Deck 9: One Step Binomial Trees

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 9: One Step Binomial Trees

1

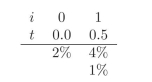

What is the risk neutral probability p∗ ofthetreepresented?

We have that p∗ = 0.7038.

2

Are forward interest rates equal to the market's expectation of future interest rates?

No. Current high forward rates might mean two things: either market participants expect higher interest rates; or they are strongly averse to risk, and thus the price of long term bonds is low today.

3

Using risk neutral pricing obtain the value for a European option on inter- est rates with maturity at t =0.5, rK =1.5% and payo?: 100 × max(rt ? rK, 0).

The price is 1.7419.

4

You are given the following interest rate tree. Use it when required in the

exercises.

What is a replicating portfolio?

exercises.

What is a replicating portfolio?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

Given the tree at the begining of this chapter, what is the value of a zero coupon bond maturing in six months?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

Assuming that there is a risk premium in the market (people worry about risk and expect to be compensated for it), is risk neutral probability for an up state (high interest rates) higher, lower or the same as the risk natural probability?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

from a given risk neutral tree can you compute the mar- ket participants' expectation on the level of interest rates in the future? Explain.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

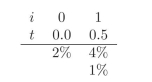

You are given the following interest rate tree. Use it when required in the

exercises.

What is the favored approach in the development of interest rate models? CAPM?

exercises.

What is the favored approach in the development of interest rate models? CAPM?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

For pricing purposes how important is it to know the true probabilities?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

Why are forward interst rates and the risk neutral expected future interest rates not the same?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

What is a risk neutral probability?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

What is the market price of risk?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

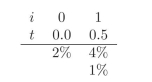

What is the market price of risk underlying the tree presented?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

What is risk neutral pricing?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

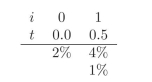

What values can a one year zero coupon bond take at t =0.5?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck