Deck 17: Dynamic Hedging and Relative Value Trades

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 17: Dynamic Hedging and Relative Value Trades

1

Using Monte Carlo Simulations, what steps do you need to follow in order to price a coupon bond?

Once you have simulated the interest rate path, discount the payoff and take expectations.

2

What is a Monte Carlo Simulation?

A Monte Carlo Simulation is a methodology of predicting the behavior of a variable by simulating a large number of paths under which the random component of the variable can take any value. The result is a large sample of possible values for the variable from which we can infer its expected value and other moments.

3

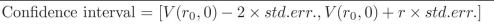

How is a 95% conficende interval defined?

4

How can an interest rate process be simulated?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

Is the price obtained from Monte Carlos Simulations exaclty the same as the one obtained through an analytical formula?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

How can you increase the accuracy of the price given by the model when using Monte Carlo Simulations?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

What is a standard error?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

8

What is a confidence interval?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

What risks are involved in a range ?oater?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

How is the Risk Neutral process obtained?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

Why were range floaters so popular during the mid-nineties?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

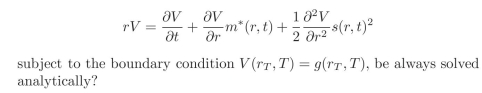

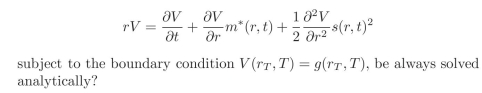

What is the Feynman-Kac Theorem?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

How can you compute gamma?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

There is a "Forward Approximation" and a "Central Approximation", is there a "Backward Apporximation"? How can you compute it?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

Can the following equation

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

When computing ∂V/∂r, what is the difference between "Central Approx- imation" and "Forward Approximation"? Which one is closer to the true value?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

How can you compute theta?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

What is a range floater?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck