Deck 13: Corporate Valuation, Value-Based Management, and Corporate Governance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 13: Corporate Valuation, Value-Based Management, and Corporate Governance

1

Zhdanov Inc. forecasts that its free cash flow in the coming year, i.e., at t = 1, will be -$10 million, but its FCF at t = 2 will be $20 million. After Year 2, FCF is expected to grow at a constant rate of 4% forever. If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions?

A) $158

B) $167

C) $175

D) $184

E) $193

A) $158

B) $167

C) $175

D) $184

E) $193

B

2

Which of the following is NOT normally regarded as being a good reason to establish an ESOP?

A) To increase worker productivity.

B) To enable the firm to borrow at a below-market interest rate.

C) To make it easier to grant stock options to employees.

D) To help prevent a hostile takeover.

E) To help retain valued employees.

A) To increase worker productivity.

B) To enable the firm to borrow at a below-market interest rate.

C) To make it easier to grant stock options to employees.

D) To help prevent a hostile takeover.

E) To help retain valued employees.

C

3

The CEO of D'Amico Motors has been granted some stock options that have provisions similar to most other executive stock options. If D'Amico's stock underperforms the market, these options will necessarily be worthless.

False

4

A poison pill is also known as a corporate restructuring.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose Yon Sun Corporation's free cash flow during the just-ended year (t = 0) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions?

A) $948

B) $998

C) $1,050

D) $1,103

E) $1,158

A) $948

B) $998

C) $1,050

D) $1,103

E) $1,158

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

ESOPs were originally designed to help improve worker productivity, but today they are also used to help prevent hostile takeovers.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

Simonyan Inc. forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5% thereafter. If the weighted average cost of capital is 10% and the cost of equity is 15%, what is the horizon value, in millions at t = 3?

A) $840

B) $882

C) $926

D) $972

E) $1,021

A) $840

B) $882

C) $926

D) $972

E) $1,021

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

If a company's expected return on invested capital is less than its cost of equity, then the company must also have a negative market value added (MVA).

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

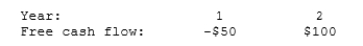

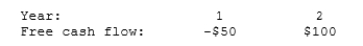

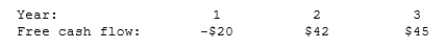

Leak Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments).

A) $1,456

B) $1,529

C) $1,606

D) $1,686

E) $1,770

A) $1,456

B) $1,529

C) $1,606

D) $1,686

E) $1,770

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

Two important issues in corporate governance are (1) the rules that cover the board's ability to fire the CEO and (2)the rules that cover the CEO's ability to remove members of the board.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

Free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

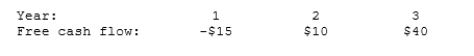

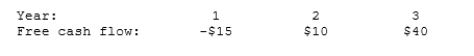

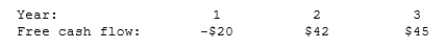

A company forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

A) $315

B) $331

C) $348

D) $367

E) $386

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Based on the corporate valuation model, Bernile Inc.'s value of operations is $750 million. Its balance sheet shows $50 million of short-term investments that are unrelated to operations, $100 million of accounts payable, $100 million of notes payable, $200 million of long-term debt, $40 million of common stock (par plus paid-in-capital), and $160 million of retained earnings. What is the best estimate for the firm's value of equity, in millions?

A) $429

B) $451

C) $475

D) $500

E) $525

A) $429

B) $451

C) $475

D) $500

E) $525

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

Value-based management focuses on sales growth, profitability, capital requirements, the weighted average cost of capital, and the dividend growth rate.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose Leonard, Nixon, & Shull Corporation's projected free cash flow for next year is $100,000, and FCF is expected to grow at a constant rate of 6%. If the company's weighted average cost of capital is 11%, what is the value of its operations?

A) $1,714,750

B) $1,805,000

C) $1,900,000

D) $2,000,000

E) $2,100,000

A) $1,714,750

B) $1,805,000

C) $1,900,000

D) $2,000,000

E) $2,100,000

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT normally regarded as being a barrier to hostile takeovers?

A) Abnormally high executive compensation.

B) Targeted share repurchases.

C) Shareholder rights provisions.

D) Restricted voting rights.

E) Poison pills.

A) Abnormally high executive compensation.

B) Targeted share repurchases.

C) Shareholder rights provisions.

D) Restricted voting rights.

E) Poison pills.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is NOT CORRECT?

A) The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends.

B) The corporate valuation model discounts free cash flows by the required return on equity.

C) The corporate valuation model can be used to find the value of a division.

D) An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements.

E) Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value.

A) The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends.

B) The corporate valuation model discounts free cash flows by the required return on equity.

C) The corporate valuation model can be used to find the value of a division.

D) An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements.

E) Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

The corporate valuation model cannot be used unless a company doesn't pay dividends.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

Akyol Corporation is undergoing a restructuring, and its free cash flows are expected to be unstable during the next few years. However, FCF is expected to be $50 million in Year 5, i.e., FCF at t = 5 equals

$50 million, and the FCF growth rate is expected to be constant at 6% beyond that point. If the weighted average cost of capital is 12%, what is the horizon value (in millions) at t = 5?

A) $719

B) $757

C) $797

D) $839

E) $883

$50 million, and the FCF growth rate is expected to be constant at 6% beyond that point. If the weighted average cost of capital is 12%, what is the horizon value (in millions) at t = 5?

A) $719

B) $757

C) $797

D) $839

E) $883

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following does NOT always increase a company's market value?

A) Increasing the expected growth rate of sales.

B) Increasing the expected operating profitability (NOPAT/Sales).

C) Decreasing the capital requirements (Capital/Sales).

D) Decreasing the weighted average cost of capital.

A) Increasing the expected growth rate of sales.

B) Increasing the expected operating profitability (NOPAT/Sales).

C) Decreasing the capital requirements (Capital/Sales).

D) Decreasing the weighted average cost of capital.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

Vasudevan Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

A) $586

B) $617

C) $648

D) $680

E) $714

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

Based on the corporate valuation model, the value of a company's operations is $1,200 million. The company's balance sheet shows $80

1)

A) $24.90

B) $27.67

C) $30.43

D) $33.48

E) $36.82

1)

A) $24.90

B) $27.67

C) $30.43

D) $33.48

E) $36.82

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

Based on the corporate valuation model, Hunsader's value of operations is $300 million. The balance sheet shows $20 million of short-term investments that are unrelated to operations, $50 million of accounts payable, $90 million of notes payable, $30 million of long-term debt,

$40 million of preferred stock, and $100 million of common equity. The company has 10 million shares of stock outstanding. What is the best estimate of the stock's price per share?

Hard:

A) $13.72

B) $14.44

C) $15.20

D) $16.00

E) $16.80

$40 million of preferred stock, and $100 million of common equity. The company has 10 million shares of stock outstanding. What is the best estimate of the stock's price per share?

Hard:

A) $13.72

B) $14.44

C) $15.20

D) $16.00

E) $16.80

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

Based on the corporate valuation model, the value of a company's operations is $900 million. Its balance sheet shows $70 million in accounts receivable, $50 million in inventory, $30 million in short- term investments that are unrelated to operations, $20 million in accounts payable, $110 million in notes payable, $90 million in long- term debt, $20 million in preferred stock, $140 million in retained earnings, and $280 million in total common equity. If the company has

25 million shares of stock outstanding, what is the best estimate of the stock's price per share?

A) $23.00

B) $25.56

C) $28.40

D) $31.24

E) $34.36

25 million shares of stock outstanding, what is the best estimate of the stock's price per share?

A) $23.00

B) $25.56

C) $28.40

D) $31.24

E) $34.36

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck