Deck 4: Accrual Accounting Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

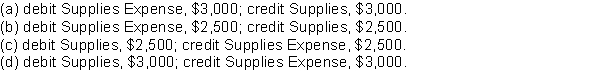

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

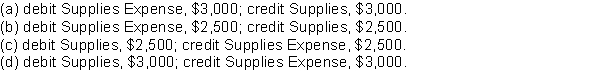

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/87

Play

Full screen (f)

Deck 4: Accrual Accounting Concepts

1

Since some costs are not recorded, adjusting entries are necessary.

True

2

The cost of any depreciable asset less accumulated depreciation reflects the carrying amount of the asset.

True

3

Under the cash basis of accounting, expense recognition generally does not follow revenue recognition.

True

4

Revenue must be recognized when (or as) the company satisfies the performance obligation, regardless of whether or not the transaction price has been determined.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

5

Accounting divides the economic life of a business entity into time periods.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

6

An accounting transaction never affects more than one accounting time period.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

7

Revenue recognition follows expense recognition.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

8

The balances of the Depreciation Expense and the Accumulated Depreciation accounts should always be the same.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

9

Prepaid expenses are costs that are paid for before they are used.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

10

When money is received from a customer prior to the delivery of goods or the performance of a service, it is recorded as revenue.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

11

Under the accrual basis of accounting, expenses are only recognized when they are paid.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

12

Revenue results when there is an increase in a liability or a decrease in an asset.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

13

Expense recognition always coincides with revenue recognition.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

14

The carrying amount of a depreciable asset is always equal to its actual value because depreciation is a valuation technique.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

15

Expense recognition is tied to changes in assets and liabilities.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

16

Accumulated Depreciation is a liability account and its normal account balance is a credit.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

17

For a private company reporting under ASPE, adjusting entries must be prepared at least quarterly.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

18

Under the cash basis of accounting, revenue is only recognized when cash is received.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

19

The purchase of certain types of long-lived (non-current) assets is essentially a long-term prepayment for services.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

20

Expenses paid before being used or consumed are initially recorded as liabilities.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

21

A contra asset account is subtracted from a related asset account in the statement of financial position and has a normal credit balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

22

Closing entries result in the transfer of net income or loss into the Retained Earnings account.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

23

When closing entries are posted, the result is a zero balance in each income statement account.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

24

Under IFRS, which of the following is generally not a guideline for recognizing revenue?

A) When (or as) the company satisfies the performance obligation.

B) The contract is identified with the client.

C) Collection is reasonably assured.

D) The transaction price is determinable.

A) When (or as) the company satisfies the performance obligation.

B) The contract is identified with the client.

C) Collection is reasonably assured.

D) The transaction price is determinable.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

25

The Dividends Declared account is closed to the Income Summary account at the end of each year.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

26

Adjusting entries never affect cash.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

27

When preparing the statement of financial position, the balance of Retained Earnings is taken from the Adjusted Trial Balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

28

The purpose of an adjusted trial balance is to ensure all adjusting entries have been recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

29

The post-closing trial balance will contain only permanent accounts.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

30

Financial statements are generally prepared before the closing entries are posted.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

31

Closing entries are prepared before adjusting entries.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not generally an accounting time period?

A) a week

B) a month

C) a quarter

D) a year

A) a week

B) a month

C) a quarter

D) a year

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

33

The Income Summary account is a permanent account.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

34

The post-closing trial balance will have fewer accounts than the adjusted trial balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

35

The statement of financial position and income statement can be prepared from the information provided by an adjusted trial balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

36

If a three-month, 6% bank loan for $5,000 is signed on October 1, the interest expense for the month of October is $25.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

37

The statement of changes in equity is prepared from the Common Shares, Retained Earnings and Dividends Declared accounts on the adjusted trial balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

38

The adjustment for accrued salaries results from services being paid for after the services are performed.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

39

Adjusting entries are needed

A) to produce relevant financial information.

B) only under the cash basis of accounting.

C) to update accounts at the beginning of the accounting period.

D) for budgeting purposes.

A) to produce relevant financial information.

B) only under the cash basis of accounting.

C) to update accounts at the beginning of the accounting period.

D) for budgeting purposes.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

40

An adjusted trial balance must be prepared before the adjusting entries can be recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

41

The preparation of adjusting entries

A) is straight-forward because the accounts that need adjustment will be out of balance.

B) requires an understanding of the company's operations and the inter-relationship of accounts.

C) is only required for accounts that do not have a normal balance.

D) is optional when financial statements are prepared.

A) is straight-forward because the accounts that need adjustment will be out of balance.

B) requires an understanding of the company's operations and the inter-relationship of accounts.

C) is only required for accounts that do not have a normal balance.

D) is optional when financial statements are prepared.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

42

Using accrual accounting, expenses are recorded and reported only

A) when they are incurred for the purpose of generating revenue, whether or not cash is paid.

B) when they are incurred and paid at the same time.

C) if they are paid before they are incurred.

D) if they are paid after they are incurred.

A) when they are incurred for the purpose of generating revenue, whether or not cash is paid.

B) when they are incurred and paid at the same time.

C) if they are paid before they are incurred.

D) if they are paid after they are incurred.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

43

Adjusting entries are required

A) because some costs expire with the passage of time, but have not yet been recorded.

B) when the company's net income is below budget.

C) when expenses are recorded in the period in which they are incurred.

D) when revenues are recorded in the period in which they are earned.

A) because some costs expire with the passage of time, but have not yet been recorded.

B) when the company's net income is below budget.

C) when expenses are recorded in the period in which they are incurred.

D) when revenues are recorded in the period in which they are earned.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

44

Which one of the following is not a justification for adjusting entries?

A) Adjusting entries are necessary to ensure that revenue recognition criteria are followed.

B) Adjusting entries are necessary to ensure that expense recognition criteria are followed.

C) Adjusting entries are necessary to enable financial statements to be in conformity with IFRS or ASPE.

D) Adjusting entries are necessary to bring the general ledger accounts in line with the budget.

A) Adjusting entries are necessary to ensure that revenue recognition criteria are followed.

B) Adjusting entries are necessary to ensure that expense recognition criteria are followed.

C) Adjusting entries are necessary to enable financial statements to be in conformity with IFRS or ASPE.

D) Adjusting entries are necessary to bring the general ledger accounts in line with the budget.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

45

Fang's Tune-Up Shop Ltd. uses the accrual basis of accounting. Fang services a car on May 31. The customer picks up the vehicle on June 1 and mails payment to Fang on June 5. Fang receives the cheque in the mail on June 6. When would Fang recognize the revenue as being earned?

A) June 6

B) June 5

C) June 1

D) May 31

A) June 6

B) June 5

C) June 1

D) May 31

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

46

An adjusting entry to a prepaid expense

A) is not required in the future if prepaid costs are initially recorded as an asset.

B) reduces a company's liabilities.

C) is required to recognize costs that expire with time.

A) is not required in the future if prepaid costs are initially recorded as an asset.

B) reduces a company's liabilities.

C) is required to recognize costs that expire with time.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

47

Wong's Tune-Up Shop Limited uses the cash basis of accounting. Wong services a car on May 31. The customer picks up the vehicle on June 1 and mails payment to Wong on June 5. Wong receives the cheque in the mail on June 6. When would Wong recognize the revenue as being earned?

A) June 6

B) June 5

C) June 1

D) May 31

A) June 6

B) June 5

C) June 1

D) May 31

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

48

The general term employed to indicate an expense that has not been paid or revenue that has not been received and has not yet been recognized in the accounts is a(n)

A) contra asset.

B) prepayment.

C) asset.

D) accrual.

A) contra asset.

B) prepayment.

C) asset.

D) accrual.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

49

In general, revenue recognition occurs

A) when cash is received.

B) when it is earned.

C) when expenses are incurred.

D) in the period that income taxes are paid.

A) when cash is received.

B) when it is earned.

C) when expenses are incurred.

D) in the period that income taxes are paid.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

50

Recording transactions that affect a company's financial statements in the periods in which they occur rather than when cash is received or paid is called

A) time period accounting.

B) the cash basis of accounting.

C) monetary accounting.

D) the accrual basis of accounting.

A) time period accounting.

B) the cash basis of accounting.

C) monetary accounting.

D) the accrual basis of accounting.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

51

Some accounts need to be adjusted because

A) there are never enough accounts to record all the transactions.

B) they are not up to date at the time financial statements are prepared.

C) there are always errors made in recording transactions.

D) management can't decide what they want to report.

A) there are never enough accounts to record all the transactions.

B) they are not up to date at the time financial statements are prepared.

C) there are always errors made in recording transactions.

D) management can't decide what they want to report.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

52

Under the accrual basis of accounting

A) cash must be received before revenue is recognized.

B) net income is calculated by matching cash outflows against cash inflows.

C) revenue is recognized when earned, while expenses are recognized when incurred to generate revenue.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles.

A) cash must be received before revenue is recognized.

B) net income is calculated by matching cash outflows against cash inflows.

C) revenue is recognized when earned, while expenses are recognized when incurred to generate revenue.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

53

Adjusting entries can be classified as

A) postponements and advances.

B) accruals and prepayments.

C) prepayments and postponements.

D) accruals and advances.

A) postponements and advances.

B) accruals and prepayments.

C) prepayments and postponements.

D) accruals and advances.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

54

Guardian Corp. sells $6,250 of goods on account in the current year and collects $3,250 of this. It incurs $4,200 in expenses on account during the current year and pays $2,600 of them. Guardian would report what amount of net income under the cash and accrual bases of accounting, respectively?

A) $2,050 on the cash basis and $3,000 on the accrual basis

B) $3,250 on the cash basis and $4,200 on the accrual basis

C) $3,000 on the cash basis and $1,600 on the accrual basis

D) $650 on the cash basis and $2,050 on the accrual basis

A) $2,050 on the cash basis and $3,000 on the accrual basis

B) $3,250 on the cash basis and $4,200 on the accrual basis

C) $3,000 on the cash basis and $1,600 on the accrual basis

D) $650 on the cash basis and $2,050 on the accrual basis

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

55

Under IFRS, revenue recognition criteria include recognizing revenue when

A) cash is received.

B) the company satisfies the performance obligation.

C) related expenses are recognized.

D) the revenue is recorded.

A) cash is received.

B) the company satisfies the performance obligation.

C) related expenses are recognized.

D) the revenue is recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

56

A furniture factory's employees work overtime in February to finish an order that is sold on February 28. The office sends a statement to the customer in early March and payment is received by mid-March. The overtime salaries should be expensed in

A) February.

B) March.

C) the period when the workers receive their cheques.

D) either February or March depending on when the pay period ends.

A) February.

B) March.

C) the period when the workers receive their cheques.

D) either February or March depending on when the pay period ends.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

57

On February 15, a local business receives an invoice for electricity used in the month of January and pays it on March 1. In which month should the business recognize the expense?

A) February

B) January

C) March

D) No expense should be recorded.

A) February

B) January

C) March

D) No expense should be recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

58

A dress shop makes a dress that sells for $200 and delivers it to the customer on June 30. The customer is sent a statement on July 7 and a cheque is received by the dress shop on July 11. When should the $200 be recognized as revenue?

A) July 7

B) July 11

C) June 30

D) July 1

A) July 7

B) July 11

C) June 30

D) July 1

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is true regarding depreciation?

A) Depreciation is a valuation concept; that is, we allocate costs to reflect the actual change in the value of the asset.

B) Depreciation allocates the cost of a long-lived asset to the accounting periods over which it is used.

C) Depreciation expense will typically will be shown on the statement of financial position.

D) Accumulated depreciation has a normal debit balance.

A) Depreciation is a valuation concept; that is, we allocate costs to reflect the actual change in the value of the asset.

B) Depreciation allocates the cost of a long-lived asset to the accounting periods over which it is used.

C) Depreciation expense will typically will be shown on the statement of financial position.

D) Accumulated depreciation has a normal debit balance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

60

Adjusting entries are

A) not necessary if the accounting system is operating properly.

B) usually required before financial statements are prepared.

C) made whenever management desires to change an account balance.

D) made to statement of financial position accounts only.

A) not necessary if the accounting system is operating properly.

B) usually required before financial statements are prepared.

C) made whenever management desires to change an account balance.

D) made to statement of financial position accounts only.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

61

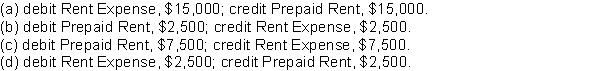

On July 1, Kingston Store paid $15,000 to Location Realty for six months rent, starting July 1. Prepaid Rent was debited for the full amount. If financial statements are prepared on July 31, the adjusting entry to be made by Kingston Store is

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

62

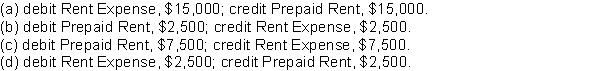

The balance in the Prepaid Rent account before adjustment at the end of the year is $12,000 and represents three months rent starting on November 1. The adjusting entry required on December 31, assuming adjusting entries have not previously been made, is

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

63

When a company performs a service for which payment was received in advance, a journal entry is recorded that will

A) increase revenue and decrease unearned revenue.

B) decrease revenue and increase unearned revenue.

C) increase cash and increase revenue.

D) increase cash and decrease unearned revenue.

A) increase revenue and decrease unearned revenue.

B) decrease revenue and increase unearned revenue.

C) increase cash and increase revenue.

D) increase cash and decrease unearned revenue.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

64

An asset purchased for $130,000 on the first day of the fiscal year with a useful life of 5 years has an annual depreciation expense of

A) $25,000.

B) $125,000.

C) $26,000.

D) $2,167.

A) $25,000.

B) $125,000.

C) $26,000.

D) $2,167.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

65

A legal firm received $2,000 cash for legal services to be rendered in the future. The full amount was credited to Unearned Revenue. If the legal services have been provided at the end of the accounting period and no adjusting entry has previously been made, this would cause

A) expenses to be overstated.

B) net income to be overstated.

C) liabilities to be understated.

D) revenues to be understated.

A) expenses to be overstated.

B) net income to be overstated.

C) liabilities to be understated.

D) revenues to be understated.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

66

Unearned revenues are

A) received and recorded as liabilities before they are earned.

B) earned and recorded as liabilities before they are received.

C) earned but not yet received or recorded.

D) earned and already received and recorded.

A) received and recorded as liabilities before they are earned.

B) earned and recorded as liabilities before they are received.

C) earned but not yet received or recorded.

D) earned and already received and recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

67

McCloud Realty received a cheque for $21,000 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client. Unearned Revenue was credited for the full $21,000. Financial statements will be prepared on July 31. McCloud Realty should make the following adjusting entry on July 31:

A) debit Unearned Revenue, $3,500; credit Rent Revenue, $3,500.

B) debit Rent Revenue, $3,500; credit Unearned Revenue, $3,500.

C) debit Unearned Revenue, $21,000; credit Rent Revenue, $21,000.

D) debit Cash, $3,500; credit Rent Revenue, $3,500.

A) debit Unearned Revenue, $3,500; credit Rent Revenue, $3,500.

B) debit Rent Revenue, $3,500; credit Unearned Revenue, $3,500.

C) debit Unearned Revenue, $21,000; credit Rent Revenue, $21,000.

D) debit Cash, $3,500; credit Rent Revenue, $3,500.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

68

The adjusting entry for unearned revenues results in

A) an increase to a liability account and a decrease to a revenue account.

B) a decrease to a liability account and an increase to a revenue account.

C) neither an increase or a decrease to a liability account.

D) neither an increase or a decrease to a revenue account.

A) an increase to a liability account and a decrease to a revenue account.

B) a decrease to a liability account and an increase to a revenue account.

C) neither an increase or a decrease to a liability account.

D) neither an increase or a decrease to a revenue account.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

69

Prepare the required year end adjusting entries for each independent case listed below. Assume no adjustments were made during the year.Case 1Ainsworth Corporation began the year with a $6,200 balance in the Supplies account. During the year, $2,750 worth of additional supplies were purchased. A physical count of supplies on hand at the end of the year revealed that $3,875 worth of supplies had been used during the year.Case 2Brownstone Co. Ltd. has a calendar fiscal year. On Oct 1, the company purchased equipment for $45,000. The estimated useful life of the equipment is 9 years.Case 3Michaela Management Ltd. is in the business of renting out several apartment buildings and prepares monthly financial statements. It has been determined that two tenants in $950 per month apartments and one tenant in the $1,400 per month apartment had not paid their December rent as of December 31.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

70

Unearned revenue is classified as a(n)

A) asset account.

B) revenue account.

C) equity account.

D) liability.

A) asset account.

B) revenue account.

C) equity account.

D) liability.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following reflects the balances of prepayment accounts prior to adjustment?

A) Statement of financial position accounts are understated and income statement accounts are understated.

B) Statement of financial position accounts are overstated and income statement accounts are overstated.

C) Statement of financial position accounts are overstated and income statement accounts are understated.

D) Statement of financial position accounts are understated and income statement accounts are overstated.

A) Statement of financial position accounts are understated and income statement accounts are understated.

B) Statement of financial position accounts are overstated and income statement accounts are overstated.

C) Statement of financial position accounts are overstated and income statement accounts are understated.

D) Statement of financial position accounts are understated and income statement accounts are overstated.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

72

An asset-expense relationship exists with

A) liability accounts.

B) revenue accounts.

C) prepaid expense adjusting entries.

D) accrued expense adjusting entries.

A) liability accounts.

B) revenue accounts.

C) prepaid expense adjusting entries.

D) accrued expense adjusting entries.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

73

Accumulated Depreciation is a(n)

A) expense account.

B) shareholders' equity account.

C) liability account.

D) contra asset account.

A) expense account.

B) shareholders' equity account.

C) liability account.

D) contra asset account.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

74

If a business has received cash in advance of services being performed and credits a liability account, the adjusting entry needed after the services are performed will be

A) debit Unearned Revenue and credit Cash.

B) debit Unearned Revenue and credit Sales.

C) credit Unearned Revenue and debit Sales.

D) debit Unearned Revenue and credit Accounts Receivable.

A) debit Unearned Revenue and credit Cash.

B) debit Unearned Revenue and credit Sales.

C) credit Unearned Revenue and debit Sales.

D) debit Unearned Revenue and credit Accounts Receivable.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

75

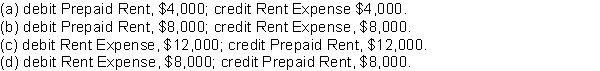

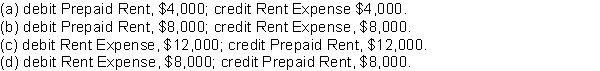

The Town Laundry Ltd. purchased $5,500 worth of laundry supplies on June 2 and recorded the purchase as an asset in the Supplies account. On June 30, a count of the laundry supplies indicated only $3,000 on hand. The adjusting entry that should be made by the company on June 30 is

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

76

The Jasmine Corporation purchased a notebook computer for $3,600 on December 1. The useful life of the notebook computer is estimated to be 3 years. If financial statements are to be prepared on December 31, the company should make the following adjusting entry:

A) debit Depreciation Expense, $1,200; credit Accumulated Depreciation-Equipment, $1,200.

B) debit Depreciation Expense, $100; credit Accumulated Depreciation-Equipment, $100.

C) debit Accumulated Depreciation-Equipment, $1,200; credit Depreciation Expense, $1,200.

D) debit Equipment, $100; credit Accumulated Depreciation-Equipment, $100.

A) debit Depreciation Expense, $1,200; credit Accumulated Depreciation-Equipment, $1,200.

B) debit Depreciation Expense, $100; credit Accumulated Depreciation-Equipment, $100.

C) debit Accumulated Depreciation-Equipment, $1,200; credit Depreciation Expense, $1,200.

D) debit Equipment, $100; credit Accumulated Depreciation-Equipment, $100.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following accounts would not likely need to be adjusted at year end?

A) Supplies

B) Equipment

C) Prepaid Insurance

D) Unearned Revenue

A) Supplies

B) Equipment

C) Prepaid Insurance

D) Unearned Revenue

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

78

Prepaid expenses are

A) paid and recorded in an asset account before they are used or consumed.

B) paid and recorded in an asset account after they are used or consumed.

C) incurred but not yet paid or recorded.

D) incurred and already paid or recorded.

A) paid and recorded in an asset account before they are used or consumed.

B) paid and recorded in an asset account after they are used or consumed.

C) incurred but not yet paid or recorded.

D) incurred and already paid or recorded.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

79

Griffin Inc. purchased supplies costing $4,250 and debited Supplies for the full amount. At the end of the accounting period, a physical count of supplies revealed $2,100 still on hand. The appropriate adjusting journal entry to be made at the end of the period would be

A) debit Supplies Expense, $2,100; credit Supplies, $2,100.

B) debit Supplies Expense, $2,150; credit Supplies, $2,150.

C) debit Supplies, $4,250; credit Supplies Expense, $4,250.

D) debit Supplies, $2,100; credit Supplies Expense, $2,100.

A) debit Supplies Expense, $2,100; credit Supplies, $2,100.

B) debit Supplies Expense, $2,150; credit Supplies, $2,150.

C) debit Supplies, $4,250; credit Supplies Expense, $4,250.

D) debit Supplies, $2,100; credit Supplies Expense, $2,100.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

80

Ray Autobody purchased a car jack for $16,000 on July 1. The estimated useful life of the car jack is 4 years. If the financial statements are prepared on December 31, Ray should make the following adjusting journal entry, assuming adjusting entries are made only annually:

A) debit Depreciation Expense, $2,000, credit Accumulated Depreciation-Equipment, $2,000.

B) debit Depreciation Expense, $1,667, credit Accumulated Depreciation-Equipment, $1,667.

C) debit Depreciation Expense, $4,000, credit Accumulated Depreciation-Equipment, $4,000.

D) debit Equipment, $2,000, credit Accumulated Depreciation-Equipment, $2,000.

A) debit Depreciation Expense, $2,000, credit Accumulated Depreciation-Equipment, $2,000.

B) debit Depreciation Expense, $1,667, credit Accumulated Depreciation-Equipment, $1,667.

C) debit Depreciation Expense, $4,000, credit Accumulated Depreciation-Equipment, $4,000.

D) debit Equipment, $2,000, credit Accumulated Depreciation-Equipment, $2,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck