Deck 9: Long-Lived Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/122

Play

Full screen (f)

Deck 9: Long-Lived Assets

1

The process of allocating the cost of plant and equipment over the time period of which they are used is referred to as:

A) depreciation.

B) depletion.

C) amortization.

D) deferred costs.

A) depreciation.

B) depletion.

C) amortization.

D) deferred costs.

A

2

During extended periods of rising prices of plant and equipment, the amount required to replace long-lived assets is typically:

A) less than total accumulated depreciation of those assets.

B) equal to the sum of all the depreciation recognized on those assets.

C) less than the balance sheet value of those assets.

D) greater than the sum of total depreciation expense recognized on those assets.

A) less than total accumulated depreciation of those assets.

B) equal to the sum of all the depreciation recognized on those assets.

C) less than the balance sheet value of those assets.

D) greater than the sum of total depreciation expense recognized on those assets.

D

3

An increase in accumulated depreciation:

A) increases total assets.

B) decreases total assets.

C) decreases the current ratio.

D) increases the quick ratio.

A) increases total assets.

B) decreases total assets.

C) decreases the current ratio.

D) increases the quick ratio.

B

4

The Favre Company made the following expenditures related to its building:  The amount of the preceding expenditures that should be immediately expensed is:

The amount of the preceding expenditures that should be immediately expensed is:

A) $0.

B) $1,700.

C) $34,700.

D) $19,700.

The amount of the preceding expenditures that should be immediately expensed is:

The amount of the preceding expenditures that should be immediately expensed is:A) $0.

B) $1,700.

C) $34,700.

D) $19,700.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

5

On January 1, Scion Co. purchased land with a usable building on it for $210,000. At the time of purchase, the fair market values of the land and building were $80,000 and $160,000, respectively. Scion assigned the entire purchase cost of $240,000 to land. Scion should depreciate the building using the straight-line method over 20 years with an expected zero residual value. As a result of Scion's treatment of the purchase of land and building, its current net income is:

A) understated by $10,500.

B) understated by $7,000.

C) overstated by $7,000.

D) overstated by $10,500.

A) understated by $10,500.

B) understated by $7,000.

C) overstated by $7,000.

D) overstated by $10,500.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following long-lived assets is not amortized or depreciated to an expense?

A) Equipment use in production of inventory goods

B) Land improvements

C) Land

D) Company computers replaced every two years

A) Equipment use in production of inventory goods

B) Land improvements

C) Land

D) Company computers replaced every two years

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

7

Equipment with a cost of $22,000 and accumulated depreciation of $15,000 was retired with a gain of $1,000. The cash received from the disposition of equipment is:

A) $7,000.

B) $8,000.

C) $6,000.

D) $14,000.

A) $7,000.

B) $8,000.

C) $6,000.

D) $14,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

8

The balance in accumulated depreciation on January 1 and December 31 is $15,000 and $19,000, respectively, during a year in which no assets were disposed. Depreciation expense during the year is:

A) $19,000.

B) $15,000.

C) $4,000.

D) $34,000.

A) $19,000.

B) $15,000.

C) $4,000.

D) $34,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

9

The process of expensing the cost of a gold mine as gold is withdrawn is referred to as:

A) amortization.

B) depletion.

C) depreciation.

D) decomposition.

A) amortization.

B) depletion.

C) depreciation.

D) decomposition.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following actions will help solve a cash shortage problem?

A) Issue common stock in exchange for plant assets

B) Recognize depreciation expense

C) Purchased long-lived asset by issuing long-term debt d Retire plant assets at salvage value

A) Issue common stock in exchange for plant assets

B) Recognize depreciation expense

C) Purchased long-lived asset by issuing long-term debt d Retire plant assets at salvage value

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

11

Depreciation is an expense that does not use cash during the period in which it is recognized. When did (will) the cash outflow associated with the asset occur?

A) When the asset is retired

B) There is no cash outflow associated with depreciation or the asset.

C) When the replacement cost of the asset increases

D) When the asset was acquired

A) When the asset is retired

B) There is no cash outflow associated with depreciation or the asset.

C) When the replacement cost of the asset increases

D) When the asset was acquired

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, Comicon Corp. purchased land with a usable building on it for $300,000. At the time of purchase, the fair market values of the land and building were $100,000 and $150,000, respectively. Comicon depreciates the building using the straight-line method over 20 years with an expected $24,000 residual value. The annual depreciation expense on the building is:

A) $0.

B) $5,000.

C) $7,800.

D) $10,800.

A) $0.

B) $5,000.

C) $7,800.

D) $10,800.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1, a company purchased land with a usable building on it for $270,000. At the time of purchase, the fair market values of the land and building were $120,000 and $200,000, respectively. The gain from the purchase of the land and building is:

A) $0.

B) $50,000.

C) $80,000.

D) $320,000.

A) $0.

B) $50,000.

C) $80,000.

D) $320,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

14

Monroe Co. purchased a tract of land paying $100,000 in cash and assumed an existing mortgage of $60,000. The municipal tax bill disclosed an assessed valuation of $180,000. The amount Monroe should record as land connected with this acquisition is:

A) $100,000.

B) $160,000.

C) $180,000.

D) $200,000.

A) $100,000.

B) $160,000.

C) $180,000.

D) $200,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

15

The purpose of recording depreciation expense is to:

A) provide cash necessary to replace plant assets when they are used up.

B) record the balance sheet amount of plant assets at replacement value.

C) match expenses with revenues using a reasonable systematic method.

D) gain a better understanding of estimating the extraction of natural resources.

A) provide cash necessary to replace plant assets when they are used up.

B) record the balance sheet amount of plant assets at replacement value.

C) match expenses with revenues using a reasonable systematic method.

D) gain a better understanding of estimating the extraction of natural resources.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

16

Accumulated depreciation is an account which:

A) adjusts plant and equipment so that its balance sheet value approximates its replacement cost.

B) is a long-term liability.

C) is equal to total depreciation expense recorded and decreases total plant and equipment.

D) reduces intangible assets.

A) adjusts plant and equipment so that its balance sheet value approximates its replacement cost.

B) is a long-term liability.

C) is equal to total depreciation expense recorded and decreases total plant and equipment.

D) reduces intangible assets.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

17

Moss Company purchased a building costing $800,000 on January 1, 2010. Moss is depreciating the building over 80 years using the straight-line method with no salvage value. The economic life of the building is expected to be 40 years. As a result of Moss's accounting procedure, its 2010:

A) earnings per share is understated and debt/equity ratio is overstated.

B) earnings per share is understated and debt/equity ratio is understated.

C) earnings per share is overstated and debt/equity ratio is overstated.

D) earnings per share is overstated and debt/equity ratio is understated.

A) earnings per share is understated and debt/equity ratio is overstated.

B) earnings per share is understated and debt/equity ratio is understated.

C) earnings per share is overstated and debt/equity ratio is overstated.

D) earnings per share is overstated and debt/equity ratio is understated.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

18

The process of expensing the cost of patents over an extended period of years is referred to as:

A) classification.

B) depletion.

C) depreciation.

D) amortization.

A) classification.

B) depletion.

C) depreciation.

D) amortization.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following should be classified as land on the balance sheet?

A) A shed that houses the company's equipment.

B) Mineral rights representing gold in the soil

C) Two tracts of property that houses the company's backup computer site

D) Sidewalks and driveways which lead to the company's office building

A) A shed that houses the company's equipment.

B) Mineral rights representing gold in the soil

C) Two tracts of property that houses the company's backup computer site

D) Sidewalks and driveways which lead to the company's office building

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

20

A company which complains that although their income is quite satisfactory, cash is not available for dividends because of the high cost of replacing fixed assets in operating in an economic environment where:

A) inflation is non-existent.

B) the balance sheet value of long-lived assets is more than their replacement value.

C) the prices of long-lived assets have been decreasing over an extended period of time.

D) expenditures required to replace long-lived assets are greater than depreciation expense.

A) inflation is non-existent.

B) the balance sheet value of long-lived assets is more than their replacement value.

C) the prices of long-lived assets have been decreasing over an extended period of time.

D) expenditures required to replace long-lived assets are greater than depreciation expense.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1, 2010, Lane Company made a $12,000 expenditure on a fully depreciated machine. The expenditure increased the expected life of the new machine for two years until December 31, 2011. Lane uses straight-line depreciation with no salvage value. However, Lane erroneously expensed this capital expenditure. As a result of this error,

A) 2010 income is overstated by $3,000 and 2011 income is understated by $3,000.

B) 2010 income is understated by $6,000 and 2011 income is overstated by $6,000.

C) 2010 income is understated by $6,000 and 2011 income is overstated by $3,000.

D) 2010 income is understated by $6,000 and 2011 income is correctly stated.

A) 2010 income is overstated by $3,000 and 2011 income is understated by $3,000.

B) 2010 income is understated by $6,000 and 2011 income is overstated by $6,000.

C) 2010 income is understated by $6,000 and 2011 income is overstated by $3,000.

D) 2010 income is understated by $6,000 and 2011 income is correctly stated.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

22

Forgetting to record depreciation expense during 2010l:

A) understates the debt/equity ratio.

B) understates the current ratio.

C) overstates the debt/equity ratio.

D) overstates the current ratio.

A) understates the debt/equity ratio.

B) understates the current ratio.

C) overstates the debt/equity ratio.

D) overstates the current ratio.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

23

If the straight-line method of depreciation of an asset with a 5-year life expectancy and no salvage value is used, then the percentage of cost that is recognized as depreciation expense for the first two years of the asset's life is, respectively,

A) 25% and 25%.

B) 40% and 20%.

C) 40% and 40%.

D) 20% and 20%.

A) 25% and 25%.

B) 40% and 20%.

C) 40% and 40%.

D) 20% and 20%.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following will impact the amount of depreciation expensed throughout the life of plant assets?

A) The amount of capitalized cost.

B) Maintenance costs throughout the asset's useful life.

C) The expected cost of a replacement asset.

D) The current market value.

A) The amount of capitalized cost.

B) Maintenance costs throughout the asset's useful life.

C) The expected cost of a replacement asset.

D) The current market value.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

25

A machine was purchased on January 1 for $100,000. The machine has an estimated useful life of 4 years with a salvage value of $20,000. Under the straight-line method, accumulated depreciation at the end of year 2 is:

a. $25,000

b. $22,500

c. $50,000

d. $40,000

a. $25,000

b. $22,500

c. $50,000

d. $40,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of the following depreciation methods will typically result in the smallest amount of current taxes paid during the early periods of an asset's life?

A) 150% declining balance method.

B) Units of production method.

C) Double-declining-balance method.

D) Straight-line method.

A) 150% declining balance method.

B) Units of production method.

C) Double-declining-balance method.

D) Straight-line method.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the least problematic factor to determine when preparing to calculate depreciation?

A) useful life.

B) estimated salvage value.

C) technical obsolescence.

D) acquisition cost.

A) useful life.

B) estimated salvage value.

C) technical obsolescence.

D) acquisition cost.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

28

When companies construct their own long-lived assets, all costs required to get the asset into operating condition must be:

A) expensed immediately.

B) included in the long-lived asset's cost.

C) recognized as a maintenance cost.

D) treated as a cost necessary to maintain the plant asset's current level of productivity.

A) expensed immediately.

B) included in the long-lived asset's cost.

C) recognized as a maintenance cost.

D) treated as a cost necessary to maintain the plant asset's current level of productivity.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

29

The balance in accumulated depreciation on January 1 and December 31 is $12,000 and $9,000, respectively, during a year in which an asset with a cost of $4,000 and net book value of $0 was retired. Depreciation expense for the current year is:

A) $9,000.

B) $3,000.

C) $1,000.

D) $7,000.

A) $9,000.

B) $3,000.

C) $1,000.

D) $7,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following depreciation methods will typically result in the smallest earnings per share during the early periods of an asset's life?

A) 150% declining balance method.

B) Units of production method.

C) Double-declining-balance method.

D) Straight-line method.

A) 150% declining balance method.

B) Units of production method.

C) Double-declining-balance method.

D) Straight-line method.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

31

Kristin, Inc. depreciates its plant assets over a 10-year life with a 10% salvage value. Using straight-line depreciation, which calculation will Kristin use during year 2 of the asset's life?

A) 10% x (Cost - Salvage Value)

B) (Cost - Salvage Value)/10 x 10%

C) Book Value x 10%

D) Book Value x [10% - Salvage Value]

A) 10% x (Cost - Salvage Value)

B) (Cost - Salvage Value)/10 x 10%

C) Book Value x 10%

D) Book Value x [10% - Salvage Value]

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

32

Failure to record depreciation expense during a year:

A) understates net income.

B) overstates total assets.

C) overstates total debt.

D) overstates contributed capital.

A) understates net income.

B) overstates total assets.

C) overstates total debt.

D) overstates contributed capital.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

33

Which one of the costs below should be included as part of the cost of land?

A) Razing an old building.

B) Cost of a building permit.

C) Cost of driveways.

D) Shrubs and trees with limited lives.

A) Razing an old building.

B) Cost of a building permit.

C) Cost of driveways.

D) Shrubs and trees with limited lives.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

34

Salvage value is:

A) a method of depreciating plant assets.

B) the dollar amount that can be recovered when the asset is sold, traded, or scrapped.

C) an asset's current estimated market value.

D) a physical obsolescence condition.

A) a method of depreciating plant assets.

B) the dollar amount that can be recovered when the asset is sold, traded, or scrapped.

C) an asset's current estimated market value.

D) a physical obsolescence condition.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

35

A machine was purchased on January 1 for $100,000. The machine has an estimated useful life of 5 years with a salvage value of $10,000. Under the double-declining-balance method, depreciation expense for each of the first two years is, respectively,

a. $45,000 and $22,500.

b. $40,000 and $24,000.

c. $45,000 and $ 27,500.

d. $22,500 and $ 22,500.

a. $45,000 and $22,500.

b. $40,000 and $24,000.

c. $45,000 and $ 27,500.

d. $22,500 and $ 22,500.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

36

Which one of the following is not one of the questions asked when accounting for long-lived assets?

A) Over what period of time should this cost be allocated?

B) What dollar amount should be included in the capitalized cost of the long-lived asset?

C) At what rate should this cost be allocated?

D) How much will a replacement asset cost?

A) Over what period of time should this cost be allocated?

B) What dollar amount should be included in the capitalized cost of the long-lived asset?

C) At what rate should this cost be allocated?

D) How much will a replacement asset cost?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

37

Natural resource costs:

A) include rights, privileges, and benefits of an economic resource that have no physical existence.

B) are depreciated.

C) include the cost of the equipment used to extract the natural resource.

D) include the cost of acquiring the rights to extract natural resources.

A) include rights, privileges, and benefits of an economic resource that have no physical existence.

B) are depreciated.

C) include the cost of the equipment used to extract the natural resource.

D) include the cost of acquiring the rights to extract natural resources.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

38

Sandeep Inc. uses double-declining-balance depreciation for an asset with a 4-year life expectancy and no salvage value. Depreciation expense for the second year of the asset's life is calculated by:

A) [2 x Book Value]/4

B) [2 x (Cost - Salvage Value]/4

C) [(2 x Book Value)/4] - Accumulated Depreciation

D) [2 x Cost]/4

A) [2 x Book Value]/4

B) [2 x (Cost - Salvage Value]/4

C) [(2 x Book Value)/4] - Accumulated Depreciation

D) [2 x Cost]/4

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

39

A machine was purchased on January 1 for $50,000. The machine has an estimated useful life of 10 years with a salvage value of $2,000. Under the double-declining-balance, depreciation expense for each of the first two years is, respectively,

a. $12,000 and $12,000.

b. $10,000 and $8,000.

c. $12,000 and $9,500.

d. $12,500 and $12,500.

a. $12,000 and $12,000.

b. $10,000 and $8,000.

c. $12,000 and $9,500.

d. $12,500 and $12,500.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

40

A machine was purchased on January 1 for $100,000. The machine has an estimated useful life of 5 years with a salvage value of $20,000. Under the straight-line method, the book value and the accumulated depreciation of the machine at the end of year two is respectively,

A) $60,000 and $40,000

B) $68,000 and $32,000

C) $40,000 and $60,000

D) $48,000 and $32,000

A) $60,000 and $40,000

B) $68,000 and $32,000

C) $40,000 and $60,000

D) $48,000 and $32,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

41

The calculation of a 'depreciation base' requires subtracting:

A) the salvage value from the asset's book value.

B) the asset's book value from its original cost.

C) the asset's salvage value from its capitalized cost.

D) accumulated depreciation from the asset's original cost.

A) the salvage value from the asset's book value.

B) the asset's book value from its original cost.

C) the asset's salvage value from its capitalized cost.

D) accumulated depreciation from the asset's original cost.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

42

Farmdale Company purchased three assets for $400,000. These assets have fair market values as follows:  If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?

A) $100,000

B) $120,000

C) $200,000

D) $80,000

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?A) $100,000

B) $120,000

C) $200,000

D) $80,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

43

Once a company establishes that an estimated useful life of a plant asset has changed significantly:

A) the plant asset must be disposed.

B) the change must be made for the current and future years.

C) a correcting journal entry must be made.

D) the previous year's financial statements must be corrected.

A) the plant asset must be disposed.

B) the change must be made for the current and future years.

C) a correcting journal entry must be made.

D) the previous year's financial statements must be corrected.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

44

Intangible assets differ from plant assets in that they:

A) are consumed in the current accounting period.

B) include prepaid expenses that extend beyond the current accounting period.

C) have no physical existence.

D) are matched against the revenue in the period the related revenue is recognized.

A) are consumed in the current accounting period.

B) include prepaid expenses that extend beyond the current accounting period.

C) have no physical existence.

D) are matched against the revenue in the period the related revenue is recognized.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

45

Farmdale Company purchased three assets for $400,000. These assets have fair market values as follows:  If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the land?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the land?

a. $75,000

b. $120,000

c. $200,000

d. $80,000

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the land?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the land? a. $75,000

b. $120,000

c. $200,000

d. $80,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

46

When a plant asset is traded in for a similar asset, the valuation of the new plant asset should be:

A) at the original cost of the old asset.

B) at the fair market value of the asset given up, or the asset received, whichever is more clearly evident.

C) at the replacement cost of the old asset.

D) at the value at which the new asset received was carried in the accounting records of the manufacturer.

A) at the original cost of the old asset.

B) at the fair market value of the asset given up, or the asset received, whichever is more clearly evident.

C) at the replacement cost of the old asset.

D) at the value at which the new asset received was carried in the accounting records of the manufacturer.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, Eagle Co. paid $65,000 for a new truck. It was estimated that the truck would be driven 300,000 miles during the next 5 years, at which time it would have a salvage value of $10,000. At the end of the first and second years, the odometer registered 55,000 and 115,000 miles, respectively. What is the book value of the truck using straight-line depreciation at the end of the second year?

A) $47,000

B) $43,000

C) $43,533

D) $56,000

A) $47,000

B) $43,000

C) $43,533

D) $56,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

48

The units of production method of depreciation:

A) allocates the cost of the long-lived asset based on an activity.

B) allocates an equal amount of plant asset cost to each accounting period.

C) is an accelerated method.

D) is used when an asset has no salvage value.

A) allocates the cost of the long-lived asset based on an activity.

B) allocates an equal amount of plant asset cost to each accounting period.

C) is an accelerated method.

D) is used when an asset has no salvage value.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

49

Which one of the following costs would be capitalized as an 'organizational cost'?

A) Goodwill

B) Underwriting a company's first stock issuance

C) Copyrights

D) None of the above

A) Goodwill

B) Underwriting a company's first stock issuance

C) Copyrights

D) None of the above

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

50

One primary reason management may choose a particular depreciation method is:

A) to save cash for the replacement of the plant asset.

B) to avoid violation of debt covenants tied to net income.

C) to decrease the cash flows of the company.

D) to hide judgment errors that managers have made during the accounting period.

A) to save cash for the replacement of the plant asset.

B) to avoid violation of debt covenants tied to net income.

C) to decrease the cash flows of the company.

D) to hide judgment errors that managers have made during the accounting period.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

51

Farmdale Company purchased three assets for $400,000. These assets have fair market values as follows:  If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the inventory?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the inventory?

A) $100,000

B) $120,000

C) $200,000

D) $80,000

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the inventory?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the inventory?A) $100,000

B) $120,000

C) $200,000

D) $80,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

52

When a plant asset is sold, its original cost and its:

A) market value must be removed from the accounting records.

B) accumulated depreciation must be removed from the accounting records.

C) salvage value must be expensed immediately.

D) related maintenance costs must be transferred to the income statement immediately.

A) market value must be removed from the accounting records.

B) accumulated depreciation must be removed from the accounting records.

C) salvage value must be expensed immediately.

D) related maintenance costs must be transferred to the income statement immediately.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

53

On February 1, 2008, James Co., which uses straight-line depreciation, purchased equipment for $88,000 with a useful life of 12 years and $4,000 salvage value. On February 1, 2012, the equipment was sold for $56,000. Which of the following would James recognize as a result of this disposition?

A) $7,000 loss

B) $4,000 loss

C) $4,000 gain

D) No gain or loss

A) $7,000 loss

B) $4,000 loss

C) $4,000 gain

D) No gain or loss

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

54

Land and a building were purchased for $240,000. A reliable market value of the land is $75,000 and for the building, $225,000. What are the respective separate costs assigned to the land and building?

A) $75,000 and $225,000

B) $75,000 and $165,000

C) $60,000 and $180,000

D) $80,000 and $160,000

A) $75,000 and $225,000

B) $75,000 and $165,000

C) $60,000 and $180,000

D) $80,000 and $160,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

55

Jeter Inc. acquired machinery on January 1, 2004 at a cost of $55,000. The machinery was depreciated over five years using the straight line method and a salvage value of $2,000. In 2010 the machinery was sold for $3,000. The income statement for 2010 will reflect which of the following:

A) Gain of $1,000

B) Gain of $3,000

C) Loss of $52,000

D) No gain or loss

A) Gain of $1,000

B) Gain of $3,000

C) Loss of $52,000

D) No gain or loss

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

56

During 2009, Erie Inc. developed a new process for packaging products. Erie paid its employees $450,000 over the past five years in developing this process. On January 1, 2009, Erie paid $12,000 to register the packaging patent. The company believes the patent will produce profits for 10 years. The patent has a 17-year legal life. How much amortization expense should be recognized during 2009?

a. $27,118

b. $46,200

c. $1,200

d. $647

a. $27,118

b. $46,200

c. $1,200

d. $647

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

57

Once a plant asset becomes fully depreciated, the:

A) asset may no longer be used.

B) asset may still be used.

C) asset should be retired.

D) cost of the asset must be removed from the accounting records.

A) asset may no longer be used.

B) asset may still be used.

C) asset should be retired.

D) cost of the asset must be removed from the accounting records.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

58

On December 1, Douglas Corp. purchased a tract of land for $285,000 to be used as a factory site. An old unusable building on the land was razed (torn down), and the salvaged materials from the demolition were sold. These cash expenditures and receipts and other costs incurred during December are as follows:  What would be the balance in Douglas's Land account on its December 31 balance sheet?

What would be the balance in Douglas's Land account on its December 31 balance sheet?

A) $285,000

B) $337,500

C) $340,500

D) $331,000

What would be the balance in Douglas's Land account on its December 31 balance sheet?

What would be the balance in Douglas's Land account on its December 31 balance sheet?A) $285,000

B) $337,500

C) $340,500

D) $331,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

59

On July 31, 2010, equipment is purchased for $66,000 with a 4-year life expectancy and salvage value of $5,000. If the double-declining-balance method is used, calculate depreciation expense for the year ending December 31, 2010.

a. $13,750

b. $12,708

c. $33,000

d. $31,000

a. $13,750

b. $12,708

c. $33,000

d. $31,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

60

On January 1, Mondale Co. paid $92,000 for a new truck. It was estimated that the truck would be driven 200,000 miles during the next 8 years, at which time it would have a salvage value of $7,000. At the end of the first three years, the odometer registered 27,000, 53,000, and 78,000 miles, respectively. What is the book value of the truck using the activity method of depreciation at the end of the third year?

A) $67,150

B) $24,850

C) $51,850

D) $58,850

A) $67,150

B) $24,850

C) $51,850

D) $58,850

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

61

The following items represent common post acquisition expenditures incurred on equipment. A. An overhaul to increase useful life of the equipment

B) Cost of a muffler to reduce equipment noise

C) Lubrication service

D) Costs of redesign to increase output

Identify which of these items are considered to be betterments.

A) A only

B) A, B, and D

C) A and D

D) A and B

B) Cost of a muffler to reduce equipment noise

C) Lubrication service

D) Costs of redesign to increase output

Identify which of these items are considered to be betterments.

A) A only

B) A, B, and D

C) A and D

D) A and B

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

62

Lincoln Co. purchased a piece of property (land and building) at a tax sale for $110,000. Reliable estimates of the fair market values of the land and building are $34,000 and $70,000, respectively. What is the gain that Lincoln Co. should record from this advantageous purchase?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

63

Land and a building were purchased for $90,000. A reliable market value of the land is $40,000 and for the building, $80,000. What are the separate costs assigned to the land and building?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

64

The following items represent common post acquisition expenditures incurred on equipment. A. Replacement of defective parts

B) Rewiring costs to increase operating speed

C) Painting costs

D) Repair of the major circuitry of the equipment

Identify which of these items are considered to be maintenance items.

A) A and C

B) C only

C) A, B, and C

D) A, C, and D

B) Rewiring costs to increase operating speed

C) Painting costs

D) Repair of the major circuitry of the equipment

Identify which of these items are considered to be maintenance items.

A) A and C

B) C only

C) A, B, and C

D) A, C, and D

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

65

Rio Grande Company purchased equipment on January 1, 2010 for $75,000. The estimated useful life of the equipment is 5 years, the salvage value is $10,000, and the company uses the double-declining balance method to depreciate fixed assets. How much depreciation would Rio Grande record for the fourth year of the equipment's use?

A) $6,480

B) $6,200

C) $5,616

D) $6,000

A) $6,480

B) $6,200

C) $5,616

D) $6,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

66

For each account listed in 1 through 12 below, identify which reporting section (a through d) each would appear on a company's financial statements. You may use each letter more than once or not at all.

_____ 1. Depreciation expense

_____ 1. Depreciation expense

_____ 2. Accumulated depreciation

_____ 3. Betterments

_____ 4. Oil reserve

_____ 5. Land

_____ 6. Organizational costs

_____ 7. Amortization expense

_____ 8. Total amortization since inception

_____ 9. Gain on sale of patent

_____ 10. Copyright

_____ 11. Patents

_____ 12. Goodwill

_____ 1. Depreciation expense

_____ 1. Depreciation expense_____ 2. Accumulated depreciation

_____ 3. Betterments

_____ 4. Oil reserve

_____ 5. Land

_____ 6. Organizational costs

_____ 7. Amortization expense

_____ 8. Total amortization since inception

_____ 9. Gain on sale of patent

_____ 10. Copyright

_____ 11. Patents

_____ 12. Goodwill

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

67

Apple Inc. purchased a used pickup truck with an advertised price of $18,900 for $17,000 cash. While Jeff, the CEO, was driving the truck to get supplies, he was stopped by a highway patrol woman and received a $50 speeding ticket and a warning for a nonfunctioning brake light. Jeff had failed to notice when this problem when he purchased the truck. If Jeff knew about the brake light condition, he would have paid only $16,500 for the car. The cost, not under warranty, of replacing the brake light was $50. Calculate the cost to be capitalized to the truck account.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

68

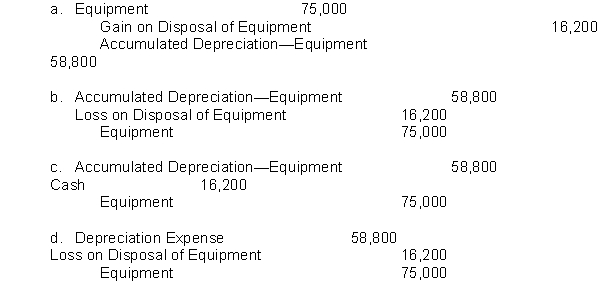

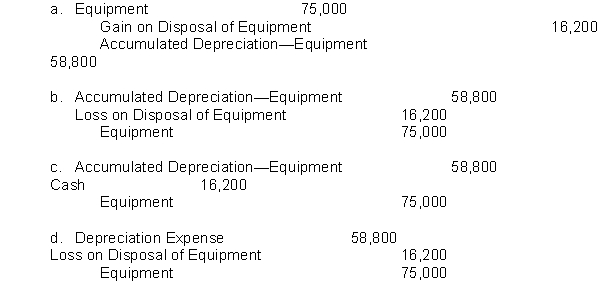

Rio Grande Company purchased equipment on January 1, 2010 for $75,000. The estimated useful life of the equipment is 5 years, the salvage value is $10,000, and the company uses the double-declining balance method to depreciate fixed assets. Which of the following journal entries would Rio Grande record if the equipment is scrapped after three years?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

69

Select the method of depreciation listed in a through c that is best for each purpose listed in items 1 through 5.

1. _______ Creates the largest net income in the early years of life

2. _______ Erratic due to unpredictable sales levels

3. _______ Creates the smallest taxable income in the early years of life

4. _______ Technological competitive changes are rapid

1. _______ Creates the largest net income in the early years of life

2. _______ Erratic due to unpredictable sales levels

3. _______ Creates the smallest taxable income in the early years of life

4. _______ Technological competitive changes are rapid

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

70

On December 1, Dominican Corp. purchased a tract of land for $325,000 to be used as a factory site. An old unusable building on the land was razed (torn down), and the salvaged materials from the demolition were sold. These cash expenditures and receipts and other costs incurred during December are as follows:

Calculate the balance in Dominican's Land account on its December 31 balance sheet.

Calculate the balance in Dominican's Land account on its December 31 balance sheet.

Calculate the balance in Dominican's Land account on its December 31 balance sheet.

Calculate the balance in Dominican's Land account on its December 31 balance sheet.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

71

For each transaction numbered 1 through 5 below, identify in which account listed in a through d it would be reported. You may use each letter more than once or not at all.

_____ 1. Freight charges related to the acquisition costs of a production machine

_____ 1. Freight charges related to the acquisition costs of a production machine

_____ 2. Interest costs incurred during the construction period of a building built by a company for its own use

_____ 3. Costs paid to clear land

_____ 4. Annual painting costs of an office building

_____ 5. Sales taxes paid related to a machine purchased

_____ 1. Freight charges related to the acquisition costs of a production machine

_____ 1. Freight charges related to the acquisition costs of a production machine_____ 2. Interest costs incurred during the construction period of a building built by a company for its own use

_____ 3. Costs paid to clear land

_____ 4. Annual painting costs of an office building

_____ 5. Sales taxes paid related to a machine purchased

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

72

On January 1, Hampton Company paid $48,000 for a new delivery truck. It was estimated that the truck would be driven 100,000 miles during the next 5 years, at which time it would have a salvage value of $3,000. During the first and second years, the odometer registered 22,000 and 40,000 miles, respectively. How much is accumulated depreciation using the activity (miles driven) method at the end of year 2?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

73

For each transaction numbered 1 through 6 below, identify its effects on the accounting equation by selecting from the effects listed in a through

f. You may use each letter more than once or not at all.

____ 1. Equipment is purchased by incurring a long-term mortgage payable and paying the balance in cash

____ 2. Paid for transportation of equipment shipped from the vendor to our plant

____ 3. Paid for speeding ticket received while transporting the equipment to the manufacturing plant

____ 4. Depreciated the equipment during the first year of use

____ 5. Paid for lubrication and periodic tune ups of the equipment

____ 6. Sold the equipment, receiving more money than its book value

f. You may use each letter more than once or not at all.

____ 1. Equipment is purchased by incurring a long-term mortgage payable and paying the balance in cash

____ 2. Paid for transportation of equipment shipped from the vendor to our plant

____ 3. Paid for speeding ticket received while transporting the equipment to the manufacturing plant

____ 4. Depreciated the equipment during the first year of use

____ 5. Paid for lubrication and periodic tune ups of the equipment

____ 6. Sold the equipment, receiving more money than its book value

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

74

For each cost that appears in items 1 through 6 below, select the account in which it would be included and reported from those listed in a through

c. You may use more than one answer for each cost. If the cost is not capitalized, place an X in the space provided.

_____ 1. Installation costs of a special attachment to newly acquired equipment

_____ 1. Installation costs of a special attachment to newly acquired equipment

_____ 2. Freight costs for shipping the equipment into our manufacturing facility

_____ 3. Costs of repairing a hole knocked in the wall during installation of new equipment

_____ 4. Interest costs on a mortgage loan used to purchase a newly acquired building

_____ 5. Property taxes paid on land for the current year on which a new building was erected

_____ 6. Training session to teach faculty how to use computer projection equipment recently installed in classrooms

c. You may use more than one answer for each cost. If the cost is not capitalized, place an X in the space provided.

_____ 1. Installation costs of a special attachment to newly acquired equipment

_____ 1. Installation costs of a special attachment to newly acquired equipment_____ 2. Freight costs for shipping the equipment into our manufacturing facility

_____ 3. Costs of repairing a hole knocked in the wall during installation of new equipment

_____ 4. Interest costs on a mortgage loan used to purchase a newly acquired building

_____ 5. Property taxes paid on land for the current year on which a new building was erected

_____ 6. Training session to teach faculty how to use computer projection equipment recently installed in classrooms

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

75

For each transaction numbered 1 through 5 below, identify which effect(s) (a through d) that each transaction would have on the current and debt/equity ratios. You may use each letter more than once or not at all. Some transactions have two answers.

____ 1. Equipment is purchased by incurring a long-term note payable and paying the balance in cash

____ 1. Equipment is purchased by incurring a long-term note payable and paying the balance in cash

____ 2. Paid for transportation of equipment shipped from a supplier

____ 3. Depreciated the equipment during the first year of use

____ 4. Paid for lubrication and periodic maintenance of the equipment

____ 5. Sold the equipment, receiving more money than its book value

____ 1. Equipment is purchased by incurring a long-term note payable and paying the balance in cash

____ 1. Equipment is purchased by incurring a long-term note payable and paying the balance in cash____ 2. Paid for transportation of equipment shipped from a supplier

____ 3. Depreciated the equipment during the first year of use

____ 4. Paid for lubrication and periodic maintenance of the equipment

____ 5. Sold the equipment, receiving more money than its book value

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

76

Rio Grande Company purchased equipment on January 1, 2009 for $75,000. The estimated useful life of the equipment is 5 years, the salvage value is $10,000, and the company uses the double-declining balance method to depreciate fixed assets. Which of the following would be included in the journal entry that Rio Grande would record at the end of the fifth year, if the equipment and $19,000 cash are traded for a dissimilar fixed asset with a FMV of $25,000?

A) A credit to Fixed Assets for $25,000.

B) A credit to Equipment for $10,000.

C) A credit to Gain on Disposal of Equipment for $4,000.

D) A debit to Loss on Disposal of Equipment for $4,000.

A) A credit to Fixed Assets for $25,000.

B) A credit to Equipment for $10,000.

C) A credit to Gain on Disposal of Equipment for $4,000.

D) A debit to Loss on Disposal of Equipment for $4,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

77

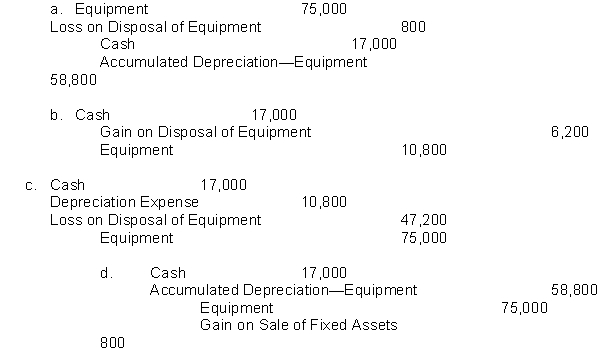

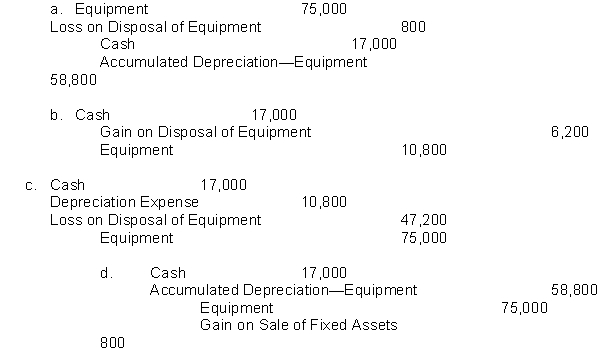

Rio Grande Company purchased equipment on January 1, 2010 for $75,000. The estimated useful life of the equipment is 5 years, the salvage value is $10,000, and the company uses the double-declining balance method to depreciate fixed assets. Which of the following journal entries would Rio Grande record if the equipment is sold for $17,000 after three years?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

78

Rio Grande Company purchased equipment on January 1, 2010 for $75,000. The estimated useful life of the equipment is 5 years, the salvage value is $10,000, and the company uses the double-declining balance method to depreciate fixed assets. Which of the following journal entries would Rio Grande record if the equipment is scrapped after five years?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

79

For each transaction numbered 1 through 6 below, identify which accounting treatment-capitalized or expensed-should be used to properly account for the transactions. You may use each letter more than once or not at all.

______1. Freight costs on production equipment in transit

______1. Freight costs on production equipment in transit

______2. Sales tax on equipment purchase

______3. Damaged during installation and repair costs

______4. Interest paid on construction loan during the building period

______5. Survey costs by contractor

______6. Construction insurance to cover theft or vandalism during building construction

______1. Freight costs on production equipment in transit

______1. Freight costs on production equipment in transit______2. Sales tax on equipment purchase

______3. Damaged during installation and repair costs

______4. Interest paid on construction loan during the building period

______5. Survey costs by contractor

______6. Construction insurance to cover theft or vandalism during building construction

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

80

Arnez Company purchased a building and equipment for $110,000. Although a reliable market value of the building could not be determined, the equipment's market value is $70,000. What are the separate costs assigned to the building and equipment?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck