Deck 3: The Measurement Fundamentals of Financial Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 3: The Measurement Fundamentals of Financial Accounting

1

Recognition of increases in purchasing power of monetary units is inconsistent with the:

A) economic entity assumption.

B) going concern assumption.

C) consistency principle.

D) stable dollar assumption.

A) economic entity assumption.

B) going concern assumption.

C) consistency principle.

D) stable dollar assumption.

D

2

Which one of the following statements best describes the concept of consistency?

A) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

B) Accounting numbers are consistently market value.

C) Different firms use identical accounting measurement methods for similar events.

D) Similar events are measured using identical accounting procedures from period to period.

A) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

B) Accounting numbers are consistently market value.

C) Different firms use identical accounting measurement methods for similar events.

D) Similar events are measured using identical accounting procedures from period to period.

D

3

A company prepares financial statements once every year. What practice does this assumption illustrate?

A) Going concern assumption

B) Fiscal period assumption

C) The five-year moving theory

D) Stable dollar assumption

A) Going concern assumption

B) Fiscal period assumption

C) The five-year moving theory

D) Stable dollar assumption

B

4

By recognizing the economic effects of inflation on the accounting financial statements, which accounting assumption is ignored?

A) Economic entity assumption

B) Going concern assumption

C) Stable dollar assumption

D) Fiscal period assumption

A) Economic entity assumption

B) Going concern assumption

C) Stable dollar assumption

D) Fiscal period assumption

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

Today's fair market value would be the same as:

A) the cash price of the asset when it was originally purchased.

B) the current price paid for an item in the input market.

C) the value of an item in the output market or sales price.

D) the discounted future cash flows from input and output markets.

A) the cash price of the asset when it was originally purchased.

B) the current price paid for an item in the input market.

C) the value of an item in the output market or sales price.

D) the discounted future cash flows from input and output markets.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following is violated when a firm measures property, plant, and equipment at its estimated selling price?

A) Objectivity

B) Economic entity assumption

C) Materiality

D) Input markets

A) Objectivity

B) Economic entity assumption

C) Materiality

D) Input markets

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following statements best describes objectivity?

A) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

B) The measurement of an event is verifiable and reliable.

C) Different firms use identical accounting measurement methods for similar events.

D) Objectives are laid out that are conservative or too aggressive by management.

A) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

B) The measurement of an event is verifiable and reliable.

C) Different firms use identical accounting measurement methods for similar events.

D) Objectives are laid out that are conservative or too aggressive by management.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Expensing the cost of a pencil holder that cost $1.25 instead of capitalizing it as a plant asset and depreciating it over its estimated useful life of 10 years:

A) violates the economic entity assumption.

B) violates GAAP since pencil holders are important assets.

C) is justified because of materiality.

D) is appropriate because of the stable dollar assumption.

A) violates the economic entity assumption.

B) violates GAAP since pencil holders are important assets.

C) is justified because of materiality.

D) is appropriate because of the stable dollar assumption.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

The valuation basis used to measure short-term investments is:

A) fair market value.

B) replacement cost.

C) original cost.

D) present value.

A) fair market value.

B) replacement cost.

C) original cost.

D) present value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

The valuation basis used to measure long-term liabilities is:

A) present value.

B) replacement cost.

C) fair market value.

D) historical cost.

A) present value.

B) replacement cost.

C) fair market value.

D) historical cost.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

Ten years after a company purchases a plot of land, it is measured on the balance sheet at its cost from the year it was purchased instead of its current selling price. This accounting practice is justified by the:

A) financial period assumption.

B) going concern assumption.

C) fiscal period assumption.

D) original cost base.

A) financial period assumption.

B) going concern assumption.

C) fiscal period assumption.

D) original cost base.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Present value, as of today, would be the same as:

A) the cash price of the asset when it was purchased.

B) the present price of any given product or service.

C) the selling price.

D) the discounted value of future cash flows.

A) the cash price of the asset when it was purchased.

B) the present price of any given product or service.

C) the selling price.

D) the discounted value of future cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

Original cost may be defined as the:

A) cash price of the asset when purchased.

B) discounted future cash flows.

C) selling price.

D) price you bought the item for when it was first released for consumer sales.

A) cash price of the asset when purchased.

B) discounted future cash flows.

C) selling price.

D) price you bought the item for when it was first released for consumer sales.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Net realizable value is:

A) the input price of liabilities.

B) a form of market value.

C) a present value concept.

D) the current input cost.

A) the input price of liabilities.

B) a form of market value.

C) a present value concept.

D) the current input cost.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Which assumption is applied when Laramie recognizes the operations of its wholly owned subsidiary, Big Sky, separately and distinctly from its own operations?

A) Economic entity assumption

B) Going concern assumption

C) Fiscal period assumption

D) The subsidiary stability assumption

A) Economic entity assumption

B) Going concern assumption

C) Fiscal period assumption

D) The subsidiary stability assumption

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

When preparing the financial statements, we assume that the life of the entity will continue beyond the current period. Which assumption are we most likely following?

A) Stable dollar theory.

B) Going concern assumption.

C) Economic entity assumption.

D) Fiscal period assumption.

A) Stable dollar theory.

B) Going concern assumption.

C) Economic entity assumption.

D) Fiscal period assumption.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

The shareholders' equity section of the balance sheet is:

A) a residual interest based on the book value of the company.

B) the amount for which the owner could sell the company.

C) valued at the present value of the dividends paid to shareholders.

D) the difference between the fair market value and the original cost of the company's assets.

A) a residual interest based on the book value of the company.

B) the amount for which the owner could sell the company.

C) valued at the present value of the dividends paid to shareholders.

D) the difference between the fair market value and the original cost of the company's assets.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following is violated when a firm has a policy of accelerating the recognition of depreciation expense during good years and decreasing depreciation expense during lean years?

A) Relevance

B) Matching

C) Consistency

D) Conservatism

A) Relevance

B) Matching

C) Consistency

D) Conservatism

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

The valuation basis used to measure accounts payable is:

A) fair value.

B) replacement cost.

C) face value.

D) present value.

A) fair value.

B) replacement cost.

C) face value.

D) present value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

Most companies prepare annual financial statements:

A) with a fiscal ending date of June 30.

B) on the calendar year.

C) at a different date each year.

D) every two weeks.

A) with a fiscal ending date of June 30.

B) on the calendar year.

C) at a different date each year.

D) every two weeks.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Which one of the following reflects the proper inventory valuation on a company's balance sheet?

A) Lower of original cost or face value

B) Net realizable value

C) Lower of cost or market

D) Expected selling price

A) Lower of original cost or face value

B) Net realizable value

C) Lower of cost or market

D) Expected selling price

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following statements best describes the concept of conservatism?

A) Profits should be accelerated in all cases.

B) The measurement of an event is verifiable and reliable.

C) The value of goods and services provided is recognized when earned.

D) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

A) Profits should be accelerated in all cases.

B) The measurement of an event is verifiable and reliable.

C) The value of goods and services provided is recognized when earned.

D) When uncertainty exists, understating assets, overstating liabilities, accelerating recognition of losses, and delaying recognition of gains is preferred.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following is violated when a company pays for its CEO's personal groceries using the company's bank account?

A) Stable dollar

B) Economic entity

C) Going concern

D) Ethical principle of accounting

A) Stable dollar

B) Economic entity

C) Going concern

D) Ethical principle of accounting

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following are exceptions to financial accounting measurement?

A) Consistency and conservatism

B) Objectivity and materiality

C) Going concern and materiality

D) Conservatism and materiality

A) Consistency and conservatism

B) Objectivity and materiality

C) Going concern and materiality

D) Conservatism and materiality

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

The valuation basis used to measure equipment and other plant assets on the balance sheet is:

A) the dollar amount for which the assets can be sold.

B) the cash expected to be received in the future.

C) the original cost adjusted for depreciation.

D) the assets' net realizable value.

A) the dollar amount for which the assets can be sold.

B) the cash expected to be received in the future.

C) the original cost adjusted for depreciation.

D) the assets' net realizable value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

A business entity operates in two general markets. They are:

A) a producer and a consumer market.

B) an economic and a fiscal market.

C) an input and an output market.

D) a profit and a non-profit market.

A) a producer and a consumer market.

B) an economic and a fiscal market.

C) an input and an output market.

D) a profit and a non-profit market.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following is violated when a sole proprietor records its magazine stand at the present value of the cash flows expected to be earned from the sale of magazine over the expected life of the stand?

A) Original cost

B) Fair market value

C) Going concern

D) Revenue recognition

A) Original cost

B) Fair market value

C) Going concern

D) Revenue recognition

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Which one of the following is violated when a firm reports its long-term debt at the present value of the cash flows associated with that debt?

A) Matching

B) No violations occurred. This accounting is correct.

C) Revenue recognition

D) Gross value of the debt

A) Matching

B) No violations occurred. This accounting is correct.

C) Revenue recognition

D) Gross value of the debt

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

As fiscal periods become shorter, the application of certain accounting methods become:

A) more arbitrary and subjective.

B) more objective.

C) more accurate.

D) more conservative.

A) more arbitrary and subjective.

B) more objective.

C) more accurate.

D) more conservative.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following is violated when a department store records revenue for gift certificates sold to customers that are not expected to be redeemed until next year?

A) Matching

B) Revenue recognition criteria

C) Going concern

D) Expense versus revenue concept

A) Matching

B) Revenue recognition criteria

C) Going concern

D) Expense versus revenue concept

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

The valuation basis used to measure accounts receivable is:

A) the original cost of the goods sold.

B) current input cost

C) net realizable value.

D) replacement cost.

A) the original cost of the goods sold.

B) current input cost

C) net realizable value.

D) replacement cost.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Which one of the following is violated when a firm measures accounts receivable at its face amount even though knowing some customers may not pay the amounts due?

A) Consistency

B) Conservatism

C) Materiality

D) Revenue recognition criteria

A) Consistency

B) Conservatism

C) Materiality

D) Revenue recognition criteria

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Why must measures of performance and financial position be available on a timely basis?

A) For the users of the financial information to make decisions

B) For the SEC to determine whether the company should be shut down or not

C) FASB requires this information to be submitted to them for approval

D) For management to have time to manipulate income

A) For the users of the financial information to make decisions

B) For the SEC to determine whether the company should be shut down or not

C) FASB requires this information to be submitted to them for approval

D) For management to have time to manipulate income

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

The fiscal period assumption states that the operating life of an economic entity:

A) is generally for a period of one year.

B) can be any period management decides it to be.

C) must be an entity separately distinct from its owners.

D) can be divided into time periods over which measures can be developed and applied.

A) is generally for a period of one year.

B) can be any period management decides it to be.

C) must be an entity separately distinct from its owners.

D) can be divided into time periods over which measures can be developed and applied.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

Which one of the following is violated when a retail store records revenue for a bank credit card sale prior to receiving the money from the bank?

A) No violation occurred

B) Objectivity

C) Going concern

D) Revenue recognition criteria

A) No violation occurred

B) Objectivity

C) Going concern

D) Revenue recognition criteria

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Which one of the following is most likely violated if firm increases the dollar amount reported for unsold inventory on the balance sheet to a cost it anticipates it will have to pay for future inventory items?

A) Consistency

B) Conservatism

C) Going concern

D) Economic entity

A) Consistency

B) Conservatism

C) Going concern

D) Economic entity

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

The stable dollar assumption assumes that:

A) the monetary unit is the functional currency of any country in which a company operates.

B) inflationary effects should be recognized in the financial statements

C) economic wealth is not measurable.

D) the monetary unit is stable across time.

A) the monetary unit is the functional currency of any country in which a company operates.

B) inflationary effects should be recognized in the financial statements

C) economic wealth is not measurable.

D) the monetary unit is stable across time.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

Technically, the valuation basis used to measure shareholders' equity is:

A) original cost adjusted to net book value.

B) replacement value.

C) net realizable value.

D) None of these.

A) original cost adjusted to net book value.

B) replacement value.

C) net realizable value.

D) None of these.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following is violated when a company recognizes revenue upon the receipt of cash from a customer who has paid in advance for services?

A) Expense policy

B) Objectivity

C) Matching

D) Revenue recognition criteria

A) Expense policy

B) Objectivity

C) Matching

D) Revenue recognition criteria

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following is violated when a company records cost of goods sold expense at the time when inventory is purchased?

A) Relevance

B) Historical cost

C) Matching

D) Revenue recognition criteria

A) Relevance

B) Historical cost

C) Matching

D) Revenue recognition criteria

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

Jeter Company ordered 400 toy wagons from Lamar, Inc. on May 1, 2010. Jeter Company paid for them on May 20 at a cost of $2 each. Jeter sold 50 of them on June 2, 2010, for $4 each to Gilloz Company. Gilloz Company paid Jeter on June 10. How much revenue should Jeter Company recognize at the preferred point of revenue recognition?

A) $240

B) $100

C) $1,000

D) $200

A) $240

B) $100

C) $1,000

D) $200

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Seinfeld Company has land with an original cost of $68,000 and a fair market value of $81,000. Seinfeld has considered selling its business next year and listing the land with a realtor for $100,000. At what amount would land be measured on the December 31, 2010 balance sheet?

A) $100,000

B) $81,000

C) $15,000

D) $68,000

A) $100,000

B) $81,000

C) $15,000

D) $68,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

When in doubt, financial statements should:

A) understate assets, overstate liabilities, delay the recognition of gains, and accelerate the recognition of losses.

B) understate assets and liabilities and delay the recognition of gains and losses.

C) understate assets, overstate liabilities, and delay the recognition of gains and losses.

D) overstate assets and understate liabilities.

A) understate assets, overstate liabilities, delay the recognition of gains, and accelerate the recognition of losses.

B) understate assets and liabilities and delay the recognition of gains and losses.

C) understate assets, overstate liabilities, and delay the recognition of gains and losses.

D) overstate assets and understate liabilities.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following represents two of the four criteria that must be met before revenue can be included in the income statement?

A) The amount of revenue must be objectively measurable and the cash must be collected.

B) The company elects to record the revenue and the cash for payment is relatively certain.

C) The company must intend to transfer the goods or services to the buyer and the collection of cash must be reasonably assured.

D) The collection of cash must be reasonably assured and the amount of revenue can be objectively measured.

A) The amount of revenue must be objectively measurable and the cash must be collected.

B) The company elects to record the revenue and the cash for payment is relatively certain.

C) The company must intend to transfer the goods or services to the buyer and the collection of cash must be reasonably assured.

D) The collection of cash must be reasonably assured and the amount of revenue can be objectively measured.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

Jeter Company ordered 400 toy wagons from Lamar, Inc. on May 1, 2010. Jeter Company paid for them on May 20 at a cost of $2 each. Jeter sold 50 of them on June 2, 2010, for $4 each to Gilloz Company. Gilloz Company paid Jeter on June 10. Which amount represents Jeter Company's input markets related to this sale?

A) $300

B) $800

C) $1,600

D) $250

A) $300

B) $800

C) $1,600

D) $250

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Information is considered material if:

A) it would have a bearing on decisions of those who use the financial statements.

B) there is a substantial likelihood that a reasonable investor would not be concerned about the information.

C) an item is so insignificant that users would likely ignore it.

D) the FASB explicitly rules the transaction or item to be material.

A) it would have a bearing on decisions of those who use the financial statements.

B) there is a substantial likelihood that a reasonable investor would not be concerned about the information.

C) an item is so insignificant that users would likely ignore it.

D) the FASB explicitly rules the transaction or item to be material.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following is considered an unrealistic assumption in accounting?

A) Economic entity

B) Stable dollar

C) Going concern

D) Fiscal period concept

A) Economic entity

B) Stable dollar

C) Going concern

D) Fiscal period concept

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

The matching principle states that:

A) expenses should be recognized in the period that the related revenue is recognized.

B) after expenses have been identified in a particular accounting period in which they were incurred, revenues can be recognized.

C) each company should use the same accounting principles as other companies use.

D) for every dollar of revenue recognized, the company should recognize a corresponding dollar of expenses.

A) expenses should be recognized in the period that the related revenue is recognized.

B) after expenses have been identified in a particular accounting period in which they were incurred, revenues can be recognized.

C) each company should use the same accounting principles as other companies use.

D) for every dollar of revenue recognized, the company should recognize a corresponding dollar of expenses.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Short-term investments have an original cost of $29,000 and a market price of $31,000 at December 31, 2010. At what amount would the investments be measured on the December 31, 2010 balance sheet?

A) $29,000

B) $31,000

C) ($2,000)

D) $2,000

A) $29,000

B) $31,000

C) ($2,000)

D) $2,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

The principle of consistency states that:

A) companies should choose a set of accounting methods and use them from one period to the next.

B) once a company selects an accounting method, it must use that method throughout the company's entire existence.

C) a company may change any accounting method, provided the SEC approves the change.

D) companies should elect to use methods that consistently inflate profits.

A) companies should choose a set of accounting methods and use them from one period to the next.

B) once a company selects an accounting method, it must use that method throughout the company's entire existence.

C) a company may change any accounting method, provided the SEC approves the change.

D) companies should elect to use methods that consistently inflate profits.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

Objective accounting information:

A) cannot be used in the financial statements.

B) requires that values of transactions and related assets and liabilities created by them be arbitrarily determined.

C) ensures that revenue matches expenses for every accounting period.

D) states that financial accounting information must be reliable and verifiable.

A) cannot be used in the financial statements.

B) requires that values of transactions and related assets and liabilities created by them be arbitrarily determined.

C) ensures that revenue matches expenses for every accounting period.

D) states that financial accounting information must be reliable and verifiable.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

Jeter Company ordered 400 toy wagons from Lamar, Inc. on May 1, 2010. Jeter Company paid for them on May 20 at a cost of $2 each. Jeter sold 50 of them on June 2, 2010, for $4 each to Gilloz Company. Gilloz Company paid Jeter on June 10. On which date should Jeter Company recognize revenue?

A) May 1

B) May 20

C) June 10

D) June 2

A) May 1

B) May 20

C) June 10

D) June 2

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Why would a company recognize the cost of an asset on its balance sheet rather than treat it as an expense on the date it is acquired?

A) Conservatism requires this recognition.

B) Matching requires costs to be matched against the related revenues of the asset.

C) Strictly to record the amount in the most economically favorable manner possible for the company.

D) The stable dollar concept will not allow inflation to be added to expenses, but does allow inflation to be added to assets.

A) Conservatism requires this recognition.

B) Matching requires costs to be matched against the related revenues of the asset.

C) Strictly to record the amount in the most economically favorable manner possible for the company.

D) The stable dollar concept will not allow inflation to be added to expenses, but does allow inflation to be added to assets.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Morgan Shipping held cash of $1 million throughout 2010 when the general price level decreased by over 30 percent. Morgan Shipping:

A) has more than $1 million of purchasing power at the end of the period.

B) has less than $1 million purchasing power at the end of the period.

C) must recognize the gain due to general price level increases in its income statement.

D) has the same $1 million purchasing power at the end of the period as at the beginning of the period.

A) has more than $1 million of purchasing power at the end of the period.

B) has less than $1 million purchasing power at the end of the period.

C) must recognize the gain due to general price level increases in its income statement.

D) has the same $1 million purchasing power at the end of the period as at the beginning of the period.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Equipment with an original cost of $39,000 has a fair market value of $34,000, current replacement cost of $41,000, and a depreciated value of $36,000 on December 31, 2010. At what amount would net equipment be measured on the December 31, 2010 balance sheet?

A) $38,000

B) $36,000

C) $41,000

D) $34,000

A) $38,000

B) $36,000

C) $41,000

D) $34,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

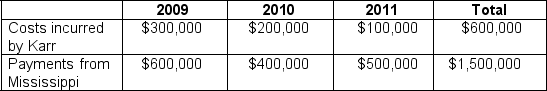

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:  If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

A) $600,000; $400,000; $500,000

B) $300,000; $200,000; $400,000

C) $400,000; $400,000; $400,000

D) $300,000; $200,000; $100,000

If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?A) $600,000; $400,000; $500,000

B) $300,000; $200,000; $400,000

C) $400,000; $400,000; $400,000

D) $300,000; $200,000; $100,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

Sheena Company has accounts receivable of $13,000, with an estimated net realizable value of $12,000 on December 31, 2010. At what amount would the accounts receivable be measured on the December 31, 2010 balance sheet?

A) $1,000

B) $13,000

C) $12,000

D) ($1,000)

A) $1,000

B) $13,000

C) $12,000

D) ($1,000)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

The most common point of revenue recognition is:

A) when the cash is collected from the customer.

B) when the customer elects to issue the check to pay for goods shipped.

C) when the goods are delivered to the customer.

D) as the goods are being produced.

A) when the cash is collected from the customer.

B) when the customer elects to issue the check to pay for goods shipped.

C) when the goods are delivered to the customer.

D) as the goods are being produced.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Everett, Inc.'s reporting period ends on June 30th every year. This is an example of:

A) matching.

B) fiscal period.

C) materiality.

D) relevance.

A) matching.

B) fiscal period.

C) materiality.

D) relevance.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

The monetary unit that a company uses to measure economic transactions is primarily determined by the:

A) stable dollar concept adjusted for inflationary effects.

B) markets in which a company operates.

C) fiscal period a company has chosen.

D) decision by management to elect to use a given currency.

A) stable dollar concept adjusted for inflationary effects.

B) markets in which a company operates.

C) fiscal period a company has chosen.

D) decision by management to elect to use a given currency.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Equipment with an original cost of $50,000 has a fair market value of $65,000 and accumulated depreciation of $15,000 on December 31, 2010. What amount would the December 31, 2010 balance sheet show as the equipment's net book value?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

For each financial statement item listed in 1 through 5 below, identify the financial statement valuation (listed in a through h) at which it should be reported. You may use each letter more than once or not at all.  ____ 1. Cash

____ 1. Cash

____ 2. Short-term investments

____ 3. Accounts receivable

____ 4. Long-term liabilities

____ 5. Office building

____ 1. Cash

____ 1. Cash____ 2. Short-term investments

____ 3. Accounts receivable

____ 4. Long-term liabilities

____ 5. Office building

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

Three years ago, Astro Masters, Inc. purchased the three assets listed in the following table. The chief financial officer, Bill Moss, is presently trying to decide what to do with each asset. He has three options for each asset: (1) sell it; (2) keep it; and (3) sell it and replace it with an equivalent asset. The following information is provided to aid his decision.

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset A?

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset A?

a. Option 1

b. Option 2

c. Option 3

d. Both Options 2 & 3 provide the same total cash flows.

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset A?

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset A? a. Option 1

b. Option 2

c. Option 3

d. Both Options 2 & 3 provide the same total cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

Match the descriptions listed in letters a through e below with the proper valuation numbered from 1 through 4.

____ 1. Present value

____ 1. Present value

____ 2. Fair market value

____ 3. Replacement cost

____ 4. Residual interest

____ 1. Present value

____ 1. Present value____ 2. Fair market value

____ 3. Replacement cost

____ 4. Residual interest

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

On December 1, 2010, Karr Company purchased inventory for $55,000. On December 31, 2010, the replacement cost of that inventory is $57,000. At what amount would inventory be measured on the December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Three years ago, Astro Masters, Inc. purchased the three assets listed in the following table. The chief financial officer, Bill Moss, is presently trying to decide what to do with each asset. He has three options for each asset: (1) sell it; (2) keep it; and (3) sell it and replace it with an equivalent asset. The following information is provided to aid his decision.

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset B?

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset B?

a. Option 1

b. Option 2

c. Option 3

d. Both Options 2 & 3 provide the same total cash flows.

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset B?

Based on your calculations of total cash flows, which of the following options is the best for Bill to pursue with respect to Asset B? a. Option 1

b. Option 2

c. Option 3

d. Both Options 2 & 3 provide the same total cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

On December 31, 2010, total assets and liabilities are measured at $16,000 and $12,000, respectively. The total market value of the company's common stock is $7,000. At what amount would shareholders' equity be measured on the December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Three years ago, Astro Masters, Inc. purchased the three assets listed in the following table. The chief financial officer, Bill Moss, is presently trying to decide what to do with each asset. He has three options for each asset: (1) sell it; (2) keep it; and (3) sell it and replace it with an equivalent asset. The following information is provided to aid his decision.  On December 31, 2009, just before preparing the company's financial statements, Bill decides to replace Asset A and keep both Assets B and C. According to generally accepted accounting principles, at what dollar amount he report each of these respective assets on the balance sheet?

On December 31, 2009, just before preparing the company's financial statements, Bill decides to replace Asset A and keep both Assets B and C. According to generally accepted accounting principles, at what dollar amount he report each of these respective assets on the balance sheet?

A) $4,500; $2,000; $2,500

B) $1,500; $2,000; $2,500

C) $2,000; $1,000; $3,500

D) $1,500; $2,500; $4,000

On December 31, 2009, just before preparing the company's financial statements, Bill decides to replace Asset A and keep both Assets B and C. According to generally accepted accounting principles, at what dollar amount he report each of these respective assets on the balance sheet?

On December 31, 2009, just before preparing the company's financial statements, Bill decides to replace Asset A and keep both Assets B and C. According to generally accepted accounting principles, at what dollar amount he report each of these respective assets on the balance sheet?A) $4,500; $2,000; $2,500

B) $1,500; $2,000; $2,500

C) $2,000; $1,000; $3,500

D) $1,500; $2,500; $4,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

Short-term investments have an original cost of $2,500 and a market price of $3,000 at December 31, 2010. At what amount would the investments be measured on the December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Match the descriptions listed in letters a through e below with the proper assumption numbered from 1 through 4 below.

____ 1. Economic entity assumption

____ 1. Economic entity assumption

____ 2. Stable dollar assumption

____ 3. Going concern assumption

____ 4. Fiscal period assumption

____ 1. Economic entity assumption

____ 1. Economic entity assumption____ 2. Stable dollar assumption

____ 3. Going concern assumption

____ 4. Fiscal period assumption

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

During 2010, Hamot Company sold $30,000 of computer chips to a distributor on account. The distributor planned to sell those chips to a German company. The sold chips were shipped to a warehouse owned by Hamot and were still there on December 31, 2010. Hamot's CFO left two messages for the distributor but received no return calls. The distributor has had no prior dealings with Hamot or any other manufacturer of computer chips. None of the past due balance of $30,000 has been paid. How much sales revenue associated with this transaction would be reported on the income statement for the year ending December 31, 2010? Explain your selection.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

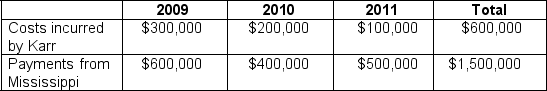

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010?

a. $100,000

b. $200,000

c. $300,000

d. $400,000

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010? a. $100,000

b. $200,000

c. $300,000

d. $400,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

During January of 2010, Barry Corporation purchased five acres of land for cash of $110,000 from Foley Company. On December 31, 2010, after Barry built its plant, it was estimated that the land's fair market value was $140,000. At what amount would land be measured on Barry's December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011?

a. $600,000

b. $400,000

c. $300,000

d. $150,000

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2011? a. $600,000

b. $400,000

c. $300,000

d. $150,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

For each financial concept listed in 1 through 5 below, identify in which category (listed in a through f) it should be matched. You may use each letter more than once or not at all.

____ 1. Comparability

____ 1. Comparability

____ 2. Objectivity

____ 3. Revenue recognition criteria

____ 4. Matching concept

____ 5. Consistency

____ 1. Comparability

____ 1. Comparability____ 2. Objectivity

____ 3. Revenue recognition criteria

____ 4. Matching concept

____ 5. Consistency

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

For each financial statement item listed in 1 through 5 below, identify at which financial statement valuation (listed in a through g) the item should be reported. You may use each letter more than once or not at all.

____ 1. Inventory

____ 1. Inventory

____ 2. Plant and equipment (book value)

____ 3. Land used for plant site

____ 4. Current liabilities

____ 5. Long-term notes receivable

____ 1. Inventory

____ 1. Inventory____ 2. Plant and equipment (book value)

____ 3. Land used for plant site

____ 4. Current liabilities

____ 5. Long-term notes receivable

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Accounts receivable have a face value of $10,000 and estimated net realizable value of $8,000 on December 31, 2010. At what amount would the accounts receivable be measured on the December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Equipment with an original cost of $23,000 has a fair market value of $19,000, current replacement cost of $26,000, and a depreciated value of $20,000 on December 31, 2010. At what amount would net equipment be measured on the December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

On May 1, 2009, $9,000 of annual magazine subscriptions were sold by Glolar, Inc. The subscribed magazines are delivered on the first day of each month beginning on May 1, 2009. The total cost of the subscribed magazines is $3,600 or $300 per month.

A. Determine the amount of revenue during 2009.

B. Explain how the matching concept is applied relative to the magazines.

A. Determine the amount of revenue during 2009.

B. Explain how the matching concept is applied relative to the magazines.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

Three years ago, Astro Masters, Inc. purchased the three assets listed in the following table. The chief financial officer, Bill Moss, is presently trying to decide what to do with each asset. He has three options for each asset: (1) sell it; (2) keep it; and (3) sell it and replace it with an equivalent asset. The following information is provided to aid his decision.

Based on your calculations, what would be the total cash flows associated with selling and replacing Asset C with an equivalent asset?

Based on your calculations, what would be the total cash flows associated with selling and replacing Asset C with an equivalent asset?

a. $2,500

b. $5,500

c. $5,000

d. $4,500

Based on your calculations, what would be the total cash flows associated with selling and replacing Asset C with an equivalent asset?

Based on your calculations, what would be the total cash flows associated with selling and replacing Asset C with an equivalent asset? a. $2,500

b. $5,500

c. $5,000

d. $4,500

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck