Deck 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings

1

Duff Inc. owns 75% of Paddy Corp. and uses the Equity Method to account for its investment. Paddy purchased $120,000 face value of Duff's 12% par value bonds on January 1, 2011 for $100,000, when Duff's bond liability consisted of $240,000 par of 12% Bonds maturing on January 1, 2021. There was an unamortized bond discount of $20,000 attached to the bonds on that date. Interest payment dates are June 30 and December 31 each year. Straight line amortization is used. Both companies have a December 31 year end. Intercompany bond gains and losses are to be allocated to each company. During 2011, Paddy earned a net income of $80,000 and paid dividends of $20,000. What amount of interest expense, excluding amortization of the bond discount, (if any) would have to be eliminated in 2011 as a result of the intercompany sale of the bonds?

A) None.

B) $12,000.

C) $12,200.

D) $14,400.

A) None.

B) $12,000.

C) $12,200.

D) $14,400.

D

2

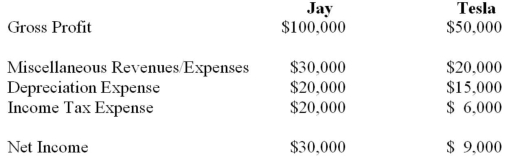

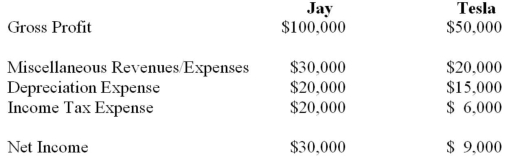

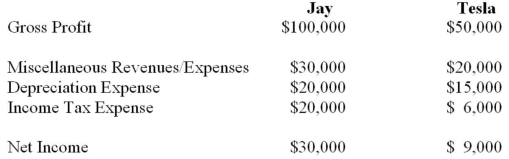

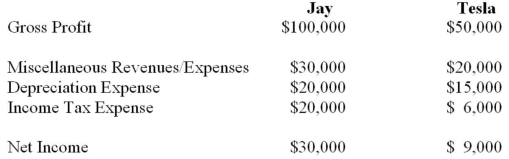

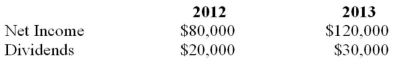

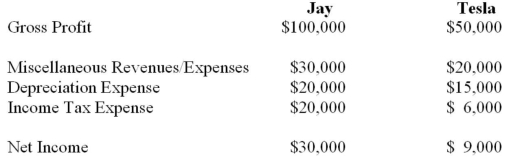

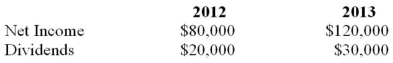

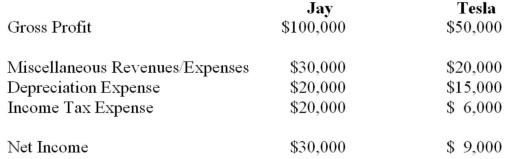

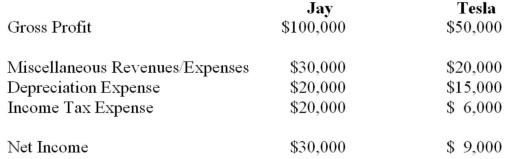

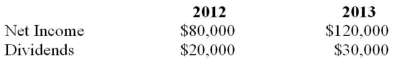

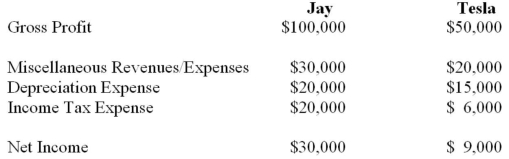

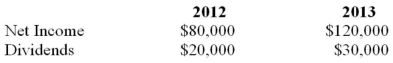

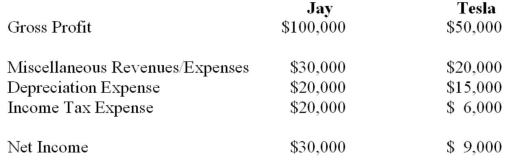

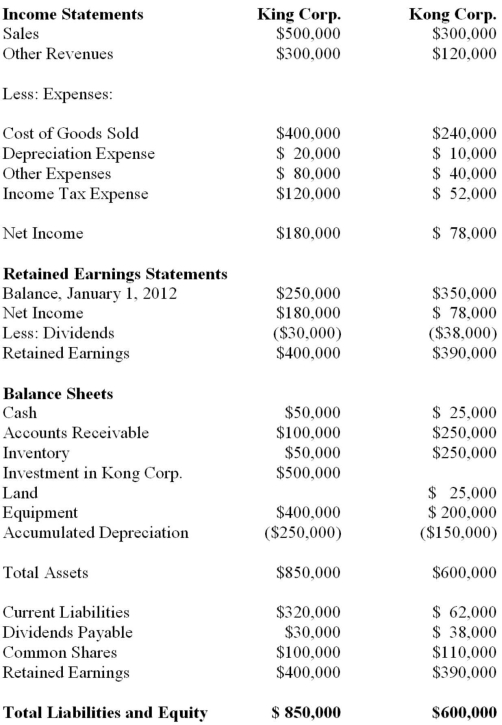

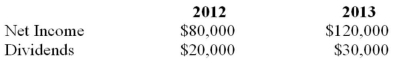

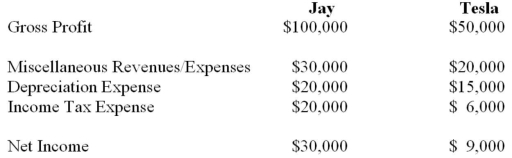

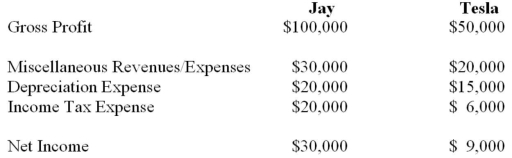

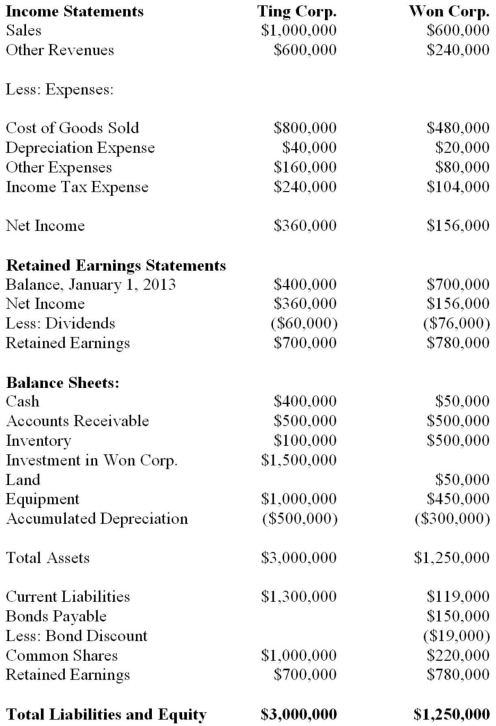

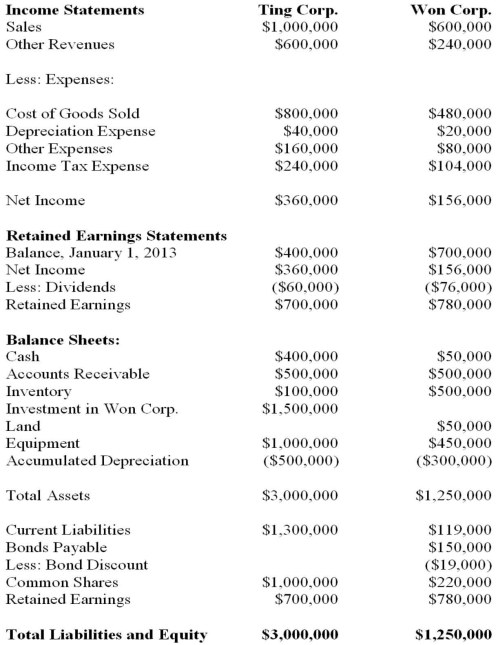

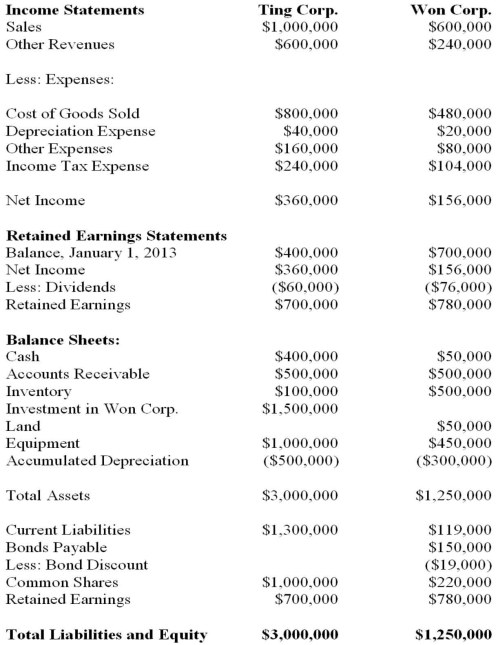

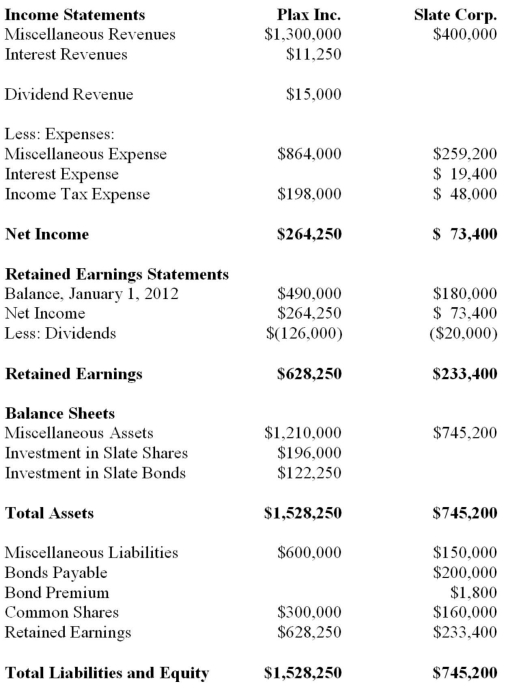

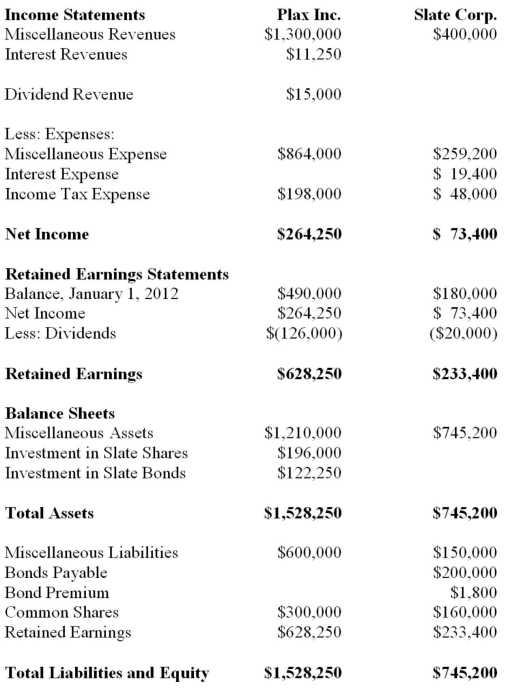

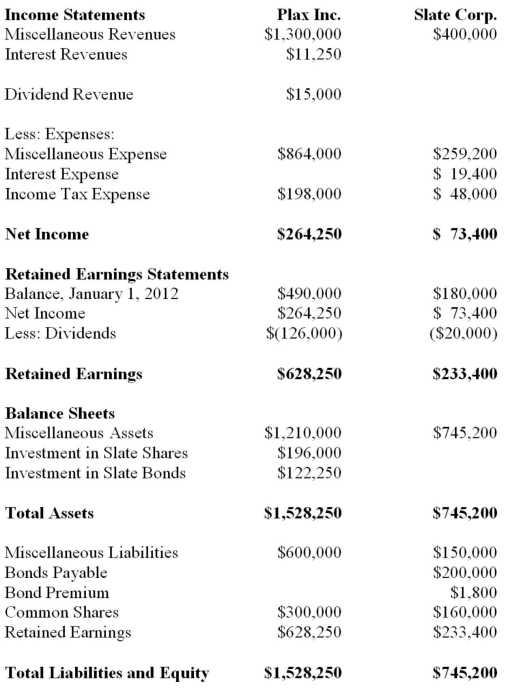

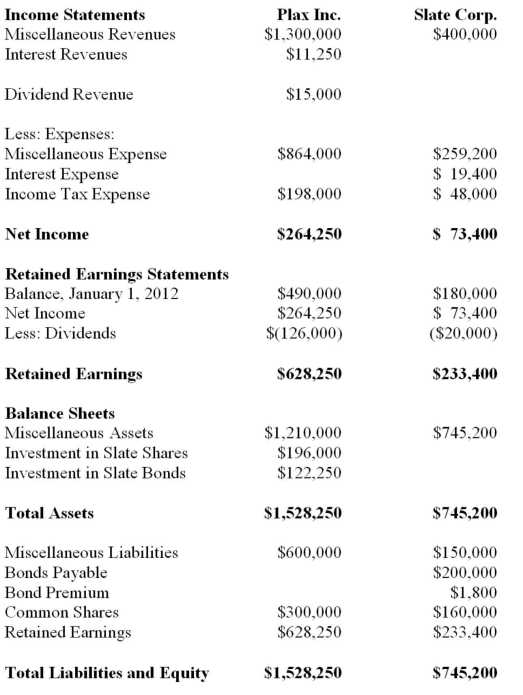

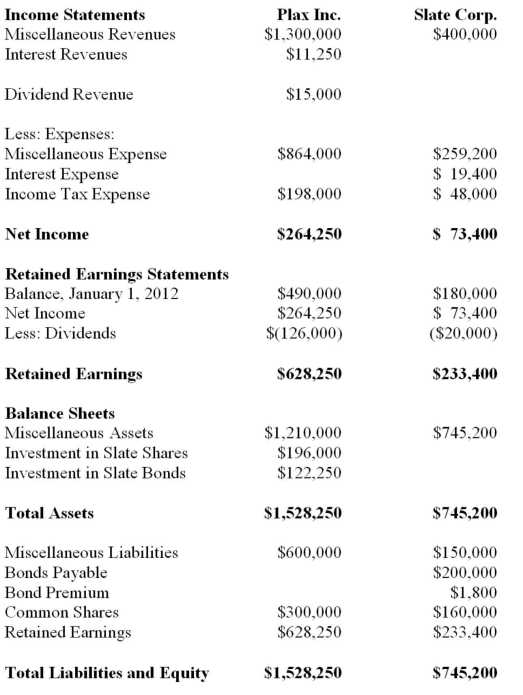

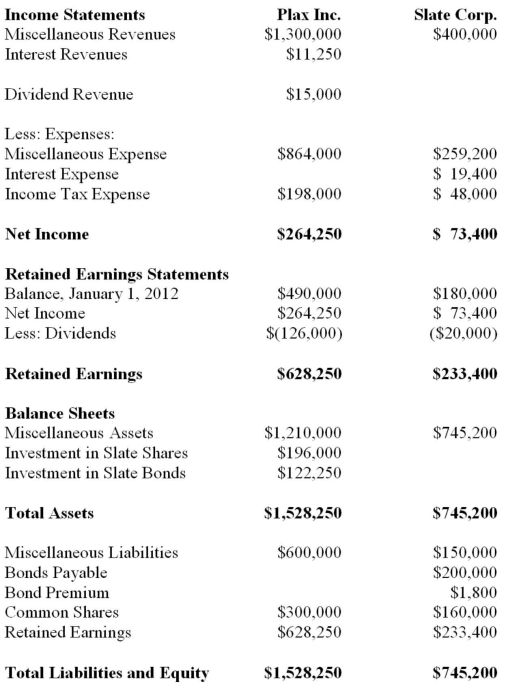

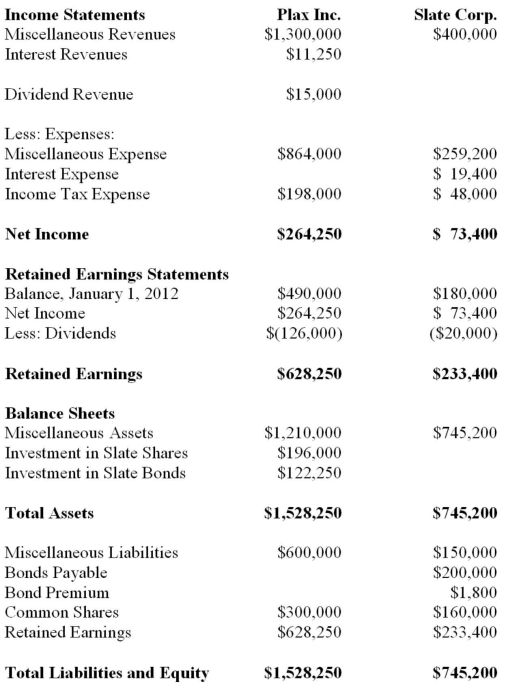

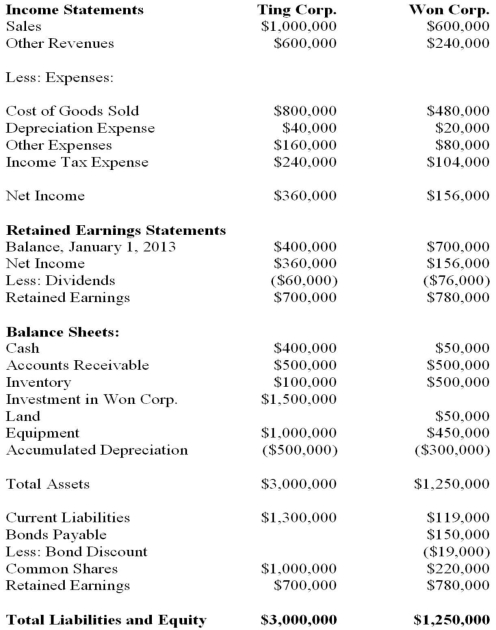

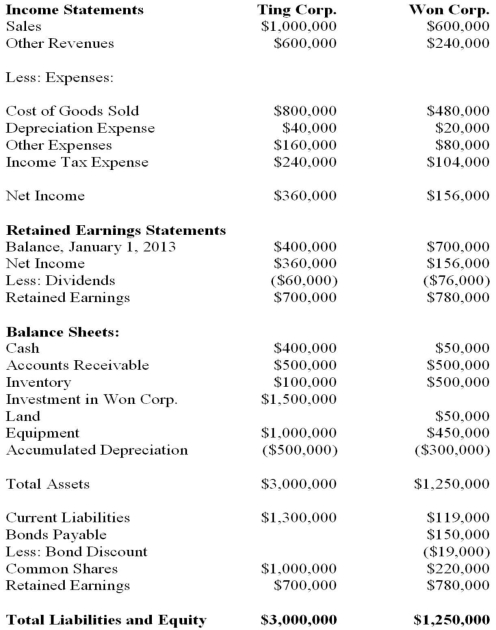

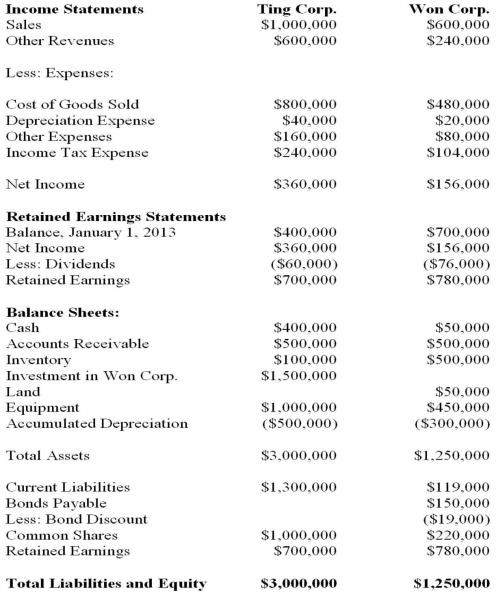

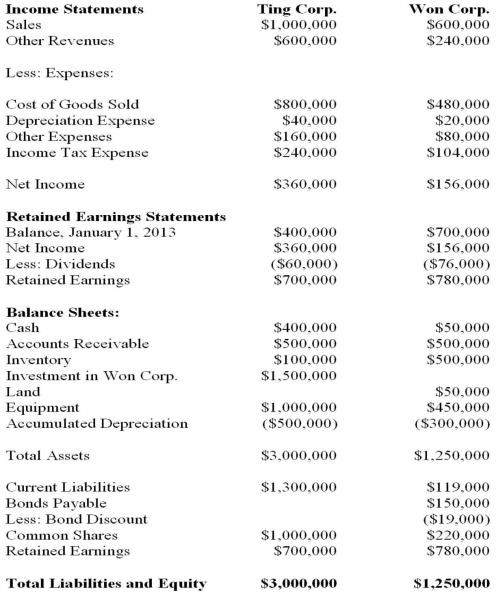

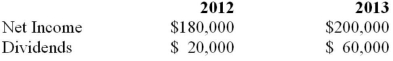

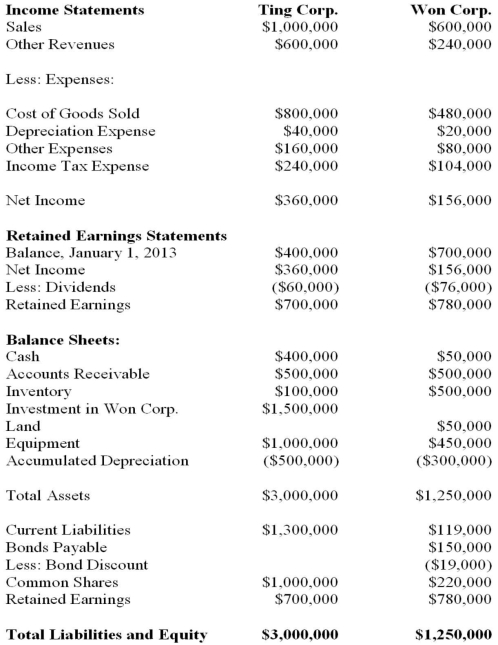

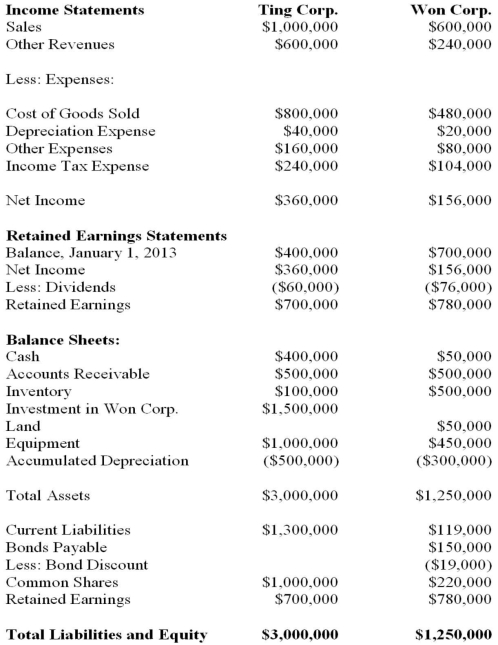

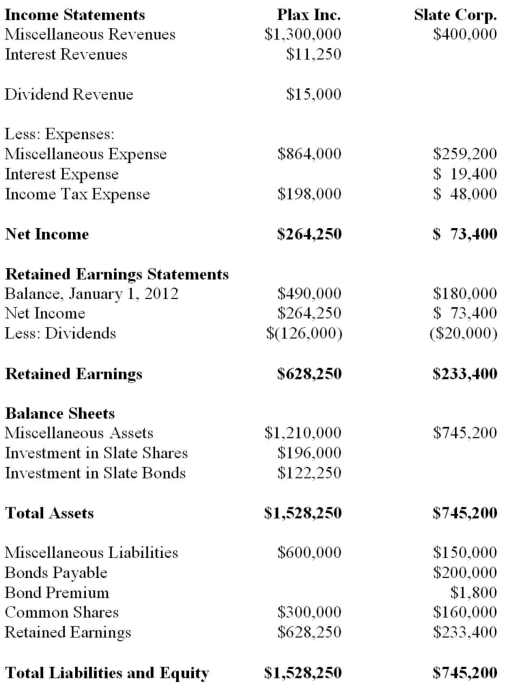

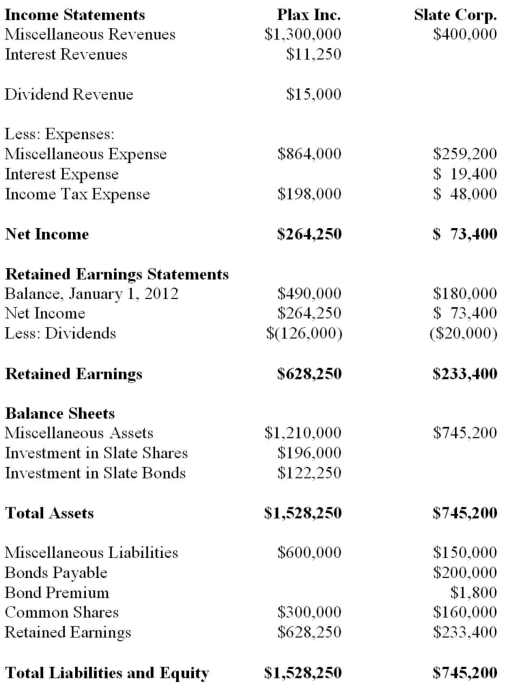

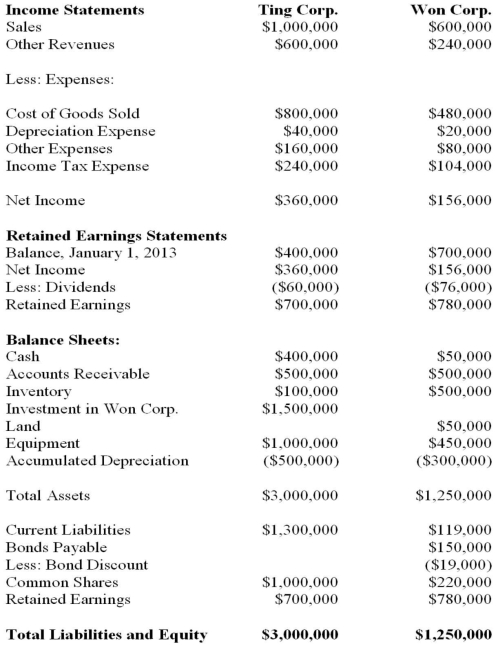

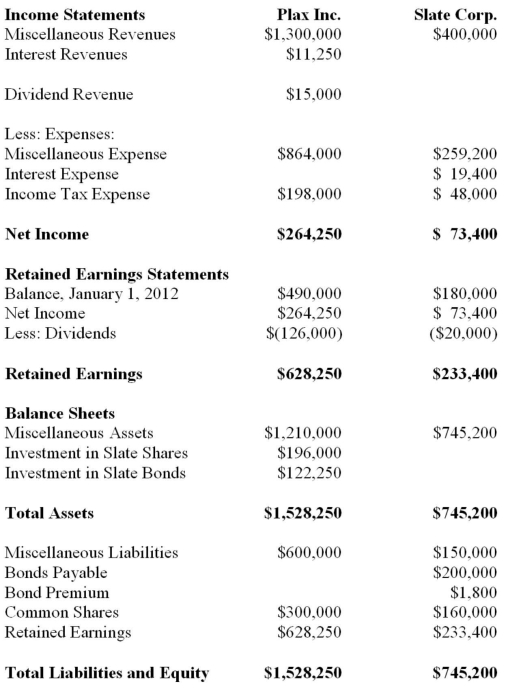

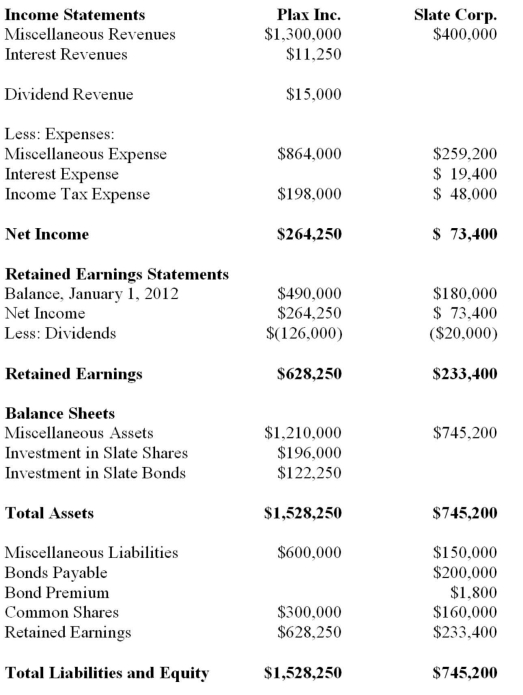

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

A) Nil.

B) $1,458.

C) $1,800.

D) $1,818.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:A) Nil.

B) $1,458.

C) $1,800.

D) $1,818.

B

3

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The controlling interest (attributable to the shareholders of Jay) in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The controlling interest (attributable to the shareholders of Jay) in Jay's 2013 Consolidated Net Income would be:

A) $30,000.

B) $35,832.

C) $36,000.

D) $37,200.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The controlling interest (attributable to the shareholders of Jay) in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The controlling interest (attributable to the shareholders of Jay) in Jay's 2013 Consolidated Net Income would be:A) $30,000.

B) $35,832.

C) $36,000.

D) $37,200.

B

4

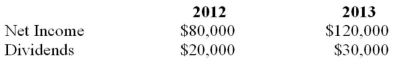

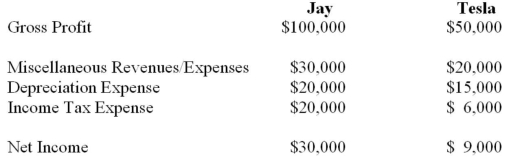

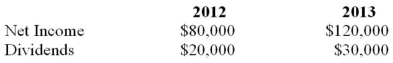

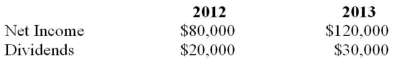

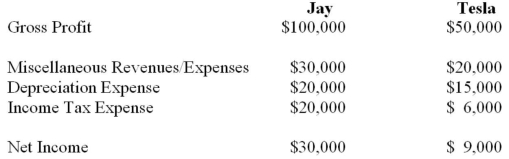

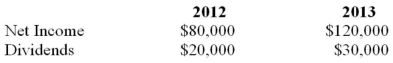

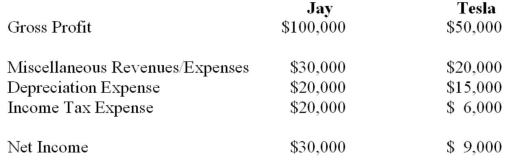

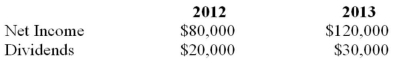

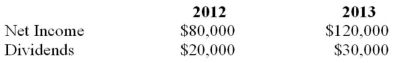

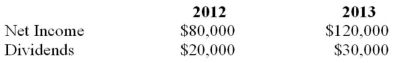

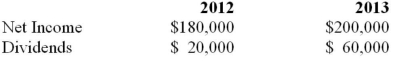

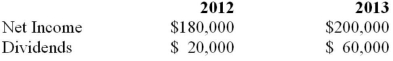

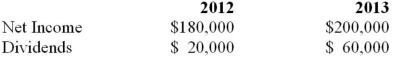

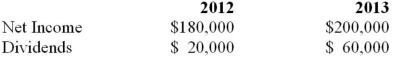

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  How much intercompany (after-tax) profit was realized during 2013 from Rin's 2012 sale of assets to Stempy?

How much intercompany (after-tax) profit was realized during 2013 from Rin's 2012 sale of assets to Stempy?

A) Nil.

B) $1,000.

C) $2,000.

D) $10,000.

How much intercompany (after-tax) profit was realized during 2013 from Rin's 2012 sale of assets to Stempy?

How much intercompany (after-tax) profit was realized during 2013 from Rin's 2012 sale of assets to Stempy?A) Nil.

B) $1,000.

C) $2,000.

D) $10,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:

A) $15,000.

B) $34,850.

C) $34,880.

D) $35,000.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:A) $15,000.

B) $34,850.

C) $34,880.

D) $35,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the total amount of unrealized profit (after-tax) remaining at the end of 2012?

What is the total amount of unrealized profit (after-tax) remaining at the end of 2012?

A) $1,000.

B) $2,000.

C) $9,000.

D) $10,000.

What is the total amount of unrealized profit (after-tax) remaining at the end of 2012?

What is the total amount of unrealized profit (after-tax) remaining at the end of 2012?A) $1,000.

B) $2,000.

C) $9,000.

D) $10,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Duff Inc. owns 75% of Paddy Corp. and uses the Equity Method to account for its investment. Paddy purchased $120,000 face value of Duff's 12% par value bonds on January 1, 2011 for $100,000, when Duff's bond liability consisted of $240,000 par of 12% Bonds maturing on January 1, 2021. There was an unamortized bond discount of $20,000 attached to the bonds on that date. Interest payment dates are June 30 and December 31 each year. Straight line amortization is used. Both companies have a December 31 year end. Intercompany bond gains and losses are to be allocated to each company. During 2011, Paddy earned a net income of $80,000 and paid dividends of $20,000. What amount would be shown on Duff's 2011 Consolidated Statement of Financial Position under bonds payable?

A) $110,000.

B) $111,000.

C) $112,000.

D) $220,000.

A) $110,000.

B) $111,000.

C) $112,000.

D) $220,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of income tax expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of income tax expense appearing on Jay's 2013 Consolidated Income Statement would be:

A) $24,860.

B) $25,040.

C) $26,000.

D) $34,880.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of income tax expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of income tax expense appearing on Jay's 2013 Consolidated Income Statement would be:A) $24,860.

B) $25,040.

C) $26,000.

D) $34,880.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

Duff Inc. owns 75% of Paddy Corp. and uses the Equity Method to account for its investment. Paddy purchased $120,000 face value of Duff's 12% par value bonds on January 1, 2011 for $100,000, when Duff's bond liability consisted of $240,000 par of 12% Bonds maturing on January 1, 2021. There was an unamortized bond discount of $20,000 attached to the bonds on that date. Interest payment dates are June 30 and December 31 each year. Straight line amortization is used. Both companies have a December 31 year end. Intercompany bond gains and losses are to be allocated to each company. During 2011, Paddy earned a net income of $80,000 and paid dividends of $20,000. What was the pre-tax gain or loss to Paddy Inc. on the intercompany purchase of the bonds?

A) $20,000 loss.

B) Nil.

C) $20,000 gain.

D) $40,000 loss.

A) $20,000 loss.

B) Nil.

C) $20,000 gain.

D) $40,000 loss.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the balance in the Investment in Stempy account at the end of 2013?

What is the balance in the Investment in Stempy account at the end of 2013?

A) $300,000.

B) $350,000.

C) $444,960.

D) $469,000.

What is the balance in the Investment in Stempy account at the end of 2013?

What is the balance in the Investment in Stempy account at the end of 2013?A) $300,000.

B) $350,000.

C) $444,960.

D) $469,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of deferred taxes appearing on Jay's 2013 Consolidated Statement of Financial Position would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of deferred taxes appearing on Jay's 2013 Consolidated Statement of Financial Position would be:

A) Nil.

B) $1,000.

C) $1,140.

D) $2,550.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of deferred taxes appearing on Jay's 2013 Consolidated Statement of Financial Position would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of deferred taxes appearing on Jay's 2013 Consolidated Statement of Financial Position would be:A) Nil.

B) $1,000.

C) $1,140.

D) $2,550.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

Duff Inc. owns 75% of Paddy Corp. and uses the Equity Method to account for its investment. Paddy purchased $120,000 face value of Duff's 12% par value bonds on January 1, 2011 for $100,000, when Duff's bond liability consisted of $240,000 par of 12% Bonds maturing on January 1, 2021. There was an unamortized bond discount of $20,000 attached to the bonds on that date. Interest payment dates are June 30 and December 31 each year. Straight line amortization is used. Both companies have a December 31 year end. Intercompany bond gains and losses are to be allocated to each company. During 2011, Paddy earned a net income of $80,000 and paid dividends of $20,000. What was the pre-tax gain or loss to Duff Inc. on the intercompany sale of the bonds?

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D) $10,000 gain.

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D) $10,000 gain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  How much intercompany (after-tax) profit was realized during 2013 on Stempy's 2013 sale of assets to Rin?

How much intercompany (after-tax) profit was realized during 2013 on Stempy's 2013 sale of assets to Rin?

A) Nil.

B) $1,000.

C) $2,000.

D) $10,000.

How much intercompany (after-tax) profit was realized during 2013 on Stempy's 2013 sale of assets to Rin?

How much intercompany (after-tax) profit was realized during 2013 on Stempy's 2013 sale of assets to Rin?A) Nil.

B) $1,000.

C) $2,000.

D) $10,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of Miscellaneous Revenues/Expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of Miscellaneous Revenues/Expense appearing on Jay's 2013 Consolidated Income Statement would be:

A) $47,000.

B) $47,600.

C) $50,000.

D) $53,000.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of Miscellaneous Revenues/Expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of Miscellaneous Revenues/Expense appearing on Jay's 2013 Consolidated Income Statement would be:A) $47,000.

B) $47,600.

C) $50,000.

D) $53,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

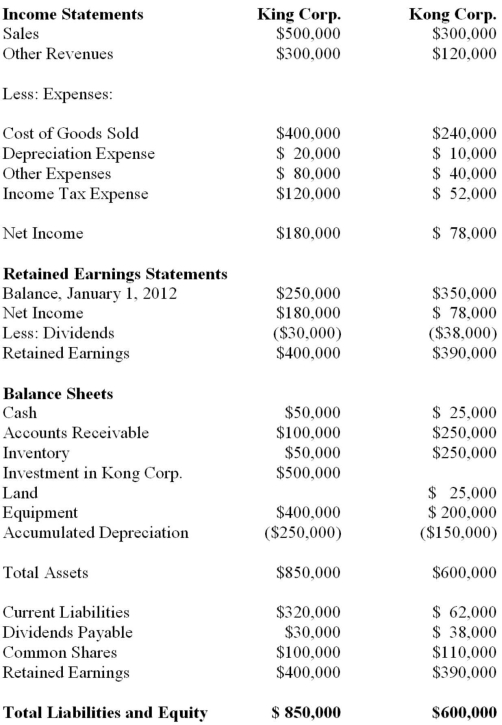

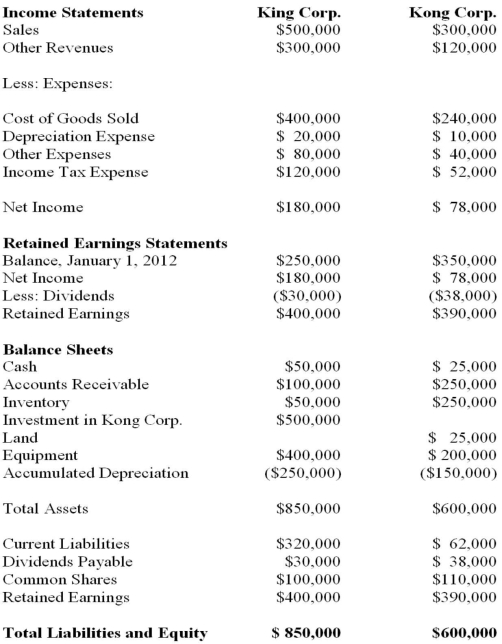

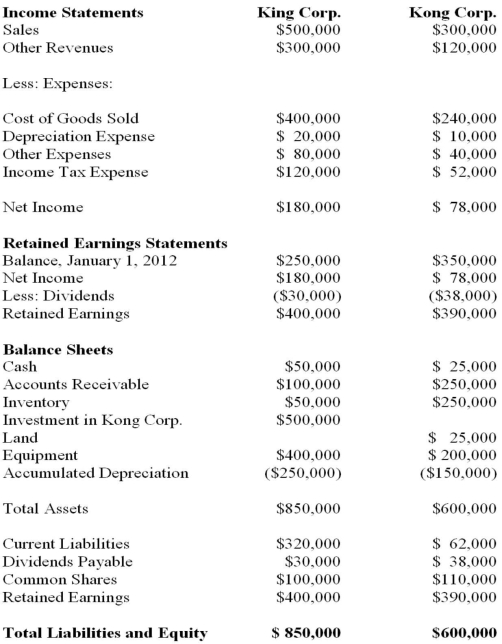

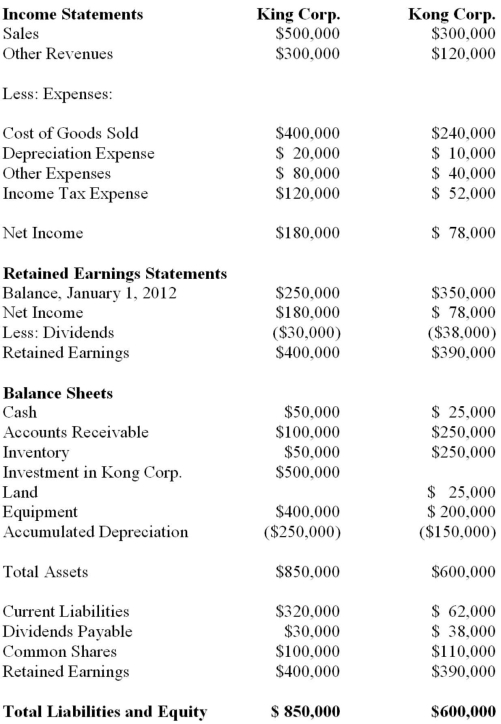

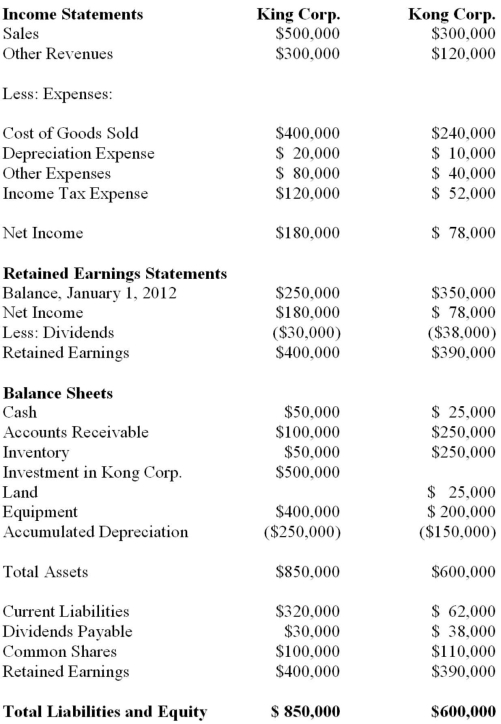

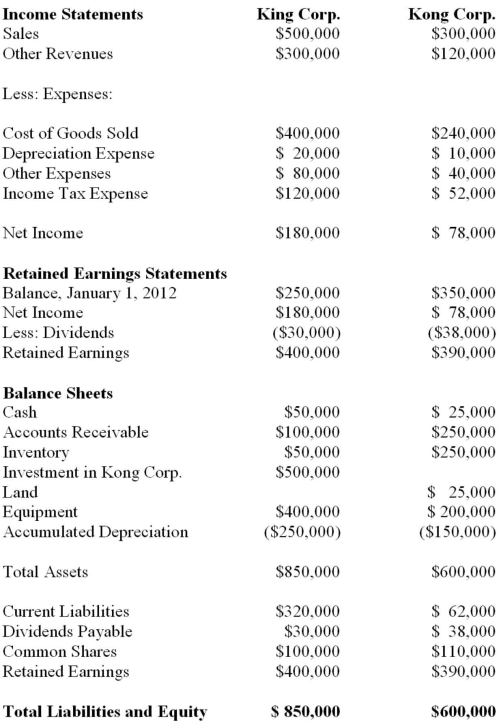

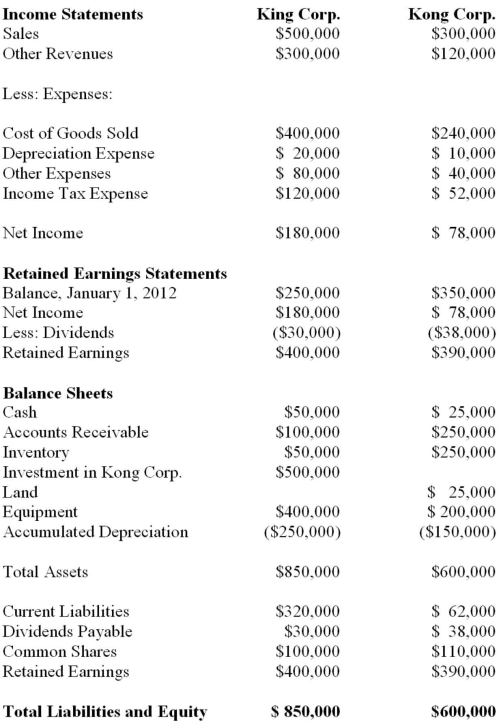

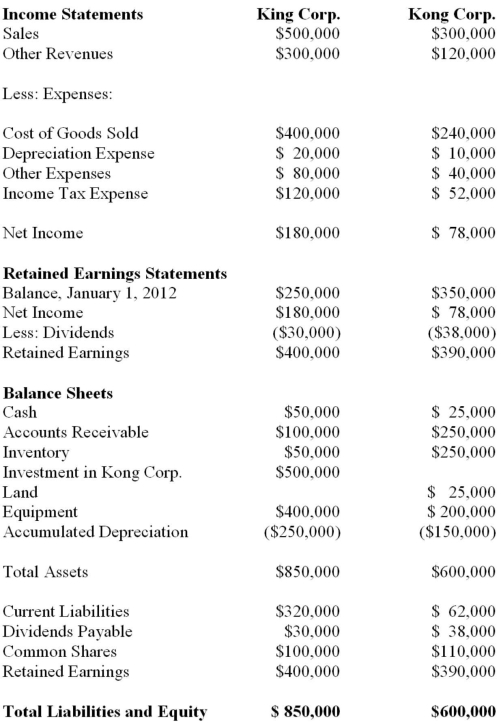

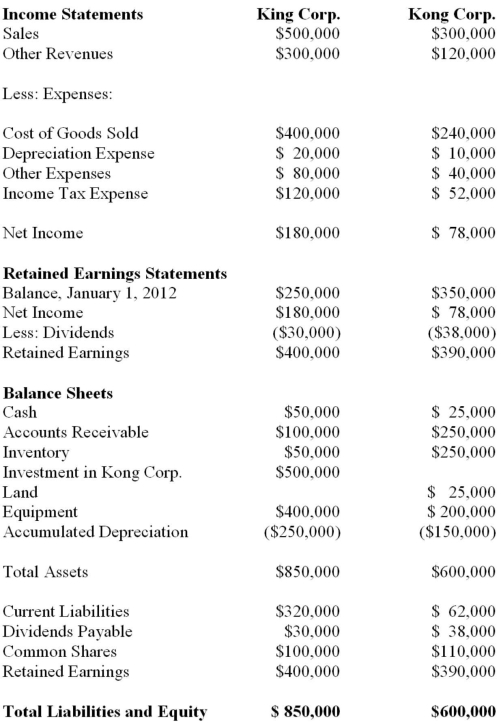

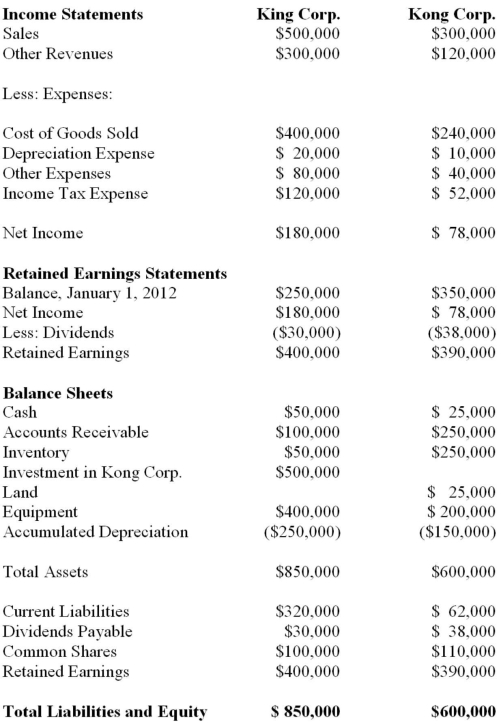

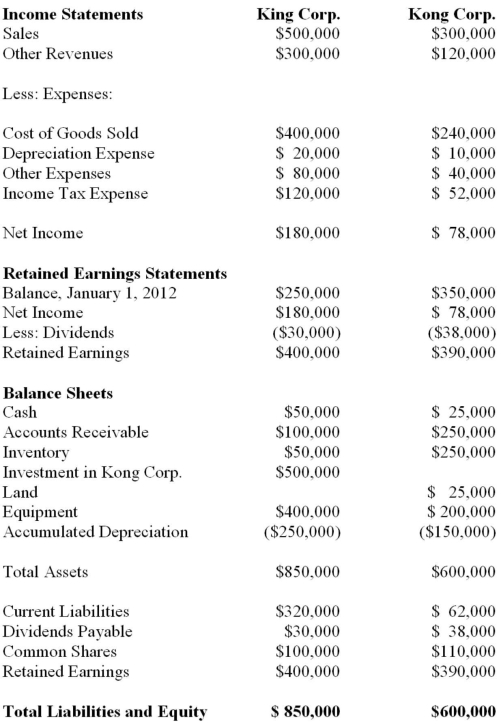

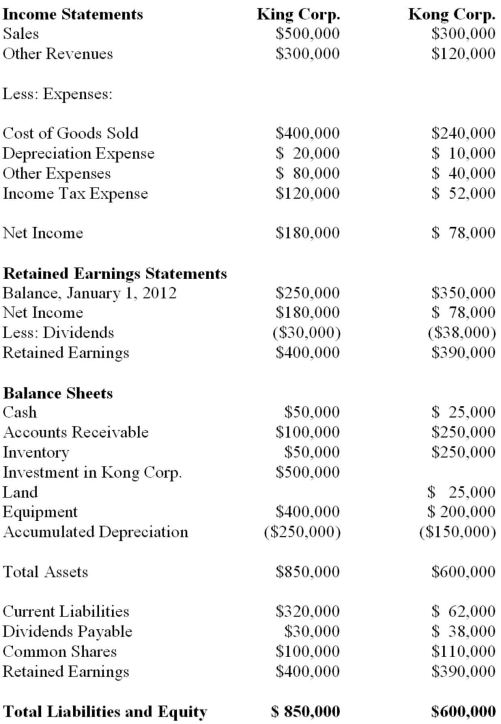

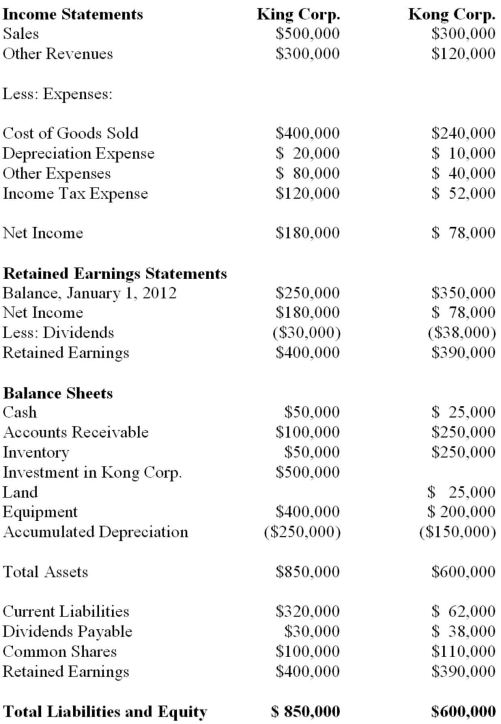

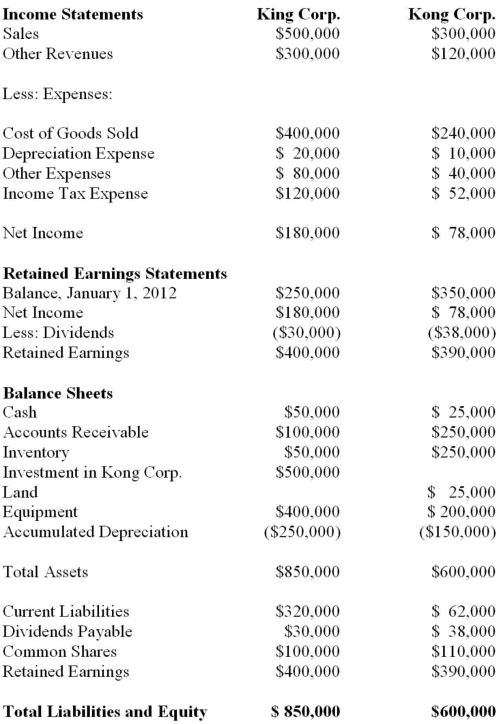

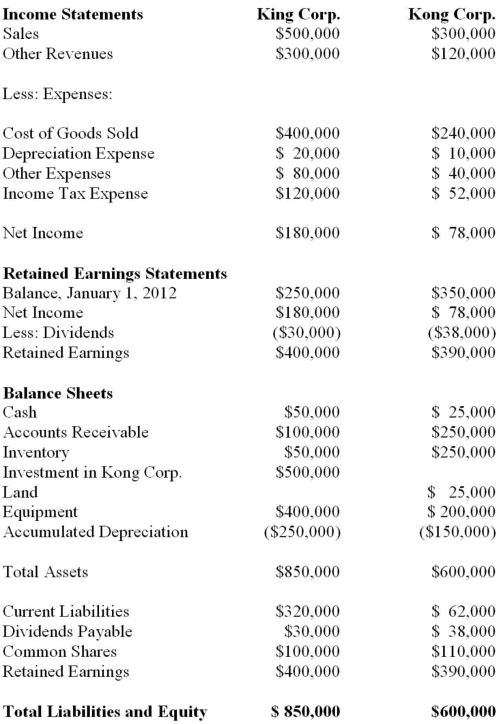

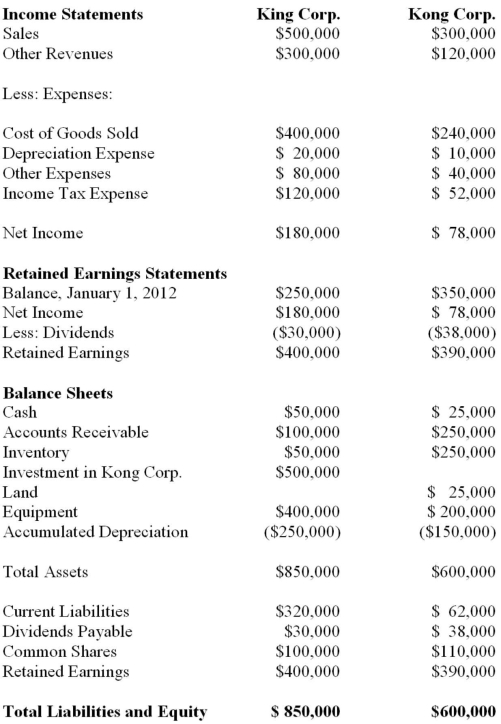

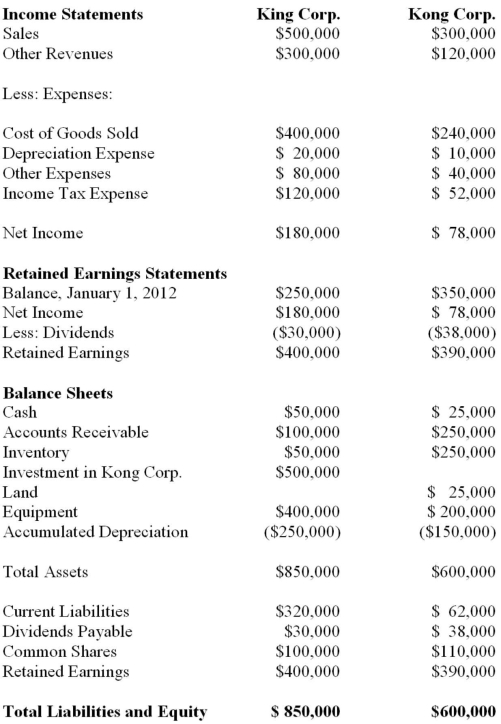

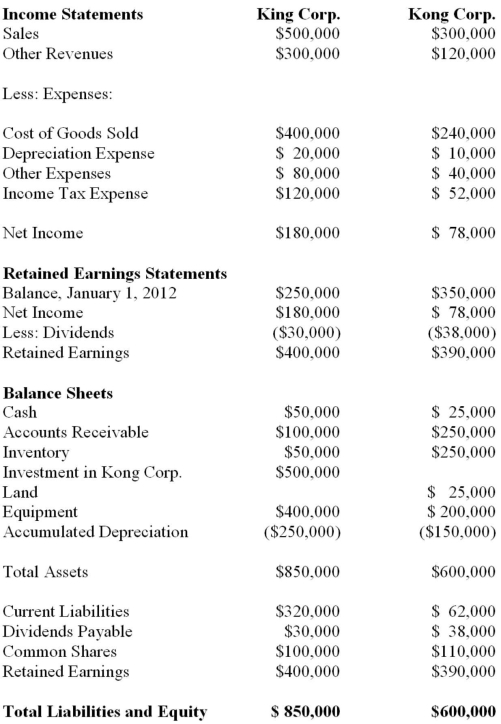

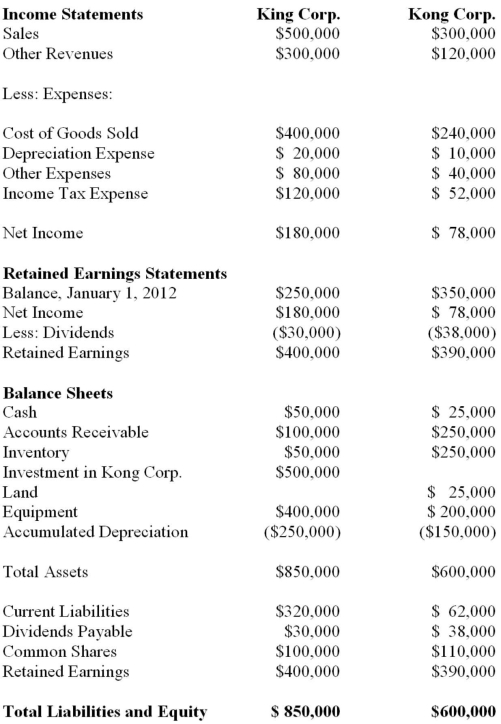

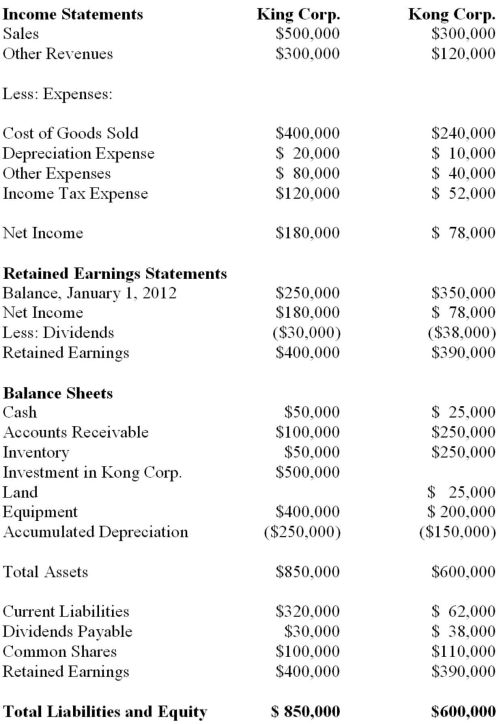

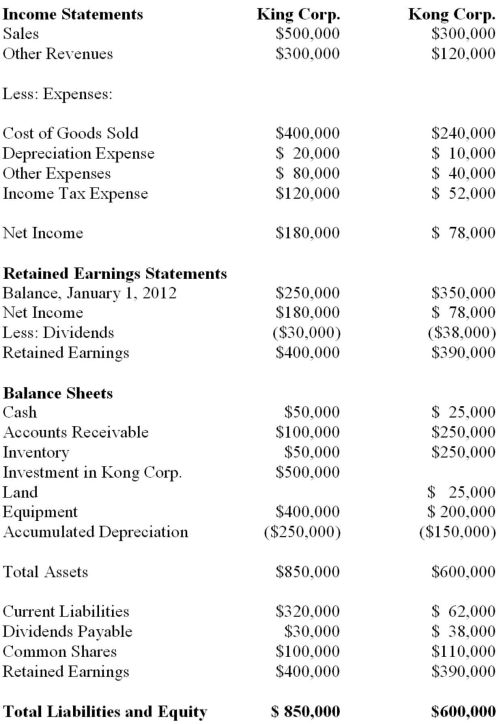

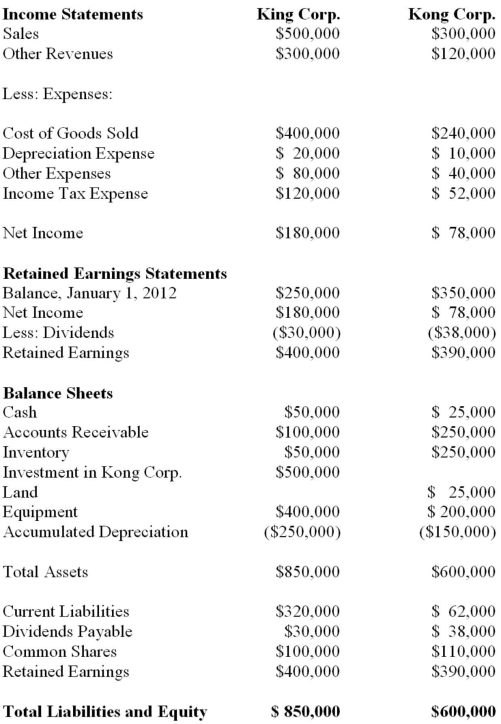

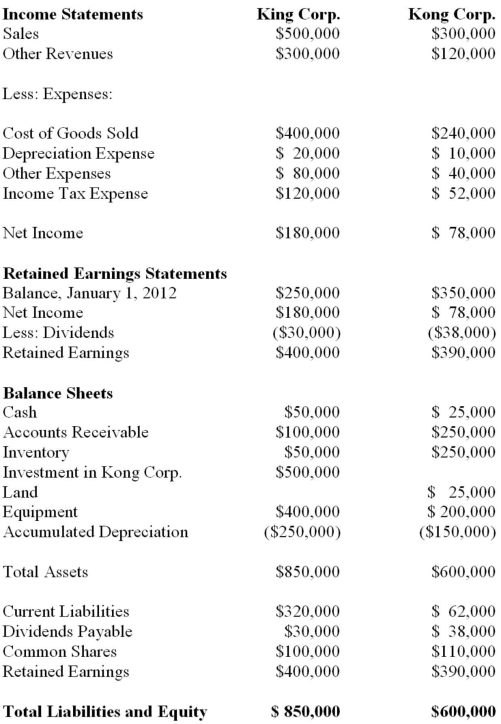

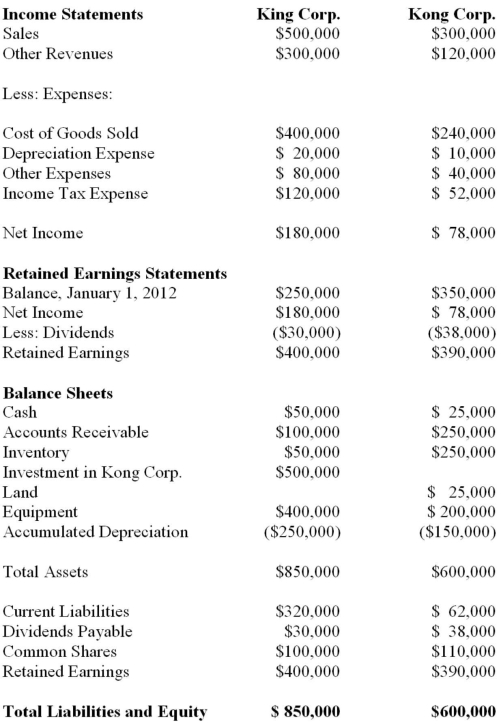

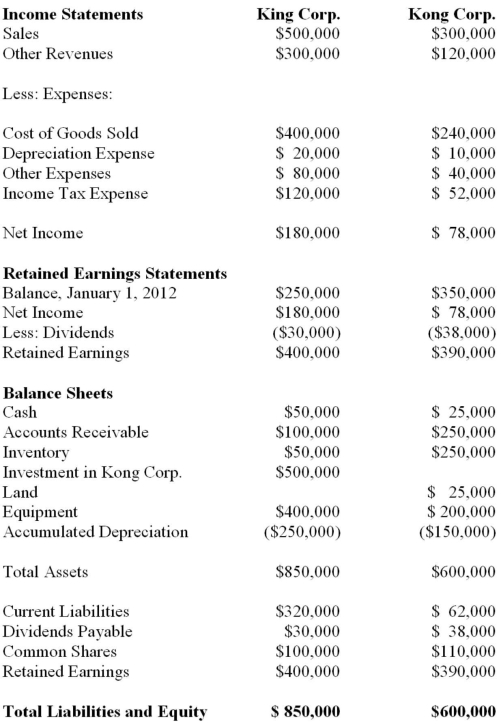

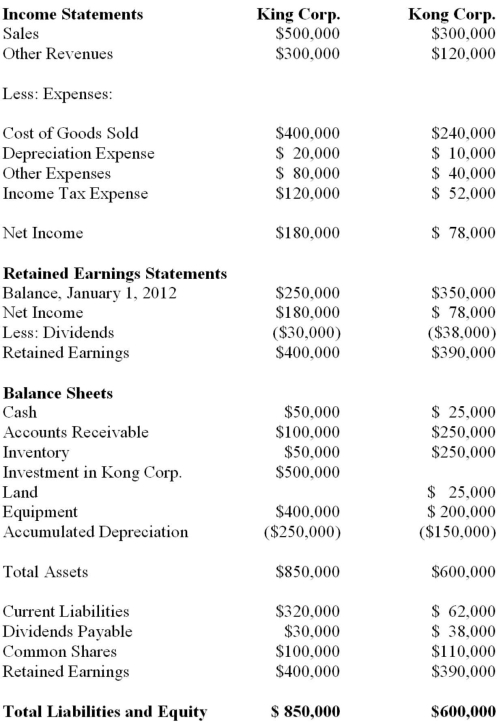

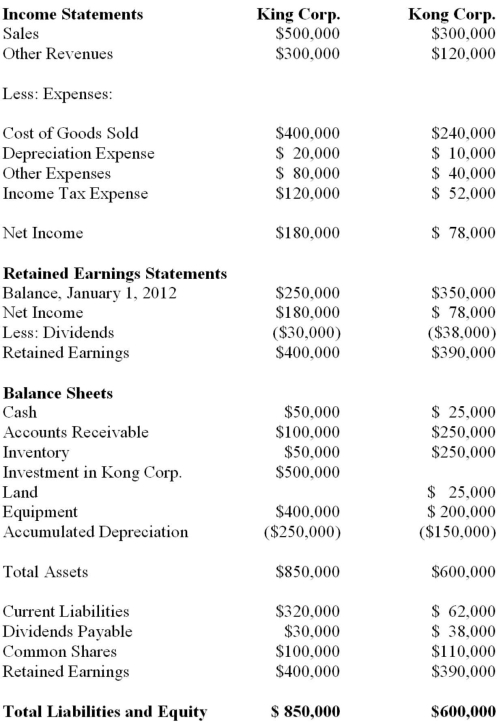

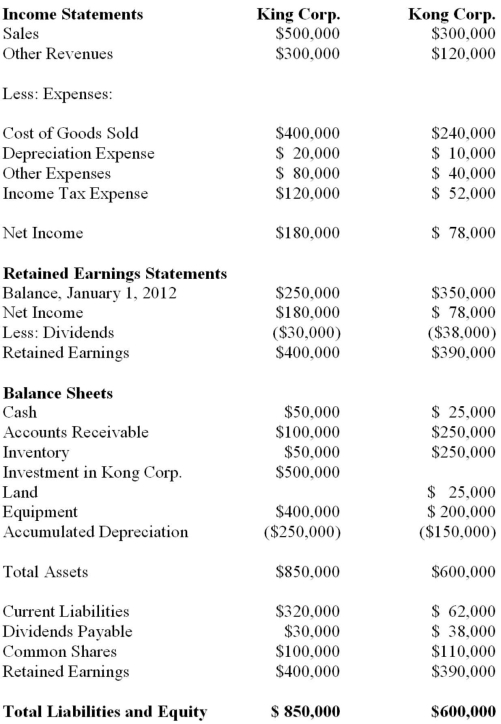

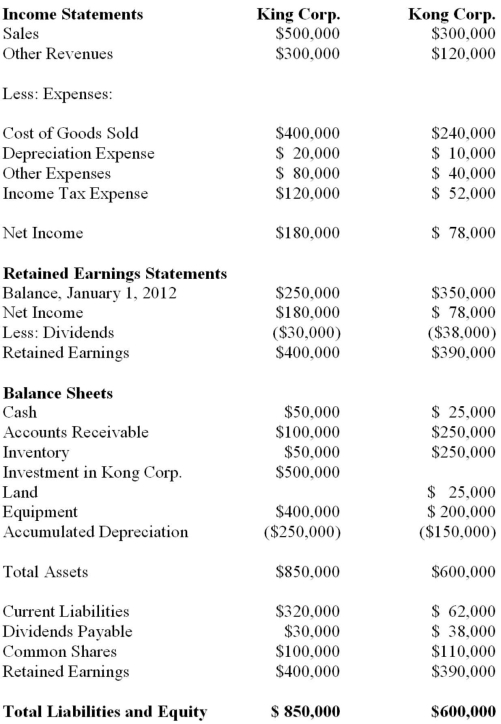

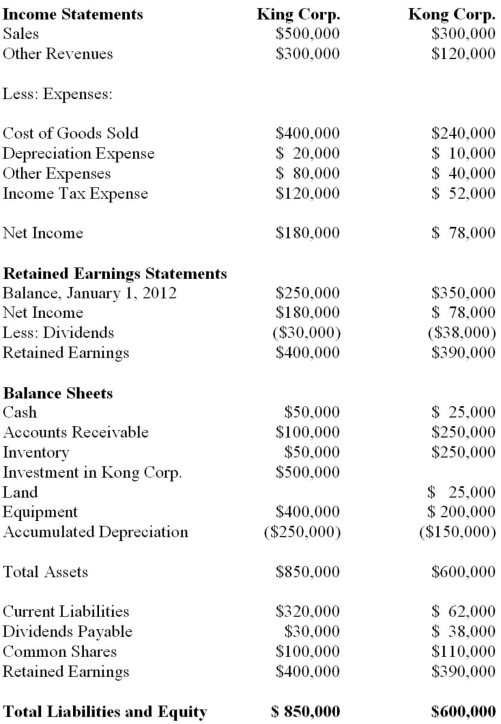

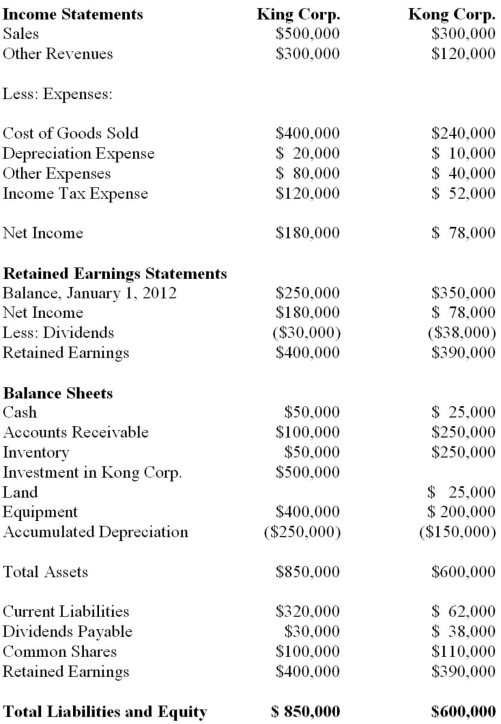

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. The amount of goodwill arising from this business combination is:

A) Nil.

B) $72,000.

C) $130,000.

D) $220,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. The amount of goodwill arising from this business combination is:

A) Nil.

B) $72,000.

C) $130,000.

D) $220,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. The amount of goodwill appearing on King's December 31, 2012 Consolidated Statement of Financial Position would be:

A) Nil.

B) $126,000.

C) $224,000.

D) $240,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. The amount of goodwill appearing on King's December 31, 2012 Consolidated Statement of Financial Position would be:

A) Nil.

B) $126,000.

C) $224,000.

D) $240,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a chapters) valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the amount of the amortization of the acquisition differential during 2013?

What is the amount of the amortization of the acquisition differential during 2013?

A) $7,200.

B) $8,800.

C) $10,000.

D) $80,000.

What is the amount of the amortization of the acquisition differential during 2013?

What is the amount of the amortization of the acquisition differential during 2013?A) $7,200.

B) $8,800.

C) $10,000.

D) $80,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?

What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?

A) Nil.

B) $26,000.

C) $27,000.

D) $30,000.

What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?

What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?A) Nil.

B) $26,000.

C) $27,000.

D) $30,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of gross profit appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of gross profit appearing on Jay's 2013 Consolidated Income Statement would be:

A) $147,000.

B) $147,600.

C) $150,000.

D) $153,000.

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of gross profit appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of gross profit appearing on Jay's 2013 Consolidated Income Statement would be:A) $147,000.

B) $147,600.

C) $150,000.

D) $153,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

Duff Inc. owns 75% of Paddy Corp. and uses the Equity Method to account for its investment. Paddy purchased $120,000 face value of Duff's 12% par value bonds on January 1, 2011 for $100,000, when Duff's bond liability consisted of $240,000 par of 12% Bonds maturing on January 1, 2021. There was an unamortized bond discount of $20,000 attached to the bonds on that date. Interest payment dates are June 30 and December 31 each year. Straight line amortization is used. Both companies have a December 31 year end. Intercompany bond gains and losses are to be allocated to each company. During 2011, Paddy earned a net income of $80,000 and paid dividends of $20,000. What would be the pre-tax gain or loss to the combined entity on the intercompany sale of the bonds?

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D) $10,000 gain.

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D) $10,000 gain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

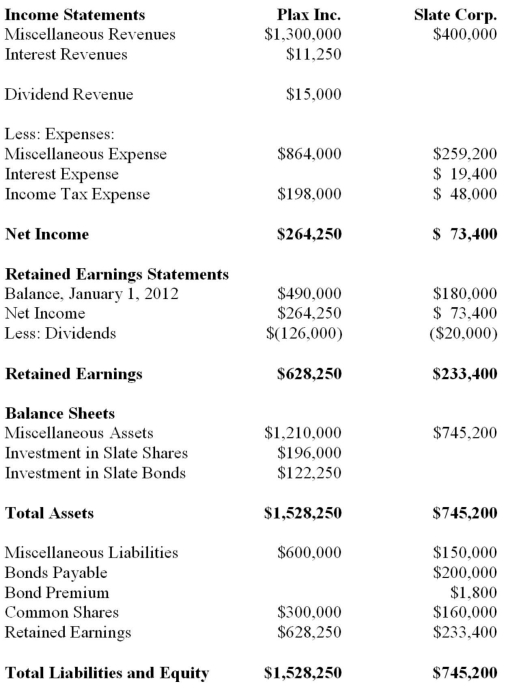

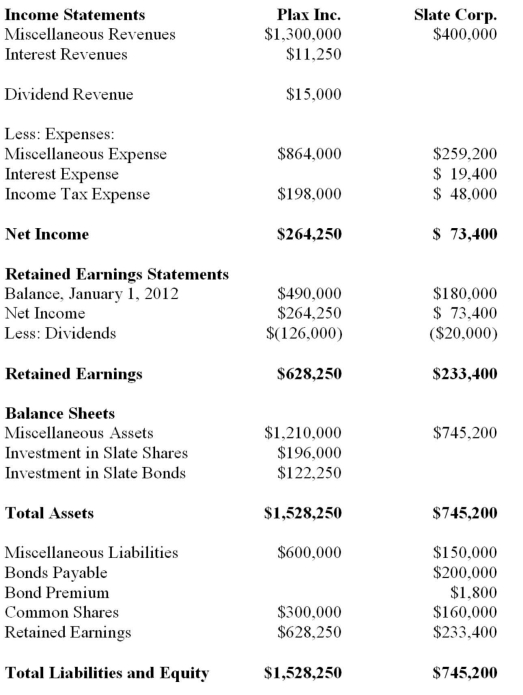

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2012. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. Ignoring income taxes and any minority interest effects, what is the amount of profit realized during 2012 from the intercompany sale of equipment?

A) Nil.

B) $4,000.

C) $5,000.

D) $8,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. Ignoring income taxes and any minority interest effects, what is the amount of profit realized during 2012 from the intercompany sale of equipment?

A) Nil.

B) $4,000.

C) $5,000.

D) $8,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for land?

A) $15,000.

B) $17,000.

C) $21,000.

D) $25,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for land?

A) $15,000.

B) $17,000.

C) $21,000.

D) $25,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

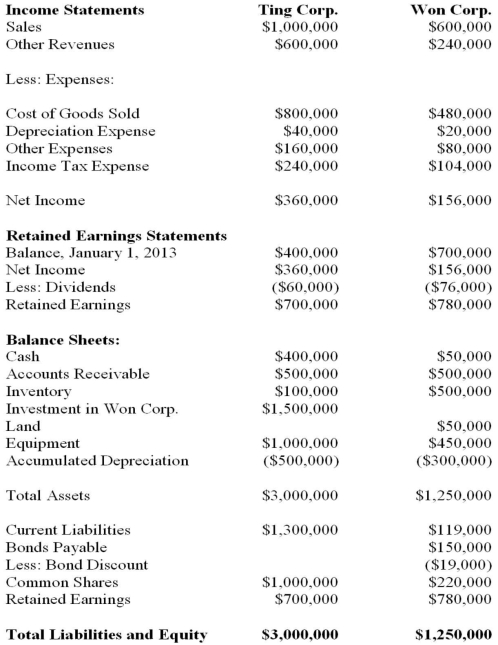

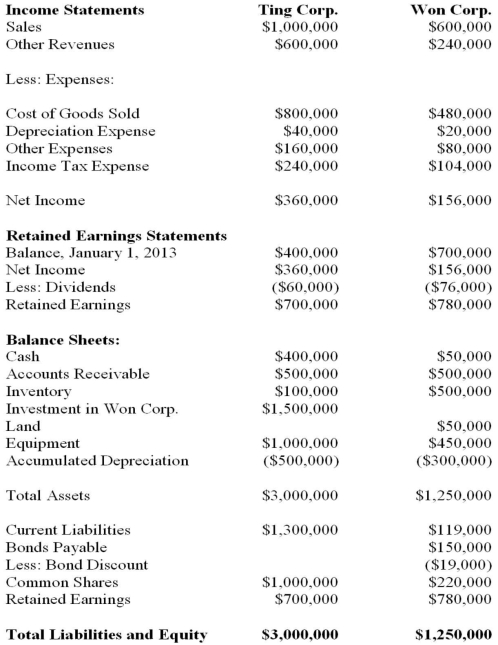

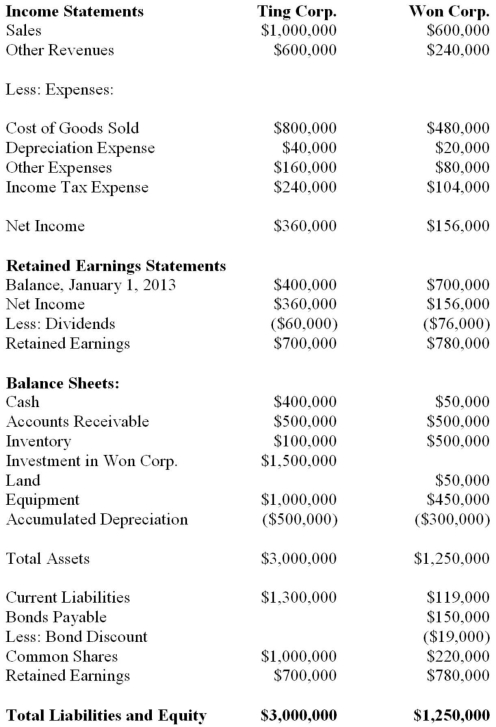

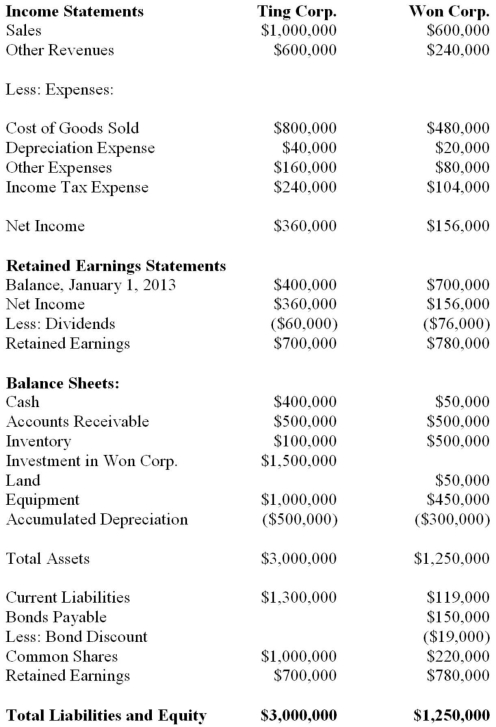

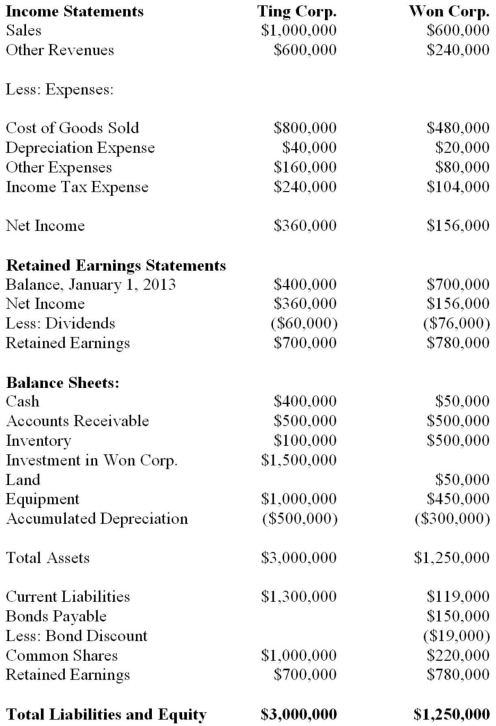

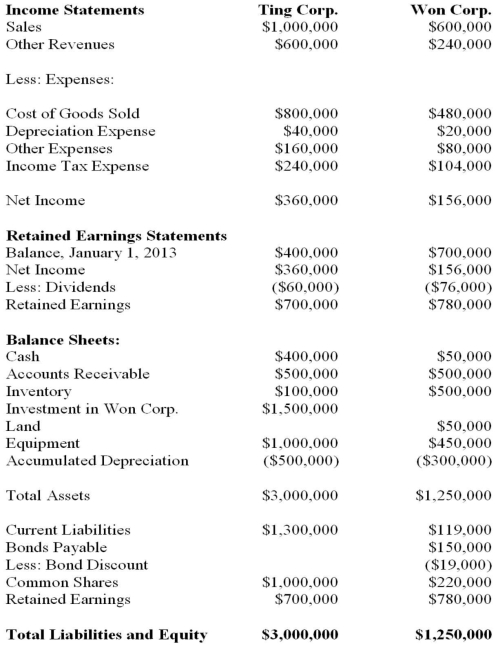

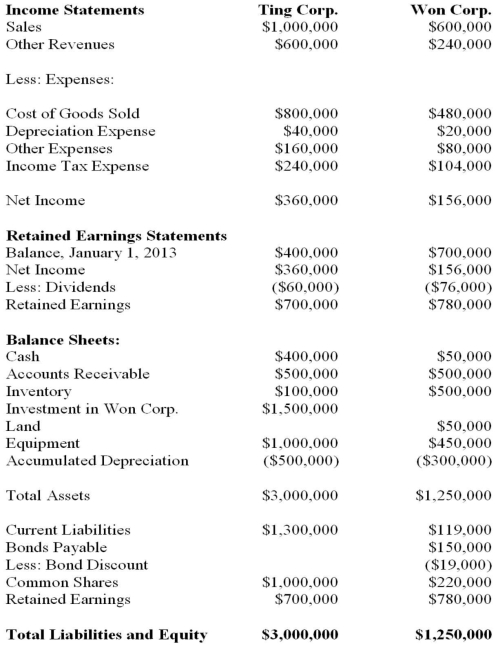

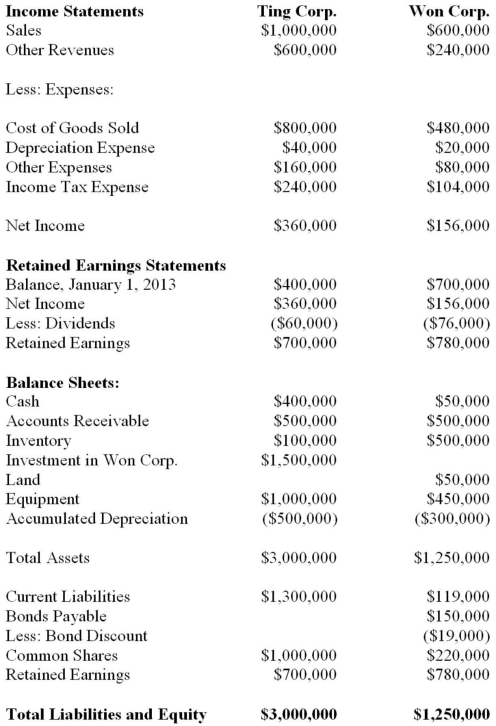

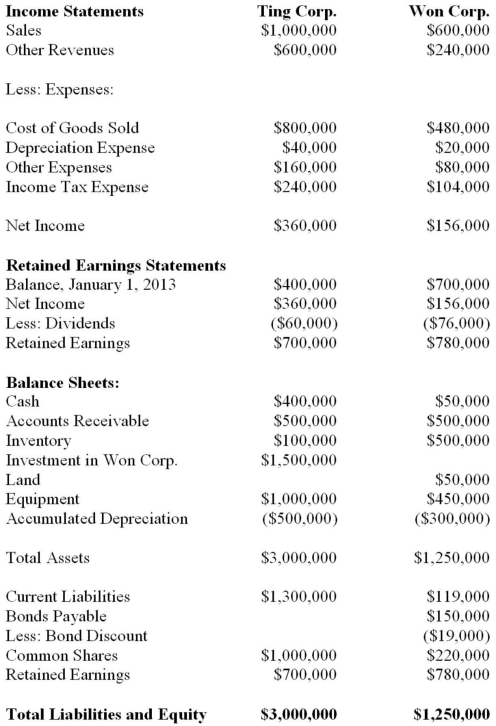

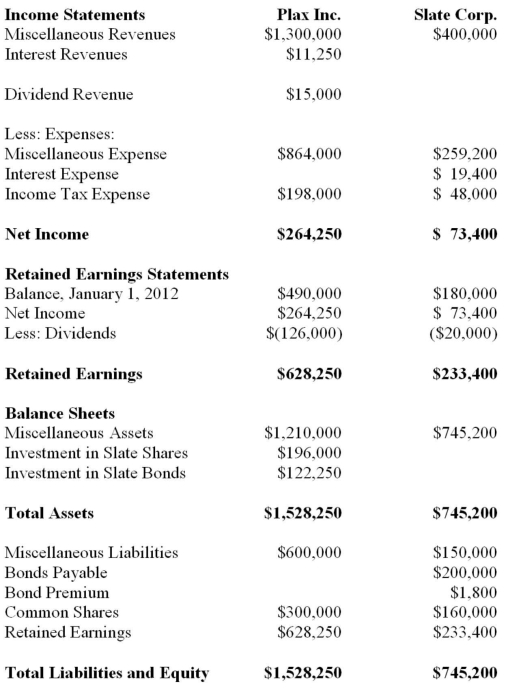

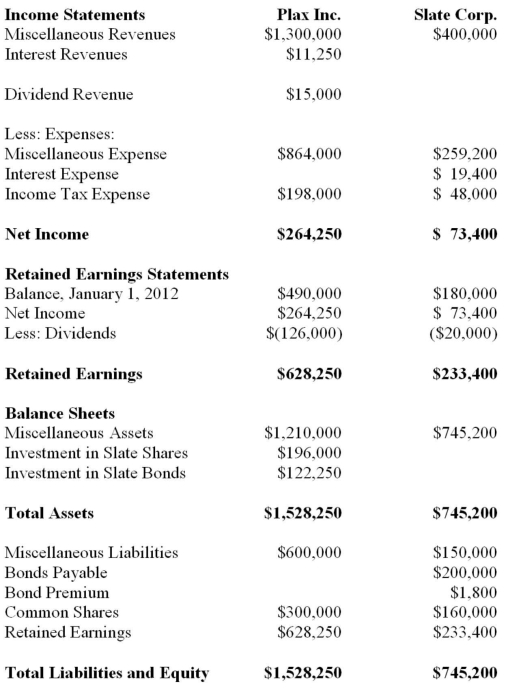

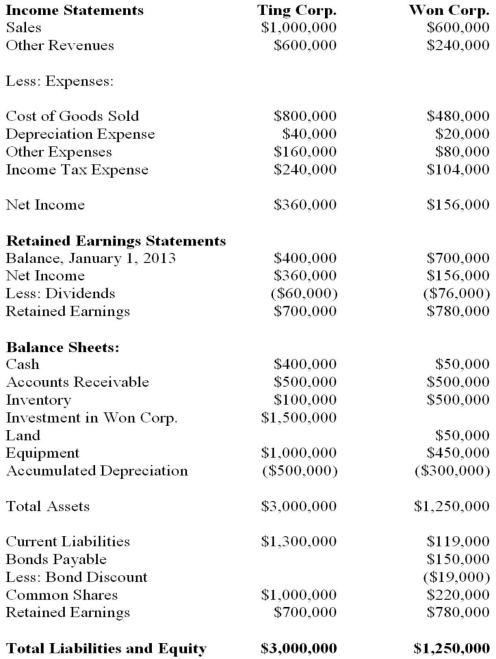

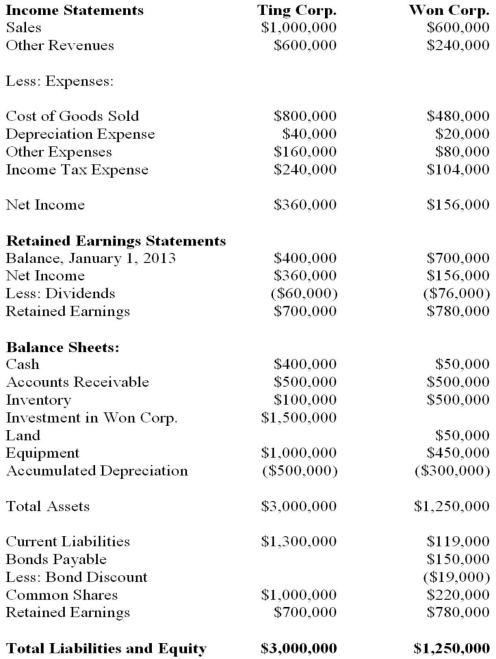

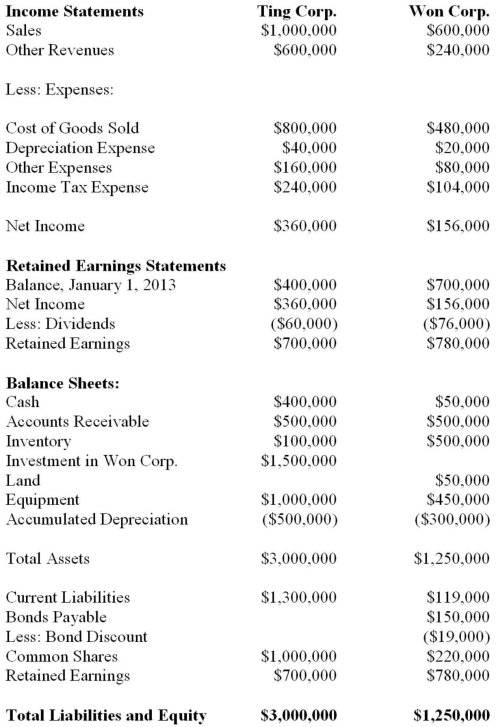

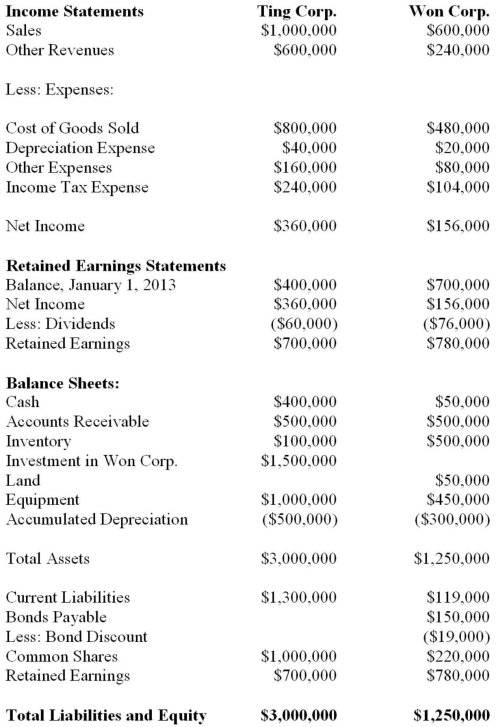

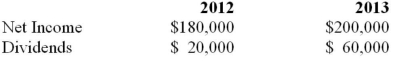

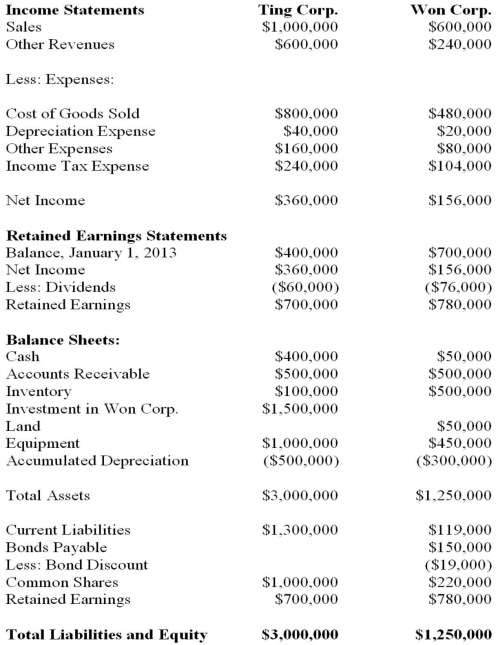

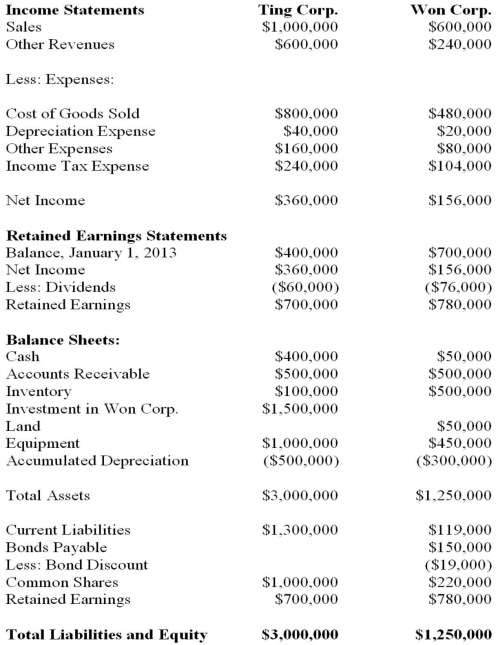

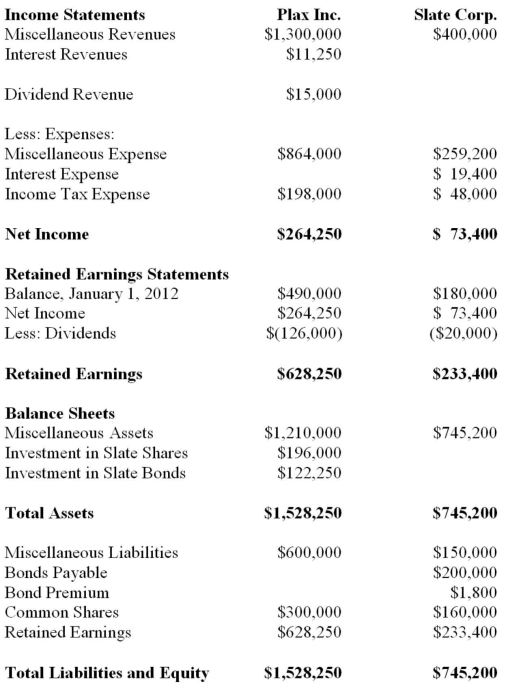

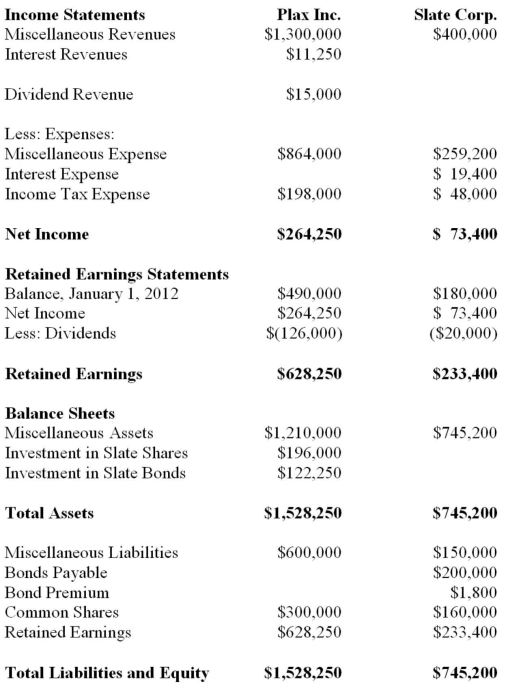

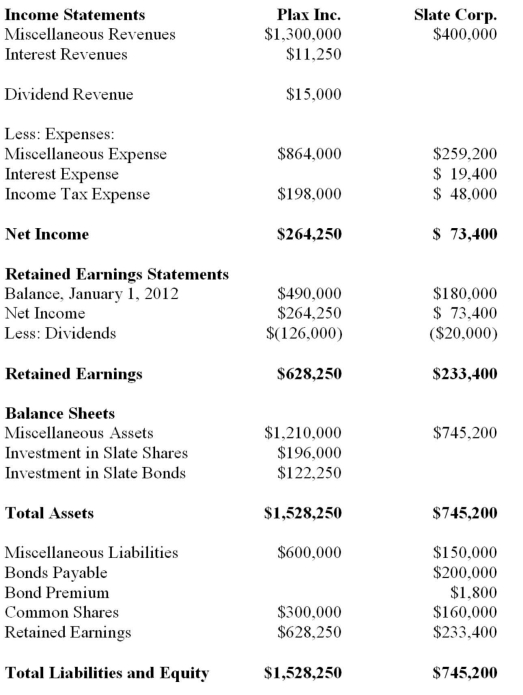

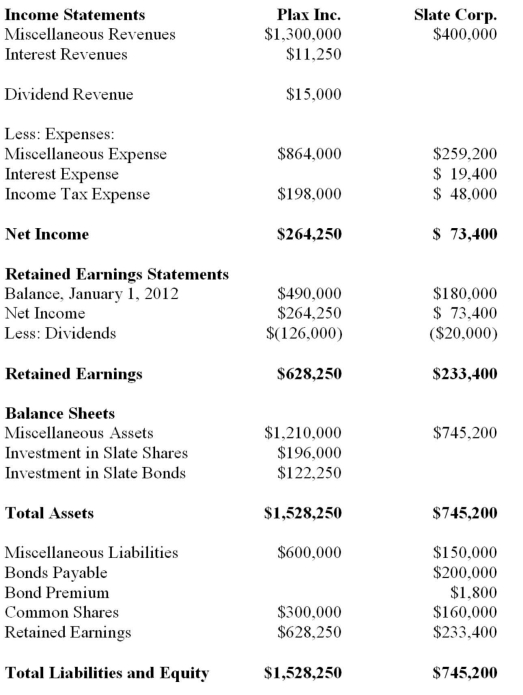

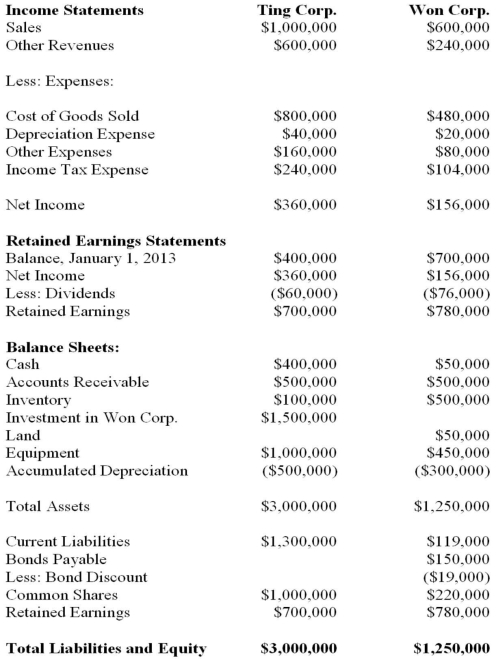

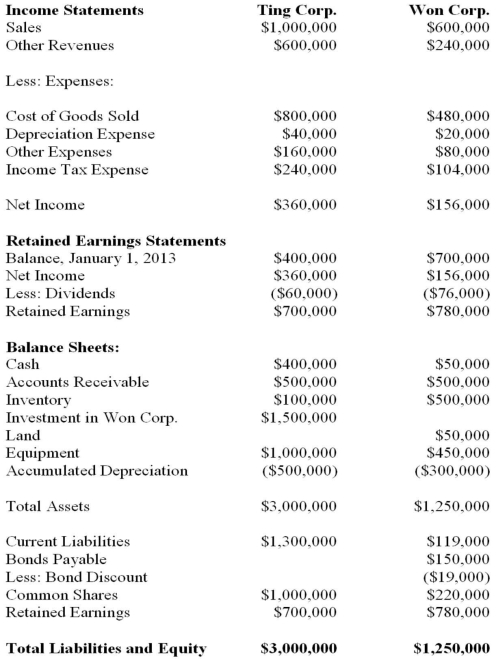

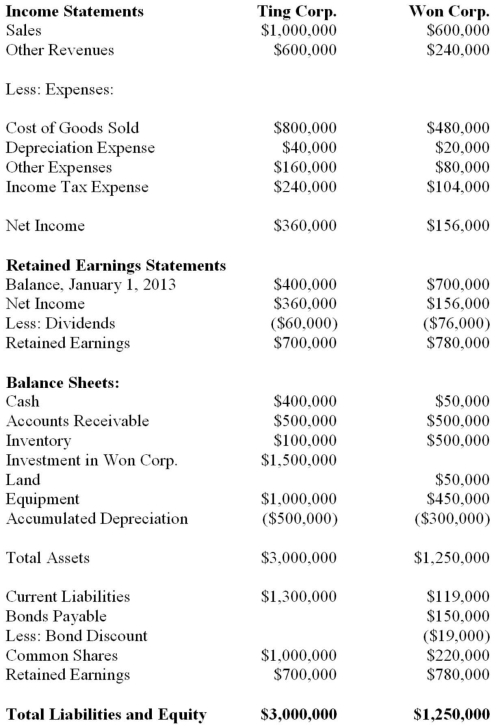

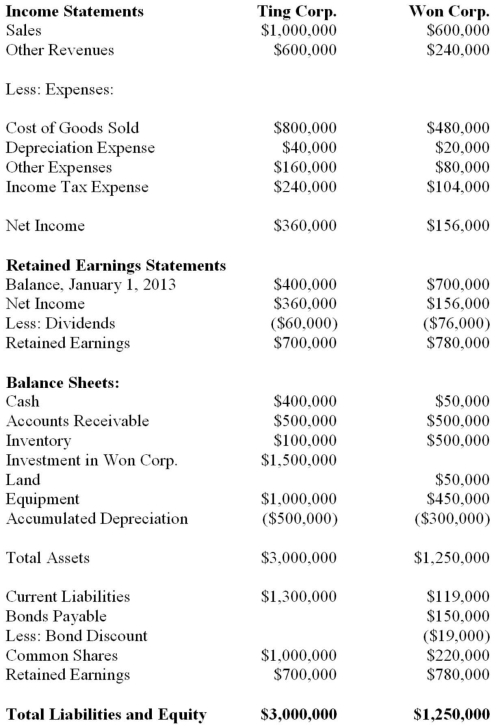

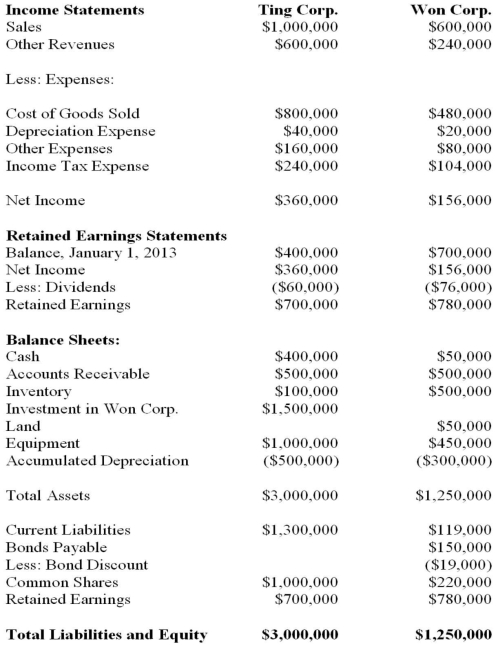

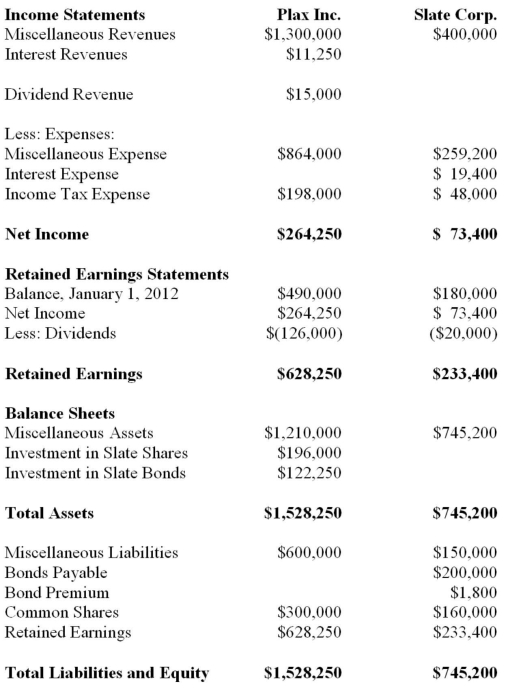

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Won?

A) Won would record a loss $14,000.

B) Won would record a loss of $10,000.

C) Won would record a gain of $4,000.

D) Won would record a gain of $10,000.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Won?

A) Won would record a loss $14,000.

B) Won would record a loss of $10,000.

C) Won would record a gain of $4,000.

D) Won would record a gain of $10,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2012?

A) $2,000.

B) $5,000.

C) $7,000.

D) $10,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2012?

A) $2,000.

B) $5,000.

C) $7,000.

D) $10,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2012. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. Ignoring income taxes and any minority interest effects, what is the amount of unrealized profit remaining from the intercompany sale of equipment at December 31, 2012?

A) Nil.

B) $10,000.

C) $15,000.

D) $20,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. Ignoring income taxes and any minority interest effects, what is the amount of unrealized profit remaining from the intercompany sale of equipment at December 31, 2012?

A) Nil.

B) $10,000.

C) $15,000.

D) $20,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2012. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount of other revenue appearing on King's Consolidated Income Statement for the year ended December 31, 2012?

A) $359,600.

B) $399,600.

C) $410,000.

D) $420,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount of other revenue appearing on King's Consolidated Income Statement for the year ended December 31, 2012?

A) $359,600.

B) $399,600.

C) $410,000.

D) $420,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for deferred income taxes?

A) Nil.

B) $10,000.

C) $11,200.

D) $12,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for deferred income taxes?

A) Nil.

B) $10,000.

C) $11,200.

D) $12,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the non-controlling Interest amount appearing on King's Consolidated Statement of Financial Position at January 1, 2012?

A) $100,000.

B) $101,800.

C) $125,000.

D) $185,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the non-controlling Interest amount appearing on King's Consolidated Statement of Financial Position at January 1, 2012?

A) $100,000.

B) $101,800.

C) $125,000.

D) $185,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What amount of sales revenue would appear on King's Consolidated Income Statement for the year ended December 31, 2012?

A) $750,000.

B) $790,000.

C) $800,000.

D) $810,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What amount of sales revenue would appear on King's Consolidated Income Statement for the year ended December 31, 2012?

A) $750,000.

B) $790,000.

C) $800,000.

D) $810,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Ting's December 31, 2013 Consolidated Income Statement?

A) Ting would record a loss of $15,000.

B) Ting would record a loss of $10,000.

C) Ting would record a gain of $5,000.

D) Ting would record a gain of $15,000.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Ting's December 31, 2013 Consolidated Income Statement?

A) Ting would record a loss of $15,000.

B) Ting would record a loss of $10,000.

C) Ting would record a gain of $5,000.

D) Ting would record a gain of $15,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for inventories?

A) $295,000.

B) $296,000.

C) $297,000.

D) $300,000.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Statement of Financial Position for inventories?

A) $295,000.

B) $296,000.

C) $297,000.

D) $300,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.