Deck 9: Replacement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 9: Replacement Analysis

1

Yellowjacket, Inc., a large textile company, is trying to decide how long it should retain one of its machines used in the sludge dewatering processes. The machine currently is estimated to have a $35,000 market value and a future market value of $18,000 next year, decreasing $1700 per year over its remaining maximum useful life of 8 years. The operating cost is expected to be $5500 next year, increasing by $450 each year thereafter. If the company's MARR is 15% per year, what is the economic service life of this asset?

EUAC1 = $27,750.00

EUAC2 = $19,656.67 EUAC3 = $17,033.40 EUAC4 = $15,773.47 EUAC5 = $15,054.80 EUAC6 = $14,605.84 EUAC7 = $14,311.29 EUAC8 = $14,108.40

The economic service life with the minimum EUAC should be selected.

EUAC2 = $19,656.67 EUAC3 = $17,033.40 EUAC4 = $15,773.47 EUAC5 = $15,054.80 EUAC6 = $14,605.84 EUAC7 = $14,311.29 EUAC8 = $14,108.40

The economic service life with the minimum EUAC should be selected.

2

A challenger asset with a maximum useful life of 6 years has a first cost of $43,000 and an estimated annual operating cost of $6250. The market value is expected to decrease by

$6450 each year for the next 6 years. If the MARR is 10% per year, what is the economic service life of this asset?

$6450 each year for the next 6 years. If the MARR is 10% per year, what is the economic service life of this asset?

The economic service life is 6 years with EUAC = $15,565.52

3

Three years ago, a company purchased a system of modular office furniture at a cost of

$29,000. Straight- line depreciation with no salvage value and a 5- year recovery period was used to write off the capital investment. A market value of $12,600 is expected if the system is sold now. If the system is kept, the company expects annual maintenance costs of $5500 each year and zero market value at the end of useful life. If the company decides to buy a new system, the new system will cost $32,000 and have a zero market value at the end of the estimated life of 5 years. The company expects annual maintenance costs of

$8500 each year. Assume an effective tax rate of 39% and an after- tax MARR of 7% per year. Determine whether the replacement now is economical.

$29,000. Straight- line depreciation with no salvage value and a 5- year recovery period was used to write off the capital investment. A market value of $12,600 is expected if the system is sold now. If the system is kept, the company expects annual maintenance costs of $5500 each year and zero market value at the end of useful life. If the company decides to buy a new system, the new system will cost $32,000 and have a zero market value at the end of the estimated life of 5 years. The company expects annual maintenance costs of

$8500 each year. Assume an effective tax rate of 39% and an after- tax MARR of 7% per year. Determine whether the replacement now is economical.

AWD7%) = - $7846.35 AWC7%) = - $10,493.80

AWD7%) > AWC7%); therefore, the current system should be retained.

AWD7%) > AWC7%); therefore, the current system should be retained.

4

A bin activator has an initial cost of $34,000 and a salvage value described by

S = 34,000 - 3300k, where k is the number of years since the bin activator was purchased. The net annual revenue is estimated by R = 5000 + 600k. The equipment will have a maximum useful life of 5 years. If the company's MARR is 4% per year, when is the best time to abandon the equipment?

S = 34,000 - 3300k, where k is the number of years since the bin activator was purchased. The net annual revenue is estimated by R = 5000 + 600k. The equipment will have a maximum useful life of 5 years. If the company's MARR is 4% per year, when is the best time to abandon the equipment?

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Lumberjack Power, operator of a nuclear power plant, is planning to replace its current equipment with some that is more environmentally friendly. The old equipment has annual operating expenses of $6750 and can be kept for 8 more years. The equipment will have a salvage value of $4000, if sold 8 years from now, and has a current market value of

$24,000, if it is sold now. The new equipment has an initial cost of $62,000 and has estimated annual operating expenses of $6250 each year. The estimated market value of the new equipment is $19,000 after 8 years of operation. If the company's MARR is 16% per year, should the equipment be replaced? Use a study period of 8 years and the present worth method.

$24,000, if it is sold now. The new equipment has an initial cost of $62,000 and has estimated annual operating expenses of $6250 each year. The estimated market value of the new equipment is $19,000 after 8 years of operation. If the company's MARR is 16% per year, should the equipment be replaced? Use a study period of 8 years and the present worth method.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Aztec, a manufacturer of hard board and fiber cement sidings and panels, purchased equipment for its new product line 9 years ago at a cost of $43,000. The asset has a market value of $17,700, if it were sold now. The current asset is expected to provide adequate services for another 3 years, given that the annual maintenance costs of $7250 is provided. It is estimated that, if the current asset is continued in service, its final market value will be

$9600 three years from now. However, due to changing customer needs, a new piece of machinery is being considered for the product line. The company can purchase the new equipment at a cost of $51,000 and a $540 salvage value at the end of 15- year economic life.

The new equipment has annual maintenance costs of $5250. The SL method with a

15- years life and zero market value is used to write off both assets. Determine whether replacement now is economical based on an after- tax annual worth analysis with an effective tax rate of 38% and an after- tax MARR of 2% per year.

$9600 three years from now. However, due to changing customer needs, a new piece of machinery is being considered for the product line. The company can purchase the new equipment at a cost of $51,000 and a $540 salvage value at the end of 15- year economic life.

The new equipment has annual maintenance costs of $5250. The SL method with a

15- years life and zero market value is used to write off both assets. Determine whether replacement now is economical based on an after- tax annual worth analysis with an effective tax rate of 38% and an after- tax MARR of 2% per year.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

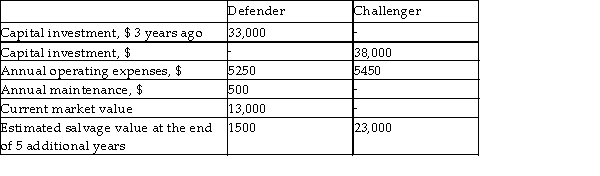

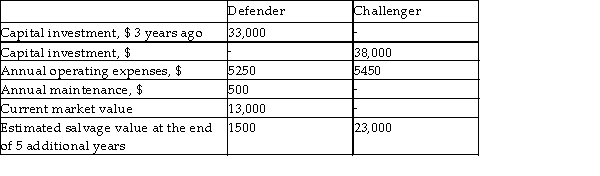

Bruin Manufacturing is evaluating whether it should retain its current environmental test chamber and room or sell it immediately and purchase a new one. The relevant costs are shown below. The current one can be kept for another 5 years, given that an additional maintenance cost of $500 each year is provided each year. Determine whether the current equipment should be replaced. Use a before- tax MARR of 13% per year and the annual cost method.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

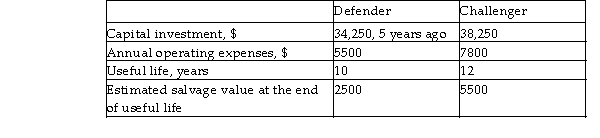

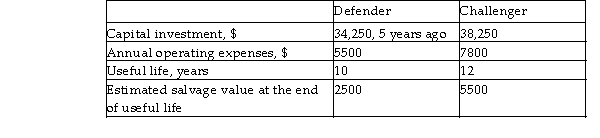

Razorback Corp. is evaluating whether it should keep its automatic guided vehicle or sell it immediately and purchase a new one. The current vehicle can be sold for $28,000 now; however, with an overhaul of $8250, the current vehicle can last another 5 years. Other relevant costs are shown below. Use a before- tax MARR of 5% per year and determine whether the current vehicle should be replaced.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck