Deck 10: Introduction to Liabilities: Economic Consequences, Current Liabilities, and Contingencies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

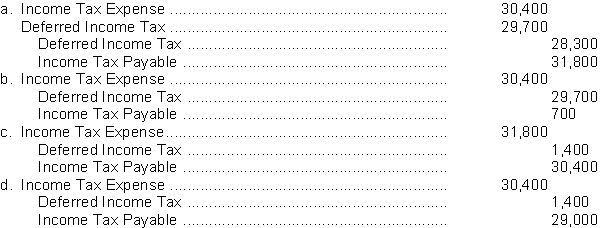

Question

Question

Question

Question

Question

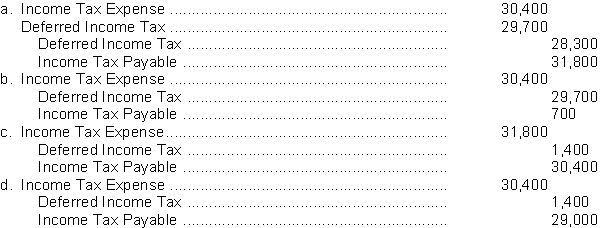

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/102

Play

Full screen (f)

Deck 10: Introduction to Liabilities: Economic Consequences, Current Liabilities, and Contingencies

1

If a loss contingency related to a lawsuit against a firm is deemed to have a reasonable probability of requiring ultimate payment, then the proper accounting treatment of the loss contingency will

A) require note disclosure.

B) decrease the debt/asset ratio.

C) increase the accounts payable/sales ratio.

D) decrease the debt/equity ratio.

A) require note disclosure.

B) decrease the debt/asset ratio.

C) increase the accounts payable/sales ratio.

D) decrease the debt/equity ratio.

A

2

If the current ratio is currently greater than 1.0, which one of the following events would increase the current ratio?

A) Purchase of inventory on account

B) Receipt of money from a customer prior to the performance of service

C) Warranty expense is accrued

D) Sale of plant asset at a gain

A) Purchase of inventory on account

B) Receipt of money from a customer prior to the performance of service

C) Warranty expense is accrued

D) Sale of plant asset at a gain

D

3

Which one of the following transactions decreases a company's quick assets?

A) The board of directors declares a cash dividend to be paid next month.

B) Salary expense is accrued.

C) Depreciation expense is recorded.

D) A prepaid account is created due to the payment of insurance in advance.

A) The board of directors declares a cash dividend to be paid next month.

B) Salary expense is accrued.

C) Depreciation expense is recorded.

D) A prepaid account is created due to the payment of insurance in advance.

D

4

Collecting sales taxes from customers

A) decreases net income.

B) increases the debt/equity ratio.

C) increases the current ratio.

D) decreases net worth.

A) decreases net income.

B) increases the debt/equity ratio.

C) increases the current ratio.

D) decreases net worth.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following events decreases the debt/asset ratio?

A) Bonds are retired with a gain.

B) Warranty expense is accrued.

C) Some of the long-term debt matures next year.

D) The board of directors declares a cash dividend to be paid next month.

A) Bonds are retired with a gain.

B) Warranty expense is accrued.

C) Some of the long-term debt matures next year.

D) The board of directors declares a cash dividend to be paid next month.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

6

If the quick ratio is currently greater than 1.0, which one of the following events would increase the quick ratio?

A) Warranty expense is accrued.

B) A cash dividend previously declared is paid.

C) Long-term debt is paid off.

D) Inventory is purchased on account.

A) Warranty expense is accrued.

B) A cash dividend previously declared is paid.

C) Long-term debt is paid off.

D) Inventory is purchased on account.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following is the result of the amortization of a discount on a short-term note payable?

A) Increases assets and decreases liabilities

B) Decreases assets and increases liabilities

C) Increases liabilities and decreases shareholders' equity

D) Decreases liabilities and owners' equity

A) Increases assets and decreases liabilities

B) Decreases assets and increases liabilities

C) Increases liabilities and decreases shareholders' equity

D) Decreases liabilities and owners' equity

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

8

Accruing warranty expense will

A) increase the debt/equity ratio.

B) increase the current ratio.

C) reduce uncollectible accounts during the period.

D) increase inventory turnover.

A) increase the debt/equity ratio.

B) increase the current ratio.

C) reduce uncollectible accounts during the period.

D) increase inventory turnover.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

9

The recognition of a deferred tax liability that results from the use of straight-line depreciation on financial statements and double-declining balance on tax returns will

A) increase the current ratio.

B) increase the debt/equity ratio.

C) increase the quick ratio.

D) decrease the debt/asset ratio.

A) increase the current ratio.

B) increase the debt/equity ratio.

C) increase the quick ratio.

D) decrease the debt/asset ratio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

10

An employee of Susann Inc. failed two drug tests. The employee has sued and Susann Inc.'s. lawyers appropriately believe that, at best, it is only reasonably probable that Susann Inc. will lose the court case. The proper accounting treatment of the lawsuit will

A) increase earnings per share.

B) increase the debt/asset ratio.

C) decrease the current ratio.

D) not affect the debt/equity ratio.

A) increase earnings per share.

B) increase the debt/asset ratio.

C) decrease the current ratio.

D) not affect the debt/equity ratio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

11

One of Tonic Corp's employees invented a revolutionary coffee lid that cools coffee as you drink it in order to prevent burns. Two children ordered coffee and burned their mouths after failing to properly secure the lids. The children's parents sued. Tonic Corp's. lawyers believe that it is highly probable that judgment will be rendered against Tonic Corp and it is likely a payment in excess of $2 million will be incurred. The proper accounting treatment of the lawsuit will

A) decrease total liabilities.

B) increase total liabilities.

C) increase the current ratio.

D) require accountants to wait until the suit is settled to account for the event.

A) decrease total liabilities.

B) increase total liabilities.

C) increase the current ratio.

D) require accountants to wait until the suit is settled to account for the event.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

12

Dividends payable typically arise because

A) creditors want a return on funds loaned to a company.

B) cash is paid for dividends previously declared in another accounting period.

C) the board of directors declare a dividend that will be paid at a later date.

D) bond investors demand a return.

A) creditors want a return on funds loaned to a company.

B) cash is paid for dividends previously declared in another accounting period.

C) the board of directors declare a dividend that will be paid at a later date.

D) bond investors demand a return.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

13

If a contingent loss is accrued, this would:

A) decrease the debt/equity ratio.

B) decrease the debt/asset ratio.

C) decrease the current ratio.

D) have no change on the quick ratio.

A) decrease the debt/equity ratio.

B) decrease the debt/asset ratio.

C) decrease the current ratio.

D) have no change on the quick ratio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

14

Short-term notes payable typically arise because

A) the firm temporarily requires cash for operations.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) the board of directors have declared a dividend that will be paid at a later date.

D) cash is received as security that will be paid back in the future.

A) the firm temporarily requires cash for operations.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) the board of directors have declared a dividend that will be paid at a later date.

D) cash is received as security that will be paid back in the future.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

15

Which one of the following events does not have any impact on total working capital?

A) The board of directors declares a cash dividend to be paid next month.

B) Warranty expense is accrued.

C) Payment of salaries previously accrued.

D) Debt which was previously long-term matures next year.

A) The board of directors declares a cash dividend to be paid next month.

B) Warranty expense is accrued.

C) Payment of salaries previously accrued.

D) Debt which was previously long-term matures next year.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

16

Net worth is

A) assets plus liabilities.

B) total income since the company began operations.

C) total shareholders' equity.

D) another name for net income.

A) assets plus liabilities.

B) total income since the company began operations.

C) total shareholders' equity.

D) another name for net income.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following events increases working capital?

A) Purchase of inventory on credit

B) Payment of an installment of notes payable

C) Payment of sales taxes for the state

D) Selling merchandise on credit at a profit

A) Purchase of inventory on credit

B) Payment of an installment of notes payable

C) Payment of sales taxes for the state

D) Selling merchandise on credit at a profit

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

18

Deposits payable may arise because

A) cash deposits are received from customers for layaways.

B) cash is paid to a creditor as a security deposit that will be refunded in the future.

C) the company deposits sales receipts too early.

D) merchandise is delivered to customers prior to payment.

A) cash deposits are received from customers for layaways.

B) cash is paid to a creditor as a security deposit that will be refunded in the future.

C) the company deposits sales receipts too early.

D) merchandise is delivered to customers prior to payment.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

19

Unearned revenue typically arises because

A) cash is received as security that will be paid back in the future.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) a company temporarily requires cash for operations.

D) merchandise is sold to customers prior to payment.

A) cash is received as security that will be paid back in the future.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) a company temporarily requires cash for operations.

D) merchandise is sold to customers prior to payment.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

20

Accounts payable typically arise because

A) cash is received from a customer that will be paid back in the future.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) the firm temporarily borrows cash for operations.

D) amounts are owed to others for goods, supplies, and services purchased on open account.

A) cash is received from a customer that will be paid back in the future.

B) cash is received from customers prior to the rendering of services or delivery of products.

C) the firm temporarily borrows cash for operations.

D) amounts are owed to others for goods, supplies, and services purchased on open account.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

21

Contingent liabilities whose ultimate payment is reasonably probable should be

A) recorded in the body of the balance sheet.

B) disclosed in the footnotes to the financial statements.

C) ignored.

D) disclosed in the auditor's report.

A) recorded in the body of the balance sheet.

B) disclosed in the footnotes to the financial statements.

C) ignored.

D) disclosed in the auditor's report.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

22

If a loss contingency related to a lawsuit against a firm is deemed to have a remote probability of requiring ultimate payment, then the proper accounting treatment of the loss contingency will

A) increase the debt/equity ratio.

B) increase the debt/asset ratio.

C) have no effect on earnings per share.

D) increase the quick ratio.

A) increase the debt/equity ratio.

B) increase the debt/asset ratio.

C) have no effect on earnings per share.

D) increase the quick ratio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

23

Contingent liabilities whose ultimate payment is remote should be

A) recorded in the body of the balance sheet.

B) disclosed in the footnotes to the financial statements.

C) disclosed in the auditor's report.

D) ignored.

A) recorded in the body of the balance sheet.

B) disclosed in the footnotes to the financial statements.

C) disclosed in the auditor's report.

D) ignored.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

24

Gain contingencies

A) should be accrued when probable and the amount can be reasonably estimated.

B) are reported as revenues on the income statement.

C) should be accrued for anticipated lottery winnings.

D) are almost never accrued and are rarely disclosed.

A) should be accrued when probable and the amount can be reasonably estimated.

B) are reported as revenues on the income statement.

C) should be accrued for anticipated lottery winnings.

D) are almost never accrued and are rarely disclosed.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

25

What business transaction must occur in order to reduce Estimated Warranty Payable?

A) Goods under warranty are repaired in the period after the sale

B) Warranty costs are accrued at the end of the accounting period

C) Sale of goods on account

D) Customers take advantage of cash discounts for early payment

A) Goods under warranty are repaired in the period after the sale

B) Warranty costs are accrued at the end of the accounting period

C) Sale of goods on account

D) Customers take advantage of cash discounts for early payment

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

26

Abbott Co. has 5 employees who worked the entire year. Each employee earns 6 paid vacation days annually. Vacation days may be taken during December of 2009 and all of 2010. All unused vacation days are paid when the employee leaves the company. The daily wage in 2009 per employee is $100. This is an example of

A) a definite liability.

B) a third party liability.

C) a gain contingency.

D) unearned revenue.

A) a definite liability.

B) a third party liability.

C) a gain contingency.

D) unearned revenue.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

27

If a loss contingency related to a lawsuit against a firm is deemed to have a high probability of requiring ultimate payment and can be reasonably estimated, then the proper accounting treatment of the loss contingency will

A) decrease the debt/equity ratio.

B) decrease the debt/asset ratio.

C) decrease earnings per share.

D) increase net income.

A) decrease the debt/equity ratio.

B) decrease the debt/asset ratio.

C) decrease earnings per share.

D) increase net income.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

28

An income tax accrual at yearend will most likely

A) decrease earnings per share.

B) decrease the debt/asset ratio.

C) decrease the debt/equity ratio.

D) be a contingency.

A) decrease earnings per share.

B) decrease the debt/asset ratio.

C) decrease the debt/equity ratio.

D) be a contingency.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

29

Contingent liabilities whose ultimate payment is highly probable and can be reasonably estimated must be

A) ignored until actual payment is made.

B) disclosed only in the footnotes to the financial statements.

C) recorded in the body of the balance sheet.

D) disclosed in the auditor's report.

A) ignored until actual payment is made.

B) disclosed only in the footnotes to the financial statements.

C) recorded in the body of the balance sheet.

D) disclosed in the auditor's report.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

30

A suit for breach of contract seeking damages of $3,000,000 was filed against Clark Corporation on March 1, 2009. Clark's legal counsel believes that a negative outcome is highly probable. A reasonable estimate of the court's award to the plaintiff is $600,000. Settlement is expected to occur during the latter part of 2009. What accounting is necessary for the year ending June 30, 2009?

A) Note disclosure only

B) Accrue a contingent liability of $3,000,000 and provide note disclosure explaining the contingency

C) Accrue a contingent liability of $600,000 and provide note disclosure explaining the contingency

D) No disclosure or accrual necessary

A) Note disclosure only

B) Accrue a contingent liability of $3,000,000 and provide note disclosure explaining the contingency

C) Accrue a contingent liability of $600,000 and provide note disclosure explaining the contingency

D) No disclosure or accrual necessary

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

31

Sweeney, Inc. borrowed $30,000 from the bank by signing a 9-month note payable. The proper accounting treatment of recording the note will

A) increase assets and liabilities.

B) decrease assets and increase liabilities.

C) increase liabilities and owners' equity.

D) increase assets and decrease owners' equity.

A) increase assets and liabilities.

B) decrease assets and increase liabilities.

C) increase liabilities and owners' equity.

D) increase assets and decrease owners' equity.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

32

Use the information from Cen, Inc. to answer questions 35 and 36.

Cen, Inc. reported the following on its December 31, 2010, balance sheet:

Which statement is true concerning Cen's interest?

A) Central paid a total of $60 interest during 2010.

B) Interest was incurred during the year on more than one note.

C) Interest of $3,200 was accrued and paid during 2010.

D) The 'accrued interest on notes payable' amount relates to the one-year short-term notes payable.

Cen, Inc. reported the following on its December 31, 2010, balance sheet:

Which statement is true concerning Cen's interest?

A) Central paid a total of $60 interest during 2010.

B) Interest was incurred during the year on more than one note.

C) Interest of $3,200 was accrued and paid during 2010.

D) The 'accrued interest on notes payable' amount relates to the one-year short-term notes payable.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

33

A contingent liability

A) is definite in existence, but its amount and due date are not yet known.

B) has the same requirements as a contingent gain.

C) must be accrued even when it is not reasonably estimable.

D) is disclosed only in the financial statement notes if highly probable and the amount can be estimated.

A) is definite in existence, but its amount and due date are not yet known.

B) has the same requirements as a contingent gain.

C) must be accrued even when it is not reasonably estimable.

D) is disclosed only in the financial statement notes if highly probable and the amount can be estimated.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following would most likely be reported as a current liability?

A) Frequent flyer program miles accumulated by airline travelers

B) Self insurance risks on anticipated losses

C) Customers merchandise returns exchanged for different merchandise

D) The CEO's stock option package for the current year

A) Frequent flyer program miles accumulated by airline travelers

B) Self insurance risks on anticipated losses

C) Customers merchandise returns exchanged for different merchandise

D) The CEO's stock option package for the current year

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

35

Current liabilities include

A) amounts due from suppliers for credits on accounts given on returns which had previously been paid.

B) taxes withheld from employees' payroll checks which must be remitted to the IRS.

C) amounts paid for warranty repairs during the current year.

D) cash dividends to be declared by the board of directors during the next six months.

A) amounts due from suppliers for credits on accounts given on returns which had previously been paid.

B) taxes withheld from employees' payroll checks which must be remitted to the IRS.

C) amounts paid for warranty repairs during the current year.

D) cash dividends to be declared by the board of directors during the next six months.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

36

Use the information from Cen, Inc. to answer questions 35 and 36.

Cen, Inc. reported the following on its December 31, 2010, balance sheet:

How much is the maturity value of the one-year note payable that is outstanding at the end of 2010?

A) $9,500

B) $9,800

C) $10,100

D) $10,400

Cen, Inc. reported the following on its December 31, 2010, balance sheet:

How much is the maturity value of the one-year note payable that is outstanding at the end of 2010?

A) $9,500

B) $9,800

C) $10,100

D) $10,400

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

37

Liabilities are

A) sometimes credit and other times debit balances.

B) deferred amounts which will be recognized on the balance sheet when the actual due date arrives.

C) obligations arising from past transactions and payable in assets or services in the future.

D) obligations to transfer ownership of one company to other entities.

A) sometimes credit and other times debit balances.

B) deferred amounts which will be recognized on the balance sheet when the actual due date arrives.

C) obligations arising from past transactions and payable in assets or services in the future.

D) obligations to transfer ownership of one company to other entities.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following is a current liability?

A) Portions of notes payable due beyond the next accounting period

B) Sales taxes paid on new equipment acquired

C) Estimated costs of hurricanes which might develop in the Caribbean during next hurricane season

D) Football tickets sold to customers for games in the coming season

A) Portions of notes payable due beyond the next accounting period

B) Sales taxes paid on new equipment acquired

C) Estimated costs of hurricanes which might develop in the Caribbean during next hurricane season

D) Football tickets sold to customers for games in the coming season

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

39

An increase in a deferred tax liability is recognized when

A) the tax accountant omits taxable revenue from the tax returns.

B) net income measured under GAAP is greater than taxable income on tax returns because of temporary timing differences.

C) the amount of tax paid to the government is more than that calculated by the accountant on the company's tax return.

D) a tax audit by the IRS causes an increase in taxes due from a previous year's tax return.

A) the tax accountant omits taxable revenue from the tax returns.

B) net income measured under GAAP is greater than taxable income on tax returns because of temporary timing differences.

C) the amount of tax paid to the government is more than that calculated by the accountant on the company's tax return.

D) a tax audit by the IRS causes an increase in taxes due from a previous year's tax return.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following would increase the bonus for a CEO who is paid a bonus equal to a percentage of current GAAP net income?

A) Recording a decrease in the company's self-insured worker's compensation expense

B) Decreasing the estimated life of plant and equipment by an average of 8 years

C) Increasing wages for the warehouse employees

D) Collecting payments in advance from customers

A) Recording a decrease in the company's self-insured worker's compensation expense

B) Decreasing the estimated life of plant and equipment by an average of 8 years

C) Increasing wages for the warehouse employees

D) Collecting payments in advance from customers

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

41

Two types of differences exist between computing income for tax purposes and computing income for financial accounting purposes. The differences are

A) defined benefit taxes and defined contribution taxes.

B) deferred tax assets and deferred tax liabilities.

C) revenues and expenses.

D) temporary and permanent.

A) defined benefit taxes and defined contribution taxes.

B) deferred tax assets and deferred tax liabilities.

C) revenues and expenses.

D) temporary and permanent.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

42

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests $50,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 1.76

b. 2.50

c. 1.44

d. 3.24

If Jake invests $50,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 1.76

b. 2.50

c. 1.44

d. 3.24

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

43

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests $80,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 2.94

b. 3.24

c. 2.06

d. 0.83

If Jake invests $80,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 2.94

b. 3.24

c. 2.06

d. 0.83

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

44

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests the entire $100,000 of the borrowed funds in equipment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $146,667

b. $102,000

c. $80,000

d. $125,333

If Jake invests the entire $100,000 of the borrowed funds in equipment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $146,667

b. $102,000

c. $80,000

d. $125,333

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

45

The economic essence of one of the following should not be reported in the balance sheet as a current liability. Which one is not reported?

A) Free sandwich offers printed on hockey ticket stubs

B) Amounts sued for damages associated with injuries from an allegedly defective weed eater

C) Mail-in rebates from software by software companies

D) Amounts payable to an employee for a recent expense report

A) Free sandwich offers printed on hockey ticket stubs

B) Amounts sued for damages associated with injuries from an allegedly defective weed eater

C) Mail-in rebates from software by software companies

D) Amounts payable to an employee for a recent expense report

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

46

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests $80,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $93,333

b. $133,333

c. $146,667

d. $102,000

If Jake invests $80,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $93,333

b. $133,333

c. $146,667

d. $102,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

47

Pension expense is

A) accrued each period as employees require payments.

B) recognized as a long-term deferred asset.

C) accrued as employees earn their rights to future benefits.

D) calculated by dividing an employee's annual salary into the number of years the employee is expected to require pension payments.

A) accrued each period as employees require payments.

B) recognized as a long-term deferred asset.

C) accrued as employees earn their rights to future benefits.

D) calculated by dividing an employee's annual salary into the number of years the employee is expected to require pension payments.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

48

A company has a decreasing current ratio. Creditors should be concerned

A) with long-term solvency.

B) about the company's ability to pay current debts as they come due.

C) about the company's profitability.

D) about whether earnings per share is increasing or decreasing.

A) with long-term solvency.

B) about the company's ability to pay current debts as they come due.

C) about the company's profitability.

D) about whether earnings per share is increasing or decreasing.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

49

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests $50,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $45,333

b. $146,667

c. $125,333

d. $113,333

If Jake invests $50,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what is the maximum amount of current liabilities it could have without violating the debt contract?

a. $45,333

b. $146,667

c. $125,333

d. $113,333

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

50

Alpine, Inc. sells baseball tickets for professional baseball games. Cash receipts for baseball tickets are credited to Unearned Ticket Revenue. During 2010, Alpine collected $30,000 for a September, 2010 baseball game and $42,000 for a March, 2011 baseball game. The September game was played as scheduled, although $2,000 of tickets was refunded to fans that canceled because they had been permanently kicked out of the stadium for disorderly conduct. How much should be reported as Unearned Ticket Revenue at December 31, 2010?

A) $0

B) $42,000

C) $72,000

D) $40,000

A) $0

B) $42,000

C) $72,000

D) $40,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

51

A measure of the extent to which reported income is conservative is called

A) ERISA.

B) a gain contingency.

C) the conservatism ratio.

D) a line of credit.

A) ERISA.

B) a gain contingency.

C) the conservatism ratio.

D) a line of credit.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

52

Jake Company borrowed $100,000 from Guaranty Trust Bank to finance the purchase of new equipment. The loan contract provides for a 12 percent annual interest rate and states that the principal must be paid in full in ten years. The contract also requires that Jake maintains a current ratio of 1.5:1. Before Jake borrowed the $100,000, the company's current assets and current liabilities were $120,000 and $68,000 respectively.

If Jake invests the entire $100,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 3.24

b. 1.76

c. 1.31

d. 1.50

If Jake invests the entire $100,000 of the borrowed funds in equipment and keeps the rest as cash or short-term investment, what would be its current ratio?

a. 3.24

b. 1.76

c. 1.31

d. 1.50

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

53

In addition to recognizing income tax expense, the accounting necessary to record income taxes requires

A) a credit to income tax payable based on net income times the tax rate.

B) a debit to the income tax expense account for the amount of cash that must be paid for taxes.

C) computations of the amounts to record in the deferred income tax account.

D) all companies to report taxable income on the income statement

A) a credit to income tax payable based on net income times the tax rate.

B) a debit to the income tax expense account for the amount of cash that must be paid for taxes.

C) computations of the amounts to record in the deferred income tax account.

D) all companies to report taxable income on the income statement

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

54

A pension is

A) a cost such as health insurance paid on behalf of a retired or disabled employee.

B) a contingent inflow of cash anticipated from assets earning interest.

C) required of all employers.

D) usually determined by the employees' years of service.

A) a cost such as health insurance paid on behalf of a retired or disabled employee.

B) a contingent inflow of cash anticipated from assets earning interest.

C) required of all employers.

D) usually determined by the employees' years of service.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

55

Meadville Industries sells gift certificates that are redeemable in merchandise. During 2009, Meadville sold gift certificates for $88,000. Merchandise with the total price of $52,000 was redeemed during the year. For Meadville, the cost of the merchandise sold was $32,000. Meadville sold gift certificates for the first time in 2009. Assuming that Meadville uses the perpetual inventory method, the journal entry recording the redemption of the gift certificates during 2009 will include:

a. a credit to Cost of Goods Sold for $32,000

b. a debit to Deferred Revenue for $88,000

c. a credit to Sales for $52,000

d. a credit to Deferred Revenue for $52,000

a. a credit to Cost of Goods Sold for $32,000

b. a debit to Deferred Revenue for $88,000

c. a credit to Sales for $52,000

d. a credit to Deferred Revenue for $52,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

56

A defined benefit plan differs from a defined contribution plan in that a defined benefit plan

A) has a liability that must be actuarially computed.

B) is required by ERISA.

C) requires a corporation to make a series of payments of a specified amount to a pension fund.

D) requires journal entries, and the defined contribution plan does not.

A) has a liability that must be actuarially computed.

B) is required by ERISA.

C) requires a corporation to make a series of payments of a specified amount to a pension fund.

D) requires journal entries, and the defined contribution plan does not.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

57

Meadville Industries sells gift certificates that are redeemable in merchandise. During 2009, Meadville sold gift certificates for $88,000. Merchandise with the total price of $52,000 was redeemed during the year. For Meadville, the cost of the merchandise sold was $32,000. Meadville sold gift certificates for the first time in 2009. The journal entry recording the sale of the gift certificates will include:

a. a debit to Certificate Liability for $88,000

b. a debit to Deferred Revenue for $88,000

c. a credit to Sales for $88,000

d. a credit to Deferred Revenue for $88,000

a. a debit to Certificate Liability for $88,000

b. a debit to Deferred Revenue for $88,000

c. a credit to Sales for $88,000

d. a credit to Deferred Revenue for $88,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

58

Warranties should be accrued if it is

A) probable that an expense will be incurred and the amount is reasonably estimable.

B) possible that an expense will be incurred regardless of whether the amount is estimable or not.

C) possible that an expense will be incurred and the amount is reasonably estimable.

D) remote that any costs will be incurred.

A) probable that an expense will be incurred and the amount is reasonably estimable.

B) possible that an expense will be incurred regardless of whether the amount is estimable or not.

C) possible that an expense will be incurred and the amount is reasonably estimable.

D) remote that any costs will be incurred.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

59

The following information was taken from the annual report of Jones Inc.

What is Jones's conservatism ratio?

What is Jones's conservatism ratio?

a. 1.02

b. 1.52

c. 2.89

d. 1.21

What is Jones's conservatism ratio?

What is Jones's conservatism ratio? a. 1.02

b. 1.52

c. 2.89

d. 1.21

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

60

Simpson Incorporated sells fishing lures and monofilament leader material. During June, Simpson distributed 6,000 coupons to receive a free lure to each customer who purchased a dozen spools of monofilament leader material. Through December 31, 2010, Simpson honored 1,200 coupons redeemed. Simpson expects a total of 5,200 total coupons to be redeemed. Simpson sells lures for $1.00 each. The cost of each lure to Simpson is 45 cents. How much should Simpson report as a liability at December 31, 2010?

a. $6,000

b. $1,800

c. $3,600

d. $2,340

a. $6,000

b. $1,800

c. $3,600

d. $2,340

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

61

Julia Used Cars offers a one-year warranty from the date of sale on all cars it sells. From historic data, Bill Julia estimates that, on average, each car will require the company to incur warranty cost of $820. The cars sold for an average of $9,500 each. The following activities occurred during 2010.

If Julia accrued its warranty liability with a single adjusting entry at year-end, the journal entry would include:

If Julia accrued its warranty liability with a single adjusting entry at year-end, the journal entry would include:

a. a debit to Contingent Warranty Liability for $28,700

b. a debit to Warranty Expense for $28,700

c. a credit to Parts for $17,220

d. a credit to Cash for $28,700

If Julia accrued its warranty liability with a single adjusting entry at year-end, the journal entry would include:

If Julia accrued its warranty liability with a single adjusting entry at year-end, the journal entry would include: a. a debit to Contingent Warranty Liability for $28,700

b. a debit to Warranty Expense for $28,700

c. a credit to Parts for $17,220

d. a credit to Cash for $28,700

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

62

On December 31, 2008, Seminole Co. had current assets of $25,000 in cash and current liabilities of $8,000 in accounts payable, resulting in a current ratio of 3.13. The company estimates that warranty expense for 2009 is 6% of sales that totaled $200,000. Calculate Seminole's current ratio after warranty expense is recognized.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

63

The following information was taken from the annual report of Jones Inc.

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

Based on this information, what journal entry should Jones make in 2010 to record its income taxes?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

64

Pacific Company estimates warranty expense as 10% of sales. On January 1, warranties payable was $10,000. During the year, Pacific paid $8,000 to meet its warranty obligations and recorded sales of $300,000. Calculate warranties payable on December 31.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

65

On October 1, Accurate Company borrowed $2,000 in return for a nine-month note payable with a maturity value of $2,600. Calculate the amount of interest expense and the balance sheet value for the year ending December 31.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

66

For each item numbered 1 through 16 below, select the appropriate effect on liabilities listed in a through e that each transaction describes. You may use each letter more than once or not at all. In some cases, two effects are correct.

____ 1. Purchased supplies on account.

____ 1. Purchased supplies on account.

____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customers prior to delivery of the product to the customer.

____ 9. Delivered products to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes that the firm has to pay to the federal government within three months.

____ 12. Accrued a bonus amounting to 5% on reported income to the CEO.

____ 13. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is remote.

____ 14. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is reasonably possible.

____ 15. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is highly probable.

____ 16. Accrued warranty expense.

____ 1. Purchased supplies on account.

____ 1. Purchased supplies on account.____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customers prior to delivery of the product to the customer.

____ 9. Delivered products to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes that the firm has to pay to the federal government within three months.

____ 12. Accrued a bonus amounting to 5% on reported income to the CEO.

____ 13. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is remote.

____ 14. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is reasonably possible.

____ 15. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is highly probable.

____ 16. Accrued warranty expense.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

67

On December 31, 2009, Roper Company had current assets of $15,000 in cash and current liabilities of $8,000 in accounts payable, resulting in a current ratio of 1.88. The company needs to increase its current ratio to 2.75 by December 31, 2010. Calculate the amount of accounts payable that needs to be paid in order to boost the current ratio to 2.75.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

68

The following information was taken from the annual report of Leno Inc.

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

69

As a security analyst for Market Masters, Inc., you have chosen to invest in one high-tech firm. You have narrowed your choice between RamTech Company or Accutrex Industries, firms of similar size and direct competitors in the industry. The following information was taken from their 2009 annual reports:

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

70

On July 1, Gordon Company borrowed $10,000 in return for an eight-month note payable with a maturity value of $10,600. Calculate the amount of interest expense for the current year.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

71

Julia Used Cars offers a one-year warranty from the date of sale on all cars it sells. From historic data, Bill Julia estimates that, on average, each car will require the company to incur warranty cost of $820. The following activities occurred during 2010.

If the January 1, 2010 beginning balance in the warranty liability account was $2,500, what would be the year-end warranty liability balance?

If the January 1, 2010 beginning balance in the warranty liability account was $2,500, what would be the year-end warranty liability balance?

a. $31,200

b. $16,200

c. $11,200

d. $13,700

If the January 1, 2010 beginning balance in the warranty liability account was $2,500, what would be the year-end warranty liability balance?

If the January 1, 2010 beginning balance in the warranty liability account was $2,500, what would be the year-end warranty liability balance? a. $31,200

b. $16,200

c. $11,200

d. $13,700

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

72

On January 1 and December 31, warranties payable were $6,000 and $4,000, respectively. During the current year, sales were $100,000, upon which 3% was estimated to be the amount required for future warranty payments. Calculate the amount paid for warranties during the current year.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

73

The following information was taken from the annual report of Leno Inc.

What is Leno's conservatism ratio?

What is Leno's conservatism ratio?

a. 0.63

b. 0.91

c. 0.69

d. 0.86

What is Leno's conservatism ratio?

What is Leno's conservatism ratio? a. 0.63

b. 0.91

c. 0.69

d. 0.86

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

74

On July 1, Falcon Company borrowed $2,000 in return for a one-year note payable with a maturity value of $2,200. Calculate the balance sheet value of the note on December 31.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

75

Select the letter of the effect on the ratios (a through c) as a result of each transaction listed in items 1 through 16.

____ 1. Purchased supplies on account to be used next month.

____ 1. Purchased supplies on account to be used next month.

____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customer prior to delivery of the product to the customer.

____ 9. Delivered product to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes the firm has to pay to the federal government within three months.

____ 12. Paid a bonus (not previously accrued) amounting to 5% on reported income to the CEO for the current year.

____ 13. A large payment is remotely probable resulting from a lawsuit filed against the firm.

____ 14. A large payment is reasonably probable resulting from a lawsuit filed against the firm.

____ 15. A $10,000 payment is highly probable resulting from a lawsuit filed against the firm.

____ 16. Bondholder converted bond into stock through conversion feature.

____ 1. Purchased supplies on account to be used next month.

____ 1. Purchased supplies on account to be used next month.____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customer prior to delivery of the product to the customer.

____ 9. Delivered product to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes the firm has to pay to the federal government within three months.

____ 12. Paid a bonus (not previously accrued) amounting to 5% on reported income to the CEO for the current year.

____ 13. A large payment is remotely probable resulting from a lawsuit filed against the firm.

____ 14. A large payment is reasonably probable resulting from a lawsuit filed against the firm.

____ 15. A $10,000 payment is highly probable resulting from a lawsuit filed against the firm.

____ 16. Bondholder converted bond into stock through conversion feature.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

76

Bradley Incorporated owns a chain of retail stores. During December of 2009, a customer slipped in a doorway of its Missouri store and broke his ribs. He is suing Bradley for $200,000 for negligence. Bradley's legal counsel believes that it is only reasonably probable that Bradley will lose its defense of the lawsuit because, although the doorway was icy due to an ice storm that was occurring at the time of the fall, a sign on the door warned customers that the doorway was slippery when icy. On December 30, 2009, before considering the effects of this lawsuit, Bradley's current assets, total assets, current liabilities, and total liabilities were $420,000, $840,000, $100,000, and $300,000, respectively. After this event is properly accounted for, calculate Bradley's debt/equity ratio on December 31, 2009.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

77

Beacon Incorporated owns a chain of retail stores. During December of 2009, a customer slipped in a doorway of its Virginia store and broke his ribs. He is suing Beacon for $200,000 for negligence. Beacon's legal counsel believes that it is remote that Beacon will lose its defense of the lawsuit because the doorway recently was rebuilt with all-weather traction stripping and a sign on the door warned customers that the doorway was slippery when icy. On December 30, 2009, before considering the effects of this lawsuit, Beacon's current assets, total assets, current liabilities, and total liabilities were $420,000, $840,000, $100,000, and $300,000, respectively. After this event is properly accounted for, calculate Beacon's debt/asset ratio on December 31, 2009.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

78

Julia Used Cars offers a one-year warranty from the date of sale on all cars it sells. From historic data, Bill Julia estimates that, on average, each car will require the company to incur warranty cost of $820. The cars sold for an average of $9,500 each. The following activities occurred during 2010.  Assume that the breakdown of warranty costs is 40% parts and 60% wages (paid in cash). Based on this information, which of the following journal entries would be made on September 1?

Assume that the breakdown of warranty costs is 40% parts and 60% wages (paid in cash). Based on this information, which of the following journal entries would be made on September 1?

Assume that the breakdown of warranty costs is 40% parts and 60% wages (paid in cash). Based on this information, which of the following journal entries would be made on September 1?

Assume that the breakdown of warranty costs is 40% parts and 60% wages (paid in cash). Based on this information, which of the following journal entries would be made on September 1?

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

79

On October 1, 2009, Brooks Company borrowed $6,000 in return for a nine-month note payable with a maturity value of $6,600. Fill in the partial balance sheet that appears below as of December 31, 2009.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

80

Pitts Incorporated owns a chain of retail stores. During December of 2009, a customer slipped in a doorway of its Nebraska store and broke his ribs. He is suing Pitts for $200,000 for negligence. The legal counsel of Pitts believes that it is remote that Pitts will lose its defense of the lawsuit because the doorway recently was rebuilt with all-weather traction stripping and a sign on the door warned customers that the doorway was slippery when icy. On December 30, 2009, before considering the effects of this lawsuit, The company's current assets, total assets, current liabilities, and total liabilities were $420,000, $840,000, $100,000, and $300,000, respectively. After this event is properly accounted for, calculate the company's debt/equity ratio on December 31, 2009.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck