Deck 10: Long-Term Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 10: Long-Term Liabilities

1

Off-balance sheet financing occurs for all leases.

False

2

Non-financial covenants may include a requirement to have an annual audit.

True

3

Pension funds are described as underfunded if the value of the pensions fund assets is less than the present value of the future pension obligations.

True

4

The two kinds of pension plans that are commonly used by employers are: defined obligation plans and defined contribution plans.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

An actuary is only necessary when there is a dispute between contributions made and benefits expected to be received for a defined benefit plan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Companies must always accrue interest between the last loan payment date and the company's reporting date.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

The interest rate paid on the bond is known as the effective rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Companies are not required to disclose the details of their long-term loans in the notes to the financial statements.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

Under all leases the liability is recorded as "lease liability."

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

An investment banker is usually hired to assist a company in issuing debt securities.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

Debentures can be either senior or subordinated.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

A public offering is open to all investors including institutions.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

There is an inverse relationship between the discount rate and the selling price of a bond.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Bank loan covenants only pertain to financial data such as ratios.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Benefits that are not contingent upon an employee's continued employment are called vested benefits.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

The carrying value of a bond issued at a discount decreases over time.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

Post-employment benefits other than pensions are expensed on an accrual basis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Restrictions placed on a company by the lender are also known as covenants.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

All bond covenants are recorded in an agreement called a debenture agreement.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

A defined benefit plan is similar to a defined contribution plan in that only employers contribute to the plan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

A deferred tax asset can be recognized when lower income tax payable will occur in the future.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

A temporary difference is a difference between tax and accounting income that will not reverse in a future period.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

The distinction between senior and subordinated debt is associated with

A) general debenture bonds.

B) mortgage bonds.

C) collateral trust bonds.

D) commercial bonds.

A) general debenture bonds.

B) mortgage bonds.

C) collateral trust bonds.

D) commercial bonds.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Depreciation expense and Capital Cost Allowance create temporary differences for the purpose of calculating future taxes.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

A long-term loan against which collateral has been pledged is known as

A) bank indebtedness.

B) Line of Credit.

C) Mortgage Payable.

D) Lease Liability.

A) bank indebtedness.

B) Line of Credit.

C) Mortgage Payable.

D) Lease Liability.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Net debt is the name given to the amount of interest-bearing debt less all current assets.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Temporary differences between accounting and taxable income will eventually offset.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Blended payment loans require a loan amortization schedule separating principal and interest. This is required, in part, because

A) interest only is reflected on the cash flow statement.

B) interest and principal needs to be reflected under current and not current liabilities section of the statement of financial positon.

C) the interest expense is recorded separately from the reduction of the loan payable.

D) none of the above

A) interest only is reflected on the cash flow statement.

B) interest and principal needs to be reflected under current and not current liabilities section of the statement of financial positon.

C) the interest expense is recorded separately from the reduction of the loan payable.

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

The calculation of future taxes is based on the temporary differences between accounting income and taxable income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

The debt/equity ratio is most commonly used by a lender in order to evaluate an entity's profitability.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

Long-term liabilities include all of the following, except for

A) future income taxes.

B) lease liabilities.

C) wage obligations.

D) pension liabilities.

A) future income taxes.

B) lease liabilities.

C) wage obligations.

D) pension liabilities.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Loans that require payments of principal plus interest are referred to as

A) Lines of Credit.

B) instalment loans.

C) bank overdraft.

D) Bonds Payable.

A) Lines of Credit.

B) instalment loans.

C) bank overdraft.

D) Bonds Payable.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Leverage is the extent to which a company is using the funds provided by its shareholders to generate returns for creditors.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

Long-term liabilities are significant to users for all of the following reasons, except

A) it affects the company for many years into the future.

B) it has an impact on the firm's liquidity.

C) it provides information on potential litigation and contractual obligations.

D) it provides information about the health of employee pension plans.

A) it affects the company for many years into the future.

B) it has an impact on the firm's liquidity.

C) it provides information on potential litigation and contractual obligations.

D) it provides information about the health of employee pension plans.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

The debt to equity ratio measures the extent of debt relative to each dollar in equity.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Liabilities are the result of events or transactions that have already occurred.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Deferred income taxes represent amounts due to Canada Revenue Agency in the current year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

A purchase commitment is an example of a mutually unexecuted contract.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

The interest-coverage ratio uses interest expense as its numerator.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Hybrid pension plans are also known as target benefit plans.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

If a bond sells at a premium, the amortization of the premium will

A) have no effect on periodic expense.

B) decrease periodic expense.

C) increase periodic interest expense.

D) make periodic interest expense equal to the periodic interest payment.

A) have no effect on periodic expense.

B) decrease periodic expense.

C) increase periodic interest expense.

D) make periodic interest expense equal to the periodic interest payment.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

From the lessee's perspective, a lease results in all of the following except

A) recognition of an asset on the Statement of Financial Position.

B) recognition of a liability on the Statement of Financial Position.

C) recognition of interest expense on the Statement of Income.

D) recognition of rent expense on the Statement of Income.

A) recognition of an asset on the Statement of Financial Position.

B) recognition of a liability on the Statement of Financial Position.

C) recognition of interest expense on the Statement of Income.

D) recognition of rent expense on the Statement of Income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

If a bond is issued at a discount, the coupon rate is

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

A lease will be reflected on the Statement of Financial Position of the lessee as

A) a current liability.

B) a non-current liability.

C) a non-current liability and a fixed asset.

D) nothing; it is not reflected on the Statement of Financial Position.

A) a current liability.

B) a non-current liability.

C) a non-current liability and a fixed asset.

D) nothing; it is not reflected on the Statement of Financial Position.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements concerning pensions is correct?

A) Defined benefit plans offer a retiree more security than defined contribution plans.

B) The accounting for a defined contribution plan is more complex than for a defined benefit plan.

C) Pension funding must always equal the pension expense.

D) The employee will forfeit vested pension contributions if he/she is terminated.

A) Defined benefit plans offer a retiree more security than defined contribution plans.

B) The accounting for a defined contribution plan is more complex than for a defined benefit plan.

C) Pension funding must always equal the pension expense.

D) The employee will forfeit vested pension contributions if he/she is terminated.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

If a bond is trading at 103 the

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense cannot be determined.

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense cannot be determined.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

DRM Corporation leased a piece of machinery on January 1, 2020. At the date of signing the asset and lease obligation were recorded for $42,000. The first lease payment of $6,000 was due December 31, 2020 and the interest rate they used in their calculations was 7%. The lease term was 10 years. Which of the following best describes what would be reported on DRM's Statement of Income for the year ending December 31, 2020?

A) $6,000 Lease Expense

B) $6,000 Lease Expense, $4,200 Depreciation Expense

C) $2,940 Interest Expense, $1,260 Depreciation Expense

D) $2,940 Interest Expense, $4,200 Depreciation Expense

A) $6,000 Lease Expense

B) $6,000 Lease Expense, $4,200 Depreciation Expense

C) $2,940 Interest Expense, $1,260 Depreciation Expense

D) $2,940 Interest Expense, $4,200 Depreciation Expense

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

The entry made when cash is set aside to pay for future pension benefits is called a(n)

A) funding entry.

B) adjusting entry.

C) accrual entry.

D) reclassification entry.

A) funding entry.

B) adjusting entry.

C) accrual entry.

D) reclassification entry.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

If a bond is trading at 98 the

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense cannot be determined.

A) the interest expense is greater than the interest payment.

B) the interest expense is less than the interest payment.

C) the interest expense is equal to the interest payment.

D) the interest expense cannot be determined.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

The proceeds from the sale of a bond are equal to

A) the face value of the bond.

B) the face value of the bond plus the present value of the interest to be paid.

C) the maturity value of the bond plus the interest to be paid.

D) the present value of the principal and interest to be paid.

A) the face value of the bond.

B) the face value of the bond plus the present value of the interest to be paid.

C) the maturity value of the bond plus the interest to be paid.

D) the present value of the principal and interest to be paid.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements about defined benefit pension plans is true?

A) The expense is equal to the contribution amounts in a period.

B) The contributions to the fund are equal to the benefits paid in a period.

C) The expense is equal to the present value of the future benefit obligations incurred that period.

D) The amount of benefits the employee will receive depends on the performance of the pension plan.

A) The expense is equal to the contribution amounts in a period.

B) The contributions to the fund are equal to the benefits paid in a period.

C) The expense is equal to the present value of the future benefit obligations incurred that period.

D) The amount of benefits the employee will receive depends on the performance of the pension plan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

If a bond is issued at a premium, the coupon rate is

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

A) equal to the effective rate.

B) less than the effective rate.

C) greater than the effective rate.

D) not needed to determine the bond's sale price.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Reasons a company may choose to lease an asset include all of the following, except for

A) short-term need for the asset.

B) high risk of obsolescence.

C) lack of cash.

D) preferential tax treatment of leased assets.

A) short-term need for the asset.

B) high risk of obsolescence.

C) lack of cash.

D) preferential tax treatment of leased assets.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

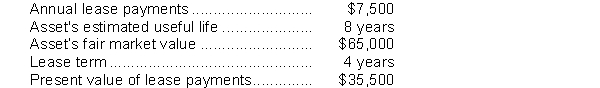

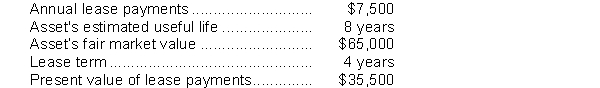

Canin Cranes Co. leased an asset under the following terms:  The lessee's entry to record the leased asset and lease acquired would include a

The lessee's entry to record the leased asset and lease acquired would include a

A) debit to right-of-use for $35,500.

B) debit to right-of-use for $40,000.

C) credit to lease liability for $7,500.

D) credit to lease payable for $7,500.

The lessee's entry to record the leased asset and lease acquired would include a

The lessee's entry to record the leased asset and lease acquired would include aA) debit to right-of-use for $35,500.

B) debit to right-of-use for $40,000.

C) credit to lease liability for $7,500.

D) credit to lease payable for $7,500.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

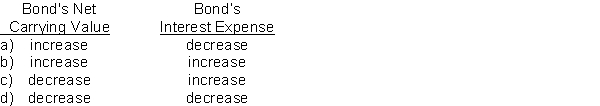

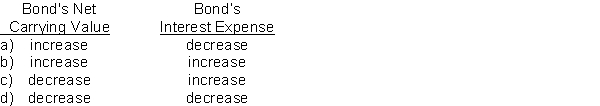

How would the Amortization of a bond discount affect each of the following?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

Vested benefits in a pension plan

A) belong to an employee even if they leave the firm.

B) are paid to an employee if they leave the firm.

C) revert to the company if an employee leaves the firm.

D) are paid to an employee in the year of vesting.

A) belong to an employee even if they leave the firm.

B) are paid to an employee if they leave the firm.

C) revert to the company if an employee leaves the firm.

D) are paid to an employee in the year of vesting.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

A bond issue is a form of

A) equity financing.

B) debt financing.

C) collateral financing.

D) financing similar to an instalment loan.

A) equity financing.

B) debt financing.

C) collateral financing.

D) financing similar to an instalment loan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

All of the following are used to determine the bond premium or the bond discount except for

A) market rate.

B) yield rate.

C) coupon rate.

D) capital rate.

A) market rate.

B) yield rate.

C) coupon rate.

D) capital rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Restrictions placed on a company in their bond indenture agreement are known as

A) collateral.

B) bond indenture.

C) bond covenants.

D) agreements.

A) collateral.

B) bond indenture.

C) bond covenants.

D) agreements.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

An employee has been working for a university with a defined benefit pension plan for 34 years. The employee's highest five year average earnings is $95,000. If the employee expects to receive 2% of these earnings based on years of service, what is the employee's expected pension benefit if he or she retires in 6 years?

A) $64,600

B) $95,000

C) $47,500

D) $76,000

A) $64,600

B) $95,000

C) $47,500

D) $76,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

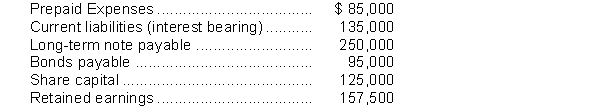

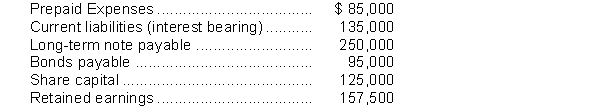

Resolute Limited reported the following items on their Statement of Financial Position:  The debt to equity ratio for Resolute is closest to

The debt to equity ratio for Resolute is closest to

A) 2.0.

B) 1.7.

C) 1.22.

D) 0.88.

The debt to equity ratio for Resolute is closest to

The debt to equity ratio for Resolute is closest toA) 2.0.

B) 1.7.

C) 1.22.

D) 0.88.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

On January 1, 2020, Barrymore Ltd. issued $200,000, 8%, 10-year bonds, when the market interest rate was 10%. Therefore, the bonds were trading at $175,076, Interest is payable semi-annually on July 1 and January 1. The company has a calendar year end.

Instructions

a) Record the issue of the bonds.

b) Record the first interest payment on July 1, 2020. Round to nearest dollar.

Instructions

a) Record the issue of the bonds.

b) Record the first interest payment on July 1, 2020. Round to nearest dollar.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

The depreciation method that is allowable under the Income Tax Act is referred to as

A) Straight-line.

B) Diminishing balance.

C) Capital cost allowance.

D) Units of depletion.

E) All are allowed.

A) Straight-line.

B) Diminishing balance.

C) Capital cost allowance.

D) Units of depletion.

E) All are allowed.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

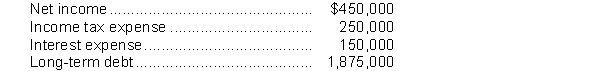

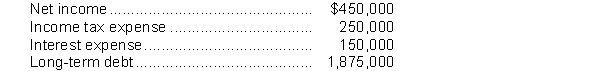

The following information is from the financial statements of Shakespeare Inc.:  The interest-coverage ratio for Shakespeare would be closest to

The interest-coverage ratio for Shakespeare would be closest to

A) 3 times.

B) 4.7 times.

C) 5.7 times.

D) 8 times.

The interest-coverage ratio for Shakespeare would be closest to

The interest-coverage ratio for Shakespeare would be closest toA) 3 times.

B) 4.7 times.

C) 5.7 times.

D) 8 times.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following losses would only require footnote disclosure only?

A) a probable loss with an amount that can be reasonably estimated

B) a probable loss of a known amount

C) a gain considered not probable

D) a probable loss with an amount that cannot be reasonably estimated

A) a probable loss with an amount that can be reasonably estimated

B) a probable loss of a known amount

C) a gain considered not probable

D) a probable loss with an amount that cannot be reasonably estimated

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

A pension plan that shares the risk for an underfunded plan between the employees and employer is knows as a ___ plan.

A) Target Benefit

B) Defined Benefit

C) Defined Contribution

D) Canada Pension Plan

A) Target Benefit

B) Defined Benefit

C) Defined Contribution

D) Canada Pension Plan

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

The interest-coverage ratio is calculated as

A) (net income - taxes - interest - depreciation) ÷ interest.

B) (net income + taxes - interest - depreciation) ÷ interest.

C) (net income + interest + depreciation) ÷ interest.

D) (net income + taxes + interest + depreciation) ÷ interest.

A) (net income - taxes - interest - depreciation) ÷ interest.

B) (net income + taxes - interest - depreciation) ÷ interest.

C) (net income + interest + depreciation) ÷ interest.

D) (net income + taxes + interest + depreciation) ÷ interest.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

How should a liability that has an unlikely chance of occurring and is insignificant in size be disclosed?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

A deferred income tax asset is created when the difference will result in

A) higher income tax payable in the future.

B) no income tax payable in the future.

C) lower income tax payable in the future.

D) none of the above.

A) higher income tax payable in the future.

B) no income tax payable in the future.

C) lower income tax payable in the future.

D) none of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Mutually unexecuted contracts refers to

A) contracts that have been cancelled by either party.

B) contracts that have not been fully negotiated, the parties cannot agree on the terms.

C) contracts related to future transactions.

D) contracts that have no commitments.

A) contracts that have been cancelled by either party.

B) contracts that have not been fully negotiated, the parties cannot agree on the terms.

C) contracts related to future transactions.

D) contracts that have no commitments.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

How should a liability that has a probable chance of occurring and can be reasonably estimated be disclosed?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

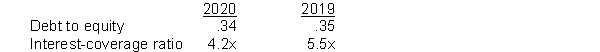

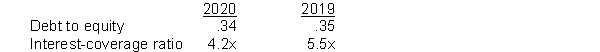

The debt to equity ratio and interest-coverage ratio for Vega Corporation for the last two years are as follows:  Which of the following conclusions could be made about Vega Corporation?

Which of the following conclusions could be made about Vega Corporation?

A) The company is less able to pay its interest costs in 2020.

B) The company is better able to pay its interest costs in 2020.

C) The company has more debt outstanding in 2020.

D) The company is less risky in 2020.

Which of the following conclusions could be made about Vega Corporation?

Which of the following conclusions could be made about Vega Corporation?A) The company is less able to pay its interest costs in 2020.

B) The company is better able to pay its interest costs in 2020.

C) The company has more debt outstanding in 2020.

D) The company is less risky in 2020.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

A pension plan that pays employees benefits upon retirement based on their length of service and salary is called a

A) defined contribution plan.

B) defined service plan.

C) defined benefit plan.

D) defined performance plan.

A) defined contribution plan.

B) defined service plan.

C) defined benefit plan.

D) defined performance plan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

On August 31, 2020, Montrose Mortgage enters into a 10-year, 6%, $200,000 mortgage to finance the construction of a condo complex. The terms provide for monthly instalment payments at the end of each month, commencing September 30, 2020.

Instructions

a) Record the issue of the mortgage payable on August 31, 2020.

b) Record the first two instalment payments on September 30, 2020 and October 30, 2020, assuming the payment is (1) a fixed principal payment of $1,667, and (2) a blended principal and interest payment of $2,220. Round your answers to the nearest dollar.

Instructions

a) Record the issue of the mortgage payable on August 31, 2020.

b) Record the first two instalment payments on September 30, 2020 and October 30, 2020, assuming the payment is (1) a fixed principal payment of $1,667, and (2) a blended principal and interest payment of $2,220. Round your answers to the nearest dollar.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

How should a liability that has a probable chance of occurring but the amount of the loss cannot be reasonably estimated be disclosed?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

When the occurrence of a liability is dependent on the outcome of some future event, the liability is referred to as a(n)

A) contingent liability.

B) commitment.

C) accrued liability.

D) accounts payable.

A) contingent liability.

B) commitment.

C) accrued liability.

D) accounts payable.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

A debt to equity ratio of 50% indicates that

A) half of the company's assets are financed through equity.

B) 50% of the company's interest expense comes from long-term debt financing.

C) the company is close to bankruptcy.

D) the company spends 50% of its operating earnings on interest.

A) half of the company's assets are financed through equity.

B) 50% of the company's interest expense comes from long-term debt financing.

C) the company is close to bankruptcy.

D) the company spends 50% of its operating earnings on interest.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

A pension plan that pays employees benefits upon retirement based on how well the investments in the pension plan perform is called a

A) defined contribution plan.

B) defined performance plan.

C) defined benefit plan.

D) defined investment plan.

A) defined contribution plan.

B) defined performance plan.

C) defined benefit plan.

D) defined investment plan.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following would best describe a contingent liability?

A) an obligation to transfer services instead of cash to settle a liability

B) an obligation where the costs will be covered by insurance

C) an obligation with a high degree of uncertainty about the amount or timing of the payment

D) an obligation with a low degree of uncertainty about the amount or timing of the payment

A) an obligation to transfer services instead of cash to settle a liability

B) an obligation where the costs will be covered by insurance

C) an obligation with a high degree of uncertainty about the amount or timing of the payment

D) an obligation with a low degree of uncertainty about the amount or timing of the payment

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

If the assets in the pension fund exceed the present value of future pension obligations, the pension fund is described as

A) fully funded.

B) underfunded.

C) partially funded.

D) overfunded.

A) fully funded.

B) underfunded.

C) partially funded.

D) overfunded.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck