Deck 14: Macroeconomic Policy: Challenges in a Global Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/270

Play

Full screen (f)

Deck 14: Macroeconomic Policy: Challenges in a Global Economy

1

One of the key factors leading to the Great Recession was

A) a worldwide savings glut.

B) a shortage of housing in the United States.

C) a surplus in the federal budget.

D) the war in Iraq.

A) a worldwide savings glut.

B) a shortage of housing in the United States.

C) a surplus in the federal budget.

D) the war in Iraq.

a worldwide savings glut.

2

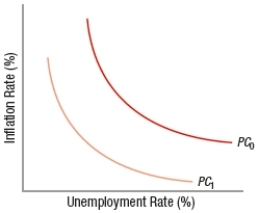

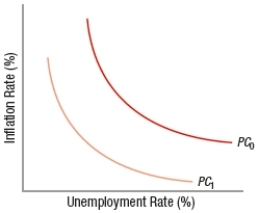

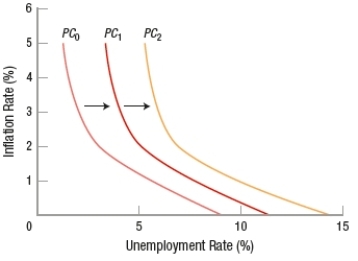

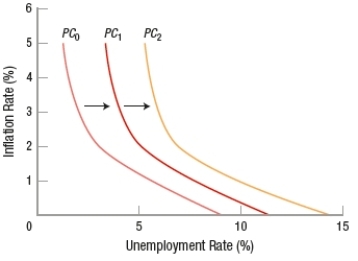

(Figure: Understanding Phillips Curves Shifts 2) What would cause an outward shift from Phillips curve PC1 to Phillips curve PC0?

A) a decrease in the expected inflation rate

B) an increase in the expected inflation rate

C) a decrease in the natural rate of unemployment

D) an increase in the natural rate of unemployment

A) a decrease in the expected inflation rate

B) an increase in the expected inflation rate

C) a decrease in the natural rate of unemployment

D) an increase in the natural rate of unemployment

an increase in the expected inflation rate

3

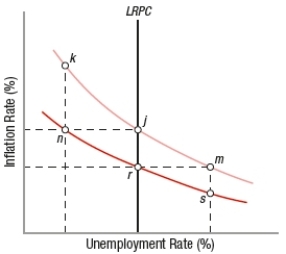

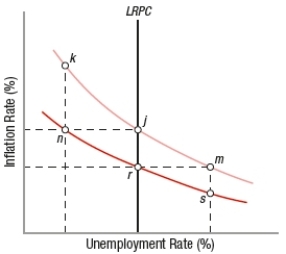

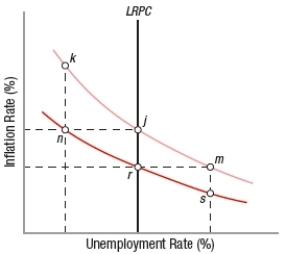

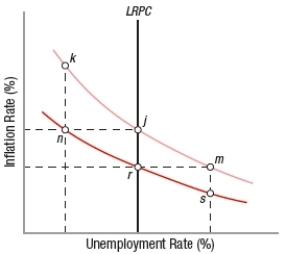

(Figure: Determining Long-Run and Short-Run Economic Shifts) Starting at point r, the economy will move to point _____ in the long run if policymakers successfully increase aggregate demand.

A) m

B) s

C) j

D) n

A) m

B) s

C) j

D) n

j

4

Which of these is NOT a factor that explains jobless recoveries?

A) rising productivity

B) the increased use of temporary and part-time workers

C) lax labor laws

D) an increase in outsourcing

A) rising productivity

B) the increased use of temporary and part-time workers

C) lax labor laws

D) an increase in outsourcing

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

5

According to the Phillips curve analysis, the way to solve inflation is to _____ unemployment or _____.

A) increase; increase productivity

B) increase; decrease productivity

C) decrease; increase the money supply

D) increase; increase the money supply

A) increase; increase productivity

B) increase; decrease productivity

C) decrease; increase the money supply

D) increase; increase the money supply

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

6

Monetized debt is paid for by a(n)

A) decrease in the money supply.

B) increase in U.S. Treasury securities outstanding.

C) increase in the money supply.

D) decrease in world demand for U.S. Treasuries.

A) decrease in the money supply.

B) increase in U.S. Treasury securities outstanding.

C) increase in the money supply.

D) decrease in world demand for U.S. Treasuries.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

7

The graph that shows the tradeoff between inflation and money wages is called the

A) misery index.

B) employment line.

C) Phillips curve.

D) minimization curve.

A) misery index.

B) employment line.

C) Phillips curve.

D) minimization curve.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

8

If policymakers want to keep unemployment below the natural rate, they must continually increase aggregate demand so that inflation is always greater than anticipated, thereby setting up an inflationary spiral.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

9

In the long run, any demand-side policy that attempts to reduce unemployment below its natural rate will

A) cause inflation.

B) be successful.

C) increase the natural rate.

D) lower GDP.

A) cause inflation.

B) be successful.

C) increase the natural rate.

D) lower GDP.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

10

Deflation can be a problem because it

A) leads to higher wages.

B) makes it more difficult to pay off debt.

C) can easily become hyperinflation.

D) increases interest rates.

A) leads to higher wages.

B) makes it more difficult to pay off debt.

C) can easily become hyperinflation.

D) increases interest rates.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement about adjustable-rate mortgages is true?

A) Interest rates cannot change over the life of the mortgage.

B) Adjustable-rate mortgages are especially attractive to high-income buyers.

C) Adjustable-rate mortgages usually have interest rates lower than market rates during their first year.

D) Adjustable-rate mortgages are more attractive when interest rates on fixed mortgages fall.

A) Interest rates cannot change over the life of the mortgage.

B) Adjustable-rate mortgages are especially attractive to high-income buyers.

C) Adjustable-rate mortgages usually have interest rates lower than market rates during their first year.

D) Adjustable-rate mortgages are more attractive when interest rates on fixed mortgages fall.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

12

Ceteris paribus, if workers receive all their productivity increases in the form of higher wages, then wage inflation will remain stable.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

13

According to the equation for the Phillips curve, if nominal wages increase by 3% and productivity increases 2%, then inflation will change by

A) -5%.

B) -1%.

C) 1%.

D) 5%.

A) -5%.

B) -1%.

C) 1%.

D) 5%.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

14

A consequence of trying to keep unemployment below its natural level is ever-accelerating inflation.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

15

Robert Lucas argued that

A) workers and employers would adjust to macroeconomic inflationary policies designed to increase employment and thereby negate the policies.

B) the opportunity cost of macroeconomic policies was always negative.

C) workers were more important than employers in determining macroeconomic policy.

D) macroeconomic policy would work only with a three-year lag.

A) workers and employers would adjust to macroeconomic inflationary policies designed to increase employment and thereby negate the policies.

B) the opportunity cost of macroeconomic policies was always negative.

C) workers were more important than employers in determining macroeconomic policy.

D) macroeconomic policy would work only with a three-year lag.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose the economy is currently in equilibrium, with unemployment equal to the natural rate, and that people form expectations rationally. If the Federal Reserve announces that it is going to decrease the money supply, then the economy will

A) permanently move to a higher level of output and a higher price level.

B) move to a lower price level but remain at potential GDP.

C) permanently move to a lower level of output and a lower price level.

D) move to a higher GDP level but remain at a constant price level.

A) permanently move to a higher level of output and a higher price level.

B) move to a lower price level but remain at potential GDP.

C) permanently move to a lower level of output and a lower price level.

D) move to a higher GDP level but remain at a constant price level.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

17

The main practical difference between the rational expectations and adaptive expectations theories is the speed of adjustment in the economy.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

18

One of the trigger points for the financial crisis of 2007-2009 was that subprime borrowers defaulted when the interest on adjustable-rate mortgages went up.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

19

What factor does NOT help to explain the recent phenomenon of a jobless recovery?

A) a rapid increase in productivity

B) greater reliance on temporary and part-time workers

C) outsourcing

D) higher levels of government stimulus spending

A) a rapid increase in productivity

B) greater reliance on temporary and part-time workers

C) outsourcing

D) higher levels of government stimulus spending

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

20

Adjustable-rate mortgages usually have interest rates lower than market rates during the first year.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

21

Wages above market-clearing rates, intended to improve morale and reduce turnover, are called _____ wages.

A) efficiency

B) high-cost

C) undeserved

D) profit-impediment

A) efficiency

B) high-cost

C) undeserved

D) profit-impediment

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

22

The Phillips curve

A) was developed by economists at Phillips 66.

B) shows the effectiveness of government policy.

C) is used by economists to determine optimal oil prices.

D) shows the relationship between unemployment and inflation.

A) was developed by economists at Phillips 66.

B) shows the effectiveness of government policy.

C) is used by economists to determine optimal oil prices.

D) shows the relationship between unemployment and inflation.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

23

By paying an efficiency wage, employers give employees an incentive to shirk their duties.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

24

The adjustable-rate mortgage was the standard type before the early 2000s.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

25

According to the equation for the Phillips curve, if wages increase by 3% and productivity increases by 5%, then inflation will be

A) -8%.

B) -2%.

C) 2%.

D) 8%.

A) -8%.

B) -2%.

C) 2%.

D) 8%.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

26

One can understand the debt obligations stemming from health care and Social Security by looking at current deficit statistics.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

27

If workers fail to anticipate inflation increases, their real wages are likely to fall.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

28

Milton Friedman argued that

A) people's experiences determine their behavior.

B) people's expectations determine their behavior.

C) people are irrational.

D) in the long run, people's expectations are irrelevant.

A) people's experiences determine their behavior.

B) people's expectations determine their behavior.

C) people are irrational.

D) in the long run, people's expectations are irrelevant.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose the economy is at the natural rate of unemployment, but it's an election year and expansionary policies are used to reduce the unemployment rate. If inflation now exceeds expected inflation, real wages have _____ and workers will demand _____ in their nominal wages.

A) risen; increases

B) risen; decreases

C) fallen; no changes

D) fallen; increases

A) risen; increases

B) risen; decreases

C) fallen; no changes

D) fallen; increases

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

30

One implication of the long-run Phillips curve is that

A) economic policies to keep the unemployment rate below its natural rate will lead to accelerating inflation.

B) in the long run, the government can accurately estimate the natural rate of unemployment.

C) in the long run, the curve becomes upward sloping.

D) the natural rate of unemployment must be lowered to zero.

A) economic policies to keep the unemployment rate below its natural rate will lead to accelerating inflation.

B) in the long run, the government can accurately estimate the natural rate of unemployment.

C) in the long run, the curve becomes upward sloping.

D) the natural rate of unemployment must be lowered to zero.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

31

The rational expectations theory describes the assumption that people are _____, and the adaptive expectations theory describes the assumption that people are _____.

A) forward-looking; backward-looking

B) backward-looking; forward-looking

C) rational; irrational

D) profit maximizers; loss minimizers

A) forward-looking; backward-looking

B) backward-looking; forward-looking

C) rational; irrational

D) profit maximizers; loss minimizers

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

32

Which of these does NOT describe the natural rate of unemployment?

A) the point at which the rates of change in productivity and wages are equal

B) the unemployment rate that exerts inflationary pressures

C) the unemployment rate at which inflation equals expected inflation, resulting in zero price pressures on the economy

D) the point at which the rates of change in productivity and wages are equal and the unemployment rate exerts no inflationary pressures

A) the point at which the rates of change in productivity and wages are equal

B) the unemployment rate that exerts inflationary pressures

C) the unemployment rate at which inflation equals expected inflation, resulting in zero price pressures on the economy

D) the point at which the rates of change in productivity and wages are equal and the unemployment rate exerts no inflationary pressures

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

33

The Phillips curve tradeoff worsened in the 1970s because of

A) oil shocks.

B) aggressive unions.

C) environmental concerns.

D) the Watergate scandal.

A) oil shocks.

B) aggressive unions.

C) environmental concerns.

D) the Watergate scandal.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

34

(Figure: Understanding Economic Shifts) The graph depicts

A) an expansion.

B) decreasing unemployment rates.

C) stagflation.

D) deflation.

A) an expansion.

B) decreasing unemployment rates.

C) stagflation.

D) deflation.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

35

Country X is practicing expansionary monetary policy. This helps improve its trade balance.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

36

One of the reasons wages may be sticky is because of

A) imperfect information.

B) inefficiency wages.

C) the Phillips curve.

D) Friedman's curse.

A) imperfect information.

B) inefficiency wages.

C) the Phillips curve.

D) Friedman's curse.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

37

Any action that reduces the public's perception of the rate of future inflation will shift the Phillips curve to the left.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

38

The Phillips curve shows a positive relationship between wages and unemployment.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

39

Which of these is NOT a cost of using fiscal or monetary policy to address a jobless recovery?

A) Expansionary monetary policy may lead to inflation in the long run.

B) Government spending might crowd out spending by consumers and firms.

C) Lower interest rates encourage consumers to increase spending.

D) Cutting taxes and increasing government spending increases the national debt.

A) Expansionary monetary policy may lead to inflation in the long run.

B) Government spending might crowd out spending by consumers and firms.

C) Lower interest rates encourage consumers to increase spending.

D) Cutting taxes and increasing government spending increases the national debt.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

40

Wall Street ratings firms had an incentive to give overly glowing ratings to collateralized debt obligations because the firm received a higher fee for giving higher ratings.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

41

When the growth in productivity is _____ the rate of change in wages, inflation is _____, and the level of unemployment at that point is _____ the natural rate of unemployment.

A) greater than; positive; less than

B) less than; zero; greater than

C) equal to; zero; equal to

D) equal to; negative; less than

A) greater than; positive; less than

B) less than; zero; greater than

C) equal to; zero; equal to

D) equal to; negative; less than

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

42

According to the original Phillips curve, there is an inverse relationship between money wages and the unemployment level.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

43

The long-run Phillips curve

A) shows a tradeoff between inflation and unemployment.

B) graphs as an upward sloping curve.

C) is a horizontal line at the expected rate of inflation.

D) is a vertical line at the natural rate of unemployment.

A) shows a tradeoff between inflation and unemployment.

B) graphs as an upward sloping curve.

C) is a horizontal line at the expected rate of inflation.

D) is a vertical line at the natural rate of unemployment.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

44

For developed countries like the United States and Japan, the increased pace of globalization has brought increased competition for resources.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

45

One major conclusion of the rational expectations theory is that

A) macroeconomic policy can be used to fine-tune the economy.

B) macroeconomic policy has no impact on GDP, even in the short run.

C) consumers do not always make rational decisions.

D) citizens cannot rationally expect the government to pursue the proper economic policy.

A) macroeconomic policy can be used to fine-tune the economy.

B) macroeconomic policy has no impact on GDP, even in the short run.

C) consumers do not always make rational decisions.

D) citizens cannot rationally expect the government to pursue the proper economic policy.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose policymakers want to keep the unemployment rate below its natural rate by increasing demand. A consequence of this policy would be

A) an increase in aggregate supply.

B) a stable Phillips curve.

C) increasing structural unemployment.

D) accelerating inflation.

A) an increase in aggregate supply.

B) a stable Phillips curve.

C) increasing structural unemployment.

D) accelerating inflation.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

47

A shortcoming of the rational expectations hypothesis is that

A) it ignores short-term wage stickiness.

B) people prefer rational ignorance in making decisions.

C) it ignores the role of saving.

D) it is inconsistent with the long-run Phillips curve.

A) it ignores short-term wage stickiness.

B) people prefer rational ignorance in making decisions.

C) it ignores the role of saving.

D) it is inconsistent with the long-run Phillips curve.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

48

When inflationary expectations are added to the Phillips curve, the nonaccelerating inflation rate of unemployment is defined as the unemployment rate at which the

A) inflation rate is always zero.

B) actual inflation rate exceeds the expected inflation rate.

C) actual inflation rate is less than the expected inflation rate.

D) actual inflation rate equals the expected inflation rate.

A) inflation rate is always zero.

B) actual inflation rate exceeds the expected inflation rate.

C) actual inflation rate is less than the expected inflation rate.

D) actual inflation rate equals the expected inflation rate.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

49

The 2007-2009 recession was not as severe as the previous two recessions, in 1990 and 2001.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

50

Adaptive expectations are driven by emotions.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

51

The natural rate of unemployment is the rate at which inflation equals expected inflation, resulting in zero price pressures in the economy.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

52

Rational expectations analysis leads to the conclusion that policy changes will be effective in the short run.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

53

Most economists agree that expansionary fiscal policy is not effective in addressing a jobless recovery.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

54

(Figure: Determining Long-Run and Short-Run Economic Shifts) Starting at point r, the economy will move to point _____ in the short run if policymakers successfully increase aggregate demand.

A) m

B) s

C) j

D) n

A) m

B) s

C) j

D) n

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

55

Unanticipated inflation results in

A) increasing real wages.

B) decreasing nominal wages.

C) decreasing real wages.

D) increasing nominal and real wages.

A) increasing real wages.

B) decreasing nominal wages.

C) decreasing real wages.

D) increasing nominal and real wages.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

56

When the expected rate of inflation increases, the Phillips curve

A) shifts to the right.

B) shifts to the left.

C) becomes horizontal.

D) disappears.

A) shifts to the right.

B) shifts to the left.

C) becomes horizontal.

D) disappears.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

57

One of the trigger points for the financial crisis of 2007-2009 was that Congress failed to balance the federal budget.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

58

Which company did the Federal Reserve and the Treasury allow to fail to send a message to the financial markets about the costs of risky behavior?

A) AIG

B) Chrysler

C) Ford

D) Lehman Brothers

A) AIG

B) Chrysler

C) Ford

D) Lehman Brothers

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

59

When QE ended in 2014, the Fed had accumulated over _____ trillion in mortgage-backed securities.

A) $1.425

B) $0.6

C) $3.725

D) $1.7

A) $1.425

B) $0.6

C) $3.725

D) $1.7

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

60

_____ expectations measure the rate of inflation expected by workers for any given period.

A) Rational

B) Natural

C) Wage

D) Inflationary

A) Rational

B) Natural

C) Wage

D) Inflationary

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

61

If inflationary expectations fall

A) there is a movement down along the Phillips curve.

B) the Phillips curve shifts outward.

C) the Phillips curve shifts inward.

D) there is a movement up along the Phillips curve.

A) there is a movement down along the Phillips curve.

B) the Phillips curve shifts outward.

C) the Phillips curve shifts inward.

D) there is a movement up along the Phillips curve.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

62

Which statement(s) is/are TRUE? I. People on fixed incomes will not be hurt if the United States monetizes its debt.

II) If the cost of Medicare changes as health care costs increase, it would enhance the government's ability to keep deficits and the national debt under control over the long term.

III) If the United States monetizes its debt, it will result in a weaker dollar if foreigners hold fewer U.S. dollars.

A) I only

B) II only

C) III only

D) I, II, and III only

II) If the cost of Medicare changes as health care costs increase, it would enhance the government's ability to keep deficits and the national debt under control over the long term.

III) If the United States monetizes its debt, it will result in a weaker dollar if foreigners hold fewer U.S. dollars.

A) I only

B) II only

C) III only

D) I, II, and III only

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

63

The efficiency wage theory states that by paying their employees more than the market-clearing wage, employers hope to

A) reduce productivity.

B) set up incentives for employees to shirk their duties.

C) increase turnover.

D) improve employee morale.

A) reduce productivity.

B) set up incentives for employees to shirk their duties.

C) increase turnover.

D) improve employee morale.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

64

Robert Lucas argued that the theory of rational expectations suggests that tax cuts will work if used temporarily.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

65

Essentially, the way to reduce inflationary expectations using demand-side policies is to cause an economic slowdown.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

66

As inflationary expectations rise, the _____ Phillips curve shifts to the _____.

A) long-run; right

B) short-run; right

C) long-run; left

D) short-run; left

A) long-run; right

B) short-run; right

C) long-run; left

D) short-run; left

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

67

The adaptive expectations model concludes that individuals use past events to form expectations.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

68

Assume that inflation rates for the past 5 years have been 1%, 2%, 2.5%, 2%, 2%. The Federal Reserve announces that it is going to decrease the money supply because it is concerned about inflationary pressures in the economy. If people form their expectations _____, then in light of the Fed's announcement, they will expect an inflation rate of _____.

A) rationally; 2.5%

B) adaptively; 2%

C) adaptively; 1.9%

D) rationally; 4%

A) rationally; 2.5%

B) adaptively; 2%

C) adaptively; 1.9%

D) rationally; 4%

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

69

Increases in productivity contributed to the jobless recovery after the 2007-2009 recession.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

70

The 2007-2009 recession was brought on when the Federal Reserve used excessive tightening of the money supply to solve the period of stagflation from 2004 to 2007.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

71

Suppose the Federal Reserve announces that its policy will increase the supply of money next year. This announcement can be expected to

A) increase unemployment.

B) shift the Phillips curve to the right.

C) reduce tax revenues.

D) shift the Phillips curve to the left.

A) increase unemployment.

B) shift the Phillips curve to the right.

C) reduce tax revenues.

D) shift the Phillips curve to the left.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

72

Expansionary monetary policy leads to inflation and is therefore not an appropriate policy for addressing a jobless recovery.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

73

If rational expectations theory is correct, then any increase in aggregate demand caused by announced expansionary policies

A) leads to a short-run increase in real output but no long-run increase.

B) causes the inflation rate to fall.

C) is offset by rising inflationary expectations, causing the short-run aggregate supply curve to immediately shift to the left.

D) is offset by rising inflationary expectations, causing the short-run aggregate supply curve to slowly shift to the left.

A) leads to a short-run increase in real output but no long-run increase.

B) causes the inflation rate to fall.

C) is offset by rising inflationary expectations, causing the short-run aggregate supply curve to immediately shift to the left.

D) is offset by rising inflationary expectations, causing the short-run aggregate supply curve to slowly shift to the left.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

74

In a global economy, a problem with using fiscal and monetary policies to fix the problems in our country is that those policies

A) are more likely to help other countries than to help us.

B) become completely ineffective.

C) make our trade balance deteriorate.

D) can lead to retaliatory actions by other nations.

A) are more likely to help other countries than to help us.

B) become completely ineffective.

C) make our trade balance deteriorate.

D) can lead to retaliatory actions by other nations.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

75

The long-run Phillips curve is vertical.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

76

Monetized debt occurs when debt is reduced by a fall in the money supply.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

77

The stagflation of the 1960s and 1970s showed policymakers that

A) the Phillips curve should slope upward.

B) the Phillips curve was always a useful tool of analysis.

C) the Phillips curve could shift over time.

D) Keynes was wrong in his analysis of aggregate demand.

A) the Phillips curve should slope upward.

B) the Phillips curve was always a useful tool of analysis.

C) the Phillips curve could shift over time.

D) Keynes was wrong in his analysis of aggregate demand.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

78

According to the equation for the Phillips curve, if nominal wages and labor productivity both rise by 3%

A) unemployment rises by 3%.

B) unemployment falls by 3%.

C) unemployment is at its natural rate.

D) inflation is increasing.

A) unemployment rises by 3%.

B) unemployment falls by 3%.

C) unemployment is at its natural rate.

D) inflation is increasing.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

79

Rational expectations theory suggests that the Federal Reserve and other policymakers must fool the public if their policies are to have short-term effects.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck

80

One implication of the Phillips curve when it is unable to shift in the short run is that

A) fiscal and monetary policies have no impact on the economy.

B) the economy is in a liquidity trap.

C) policymakers face a tradeoff between low unemployment and low inflation.

D) fiscal policy is more effective than monetary policy.

A) fiscal and monetary policies have no impact on the economy.

B) the economy is in a liquidity trap.

C) policymakers face a tradeoff between low unemployment and low inflation.

D) fiscal policy is more effective than monetary policy.

Unlock Deck

Unlock for access to all 270 flashcards in this deck.

Unlock Deck

k this deck