Deck 13: Personal Financial Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/260

Play

Full screen (f)

Deck 13: Personal Financial Management

1

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

John Lee's savings account has a balance of $4610. After 21 months, what will the amount of interest be at 4.3% per year?

A)$219.24

B)$198.23

C)$346.90

D)$219.52

unless otherwise indicated.

John Lee's savings account has a balance of $4610. After 21 months, what will the amount of interest be at 4.3% per year?

A)$219.24

B)$198.23

C)$346.90

D)$219.52

C

2

Find the future value of the deposit if the account pays simple interest.

$1800 at 3% for 5 years

A)$2070

B)$2065

C)$2124

D)$1942

$1800 at 3% for 5 years

A)$2070

B)$2065

C)$2124

D)$1942

A

3

Use the compound interest formula to compute the future value of the investment.

$9000 at 8% compounded semiannually for 8 years

A)$14,760.00

B)$12,317.12

C)$16,658.37

D)$16,856.83

$9000 at 8% compounded semiannually for 8 years

A)$14,760.00

B)$12,317.12

C)$16,658.37

D)$16,856.83

D

4

Find the future value of the deposit if the account pays simple interest.

$1450 at 4% for 2.1 years

A)$1514.11

B)$1566.00

C)$1629.80

D)$1571.80

$1450 at 4% for 2.1 years

A)$1514.11

B)$1566.00

C)$1629.80

D)$1571.80

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

5

Use the compound interest formula to compute the future value of the investment.

$1300 at 2% compounded quarterly for 6 years

A)$1339.49

B)$1465.31

C)$1456.00

D)$1464.01

$1300 at 2% compounded quarterly for 6 years

A)$1339.49

B)$1465.31

C)$1456.00

D)$1464.01

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

6

Use the compound interest formula to compute the future value of the investment.

$19,000 at 1% compounded annually for 13 years

A)$21,623.77

B)$21,280.00

C)$21,409.68

D)$21,470.00

$19,000 at 1% compounded annually for 13 years

A)$21,623.77

B)$21,280.00

C)$21,409.68

D)$21,470.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

7

$4000 at 4.07% for 28 months

A)$4558.40

B)$37,986.67

C)$379.87

D)$5.81

A)$4558.40

B)$37,986.67

C)$379.87

D)$5.81

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

8

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

Martin takes out a simple interest loan at 4 %. After 10 months the amount of interest on the loan is $80.93. What was the amount of the loan? Round to the nearest dollar.

A)$2428

B)$2768

C)$24

D)$2389

unless otherwise indicated.

Martin takes out a simple interest loan at 4 %. After 10 months the amount of interest on the loan is $80.93. What was the amount of the loan? Round to the nearest dollar.

A)$2428

B)$2768

C)$24

D)$2389

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

9

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

John forgot to pay his $408.00 income tax on time. The IRS charged a penalty of 5% for the 74 days the money was late. Find the penalty that was paid. (Use a 365 day year.)

A)$4.14

B)$0.34

C)$4.08

D)$412.14

unless otherwise indicated.

John forgot to pay his $408.00 income tax on time. The IRS charged a penalty of 5% for the 74 days the money was late. Find the penalty that was paid. (Use a 365 day year.)

A)$4.14

B)$0.34

C)$4.08

D)$412.14

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

10

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

Andy Jones opened a security service company. To pay for startup costs, Andy Jones borrowed $40,000 from a bank at 5% for 1 year. Find the interest.

A)$2000.00

B)$42,000.00

C)$2400.00

D)$200.00

unless otherwise indicated.

Andy Jones opened a security service company. To pay for startup costs, Andy Jones borrowed $40,000 from a bank at 5% for 1 year. Find the interest.

A)$2000.00

B)$42,000.00

C)$2400.00

D)$200.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

11

$1660 at 6% for 4 months

A)$398.40

B)$33.20

C)$24.90

D)$3320.00

A)$398.40

B)$33.20

C)$24.90

D)$3320.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

12

$900 at 3% for 1 year

A)$27

B)$270

C)$3.00

D)$2.70

A)$27

B)$270

C)$3.00

D)$2.70

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

13

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

14

$2950 at 4% for 1 years

A)$118.00

B)$11,800.00

C)$11.80

D)$737.50

A)$118.00

B)$11,800.00

C)$11.80

D)$737.50

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

15

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

16

Find the future value of the deposit if the account pays simple interest.

$760 at 4% for 9 months

A)$782.99

B)$780.27

C)$785.33

D)$782.80

$760 at 4% for 9 months

A)$782.99

B)$780.27

C)$785.33

D)$782.80

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

17

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

Allan borrowed $3900 from his father to buy a car. He repaid him after 9 months with interest of 7% per year. Find the total amount he repaid.

A)$4104.75

B)$4173.00

C)$4082.00

D)$204.75

unless otherwise indicated.

Allan borrowed $3900 from his father to buy a car. He repaid him after 9 months with interest of 7% per year. Find the total amount he repaid.

A)$4104.75

B)$4173.00

C)$4082.00

D)$204.75

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

18

$800 at 8% for 8 years

A)$800.00

B)$512.00

C)$51.20

D)$12.50

A)$800.00

B)$512.00

C)$51.20

D)$12.50

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

19

Solve the problem. Assume that simple interest is being calculated in each case. Round the answer to the nearest cent

unless otherwise indicated.

Annie's cafe borrows $5900 at 7% for 60 days. Find the total amount that must be repaid after 60 days. (Use a 365 day year.)

A)$5906.79

B)$6313.00

C)$5967.89

D)$6578.90

unless otherwise indicated.

Annie's cafe borrows $5900 at 7% for 60 days. Find the total amount that must be repaid after 60 days. (Use a 365 day year.)

A)$5906.79

B)$6313.00

C)$5967.89

D)$6578.90

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

20

Find the future value of the deposit if the account pays simple interest.

$2000 at 2.4% for 4 years

A)$2192.00

B)$2187.20

C)$2240.00

D)$2101.05

$2000 at 2.4% for 4 years

A)$2192.00

B)$2187.20

C)$2240.00

D)$2101.05

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

21

Use the compound interest formula to compute the future value of the investment.

$700 at 6.5% compounded daily for 11 years (assume 360 days per year)

A)$1399.41

B)$852.28

C)$1430.84

D)$701.39

$700 at 6.5% compounded daily for 11 years (assume 360 days per year)

A)$1399.41

B)$852.28

C)$1430.84

D)$701.39

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

22

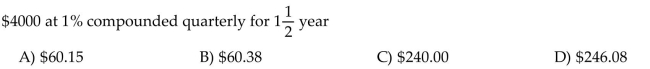

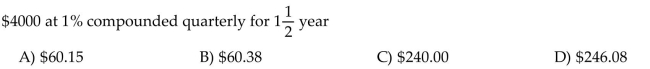

Find the compound interest earned by the deposit. Round to the nearest cent.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

23

Find the compound interest earned by the deposit. Round to the nearest cent.

$2000 at 1% compounded semiannually for 8 years

A)$165.71

B)$160.00

C)$166.14

D)$81.41

$2000 at 1% compounded semiannually for 8 years

A)$165.71

B)$160.00

C)$166.14

D)$81.41

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

24

Find the present value for the given future amount. Round to the nearest cent.

A = $12,400, 3 years r = 4% compounded annually

A)$11,023.55

B)$1376.45

C)$13,948.31

D)$11,464.50

A = $12,400, 3 years r = 4% compounded annually

A)$11,023.55

B)$1376.45

C)$13,948.31

D)$11,464.50

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

25

Use the compound interest formula to compute the future value of the investment.

$1100 at 1% compounded monthly for 12 months

A)$1100.92

B)$1239.51

C)$1111.05

D)$1111.00

$1100 at 1% compounded monthly for 12 months

A)$1100.92

B)$1239.51

C)$1111.05

D)$1111.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

26

Use the compound interest formula to compute the future value of the investment.

$1620 at 7.4% compounded annually for 16 years

A)$3418.20

B)$4726.93

C)$3538.08

D)$5076.72

$1620 at 7.4% compounded annually for 16 years

A)$3418.20

B)$4726.93

C)$3538.08

D)$5076.72

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

27

Find the present value for the given future amount. Round to the nearest cent.

A = $37,000, 10 years r = 8% compounded semiannually

A)$17,138.16

B)$20,113.68

C)$81,071.56

D)$16,886.32

A = $37,000, 10 years r = 8% compounded semiannually

A)$17,138.16

B)$20,113.68

C)$81,071.56

D)$16,886.32

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

28

Use the compound interest formula to compute the future value of the investment.

$3250 at 5.5% compounded daily for 15 years (assume 360 days per year)

A)$3257.46

B)$4079.97

C)$7255.55

D)$7415.65

$3250 at 5.5% compounded daily for 15 years (assume 360 days per year)

A)$3257.46

B)$4079.97

C)$7255.55

D)$7415.65

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

29

Find the compound interest earned by the deposit. Round to the nearest cent.

$1320 at 1.6% compounded annually for 6 years

A)$131.90

B)$105.60

C)$109.03

D)$126.72

$1320 at 1.6% compounded annually for 6 years

A)$131.90

B)$105.60

C)$109.03

D)$126.72

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

30

Find the compound interest earned by the deposit. Round to the nearest cent.

$4100 at 2.9% compounded semiannually for 5 years

A)$634.83

B)$594.50

C)$306.00

D)$630.00

$4100 at 2.9% compounded semiannually for 5 years

A)$634.83

B)$594.50

C)$306.00

D)$630.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

31

Use the compound interest formula to compute the future value of the investment.

$5000 at 6.5% compounded monthly for 4 years

A)$28,244.37

B)$5184.08

C)$5109.22

D)$6480.10

$5000 at 6.5% compounded monthly for 4 years

A)$28,244.37

B)$5184.08

C)$5109.22

D)$6480.10

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

32

Use the compound interest formula to compute the future value of the investment.

$5000 at 7.25% compounded continuously for 7 years

A)$10,323.66

B)$5375.96

C)$8305.67

D)$3759.51

$5000 at 7.25% compounded continuously for 7 years

A)$10,323.66

B)$5375.96

C)$8305.67

D)$3759.51

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

33

Find the present value for the given future amount. Round to the nearest cent.

A = $4200, 9 years r = 8% compounded annually

A)$8395.82

B)$2269.13

C)$2098.95

D)$2101.05

A = $4200, 9 years r = 8% compounded annually

A)$8395.82

B)$2269.13

C)$2098.95

D)$2101.05

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

34

Find the compound interest earned by the deposit. Round to the nearest cent.

$3000 compounded continuously at 3.3% for 20 months. (Assume 608 days.)Round the answer to the nearest dollar.

A)$170

B)$-116

C)$167

D)$168

$3000 compounded continuously at 3.3% for 20 months. (Assume 608 days.)Round the answer to the nearest dollar.

A)$170

B)$-116

C)$167

D)$168

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

35

Use the compound interest formula to compute the future value of the investment.

$800 at 6.3% compounded semiannually for 12 years

A)$1665.29

B)$1684.04

C)$1404.80

D)$1160.70

$800 at 6.3% compounded semiannually for 12 years

A)$1665.29

B)$1684.04

C)$1404.80

D)$1160.70

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

36

Use the compound interest formula to compute the future value of the investment.

$5500 at 8% compounded monthly for 7 years

A)$7688.66

B)$9610.82

C)$196,473.48

D)$5761.86

$5500 at 8% compounded monthly for 7 years

A)$7688.66

B)$9610.82

C)$196,473.48

D)$5761.86

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

37

Find the compound interest earned by the deposit. Round to the nearest cent.

$300 at 3% compounded quarterly for 3 years

A)$27.00

B)$28.14

C)$306.80

D)$27.82

$300 at 3% compounded quarterly for 3 years

A)$27.00

B)$28.14

C)$306.80

D)$27.82

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

38

Find the compound interest earned by the deposit. Round to the nearest cent.

$3000 at 2% compounded annually for 10 years

A)$600.00

B)$585.28

C)$656.98

D)$540.00

$3000 at 2% compounded annually for 10 years

A)$600.00

B)$585.28

C)$656.98

D)$540.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

39

Find the present value for the given future amount. Round to the nearest cent.

A = $4000, 12 years r = 4% compounded semiannually

A)$2486.89

B)$2498.39

C)$1513.11

D)$6433.75

A = $4000, 12 years r = 4% compounded semiannually

A)$2486.89

B)$2498.39

C)$1513.11

D)$6433.75

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

40

Find the compound interest earned by the deposit. Round to the nearest cent.

$7824 at 4% compounded continuously for 4 years

A)$2122.03

B)$3389.90

C)$1357.55

D)$9181.55

$7824 at 4% compounded continuously for 4 years

A)$2122.03

B)$3389.90

C)$1357.55

D)$9181.55

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

41

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

5% compounded semiannually

A)5.12%

B)5.00%

C)5.09%

D)5.06%

0.01%.

5% compounded semiannually

A)5.12%

B)5.00%

C)5.09%

D)5.06%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

42

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

4.1% compounded hourly (assume 365 days per year)

A)4.18%

B)4.24%

C)4.19%

D)104.19%

0.01%.

4.1% compounded hourly (assume 365 days per year)

A)4.18%

B)4.24%

C)4.19%

D)104.19%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

43

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

3.9% compounded every minute (assume 365 days per year)

A)3.98%

B)103.98%

C)3.97%

D)4.03%

0.01%.

3.9% compounded every minute (assume 365 days per year)

A)3.98%

B)103.98%

C)3.97%

D)4.03%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

44

Solve the problem.

Joe is buying some kitchen equipment for his new apartment. The total cost is $3400 and he places a down payment of $340. There is add-on interest of 9%. What is the total amount to be repaid if he

Takes 5 years to pay for the purchase?

A)$3335.40

B)$140,760.00

C)$4437.00

D)None of the above is correct.

Joe is buying some kitchen equipment for his new apartment. The total cost is $3400 and he places a down payment of $340. There is add-on interest of 9%. What is the total amount to be repaid if he

Takes 5 years to pay for the purchase?

A)$3335.40

B)$140,760.00

C)$4437.00

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

45

Solve the problem.

You just put $1650 in a CD that is expected to earn 9% compounded quarterly, and $30,000 in a savings account that is expected to earn 4% compounded semiannually. Determine when, to the

Nearest year, the values of your two investments will be the same.

A)76 years

B)41 years

C)23 years

D)59 years

You just put $1650 in a CD that is expected to earn 9% compounded quarterly, and $30,000 in a savings account that is expected to earn 4% compounded semiannually. Determine when, to the

Nearest year, the values of your two investments will be the same.

A)76 years

B)41 years

C)23 years

D)59 years

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

46

Solve the problem.

Joe is buying some kitchen equipment for his new apartment. The total cost is $3700 and he places a down payment of $370. There is add-on interest of 9%. Find the total interest Joe will pay if it takes

Him 3 year(s)to pay for his purchase?

A)$89,910.00

B)$899.10

C)$299.70

D)None of the above is correct.

Joe is buying some kitchen equipment for his new apartment. The total cost is $3700 and he places a down payment of $370. There is add-on interest of 9%. Find the total interest Joe will pay if it takes

Him 3 year(s)to pay for his purchase?

A)$89,910.00

B)$899.10

C)$299.70

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

47

Solve the problem.

The average cost of a 4-year college education is projected to be $120,000 in 15 years. How much money should be invested now at 7.5%, compounded quarterly, to provide $120,000 in 15 years?

A)$39,366.24

B)$12,914.17

C)$90,816.95

D)$120,000.00

The average cost of a 4-year college education is projected to be $120,000 in 15 years. How much money should be invested now at 7.5%, compounded quarterly, to provide $120,000 in 15 years?

A)$39,366.24

B)$12,914.17

C)$90,816.95

D)$120,000.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

48

Solve the problem.

Use the rule of 70 to estimate the annual inflation rate (to the nearest tenth of a percent)that would cause the general level of prices to double in 28 years.

A)2.4%

B)2.5%

C)2.9%

D)2.3%

Use the rule of 70 to estimate the annual inflation rate (to the nearest tenth of a percent)that would cause the general level of prices to double in 28 years.

A)2.4%

B)2.5%

C)2.9%

D)2.3%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

49

Find the present value for the given future amount. Round to the nearest cent.

A = $4900, 8 years r = 8% compounded quarterly

A)$2647.32

B)$2299.90

C)$2600.10

D)$9234.25

A = $4900, 8 years r = 8% compounded quarterly

A)$2647.32

B)$2299.90

C)$2600.10

D)$9234.25

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

50

Solve the problem.

You have money in an account at 4% interest, compounded monthly. To the nearest year, how long will it take for your money to double?

A)24 years

B)14 years

C)10 years

D)17 years

You have money in an account at 4% interest, compounded monthly. To the nearest year, how long will it take for your money to double?

A)24 years

B)14 years

C)10 years

D)17 years

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

51

Solve the problem.

The 2006 price of a certain type of car is $24,700. Estimate the price of the same car in the year 2020. Assume a constant annual inflation rate of 2.2%. Give a number of significant figures consistent

With the 2006 price given.

A)$34,837.17

B)$33,497.28

C)$32,307.60

D)$32,157.39

The 2006 price of a certain type of car is $24,700. Estimate the price of the same car in the year 2020. Assume a constant annual inflation rate of 2.2%. Give a number of significant figures consistent

With the 2006 price given.

A)$34,837.17

B)$33,497.28

C)$32,307.60

D)$32,157.39

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

52

Solve the problem.

$8791 is deposited into a savings account at 8% interest, compounded annually. To the nearest year, how long will it take for the account balance to reach $1,000,000?

A)62 years

B)55 years

C)43 years

D)86 years

$8791 is deposited into a savings account at 8% interest, compounded annually. To the nearest year, how long will it take for the account balance to reach $1,000,000?

A)62 years

B)55 years

C)43 years

D)86 years

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

53

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

3% compounded quarterly

A)3.04%

B)3.02%

C)3.00%

D)3.03%

0.01%.

3% compounded quarterly

A)3.04%

B)3.02%

C)3.00%

D)3.03%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

54

Solve the problem.

Use the rule of 70 to estimate the years to double for an annual inflation rate of 6%.

A)9 years

B)13 years

C)12 years

D)14 years

Use the rule of 70 to estimate the years to double for an annual inflation rate of 6%.

A)9 years

B)13 years

C)12 years

D)14 years

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

55

Solve the problem.

Joe is buying some kitchen equipment for his new apartment. The total cost is $2300 and he places a down payment of $230. There is add-on interest of 12%. What is the total amount he will be

Financing?

A)$2070.00

B)$2990.00

C)$2300.00

D)None of the above is correct.

Joe is buying some kitchen equipment for his new apartment. The total cost is $2300 and he places a down payment of $230. There is add-on interest of 12%. What is the total amount he will be

Financing?

A)$2070.00

B)$2990.00

C)$2300.00

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

56

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

4.7% compounded monthly

A)0.39%

B)0.05%

C)4.80%

D)104.80%

0.01%.

4.7% compounded monthly

A)0.39%

B)0.05%

C)4.80%

D)104.80%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

57

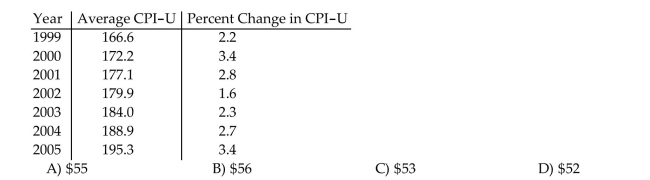

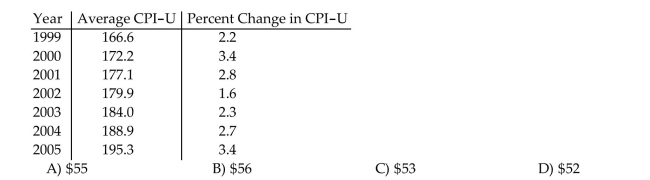

Solve the problem.

Use the inflation proportion to estimate the 2005 price of a jacket which costs $470 in 2000. Assume that the price increased at the average annual rate shown in the table below. Round your answer to

The nearest dollar.

Use the inflation proportion to estimate the 2005 price of a jacket which costs $470 in 2000. Assume that the price increased at the average annual rate shown in the table below. Round your answer to

The nearest dollar.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

58

Solve the problem.

Ellen invests her money in a savings account which compounds interest quarterly and which gives an effective annual yield of 4.18%. What is the nominal rate?

A)4.12%

B)4.14%

C)4.25%

D)4.09%

Ellen invests her money in a savings account which compounds interest quarterly and which gives an effective annual yield of 4.18%. What is the nominal rate?

A)4.12%

B)4.14%

C)4.25%

D)4.09%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

59

Solve the problem.

Miguel invests his money in a savings account which gives an effective annual yield of 3.5%. The nominal rate is 3.45%. How often does compounding occur - daily, monthly, quarterly, or

Semiannually?

A)quarterly

B)monthly

C)semiannually

D)daily

Miguel invests his money in a savings account which gives an effective annual yield of 3.5%. The nominal rate is 3.45%. How often does compounding occur - daily, monthly, quarterly, or

Semiannually?

A)quarterly

B)monthly

C)semiannually

D)daily

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

60

Find the effective annual interest rate for the given nominal annual interest rate. Round your answers to the nearest

0.01%.

4.3% compounded daily (assume 365 days per year)

A)104.39%

B)0.01%

C)0.04%

D)4.39%

0.01%.

4.3% compounded daily (assume 365 days per year)

A)104.39%

B)0.01%

C)0.04%

D)4.39%

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

61

Solve the problem.

The unpaid balance in an account on May 1 was $221. A purchase of $27 was made on May 8. A $80 payment was made on May 22. The finance charge rate was 1.25% per month of the average

Daily balance. Find the new balance at the end of May.

A)$170.70

B)$222.23

C)$169.25

D)$142.19

The unpaid balance in an account on May 1 was $221. A purchase of $27 was made on May 8. A $80 payment was made on May 22. The finance charge rate was 1.25% per month of the average

Daily balance. Find the new balance at the end of May.

A)$170.70

B)$222.23

C)$169.25

D)$142.19

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

62

Solve the problem.

Tony and Barb decide to buy new living room furniture worth $6000. They make a down payment of $600. Barb decides they should pay off what they owe in 30 monthly payments. Find the amount

Of the monthly payment at 8% add-on interest.

A)$540.00

B)$3780.00

C)$6480.00

D)$216.00

Tony and Barb decide to buy new living room furniture worth $6000. They make a down payment of $600. Barb decides they should pay off what they owe in 30 monthly payments. Find the amount

Of the monthly payment at 8% add-on interest.

A)$540.00

B)$3780.00

C)$6480.00

D)$216.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

63

On April 1, the unpaid balance in an account was $218. A payment of $30 was made on April 11. On April 21, a $40 purchase was made. The finance charge rate was 1.15% per month of the

Average daily balance. Find the new balance at the end of April.

A)$190.28

B)$220.28

C)$229.15

D)$230.43

Average daily balance. Find the new balance at the end of April.

A)$190.28

B)$220.28

C)$229.15

D)$230.43

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

64

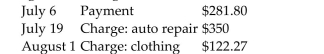

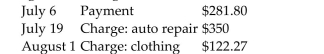

On the July 5 billing date, David had a balance due of $1027.85 on his credit card. The transactions during the following month were:  The interest rate on the card is 1.3% per month. Using the average daily balance method, find the

The interest rate on the card is 1.3% per month. Using the average daily balance method, find the

Finance charge on August 5 (July has 31 days).

A)$12.37

B)$12.41

C)$12.52

D)$11.89

The interest rate on the card is 1.3% per month. Using the average daily balance method, find the

The interest rate on the card is 1.3% per month. Using the average daily balance method, find theFinance charge on August 5 (July has 31 days).

A)$12.37

B)$12.41

C)$12.52

D)$11.89

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

65

Solve the problem.

Charlie cannot remember how much he financed to buy his car. He does remember that his monthly payment is $500. His add-on interest rate was 9% and he made a total of 36 payments.

Find the amount of his loan to the nearest penny.

A)$14,173.23

B)$4864.86

C)$4245.28

D)None of the above is correct.

Charlie cannot remember how much he financed to buy his car. He does remember that his monthly payment is $500. His add-on interest rate was 9% and he made a total of 36 payments.

Find the amount of his loan to the nearest penny.

A)$14,173.23

B)$4864.86

C)$4245.28

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

66

Solve the problem. Round to the nearest cent.

On January 1, the unpaid balance in an account was $195. A payment of $50 was made on January 25. The finance charge rate was 1.2% per month of the average daily balance. Find the finance

Charge for the month of January.

A)$1.74

B)$4.08

C)$2.34

D)$2.20

On January 1, the unpaid balance in an account was $195. A payment of $50 was made on January 25. The finance charge rate was 1.2% per month of the average daily balance. Find the finance

Charge for the month of January.

A)$1.74

B)$4.08

C)$2.34

D)$2.20

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

67

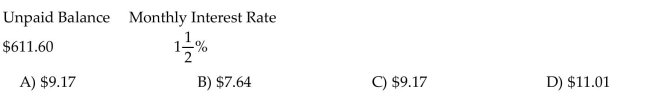

Find the finance charge on the open-end charge account. Assume interest is calculated on the unpaid balance of the

account.

Unpaid Balance Monthly Interest Rate

account.

Unpaid Balance Monthly Interest Rate

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

68

Solve the problem. Round to the nearest cent.

The unpaid balance in an account on December 1 was $174. A payment of $45 was made on December 18. The finance charge rate was 1.2% per month of the average daily balance. Find the

Finance charge for the month of December.

A)$1.84

B)$3.64

C)$1.55

D)$1.74

The unpaid balance in an account on December 1 was $174. A payment of $45 was made on December 18. The finance charge rate was 1.2% per month of the average daily balance. Find the

Finance charge for the month of December.

A)$1.84

B)$3.64

C)$1.55

D)$1.74

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

69

Solve the problem.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

70

Solve the problem.

The March 1 unpaid balance in an account was $150. On March 10, a payment of $20 was made.No new purchases were made in March. The finance charge rate was 1.3% per month of the average

Daily balance. Find the new balance at the end of March.

A)$131.30

B)$131.71

C)$131.77

D)$147.65

The March 1 unpaid balance in an account was $150. On March 10, a payment of $20 was made.No new purchases were made in March. The finance charge rate was 1.3% per month of the average

Daily balance. Find the new balance at the end of March.

A)$131.30

B)$131.71

C)$131.77

D)$147.65

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

71

Solve the problem.

Barb is buying a new car for $13,000. Her old car has a trade-in Value of $2500. The dealer informs her that the financing charge is 7% add-on interest. If she wishes to take 2 years to pay off the car,

What will be the total amount to be repaid?

A)$11,235.00

B)$14,820.00

C)$11,970.00

D)$157,500.00

Barb is buying a new car for $13,000. Her old car has a trade-in Value of $2500. The dealer informs her that the financing charge is 7% add-on interest. If she wishes to take 2 years to pay off the car,

What will be the total amount to be repaid?

A)$11,235.00

B)$14,820.00

C)$11,970.00

D)$157,500.00

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

72

How many monthly payments of $139.44 are necessary to pay off a $4000 loan if the add-on interest rate is 8.5%?

A)40 payments

B)30 payments

C)36 payments

D)None of the above is correct.

A)40 payments

B)30 payments

C)36 payments

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

73

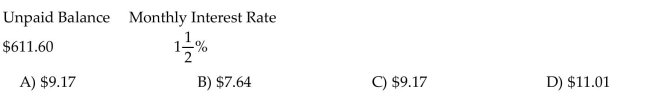

Find the finance charge on the open-end charge account. Assume interest is calculated on the unpaid balance of the

account.

account.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

74

Solve the problem. Round to the nearest cent.

On October 1, the unpaid balance in an account was $114. No payments were made that month. The finance charge rate was 1.4% per month of the average daily balance. Find the finance charge

For the month of October.

A)$1.74

B)$1.60

C)$1.50

D)$1.46

On October 1, the unpaid balance in an account was $114. No payments were made that month. The finance charge rate was 1.4% per month of the average daily balance. Find the finance charge

For the month of October.

A)$1.74

B)$1.60

C)$1.50

D)$1.46

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

75

Find the finance charge on the open-end charge account. Assume interest is calculated on the unpaid balance of the

account.

Unpaid Balance Monthly Interest Rate

account.

Unpaid Balance Monthly Interest Rate

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

76

Solve the problem.

The unpaid balance in an account at the beginning of December was $222. A payment of $70 was made on December 20. No new purchases were made in December. The finance charge rate was

1.1% per month of the average daily balance. Find the new balance at the end of December.

A)$173.44

B)$153.10

C)$154.09

D)$154.14

The unpaid balance in an account at the beginning of December was $222. A payment of $70 was made on December 20. No new purchases were made in December. The finance charge rate was

1.1% per month of the average daily balance. Find the new balance at the end of December.

A)$173.44

B)$153.10

C)$154.09

D)$154.14

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

77

Solve the problem. Round to the nearest cent.

On September 1, the unpaid balance in an account was $188. On September 3, a payment of $60 was made. The finance charge rate was 1.0% per month of the average daily balance. Find the

Finance charge for the month of September.

A)$1.32

B)$3.16

C)$1.34

D)$1.28

On September 1, the unpaid balance in an account was $188. On September 3, a payment of $60 was made. The finance charge rate was 1.0% per month of the average daily balance. Find the

Finance charge for the month of September.

A)$1.32

B)$3.16

C)$1.34

D)$1.28

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

78

Solve the problem.

Bill makes a $167.33 per month payment for 3 years to pay off a $4000 loan. What was the add-on interest rate?

A)10.3%

B)8.5%

C)16.9%

D)None of the above is correct.

Bill makes a $167.33 per month payment for 3 years to pay off a $4000 loan. What was the add-on interest rate?

A)10.3%

B)8.5%

C)16.9%

D)None of the above is correct.

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

79

Solve the problem. Round to the nearest cent.

The unpaid balance in an account on November 1 was $124. A payment of $50 was made on November 12. The finance charge rate was 1.2% per month of the average daily balance. Find the

Finance charge for the month of November.

A)$1.13

B)$0.89

C)$2.38

D)$1.11

The unpaid balance in an account on November 1 was $124. A payment of $50 was made on November 12. The finance charge rate was 1.2% per month of the average daily balance. Find the

Finance charge for the month of November.

A)$1.13

B)$0.89

C)$2.38

D)$1.11

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck

80

Solve the problem.

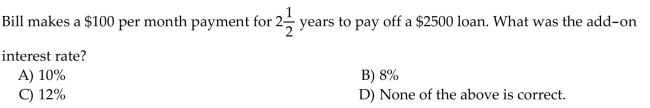

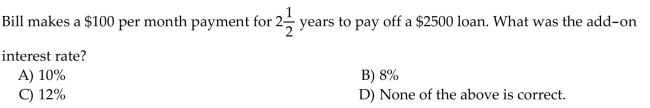

How many monthly payments of $100 are necessary to pay off a $2500 loan if the add-on interest rate is 8%?

A)36 payments

B)28 payments

C)30 payments

D)40 payments

How many monthly payments of $100 are necessary to pay off a $2500 loan if the add-on interest rate is 8%?

A)36 payments

B)28 payments

C)30 payments

D)40 payments

Unlock Deck

Unlock for access to all 260 flashcards in this deck.

Unlock Deck

k this deck