Deck 10: The Basics of Capital Budgeting: Evaluating Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 10: The Basics of Capital Budgeting: Evaluating Cash Flows

1

The phenomenon called "multiple internal rates of return" arises when two or more mutually exclusive projects that have different lives are compared to one another.

False

2

Both the regular and the modified IRR (MIRR) methods have wide appeal to professors, but most business executives prefer the NPV method to either of the IRR methods.

False

3

The primary reason that the NPV method is conceptually superior to the IRR method for evaluating mutually exclusive investments is that multiple IRRs may exist, and when that happens, we don't know which IRR is relevant.

False

4

The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

Because "present value" refers to the value of cash flows that occur at different points in time, a series of present values of cash flows should not be summed to determine the value of a capital budgeting project.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one first. In theory, such conflicts should be resolved in favor of the project with the higher positive NPV.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

A project's IRR is independent of the firm's cost of capital. In other words, a project's IRR doesn't change with a change in the firm's cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

A firm should never accept a project if its acceptance would lead to an increase in the firm's cost of capital (its WACC).

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

A basic rule in capital budgeting is that If a project's NPV exceeds its IRR, then the project should be accepted.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

The NPV method's assumption that cash inflows are reinvested at the cost of capital is generally more reasonable than the IRR's assumption that cash flows are reinvested at the IRR. This is an important reason why the NPV method is generally preferred over the IRR method.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

One advantage of the payback method for evaluating potential investments is that it provides information about a project's liquidity and risk.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

The NPV method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

When considering two mutually exclusive projects, the firm should always select the project whose internal rate of return is the highest, provided the projects have the same initial cost. This statement is true regardless of whether the projects can be repeated or not.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs) with the present value of the cash inflows.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one first. In theory, such conflicts should be resolved in favor of the project with the higher positive IRR.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

For a project with one initial cash outflow followed by a series of positive cash inflows, the modified IRR (MIRR) method involves compounding the cash inflows out to the end of the project's life, summing those compounded cash flows to form a terminal value (TV), and then finding the discount rate that causes the PV of the TV to equal the project's cost.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

Other things held constant, an increase in the cost of capital will result in a decrease in a project's IRR.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

Under certain conditions, a project may have more than one IRR. One such condition is when, in addition to the initial investment at time = 0, a negative cash flow (or cost) occurs at the end of the project's life.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

Assuming that their NPVs based on the firm's cost of capital are equal, the NPV of a project whose cash flows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a project whose cash flows come in later in its life.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

When evaluating mutually exclusive projects, the modified IRR (MIRR) always leads to the same capital budgeting decisions as the NPV method, regardless of the relative lives or sizes of the projects being evaluated.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

The NPV and IRR methods, when used to evaluate two independent and equally risky projects, will lead to different accept/reject decisions and thus capital budgets if the projects' IRRs are greater than their cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is CORRECT?

A) The shorter a project's payback period, the less desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback is that this method does not take account of cash flows beyond the payback period.

C) If a project's payback is positive, then the project should be accepted because it must have a positive NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

A) The shorter a project's payback period, the less desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback is that this method does not take account of cash flows beyond the payback period.

C) If a project's payback is positive, then the project should be accepted because it must have a positive NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

C) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

D) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

E) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

A) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

C) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

D) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

E) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

No conflict will exist between the NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, if the projects' cost of capital exceeds the rate at which the projects' NPV profiles cross.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

The IRR of normal Project X is greater than the IRR of normal Project Y, and both IRRs are greater than zero. Also, the NPV of X is greater than the NPV of Y at the cost of capital. If the two projects are mutually exclusive, Project X should definitely be selected, and the investment made, provided we have confidence in the data. Put another way, it is impossible to draw NPV profiles that would suggest not accepting Project X.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is CORRECT?

A) The regular payback method recognizes all cash flows over a project's life.

B) The discounted payback method recognizes all cash flows over a project's life, and it also adjusts these cash flows to account for the time value of money.

C) The regular payback method was, years ago, widely used, but virtually no companies even calculate the payback today.

D) The regular payback is useful as an indicator of a project's liquidity because it gives managers an idea of how long it will take to recover the funds invested in a project.

E) The regular payback does not consider cash flows beyond the payback year, but the discounted payback overcomes this defect.

A) The regular payback method recognizes all cash flows over a project's life.

B) The discounted payback method recognizes all cash flows over a project's life, and it also adjusts these cash flows to account for the time value of money.

C) The regular payback method was, years ago, widely used, but virtually no companies even calculate the payback today.

D) The regular payback is useful as an indicator of a project's liquidity because it gives managers an idea of how long it will take to recover the funds invested in a project.

E) The regular payback does not consider cash flows beyond the payback year, but the discounted payback overcomes this defect.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital, the payback method and NPV method would always lead to the same decision on which project to undertake.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting this TV at the WACC.

B) A project's regular IRR is found by discounting the cash inflows at the WACC to find the present value (PV), then compounding this PV to find the IRR.

C) If a project's IRR is greater than the WACC, then its NPV must be negative.

D) To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

E) To find a project's IRR, we must find a discount rate that is equal to the WACC.

A) A project's regular IRR is found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting this TV at the WACC.

B) A project's regular IRR is found by discounting the cash inflows at the WACC to find the present value (PV), then compounding this PV to find the IRR.

C) If a project's IRR is greater than the WACC, then its NPV must be negative.

D) To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

E) To find a project's IRR, we must find a discount rate that is equal to the WACC.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC.

B) The lower the WACC used to calculate a project's NPV, the lower the calculated NPV will be.

C) If a project's NPV is less than zero, then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero, then its IRR must be less than zero.

A) A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC.

B) The lower the WACC used to calculate a project's NPV, the lower the calculated NPV will be.

C) If a project's NPV is less than zero, then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero, then its IRR must be less than zero.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

An increase in the firm's WACC will decrease projects' NPVs, which could change the accept/reject decision for any potential project. However, such a change would have no impact on projects' IRRs. Therefore, the accept/reject decision under the IRR method is independent of the cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

The regular payback method is deficient in that it does not take account of cash flows beyond the payback period. The discounted payback method corrects this fault.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT?

A) A project's IRR increases as the WACC declines.

B) A project's NPV increases as the WACC declines.

C) A project's MIRR is unaffected by changes in the WACC.

D) A project's regular payback increases as the WACC declines.

E) A project's discounted payback increases as the WACC declines.

A) A project's IRR increases as the WACC declines.

B) A project's NPV increases as the WACC declines.

C) A project's MIRR is unaffected by changes in the WACC.

D) A project's regular payback increases as the WACC declines.

E) A project's discounted payback increases as the WACC declines.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

C) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

E) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

A) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

C) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

E) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

In theory, capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital. The decision criterion should not be affected by managers' tastes, choice of accounting method, or the profitability of other independent projects.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

Project S has a pattern of high cash flows in its early life, while Project L has a longer life, with large cash flows late in its life. Neither has negative cash flows after Year 0, and at the current cost of capital, the two projects have identical NPVs. Now suppose interest rates and money costs decline. Other things held constant, this change will cause L to become preferred to S.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

Normal Projects S and L have the same NPV when the discount rate is zero. However, Project S's cash flows come in faster than those of L. Therefore, we know that at any discount rate greater than zero, L will have the higher NPV.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

If the IRR of normal Project X is greater than the IRR of mutually exclusive (and also normal) Project Y, we can conclude that the firm should always select X rather than Y if X has NPV > 0.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

The NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, will lead to different accept/reject decisions and thus capital budgets if the cost of capital at which the projects' NPV profiles cross is less than the projects' cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is CORRECT?

A) If a project has "normal" cash flows, then its IRR must be positive.

B) If a project has "normal" cash flows, then its MIRR must be positive.

C) If a project has "normal" cash flows, then it will have exactly two real IRRs.

D) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

E) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

A) If a project has "normal" cash flows, then its IRR must be positive.

B) If a project has "normal" cash flows, then its MIRR must be positive.

C) If a project has "normal" cash flows, then it will have exactly two real IRRs.

D) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

E) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC.

B) A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR.

C) If a project's IRR is smaller than the WACC, then its NPV will be positive.

D) A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost.

A) A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC.

B) A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR.

C) If a project's IRR is smaller than the WACC, then its NPV will be positive.

D) A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is CORRECT?

A) If a project with normal cash flows has an IRR greater than the WACC, the project must also have a positive NPV.

B) If Project A's IRR exceeds Project B's, then A must have the higher NPV.

C) A project's MIRR can never exceed its IRR.

D) If a project with normal cash flows has an IRR less than the WACC, the project must have a positive NPV.

E) If the NPV is negative, the IRR must also be negative.

A) If a project with normal cash flows has an IRR greater than the WACC, the project must also have a positive NPV.

B) If Project A's IRR exceeds Project B's, then A must have the higher NPV.

C) A project's MIRR can never exceed its IRR.

D) If a project with normal cash flows has an IRR less than the WACC, the project must have a positive NPV.

E) If the NPV is negative, the IRR must also be negative.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Assume that the economy is enjoying a strong boom, and as a result interest rates and money costs generally are relatively high. The WACC for two mutually exclusive projects that are being considered is 12%. Project S has an IRR of 20% while Project L's IRR is 15%. The projects have the same NPV at the 12% current WACC. However, you believe that the economy will soon fall into a mild recession, and money costs and thus your WACC will soon decline. You also think that the projects will not be funded until the WACC has decreased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following statements is CORRECT?

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

C) You should recommend Project L, because at the new WACC it will have the higher NPV.

D) You should recommend Project S, because at the new WACC it will have the higher NPV.

E) You should recommend Project L because it will have both a higher IRR and a higher NPV under the new conditions.

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

C) You should recommend Project L, because at the new WACC it will have the higher NPV.

D) You should recommend Project S, because at the new WACC it will have the higher NPV.

E) You should recommend Project L because it will have both a higher IRR and a higher NPV under the new conditions.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is CORRECT?

A) An NPV profile graph shows how a project's payback varies as the cost of capital changes.

B) The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases.

C) An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life.

D) An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital.

A) An NPV profile graph shows how a project's payback varies as the cost of capital changes.

B) The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases.

C) An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life.

D) An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV.

B) The higher the WACC used to calculate the NPV, the lower the calculated NPV will be.

C) If a project's NPV is greater than zero, then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero, then its IRR must be less than zero.

E) The NPVs of relatively risky projects should be found using relatively low WACCs.

A) A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV.

B) The higher the WACC used to calculate the NPV, the lower the calculated NPV will be.

C) If a project's NPV is greater than zero, then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero, then its IRR must be less than zero.

E) The NPVs of relatively risky projects should be found using relatively low WACCs.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is CORRECT?

A) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR.

C) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the risk-free rate.

D) The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

A) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR.

C) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the risk-free rate.

D) The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is CORRECT?

A) The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability.

B) If the cost of capital declines, this lowers a project's NPV.

C) The NPV method is regarded by most academics as being the best indicator of a project's profitability; hence, most academics recommend that firms use only this one method.

D) A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life.

E) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project.

A) The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability.

B) If the cost of capital declines, this lowers a project's NPV.

C) The NPV method is regarded by most academics as being the best indicator of a project's profitability; hence, most academics recommend that firms use only this one method.

D) A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life.

E) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is CORRECT?

A) For a project with normal cash flows, any change in the WACC will change both the NPV and the IRR.

B) To find the MIRR, we first compound cash flows at the regular IRR to find the TV, and then we discount the TV at the WACC to find the PV.

C) The NPV and IRR methods both assume that cash flows can be reinvested at the WACC. However, the MIRR method assumes reinvestment at the MIRR itself.

D) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the higher IRR probably has more of its cash flows coming in the later years.

E) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the lower IRR probably has more of its cash flows coming in the later years.

A) For a project with normal cash flows, any change in the WACC will change both the NPV and the IRR.

B) To find the MIRR, we first compound cash flows at the regular IRR to find the TV, and then we discount the TV at the WACC to find the PV.

C) The NPV and IRR methods both assume that cash flows can be reinvested at the WACC. However, the MIRR method assumes reinvestment at the MIRR itself.

D) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the higher IRR probably has more of its cash flows coming in the later years.

E) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the lower IRR probably has more of its cash flows coming in the later years.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

Westchester Corp. is considering two equally risky, mutually exclusive projects, both of which have normal cash flows. Project A has an IRR of 11%, while Project B's IRR is 14%. When the WACC is 8%, the projects have the same NPV. Given this information, which of the following statements is CORRECT?

A) If the WACC is 13%, Project A's NPV will be higher than Project B's.

B) If the WACC is 9%, Project A's NPV will be higher than Project B's.

C) If the WACC is 6%, Project B's NPV will be higher than Project A's.

D) If the WACC is greater than 14%, Project A's IRR will exceed Project B's.

E) If the WACC is 9%, Project B's NPV will be higher than Project A's.

A) If the WACC is 13%, Project A's NPV will be higher than Project B's.

B) If the WACC is 9%, Project A's NPV will be higher than Project B's.

C) If the WACC is 6%, Project B's NPV will be higher than Project A's.

D) If the WACC is greater than 14%, Project A's IRR will exceed Project B's.

E) If the WACC is 9%, Project B's NPV will be higher than Project A's.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is CORRECT?

A) The MIRR and NPV decision criteria can never conflict.

B) The IRR method can never be subject to the multiple IRR problem, while the MIRR method can be.

C) One reason some people prefer the MIRR to the regular IRR is that the MIRR is based on a generally more reasonable reinvestment rate assumption.

D) The higher the WACC, the shorter the discounted payback period.

E) The MIRR method assumes that cash flows are reinvested at the crossover rate.

A) The MIRR and NPV decision criteria can never conflict.

B) The IRR method can never be subject to the multiple IRR problem, while the MIRR method can be.

C) One reason some people prefer the MIRR to the regular IRR is that the MIRR is based on a generally more reasonable reinvestment rate assumption.

D) The higher the WACC, the shorter the discounted payback period.

E) The MIRR method assumes that cash flows are reinvested at the crossover rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is CORRECT?

A) One advantage of the NPV over the IRR is that NPV takes account of cash flows over a project's full life whereas IRR does not.

B) One advantage of the NPV over the IRR is that NPV assumes that cash flows will be reinvested at the WACC, whereas IRR assumes that cash flows are reinvested at the IRR. The NPV assumption is generally more appropriate.

C) One advantage of the NPV over the MIRR method is that NPV takes account of cash flows over a project's full life whereas MIRR does not.

D) One advantage of the NPV over the MIRR method is that NPV discounts cash flows whereas the MIRR is based on undiscounted cash flows.

E) Since cash flows under the IRR and MIRR are both discounted at the same rate (the WACC), these two methods always rank mutually exclusive projects in the same order.

A) One advantage of the NPV over the IRR is that NPV takes account of cash flows over a project's full life whereas IRR does not.

B) One advantage of the NPV over the IRR is that NPV assumes that cash flows will be reinvested at the WACC, whereas IRR assumes that cash flows are reinvested at the IRR. The NPV assumption is generally more appropriate.

C) One advantage of the NPV over the MIRR method is that NPV takes account of cash flows over a project's full life whereas MIRR does not.

D) One advantage of the NPV over the MIRR method is that NPV discounts cash flows whereas the MIRR is based on undiscounted cash flows.

E) Since cash flows under the IRR and MIRR are both discounted at the same rate (the WACC), these two methods always rank mutually exclusive projects in the same order.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of 15%, while Project L's IRR is 12%. The two projects have the same NPV when the WACC is 7%. Which of the following statements is CORRECT?

A) If the WACC is 10%, both projects will have positive NPVs.

B) If the WACC is 6%, Project S will have the higher NPV.

C) If the WACC is 13%, Project S will have the lower NPV.

D) If the WACC is 10%, both projects will have a negative NPV.

E) Project S's NPV is more sensitive to changes in WACC than Project L's.

A) If the WACC is 10%, both projects will have positive NPVs.

B) If the WACC is 6%, Project S will have the higher NPV.

C) If the WACC is 13%, Project S will have the lower NPV.

D) If the WACC is 10%, both projects will have a negative NPV.

E) Project S's NPV is more sensitive to changes in WACC than Project L's.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

Projects S and L both have an initial cost of $10,000, followed by a series of positive cash inflows. Project S's undiscounted net cash flows total $20,000, while L's total undiscounted flows are $30,000. At a WACC of 10%, the two projects have identical NPVs. Which project's NPV is more sensitive to changes in the WACC?

A) Project S.

B) Project L.

C) Both projects are equally sensitive to changes in the WACC since their NPVs are equal at all costs of capital.

D) Neither project is sensitive to changes in the discount rate, since both have NPV profiles that are horizontal.

A) Project S.

B) Project L.

C) Both projects are equally sensitive to changes in the WACC since their NPVs are equal at all costs of capital.

D) Neither project is sensitive to changes in the discount rate, since both have NPV profiles that are horizontal.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is CORRECT?

A) For a project to have more than one IRR, then both IRRs must be greater than the WACC.

B) If two projects are mutually exclusive, then they are likely to have multiple IRRs.

C) If a project is independent, then it cannot have multiple IRRs.

D) Multiple IRRs can occur only if the signs of the cash flows change more than once.

E) If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon.

A) For a project to have more than one IRR, then both IRRs must be greater than the WACC.

B) If two projects are mutually exclusive, then they are likely to have multiple IRRs.

C) If a project is independent, then it cannot have multiple IRRs.

D) Multiple IRRs can occur only if the signs of the cash flows change more than once.

E) If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Assume that the economy is in a mild recession, and as a result interest rates and money costs generally are relatively low. The WACC for two mutually exclusive projects that are being considered is 8%. Project S has an IRR of 20% while Project L's IRR is 15%. The projects have the same NPV at the 8% current WACC. However, you believe that the economy is about to recover, and money costs and thus your WACC will also increase. You also think that the projects will not be funded until the WACC has increased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following statements is CORRECT?

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

C) You should recommend Project L, because at the new WACC it will have the higher NPV.

D) You should recommend Project S, because at the new WACC it will have the higher NPV.

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

C) You should recommend Project L, because at the new WACC it will have the higher NPV.

D) You should recommend Project S, because at the new WACC it will have the higher NPV.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

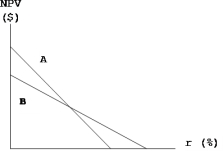

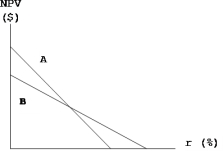

Projects A and B have identical expected lives and identical initial cash outflows (costs). However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below:  Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

A) More of Project A's cash flows occur in the later years.

B) More of Project B's cash flows occur in the later years.

C) We must have information on the cost of capital in order to determine which project has the larger early cash flows.

D) The NPV profile graph is inconsistent with the statement made in the problem.

E) The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR.

Which of the following statements is CORRECT?

Which of the following statements is CORRECT?A) More of Project A's cash flows occur in the later years.

B) More of Project B's cash flows occur in the later years.

C) We must have information on the cost of capital in order to determine which project has the larger early cash flows.

D) The NPV profile graph is inconsistent with the statement made in the problem.

E) The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Four of the following statements are truly disadvantages of the regular payback method, but one is not a disadvantage of this method. Which one is NOT a disadvantage of the payback method?

A) Lacks an objective, market-determined benchmark for making decisions.

B) Ignores cash flows beyond the payback period.

C) Does not directly account for the time value of money.

D) Does not provide any indication regarding a project's liquidity or risk.

A) Lacks an objective, market-determined benchmark for making decisions.

B) Ignores cash flows beyond the payback period.

C) Does not directly account for the time value of money.

D) Does not provide any indication regarding a project's liquidity or risk.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is CORRECT?

A) The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

B) The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

C) The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

D) The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

E) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

A) The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

B) The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

C) The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

D) The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

E) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

Projects C and D are mutually exclusive and have normal cash flows. Project C has a higher NPV if the WACC is less than 12%, whereas Project D has a higher NPV if the WACC exceeds 12%. Which of the following statements is CORRECT?

A) Project D probably has a higher IRR.

B) Project D is probably larger in scale than Project C.

C) Project C probably has a faster payback.

D) Project C probably has a higher IRR.

E) The crossover rate between the two projects is below 12%.

A) Project D probably has a higher IRR.

B) Project D is probably larger in scale than Project C.

C) Project C probably has a faster payback.

D) Project C probably has a higher IRR.

E) The crossover rate between the two projects is below 12%.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is CORRECT?

A) The NPV, IRR, MIRR, and discounted payback (using a payback requirement of 3 years or less) methods always lead to the same accept/reject decisions for independent projects.

B) For mutually exclusive projects with normal cash flows, the NPV and MIRR methods can never conflict, but their results could conflict with the discounted payback and the regular IRR methods.

C) Multiple IRRs can exist, but not multiple MIRRs. This is one reason some people favor the MIRR over the regular IRR.

D) If a firm uses the discounted payback method with a required payback of 4 years, then it will accept more projects than if it used a regular payback of 4 years.

A) The NPV, IRR, MIRR, and discounted payback (using a payback requirement of 3 years or less) methods always lead to the same accept/reject decisions for independent projects.

B) For mutually exclusive projects with normal cash flows, the NPV and MIRR methods can never conflict, but their results could conflict with the discounted payback and the regular IRR methods.

C) Multiple IRRs can exist, but not multiple MIRRs. This is one reason some people favor the MIRR over the regular IRR.

D) If a firm uses the discounted payback method with a required payback of 4 years, then it will accept more projects than if it used a regular payback of 4 years.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is CORRECT?

A) The IRR method appeals to some managers because it gives an estimate of the rate of return on projects rather than a dollar amount, which the NPV method provides.

B) The discounted payback method eliminates all of the problems associated with the payback method.

C) When evaluating independent projects, the NPV and IRR methods often yield conflicting results regarding a project's acceptability.

D) To find the MIRR, we discount the TV at the IRR.

A) The IRR method appeals to some managers because it gives an estimate of the rate of return on projects rather than a dollar amount, which the NPV method provides.

B) The discounted payback method eliminates all of the problems associated with the payback method.

C) When evaluating independent projects, the NPV and IRR methods often yield conflicting results regarding a project's acceptability.

D) To find the MIRR, we discount the TV at the IRR.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

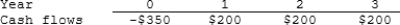

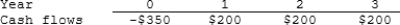

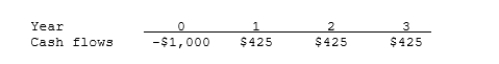

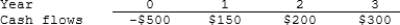

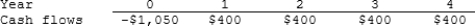

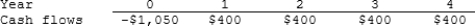

Resnick Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one cash outflow at t = 0 followed by a series of positive cash flows.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then its MIRR will be greater than the IRR.

D) To find a project's MIRR, we compound cash inflows at the regular IRR and then find the discount rate that causes the PV of the terminal value to equal the initial cost.

E) To find a project's MIRR, the textbook procedure compounds cash inflows at the WACC and then finds the discount rate that causes the PV of the terminal value to equal the initial cost.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then its MIRR will be greater than the IRR.

D) To find a project's MIRR, we compound cash inflows at the regular IRR and then find the discount rate that causes the PV of the terminal value to equal the initial cost.

E) To find a project's MIRR, the textbook procedure compounds cash inflows at the WACC and then finds the discount rate that causes the PV of the terminal value to equal the initial cost.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

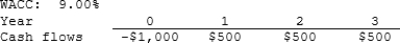

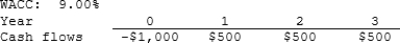

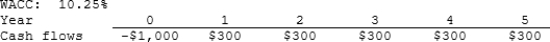

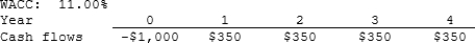

Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $265.65

B) $278.93

C) $292.88

D) $307.52

E) $322.90

A) $265.65

B) $278.93

C) $292.88

D) $307.52

E) $322.90

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

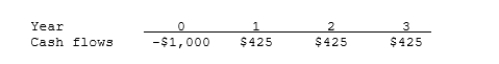

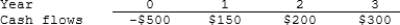

Mansi Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 1.91 years

B) 2.12 years

C) 2.36 years

D) 2.59 years

A) 1.91 years

B) 2.12 years

C) 2.36 years

D) 2.59 years

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 12.55%

B) 13.21%

C) 13.87%

D) 14.56%

E) 15.29%

A) 12.55%

B) 13.21%

C) 13.87%

D) 14.56%

E) 15.29%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

Thorley Inc. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 9.43%

B) 9.91%

C) 10.40%

D) 10.92%

E) 11.47%

A) 9.43%

B) 9.91%

C) 10.40%

D) 10.92%

E) 11.47%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

Taggart Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 1.86 years

B) 2.07 years

C) 2.30 years

D) 2.53 years

E) 2.78 years

A) 1.86 years

B) 2.07 years

C) 2.30 years

D) 2.53 years

E) 2.78 years

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

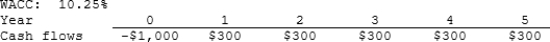

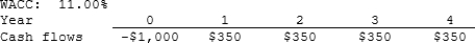

Harry's Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then the MIRR will be less than the IRR.

D) If a project's IRR is greater than its WACC, then the MIRR will be greater than the IRR.

E) To find a project's MIRR, we compound cash inflows at the IRR and then discount the terminal value back to t = 0 at the WACC.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then the MIRR will be less than the IRR.

D) If a project's IRR is greater than its WACC, then the MIRR will be greater than the IRR.

E) To find a project's MIRR, we compound cash inflows at the IRR and then discount the terminal value back to t = 0 at the WACC.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

Projects S and L both have normal cash flows, and the projects have the same risk, hence both are evaluated with the same WACC, 10%. However, S has a higher IRR than L. Which of the following statements is CORRECT?

A) Project S must have a higher NPV than Project L.

B) If Project S has a positive NPV, Project L must also have a positive NPV.

C) If the WACC falls, each project's IRR will increase.

D) If the WACC increases, each project's IRR will decrease.

A) Project S must have a higher NPV than Project L.

B) If Project S has a positive NPV, Project L must also have a positive NPV.

C) If the WACC falls, each project's IRR will increase.

D) If the WACC increases, each project's IRR will decrease.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

You are considering two mutually exclusive, equally risky, projects. Both have IRRs that exceed the WACC. Which of the following statements is CORRECT? Assume that the projects have normal cash flows, with one outflow followed by a series of inflows.

A) If the two projects' NPV profiles do not cross, then there will be a sharp conflict as to which one should be selected.

B) If the cost of capital is greater than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects. The same project will rank higher by both criteria.

C) If the cost of capital is less than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects. The same project will rank higher by both criteria.

D) For a conflict to exist between NPV and IRR, the initial investment cost of one project must exceed the cost of the other.

A) If the two projects' NPV profiles do not cross, then there will be a sharp conflict as to which one should be selected.

B) If the cost of capital is greater than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects. The same project will rank higher by both criteria.

C) If the cost of capital is less than the crossover rate, then the IRR and the NPV criteria will not result in a conflict between the projects. The same project will rank higher by both criteria.

D) For a conflict to exist between NPV and IRR, the initial investment cost of one project must exceed the cost of the other.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

McCall Manufacturing has a WACC of 10%. The firm is considering two normal, equally risky, mutually exclusive, but not repeatable projects. The two projects have the same investment costs, but Project A has an IRR of 15%, while Project B has an IRR of 20%. Assuming the projects' NPV profiles cross in the upper right quadrant, which of the following statements is CORRECT?

A) Each project must have a negative NPV.

B) Since the projects are mutually exclusive, the firm should always select Project B.

C) If the crossover rate is 8%, Project B will have the higher NPV.

D) Only one project has a positive NPV.

A) Each project must have a negative NPV.

B) Since the projects are mutually exclusive, the firm should always select Project B.

C) If the crossover rate is 8%, Project B will have the higher NPV.

D) Only one project has a positive NPV.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

Susmel Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

Projects A and B are mutually exclusive and have normal cash flows. Project A has an IRR of 15% and B's IRR is 20%. The company's WACC is 12%, and at that rate Project A has the higher NPV. Which of the following statements is CORRECT?

A) The crossover rate for the two projects must be less than 12%.

B) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale).

C) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

D) The crossover rate for the two projects must be 12%.

E) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12%.

Problems

A) The crossover rate for the two projects must be less than 12%.

B) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale).

C) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

D) The crossover rate for the two projects must be 12%.

E) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12%.

Problems

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

You are on the staff of Camden Inc. The CFO believes project acceptance should be based on the NPV, but Steve Camden, the president, insists that no project should be accepted unless its IRR exceeds the project's risk-adjusted WACC. Now you must make a recommendation on a project that has a cost of $15,000 and two cash flows: $110,000 at the end of Year 1 and -$100,000 at the end of Year 2. The president and the CFO both agree that the appropriate WACC for this project is 10%. At 10%, the NPV is $2,355.37, but you find two IRRs, one at 6.33% and one at 527%, and a MIRR of 11.32%. Which of the following statements best describes your optimal recommendation, i.e., the analysis and recommendation that is best for the company and least likely to get you in trouble with either the CFO or the president?

A) You should recommend that the project be rejected because its NPV is negative and its IRR is less than the WACC.

B) You should recommend that the project be rejected because, although its NPV is positive, it has an IRR that is less than the WACC.

C) You should recommend that the project be accepted because (1) its NPV is positive and (2) although it has two IRRs, in this case it would be better to focus on the MIRR, which exceeds the WACC. You should explain this to the president and tell him that the firm's value will increase if the project is accepted.

D) You should recommend that the project be rejected. Although its NPV is positive it has two IRRs, one of which is less than the WACC, which indicates that the firm's value will decline if the project is accepted.

A) You should recommend that the project be rejected because its NPV is negative and its IRR is less than the WACC.

B) You should recommend that the project be rejected because, although its NPV is positive, it has an IRR that is less than the WACC.

C) You should recommend that the project be accepted because (1) its NPV is positive and (2) although it has two IRRs, in this case it would be better to focus on the MIRR, which exceeds the WACC. You should explain this to the president and tell him that the firm's value will increase if the project is accepted.

D) You should recommend that the project be rejected. Although its NPV is positive it has two IRRs, one of which is less than the WACC, which indicates that the firm's value will decline if the project is accepted.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements is CORRECT? Assume that all projects being considered have normal cash flows and are equally risky.

A) If a project's IRR is equal to its WACC, then, under all reasonable conditions, the project's NPV must be negative.

B) If a project's IRR is equal to its WACC, then under all reasonable conditions, the project's IRR must be negative.

C) If a project's IRR is equal to its WACC, then under all reasonable conditions the project's NPV must be zero.

D) There is no necessary relationship between a project's IRR, its WACC, and its NPV.

E) When evaluating mutually exclusive projects, those projects with relatively long lives will tend to have relatively high NPVs when the cost of capital is relatively high.

A) If a project's IRR is equal to its WACC, then, under all reasonable conditions, the project's NPV must be negative.

B) If a project's IRR is equal to its WACC, then under all reasonable conditions, the project's IRR must be negative.

C) If a project's IRR is equal to its WACC, then under all reasonable conditions the project's NPV must be zero.

D) There is no necessary relationship between a project's IRR, its WACC, and its NPV.

E) When evaluating mutually exclusive projects, those projects with relatively long lives will tend to have relatively high NPVs when the cost of capital is relatively high.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

Project X's IRR is 19% and Project Y's IRR is 17%. The projects have the same risk and the same lives, and each has constant cash flows during each year of their lives. If the WACC is 10%, Project Y has a higher NPV than X. Given this information, which of the following statements is CORRECT?

A) The crossover rate must be less than 10%.

B) The crossover rate must be greater than 10%.

C) If the WACC is 8%, Project X will have the higher NPV.

D) If the WACC is 18%, Project Y will have the higher NPV.

E) Project X is larger in the sense that it has the higher initial cost.

A) The crossover rate must be less than 10%.

B) The crossover rate must be greater than 10%.

C) If the WACC is 8%, Project X will have the higher NPV.

D) If the WACC is 18%, Project Y will have the higher NPV.

E) Project X is larger in the sense that it has the higher initial cost.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

A company is choosing between two projects. The larger project has an initial cost of $100,000, annual cash flows of $30,000 for 5 years, and an IRR of 15.24%. The smaller project has an initial cost of $50,000, annual cash flows of $16,000 for 5 years, and an IRR of 16.63%. The projects are equally risky. Which of the following statements is CORRECT?

A) Since the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC.

B) Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC.

C) If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is.

D) Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate.

A) Since the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC.

B) Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC.

C) If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is.

D) Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

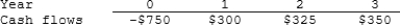

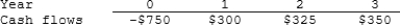

Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

Warr Company is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 14.05%

B) 15.61%

C) 17.34%

D) 19.27%

E) 21.20%

A) 14.05%

B) 15.61%

C) 17.34%

D) 19.27%

E) 21.20%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck