Deck 5: The Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 5: The Statement of Cash Flows

1

The Statement of Income reflects the overall change in cash flows for an accounting period.

False

2

The Statement of Cash Flows and Statement of Income are both important measurements of long-term profitability.

False

3

The cash position of a company takes into consideration cash and cash equivalents.

True

4

A positive cash flow from operating activities indicates that a company's financing activities are generating more cash than required for operations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

If prepaid expenses are shown as having a positive effect on cash flow, it is because prepaid expenses increased during the year.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

Cash equivalents include investments that can be readily converted into cash; investment maturity dates are irrelevant.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Cash paid for dividends to shareholders is classified as an investing activity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

The most common type of non-cash item is depreciation expense.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

In the early part of the cash-to-cash cycle, net cash flows are normally inflows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

Companies can raise an unlimited amount of cash from financing activities as long as they are willing to pay higher interest rates.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Cash from operating activities will be the same using either the direct or indirect method to prepare the Statement of Cash Flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

The Statement of Cash Flows and the Statement of Income both measure a company's performance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

The direct method is also known as the reconciliation method.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

Accounting standard setters have established three acceptable methods for preparing a Statement of Cash Flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

The Statement of Cash Flows provides a perspective of an organization's performance by highlighting the results in the net change in its cash position during the year.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

If a company has used a line of credit, then the amount of the borrowing can be considered "positive cash".

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Non-cash expenses will reduce the amount of cash a company is able to generate from its operations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

The components of a Statement of Cash Flows are investing, financing, and operating activities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

All companies must present operating activities first on the statement of cash flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

A company can only analyze its operations properly provided it has all detailed financial statements.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

Free cash flow is a commonly used measure in the management discussion and analysis section of annual reports.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following would cause an inflow of cash?

A) issuing common shares to retire long-term debt

B) payment of a dividend to the shareholders

C) incurring a loss on the sale of a capital asset

D) recognizing depreciation expense

A) issuing common shares to retire long-term debt

B) payment of a dividend to the shareholders

C) incurring a loss on the sale of a capital asset

D) recognizing depreciation expense

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

The cash flows to total liabilities ratio is used to assess company's ability to meet its liability through its operating cash flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

A large increase in accounts receivable may indicate that a company is having difficulties collecting its receivables.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following would cause an outflow of cash?

A) sale of inventory for cash

B) the sale of an investment for a loss

C) issuing common shares to acquire capital assets

D) purchase of a temporary investment

A) sale of inventory for cash

B) the sale of an investment for a loss

C) issuing common shares to acquire capital assets

D) purchase of a temporary investment

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

Major differences between the income statement and the cash flow statement include all of the following except for

A) the income statement measures cash position.

B) the income statement does not capture many creditor transactions.

C) the income statement is prepared on an accrual basis.

D) the income statement captures mainly operating activities.

A) the income statement measures cash position.

B) the income statement does not capture many creditor transactions.

C) the income statement is prepared on an accrual basis.

D) the income statement captures mainly operating activities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

One way to solve cash flow challenges is to slow down the sales growth rate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

The cash account may have a credit balance when

A) this is not possible; the normal balance for the cash account is a debit.

B) the company only has cash equivalents and no demand deposits.

C) the company has used its bank overdraft facility.

D) all of the company's cash is tied up in Accounts Receivable and Inventory.

A) this is not possible; the normal balance for the cash account is a debit.

B) the company only has cash equivalents and no demand deposits.

C) the company has used its bank overdraft facility.

D) all of the company's cash is tied up in Accounts Receivable and Inventory.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Information on a company's cash flows is used for all of the following, except

A) assess the company's ability to repay debt in the future.

B) evaluate the potential for the company to be able to pay dividends in the future.

C) evaluate a company's liquidity (i.e., the value of a company's liquid assets in comparison to its short-term debt obligations).

D) estimate the company's future cash requirements.

A) assess the company's ability to repay debt in the future.

B) evaluate the potential for the company to be able to pay dividends in the future.

C) evaluate a company's liquidity (i.e., the value of a company's liquid assets in comparison to its short-term debt obligations).

D) estimate the company's future cash requirements.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

A large increase in accounts payable indicates that a company is paying its suppliers on time.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

The Statement of ___ is used by shareholders to assess company profitability.

A) Cash Flows

B) Shareholders' Equity

C) Financial Position

D) Income

A) Cash Flows

B) Shareholders' Equity

C) Financial Position

D) Income

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Inadequate financing is the most common reason new business start-ups experience cash shortages.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

The following items are reported on a company's Statement of Income. Which of them is most likely equal to its cash flow impact?

A) Depreciation expense

B) Gain on sale of capital assets

C) Loss on sale of investment

D) Interest expense

A) Depreciation expense

B) Gain on sale of capital assets

C) Loss on sale of investment

D) Interest expense

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

"Cash" includes everything except for

A) demand deposits.

B) money market funds.

C) treasury bills.

D) bank overdrafts.

E) All of the above are included in cash.

A) demand deposits.

B) money market funds.

C) treasury bills.

D) bank overdrafts.

E) All of the above are included in cash.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

A negative net free cash flow is considered to be a good thing.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

The information presented on the statement of cash flows enables users to

A) assess the company's ability to generate cash flows from its core operations.

B) evaluate the cash flows the company has been able to obtain from investors and creditors.

C) assess the extent to which the company has invested cash to replace or add revenue-generating capital assets.

D) all of the above

A) assess the company's ability to generate cash flows from its core operations.

B) evaluate the cash flows the company has been able to obtain from investors and creditors.

C) assess the extent to which the company has invested cash to replace or add revenue-generating capital assets.

D) all of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

The cash-to-cash cycle is the time between when a company pays out cash to purchase goods until those goods are ultimately paid to the supplier.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

All of the following statements are true, except

A) to analyze operations properly you need both the Statement of Income and the Statement of Cash Flows.

B) in the long run total profits and net cash flows will be very similar.

C) the Statement of Cash Flows considers events that the Statement of Income does not.

D) the Statement of Cash Flows and the Statement of Income both cover the period of a year because profits and cash flows are very similar over the period of a year.

A) to analyze operations properly you need both the Statement of Income and the Statement of Cash Flows.

B) in the long run total profits and net cash flows will be very similar.

C) the Statement of Cash Flows considers events that the Statement of Income does not.

D) the Statement of Cash Flows and the Statement of Income both cover the period of a year because profits and cash flows are very similar over the period of a year.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

When a company is said to be undercapitalized, this if referring to its long-term assets on the Statement of Financial Position.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

A banker contemplating a loan to a company should focus on which section(s) of the Statement of Cash Flows in order to determine the company's ability to repay the loan?

A) Operating activities

B) Operating and financing activities

C) Investing activities

D) Operating and investing activities

A) Operating activities

B) Operating and financing activities

C) Investing activities

D) Operating and investing activities

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is normally disclosed as supplementary information on the Statement of Cash Flows?

A) cash paid for dividends during the year

B) depreciation expense for the year

C) property taxes paid during the year

D) cash paid for interest during the year

A) cash paid for dividends during the year

B) depreciation expense for the year

C) property taxes paid during the year

D) cash paid for interest during the year

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following transactions or activities would not be reflected on the cash flow statement?

A) The company declared and paid shareholders a dividend.

B) The company paid interest on a loan.

C) The company repurchases it own shares.

D) The company purchased land with shares.

A) The company declared and paid shareholders a dividend.

B) The company paid interest on a loan.

C) The company repurchases it own shares.

D) The company purchased land with shares.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

The activities of a corporation that are directed to investing the resources of the corporation over extended periods of time in long-term assets is considered part of which of these activities on the Statement of Cash Flows?

A) Operating activities

B) Financing activities

C) Investing activities

D) none of these

A) Operating activities

B) Financing activities

C) Investing activities

D) none of these

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

On the Statement of Cash Flows, which of the following would equal cash paid for income taxes?

A) income taxes payable plus change in cash

B) income taxes expense plus ending balance in income taxes payable

C) income taxes expense plus beginning balance in income taxes payable

D) income taxes expense plus change in income taxes payable

A) income taxes payable plus change in cash

B) income taxes expense plus ending balance in income taxes payable

C) income taxes expense plus beginning balance in income taxes payable

D) income taxes expense plus change in income taxes payable

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

Obtaining resources for the corporation from investors or debt-holders and the return of resources to shareholders and debt-holders is considered part of which of these activities on the Statement of Cash Flows?

A) Operating activities

B) Investing activities

C) Financing activities

D) none of these

A) Operating activities

B) Investing activities

C) Financing activities

D) none of these

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following would be an example of an investing activity on the Statement of Cash Flows?

A) issuance of bonds payable

B) purchase of bonds as an investment

C) issuance of common shares

D) collection of rent from tenants

A) issuance of bonds payable

B) purchase of bonds as an investment

C) issuance of common shares

D) collection of rent from tenants

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is a deduction from net income when using the indirect approach to prepare the cash from operating activities of the Statement of Cash Flows?

A) increase in accounts payable

B) increase in prepaid expenses

C) loss on sale of investments

D) depreciation expense

A) increase in accounts payable

B) increase in prepaid expenses

C) loss on sale of investments

D) depreciation expense

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

Financing activities typically involve accounts classified as

A) current assets and current liabilities.

B) current liabilities and shareholders' equity.

C) long-term liabilities and shareholders' equity.

D) current liabilities and long-term liabilities.

A) current assets and current liabilities.

B) current liabilities and shareholders' equity.

C) long-term liabilities and shareholders' equity.

D) current liabilities and long-term liabilities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following would be added to net income when using the indirect approach to prepare the cash from operating activities of the Statement of Cash Flows?

A) increase in inventory

B) gain on sale of investments

C) decrease in wages payable

D) decrease in accounts receivable

A) increase in inventory

B) gain on sale of investments

C) decrease in wages payable

D) decrease in accounts receivable

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Under the indirect approach, adjustments must be made to net income in the operations section for all of the following items, except

A) depreciation.

B) gain on the sale of equipment.

C) loss on the sale of land.

D) proceeds for the issuance of preferred shares.

A) depreciation.

B) gain on the sale of equipment.

C) loss on the sale of land.

D) proceeds for the issuance of preferred shares.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Cash flows from financing activities include

A) proceeds received from sale of equipment.

B) proceeds received from sale of the company's shares.

C) purchase of land.

D) proceeds from the sale of shares of another company.

A) proceeds received from sale of equipment.

B) proceeds received from sale of the company's shares.

C) purchase of land.

D) proceeds from the sale of shares of another company.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

How should a gain on the sale of equipment be reflected in the operating section of the Statement of Cash Flows when using the indirect method?

A) as a deduction from net income

B) as a cash inflow

C) as an addition to net income

D) It is not reflected in the operating section.

A) as a deduction from net income

B) as a cash inflow

C) as an addition to net income

D) It is not reflected in the operating section.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following would be an example of an investing activity on the Statement of Cash Flows?

A) purchase of capital assets

B) issuance of preferred shares

C) repurchase of shares issued

D) dividends paid to shareholders

A) purchase of capital assets

B) issuance of preferred shares

C) repurchase of shares issued

D) dividends paid to shareholders

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following would be an example of a financing activity on the Statement of Cash Flows?

A) payment of rent to landlord

B) repayment of a loan from another company

C) receipt of interest on investments

D) sale of equipment

A) payment of rent to landlord

B) repayment of a loan from another company

C) receipt of interest on investments

D) sale of equipment

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

Investing activities typically involve accounts classified as

A) long-term assets.

B) long-term liabilities.

C) shareholders' equity.

D) short-term assets.

A) long-term assets.

B) long-term liabilities.

C) shareholders' equity.

D) short-term assets.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

Operating activities typically involve accounts classified as

A) current assets and current liabilities.

B) current assets and long-term liabilities.

C) long-term assets and current liabilities.

D) long-term assets and long-term liabilities.

A) current assets and current liabilities.

B) current assets and long-term liabilities.

C) long-term assets and current liabilities.

D) long-term assets and long-term liabilities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

The direct method of Statement of Cash Flows preparation is

A) widely used in practice.

B) preferred by standard setters.

C) misunderstood by investors.

D) inconsistent and provided different operating results.

A) widely used in practice.

B) preferred by standard setters.

C) misunderstood by investors.

D) inconsistent and provided different operating results.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

Cash equivalents includes everything, except

A) demand deposits.

B) money market funds.

C) short-term bank loan.

D) lines of credit.

A) demand deposits.

B) money market funds.

C) short-term bank loan.

D) lines of credit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

If a company has made arrangements with a bank to borrow money in the months when they have a negative cash balance, this arrangement is a

A) bank overdraft.

B) demand loan.

C) long-term loan.

D) line of credit.

A) bank overdraft.

B) demand loan.

C) long-term loan.

D) line of credit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Under the indirect approach, in preparing the cash from operations section of the Statement of Cash Flows, depreciation is added to net income because

A) it is not a cash expense.

B) it is a cash outflow.

C) it is a source of cash.

D) it is not an allowable expense in determining net income.

A) it is not a cash expense.

B) it is a cash outflow.

C) it is a source of cash.

D) it is not an allowable expense in determining net income.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

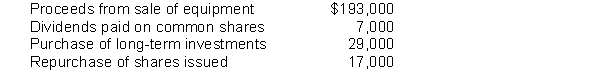

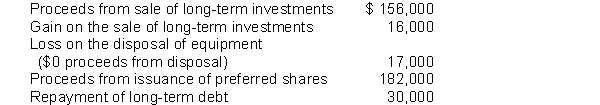

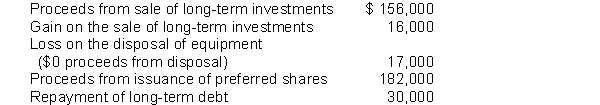

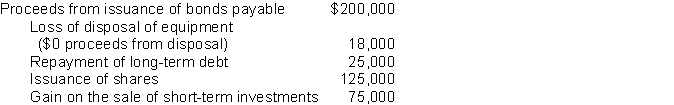

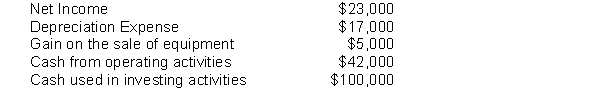

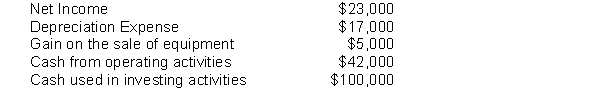

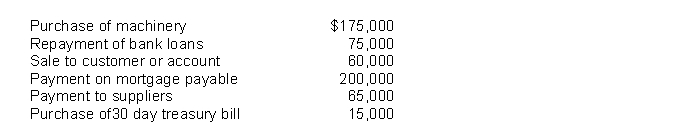

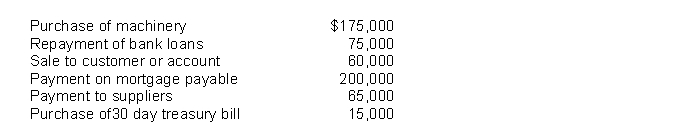

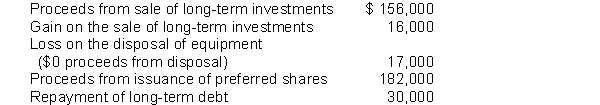

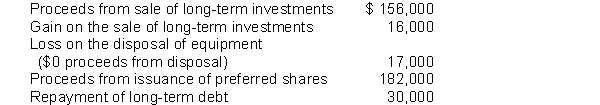

AFM Co. had the following activity during 2020:  What was the cash flow from investing activities?

What was the cash flow from investing activities?

A) $157,000

B) $140,000

C) $164,000

D) $147,000

What was the cash flow from investing activities?

What was the cash flow from investing activities?A) $157,000

B) $140,000

C) $164,000

D) $147,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

Assume a company reported net income of $53,000, loss on the sale of equipment of $10,000, and gain on sale of investments of $21,000. If there were no other adjustments to reconcile net income to cash from operating activities, the cash inflow from operating activities must have been

A) $42,000.

B) $63,000.

C) $84,000.

D) $32,000.

A) $42,000.

B) $63,000.

C) $84,000.

D) $32,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Miriam Co. reported sales of $350,000 and total expenses of $280,000; wages payable increased by $12,000; inventory decreased by $25,000; accounts payable decreased by $50,000; and depreciation was $30,000. What was the net cash flow from operating activities?

A) $87,000

B) $40,000

C) $15,000

D) $63,000

A) $87,000

B) $40,000

C) $15,000

D) $63,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

If a company reported net income for the year of $160,000, cash from operating activities of $105,000, cash flows from financing activities of $225,000, and cash used in investing activities of $450,000, what was their change in cash for the year?

A) $120,000 decrease

B) $170,000 decrease

C) $40,000 increase

D) $65,000 decrease

A) $120,000 decrease

B) $170,000 decrease

C) $40,000 increase

D) $65,000 decrease

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

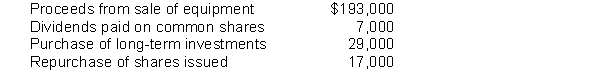

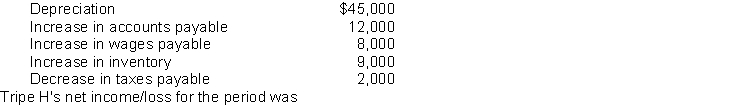

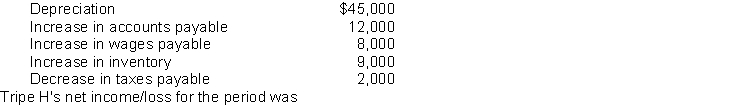

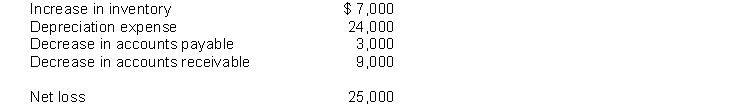

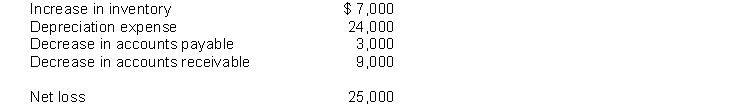

65

Tripe H Enterprises reported $26,000 of cash from operating activities and the following data:

A) $10,000 income.

B) $54,000 loss.

C) $28,000 loss.

D) $8,000 loss.

A) $10,000 income.

B) $54,000 loss.

C) $28,000 loss.

D) $8,000 loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

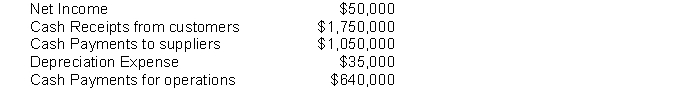

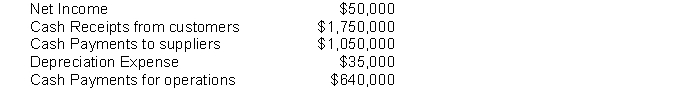

Robin Ltd. reported the following for 2020:  Using the indirect method, the net cash flow from all activities is

Using the indirect method, the net cash flow from all activities is

A) $380,000.

B) $375,000.

C) $350,000.

D) $345,000.

Using the indirect method, the net cash flow from all activities is

Using the indirect method, the net cash flow from all activities isA) $380,000.

B) $375,000.

C) $350,000.

D) $345,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

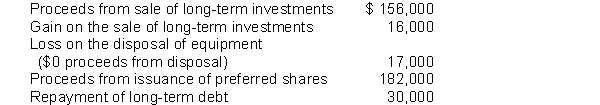

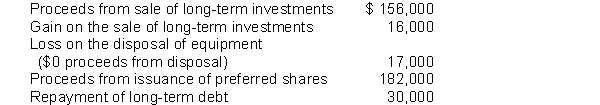

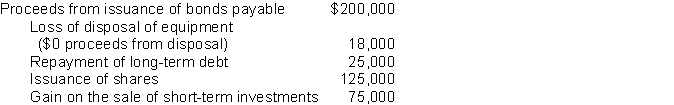

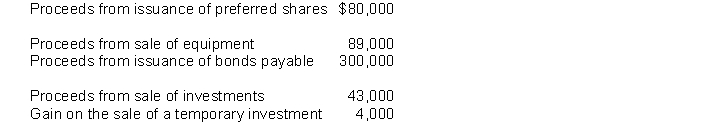

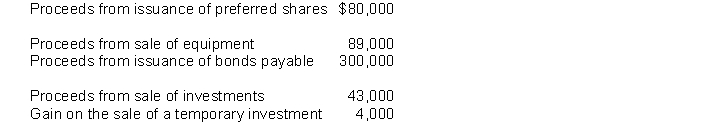

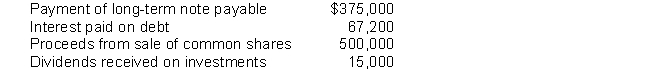

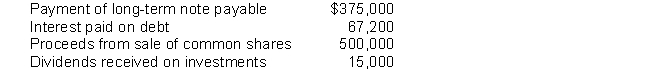

Use the following information to answer following questions

QUE Ltd had the following activity during 2020:

What was the cash flow from financing activities?

A) $135,000

B) $168,000

C) $169,000

D) $152,000

QUE Ltd had the following activity during 2020:

What was the cash flow from financing activities?

A) $135,000

B) $168,000

C) $169,000

D) $152,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

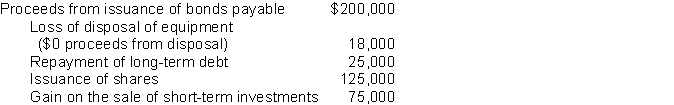

Use the following information to answer following questions

QUE Ltd had the following activity during 2020:

Craft Co. had the following activity during 2020: What was the cash flow from operating activities?

What was the cash flow from operating activities?

A) $ 25,000

B) $ 50,000

C) $ 60,000

D) $ 95,000

QUE Ltd had the following activity during 2020:

Craft Co. had the following activity during 2020:

What was the cash flow from operating activities?

What was the cash flow from operating activities?A) $ 25,000

B) $ 50,000

C) $ 60,000

D) $ 95,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information to answer following questions

Muzeen Ltd. had the following activity during 2020:

What was the cash flow from investing activities?

A) $ 57,000

B) $ 75,000

C) $ 93,000

D) $ - 0 -

Muzeen Ltd. had the following activity during 2020:

What was the cash flow from investing activities?

A) $ 57,000

B) $ 75,000

C) $ 93,000

D) $ - 0 -

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

Sargeant Ventures reported $10,000 cash used in the operating activities section of the Statement of Cash Flows and the following data: depreciation expense $10,000; an accounts payable increase of $12,000; a $3,000 decrease in accounts receivable; an increase in wages payable of $8,000; and a $15,000 gain on the sale of long-term investments. Sargeants net income/loss for the period was

A) $8,000 income.

B) $28,000 loss.

C) $38,000 loss.

D) $2,000 income.

A) $8,000 income.

B) $28,000 loss.

C) $38,000 loss.

D) $2,000 income.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

The direct approach differs from the indirect approach with regard to preparing which section of the Statement of Cash Flows?

A) Operating activities

B) Investing activities

C) Financing activities

D) There is no difference between the two approaches.

A) Operating activities

B) Investing activities

C) Financing activities

D) There is no difference between the two approaches.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information to answer following questions

Muzeen Ltd. had the following activity during 2020:

What was the cash flow from financing activities?

A) $300,000

B) $292,000

C) $325,000

D) $275,000

Muzeen Ltd. had the following activity during 2020:

What was the cash flow from financing activities?

A) $300,000

B) $292,000

C) $325,000

D) $275,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

McKim Cringan George reported a cash position of $35,000 and as of December 31, after its first year of operations. McKim also reported the following:  How much cash was provided through McKim's financing activities?

How much cash was provided through McKim's financing activities?

A) $100,000

B) $ 93,000

C) $ 90,000

D) $ 0

How much cash was provided through McKim's financing activities?

How much cash was provided through McKim's financing activities?A) $100,000

B) $ 93,000

C) $ 90,000

D) $ 0

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Determine the cash inflows from investing and financing activities given the following data:

A) investing $132,000; financing $380,000

B) investing $135,000; financing $391,000

C) investing $143,000; financing $380,000

D) investing $148,000; financing $391,000

A) investing $132,000; financing $380,000

B) investing $135,000; financing $391,000

C) investing $143,000; financing $380,000

D) investing $148,000; financing $391,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

Given the following activities:  The cash outflows for investing and financing activities were

The cash outflows for investing and financing activities were

A) investing $175,000; financing $310,000.

B) investing $190,000; financing $275,000.

C) investing $190,000; financing $310,000.

D) investing $175,000; financing $275,000.

The cash outflows for investing and financing activities were

The cash outflows for investing and financing activities wereA) investing $175,000; financing $310,000.

B) investing $190,000; financing $275,000.

C) investing $190,000; financing $310,000.

D) investing $175,000; financing $275,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

A company has surplus cash available and decides to purchase a 120-day treasury bill. The correct classification of the purchase on the Statement of Cash Flows would be

A) as an net change in cash equivalents.

B) as a cash outflow in operating activities.

C) as a cash outflow in investing activities.

D) as a cash outflow in financing activities.

A) as an net change in cash equivalents.

B) as a cash outflow in operating activities.

C) as a cash outflow in investing activities.

D) as a cash outflow in financing activities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

Concierge Co. had the following activity during 2020:  What was the cash flow from financing activities?

What was the cash flow from financing activities?

A) $57,800

B) $72,800

C) $125,000

D) $140,000

What was the cash flow from financing activities?

What was the cash flow from financing activities?A) $57,800

B) $72,800

C) $125,000

D) $140,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

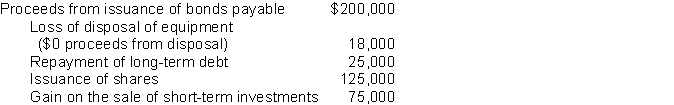

Use the following information to answer following questions

QUE Ltd had the following activity during 2020:

What was the cash flow from investing activities?

A) $16,000

B) $156,000

C) $173,000

D) $189,000

QUE Ltd had the following activity during 2020:

What was the cash flow from investing activities?

A) $16,000

B) $156,000

C) $173,000

D) $189,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Cairns Consulting Corp. company records revealed the following for the current year:  What was the net cash flow from operating activities for the year?

What was the net cash flow from operating activities for the year?

A) cash flow from (inflow) $8,000

B) cash flow from (inflow) $0

C) cash flow used (outflow) $2,000

D) cash flow used (outflow) $4,000

What was the net cash flow from operating activities for the year?

What was the net cash flow from operating activities for the year?A) cash flow from (inflow) $8,000

B) cash flow from (inflow) $0

C) cash flow used (outflow) $2,000

D) cash flow used (outflow) $4,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

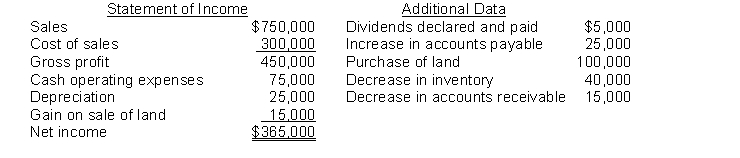

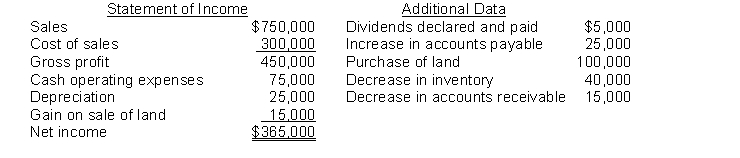

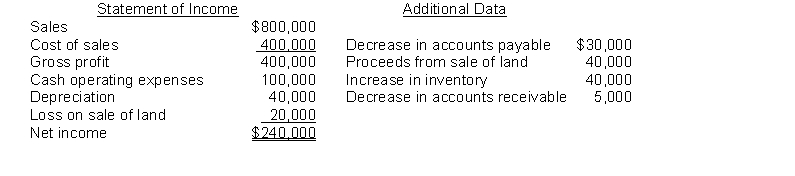

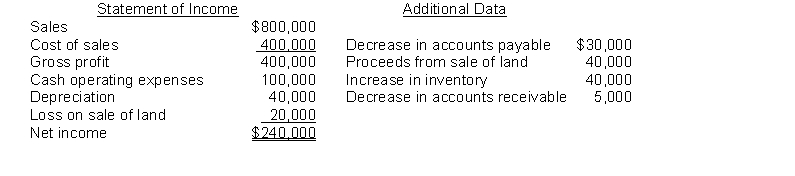

Petunia Co. reported the following for 2020:  Using the indirect method, the net cash flow from operating activities was

Using the indirect method, the net cash flow from operating activities was

A) $365,000.

B) $300,000.

C) $235,000.

D) $240,000.

Using the indirect method, the net cash flow from operating activities was

Using the indirect method, the net cash flow from operating activities wasA) $365,000.

B) $300,000.

C) $235,000.

D) $240,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck