Deck 15: Capital Structure Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 15: Capital Structure Decisions

1

Which of the following statements is CORRECT?

A) The capital structure that maximizes expected EPS also maximizes

The price per share of common stock.

B) The capital structure that minimizes the interest rate on debt also

Maximizes the expected EPS.

C) The capital structure that minimizes the required return on equity

Also maximizes the stock price.

D) The capital structure that minimizes the WACC also maximizes the

Price per share of common stock.

E) The capital structure that gives the firm the best credit rating also maximizes the stock price.

A) The capital structure that maximizes expected EPS also maximizes

The price per share of common stock.

B) The capital structure that minimizes the interest rate on debt also

Maximizes the expected EPS.

C) The capital structure that minimizes the required return on equity

Also maximizes the stock price.

D) The capital structure that minimizes the WACC also maximizes the

Price per share of common stock.

E) The capital structure that gives the firm the best credit rating also maximizes the stock price.

D

2

Business risk is affected by a firm's operations. Which of the following is NOT associated with (or does not contribute to) business risk?

A) Demand variability.

B) Sales price variability.

C) The extent to which operating costs are fixed.

D) The extent to which interest rates on the firm's debt fluctuate.

E) Input price variability.

A) Demand variability.

B) Sales price variability.

C) The extent to which operating costs are fixed.

D) The extent to which interest rates on the firm's debt fluctuate.

E) Input price variability.

D

3

Whenever a firm borrows money, it is using financial leverage.

True

4

A firm's capital structure does not affect its calculated free cash flows, because FCF reflects only operating cash flows.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

The trade-off theory states that the capital structure decision involves a tradeoff between the costs and benefits of debt financing.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

The graphical probability distribution of ROE for a firm that uses financial leverage would tend to be more peaked than the distribution if the firm used no leverage, other things held constant.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

It is possible that two firms could have identical financial and operating leverage, yet have different degrees of risk as measured by the variability of EPS.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

If a firm utilizes debt financing, an X% decline in earnings before interest and taxes (EBIT) will result in a decline in earnings per share that is larger than X.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following events is likely to encourage a company to raise its target debt ratio, other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight

Inflation.

E) The company's stock price hits a new high.

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight

Inflation.

E) The company's stock price hits a new high.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

A firm's business risk is largely determined by the financial characteristics of its industry, especially by the amount of debt the average firm in the industry uses.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

As the text indicates, a firm's financial risk has identifiable market risk and diversifiable risk components.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

Firm A has a higher degree of business risk than Firm B. Firm A can offset this by using less financial leverage. Therefore, the variability of both firms' expected EBITs could actually be identical.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

Two firms, although they operate in different industries, have the same expected earnings per share and the same standard deviation of expected EPS. Thus, the two firms must have the same business risk.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

Financial risk refers to the extra risk stockholders bear as a result of using debt as compared with the risk they would bear if no debt were used.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following would increase the likelihood that a company would increase its debt ratio, other things held constant?

A) An increase in costs incurred when filing for bankruptcy.

B) An increase in the corporate tax rate.

C) An increase in the personal tax rate.

D) The Federal Reserve tightens interest rates in an effort to fight

Inflation.

E) The company's stock price hits a new low.

A) An increase in costs incurred when filing for bankruptcy.

B) An increase in the corporate tax rate.

C) An increase in the personal tax rate.

D) The Federal Reserve tightens interest rates in an effort to fight

Inflation.

E) The company's stock price hits a new low.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

Provided a firm does not use an extreme amount of debt, financial leverage typically affects both EPS and EBIT, while operating leverage only affects EBIT.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

If Miller and Modigliani had incorporated the costs of bankruptcy into their model, it is unlikely that they would have concluded that 100% debt financing is optimal.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

An increase in the debt ratio will generally have no effect on which of these items?

A) Business risk.

B) Total risk.

C) Financial risk.

D) Market risk.

E) The firm's beta.

A) Business risk.

B) Total risk.

C) Financial risk.

D) Market risk.

E) The firm's beta.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

Different borrowers have different risks of bankruptcy, and bankruptcy is costly to lenders. Therefore, lenders charge higher rates to borrowers judged to be more at risk of going bankrupt.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is CORRECT?

A) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

B) Since debt financing is cheaper than equity financing, raising a

Company's debt ratio will always reduce its WACC.

C) Increasing a company's debt ratio will typically reduce the marginal cost of both debt and equity financing. However, this

Action still may raise the company's WACC.

D) Increasing a company's debt ratio will typically increase the marginal cost of both debt and equity financing. However, this

Action still may lower the company's WACC.

E) Since a firm's beta coefficient it not affected by its use of financial leverage, leverage does not affect the cost of equity.

A) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

B) Since debt financing is cheaper than equity financing, raising a

Company's debt ratio will always reduce its WACC.

C) Increasing a company's debt ratio will typically reduce the marginal cost of both debt and equity financing. However, this

Action still may raise the company's WACC.

D) Increasing a company's debt ratio will typically increase the marginal cost of both debt and equity financing. However, this

Action still may lower the company's WACC.

E) Since a firm's beta coefficient it not affected by its use of financial leverage, leverage does not affect the cost of equity.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

Reynolds Resorts is currently 100% equity financed. The CFO is considering a recapitalization plan under which the firm would issue long-term debt with a yield of 9% and use the proceeds to repurchase common stock. The recapitalization would not change the company's total assets, nor would it affect the firm's basic earning power, which is currently 15%. The CFO believes that this recapitalization would reduce the WACC and increase stock price. Which of the following would also be

Likely to occur if the company goes ahead with the recapitalization plan?

A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

Likely to occur if the company goes ahead with the recapitalization plan?

A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is CORRECT?

A) The capital structure that maximizes the stock price is also the capital structure that minimizes the weighted average cost of capital (WACC).

B) The capital structure that maximizes the stock price is also the

Capital structure that maximizes earnings per share.

C) The capital structure that maximizes the stock price is also the capital structure that maximizes the firm's times interest earned

(TIE) ratio.

D) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing; however, this

Still may raise the company's WACC.

E) If Congress were to pass legislation that increases the personal tax rate but decreases the corporate tax rate, this would encourage

Companies to increase their debt ratios.

Medium/Hard:

A) The capital structure that maximizes the stock price is also the capital structure that minimizes the weighted average cost of capital (WACC).

B) The capital structure that maximizes the stock price is also the

Capital structure that maximizes earnings per share.

C) The capital structure that maximizes the stock price is also the capital structure that maximizes the firm's times interest earned

(TIE) ratio.

D) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing; however, this

Still may raise the company's WACC.

E) If Congress were to pass legislation that increases the personal tax rate but decreases the corporate tax rate, this would encourage

Companies to increase their debt ratios.

Medium/Hard:

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is CORRECT?

A) If corporate tax rates were decreased while other things were held constant, and if the Modigliani-Miller tax-adjusted tradeoff theory of capital structure were correct, this would tend to cause

Corporations to decrease their use of debt.

B) A change in the personal tax rate should not affect firms' capital

Structure decisions.

C) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt, while business risk reflects both the use of debt and such factors as sales

Variability, cost variability, and operating leverage.

D) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC,

And (3) maximizes its EPS.

E) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the average corporation.

A) If corporate tax rates were decreased while other things were held constant, and if the Modigliani-Miller tax-adjusted tradeoff theory of capital structure were correct, this would tend to cause

Corporations to decrease their use of debt.

B) A change in the personal tax rate should not affect firms' capital

Structure decisions.

C) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt, while business risk reflects both the use of debt and such factors as sales

Variability, cost variability, and operating leverage.

D) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC,

And (3) maximizes its EPS.

E) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the average corporation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

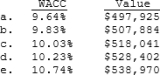

Based on the information below, what is Ezzel Enterprises' optimal capital structure?

A) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

B) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

C) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

D) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

E) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

A) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

B) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

C) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

D) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

E) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

The firm's target capital structure should be consistent with which of the following statements?

A) Maximize the earnings per share (EPS).

B) Minimize the cost of debt (rd).

C) Obtain the highest possible bond rating.

D) Minimize the cost of equity (rs).

E) Minimize the weighted average cost of capital (WACC).

A) Maximize the earnings per share (EPS).

B) Minimize the cost of debt (rd).

C) Obtain the highest possible bond rating.

D) Minimize the cost of equity (rs).

E) Minimize the weighted average cost of capital (WACC).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

If debt financing is used, which of the following is CORRECT?

A) The percentage change in net operating income will be greater than a given percentage change in net income.

B) The percentage change in net operating income will be equal to a

Given percentage change in net income.

C) The percentage change in net income relative to the percentage change in net operating income will depend on the interest rate

Charged on debt.

D) The percentage change in net income will be greater than the

Percentage change in net operating income.

E) The percentage change in sales will be greater than the percentage change in EBIT, which in turn will be greater than the percentage change in net income.

A) The percentage change in net operating income will be greater than a given percentage change in net income.

B) The percentage change in net operating income will be equal to a

Given percentage change in net income.

C) The percentage change in net income relative to the percentage change in net operating income will depend on the interest rate

Charged on debt.

D) The percentage change in net income will be greater than the

Percentage change in net operating income.

E) The percentage change in sales will be greater than the percentage change in EBIT, which in turn will be greater than the percentage change in net income.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is CORRECT?

A) In general, a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate

Would affect firms' capital structure decisions.

C) A firm with high business risk is more likely to increase its use of financial leverage than a firm with low business risk, assuming

All else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of

Debt, it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt. Increasing its use of debt to the point where it is at its optimal capital

Structure will decrease the costs of both debt and equity financing.

A) In general, a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate

Would affect firms' capital structure decisions.

C) A firm with high business risk is more likely to increase its use of financial leverage than a firm with low business risk, assuming

All else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of

Debt, it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt. Increasing its use of debt to the point where it is at its optimal capital

Structure will decrease the costs of both debt and equity financing.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

Companies HD and LD have the same total assets, operating income (EBIT), tax rate, and business risk. Company HD, however, has a much higher debt ratio than LD. Also HD's basic earning power (BEP) exceeds its cost of debt (rd). Which of the following statements is CORRECT?

A) HD should have a higher return on assets (ROA) than LD.

B) HD should have a higher times interest earned (TIE) ratio than LD.

C) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be

Higher than LD's.

D) Given that BEP > rd, HD's stock price must exceed that of LD.

E) Given that BEP > rd, LD's stock price must exceed that of HD.

A) HD should have a higher return on assets (ROA) than LD.

B) HD should have a higher times interest earned (TIE) ratio than LD.

C) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be

Higher than LD's.

D) Given that BEP > rd, HD's stock price must exceed that of LD.

E) Given that BEP > rd, LD's stock price must exceed that of HD.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements best describes the optimal capital structure?

A) The optimal capital structure is the mix of debt, equity, and preferred stock that maximizes the company's earnings per share (EPS).

B) The optimal capital structure is the mix of debt, equity, and

Preferred stock that maximizes the company's stock price.

C) The optimal capital structure is the mix of debt, equity, and

Preferred stock that minimizes the company's cost of equity.

D) The optimal capital structure is the mix of debt, equity, and

Preferred stock that minimizes the company's cost of debt.

E) The optimal capital structure is the mix of debt, equity, and preferred stock that minimizes the company's cost of preferred stock.

A) The optimal capital structure is the mix of debt, equity, and preferred stock that maximizes the company's earnings per share (EPS).

B) The optimal capital structure is the mix of debt, equity, and

Preferred stock that maximizes the company's stock price.

C) The optimal capital structure is the mix of debt, equity, and

Preferred stock that minimizes the company's cost of equity.

D) The optimal capital structure is the mix of debt, equity, and

Preferred stock that minimizes the company's cost of debt.

E) The optimal capital structure is the mix of debt, equity, and preferred stock that minimizes the company's cost of preferred stock.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

Volga Publishing is considering a proposed increase in its debt ratio, which would also increase the company's interest expense. The plan would involve issuing new bonds and using the proceeds to buy back

Shares of its common stock. The company's CFO thinks the plan will not

Change total assets or operating income, but that it will increase earnings per share (EPS). Assuming the CFO's estimates are correct, which of the following statements is CORRECT?

A)

Since the proposed plan increases Volga's financial risk, the company's stock price still might fall even if EPS increases.

B) If the plan reduces the WACC, the stock price is also likely to

Decline.

C) Since the plan is expected to increase EPS, this implies that net

Income is also expected to increase.

D) If the plan does increase the EPS, the stock price will

Automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding, and that will increase their liquidity and thus lower the interest rate on the

Currently outstanding bonds.

Shares of its common stock. The company's CFO thinks the plan will not

Change total assets or operating income, but that it will increase earnings per share (EPS). Assuming the CFO's estimates are correct, which of the following statements is CORRECT?

A)

Since the proposed plan increases Volga's financial risk, the company's stock price still might fall even if EPS increases.

B) If the plan reduces the WACC, the stock price is also likely to

Decline.

C) Since the plan is expected to increase EPS, this implies that net

Income is also expected to increase.

D) If the plan does increase the EPS, the stock price will

Automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding, and that will increase their liquidity and thus lower the interest rate on the

Currently outstanding bonds.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

Other things held constant, which of the following events is most likely to encourage a firm to increase the amount of debt in its capital structure?

A) Its sales become less stable over time.

B) The costs that would be incurred in the event of bankruptcy increase.

C) Management believes that the firm's stock has become overvalued.

D) Its degree of operating leverage increases.

E) The corporate tax rate increases.

A) Its sales become less stable over time.

B) The costs that would be incurred in the event of bankruptcy increase.

C) Management believes that the firm's stock has become overvalued.

D) Its degree of operating leverage increases.

E) The corporate tax rate increases.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

Firms U and L each have the same amount of assets, and both have a basic earning power ratio of 20%. Firm U is unleveraged, i.e., it is 100% equity financed, while Firm L is financed with 50% debt and 50% equity. Firm L's debt has a before-tax cost of 8%. Both firms have positive net income. Which of the following statements is CORRECT?

A) The two companies have the same times interest earned (TIE) ratio.

B) Firm L has a lower ROA than Firm U.

C) Firm L has a lower ROE than Firm U.

D) Firm L has the higher times interest earned (TIE) ratio.

E) Firm L has a higher EBIT than Firm U.

A) The two companies have the same times interest earned (TIE) ratio.

B) Firm L has a lower ROA than Firm U.

C) Firm L has a lower ROE than Firm U.

D) Firm L has the higher times interest earned (TIE) ratio.

E) Firm L has a higher EBIT than Firm U.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is CORRECT?

A) A firm's business risk is determined solely by the financial

Characteristics of its industry.

B) The factors that affect a firm's business risk are affected by industry characteristics and economic conditions. Unfortunately, these factors are generally beyond the control of the firm's

Management.

C) One of the benefits to a firm of being at or near its target

Capital structure is that this eliminates any risk of bankruptcy.

D) A firm's financial risk can be minimized by diversification.

E) The amount of debt in its capital structure can under no

Circumstances affect a company's business risk.

A) A firm's business risk is determined solely by the financial

Characteristics of its industry.

B) The factors that affect a firm's business risk are affected by industry characteristics and economic conditions. Unfortunately, these factors are generally beyond the control of the firm's

Management.

C) One of the benefits to a firm of being at or near its target

Capital structure is that this eliminates any risk of bankruptcy.

D) A firm's financial risk can be minimized by diversification.

E) The amount of debt in its capital structure can under no

Circumstances affect a company's business risk.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is CORRECT?

A) Increasing financial leverage is one way to increase a firm's basic earning power (BEP).

B) If a firm lowered its fixed costs while increasing its variable costs, holding total costs at the present level of sales constant,

This would decrease its operating leverage.

C) The debt ratio that maximizes EPS generally exceeds the debt ratio

That maximizes share price.

D) If a company were to issue debt and use the money to repurchase common stock, this action would have no impact on its basic earning power ratio. (Assume that the repurchase has no impact on the

Company's operating income.)

E) If changes in the bankruptcy code made bankruptcy less costly to corporations, this would likely reduce the average corporation's debt ratio.

A) Increasing financial leverage is one way to increase a firm's basic earning power (BEP).

B) If a firm lowered its fixed costs while increasing its variable costs, holding total costs at the present level of sales constant,

This would decrease its operating leverage.

C) The debt ratio that maximizes EPS generally exceeds the debt ratio

That maximizes share price.

D) If a company were to issue debt and use the money to repurchase common stock, this action would have no impact on its basic earning power ratio. (Assume that the repurchase has no impact on the

Company's operating income.)

E) If changes in the bankruptcy code made bankruptcy less costly to corporations, this would likely reduce the average corporation's debt ratio.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

Companies HD and LD have identical tax rates, total assets, and basic earning power ratios, and their basic earning power exceeds their before-tax cost of debt, rd. However, Company HD has a higher debt ratio and thus more interest expense than Company LD. Which of the following statements is CORRECT?

A) Company HD has a higher net income than Company LD.

B) Company HD has a lower ROA than Company LD.

C) Company HD has a lower ROE than Company LD.

D) The two companies have the same ROA.

E) The two companies have the same ROE.

A) Company HD has a higher net income than Company LD.

B) Company HD has a lower ROA than Company LD.

C) Company HD has a lower ROE than Company LD.

D) The two companies have the same ROA.

E) The two companies have the same ROE.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

Blemker Corporation has $500 million of total assets, its basic earning power is 15%, and it currently has no debt in its capital structure.

The CFO is contemplating a recapitalization where it will issue debt at a cost of 10% and use the proceeds to buy back shares of the company's common stock, paying book value. If the company proceeds with the recapitalization, its operating income, total assets, and tax rate will remain unchanged. Which of the following is most likely to occur as a result of the recapitalization?

A) The ROA would increase.

B) The ROA would remain unchanged.

C) The basic earning power ratio would decline.

D) The basic earning power ratio would increase.

E) The ROE would increase.

The CFO is contemplating a recapitalization where it will issue debt at a cost of 10% and use the proceeds to buy back shares of the company's common stock, paying book value. If the company proceeds with the recapitalization, its operating income, total assets, and tax rate will remain unchanged. Which of the following is most likely to occur as a result of the recapitalization?

A) The ROA would increase.

B) The ROA would remain unchanged.

C) The basic earning power ratio would decline.

D) The basic earning power ratio would increase.

E) The ROE would increase.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is CORRECT?

A) As a rule, the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and

Minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity, which

Is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of

Debt, the cost of equity, and the WACC.

E) The optimal capital structure simultaneously maximizes stock price

And minimizes the WACC.

A) As a rule, the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and

Minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity, which

Is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of

Debt, the cost of equity, and the WACC.

E) The optimal capital structure simultaneously maximizes stock price

And minimizes the WACC.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output, this will

A) normally lead to an increase in its fixed assets turnover ratio.

B) normally lead to a decrease in its business risk.

C) normally lead to a decrease in the standard deviation of its

Expected EBIT.

D) normally lead to a decrease in the variability of its expected EPS.

E) normally lead to a reduction in its fixed assets turnover ratio.

A) normally lead to an increase in its fixed assets turnover ratio.

B) normally lead to a decrease in its business risk.

C) normally lead to a decrease in the standard deviation of its

Expected EBIT.

D) normally lead to a decrease in the variability of its expected EPS.

E) normally lead to a reduction in its fixed assets turnover ratio.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is CORRECT?

A) A firm can use retained earnings without paying a flotation cost. Therefore, while the cost of retained earnings is not zero, its

Cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock

Price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its

Earnings per share.

D) If a firm finds that the cost of debt is less than the cost of

Equity, increasing its debt ratio must reduce its WACC.

E) Other things held constant, if corporate tax rates declined, then the Modigliani-Miller tax-adjusted tradeoff theory would suggest

That firms should increase their use of debt.

A) A firm can use retained earnings without paying a flotation cost. Therefore, while the cost of retained earnings is not zero, its

Cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock

Price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its

Earnings per share.

D) If a firm finds that the cost of debt is less than the cost of

Equity, increasing its debt ratio must reduce its WACC.

E) Other things held constant, if corporate tax rates declined, then the Modigliani-Miller tax-adjusted tradeoff theory would suggest

That firms should increase their use of debt.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is CORRECT, holding other things constant?

A) Firms whose assets are relatively liquid tend to have relatively low

Bankruptcy costs, hence they tend to use relatively little debt.

B) An increase in the personal tax rate is likely to increase the debt ratio of the average corporation.

C) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the

Average corporation.

D) An increase in the company's degree of operating leverage is likely

To encourage a company to use more debt in its capital structure.

E) An increase in the corporate tax rate is likely to encourage a company to use more debt in its capital structure.

A) Firms whose assets are relatively liquid tend to have relatively low

Bankruptcy costs, hence they tend to use relatively little debt.

B) An increase in the personal tax rate is likely to increase the debt ratio of the average corporation.

C) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the

Average corporation.

D) An increase in the company's degree of operating leverage is likely

To encourage a company to use more debt in its capital structure.

E) An increase in the corporate tax rate is likely to encourage a company to use more debt in its capital structure.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

Elephant Books sells paperback books for $7 each. The variable cost per book is $5. At current annual sales of 200,000 books, the publisher is just breaking even. It is estimated that if the authors' royalties are reduced, the variable cost per book will drop by $1. Assume authors' royalties are reduced and sales remain constant; how much more money can the publisher put into advertising (a fixed cost) and still break even?

A) $600,000

B) $466,667

C) $333,333

D) $200,000

E) None of the above

A) $600,000

B) $466,667

C) $333,333

D) $200,000

E) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

Vafeas Inc.'s capital structure consists of 80% debt and 20% common equity, its beta is 1.60, and its tax rate is 35%. However, the CFO thinks the company has too much debt, and he is considering moving to a capital structure with 40% debt and 60% equity. The risk-free rate is 5.0% and the market risk premium is 6.0%. By how much would the capital structure shift change the firm's cost of equity?

A) -5.20%

B) -5.78%

C) -6.36%

D) -6.99%

E) -7.69%

A) -5.20%

B) -5.78%

C) -6.36%

D) -6.99%

E) -7.69%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

A group of venture investors is considering putting money into Lemma Books, which wants to produce a new reader for electronic books. The variable cost per unit is estimated at $250, the sales price would be set at twice the VC/unit, fixed costs are estimated at $750,000, and the investors will put up the funds if the project is likely to have an operating income of $500,000 or more. What sales volume would be required in order to meet this profit goal?

A) 4,513

B) 4,750

C) 5,000

D) 5,250

E) 5,513

A) 4,513

B) 4,750

C) 5,000

D) 5,250

E) 5,513

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

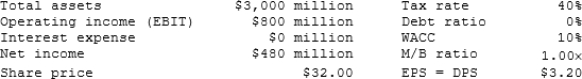

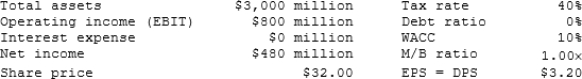

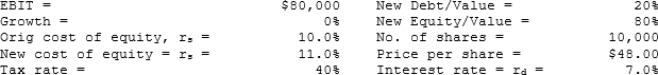

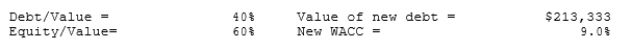

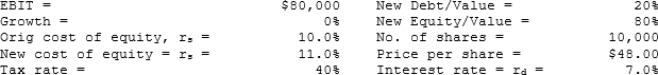

A consultant has collected the following information regarding Young Publishing:  The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS). The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS). The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3,200

B) $3,600

C) $4,000

D) $4,200

E) $4,800

Medium/Hard:

The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS). The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

The company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS). The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?A) $3,200

B) $3,600

C) $4,000

D) $4,200

E) $4,800

Medium/Hard:

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

Lauterbach Corporation uses no debt, its beta is 1.10, and its tax rate is 40%. However, the CFO is considering moving to a capital structure with 30% debt and 70% equity. If the risk-free rate is 5.0% and the market risk premium is 6.0%, by how much would the capital structure shift change the firm's cost of equity?

A) 1.53%

B) 1.70%

C) 1.87%

D) 2.05%

E) 2.26%

A) 1.53%

B) 1.70%

C) 1.87%

D) 2.05%

E) 2.26%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

Michaely Inc. is an all-equity firm with 200,000 shares outstanding. It has $2,000,000 of EBIT, which is expected to remain constant in the future. The company pays out all of its earnings, so earnings per share (EPS) equal dividends per shares (DPS). Its tax rate is 40%.

The company is considering issuing $5,000,000 of 10.0% bonds and using the proceeds to repurchase stock. The risk-free rate is 6.5%, the market risk premium is 5.0%, and the beta is currently 0.90, but the CFO believes beta would rise to 1.10 if the recapitalization occurs.

Assuming that the shares can be repurchased at the price that existed prior to the recapitalization, what would the price be following the recapitalization?

A) $65.77

B) $69.23

C) $72.69

D) $76.33

E) $80.14

The company is considering issuing $5,000,000 of 10.0% bonds and using the proceeds to repurchase stock. The risk-free rate is 6.5%, the market risk premium is 5.0%, and the beta is currently 0.90, but the CFO believes beta would rise to 1.10 if the recapitalization occurs.

Assuming that the shares can be repurchased at the price that existed prior to the recapitalization, what would the price be following the recapitalization?

A) $65.77

B) $69.23

C) $72.69

D) $76.33

E) $80.14

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

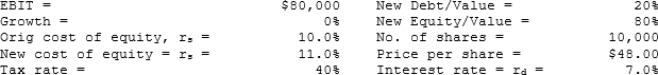

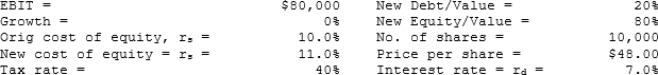

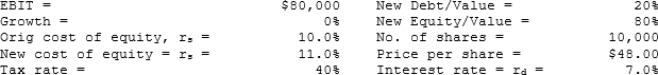

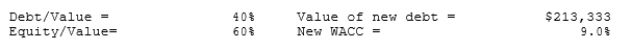

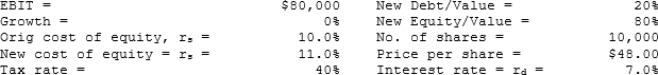

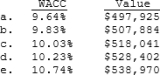

Powell Plastics, Inc. (PP) currently has zero debt. Its earnings before interest and taxes (EBIT) are $80,000, and it is a zero growth company. PP's current cost of equity is 10%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00.

PP is considering moving to a capital structure that is comprised of 30% debt and 70% equity, based on market values. The debt would have an interest rate of 8%. The new funds would be used to repurchase stock. It is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. If this plan were carried out, what would be PP's new value of operations?

A) $484,359

B) $487,805

C) $521,173

D) $560,748

E) $584,653

PP is considering moving to a capital structure that is comprised of 30% debt and 70% equity, based on market values. The debt would have an interest rate of 8%. The new funds would be used to repurchase stock. It is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. If this plan were carried out, what would be PP's new value of operations?

A) $484,359

B) $487,805

C) $521,173

D) $560,748

E) $584,653

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

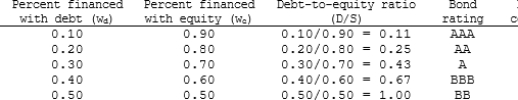

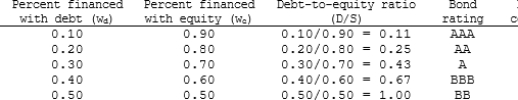

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

Dabney Electronics currently has no debt. Its operating income is $20 million and its tax rate is 40%. It pays out all of its net income as dividends and has a zero growth rate. The current stock price is $40 per share, and it has 2.5 million shares of stock outstanding. If it moves to a capital structure that has 40% debt and 60% equity (based on market values), its investment bankers believe its weighted average cost of capital would be 10%. What would its stock price be if it changes to the new capital structure?

A) $40

B) $48

C) $52

D) $54

E) $60

A) $40

B) $48

C) $52

D) $54

E) $60

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is CORRECT?

A) Generally, debt-to-total-assets ratios do not vary much among different industries, although they do vary among firms within a

Given industry.

B) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in

Most other industries.

C) Drug companies (prescription, not illegal!) generally have high debt-to-equity ratios because their earnings are very stable and, thus, they can cover the high interest costs associated with high

Debt levels.

D) Wide variations in capital structures exist both between industries and among individual firms within given industries. These differences are caused by differing business risks and also

Managerial attitudes.

E) Since most stocks sell at or very close to their book values, book value capital structures are almost always adequate for use in

Estimating firms' costs of capital.

A) Generally, debt-to-total-assets ratios do not vary much among different industries, although they do vary among firms within a

Given industry.

B) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in

Most other industries.

C) Drug companies (prescription, not illegal!) generally have high debt-to-equity ratios because their earnings are very stable and, thus, they can cover the high interest costs associated with high

Debt levels.

D) Wide variations in capital structures exist both between industries and among individual firms within given industries. These differences are caused by differing business risks and also

Managerial attitudes.

E) Since most stocks sell at or very close to their book values, book value capital structures are almost always adequate for use in

Estimating firms' costs of capital.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is CORRECT?

A) When a company increases its debt ratio, the costs of equity and debt both increase. Therefore, the WACC must also increase.

B) The capital structure that maximizes the stock price is generally

The capital structure that also maximizes earnings per share.

C) All else equal, an increase in the corporate tax rate would tend to

Encourage a company to increase its debt ratio.

D) Since debt financing raises the firm's financial risk, increasing a

Company's debt ratio will always increase its WACC.

E) Since debt is cheaper than equity, increasing a company's debt ratio will always reduce its WACC.

A) When a company increases its debt ratio, the costs of equity and debt both increase. Therefore, the WACC must also increase.

B) The capital structure that maximizes the stock price is generally

The capital structure that also maximizes earnings per share.

C) All else equal, an increase in the corporate tax rate would tend to

Encourage a company to increase its debt ratio.

D) Since debt financing raises the firm's financial risk, increasing a

Company's debt ratio will always increase its WACC.

E) Since debt is cheaper than equity, increasing a company's debt ratio will always reduce its WACC.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

Senbet Ventures is considering starting a new company to produce stereos. The sales price would be set at 1.5 times the variable cost per unit; the VC/unit is estimated to be $2.50; and fixed costs are estimated at $120,000. What sales volume would be required in order to break even, i.e., to have an EBIT of zero for the stereo business?

A) 86,640

B) 91,200

C) 96,000

D) 100,800

E) 105,840

A) 86,640

B) 91,200

C) 96,000

D) 100,800

E) 105,840

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

Stephens Electronics is considering a change in its target capital structure, which currently consists of 25% debt and 75% equity. The CFO believes the firm should use more debt, but the CEO is reluctant to increase the debt ratio. The risk-free rate, rRF, is 5.0%, the market risk premium, RPM, is 6.0%, and the firm's tax rate is 40%. Currently, the cost of equity, rs, is 11.5% as determined by the CAPM. What would be the estimated cost of equity if the firm used 60% debt? (Hint: You must first find the current beta and then the unlevered beta to solve the problem.)

A) 10.95%

B) 11.91%

C) 12.94%

D) 14.07%

E) 15.29%

A) 10.95%

B) 11.91%

C) 12.94%

D) 14.07%

E) 15.29%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

Vu Enterprises expects to have the following data during the coming year. What is Vu's expected ROE?

A) 12.51%

B) 13.14%

C) 13.80%

D) 14.49%

E) 15.21%

A) 12.51%

B) 13.14%

C) 13.80%

D) 14.49%

E) 15.21%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

Firms HD and LD are identical except for their level of debt and the interest rates they pay on debt--HD has more debt and pays a higher interest rate on that debt. Based on the data given below, what is the difference between the two firms' ROEs?

A) 2.18%

B) 2.29%

C) 2.41%

D) 2.54%

E) 2.66%

Hard:

A) 2.18%

B) 2.29%

C) 2.41%

D) 2.54%

E) 2.66%

Hard:

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

Ang Enterprises has a levered beta of 1.10, its capital structure consists of 40% debt and 60% equity, and its tax rate is 40%. What would Ang's beta be if it used no debt, i.e., what is its unlevered beta?

A) 0.64

B) 0.67

C) 0.71

D) 0.75

E) 0.79

A) 0.64

B) 0.67

C) 0.71

D) 0.75

E) 0.79

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

Simon Software Co. is trying to estimate its optimal capital structure. Right now, Simon has a capital structure that consists of 20% debt and 80% equity, based on market values. (Its D/S ratio is 0.25.) The risk- free rate is 6% and the market risk premium, rM - rRF, is 5%. Currently the company's cost of equity, which is based on the CAPM, is 12% and its tax rate is 40%. What would be Simon's estimated cost of equity if it were to change its capital structure to 50% debt and 50% equity?

A) 13.00%

B) 13.64%

C) 14.35%

D) 14.72%

E) 15.60%

A) 13.00%

B) 13.64%

C) 14.35%

D) 14.72%

E) 15.60%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

The Congress Company has identified two methods for producing playing cards. One method involves using a machine having a fixed cost of

$10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000), but it would require greater variable costs ($1.50 per deck of cards). If the selling price per deck of cards will be the same under each method, at what level of output will the two methods produce the same net operating income (EBIT)?

A) 5,000 decks

B) 10,000 decks

C) 15,000 decks

D) 20,000 decks

E) 25,000 decks

$10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000), but it would require greater variable costs ($1.50 per deck of cards). If the selling price per deck of cards will be the same under each method, at what level of output will the two methods produce the same net operating income (EBIT)?

A) 5,000 decks

B) 10,000 decks

C) 15,000 decks

D) 20,000 decks

E) 25,000 decks

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

DeLong Inc. has fixed operating costs of $470,000, variable costs of

$2)80 per unit produced, and its products sell for $4.00 per unit. What is the company's breakeven point, i.e., at what unit sales volume would income equal costs?

A) 391,667

B) 411,250

C) 431,813

D) 453,403

E) 476,073

$2)80 per unit produced, and its products sell for $4.00 per unit. What is the company's breakeven point, i.e., at what unit sales volume would income equal costs?

A) 391,667

B) 411,250

C) 431,813

D) 453,403

E) 476,073

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

Companies HD and LD have identical amounts of assets, operating income (EBIT), tax rates, and business risk. Company HD, however, has a much higher debt ratio than LD. Company HD's basic earning power ratio (BEP) exceeds its cost of debt (rd). Which of the following statements is CORRECT?

A) Company HD has a higher return on assets (ROA) than Company LD.

B) Company HD has a higher times interest earned (TIE) ratio than

Company LD.

C) Company HD has a higher return on equity (ROE) than Company LD, and its risk, as measured by the standard deviation of ROE, is also

Higher than LD's.

D) The two companies have the same ROE.

E) Company HD's ROE would be higher if it had no debt.

A) Company HD has a higher return on assets (ROA) than Company LD.

B) Company HD has a higher times interest earned (TIE) ratio than

Company LD.

C) Company HD has a higher return on equity (ROE) than Company LD, and its risk, as measured by the standard deviation of ROE, is also

Higher than LD's.

D) The two companies have the same ROE.

E) Company HD's ROE would be higher if it had no debt.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Barnes Baskets, Inc. (BB) currently has zero debt. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. BB's current cost of equity is 13%, and its tax rate is 40%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $23.08.

BB is considering moving to a capital structure that is comprised of 20% debt and 80% equity, based on market values. The debt would have an interest rate of 7%. The new funds would be used to repurchase stock.

It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise to 14%. If this plan were carried out, what would BB's new value of operations be?

A) $498,339

B) $512,188

C) $525,237

D) $540,239

E) $590,718

BB is considering moving to a capital structure that is comprised of 20% debt and 80% equity, based on market values. The debt would have an interest rate of 7%. The new funds would be used to repurchase stock.

It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise to 14%. If this plan were carried out, what would BB's new value of operations be?

A) $498,339

B) $512,188

C) $525,237

D) $540,239

E) $590,718

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Barnes Baskets, Inc. (BB) currently has zero debt. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. BB's current cost of equity is 13%, and its tax rate is 40%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $23.08.

Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but

Prior to the repurchase?

A) $14.42

B) $19.36

C) $23.91

D) $28.85

E) $35.62

Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but

Prior to the repurchase?

A) $14.42

B) $19.36

C) $23.91

D) $28.85

E) $35.62

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

The A. J. Croft Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00.

Now assume that AJC is considering changing from its original capital structure to a new capital structure with 50% debt and 50% equity. If it makes this change, its resulting market value would be $820,000.

What would be its new stock price per share?

A) $58

B) $59

C) $60

D) $61

E) $62

Now assume that AJC is considering changing from its original capital structure to a new capital structure with 50% debt and 50% equity. If it makes this change, its resulting market value would be $820,000.

What would be its new stock price per share?

A) $58

B) $59

C) $60

D) $61

E) $62

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

Powell Plastics, Inc. (PP) currently has zero debt. Its earnings before interest and taxes (EBIT) are $80,000, and it is a zero growth company. PP's current cost of equity is 10%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00.

Now assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510,638. Assume PP raises $178,723 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $45.90

B) $48.12

C) $51.06

D) $53.33

E) $58.75

Now assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510,638. Assume PP raises $178,723 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $45.90

B) $48.12

C) $51.06

D) $53.33

E) $58.75

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Barnes Baskets, Inc. (BB) currently has zero debt. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. BB's current cost of equity is 13%, and its tax rate is 40%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $23.08.

Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. BB then sells the T-bills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

A) 11,001; $28.85

B) 12,711; $35.62

C) 13,901; $42.57

D) 15,220; $54.31

E) 17,105; $89.67

Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. BB then sells the T-bills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

A) 11,001; $28.85

B) 12,711; $35.62

C) 13,901; $42.57

D) 15,220; $54.31

E) 17,105; $89.67

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

The A. J. Croft Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00.

The firm is considering moving to a capital structure that is comprised of 40% debt and 60% equity, based on market values. The new funds would be used to replace the old debt and to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on debt to rise to 7%, while the required rate of return on equity would rise to 9.5%. If this plan were carried out, what would be AJC's new WACC and total value?

A) 7.38%;

$800,008

B) 7.38%;

$813,008

C) 7.50%;

$813,008

D) 7.50%;

$790,008

E) 7.80%;

$790,008

The firm is considering moving to a capital structure that is comprised of 40% debt and 60% equity, based on market values. The new funds would be used to replace the old debt and to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on debt to rise to 7%, while the required rate of return on equity would rise to 9.5%. If this plan were carried out, what would be AJC's new WACC and total value?

A) 7.38%;

$800,008

B) 7.38%;

$813,008

C) 7.50%;

$813,008

D) 7.50%;

$790,008

E) 7.80%;

$790,008

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

The A. J. Croft Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00.

What is AJC's current total market value and weighted average cost of capital?

A) $600,000; 7.5%

B) $600,000; 8.0%

C) $800,000; 7.0%

D) $800,000; 7.5%

E) $800,000; 8.0%

What is AJC's current total market value and weighted average cost of capital?

A) $600,000; 7.5%

B) $600,000; 8.0%

C) $800,000; 7.0%

D) $800,000; 7.5%

E) $800,000; 8.0%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

Based on the data in the previous two problems, what would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock?

A) $49.43

B) $50.70

C) $52.00

D) $53.33

E) $56.00

Based on the data in the previous two problems, what would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock?

A) $49.43

B) $50.70

C) $52.00

D) $53.33

E) $56.00

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $50.67

B) $53.33

C) $56.00

D) $58.80

E) $61.74

Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $50.67

B) $53.33

C) $56.00

D) $58.80

E) $61.74

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

If this plan were carried out, what would be VF's new WACC and its new value of operations?

If this plan were carried out, what would be VF's new WACC and its new value of operations?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck