Deck 7: Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

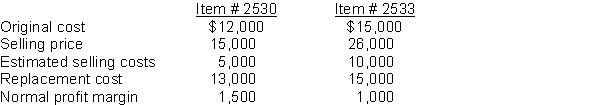

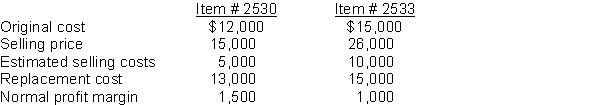

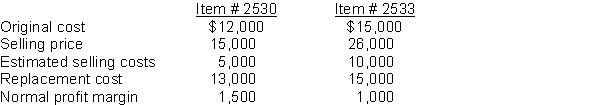

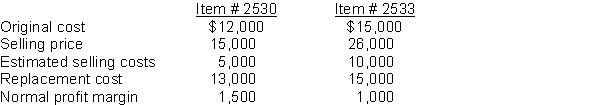

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 7: Inventory

1

Once the manufacturing process is complete, the product is transferred from the Work-in-Process account to Raw Materials account.

False

2

Perpetual inventory systems are incapable of identifying inventory shrinkage.

False

3

COGS is equal to the inventory purchased for a given time period.

False

4

The inventory turnover ratio is calculated as cost of goods sold divided by total inventory.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

Periodic inventory systems provide more relevant and timely information to managers for decision making purposes than perpetual inventory systems do.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

If a company's inventory turnover ratio is 6.6, it takes them on average 55 days to sell their inventory.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

Under the FIFO inventory formula, the cost of ending inventory and cost of goods sold will be the same under both the perpetual and periodic inventory systems.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

FOB means "For only Buyers".

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

One way to estimate the cost of goods sold is to multiply the sales revenue for the period by the inventory turnover ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

Raw materials are the components or ingredients required to make a product.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

FOB shipping means the seller owns the inventory until it reaches the buyers premise.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

The cost formula used by a firm to value inventory must match the physical flow of units through the firm.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

The Finished Goods account collects all the costs incurred as a product is being made.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

The gross margin ratio is equal to gross margin divided by sales revenue.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

If prices were rising and a Canadian company wanted to report a smaller amount of profit for tax purposes, they should use the weighted-average cost formula.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Just-in-time inventory systems are designed to reduce the cost of inventory storage and increase the amount of cash on hand.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Perpetual inventory systems provide more timely information than periodic systems.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

Companies that make products are known as retailers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

The LCM rule is usually applied to groups of similar items.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

Gross margin is the difference between sales revenue and costs of goods available for sale.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

When a perpetual inventory system is used,

A) a physical inventory count must be taken to determine cost of goods sold.

B) inventory shrinkage is difficult to determine.

C) it eliminates the need for frequent inventory counts.

D) the timeliness of data is sacrificed for lower costs of operation.

A) a physical inventory count must be taken to determine cost of goods sold.

B) inventory shrinkage is difficult to determine.

C) it eliminates the need for frequent inventory counts.

D) the timeliness of data is sacrificed for lower costs of operation.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

Propack Inc. purchases goods from a supplier FOB destination. This means that

A) while the goods are in transit Propack owns the items.

B) the supplier has paid for the shipping.

C) Propack has paid for the shipping.

D) None of the above apply.

A) while the goods are in transit Propack owns the items.

B) the supplier has paid for the shipping.

C) Propack has paid for the shipping.

D) None of the above apply.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following would most likely use a perpetual inventory system?

A) hardware store

B) shoe store

C) car dealership

D) bookstore

A) hardware store

B) shoe store

C) car dealership

D) bookstore

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

Physical inventory counts are

A) only necessary for periodic systems.

B) only necessary for perpetual systems.

C) necessary for periodic and perpetual systems as part of internal control.

D) not necessary at all if a company has an appropriate accounting system.

A) only necessary for periodic systems.

B) only necessary for perpetual systems.

C) necessary for periodic and perpetual systems as part of internal control.

D) not necessary at all if a company has an appropriate accounting system.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

The longer the inventory remains unsold, the higher the risk of

A) spoilage.

B) damage.

C) obsolescence.

D) all of the above.

A) spoilage.

B) damage.

C) obsolescence.

D) all of the above.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

When a periodic inventory system is used

A) inventory shrinkage is impossible to calculate.

B) timely data is of utmost importance.

C) cost of goods sold is always known.

D) every inventory transaction is reflected in the inventory account.

A) inventory shrinkage is impossible to calculate.

B) timely data is of utmost importance.

C) cost of goods sold is always known.

D) every inventory transaction is reflected in the inventory account.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

The cost of goods available for sale includes

A) just beginning inventory.

B) beginning inventory less ending inventory.

C) beginning inventory plus purchases less ending inventory.

D) beginning inventory plus purchases.

A) just beginning inventory.

B) beginning inventory less ending inventory.

C) beginning inventory plus purchases less ending inventory.

D) beginning inventory plus purchases.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

The major difference between the periodic and perpetual inventory systems is that inventory must be physically counted in the periodic system to determine ending inventory.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following would most likely use a periodic inventory system?

A) car dealership

B) heavy metal distributor

C) computer dealership

D) local handcrafted furniture store

A) car dealership

B) heavy metal distributor

C) computer dealership

D) local handcrafted furniture store

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

A major consideration for a company when selecting a supplier is

A) supplier location

B) online presence

C) company profitability

D) inventory valuation

A) supplier location

B) online presence

C) company profitability

D) inventory valuation

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is NOT an inventory account in a manufacturing company?

A) Raw Material

B) Work-in-Process

C) Goods Available For Sale

D) Finished Goods

A) Raw Material

B) Work-in-Process

C) Goods Available For Sale

D) Finished Goods

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is the correct flow of costs in a manufacturing operation?

A) Raw materials to finished goods to COGS

B) Raw materials to COGS to finished goods to work-in-process

C) Raw materials to work-in-process to finished goods to COGS

D) Direct materials to work-in-process to finished goods to COGS

A) Raw materials to finished goods to COGS

B) Raw materials to COGS to finished goods to work-in-process

C) Raw materials to work-in-process to finished goods to COGS

D) Direct materials to work-in-process to finished goods to COGS

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Customers become frustrated if a company does not have a product available when they order it. This is called

A) a sell out.

B) spoilage.

C) obsolescence.

D) a stockout.

A) a sell out.

B) spoilage.

C) obsolescence.

D) a stockout.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

When we calculate weighted-average using the periodic system, we recalculate a new weighted-average cost per unit after every sale.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

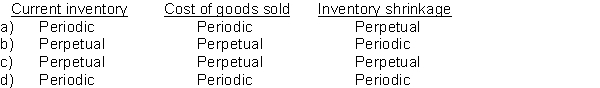

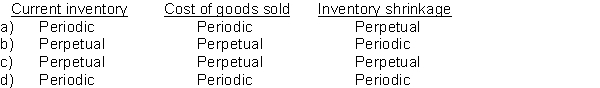

The following amounts are always known under which inventory costing system?

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

In a manufacturing process overhead costs are added to which inventory account?

A) Raw Materials

B) Finished Goods

C) Work-in-Process

D) Cost of Goods Sold

A) Raw Materials

B) Finished Goods

C) Work-in-Process

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

All of the following are manufacturing accounts EXCEPT for

A) Cost of Goods Available for Sale.

B) Raw Materials.

C) Finished Goods.

D) Work-in-Process.

A) Cost of Goods Available for Sale.

B) Raw Materials.

C) Finished Goods.

D) Work-in-Process.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

The cost-to-sales ratio is a method used to estimate inventory instead of performing a physical count.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

Goods available for sale are found in

A) work-in-process inventory.

B) raw materials inventory.

C) finished goods inventory.

D) cost of goods sold.

A) work-in-process inventory.

B) raw materials inventory.

C) finished goods inventory.

D) cost of goods sold.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

Which term describes a situation where the buyer is responsible for paying shipping and other costs incurred while goods are in transit from the seller's premise to the buyer's premises.

A) FOB shipping

B) FOB destination

C) FOB purchasing

D) FOB receiving

A) FOB shipping

B) FOB destination

C) FOB purchasing

D) FOB receiving

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements best describes net realizable value when applying the LCM rule?

A) Net realizable value is the selling price less the costs necessary to sell the item.

B) Net realizable value is the selling price plus the costs necessary to sell the item.

C) Net realizable value is the selling price plus the normal profit margin.

D) Net realizable value is the selling price less the normal profit margin.

A) Net realizable value is the selling price less the costs necessary to sell the item.

B) Net realizable value is the selling price plus the costs necessary to sell the item.

C) Net realizable value is the selling price plus the normal profit margin.

D) Net realizable value is the selling price less the normal profit margin.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

Which cost formula will produce the same results under both the periodic and perpetual inventory systems?

A) FIFO

B) weighted-average

C) They both produce the same results.

D) They both produce different results.

A) FIFO

B) weighted-average

C) They both produce the same results.

D) They both produce different results.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following should be included in the cost of inventory?

A) the cost of keeping the inventory records

B) depreciation on the inventory warehouse

C) the salesperson's commission

D) receiving and inspection costs

A) the cost of keeping the inventory records

B) depreciation on the inventory warehouse

C) the salesperson's commission

D) receiving and inspection costs

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

A small local convenience store is opening in your neighborhood. Inventory is limited and keeping initial start-up costs low is a priority. What type of inventory system would you recommend?

A) perpetual

B) periodic

C) specific identification

D) Company is so small one is not needed.

A) perpetual

B) periodic

C) specific identification

D) Company is so small one is not needed.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

In order to ensure that the inventory values presented on the statement of financial position at year end reflect the true economic benefits of the inventory, the company may need to

A) have an inventory fire sale.

B) use a perpetual inventory system.

C) use a JIT system.

D) prepare an inventory writedown.

A) have an inventory fire sale.

B) use a perpetual inventory system.

C) use a JIT system.

D) prepare an inventory writedown.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements about the weighted-average cost formula is true?

A) If prices are rising, companies prefer it because it lowers their tax liability.

B) It is the most popular method in Canada.

C) In times of rising prices, weighted-average will produce a higher net income than FIFO.

D) In time of rising prices, weighted-average produces an inventory cost per unit that is higher than the cost per unit of cost of goods sold.

A) If prices are rising, companies prefer it because it lowers their tax liability.

B) It is the most popular method in Canada.

C) In times of rising prices, weighted-average will produce a higher net income than FIFO.

D) In time of rising prices, weighted-average produces an inventory cost per unit that is higher than the cost per unit of cost of goods sold.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

Hanuv Corporation counts its ending inventory incorrectly in year 1, assuming no other inventory errors in future period,

A) the impact of the error effects the inventory account only.

B) the error effects profitability, net income and retained earnings for year 1 only.

C) the error extends in to future years indefinitely.

D) the error will self-correct by the end of year 2.

A) the impact of the error effects the inventory account only.

B) the error effects profitability, net income and retained earnings for year 1 only.

C) the error extends in to future years indefinitely.

D) the error will self-correct by the end of year 2.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

When a company is evaluating whether or not to use a perpetual vs. a periodic inventory system the following statement is most accurate.

A) A perpetual inventory system provides far superior information and should be used at any cost.

B) A periodic system is inferior and should never be used if possible.

C) The cost of the system used should be measured against the benefits it provides.

D) Both systems are equally good.

A) A perpetual inventory system provides far superior information and should be used at any cost.

B) A periodic system is inferior and should never be used if possible.

C) The cost of the system used should be measured against the benefits it provides.

D) Both systems are equally good.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

Use of the FIFO cost formula means that

A) the perpetual costing system is used.

B) the ending inventory contains the oldest costs.

C) the periodic costing system is used.

D) the ending inventory contains the most recent costs.

A) the perpetual costing system is used.

B) the ending inventory contains the oldest costs.

C) the periodic costing system is used.

D) the ending inventory contains the most recent costs.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Tamarack Co. prepares its estimate of LCM using the net realizable value. Inventory item 101 cost $45 and its current replacement cost is $50. The item is currently selling in the market for $55 and selling costs are estimated to be $6. Tamarack expects to earn a profit of $4 on the sale of this item. In its year-end financial statements, Tamarack Co. should value this item at

A) $50.

B) $45.

C) $49.

D) $55.

A) $50.

B) $45.

C) $49.

D) $55.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

Net realizable value is also known as the

A) replacement cost.

B) wholesale price.

C) estimated selling price.

D) liquidated price.

A) replacement cost.

B) wholesale price.

C) estimated selling price.

D) liquidated price.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following cost formulas would be most appropriate for costing an inventory of liquids stored in tanks?

A) weighted-average

B) FIFO

C) periodic

D) perpetual

A) weighted-average

B) FIFO

C) periodic

D) perpetual

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following would be most likely to use the specific identification method?

A) shoe store

B) car dealership

C) grocery store

D) bookstore

A) shoe store

B) car dealership

C) grocery store

D) bookstore

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements about the FIFO cost formula is true?

A) The same costs per unit are assigned to the ending inventory and the cost of goods sold.

B) Companies prefer to use FIFO because it lowers their tax liability.

C) In times of rising prices FIFO will produce a higher net income than weighted-average.

D) In time of rising prices FIFO produces an inventory cost per unit that is lower than the cost per unit of cost of goods sold.

A) The same costs per unit are assigned to the ending inventory and the cost of goods sold.

B) Companies prefer to use FIFO because it lowers their tax liability.

C) In times of rising prices FIFO will produce a higher net income than weighted-average.

D) In time of rising prices FIFO produces an inventory cost per unit that is lower than the cost per unit of cost of goods sold.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Management may use the cost formula decision tree when determining which cost formula to use. If goods are not interchangeable, management's options are

A) weighted-average.

B) FIFO.

C) Just-in-time.

D) specific identification.

A) weighted-average.

B) FIFO.

C) Just-in-time.

D) specific identification.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following cost formulas would be most appropriate when the inventory units are unique or costly?

A) FIFO

B) specific identification

C) just-in-time

D) weighted-average

A) FIFO

B) specific identification

C) just-in-time

D) weighted-average

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

An inventory of grocery items where the shelves are stocked from the back would be similar to which cost formula?

A) FIFO

B) specific identification

C) weighted-average

D) none of the above

A) FIFO

B) specific identification

C) weighted-average

D) none of the above

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

Argyle Company failed to include a number of inventory items in the inventory count at the end of the last period. Assuming no other inventory errors, the effect on the current period is

A) an overstatement of gross profit.

B) an understatement of COGS.

C) an overstatement of ending inventory.

D) an understatement of net income.

A) an overstatement of gross profit.

B) an understatement of COGS.

C) an overstatement of ending inventory.

D) an understatement of net income.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

When using the LCM rule in Canada, the market value is most commonly

A) net present value.

B) selling price less profit margin.

C) replacement cost.

D) net realizable value.

A) net present value.

B) selling price less profit margin.

C) replacement cost.

D) net realizable value.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is true under a periodic system?

A) A COGS expense is recognized each time a sale is made.

B) The inventory account is not updated with each purchase.

C) Inventory shrinkage is easily identified.

D) This system can be costly to implement.

A) A COGS expense is recognized each time a sale is made.

B) The inventory account is not updated with each purchase.

C) Inventory shrinkage is easily identified.

D) This system can be costly to implement.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

Aubergine Industries had beginning inventory of $10,000 and purchased $75,000 of merchandise during 2020. The company had sales of $90,000 and has traditionally had a cost-to-sales ratio of 75%. Using the gross margin estimation method, the company estimates its ending inventory to be

A) $67,500.

B) $65,000.

C) $17,500.

D) $22,500.

A) $67,500.

B) $65,000.

C) $17,500.

D) $22,500.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

One strategy managers use to reduce the holding costs of inventory is

A) separation of duties.

B) regular inventory counts.

C) electronic tags.

D) JIT delivery.

A) separation of duties.

B) regular inventory counts.

C) electronic tags.

D) JIT delivery.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

Very high turnovers

A) are always the goal of management.

B) may create stockouts.

C) are a measurement of profitability.

D) are unaffected by inventory writedowns.

A) are always the goal of management.

B) may create stockouts.

C) are a measurement of profitability.

D) are unaffected by inventory writedowns.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

The gross margin estimation method estimates the cost of goods sold by

A) multiplying the sales revenue by cost-to-sales ratio.

B) multiplying the cost of goods available by the gross margin percentage.

C) multiplying the costs to sales ratio by purchases.

D) multiplying the sales revenue by the inventory turnover ratio.

A) multiplying the sales revenue by cost-to-sales ratio.

B) multiplying the cost of goods available by the gross margin percentage.

C) multiplying the costs to sales ratio by purchases.

D) multiplying the sales revenue by the inventory turnover ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

The inventory writedown that results from the application of the LCM rule is often hidden in the

A) selling expense.

B) inventory account.

C) cost of goods sold.

D) loss due to market decline of inventory.

A) selling expense.

B) inventory account.

C) cost of goods sold.

D) loss due to market decline of inventory.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

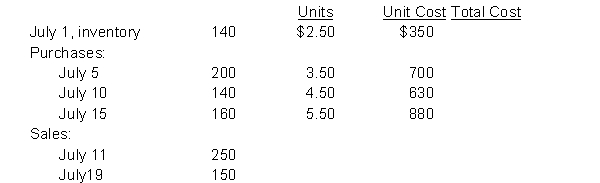

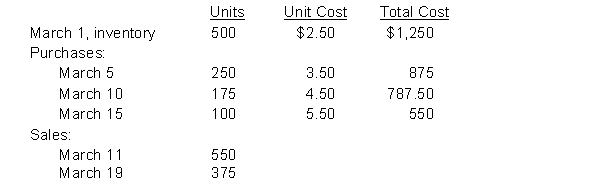

Riverside Ltd. uses a perpetual inventory system and had the following activity for a single inventory item:  Instructions

Instructions

Using the perpetual system, determine the ending inventory and cost of goods sold under:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

Show your work.

Instructions

InstructionsUsing the perpetual system, determine the ending inventory and cost of goods sold under:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

Show your work.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

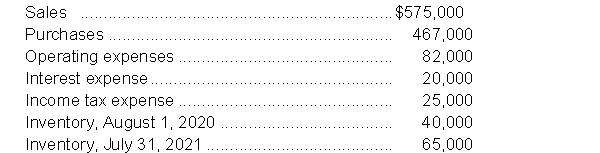

The following information is available for Acme Inc.:  Instructions

Instructions

Use the above information to calculate the cost of goods available for sale and cost of goods sold for Acme Inc. for the year ended July 31, 2021.

Instructions

InstructionsUse the above information to calculate the cost of goods available for sale and cost of goods sold for Acme Inc. for the year ended July 31, 2021.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

Foamy Suds Ltd. had a fire at its warehouse and was trying to determine the cost of the inventory lost. For the year to date, sales had been $525,000, opening inventory was $125,000, purchases to date were $318,000, and the cost-to-sales ratio is normally 60%. Inventory not damaged in the fire was $18,000. What was the cost of the inventory damaged in the fire?

A) $110,000

B) $124,000

C) $160,000

D) $74,000

A) $110,000

B) $124,000

C) $160,000

D) $74,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

Inventory turnover and days to sell inventory

A) are different names for the same metric.

B) are inversely related.

C) are interpreted to be as the higher the better.

D) none of the above

A) are different names for the same metric.

B) are inversely related.

C) are interpreted to be as the higher the better.

D) none of the above

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

Effective inventory management would have one person place the order for new inventory, a second person check it against the purchase order when it arrives, and a third person record the receipt of inventory in the accounting records. The purpose of this system is

A) to reduce spoilage.

B) to reduce storage costs.

C) to guard against stockouts.

D) to guard against internal theft and collusion.

A) to reduce spoilage.

B) to reduce storage costs.

C) to guard against stockouts.

D) to guard against internal theft and collusion.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

The inventory writedown incurred from applying the LCM rule to inventory is

A) not reflected on the Statement of Financial Position.

B) an adjustment to cost of goods sold.

C) not reflected on the Statement of Income.

D) not considered a permanent loss.

A) not reflected on the Statement of Financial Position.

B) an adjustment to cost of goods sold.

C) not reflected on the Statement of Income.

D) not considered a permanent loss.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

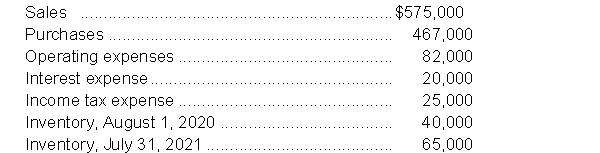

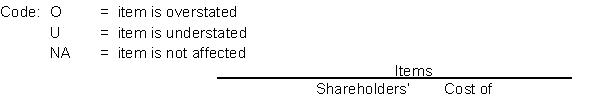

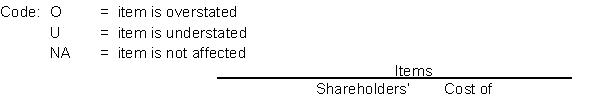

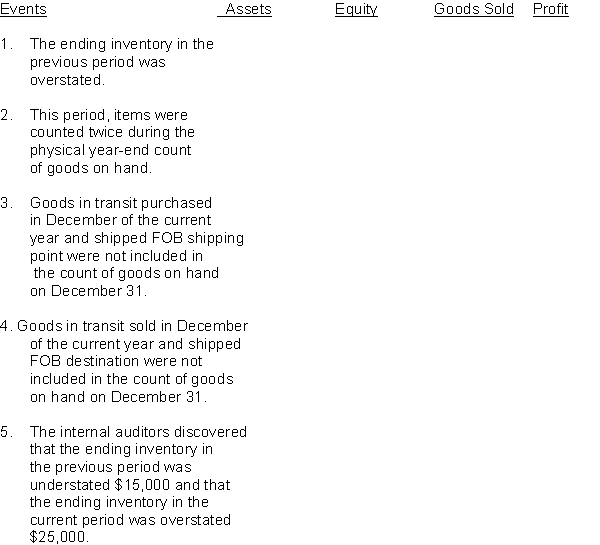

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current calendar year by placing the appropriate code under the correct heading.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

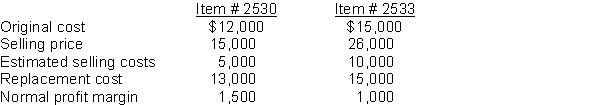

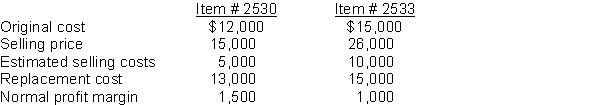

Use the following information to answer questions 70-71.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value to the inventory as a whole would be

A) $25,000.

B) $26,000.

C) $27,000.

D) $28,000.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value to the inventory as a whole would be

A) $25,000.

B) $26,000.

C) $27,000.

D) $28,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

Carolina Company has a normal markup of 40%. Its cost-to-sales ratio is

A) 71.4%.

B) 67.5%.

C) 60%.

D) Cannot be calculated.

A) 71.4%.

B) 67.5%.

C) 60%.

D) Cannot be calculated.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

In 2020 Borger Industries had beginning inventory of $106,000, purchases of $1,126,500, ending inventory of $116,000, accounts payable of $49,605, and sales of $2,147,250. Inventory turnover for 2017 was closest to

A) 9.625.

B) 10.06.

C) 10.15.

D) 10.53.

A) 9.625.

B) 10.06.

C) 10.15.

D) 10.53.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information to answer questions 70-71.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value on an item-by-item basis would be

A) $25,000.

B) $26,000.

C) $27,000.

D) $28,000.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value on an item-by-item basis would be

A) $25,000.

B) $26,000.

C) $27,000.

D) $28,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information to answer questions 70-71.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

When applying the LCM, the following is true:

A) the inventory account remains at its original value.

B) a contra account to inventory is used.

C) COGS rises when ending inventory is reduced to market value.

D) LCM can only be applied to individual items.

Pal Distributers Inc. values its inventory on an LCM basis. The following data came from the 2020 inventory, which consisted of two items:

When applying the LCM, the following is true:

A) the inventory account remains at its original value.

B) a contra account to inventory is used.

C) COGS rises when ending inventory is reduced to market value.

D) LCM can only be applied to individual items.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

Allegra Ltd. has just completed a physical inventory count at year end, July 31, 2020. Only the items on the shelves, in storage, and in the receiving area were counted. The inventory amounted to $77,000. Allegra uses a perpetual inventory system. During the year-end audit, the independent CPA discovered the following additional information:

1. There were goods in transit on July 31, 2020, from a supplier with terms FOB destination, costing $8,500. These items were excluded from the physical inventory count.

2. On July 27, 2020, a regular customer purchased goods for cash amounting to $1,000 and left them for pickup on August 4, 2020. Allegra had paid $1,200 for the goods and included them in the physical inventory count.

3. Allegra Ltd, on the date of the inventory count, received notice from a supplier that goods ordered earlier at a cost of $10,000, were shipped on July 28, 2020; the terms were FOB shipping point. The goods had not yet been received. These items were excluded from the physical inventory.

4. On July 31, 2020, there were goods in transit to customers, with terms FOB shipping point, amounting to $800 (expected delivery on August 8, 2020). The items were excluded from the physical inventory count.

5. On July 31, 2020, Allegra shipped $2,500 worth of goods to a customer, FOB destination. This shipment arrived on August 5, 2020. These items were not included in the physical inventory count.

6. Allegra, as the consignee, had goods on consignment that cost $5,000. These items were included in the physical inventory count.

Instructions

Analyze the above information and calculate a corrected amount for the ending inventory. Explain the rationale for your treatment of each item.

1. There were goods in transit on July 31, 2020, from a supplier with terms FOB destination, costing $8,500. These items were excluded from the physical inventory count.

2. On July 27, 2020, a regular customer purchased goods for cash amounting to $1,000 and left them for pickup on August 4, 2020. Allegra had paid $1,200 for the goods and included them in the physical inventory count.

3. Allegra Ltd, on the date of the inventory count, received notice from a supplier that goods ordered earlier at a cost of $10,000, were shipped on July 28, 2020; the terms were FOB shipping point. The goods had not yet been received. These items were excluded from the physical inventory.

4. On July 31, 2020, there were goods in transit to customers, with terms FOB shipping point, amounting to $800 (expected delivery on August 8, 2020). The items were excluded from the physical inventory count.

5. On July 31, 2020, Allegra shipped $2,500 worth of goods to a customer, FOB destination. This shipment arrived on August 5, 2020. These items were not included in the physical inventory count.

6. Allegra, as the consignee, had goods on consignment that cost $5,000. These items were included in the physical inventory count.

Instructions

Analyze the above information and calculate a corrected amount for the ending inventory. Explain the rationale for your treatment of each item.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

Ariel Co.'s gross profit margin increased from 41.5% in 2020 to 44.3% in 2021. Possible reasons may include:

A) increased shipping costs

B) use of early payment discounts for merchandise purchases

C) cost of obsolete product passed on to the customer

D) reduced selling prices

A) increased shipping costs

B) use of early payment discounts for merchandise purchases

C) cost of obsolete product passed on to the customer

D) reduced selling prices

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

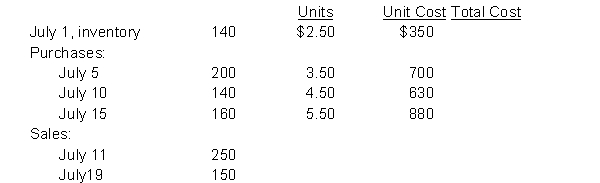

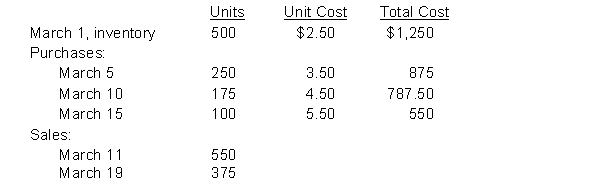

Blythe Inc. uses a perpetual inventory system and had the following activity for a single inventory item:  Instructions

Instructions

Using the perpetual system, determine the ending inventory and cost of goods sold under:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

Instructions

InstructionsUsing the perpetual system, determine the ending inventory and cost of goods sold under:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck