding special order decisions?

A) Fixed cost per unit is a necessary piece of information in the decision- making process.

B) The contribution approach offers more detailed information than does the absorption approach.

C) Fixed cost per unit is equal to total fixed costs divided by a selected volume level.

D) A fixed- cost element of an identical amount that is common among all alternatives is essentially irrelevant.

A) Fixed cost per unit is a necessary piece of information in the decision- making process.

B) The contribution approach offers more detailed information than does the absorption approach.

C) Fixed cost per unit is equal to total fixed costs divided by a selected volume level.

D) A fixed- cost element of an identical amount that is common among all alternatives is essentially irrelevant.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

5

In determining whether to purchase a labor saving machine, extreme resistance to the machine would be:

A) a relevant qualitative factor

B) a relevant quantitative factor

C) an irrelevant quantitative factor

D) an irrelevant qualitative factor

A) a relevant qualitative factor

B) a relevant quantitative factor

C) an irrelevant quantitative factor

D) an irrelevant qualitative factor

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

6

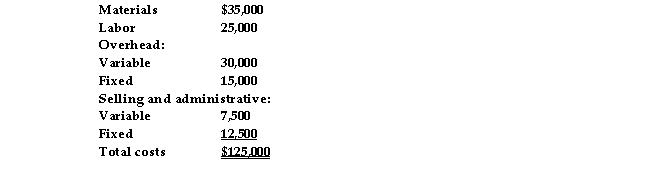

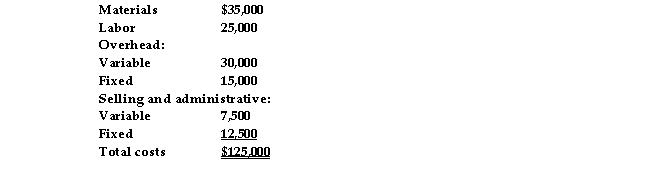

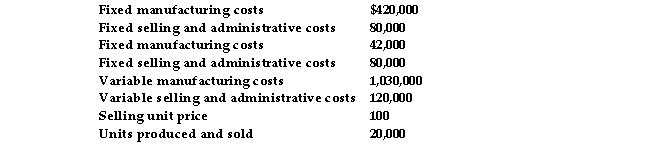

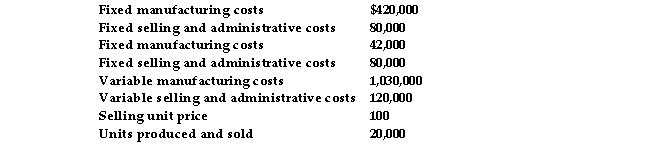

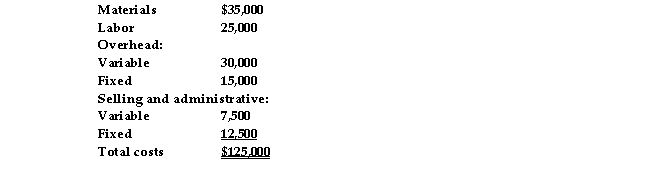

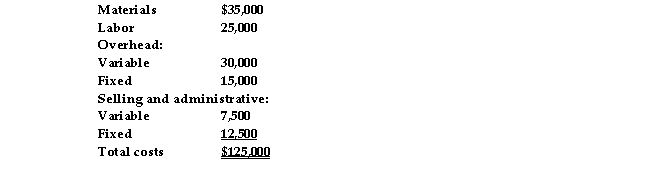

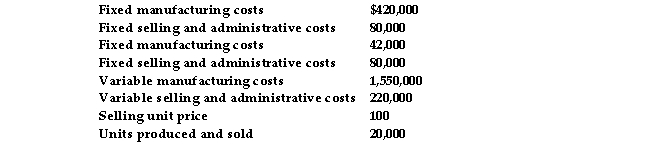

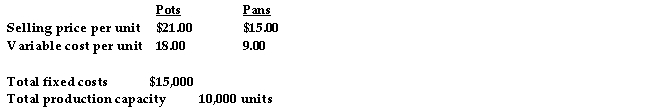

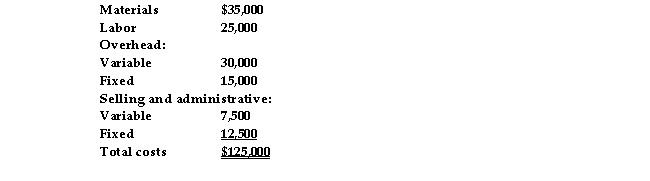

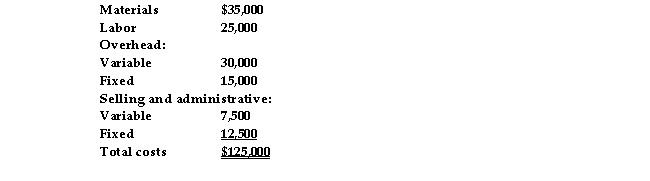

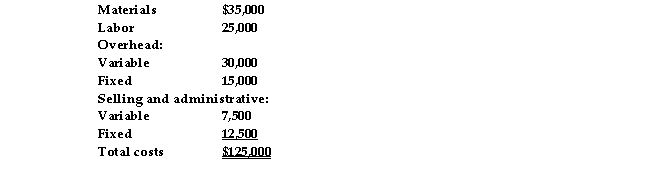

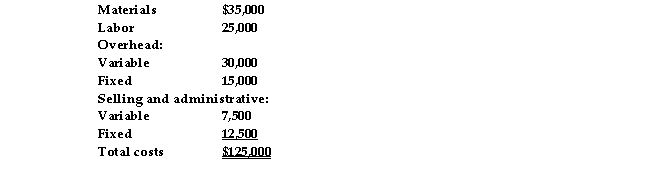

Yippee Industries budgeted the following costs for the production of its one and only product, golf balls, for the next fiscal year:  Yippee Industries has a target profit of $30,000. _ is the target price.

Yippee Industries has a target profit of $30,000. _ is the target price.

A) $155,000

B) $111,000

C) $125,000

D) $30,000

Yippee Industries has a target profit of $30,000. _ is the target price.

Yippee Industries has a target profit of $30,000. _ is the target price.A) $155,000

B) $111,000

C) $125,000

D) $30,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

7

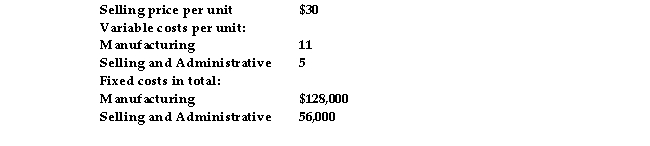

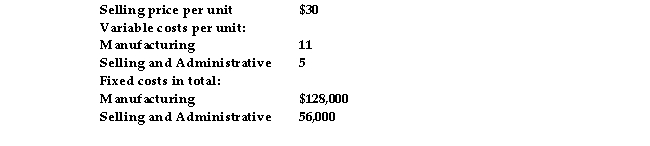

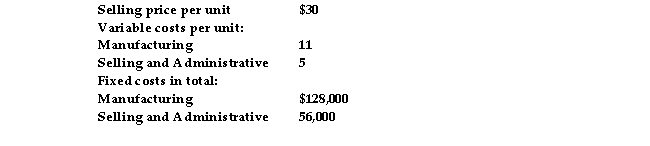

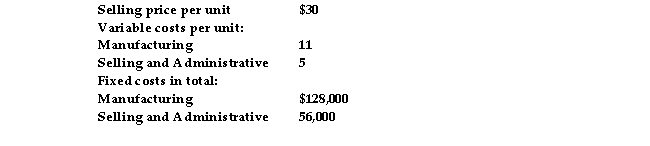

McNair Company has been producing and selling 40,000 skillets a year. McNair Company has the capacity to produce 50,000 skillets with its present facilities. The following information is also available:  is the cost per skillet using the total manufacturing cost approach.

is the cost per skillet using the total manufacturing cost approach.

A) $14.20

B) $20.00

C) $19.20

D) $16.00

is the cost per skillet using the total manufacturing cost approach.

is the cost per skillet using the total manufacturing cost approach.A) $14.20

B) $20.00

C) $19.20

D) $16.00

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

8

In deciding whether or not to add or delete a product or service, common costs are probably:

A) unavoidable and irrelevant

B) avoidable and relevant

C) irrelevant and avoidable

D) relevant and unavoidable

A) unavoidable and irrelevant

B) avoidable and relevant

C) irrelevant and avoidable

D) relevant and unavoidable

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the key question in decision making?

A) What difference will the choice make?

B) What are the past costs of each alternative?

C) What are the irrelevant costs?

D) What are the fixed costs of each alternative?

A) What difference will the choice make?

B) What are the past costs of each alternative?

C) What are the irrelevant costs?

D) What are the fixed costs of each alternative?

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

10

Additional sales will be profitable if:

A) total variable cost is less than sales price

B) the marginal cost is less than marginal revenue

C) sales price exceeds the variable product cost

D) the fixed cost equals the contribution margin

A) total variable cost is less than sales price

B) the marginal cost is less than marginal revenue

C) sales price exceeds the variable product cost

D) the fixed cost equals the contribution margin

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

11

are costs that continue even if an operation is halted.

A) Common costs

B) Unavoidable costs

C) Variable costs

D) Sunk costs

A) Common costs

B) Unavoidable costs

C) Variable costs

D) Sunk costs

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

12

is the average number of times the inventory is sold per year.

A) Inventory turnover

B) Inventory storage

C) Cost of goods available for sale

D) Cost of goods sold

A) Inventory turnover

B) Inventory storage

C) Cost of goods available for sale

D) Cost of goods sold

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

13

is the item that restricts or constrains the production or sale of a product or service.

A) A profitability constraint

B) A limiting factor

C) A resource limitation factor

D) A unit constraint

A) A profitability constraint

B) A limiting factor

C) A resource limitation factor

D) A unit constraint

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

14

In considering whether or not to produce a single product, the associated direct materials and direct labor costs would probably be:

A) an irrelevant quantitative factor

B) a relevant qualitative factor

C) an irrelevant qualitative factor

D) a relevant quantitative factor

A) an irrelevant quantitative factor

B) a relevant qualitative factor

C) an irrelevant qualitative factor

D) a relevant quantitative factor

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

15

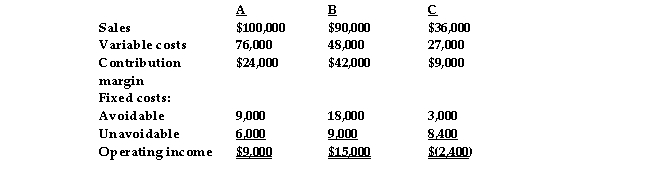

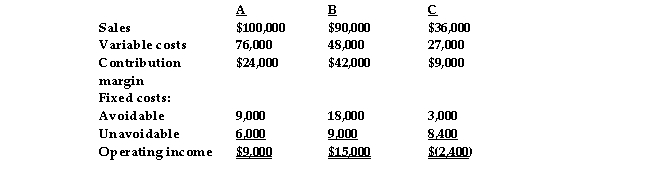

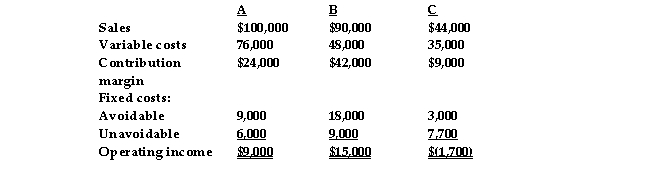

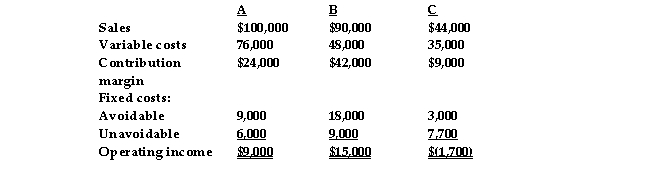

Alta Loma Industries has three product lines, A, B, and C. The following information is available:  Assume that product line C is discontinued and replaced with product line B. This will double the production and sales of product line B without increasing fixed costs. Operating income will:

Assume that product line C is discontinued and replaced with product line B. This will double the production and sales of product line B without increasing fixed costs. Operating income will:

A) increase $36,000

B) increase $42,000

C) increase $15,000

D) increase $24,000

Assume that product line C is discontinued and replaced with product line B. This will double the production and sales of product line B without increasing fixed costs. Operating income will:

Assume that product line C is discontinued and replaced with product line B. This will double the production and sales of product line B without increasing fixed costs. Operating income will:A) increase $36,000

B) increase $42,000

C) increase $15,000

D) increase $24,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

16

Marginal cost is:

A) the resulting additional cost

B) the additional cost resulting from producing and selling one additional unit

C) the cost per unit used to compute the contribution margin

D) total cost divided by contribution margin

A) the resulting additional cost

B) the additional cost resulting from producing and selling one additional unit

C) the cost per unit used to compute the contribution margin

D) total cost divided by contribution margin

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

17

Fitzgerald, Inc., provided the following information regarding its one and only product-ice skates:  is the unit cost of a pair of ice skates using the full cost approach.

is the unit cost of a pair of ice skates using the full cost approach.

A) $57.50

B) $78.50

C) $82.50

D) $51.50

is the unit cost of a pair of ice skates using the full cost approach.

is the unit cost of a pair of ice skates using the full cost approach.A) $57.50

B) $78.50

C) $82.50

D) $51.50

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

18

Riverside Industries has three product lines, A, B, and C. The following information is available:  Riverside Industries is thinking of dropping product line C because it is reporting a loss. Assuming Riverside drops line C and does not replace it, the operating income will:

Riverside Industries is thinking of dropping product line C because it is reporting a loss. Assuming Riverside drops line C and does not replace it, the operating income will:

A) increase by $600

B) decrease by $6,000

C) increase by $2,400

D) decrease by $9,000

Riverside Industries is thinking of dropping product line C because it is reporting a loss. Assuming Riverside drops line C and does not replace it, the operating income will:

Riverside Industries is thinking of dropping product line C because it is reporting a loss. Assuming Riverside drops line C and does not replace it, the operating income will:A) increase by $600

B) decrease by $6,000

C) increase by $2,400

D) decrease by $9,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

19

is a pricing decision.

A) Calculating contribution margin

B) Adding a product line

C) Submitting a sealed bid

D) Responding to a special order price

A) Calculating contribution margin

B) Adding a product line

C) Submitting a sealed bid

D) Responding to a special order price

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

20

are never relevant in the decision- making process.

A) Material costs

B) Fixed costs

C) Historical costs

D) Variable costs

A) Material costs

B) Fixed costs

C) Historical costs

D) Variable costs

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

21

Discriminatory pricing occurs when a firm:

A) sets prices so low that competitors are driven out of the market

B) sets different prices for different customers

C) sets uniform prices

D) sets prices below their competitors' prices

A) sets prices so low that competitors are driven out of the market

B) sets different prices for different customers

C) sets uniform prices

D) sets prices below their competitors' prices

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

22

Groucho Company has a current production capacity level of 200,000 units per month. At this level of production, variable costs are $0.80 per unit and fixed costs are $0.50 per unit. Current monthly sales are 184,500 units. Super Company has contacted Groucho Company about purchasing 20,000 units at $2.00 each. Current sales would not be affected by the special order and no additional fixed costs would be incurred on the special order. If Groucho Company decides to accept the special order, Groucho Company's costs will increase by:

A) $16,000

B) $24,000

C) $40,000

D) $20,000

A) $16,000

B) $24,000

C) $40,000

D) $20,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

23

Cerveza Manufacturing is considering producing a new product. Cerveza Manufacturing expects that it will sell 12,000 units over the product's expected 4- year life. Variable production costs and variable selling costs are estimated at $42 and $16 per unit, respectively. Annual fixed production and fixed selling costs are estimated at $15,000 and $5,000, respectively. Research and development costs are estimated at $184,000. If the product sells for $92 per unit, the average target markup for selling prices using a full cost approach is:

A) 13%

B) 667%

C) 87%

D) 15%

A) 13%

B) 667%

C) 87%

D) 15%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

24

Price elasticity measures:

A) the number of units a company is willing to sell

B) the effect of price changes on sales volume

C) the amount of competition in a given industry

D) the amount customers are willing to pay for a product or service

A) the number of units a company is willing to sell

B) the effect of price changes on sales volume

C) the amount of competition in a given industry

D) the amount customers are willing to pay for a product or service

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

25

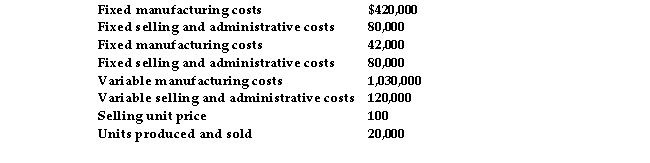

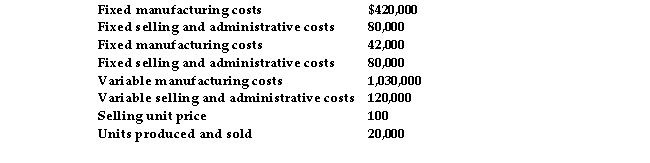

Sampras Industries budgeted the following costs for the production of its one and only product, tennis balls, for the next fiscal year:  Sampras Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total costs would be:

Sampras Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total costs would be:

A) 68%

B) 47%

C) 24%

D) 19%

Sampras Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total costs would be:

Sampras Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total costs would be:A) 68%

B) 47%

C) 24%

D) 19%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

26

The product strategy in which companies first determine the price at which they can sell a new product and then design a product that can be produced at a low enough cost to provide an adequate profit margin is referred to as:

A) discriminatory pricing

B) full costing

C) target costing

D) predatory pricing

A) discriminatory pricing

B) full costing

C) target costing

D) predatory pricing

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

27

Gatton, Inc., provided the following information regarding its one and only product-scissors:  Assuming there is excess capacity, the effect of accepting a special order for 1,000 units at a price of $80.00 per scissors will be:

Assuming there is excess capacity, the effect of accepting a special order for 1,000 units at a price of $80.00 per scissors will be:

A) net income would decrease by $80,000

B) net income would increase by $22,500

C) net income would increase by $1,000

D) net income would decrease by $200,000

Assuming there is excess capacity, the effect of accepting a special order for 1,000 units at a price of $80.00 per scissors will be:

Assuming there is excess capacity, the effect of accepting a special order for 1,000 units at a price of $80.00 per scissors will be:A) net income would decrease by $80,000

B) net income would increase by $22,500

C) net income would increase by $1,000

D) net income would decrease by $200,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

28

is (are) not a factor in pricing decisions.

A) Resource availability

B) Competitors' actions

C) Customer demands

D) Legal requirements

A) Resource availability

B) Competitors' actions

C) Customer demands

D) Legal requirements

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

29

All of the following represent a popular markup formula for pricing except:

A) as a percentage of variable manufacturing costs

B) as a percentage of all manufacturing costs plus all selling and administrative costs

C) as a percentage of all manufacturing costs

D) as a percentage of all selling and administrative costs

A) as a percentage of variable manufacturing costs

B) as a percentage of all manufacturing costs plus all selling and administrative costs

C) as a percentage of all manufacturing costs

D) as a percentage of all selling and administrative costs

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

30

Perry Corporation has been producing and selling 40,000 caps a year. The company has the capacity to produce 50,000 caps with its present facilities. The following information is also available:  The least that Perry would be willing to sell a cap for in the short run would be:

The least that Perry would be willing to sell a cap for in the short run would be:

A) $30.00

B) $14.00

C) $16.00

D) $20.40

The least that Perry would be willing to sell a cap for in the short run would be:

The least that Perry would be willing to sell a cap for in the short run would be:A) $30.00

B) $14.00

C) $16.00

D) $20.40

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

31

In perfect competition, the profit- maximizing volume is the quantity at which:

A) price exceeds marginal cost

B) contribution margin equals fixed cost

C) marginal cost equals marginal revenue

D) marginal revenue equals price

A) price exceeds marginal cost

B) contribution margin equals fixed cost

C) marginal cost equals marginal revenue

D) marginal revenue equals price

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

32

Game Company manufactures two products, A and B. The following information was gathered:  Assume Game Company could produce and sell any mix of products A and B at full capacity. If product A takes twice as long to manufacture as product B and only 120,000 hours of plant capacity are available, it is best for Game Company to produce:

Assume Game Company could produce and sell any mix of products A and B at full capacity. If product A takes twice as long to manufacture as product B and only 120,000 hours of plant capacity are available, it is best for Game Company to produce:

A) only A

B) an equal number of A and B

C) either A or B, there is no difference

D) only B

Assume Game Company could produce and sell any mix of products A and B at full capacity. If product A takes twice as long to manufacture as product B and only 120,000 hours of plant capacity are available, it is best for Game Company to produce:

Assume Game Company could produce and sell any mix of products A and B at full capacity. If product A takes twice as long to manufacture as product B and only 120,000 hours of plant capacity are available, it is best for Game Company to produce:A) only A

B) an equal number of A and B

C) either A or B, there is no difference

D) only B

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

33

is true about prediction methods.

A) That prediction methods are the same as decision models

B) That prediction methods use outputs from the decision model

C) That prediction methods generate inputs for the decision model

D) That prediction methods are the same as implementation methods

A) That prediction methods are the same as decision models

B) That prediction methods use outputs from the decision model

C) That prediction methods generate inputs for the decision model

D) That prediction methods are the same as implementation methods

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

34

When deciding whether to replace a product, service, or department, managers should choose the alternative that has:

A) the greatest contribution margin

B) the greatest contribution to pay unavoidable costs

C) the highest avoidable costs

D) the lowest overall cost

A) the greatest contribution margin

B) the greatest contribution to pay unavoidable costs

C) the highest avoidable costs

D) the lowest overall cost

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

35

Predatory pricing occurs when a firm:

A) sets different prices for different customers

B) sets uniform prices

C) sets prices below their competitors' prices

D) sets prices so low that competitors are driven out of the market

A) sets different prices for different customers

B) sets uniform prices

C) sets prices below their competitors' prices

D) sets prices so low that competitors are driven out of the market

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

36

is the additional cost resulting from producing and selling one additional unit.

A) Opportunity cost

B) Marginal cost

C) Common cost

D) Markup

A) Opportunity cost

B) Marginal cost

C) Common cost

D) Markup

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

37

Kennedy, Inc. provided the following information regarding its one and only product-a skateboard:  is the variable cost per unit of a skateboard using the contribution approach.

is the variable cost per unit of a skateboard using the contribution approach.

A) $88.50

B) $11.50

C) $77.50

D) $67.50

is the variable cost per unit of a skateboard using the contribution approach.

is the variable cost per unit of a skateboard using the contribution approach.A) $88.50

B) $11.50

C) $77.50

D) $67.50

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

38

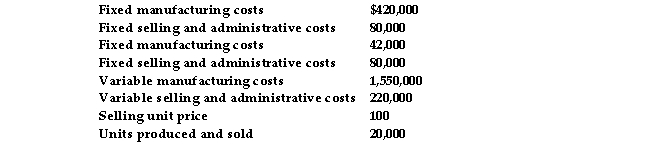

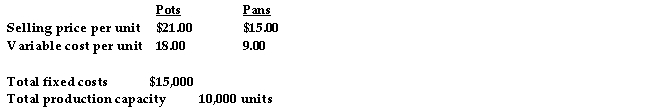

Wilson Corporation produces two products, Pots and Pans. The following information is available for these two products:  If at least 10,000 units of either Pots and/or Pans can be sold, it is best to:

If at least 10,000 units of either Pots and/or Pans can be sold, it is best to:

A) produce Pots only

B) produce 2,500 units of Pots and 7,500 units of Pans

C) produce 5,000 units of Pots and 5,000 units of Pans

D) produce Pans only

If at least 10,000 units of either Pots and/or Pans can be sold, it is best to:

If at least 10,000 units of either Pots and/or Pans can be sold, it is best to:A) produce Pots only

B) produce 2,500 units of Pots and 7,500 units of Pans

C) produce 5,000 units of Pots and 5,000 units of Pans

D) produce Pans only

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

39

In imperfect competition:

A) a firm will produce as many units as it can sell

B) a firm's market share is less than a competitor's market share

C) a firm's cost exceeds a competitor's costs

D) the price a firm charges will influence the quantity

A) a firm will produce as many units as it can sell

B) a firm's market share is less than a competitor's market share

C) a firm's cost exceeds a competitor's costs

D) the price a firm charges will influence the quantity

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

40

Each month Newton Company produces 11,000 units of a product that sells for $17 per unit, and has variable costs of $14 per unit. Total fixed costs for the month are $77,000. A special order is received for 5,000 units at a price of $15 per unit. Newton Company has adequate capacity for the special order. Relevant to the decision of whether to accept or reject this special order is the:

A) difference between the current fixed cost per unit and the expected fixed cost per unit

B) difference between the current sales price and the proposed sales price

C) difference between the offered price and the variable cost per unit

D) All of these answers are correct.

A) difference between the current fixed cost per unit and the expected fixed cost per unit

B) difference between the current sales price and the proposed sales price

C) difference between the offered price and the variable cost per unit

D) All of these answers are correct.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

41

Zippee Industries budgeted the following costs for the production of its one and only product, tennis balls, for the next fiscal year:  Zippee Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total production costs would be:

Zippee Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total production costs would be:

A) 68%

B) 158%

C) 32%

D) 48%

Zippee Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total production costs would be:

Zippee Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total production costs would be:A) 68%

B) 158%

C) 32%

D) 48%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

42

is (are) defined as any method for making a choice.

A) A decision model

B) Relevant costs

C) The implementation model

D) The prediction method

A) A decision model

B) Relevant costs

C) The implementation model

D) The prediction method

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

43

Nutty Manufacturing is considering producing a new product. Nutty Manufacturing expects that it will sell 2,000 units over the product's expected 4- year life. Variable production costs and variable selling costs are estimated at $42 and $16 per unit, respectively. Annual fixed production and fixed selling costs are estimated at $15,000 and $5,000, respectively. Research and development costs are estimated at $184,000. is the total cost over the product life cycle.

A) $380,000

B) $264,000

C) $196,000

D) $116,000

A) $380,000

B) $264,000

C) $196,000

D) $116,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

44

is the process of putting a decision into action.

A) Prediction

B) Evaluation of performance

C) Implementation

D) Feedback

A) Prediction

B) Evaluation of performance

C) Implementation

D) Feedback

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

45

Each quarter Sioux Company produces 30,000 units of a product that has variable costs of $60 per unit. Total fixed costs for the quarter are $990,000. A special order is received for 1,000 units at a price of $77 per unit. In deciding to accept or reject this special order, it is appropriate to consider the:

A) old fixed cost per unit of $33.00

B) difference between the two fixed costs per unit, which is $1.06

C) difference between the offered price and the variable cost per unit

D) new fixed cost per unit of $31.94

A) old fixed cost per unit of $33.00

B) difference between the two fixed costs per unit, which is $1.06

C) difference between the offered price and the variable cost per unit

D) new fixed cost per unit of $31.94

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

46

Savage Company produces and sells 35,000 units at $22 per unit. Savage Company's product cost is calculated as follows:  A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Savage Company has received a special order to sell 5,000 units at $12 per unit. Savage Company has excess capacity available, but these 5,000 would require 60 set- ups. If Savage Company accepts the special order, Savage Company's cost will increase by:

A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Savage Company has received a special order to sell 5,000 units at $12 per unit. Savage Company has excess capacity available, but these 5,000 would require 60 set- ups. If Savage Company accepts the special order, Savage Company's cost will increase by:

A) $47,200

B) $7,200

C) $40,000

D) $65,000

A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Savage Company has received a special order to sell 5,000 units at $12 per unit. Savage Company has excess capacity available, but these 5,000 would require 60 set- ups. If Savage Company accepts the special order, Savage Company's cost will increase by:

A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Savage Company has received a special order to sell 5,000 units at $12 per unit. Savage Company has excess capacity available, but these 5,000 would require 60 set- ups. If Savage Company accepts the special order, Savage Company's cost will increase by:A) $47,200

B) $7,200

C) $40,000

D) $65,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

47

The marketing department at Hi- Fi Electronics has determined that there is a demand for a new small appliance which would likely sell for $36. Hi- Fi Electronics currently produces a similar product for $38, using a full cost approach. Hi- Fi Electronics would like to earn a 20% profit on the new appliance. The target cost of the new appliance is:

A) $28.80

B) $38.00

C) $36.00

D) $30.00

A) $28.80

B) $38.00

C) $36.00

D) $30.00

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

48

Video Company manufactures two products, A and B. The following information was gathered:  Video Company manufactures and sells three units of A for every two units of B. If the company sold 1,500 units of A, it would report operating income (loss) of:

Video Company manufactures and sells three units of A for every two units of B. If the company sold 1,500 units of A, it would report operating income (loss) of:

A) $(25,000)

B) $34,500

C) $22,500

D) $9,500

Video Company manufactures and sells three units of A for every two units of B. If the company sold 1,500 units of A, it would report operating income (loss) of:

Video Company manufactures and sells three units of A for every two units of B. If the company sold 1,500 units of A, it would report operating income (loss) of:A) $(25,000)

B) $34,500

C) $22,500

D) $9,500

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

49

are relevant in deciding whether to add or delete a product or service.

A) Common costs

B) Avoidable costs

C) Unavoidable costs

D) All of these answers are correct.

A) Common costs

B) Avoidable costs

C) Unavoidable costs

D) All of these answers are correct.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

50

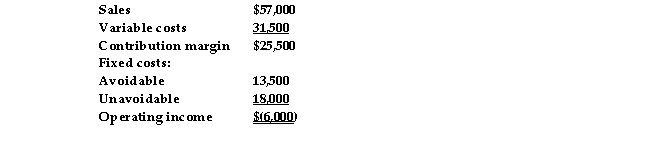

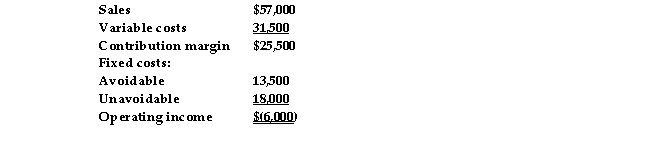

The most recent income statement for the Parma Branch of the Dinero Company is presented below.  If the Parma Branch is eliminated and the space is rented for $24,000, operating income will be:

If the Parma Branch is eliminated and the space is rented for $24,000, operating income will be:

A) increased by $24,000

B) decreased by $30,000

C) decreased by $12,000

D) increased by $12,000

If the Parma Branch is eliminated and the space is rented for $24,000, operating income will be:

If the Parma Branch is eliminated and the space is rented for $24,000, operating income will be:A) increased by $24,000

B) decreased by $30,000

C) decreased by $12,000

D) increased by $12,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

51

Marx Company has a current production capacity level of 200,000 units per month. At this level of production, variable costs are $0.50 per unit and fixed costs are $0.50 per unit. Current monthly sales are 183,000 units. Heaven Company has contacted Marx Company about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order and no additional fixed costs would be incurred on the special order. Marx Company's change in profits if the order is accepted will be:

A) a $15,000 increase

B) a $7,500 decrease

C) a $7,500 increase

D) a $15,000 decrease

A) a $15,000 increase

B) a $7,500 decrease

C) a $7,500 increase

D) a $15,000 decrease

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

52

Yetmar Corporation produces two products, Pots and Pans. The following information is available for these two products: If a maximum of 7,000 units of each product can be sold, it would be best to:

A) produce 7,000 units of Pots and 3,000 units of Pans to maximize profits

B) discontinue the production of both Pots and Pans

C) produce only 3,000 units of Pots and 7,000 units of Pans to maximize profits

D) produce 5,000 units of both Pots and Pans

A) produce 7,000 units of Pots and 3,000 units of Pans to maximize profits

B) discontinue the production of both Pots and Pans

C) produce only 3,000 units of Pots and 7,000 units of Pans to maximize profits

D) produce 5,000 units of both Pots and Pans

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

53

Watson Corporation manufactures two products, XX and YY. The following information was gathered: Assume Watson Corporation could produce and sell any mix of product XX and YY at full capacity. If product XX takes 50% longer to manufacture as product YY and only 120,000 hours of plant capacity are available, it is best for Watson to produce:

A) either XX or YY, there is no difference

B) an equal number of XX and YY

C) only YY

D) only XX

A) either XX or YY, there is no difference

B) an equal number of XX and YY

C) only YY

D) only XX

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

54

Thrilling Industries budgeted the following costs for the production of its one and only product, tennis balls, for the next fiscal year: Thrilling Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of prime costs would be:

A) 158%

B) 38%

C) 63%

D) 61%

A) 158%

B) 38%

C) 63%

D) 61%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

55

Sherbet Manufacturing is considering producing a new product. Sherbet Manufacturing expects that it will sell 2,000 units over the product's expected 4- year life. Variable production costs and variable selling costs are estimated at $42 and $16 per unit, respectively. Annual fixed production and fixed selling costs are estimated at $15,000 and $5,000, respectively. _ is the total fixed cost over the product life cycle.

A) $80,000

B) $464,000

C) $20,000

D) $116,000

A) $80,000

B) $464,000

C) $20,000

D) $116,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

56

Bulger Corporation has been producing and selling 40,000 hats a year. The Bulger Corporation has the capacity to produce 50,000 hats with its present facilities. The following information is also available:  If a special order is accepted for 10,000 hats at a price of $25 per unit, net income would:

If a special order is accepted for 10,000 hats at a price of $25 per unit, net income would:

A) decrease by $24,000

B) decrease by $140,000

C) increase by $90,000

D) increase by $250,000

If a special order is accepted for 10,000 hats at a price of $25 per unit, net income would:

If a special order is accepted for 10,000 hats at a price of $25 per unit, net income would:A) decrease by $24,000

B) decrease by $140,000

C) increase by $90,000

D) increase by $250,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

57

The contribution approach to pricing involves all of the following except that:

A) it makes it easier for managers to prepare price schedules at different volume levels

B) it emphasizes cost- volume- profit relationships

C) it assumes a given volume level

D) it displays variable and fixed cost behavior

A) it makes it easier for managers to prepare price schedules at different volume levels

B) it emphasizes cost- volume- profit relationships

C) it assumes a given volume level

D) it displays variable and fixed cost behavior

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

58

Couch Company can produce either product A or product B. If Couch Company produces product A, expected direct material cost will be $24,000. If Couch Company produces product B, expected direct material cost will be $24,000. In choosing between these alternatives, the $24,000 direct material cost is:

A) relevant because it is an expected future cost

B) relevant because it is a product cost

C) irrelevant because it does not differ between alternatives

D) irrelevant because it is an estimated cost

A) relevant because it is an expected future cost

B) relevant because it is a product cost

C) irrelevant because it does not differ between alternatives

D) irrelevant because it is an estimated cost

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

59

will not continue if an ongoing operation is changed or deleted.

A) Avoidable costs

B) Sunk costs

C) Differential costs

D) Common costs

A) Avoidable costs

B) Sunk costs

C) Differential costs

D) Common costs

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

60

Agassi Industries budgeted the following costs for the production of its one and only product, tennis balls, for the next fiscal year:  Agassi Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total variable costs would be:

Agassi Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total variable costs would be:

A) 38%

B) 158%

C) 59%

D) 63%

Agassi Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total variable costs would be:

Agassi Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of total variable costs would be:A) 38%

B) 158%

C) 59%

D) 63%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

61

In deciding whether to add or delete a product, service, or department, the depreciation associated with the custom- built equipment used to produce the product is an:

A) unavoidable variable cost

B) unavoidable fixed cost

C) avoidable variable cost

D) avoidable fixed cost

A) unavoidable variable cost

B) unavoidable fixed cost

C) avoidable variable cost

D) avoidable fixed cost

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

62

Information is relevant if it is:

A) an expected future cost or it differs among alternatives

B) an expected future cost that differs from a past cost

C) an expected future cost and it differs among alternatives

D) a historical cost and it differs among alternatives

A) an expected future cost or it differs among alternatives

B) an expected future cost that differs from a past cost

C) an expected future cost and it differs among alternatives

D) a historical cost and it differs among alternatives

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

63

is the predicted future costs and revenues that will differ among alternative courses of action.

A) Historical information

B) Predictable information

C) Sunk costs and revenues

D) Relevant information

A) Historical information

B) Predictable information

C) Sunk costs and revenues

D) Relevant information

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

64

The total of all manufacturing costs plus the total of all selling and administrative costs is equal to:

A) target cost

B) marginal cost

C) full cost

D) contribution cost

A) target cost

B) marginal cost

C) full cost

D) contribution cost

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

65

In a special order decision, fixed costs that do not differ between two alternatives are:

A) considered opportunity costs

B) important only if they are a material dollar amount

C) of major importance to the decision

D) irrelevant

A) considered opportunity costs

B) important only if they are a material dollar amount

C) of major importance to the decision

D) irrelevant

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

66

Peterson Company produces and sells 20,000 units at $20 per unit. Peterson Company's product cost is calculated as follows:

A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Peterson Company has received a special order to sell 5,000 units at $12 per unit. Peterson Company has excess capacity available, but these 5,000 would require 60 set- ups. If Peterson Company accepts the special order, Peterson Company's net income will:

A) increase by $12,800

B) increase by $20,000

C) increase by $5,000

D) decrease by $5,000

A total of 500 set- ups at a cost of $120 per set- up are required to produce the 20,000 units. Peterson Company has received a special order to sell 5,000 units at $12 per unit. Peterson Company has excess capacity available, but these 5,000 would require 60 set- ups. If Peterson Company accepts the special order, Peterson Company's net income will:

A) increase by $12,800

B) increase by $20,000

C) increase by $5,000

D) decrease by $5,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

67

If perfectly accurate and relevant information is not available for decision making, the accountant should consider using information that is:

A) imprecise but relevant

B) precise but irrelevant

C) imprecise but irrelevant

D) All of these answers are correct.

A) imprecise but relevant

B) precise but irrelevant

C) imprecise but irrelevant

D) All of these answers are correct.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

68

San Bernardino Industries has three product lines, A, B, and C. The following information is available: Assuming product line C is discontinued and the space formerly used to produce product C is rented for $15,000 per year, operating income will:

A) increase $14,400

B) increase $9,000

C) increase $6,600

D) increase $15,000

A) increase $14,400

B) increase $9,000

C) increase $6,600

D) increase $15,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

69

In deciding whether to add or delete a product, service, or department, the salary of the plant manager is an:

A) avoidable fixed cost

B) avoidable variable cost

C) unavoidable variable cost

D) unavoidable fixed cost

A) avoidable fixed cost

B) avoidable variable cost

C) unavoidable variable cost

D) unavoidable fixed cost

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

70

Citrus Industries has three product lines, A, B, and C. The following information is available: Assuming Citrus Industries can increase the selling price of product C to $30,000, all other information remaining constant, operating income will:

A) increase $6,000

B) decrease $6,000

C) decrease $3,600

D) increase $3,600

A) increase $6,000

B) decrease $6,000

C) decrease $3,600

D) increase $3,600

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

71

Denison Corporation has been producing and selling 60,000 skillets a year. The company has the capacity to produce 75,000 skillets with its present facilities. The following information is also available: is the variable cost per unit for a skillet using the contribution approach.

A) $10.00

B) $38.00

C) $34.00

D) None of these answers is correct.

A) $10.00

B) $38.00

C) $34.00

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

72

King Industries budgeted the following costs for the production of its one and only product, tennis balls, for the next fiscal year: King Industries has a target profit of $30,000. The average target markup for setting prices as a percentage of variable production costs would be:

A) 72%

B) 158%

C) 69%

D) 24%

A) 72%

B) 158%

C) 69%

D) 24%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

73

In a decision making process, the accountant's primary role is:

A) collecting relevant information

B) choosing the least costly alternative

C) identifying all possible courses of action

D) making the decision

A) collecting relevant information

B) choosing the least costly alternative

C) identifying all possible courses of action

D) making the decision

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

74

McCarville, Inc., provided the following information regarding its one and only product-scissors: is the current net income.

A) $1,650,000

B) $200

C) $350,000

D) $2,000,000

A) $1,650,000

B) $200

C) $350,000

D) $2,000,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

75

The most recent income statement for the Strongsville Branch of the July Company is presented below. The July Company is thinking of eliminating the Strongsville Branch because it is showing a loss. If the Strongsville Branch is eliminated, July's operating income will:

A) not change

B) decrease $12,000

C) increase $6,000

D) decrease $31,500

A) not change

B) decrease $12,000

C) increase $6,000

D) decrease $31,500

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

76

A one- time- only special order decision:

A) allows a company to sell products at prices which only cover fixed costs

B) has no role in segregating special and regular customers

C) involves selling products at a percentage over retail price due to the short time period involved

D) must involve unused plant capacity to avoid lost profits on regularly priced items

A) allows a company to sell products at prices which only cover fixed costs

B) has no role in segregating special and regular customers

C) involves selling products at a percentage over retail price due to the short time period involved

D) must involve unused plant capacity to avoid lost profits on regularly priced items

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

77

is not normally included in the accounting information provided to the decision maker.

A) Methods of obtaining information

B) Evaluation of the performance of the implemented decision

C) Cost predictions

D) Consumer needs analysis

A) Methods of obtaining information

B) Evaluation of the performance of the implemented decision

C) Cost predictions

D) Consumer needs analysis

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

78

Vanilla Manufacturing is considering producing a new product. Vanilla Manufacturing expects that it will sell 12,000 units over the life of the product. Variable production costs and variable selling costs are estimated at $42 and $16 per unit, respectively. Annual fixed production and fixed selling costs are estimated at $15,000 and $5,000, respectively. Research and development costs are estimated at $184,000. _ is the total variable cost over the product life cycle.

A) $716,000

B) $696,000

C) $880,000

D) $204,000

A) $716,000

B) $696,000

C) $880,000

D) $204,000

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

79

Sparrow Corporation provided the following information regarding its one and only product -tables: Assuming there is excess capacity, the effect of accepting a special order for 1,000 units at a price of

$40)00 per table is that:

A) net income would decrease by $10,000

B) net income would increase by $40,000

C) net income would increase by $11,250

D) net income would decrease by $28,750

$40)00 per table is that:

A) net income would decrease by $10,000

B) net income would increase by $40,000

C) net income would increase by $11,250

D) net income would decrease by $28,750

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

80

Bradley's Department Store can sell either products A or B. The following information was gathered: If Bradley's Department Store can sell either 8,000 units of A or 18,000 units of B at full capacity, it should sell:

A) Product A because the sales price per unit is higher

B) Product B because the total units sold is higher

C) Product B because the total contribution margin is higher

D) Product A because the contribution margin per unit is higher

A) Product A because the sales price per unit is higher

B) Product B because the total units sold is higher

C) Product B because the total contribution margin is higher

D) Product A because the contribution margin per unit is higher

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck