Deck 6: Taxes and Subsidies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

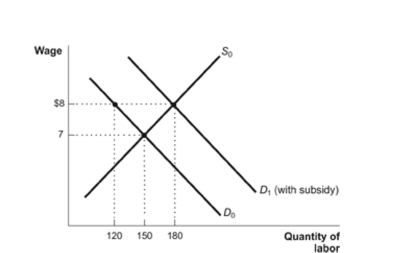

Question

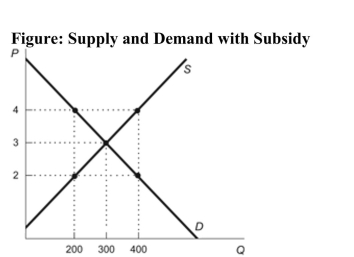

Question

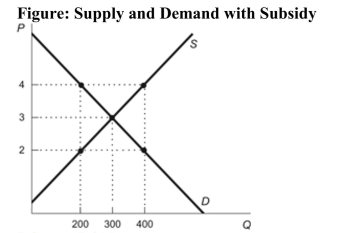

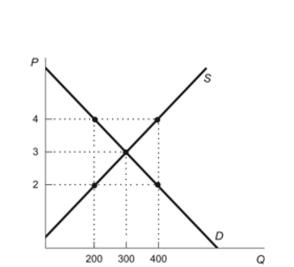

Question

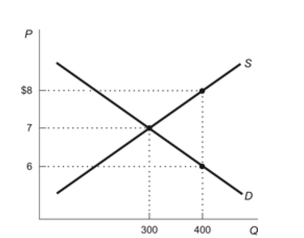

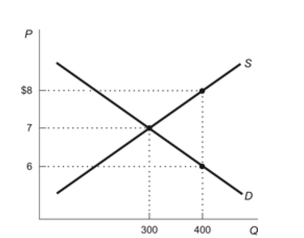

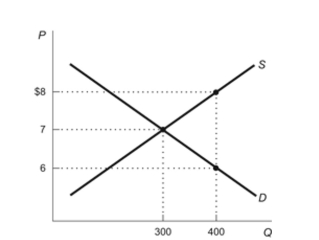

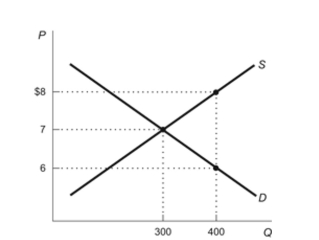

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 6: Taxes and Subsidies

1

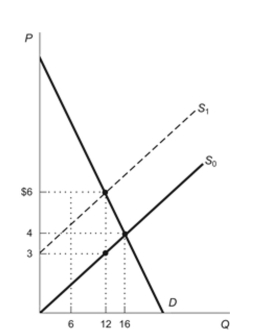

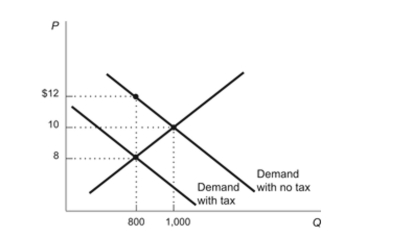

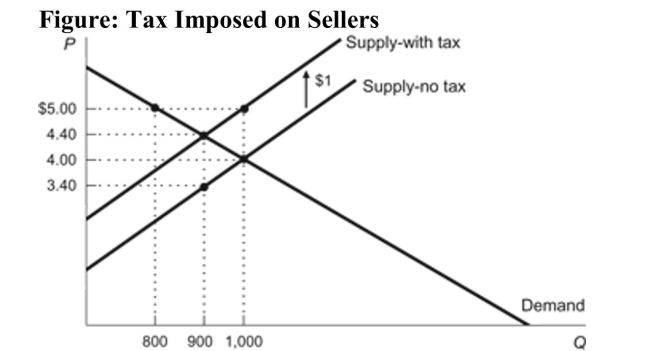

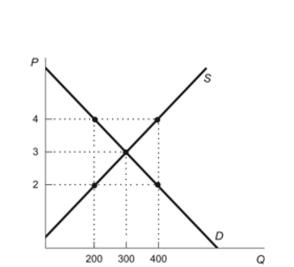

Figure: Tax on Sellers of Gadgets  Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the tax revenue that the government collects from the tax on gadgets?

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the tax revenue that the government collects from the tax on gadgets?

A) $350

B) $450

C) $175

D) $550

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the tax revenue that the government collects from the tax on gadgets?

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the tax revenue that the government collects from the tax on gadgets?A) $350

B) $450

C) $175

D) $550

A

2

A tax on sellers of popcorn will:

A) increase the size of the popcorn market.

B) reduce the size of the popcorn market.

C) may increase, decrease, or have no effect on the size of the popcorn market.

D) have no effect on the size of the popcorn market.

A) increase the size of the popcorn market.

B) reduce the size of the popcorn market.

C) may increase, decrease, or have no effect on the size of the popcorn market.

D) have no effect on the size of the popcorn market.

B

3

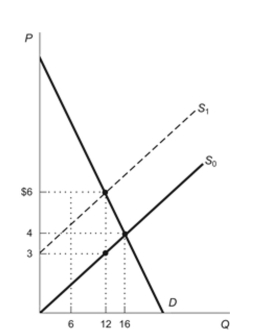

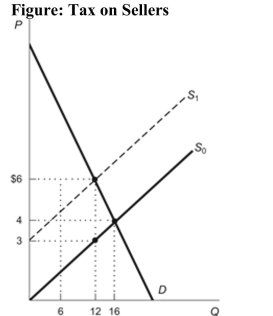

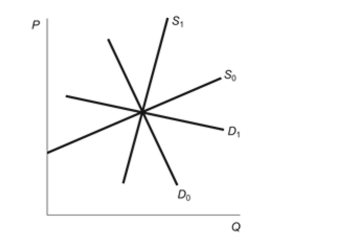

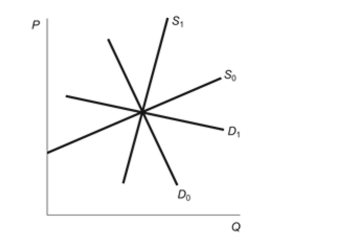

Figure: Tax on Sellers  Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. With the tax, buyers pay ________ and sellers receive ________.

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. With the tax, buyers pay ________ and sellers receive ________.

A) $6; $3

B) $6; $6

C) $3; $6

D) $3; $4

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. With the tax, buyers pay ________ and sellers receive ________.

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. With the tax, buyers pay ________ and sellers receive ________.A) $6; $3

B) $6; $6

C) $3; $6

D) $3; $4

A

4

Reference: Ref 6-1 (Figure: Tax on Sellers) If a $3 tax per unit purchased was placed on buyers instead of sellers, buyers would pay ________ and sellers would receive ________.

Reference: Ref 6-1 (Figure: Tax on Sellers) If a $3 tax per unit purchased was placed on buyers instead of sellers, buyers would pay ________ and sellers would receive ________.A) $3; $6

B) $6; $3

C) $4; $6

D) $4; $3

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the amount of the deadweight loss caused by the imposition of the tax on gadgets?

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the amount of the deadweight loss caused by the imposition of the tax on gadgets?A) $100

B) $1

C) $0.50

D) $50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Reference: Ref 6-1 (Figure: Tax on Sellers) Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. Using the figure, calculate the amount of the tax.

Reference: Ref 6-1 (Figure: Tax on Sellers) Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. Using the figure, calculate the amount of the tax.A) $1

B) $2

C) $3

D) $4

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

A tax on the seller of a product:

A) causes the seller's take-home price to rise above that paid by the buyer.

B) causes the demand curve for the product to shift to the right.

C) causes the supply curve for the product to shift to the left.

D) always causes the equilibrium quantity traded in the market to increase.

A) causes the seller's take-home price to rise above that paid by the buyer.

B) causes the demand curve for the product to shift to the right.

C) causes the supply curve for the product to shift to the left.

D) always causes the equilibrium quantity traded in the market to increase.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is TRUE? I. A $0.50 tax on each fishing lure sold raises the price per lure by $0.50. II. A tax on sellers is equivalent to a tax on buyers. III. A tax on buyers is analyzed by shifting the demand curve up by the amount of the tax.

A) I and II only

B) II and III only

C) II only

D) I, II, and III

A) I and II only

B) II and III only

C) II only

D) I, II, and III

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

A tax on sellers of apples:

A) leads sellers to supply less apples at every price.

B) leads sellers to supply more apples at every price.

C) causes the supply curve to shift to the right.

D) leads buyers to demand more apples at every price.

A) leads sellers to supply less apples at every price.

B) leads sellers to supply more apples at every price.

C) causes the supply curve to shift to the right.

D) leads buyers to demand more apples at every price.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

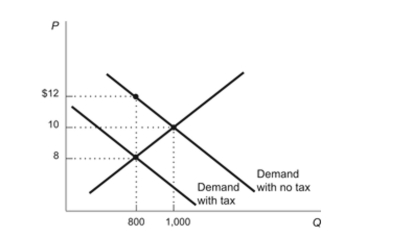

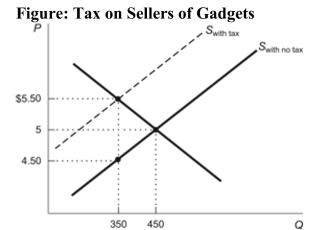

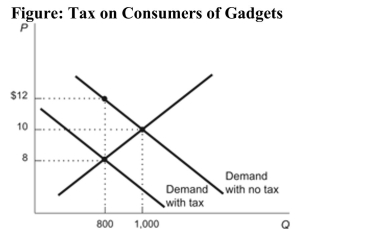

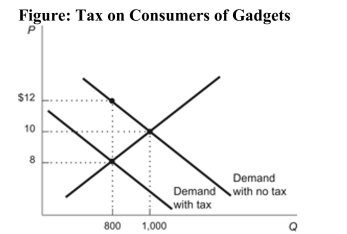

(Figure: Tax on Consumers of Gadgets) According to the figure, what is the amount of the tax that has been imposed on gadgets? Figure: Tax on Consumers of Gadgets

A) $ 4

B) $ 2

C) $ 8

D) $ 12

A) $ 4

B) $ 2

C) $ 8

D) $ 12

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

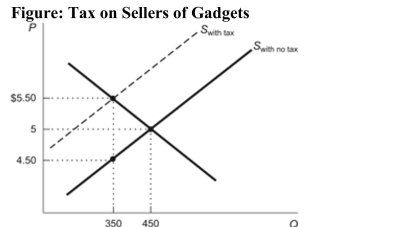

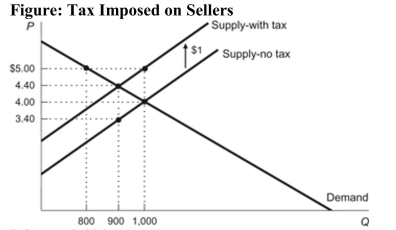

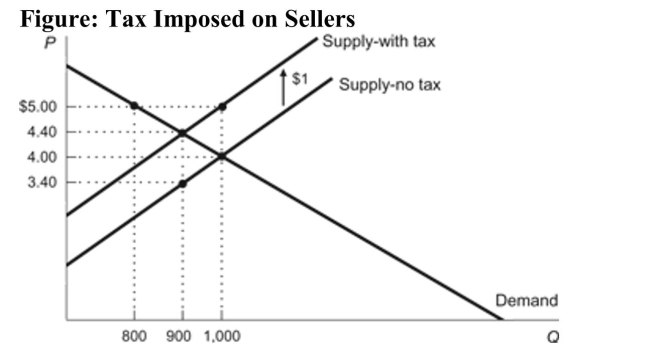

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the price that buyers pay AFTER the tax is imposed is:

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the price that buyers pay AFTER the tax is imposed is:A) $5.

B) $4.40.

C) $4.

D) $3.40.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is correct concerning the burden of a tax imposed on coffee mugs?

A) Buyers and sellers share the burden of the tax.

B) Buyers bear the entire burden of the tax.

C) Sellers bear the entire burden of the tax.

D) It depends on whether the buyers or the sellers are required to pay the tax.

A) Buyers and sellers share the burden of the tax.

B) Buyers bear the entire burden of the tax.

C) Sellers bear the entire burden of the tax.

D) It depends on whether the buyers or the sellers are required to pay the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the amount of the tax that has been imposed on the sale of gadgets?

Reference: Ref 6-2 (Figure: Tax on Sellers of Gadgets) According to the figure, what is the amount of the tax that has been imposed on the sale of gadgets?A) $0.50

B) $1.00

C) $1.50

D) $5.50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

If a tax is imposed on sellers of a product the demand curve will:

A) shift upward.

B) shift downward.

C) not shift.

D) shift upward or downward depending on elasticity of demand.

A) shift upward.

B) shift downward.

C) not shift.

D) shift upward or downward depending on elasticity of demand.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

When a tax is imposed on consumers the demand curve will:

A) shift downward by the amount of the tax.

B) shift upward by the amount of the tax.

C) shift downward by less than the amount of the tax.

D) not shift since sellers collect per unit taxes.

A) shift downward by the amount of the tax.

B) shift upward by the amount of the tax.

C) shift downward by less than the amount of the tax.

D) not shift since sellers collect per unit taxes.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. The equilibrium quantity sold under the tax is:

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. The equilibrium quantity sold under the tax is:A) 4.

B) 12.

C) 16.

D) 10.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

Without taxes, the market price per bag of apples is $5. With a $2 tax per bag of apples, buyers now pay $5.75 per bag. What is the final price per bag of apples received by sellers?

A) $5.00

B) $7.75

C) $3.00

D) $3.75

A) $5.00

B) $7.75

C) $3.00

D) $3.75

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the equilibrium price and quantity before the $1 tax is imposed are:

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the equilibrium price and quantity before the $1 tax is imposed are:A) $5 and 800.

B) $4.40 and 900.

C) $4 and 1,000.

D) $3.40 and 900

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose there is a tax of $50 on bicycles. The supply curve for bicycles slopes upward. The demand curve for bicycles slopes downward. Sellers are required by law to pay the tax. If the tax is reduced from $50 to $10 per bicycle, then the:

A) supply curve will shift downward by $40.

B) demand curve will shift downward by $40.

C) demand curve will shift upward by $40.

D) supply curve will shift upward by $40.

A) supply curve will shift downward by $40.

B) demand curve will shift downward by $40.

C) demand curve will shift upward by $40.

D) supply curve will shift upward by $40.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

The question of who pays the greater amount of a commodity tax is determined by:

A) Congress.

B) the President of the United States.

C) the relative elasticities of demand and supply.

D) the individual who writes the check for the tax.

A) Congress.

B) the President of the United States.

C) the relative elasticities of demand and supply.

D) the individual who writes the check for the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

If a tax is imposed on a market with inelastic demand and elastic supply:

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) there is no way to determine how the burden of the tax will be shared.

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) there is no way to determine how the burden of the tax will be shared.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

(Figure: Commodity Tax with Elastic Demand) According to the figure, who bears the greater burden of a commodity tax? Figure: Commodity Tax with Elastic Demand

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

Reference: Ref 6-4 Suppose that there is a tax of $5 per unit, and the demand curve is more elastic than the supply curve. Which of the following statements could be true?

Reference: Ref 6-4 Suppose that there is a tax of $5 per unit, and the demand curve is more elastic than the supply curve. Which of the following statements could be true?A) Buyers pay $3 of the tax.

B) Buyers pay $1 of the tax.

C) Sellers pay $1 of the tax.

D) Sellers pay all of the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is TRUE? The buyer will pay more of the tax burden if: I. the good is a luxury good. II. the good is a necessity. III. the good has no substitutes.

A) I only

B) II only

C) II and III only

D) I and III only

A) I only

B) II only

C) II and III only

D) I and III only

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is correct?

A) When demand is more inelastic than supply, sellers pay more of the tax.

B) When demand is more elastic than supply, sellers pay more of the tax.

C) When supply is more inelastic than demand, buyers pay more of the tax.

D) When supply is more elastic than demand, sellers pay more of the tax.

A) When demand is more inelastic than supply, sellers pay more of the tax.

B) When demand is more elastic than supply, sellers pay more of the tax.

C) When supply is more inelastic than demand, buyers pay more of the tax.

D) When supply is more elastic than demand, sellers pay more of the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

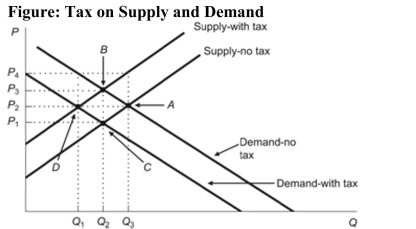

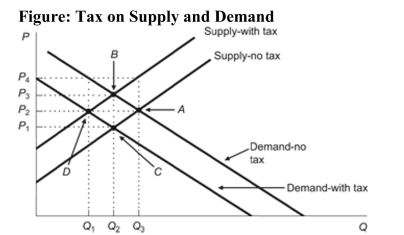

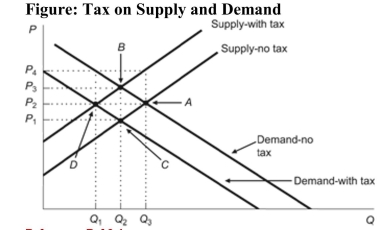

Reference: Ref 6-4 (Figure: Tax on Supply and Demand) According to the figure, if the tax is placed on sellers, the equilibrium is at Point:

Reference: Ref 6-4 (Figure: Tax on Supply and Demand) According to the figure, if the tax is placed on sellers, the equilibrium is at Point:A) A, and the equilibrium price and quantity are P3 and Q2.

B) A, and the equilibrium price and quantity are P4 and Q3.

C) B, and the equilibrium price and quantity are P3 and Q2.

D) C, and the equilibrium price and quantity are P1 and Q2

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

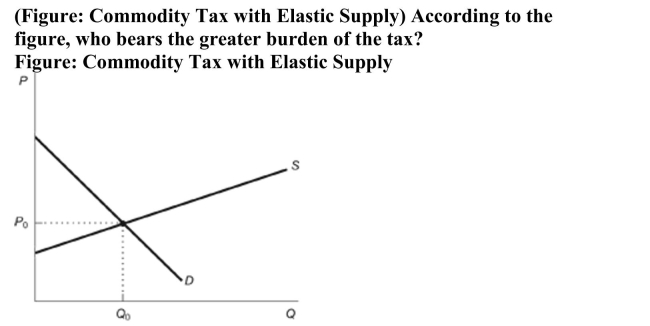

27

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Whether a buyer or a seller pays more of a commodity tax depends on:

A) their relative price elasticities.

B) the decisions made by Congress.

C) whether the demand curve is negatively or positively sloped.

D) whether the supply curve is negatively or positively sloped.

A) their relative price elasticities.

B) the decisions made by Congress.

C) whether the demand curve is negatively or positively sloped.

D) whether the supply curve is negatively or positively sloped.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the price that sellers receive AFTER the tax is imposed is:

Reference: Ref 6-3 (Figure: Tax Imposed on Sellers) According to the figure, the price that sellers receive AFTER the tax is imposed is:A) $5.

B) $4.40.

C) $4.

D) $3.40.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

Reference: Ref 6-4 (Figure: Tax on Supply and Demand) According to the figure, if the tax is placed on buyers, the equilibrium is at Point:

Reference: Ref 6-4 (Figure: Tax on Supply and Demand) According to the figure, if the tax is placed on buyers, the equilibrium is at Point:A) B, and the equilibrium price and quantity are P3 and Q2.

B) C, and the equilibrium price and quantity are P3 and Q2.

C) C, and the equilibrium price and quantity are P1 and Q2.

D) D, and the equilibrium price and quantity are P2 and Q1.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

If buyers are required to pay a tax on top of the price, buyers' willingness to pay will:

A) decrease and the demand curve will shift down.

B) decrease and the demand curve will shift up.

C) increase and the demand curve will shift down.

D) increase and the demand curve will shift up.

A) decrease and the demand curve will shift down.

B) decrease and the demand curve will shift up.

C) increase and the demand curve will shift down.

D) increase and the demand curve will shift up.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that there is a tax of $1 per unit, and the elasticity of supply is 3 and the elasticity of demand is 2 (in absolute value). How much of the $1 tax is paid by sellers?

A) $0.60

B) $0.40

C) $0.75

D) $0.67

A) $0.60

B) $0.40

C) $0.75

D) $0.67

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

With regard to tax burdens, what does the ―elasticity = escape‖ idea tell you?

A) that the curve (between demand and supply) that is relatively more elastic will bear less of the tax burden

B) that the curve (between demand and supply) that is relatively more inelastic will bear less of the tax burden

C) that the curve (between demand and supply) that is relatively more elastic will escape the tax burden entirely

D) that the ratio of the buyers' tax burden to the sellers' tax burden is always greater than 1

A) that the curve (between demand and supply) that is relatively more elastic will bear less of the tax burden

B) that the curve (between demand and supply) that is relatively more inelastic will bear less of the tax burden

C) that the curve (between demand and supply) that is relatively more elastic will escape the tax burden entirely

D) that the ratio of the buyers' tax burden to the sellers' tax burden is always greater than 1

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

(Figure: Elasticities of Supply and Demand) Which combination of demand and supply curves results in the greatest tax burden to buyers? Figure: Elasticities of Supply and Demand

A) D0 and S0

B) D1 and S1

C) D0 and S1

D) D1 and S0

A) D0 and S0

B) D1 and S1

C) D0 and S1

D) D1 and S0

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

If a tax is imposed on a market with elastic demand and inelastic supply:

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) there is no way to determine how the burden of the tax will be shared.

A) buyers will bear most of the burden of the tax.

B) sellers will bear most of the burden of the tax.

C) the burden of the tax will be shared equally between buyers and sellers.

D) there is no way to determine how the burden of the tax will be shared.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

In the market for Good X-a necessity good without any good substitutes-the workers and capital in the industry can easily find work producing other goods. The burden of the tax is likely to fall:

A) more heavily on buyers, given that demand is more inelastic than supply.

B) evenly between buyers and sellers.

C) more heavily on sellers, given that supply is more inelastic than demand.

D) more heavily on buyers, given that demand is more elastic than supply.

A) more heavily on buyers, given that demand is more inelastic than supply.

B) evenly between buyers and sellers.

C) more heavily on sellers, given that supply is more inelastic than demand.

D) more heavily on buyers, given that demand is more elastic than supply.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

If the elasticity of demand is 1 in absolute value, and the elasticity of supply is 1 in absolute value, how much of a tax burden will the buyer bear relative to the seller?

A) The buyer will bear more of the tax burden than will the seller.

B) The seller will bear more of the tax burden than will the buyer.

C) The buyer and seller will share the tax burden equally.

D) The buyer will not bear any of the tax burden since demand is unit elastic.

A) The buyer will bear more of the tax burden than will the seller.

B) The seller will bear more of the tax burden than will the buyer.

C) The buyer and seller will share the tax burden equally.

D) The buyer will not bear any of the tax burden since demand is unit elastic.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

Buyers bear a greater share of a tax burden when a tax is imposed in a market where:

A) demand is more elastic than supply.

B) supply is more elastic than demand.

C) the tax is imposed on sellers.

D) the tax is imposed on buyers.

A) demand is more elastic than supply.

B) supply is more elastic than demand.

C) the tax is imposed on sellers.

D) the tax is imposed on buyers.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

If the elasticity of demand is 2 in absolute value, and the elasticity of supply is 1 in absolute value, how much of a tax burden will the buyer bear relative to the seller?

A) The buyer will bear more of the tax burden than will the seller.

B) The seller will bear more of the tax burden than will the buyer.

C) The buyer and seller will share the tax burden equally.

D) The buyer will not bear none of the tax burden since demand curve is twice as elastic as supply.

A) The buyer will bear more of the tax burden than will the seller.

B) The seller will bear more of the tax burden than will the buyer.

C) The buyer and seller will share the tax burden equally.

D) The buyer will not bear none of the tax burden since demand curve is twice as elastic as supply.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a correct statement about tax burdens?

A) A tax burden is distributed independently of relative elasticities of supply and demand.

B) A tax burden falls most heavily on the side of the market that is closer to unit elastic.

C) A tax burden falls most heavily on the side of the market that is less elastic.

D) A tax burden falls most heavily on the side of the market that is more elastic.

A) A tax burden is distributed independently of relative elasticities of supply and demand.

B) A tax burden falls most heavily on the side of the market that is closer to unit elastic.

C) A tax burden falls most heavily on the side of the market that is less elastic.

D) A tax burden falls most heavily on the side of the market that is more elastic.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is the correct answer to the question: Why do smokers pay almost all the taxes assessed on cigarettes? I. Because they are addictive, the demand for cigarettes is relatively elastic when compared to the supply curve of cigarettes. II. Because they are addictive, the demand for cigarettes is relatively inelastic when compared to the supply of cigarettes. III. Cigarette manufacturers can very easily escape a state tax by selling in a different state.

A) I only

B) II only

C) I and III only

D) II and III only

A) I only

B) II only

C) I and III only

D) II and III only

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

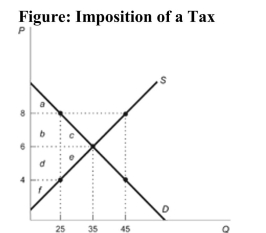

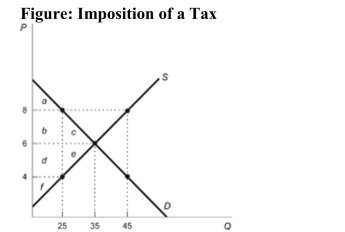

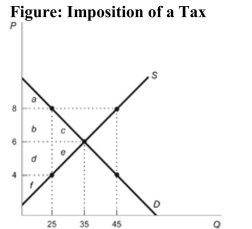

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. With a $4 tax, the deadweight loss is:

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. With a $4 tax, the deadweight loss is:A) $10.

B) $35.

C) $20.

D) $40.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. After the imposition of a $4 tax, the government collects revenues of:

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. After the imposition of a $4 tax, the government collects revenues of:A) $75.

B) $100.

C) $210.

D) $50.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

A ________ creates a situation in which the price received by sellers ________ the price paid by buyers.

A) tax; exceeds

B) tax; equals

C) subsidy; is less than

D) subsidy; exceeds

A) tax; exceeds

B) tax; equals

C) subsidy; is less than

D) subsidy; exceeds

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

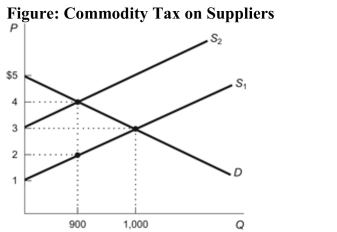

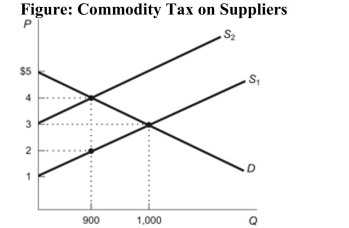

Reference: Ref 6-7 (Figure: Commodity Tax on Suppliers) Refer to the figure. If a tax shifts the supply curve from S1 to S2, tax revenue is:

Reference: Ref 6-7 (Figure: Commodity Tax on Suppliers) Refer to the figure. If a tax shifts the supply curve from S1 to S2, tax revenue is:A) $3,600.

B) $2,700.

C) $1,800.

D) $1,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Reference: Ref 6-8 (Figure: Tax on Consumers of Gadgets) Refer to the figure. What is the tax revenue that the government collects from the tax on gadgets?

Reference: Ref 6-8 (Figure: Tax on Consumers of Gadgets) Refer to the figure. What is the tax revenue that the government collects from the tax on gadgets?A) $800

B) $3,200

C) $400

D) $200

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is TRUE? A tax and subsidy are similar in that: I. they both create a deadweight loss. II. the burden of the tax and benefit of the subsidy depend on relative elasticities of demand and supply. III. they both change the equilibrium level of output.

A) I only

B) I and II only

C) I, II, and III

D) I and III only

A) I only

B) I and II only

C) I, II, and III

D) I and III only

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

To be efficient, the revenue from taxation must provide goods that have benefits that ________ the deadweight loss caused by the taxation itself.

A) maximize

B) exceed

C) eliminate

D) minimize

A) maximize

B) exceed

C) eliminate

D) minimize

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose the demand for pizza is inelastic and the supply of pizza is elastic, and the demand for cigarettes is inelastic and the supply of cigarettes is elastic. If a tax were levied on the sellers of both of these commodities, we would expect that the burden of:

A) the pizza tax would fall more heavily on sellers than on buyers, and the burden of the cigarette tax would fall more heavily on buyers than on sellers.

B) the pizza tax would fall more heavily on buyers than on sellers, and the burden of the cigarette tax would fall more heavily on sellers than on buyers.

C) both the pizza and the cigarette taxes would fall more heavily on buyers than on sellers.

D) both the pizza and the cigarette taxes would fall more heavily on sellers than on buyers.

A) the pizza tax would fall more heavily on sellers than on buyers, and the burden of the cigarette tax would fall more heavily on buyers than on sellers.

B) the pizza tax would fall more heavily on buyers than on sellers, and the burden of the cigarette tax would fall more heavily on sellers than on buyers.

C) both the pizza and the cigarette taxes would fall more heavily on buyers than on sellers.

D) both the pizza and the cigarette taxes would fall more heavily on sellers than on buyers.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

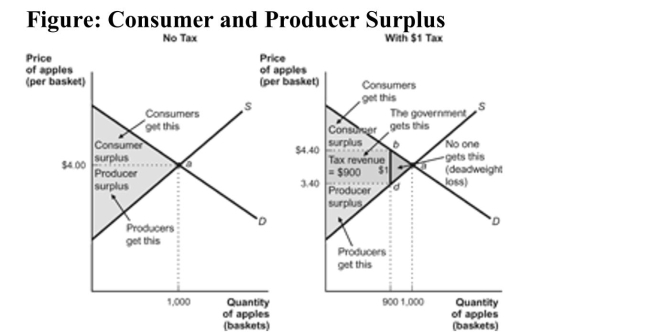

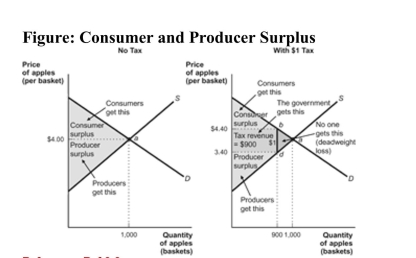

Reference: Ref 6-6 (Figure: Consumer and Producer Surplus) According to the figure, what is the value of the deadweight loss?

Reference: Ref 6-6 (Figure: Consumer and Producer Surplus) According to the figure, what is the value of the deadweight loss?A) The deadweight loss cannot be calculated.

B) $900

C) $100

D) $50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

Most labor economists believe that the supply of labor is ______ elastic than firms' demand for labor, and therefore ______ bear most of the burden of a payroll tax.

A) more; workers

B) less; workers

C) less; firms

D) more; firms

A) more; workers

B) less; workers

C) less; firms

D) more; firms

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

If the elasticity of supply is 1, and the elasticity of demand is 3 (in absolute value), then for a tax of $1 buyers will pay:

A) an extra 25 cents and sellers will receive 75 cents less.

B) an extra 75 cents and sellers will receive 25 cents less.

C) an extra 50 cents and sellers will receive 50 cents less.

D) nothing extra since this is the special case where demand is unit elastic.

A) an extra 25 cents and sellers will receive 75 cents less.

B) an extra 75 cents and sellers will receive 25 cents less.

C) an extra 50 cents and sellers will receive 50 cents less.

D) nothing extra since this is the special case where demand is unit elastic.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Reference: Ref 6-7 (Figure: Commodity Tax on Suppliers) Refer to the figure. If a tax shifts the supply curve from S1 to S2, the value of deadweight loss is:

Reference: Ref 6-7 (Figure: Commodity Tax on Suppliers) Refer to the figure. If a tax shifts the supply curve from S1 to S2, the value of deadweight loss is:A) $200.

B) $100.

C) $50.

D) $25.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Reference: Ref 6-8 (Figure: Tax on Consumers of Gadgets) Refer to the figure. What is the amount of the deadweight loss caused by the imposition of the tax on gadgets?

Reference: Ref 6-8 (Figure: Tax on Consumers of Gadgets) Refer to the figure. What is the amount of the deadweight loss caused by the imposition of the tax on gadgets?A) $800

B) $3,200

C) $400

D) $200

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

When a payroll tax is enacted or a mandate requires firms to provide health insurance the wage paid to workers ______ and the wage paid by firms ______.

A) rises; rises

B) rises; falls

C) falls; falls

D) falls; rises

A) rises; rises

B) rises; falls

C) falls; falls

D) falls; rises

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

Reference: Ref 6-6 (Figure: Consumer and Producer Surplus) According to the figure, what would happen to the deadweight loss if the tax increased to $2 per basket of apples?

Reference: Ref 6-6 (Figure: Consumer and Producer Surplus) According to the figure, what would happen to the deadweight loss if the tax increased to $2 per basket of apples?A) The new tax would minimize deadweight loss.

B) Deadweight loss does not change due to a change in the tax.

C) There is no way to tell what will happen to deadweight loss.

D) Deadweight loss will increase.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is TRUE regarding cigarette taxes?

A) Cigarette manufacturers bear almost all of the cigarette taxes.

B) Cigarette manufacturers tend to ship their product from low- tax states to high-tax states.

C) The elasticity of cigarette supply in all states is very small so cigarette manufacturers receive higher after-tax prices in higher-tax states.

D) After-tax prices received by cigarette manufacturers are about the same in all states.

A) Cigarette manufacturers bear almost all of the cigarette taxes.

B) Cigarette manufacturers tend to ship their product from low- tax states to high-tax states.

C) The elasticity of cigarette supply in all states is very small so cigarette manufacturers receive higher after-tax prices in higher-tax states.

D) After-tax prices received by cigarette manufacturers are about the same in all states.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. Consumer surplus before the $4 tax is ________, and consumer surplus after the $4 tax is ________.

Reference: Ref 6-5 (Figure: Imposition of a Tax) Refer to the figure. Consumer surplus before the $4 tax is ________, and consumer surplus after the $4 tax is ________.A) abc; a

B) a; c

C) ab; c

D) f; bd

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is NOT true for a case in which the demand for labor is more elastic than the supply of labor?

A) Firms can substitute capital for labor if the health insurance on labor gets too costly.

B) Most workers would continue to work even if their wages were lower because of the cost of health insurance.

C) Firms cannot escape the cost of health insurance for labor by employing fewer workers.

D) Firms can move overseas if the tax on labor gets too high.

A) Firms can substitute capital for labor if the health insurance on labor gets too costly.

B) Most workers would continue to work even if their wages were lower because of the cost of health insurance.

C) Firms cannot escape the cost of health insurance for labor by employing fewer workers.

D) Firms can move overseas if the tax on labor gets too high.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Martin's maximum willingness to pay for an electric boat motor is $250. Because of a tax, the price of the motor increases from $230 to $280. The deadweight loss of the tax attributable to Martin is:

A) $20.

B) $250.

C) $50.

D) $30.

A) $20.

B) $250.

C) $50.

D) $30.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Which one of the following statements about subsidies is NOT correct?

A) Subsidies cause deadweight losses.

B) Who actually receives the subsidy does not depend on who gets the check from the government.

C) Subsidies always increase the gains from trade for producers.

D) Who benefits from the subsidy depends on the relative elasticities of demand and supply.

A) Subsidies cause deadweight losses.

B) Who actually receives the subsidy does not depend on who gets the check from the government.

C) Subsidies always increase the gains from trade for producers.

D) Who benefits from the subsidy depends on the relative elasticities of demand and supply.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is correct?

A) If the elasticity of demand is greater than the elasticity of supply, sellers will receive more of the subsidy.

B) If the elasticity of demand is greater than the elasticity of supply, sellers will receive less of the subsidy.

C) If the elasticity of demand is less than the elasticity of supply, sellers will receive more of the subsidy.

D) If the elasticity of demand is greater than the elasticity of supply, buyers will receive more of the subsidy.

A) If the elasticity of demand is greater than the elasticity of supply, sellers will receive more of the subsidy.

B) If the elasticity of demand is greater than the elasticity of supply, sellers will receive less of the subsidy.

C) If the elasticity of demand is less than the elasticity of supply, sellers will receive more of the subsidy.

D) If the elasticity of demand is greater than the elasticity of supply, buyers will receive more of the subsidy.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

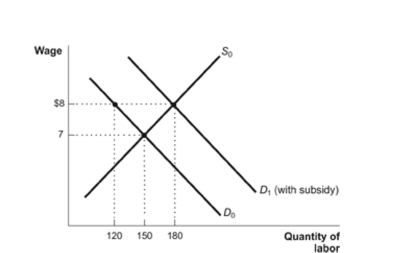

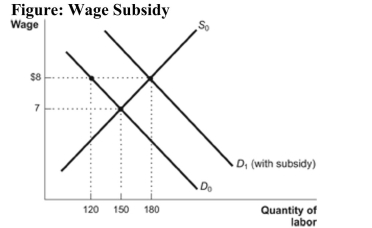

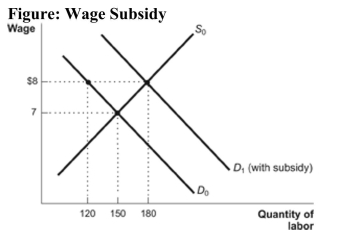

Figure: Wage Subsidy  Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. If a minimum wage of $8 had been implemented instead of a wage subsidy, how many workers would have been unemployed?

Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. If a minimum wage of $8 had been implemented instead of a wage subsidy, how many workers would have been unemployed?

A) 60

B) 30

C) 180

D) 120

Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. If a minimum wage of $8 had been implemented instead of a wage subsidy, how many workers would have been unemployed?

Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. If a minimum wage of $8 had been implemented instead of a wage subsidy, how many workers would have been unemployed?A) 60

B) 30

C) 180

D) 120

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

A wage subsidy will:

A) reduce the wages received by workers.

B) reduce the number of workers employed.

C) increase the number of workers employed.

D) increase the unemployment rate, especially among low-skilled workers.

A) reduce the wages received by workers.

B) reduce the number of workers employed.

C) increase the number of workers employed.

D) increase the unemployment rate, especially among low-skilled workers.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The quantity traded with a $2 subsidy is:

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The quantity traded with a $2 subsidy is:A) greater than 400.

B) 400.

C) 200.

D) less than 200.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

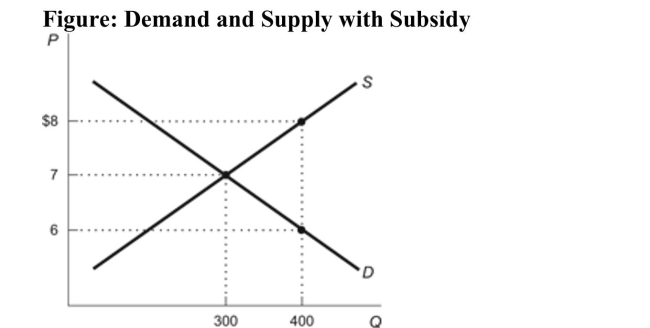

Figure: Demand and Supply with Subsidy  Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the deadweight loss caused by the subsidy?

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the deadweight loss caused by the subsidy?

A) $100

B) $200

C) $3,200

D) $800

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the deadweight loss caused by the subsidy?

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the deadweight loss caused by the subsidy?A) $100

B) $200

C) $3,200

D) $800

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. With a $2-per-unit subsidy, the price received by sellers is ________ and the price paid by consumers is ________.

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. With a $2-per-unit subsidy, the price received by sellers is ________ and the price paid by consumers is ________.A) $3; $2

B) $2; $4

C) $4; $2

D) $3; $4

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Figure: Demand and Supply with Subsidy  Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. Suppose a subsidy allows sellers to receive their product at the price of $8 with a quantity of 400 units. What is the dollar amount of the subsidy per unit of the good?

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. Suppose a subsidy allows sellers to receive their product at the price of $8 with a quantity of 400 units. What is the dollar amount of the subsidy per unit of the good?

A) $1

B) $6

C) $2

D) $100

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. Suppose a subsidy allows sellers to receive their product at the price of $8 with a quantity of 400 units. What is the dollar amount of the subsidy per unit of the good?

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. Suppose a subsidy allows sellers to receive their product at the price of $8 with a quantity of 400 units. What is the dollar amount of the subsidy per unit of the good?A) $1

B) $6

C) $2

D) $100

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

A subsidy is:

A) similar to a reverse tax.

B) calculated as the price received by sellers minus the price paid by buyers.

C) paid for by taxpayers.

D) All of the answer choices are correct.

A) similar to a reverse tax.

B) calculated as the price received by sellers minus the price paid by buyers.

C) paid for by taxpayers.

D) All of the answer choices are correct.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Figure: Supply and Demand with Subsidy  Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The deadweight loss from a $2 subsidy is:

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The deadweight loss from a $2 subsidy is:

A) $100.

B) $800.

C) $50.

D) $400.

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The deadweight loss from a $2 subsidy is:

Reference: Ref 6-9 (Figure: Supply and Demand with Subsidy) Refer to the figure. The deadweight loss from a $2 subsidy is:A) $100.

B) $800.

C) $50.

D) $400.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Unlike price floors, subsidies:

A) cause surpluses.

B) discourage firms from producing.

C) do not create surpluses.

D) create shortages.

A) cause surpluses.

B) discourage firms from producing.

C) do not create surpluses.

D) create shortages.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. How many additional workers have been hired as a result of the wage subsidy?

Reference: Ref 6-11 (Figure: Wage Subsidy) Refer to the figure. How many additional workers have been hired as a result of the wage subsidy?A) 150

B) 180

C) 30

D) No additional workers have been hired as a result of the wage subsidy.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is TRUE regarding subsidy?

A) A subsidy causes the value of goods to exceed the cost of producing the goods.

B) A subsidy reduces deadweight loss of non-beneficial trade.

C) A subsidy means that the sellers receive less than buyers pay.

D) Suppliers receive more benefit of a subsidy if the elasticity of supply is less than the elasticity of demand.

A) A subsidy causes the value of goods to exceed the cost of producing the goods.

B) A subsidy reduces deadweight loss of non-beneficial trade.

C) A subsidy means that the sellers receive less than buyers pay.

D) Suppliers receive more benefit of a subsidy if the elasticity of supply is less than the elasticity of demand.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

Not only do both wage subsidies and minimum wages increase wages, but:

A) they also increase employment.

B) they also reduce employment.

C) subsidies increase employment, whereas minimum wages reduce it.

D) subsidies reduce employment, whereas minimum wages increase it.

A) they also increase employment.

B) they also reduce employment.

C) subsidies increase employment, whereas minimum wages reduce it.

D) subsidies reduce employment, whereas minimum wages increase it.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

In a market with a downward sloping demand curve and an upward sloping supply curve, a tax placed on sellers will cause sellers to receive a lower price and buyers to pay a higher price.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

Why has the Earned Income Tax Credit (EITC) increased employment among single mothers?

A) It provides a certain amount of tax relief for single men.

B) It provides a certain amount of tax relief for childless married couples.

C) It provides a certain amount of tax relief for families with children.

D) It provides a certain amount of tax relief for all low income workers.

A) It provides a certain amount of tax relief for single men.

B) It provides a certain amount of tax relief for childless married couples.

C) It provides a certain amount of tax relief for families with children.

D) It provides a certain amount of tax relief for all low income workers.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements is correct for a specific good or service?

A) Whoever pays for a subsidy also pays the entire commodity tax on an item.

B) Whoever bears the burden of a tax also receives the benefit of the subsidy.

C) Whoever bears the burden of a tax also bears the cost of the subsidy.

D) Governments bear the burdens of both taxes and subsidies.

A) Whoever pays for a subsidy also pays the entire commodity tax on an item.

B) Whoever bears the burden of a tax also receives the benefit of the subsidy.

C) Whoever bears the burden of a tax also bears the cost of the subsidy.

D) Governments bear the burdens of both taxes and subsidies.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Reference: Ref 6-11 (Figure: Wage Subsidy) Consider the use of wage subsidies versus the minimum wage. Employment with a wage subsidy is: ________, versus employment with an $8 minimum wage is: ________.

Reference: Ref 6-11 (Figure: Wage Subsidy) Consider the use of wage subsidies versus the minimum wage. Employment with a wage subsidy is: ________, versus employment with an $8 minimum wage is: ________.A) 180; 120

B) 120; 180

C) 150; 150

D) 180; 180

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

Why do cotton growers spend billions of dollars to dam rivers and transport water hundreds of miles to grow cotton in California deserts?

A) Cotton growers in California don't pay payroll taxes.

B) The water used to grow California cotton is highly subsidized by the government.

C) Cotton growers in California are mostly operated as nonprofit enterprises.

D) The water used to grow California cotton is high in mineral contents, making for a bigger cotton yield.

A) Cotton growers in California don't pay payroll taxes.

B) The water used to grow California cotton is highly subsidized by the government.

C) Cotton growers in California are mostly operated as nonprofit enterprises.

D) The water used to grow California cotton is high in mineral contents, making for a bigger cotton yield.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the total cost of the subsidy for taxpayers?

Reference: Ref 6-10 (Figure: Supply and Demand with Subsidy) Refer to the figure. What is the total cost of the subsidy for taxpayers?A) $400

B) $800

C) $3,200

D) $2,400

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck