Deck 8: Long-Term Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 8: Long-Term Assets

1

If a company determines that due to damage, the recoverable cost of its asset is reduced, it increases accumulated depreciation.

False

2

Which of the following would not be capitalized as part of a purchased asset's cost?

A) non-refundable taxes

B) installation cost

C) shipping costs

D) insurance costs

A) non-refundable taxes

B) installation cost

C) shipping costs

D) insurance costs

D

3

Upon the disposal of an asset, if the carrying value is NOT equal to the proceeds, a gain or loss must be recognized.

True

4

Which of the following is not a tangible capital asset?

A) buildings

B) land

C) copyrights

D) equipment

A) buildings

B) land

C) copyrights

D) equipment

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Internally generated goodwill may be capitalized annually.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

The only long-term asset that cannot be separated from the business and sold is

A) land.

B) buildings.

C) goodwill.

D) trademarks.

A) land.

B) buildings.

C) goodwill.

D) trademarks.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

Barium Corp. purchased a piece of equipment on September 30 for $27,000. It cost $400 to ship the equipment to the company's facilities and another $1,000 to install the equipment. After the equipment was installed the company had to pay an additional $1,500 for increased insurance. The capitalized cost of the equipment was

A) $29,900.

B) $29,500.

C) $28,400.

D) $27,400.

A) $29,900.

B) $29,500.

C) $28,400.

D) $27,400.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

The cash inflows generated from a long-term asset will be received over several future periods.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

Capital assets include all of the following except for

A) goodwill.

B) franchise rights.

C) buildings.

D) inventory.

A) goodwill.

B) franchise rights.

C) buildings.

D) inventory.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

The total accumulated depreciation on a long-term asset is also known as the asset's amortized cost.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

In a basket purchase, the total purchase price is divided equally among the assets acquired.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Depreciation expense is a measure of an asset's increase in value due to wear and tear.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

All patents have useful and economic lives of 20 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following would not be classified as property, plant, and equipment?

A) buildings in current use

B) land purchased for resale

C) machinery

D) tools used in production

A) buildings in current use

B) land purchased for resale

C) machinery

D) tools used in production

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Under ASPE, property, plant, and equipment must be recognized using the revaluation model.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Depreciation is a cost allocation method and has nothing to do with determining an asset's market value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

An impairment loss should be recognized if the net recoverable amount of the asset exceeds the carrying value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

In 2020 as part of a property purchase, Melrose Ltd. incurred and paid 2019 property taxes. These costs should be

A) recognized as an impairment loss.

B) recognized on the Statement of Income as an expense.

C) recognized as a capital cost.

D) not be taken into consideration, these costs are irrelevant.

A) recognized as an impairment loss.

B) recognized on the Statement of Income as an expense.

C) recognized as a capital cost.

D) not be taken into consideration, these costs are irrelevant.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

Residual value directly enters into the calculation of depreciation expense under all depreciation methods.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

Basic research costs that occur prior to any decision to develop a product or process are usually capitalized.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

The depreciable amount of an asset is defined as the

A) original cost less residual value.

B) original cost less depreciation.

C) original cost less accumulated depreciation.

D) original cost.

A) original cost less residual value.

B) original cost less depreciation.

C) original cost less accumulated depreciation.

D) original cost.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

When capitalizing the cost of a purchased asset, all of the following cost should be included in capitalization except for

A) the full purchase price plus any discounts.

B) set up costs.

C) legal costs.

D) shipping costs.

A) the full purchase price plus any discounts.

B) set up costs.

C) legal costs.

D) shipping costs.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

Assets acquired in a basket purchase are to be allocated a portion of the total price based on their respective

A) fair market values.

B) book values.

C) present values.

D) assessed values.

A) fair market values.

B) book values.

C) present values.

D) assessed values.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is true with respect to capitalizing asset costs?

A) All additional costs related to acquiring an asset should be expensed.

B) Land cannot be depreciated so it should just be expensed when acquired.

C) When costs are capitalized, the company gets the tax deduction immediately.

D) Some small expenses related to the purchase of an asset can be expensed for simplicity.

A) All additional costs related to acquiring an asset should be expensed.

B) Land cannot be depreciated so it should just be expensed when acquired.

C) When costs are capitalized, the company gets the tax deduction immediately.

D) Some small expenses related to the purchase of an asset can be expensed for simplicity.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

The unexpensed portion of a depreciable asset is called

A) accumulated depreciation.

B) net realizable value.

C) estimated residual value.

D) net present value.

A) accumulated depreciation.

B) net realizable value.

C) estimated residual value.

D) net present value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

When deciding whether to expense or capitalize the costs incurred after acquiring a capital asset, which one of the following is not relevant to the decision?

A) Will these costs extend useful life?

B) Will these costs reduce asset operating costs?

C) Will these costs improve output?

D) Will these costs be incurred for more than one year?

A) Will these costs extend useful life?

B) Will these costs reduce asset operating costs?

C) Will these costs improve output?

D) Will these costs be incurred for more than one year?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

The depreciation method that most closely resembles what is allowable for tax purposes under CRA is

A) the straight-line method.

B) units-of-activity method.

C) the declining-balance method.

D) depletion method.

A) the straight-line method.

B) units-of-activity method.

C) the declining-balance method.

D) depletion method.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

The residual value is not directly used for the calculation of depreciation expense under which method?

A) units-of-activity method

B) straight-line method

C) interest capitalization method

D) declining-balance method

A) units-of-activity method

B) straight-line method

C) interest capitalization method

D) declining-balance method

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

A plot of land was purchased for $120,000 and had $10,000 of past due property taxes on it. Non-refundable taxes on the purchase were $1,400 and the title search cost $500. The capitalized cost of the land was

A) $120,000.

B) $121,900.

C) $130,000.

D) $131,900.

A) $120,000.

B) $121,900.

C) $130,000.

D) $131,900.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

The ultimate sales value of a long-term asset is referred to as its

A) residual value.

B) value in use.

C) net book value.

D) historical value.

A) residual value.

B) value in use.

C) net book value.

D) historical value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

The most commonly used method of depreciation is

A) straight-line.

B) capital cost allowance.

C) declining-balance.

D) units-of-activity.

A) straight-line.

B) capital cost allowance.

C) declining-balance.

D) units-of-activity.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following depreciation methods calculates annual depreciation expense based on an asset's cost minus its residual value?

A) deferred depreciation

B) straight-line

C) capital cost allowance

D) declining-balance

A) deferred depreciation

B) straight-line

C) capital cost allowance

D) declining-balance

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

To apply the units-of-activity method, all of the following information is needed except the

A) original cost.

B) estimated residual value.

C) estimated useful life.

D) estimated usage.

A) original cost.

B) estimated residual value.

C) estimated useful life.

D) estimated usage.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

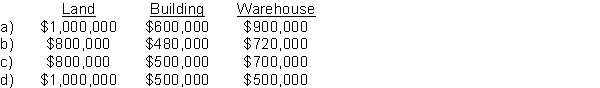

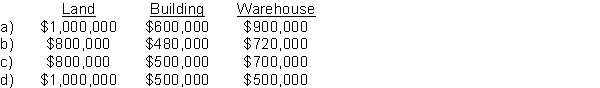

AFM Holdings Co. purchased 15 acres of land with an office building and warehouse on it for $2,000,000. The assets were appraised at: land $1,000,000, building $600,000, and warehouse $900,000. The assets were carried on the seller's books at: land $800,000, building $500,000, and warehouse $700,000. At what cost should the purchasing company record each of the assets?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

If an asset generates revenues evenly over its useful life, which depreciation method should be used?

A) capital cost allowance

B) declining-balance

C) units-of-activity

D) straight-line

A) capital cost allowance

B) declining-balance

C) units-of-activity

D) straight-line

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

A key reason that there are various acceptable depreciation methods is

A) different assets have different expected usage patterns.

B) some methods are too complicated to calculate.

C) to make it easier to calculate corporate income taxes.

D) to account for assets with indefinite lives.

A) different assets have different expected usage patterns.

B) some methods are too complicated to calculate.

C) to make it easier to calculate corporate income taxes.

D) to account for assets with indefinite lives.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

A machine was purchased for $125,500 during August; the cost included $750 in supplies that would be used with the new machine. The company had to pay $6,000 for to have the machine shipped. The capitalized cost of the equipment is

A) $125,500.

B) $126,250.

C) $131,500.

D) $132,250.

A) $125,500.

B) $126,250.

C) $131,500.

D) $132,250.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

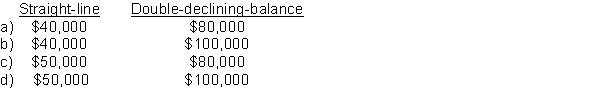

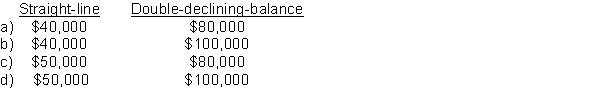

A company is depreciating a $1,000,000 building using a straight-line rate of 5%. The building has an estimated residual value of $200,000. What would the amount of depreciation be in the first year using the straight-line method and the double-declining-balance method?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

According to accounting standards, the method of depreciation chosen should

A) measure the change in an asset's value.

B) be systematic and rational.

C) allocate the most of the asset's cost to the early periods benefiting from its use.

D) recognize the reduced usefulness of an asset.

A) measure the change in an asset's value.

B) be systematic and rational.

C) allocate the most of the asset's cost to the early periods benefiting from its use.

D) recognize the reduced usefulness of an asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

Assets that produce their greatest benefits to a firm early in their useful life should be depreciated using the

A) straight-line method.

B) declining-balance method.

C) compound interest method.

D) units-of-activity method.

A) straight-line method.

B) declining-balance method.

C) compound interest method.

D) units-of-activity method.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Factors that may contribute to, or may be assessed in relation to, the impairment of PPE include

A) environmental spills or damage.

B) elimination of a business unit due to corporate restructuring.

C) the changing economic benefits of an asset.

D) all of the above

E) none of the above

A) environmental spills or damage.

B) elimination of a business unit due to corporate restructuring.

C) the changing economic benefits of an asset.

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

The depreciation expense of an asset can change for all of the following reasons except

A) change in the estimated useful life.

B) change in the asset's expected residual value.

C) increases due to additions to the asset for major repairs and improvements.

D) increase in the asset due to regular repairs and maintenance.

A) change in the estimated useful life.

B) change in the asset's expected residual value.

C) increases due to additions to the asset for major repairs and improvements.

D) increase in the asset due to regular repairs and maintenance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

The correct entry to record the annual depreciation expense for a long-term asset is

A) Dr. Accumulated depreciation.

B) Dr. Depreciation expense, Cr. Accumulated depreciation.

C) Dr. Accumulated depreciation, Cr. Long-Term asset.

D) Dr. Depreciation expense, Cr. Long-Term asset.

A) Dr. Accumulated depreciation.

B) Dr. Depreciation expense, Cr. Accumulated depreciation.

C) Dr. Accumulated depreciation, Cr. Long-Term asset.

D) Dr. Depreciation expense, Cr. Long-Term asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Upon the disposal of an asset, if the proceeds are greater than the carrying value of the asset, the company must

A) recognize a loss.

B) recognize a gain.

C) adjust the accumulated depreciation account so the carrying value equals the proceeds.

D) adjust the carrying value to market value.

A) recognize a loss.

B) recognize a gain.

C) adjust the accumulated depreciation account so the carrying value equals the proceeds.

D) adjust the carrying value to market value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

On July 1, 2020 a truck was sold for $10,000. The company originally paid $28,000 on June 30, 2013 and has recorded accumulated depreciation on it to date of $15,000. The entry to record the sale would include a

A) credit to accumulated depreciation for $15,000.

B) debit to trucks for $28,000.

C) credit to gain on sale of truck for $3,000.

D) debit to loss on sale of truck for $3,000.

A) credit to accumulated depreciation for $15,000.

B) debit to trucks for $28,000.

C) credit to gain on sale of truck for $3,000.

D) debit to loss on sale of truck for $3,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

Global Enterprises purchased a machine on January 1, 2020 for $22,500. The machine had an estimated useful life of 10 years and an estimated residual value of $2,500. Assuming Global uses straight-line depreciation, what would be the book value of the machine on December 31, 2024?

A) $ 0

B) $10,000

C) $11,250

D) $12,500

A) $ 0

B) $10,000

C) $11,250

D) $12,500

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Losses on the cash sale of capital assets

A) are the excess of the cash proceeds over the carrying value of the asset.

B) are the excess of the cash proceeds over the market value of the asset.

C) are the excess of the carrying value of the asset over the cash proceeds.

D) are the excess of the carrying value of the asset over the market value.

A) are the excess of the cash proceeds over the carrying value of the asset.

B) are the excess of the cash proceeds over the market value of the asset.

C) are the excess of the carrying value of the asset over the cash proceeds.

D) are the excess of the carrying value of the asset over the market value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

Changes in the estimates for residual value or useful life result in changes in the depreciation expense calculation. These changes are handled

A) retroactively.

B) as cumulative changes.

C) prospectively.

D) as prior period adjustments.

A) retroactively.

B) as cumulative changes.

C) prospectively.

D) as prior period adjustments.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

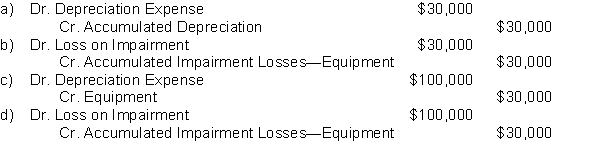

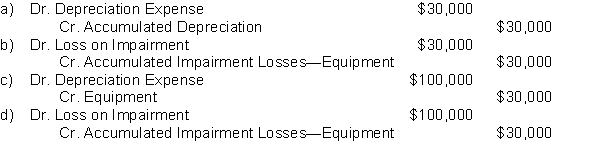

Alexa Corporation has a calendar year end and owns equipment that was purchased for $225,000 on March 1, 2020. On December 31, 2021 after the year-end adjusting entries, the carrying amount of the asset is $155,000. Due to damage, management determines the recoverable value to be $125,000. Alexa would make the following entry related to this asset:

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

An asset that cost $16,200 with a residual value of $1,200 and a useful life of 5 years was depreciated for two years using the straight-line method. In the third year, the useful life was determined to be 2 years longer than initially expected. Depreciation in the third year would be

A) $3,000.

B) $2,143.

C) $2,040.

D) $1,800.

A) $3,000.

B) $2,143.

C) $2,040.

D) $1,800.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following amortization methods ignore residual value in the calculation of the annual depreciation expense?

A) double-declining-balance and capital cost allowance

B) straight-line and double-declining-balance

C) straight-line and capital cost allowance

D) present value and straight-line

A) double-declining-balance and capital cost allowance

B) straight-line and double-declining-balance

C) straight-line and capital cost allowance

D) present value and straight-line

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

Bombay Inc. bought new computers on January 1 for $18,000 to improve the quality of their animation. The computers have a useful life of 8 years but Bombay Inc. thinks that continuing technological developments will likely mean they will replace the computers after 4 years, at which time they will be worth $2,000. If they use straight-line depreciation, the depreciation expense for the first year will be

A) $2,000.

B) $2,250.

C) $4,000.

D) $4,500.

A) $2,000.

B) $2,250.

C) $4,000.

D) $4,500.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

The Canada Revenue Agency allows corporations to deduct the following when calculating taxable income:

A) declining-balance depreciation.

B) straight-line depreciation.

C) capital cost allowance.

D) one-half of the cost of the asset in the year of acquisition.

A) declining-balance depreciation.

B) straight-line depreciation.

C) capital cost allowance.

D) one-half of the cost of the asset in the year of acquisition.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

Proctor Papers purchased a machine on January 1, 2020 at a cost of $380,000 with an estimated residual value of $30,000 at the end of its estimated useful life of 8 years. On January 1, 2022 Proctor Paper estimates that the machine only has a remaining life of 5 years and a residual value of $20,000. Proctor Paper uses straight-line depreciation. Depreciation expense for 2022 would be

A) $48,500.

B) $54,500.

C) $57,000.

D) $72,000.

A) $48,500.

B) $54,500.

C) $57,000.

D) $72,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

A depreciable asset with a cost of $42,500 has a residual value of $2,500 and a useful life of 8 years. Total estimated units of output are 80,000 and in year 1; 5,200 units were produced. Under the straight-line method and the units-of-activity method the depreciation expense for the first year would be

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

An asset being depreciated with the straight-line method has a residual value of $10,000 and accumulated depreciation of $30,000 in its second year. What was the original cost of the asset if its useful life was 5 years?

A) $160,000

B) $140,000

C) $ 85,000

D) $75,000

A) $160,000

B) $140,000

C) $ 85,000

D) $75,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

An asset with an original cost of $75,000, a residual value of $7,500, and a useful life of 5 years is given away without any consideration at the end of year five. The entry to record this is

A) Dr. Accumulated depreciation, Dr. Loss on disposal, Cr. Long-Term asset.

B) Dr. Accumulated depreciation, Cr. Gain on disposal, Cr. Long-Term asset.

C) Dr. Long-Term asset, Cr. Accumulated depreciation.

D) Dr. Accumulated depreciation, Cr. Long-Term Asset.

A) Dr. Accumulated depreciation, Dr. Loss on disposal, Cr. Long-Term asset.

B) Dr. Accumulated depreciation, Cr. Gain on disposal, Cr. Long-Term asset.

C) Dr. Long-Term asset, Cr. Accumulated depreciation.

D) Dr. Accumulated depreciation, Cr. Long-Term Asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

Cola Company purchased a bottling machine on October 1, 2018 for $250,000. The estimated useful life is 25 years and they are using straight-line depreciation. On October 1, 2019, they spent $46,000 on the machine to double its capacity and $5,000 on routine cleaning. The company's year end is September 30. What should the depreciation expense be at September 30, 2020?

A) $10,000

B) $30,000

C) $12,200

D) $11,9170

A) $10,000

B) $30,000

C) $12,200

D) $11,9170

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

If management wanted to show an increasing income over the life of an asset which method of depreciation should they choose?

A) capital cost allowance

B) declining-balance

C) units-of-activity

D) straight-line

A) capital cost allowance

B) declining-balance

C) units-of-activity

D) straight-line

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Oceanside Developments owns a piece of land it had purchased in 2019 for $400,000. When they started to develop the land in 2020, they discovered that there were environmental problems with the land. It is now estimated to be worth only $150,000. Which of the following is the correct way to account for this?

A) No accounting is necessary because the land is recorded at its historical cost, not its market value.

B) The land account should be written down to $150,000 and a loss recognized.

C) The land should be written off completely because now the company cannot use it for the purpose they intended to.

D) The land should be depreciated at a new rate to reflect the decline in its value.

A) No accounting is necessary because the land is recorded at its historical cost, not its market value.

B) The land account should be written down to $150,000 and a loss recognized.

C) The land should be written off completely because now the company cannot use it for the purpose they intended to.

D) The land should be depreciated at a new rate to reflect the decline in its value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

Harmax Limited spent $5,000 registering an internally developed patent and then another $20,000 defending and enforcing the patent in its first year. How should the patent be reflected in the financial statements?

A) the full $25,000 expensed in the year

B) $5,000 capitalized as Patent asset and the $20,000 expensed

C) $20,000 capitalized as Patent asset and the $5,000 expensed

D) the full $25,000 capitalized in the year

A) the full $25,000 expensed in the year

B) $5,000 capitalized as Patent asset and the $20,000 expensed

C) $20,000 capitalized as Patent asset and the $5,000 expensed

D) the full $25,000 capitalized in the year

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

Duval Industries purchases $110,000 of machinery on January 1, 2020. The machinery is expected to have a 5 year useful life and a residual value of $10,000. On January 1, 2023, management determines that the equipment will last for an additional 2 years and the new residual value is $6,000. Duval uses straight-line depreciation and has a calendar year end.

Instructions

Calculate the depreciation expense related to this piece of machinery and determine the carrying value of the machinery on December 31, 2023.

Instructions

Calculate the depreciation expense related to this piece of machinery and determine the carrying value of the machinery on December 31, 2023.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

Acker Limited sold a piece of equipment August 1, 2020 for proceeds of $22,000. The equipment had an original value of $60,000 and was purchased on January 1, 2017. It was estimated to have a residual value of $3,000 and 5-year useful life. Acker uses the straight-line method. Acker has a December 31 year end.

Instructions

Journalize all entries required to update depreciation and record the sale of the asset in 2020.

Instructions

Journalize all entries required to update depreciation and record the sale of the asset in 2020.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is true with respect to intangible assets with indefinite lives?

A) They should be amortized over a period of 40 years.

B) They should be expensed to income in the year they are acquired.

C) They should be evaluated each year to determine if there has been any impairment in their value.

D) They are never amortized or written down but remain on the company's balance sheet at their original cost forever.

A) They should be amortized over a period of 40 years.

B) They should be expensed to income in the year they are acquired.

C) They should be evaluated each year to determine if there has been any impairment in their value.

D) They are never amortized or written down but remain on the company's balance sheet at their original cost forever.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

Beach Front Foods Inc. has decided to add a delivery service to its business. In 2020 the company purchased a car to use to deliver customer orders. The purchase price of the car was $42,000, which includes non-refundable taxes of $5,800. The car was painted with the store logo for $1,000 and an additional $750 was spent on the annual license fee. During the year they spent $3,000 on gas and $1,000 on maintenance costs. They expect to drive the car 200,000 kilometres and have a residual value of $5,000. In 2020, they drove 27,500 km.

Instructions

a) Calculate the cost of the asset to Beach Front. Provide brief support for all items included in the cost and the reason any costs are not included.

b) Record the depreciation expense for 2020 using the units-of-activity method.

Instructions

a) Calculate the cost of the asset to Beach Front. Provide brief support for all items included in the cost and the reason any costs are not included.

b) Record the depreciation expense for 2020 using the units-of-activity method.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following methods of amortization is a company most likely to use for financial statement purposes if it purchases a patent?

A) capital cost allowance

B) double-declining-balance

C) units-of-activity

D) straight-line

A) capital cost allowance

B) double-declining-balance

C) units-of-activity

D) straight-line

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Long-term capital assets with a(n) ___ may not be depreciable.

A) finite life

B) indefinite life

C) residual value

D) undefined value

A) finite life

B) indefinite life

C) residual value

D) undefined value

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

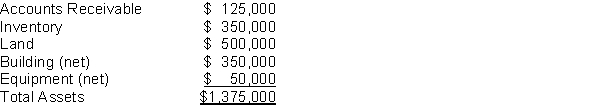

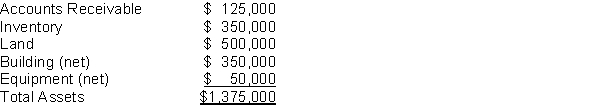

Othello Corporation purchases Shakespeare Inc. for $3.5 M. Shakespeare has the following assets all recorded at cost:  The fair value of the assets is $2,350,000 and Othello also assumes $600,000 of debt from Shakespeare.

The fair value of the assets is $2,350,000 and Othello also assumes $600,000 of debt from Shakespeare.

Instructions

Determine if there is any goodwill related to Othello's purchase of Shakespeare and if so what is the value of the goodwill. Show your work. Where is goodwill captured on the financial statements?

The fair value of the assets is $2,350,000 and Othello also assumes $600,000 of debt from Shakespeare.

The fair value of the assets is $2,350,000 and Othello also assumes $600,000 of debt from Shakespeare.Instructions

Determine if there is any goodwill related to Othello's purchase of Shakespeare and if so what is the value of the goodwill. Show your work. Where is goodwill captured on the financial statements?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

The Capital Cost Allowance (CCA)

A) ignores residual value.

B) has prescribed depreciation rates.

C) is very similar to accelerated depreciation rates.

D) all of the above

E) none of the above

A) ignores residual value.

B) has prescribed depreciation rates.

C) is very similar to accelerated depreciation rates.

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

Companies can estimate when capital assets may need to be replaced in order to maintain operating capacity by using the following ratio(s):

A) fixed asset turnover.

B) average age %.

C) current.

D) inventory turnover.

E) all of the above

A) fixed asset turnover.

B) average age %.

C) current.

D) inventory turnover.

E) all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

Depreciation Expense

A) applies to all non-current assets.

B) cannot be used for calculating income taxes.

C) is acceptable for use under GAAP and the Income Tax Act.

D) is very similar to CCA.

E) all of the above

A) applies to all non-current assets.

B) cannot be used for calculating income taxes.

C) is acceptable for use under GAAP and the Income Tax Act.

D) is very similar to CCA.

E) all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

Goodwill

A) is the net value of the purchase price less the book value of the asset.

B) has economic value and can be sold to generate revenues.

C) can be generated internally.

D) only arises when businesses are combined.

E) all of the above

A) is the net value of the purchase price less the book value of the asset.

B) has economic value and can be sold to generate revenues.

C) can be generated internally.

D) only arises when businesses are combined.

E) all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

Lucky Lure Co. purchased a machine on October 1, 2018 for $125,000. It has a $15,000 residual value and a 10-year useful life. On July 1, 2020 the machine sold for $79,500. The company uses the double-declining-balance method of depreciation. The company fiscal year end is December 31.

Instructions

Prepare the journal entries for 2018 through 2020.

Instructions

Prepare the journal entries for 2018 through 2020.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

On September 1, 2020, Muzeen Machine Co. purchased a piece of equipment which cost $68,900, has a $4,900 residual value, and an 8-year useful life. The company has a fiscal year end of August 31.

Instructions

Calculate the depreciation expense for year one under

a) Straight-line,

b) Double-declining-balance.

Instructions

Calculate the depreciation expense for year one under

a) Straight-line,

b) Double-declining-balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following intangibles would be capitalized?

A) research

B) advertising

C) goodwill acquired in a purchase

D) internally developed patent

A) research

B) advertising

C) goodwill acquired in a purchase

D) internally developed patent

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is an example of an intangible with an indefinite life?

A) a copyright on a song

B) a patent on a new technology

C) the development costs of a new drug

D) the goodwill value assigned to the excess purchase price when purchasing a company

A) a copyright on a song

B) a patent on a new technology

C) the development costs of a new drug

D) the goodwill value assigned to the excess purchase price when purchasing a company

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

The carrying amount of goodwill is

A) not relevant, because goodwill is not amortized.

B) captures impairment losses.

C) calculated using CCA.

D) all of the above

E) none of the above

A) not relevant, because goodwill is not amortized.

B) captures impairment losses.

C) calculated using CCA.

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

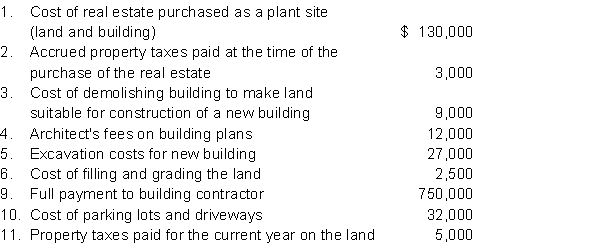

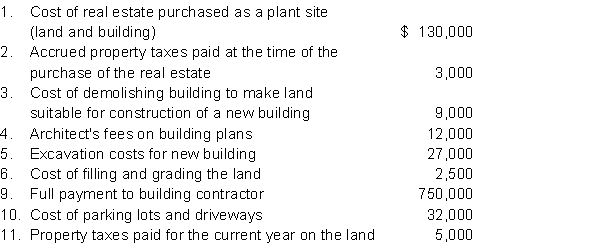

Sanitec Architecture made the following cash expenditures during its first year in operations:  Instructions

Instructions

Record the above transactions and determine the cost of the land, land improvements, and building that will appear on Sanitec's year-end statement of financial position.

Instructions

InstructionsRecord the above transactions and determine the cost of the land, land improvements, and building that will appear on Sanitec's year-end statement of financial position.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Wilma's Wicker Furniture purchased a laser-guided mitre saw on September 1, 2018 at a cost of $20,000. Depreciation for 2018 and 2019 was based on an estimated 8-year useful life and $4,000 estimated residual value. In 2020, Wilma's revised its estimates and now believes the laser mitre saw will have a total service life of an additional three years but the residual value will be only $2,000. Wilma's uses the straight-line method to depreciate all assets. Wilma's Wicker Furniture has a December 31 year end.

Instructions

Calculate depreciation expense for 2018, 2019, and 2020.

Instructions

Calculate depreciation expense for 2018, 2019, and 2020.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

Drugs R Us spent $25,000 on research and development to create a new product. The product was successfully developed and launched into the market. How should the research and development costs be treated?

A) The full $25,000 should be capitalized.

B) The research portion of the $25,000 should be capitalized.

C) The research portion of the $25,000 should be expensed.

D) The full $25,000 should be expensed.

A) The full $25,000 should be capitalized.

B) The research portion of the $25,000 should be capitalized.

C) The research portion of the $25,000 should be expensed.

D) The full $25,000 should be expensed.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck