Deck 2: Job-Order Costing: Calculating Unit Product Costs

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

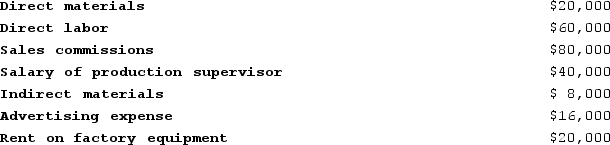

Question

Question

Question

Question

Question

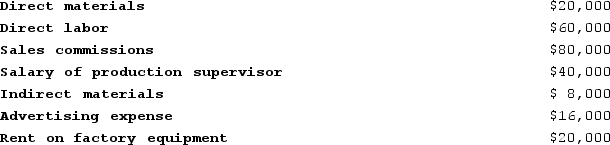

Question

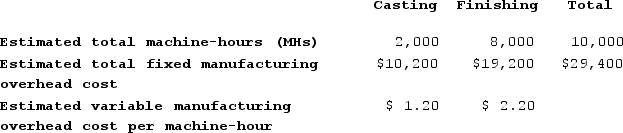

Question

Question

Question

Question

Question

Question

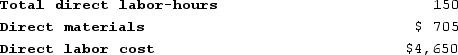

Question

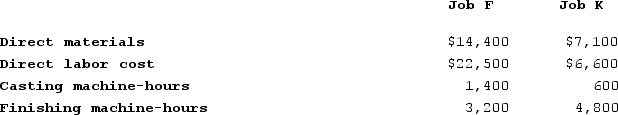

Question

Question

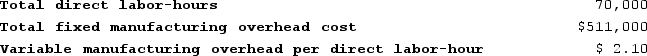

Question

Question

Question

Question

Question

Question

Question

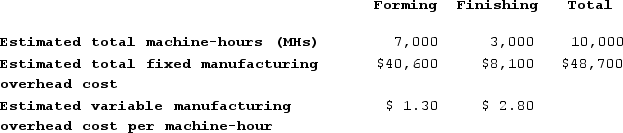

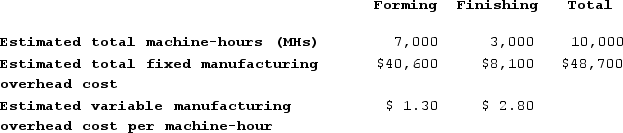

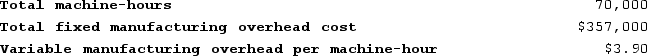

Question

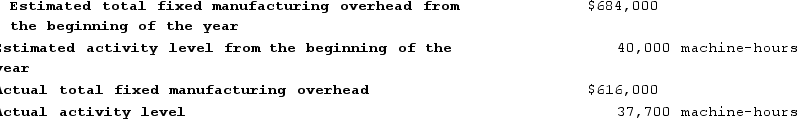

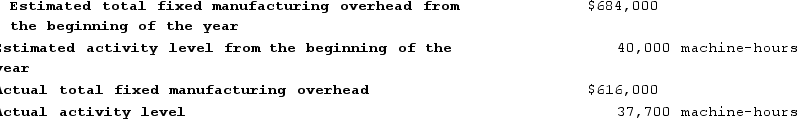

Question

Question

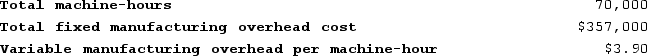

Question

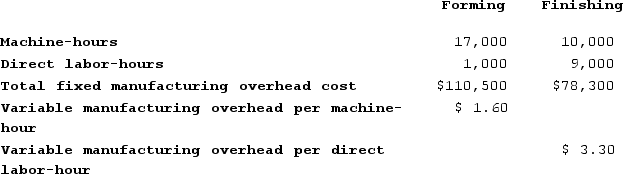

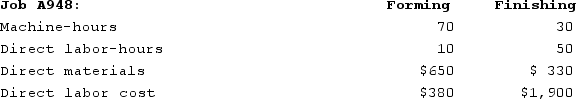

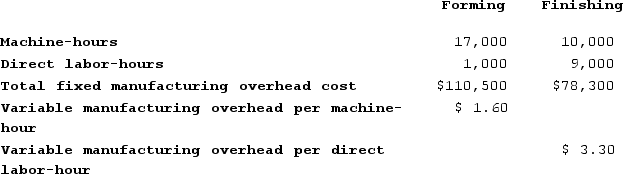

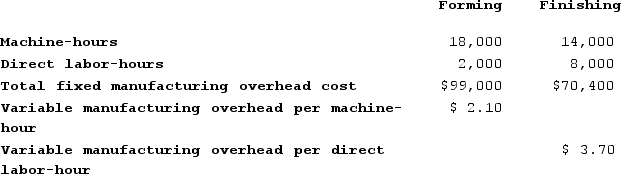

Question

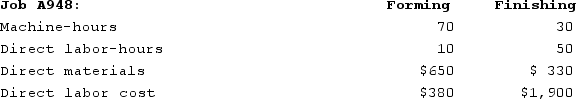

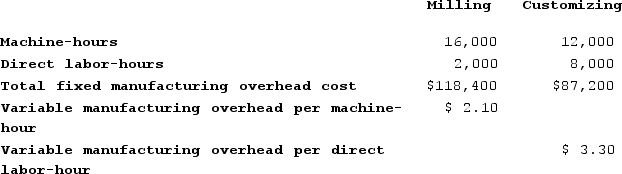

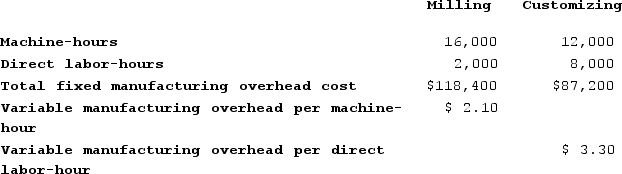

Question

Question

Question

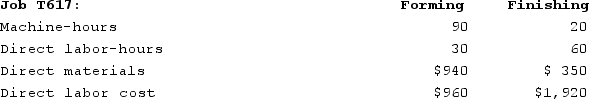

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/408

Play

Full screen (f)

Deck 2: Job-Order Costing: Calculating Unit Product Costs

1

The fact that one department may be labor intensive while another department is machine intensive explains in part why multiple predetermined overhead rates are often used in larger companies.

True

2

The costs attached to products that have not been sold are included in ending inventory on the balance sheet.

True

3

A bill of materials is a document that lists the type and quantity of each type of direct material needed to complete a unit of product.

True

4

Actual overhead costs are not assigned to jobs in a job costing system.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

5

A job cost sheet is used to record how much a customer pays for the job once the job is completed.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

6

Job cost sheets contain entries for actual direct material, actual direct labor, and actual manufacturing overhead cost incurred in completing a job.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

7

An employee time ticket is an hour-by-hour summary of the employee's activities throughout the day.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

8

If the overhead rate is computed annually based on the actual costs and activity for the year, the manufacturing overhead assigned to any particular job can be computed as soon as the job is completed.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

9

A company will improve job cost accuracy by using multiple overhead rates even if it cannot identify more than one overhead cost driver.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

10

The formula for computing the predetermined overhead rate is:Predetermined overhead rate = Estimated total amount of the allocation base÷ Estimated total manufacturing overhead cost

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

11

The appeal of using multiple departmental overhead rates is that they presumably provide a more accurate accounting of the costs caused by jobs.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

12

If the allocation base in the predetermined overhead rate does not drive overhead costs, it will nevertheless provide reasonably accurate unit product costs because of the averaging process.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

13

In a job-order cost system, indirect labor is assigned to a job using information from the employee time ticket.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

14

The amount of overhead applied to a particular job equals the actual amount of overhead caused by the job.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

15

If a job is not completed at year end, then no manufacturing overhead cost would be applied to that job when a predetermined overhead rate is used.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

16

An employee time ticket is used to record points that are earned by employees based on the hours they worked that can be used to pay for coffee, food in the cafeteria, and even in some cases for vacation travel.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

17

In absorption costing, nonmanufacturing costs are assigned to units of product.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

18

Generally speaking, when going through the process of computing a predetermined overhead rate, the estimated total manufacturing overhead cost is determined before estimating the amount of the allocation base.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

19

In a job-order costing system, costs are traced to individual units of product. The sum total of such traced costs is called the unit product cost.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

20

Job-order costing systems often use allocation bases that do not reflect how jobs actually use overhead resources.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements about using a plantwide overhead rate based on direct labor is correct?

A) Using a plantwide overhead rate based on direct labor-hours will ensure that direct labor costs are correctly traced to jobs.

B) Using a plantwide overhead rate based on direct labor costs will ensure that direct labor costs will be correctly traced to jobs.

C) It is often overly simplistic and incorrect to assume that direct labor-hours is a company's only manufacturing overhead cost driver.

D) The labor theory of value ensures that using a plantwide overhead rate based on direct labor will do a reasonably good job of assigning overhead costs to jobs.

A) Using a plantwide overhead rate based on direct labor-hours will ensure that direct labor costs are correctly traced to jobs.

B) Using a plantwide overhead rate based on direct labor costs will ensure that direct labor costs will be correctly traced to jobs.

C) It is often overly simplistic and incorrect to assume that direct labor-hours is a company's only manufacturing overhead cost driver.

D) The labor theory of value ensures that using a plantwide overhead rate based on direct labor will do a reasonably good job of assigning overhead costs to jobs.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

22

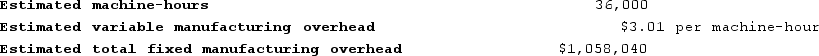

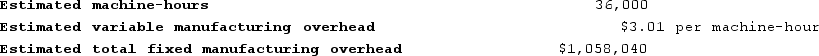

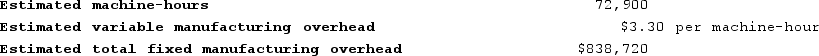

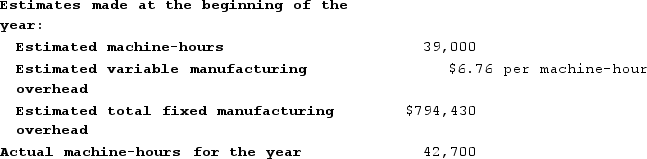

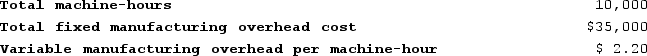

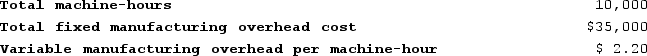

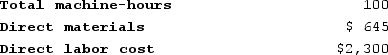

Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year appear below:  The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:

A) $29.39 per machine-hour

B) $32.40 per machine-hour

C) $32.81 per machine-hour

D) $3.01 per machine-hour

The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:A) $29.39 per machine-hour

B) $32.40 per machine-hour

C) $32.81 per machine-hour

D) $3.01 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

23

Gilchrist Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the machine-hours for the upcoming year at 37,200 machine-hours. The estimated variable manufacturing overhead was $5.94 per machine-hour and the estimated total fixed manufacturing overhead was $1,028,580. The predetermined overhead rate for the recently completed year was closest to:

A) $33.59 per machine-hour

B) $32.59 per machine-hour

C) $5.94 per machine-hour

D) $27.65 per machine-hour

A) $33.59 per machine-hour

B) $32.59 per machine-hour

C) $5.94 per machine-hour

D) $27.65 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

24

Most countries require some form of absorption costing for external reports.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is the correct formula to compute the predetermined overhead rate?

A) Predetermined overhead rate = Estimated total units in the allocation base ÷ Estimated total manufacturing overhead costs

B) Predetermined overhead rate = Estimated total manufacturing overhead costs ÷ Estimated total units in the allocation base

C) Predetermined overhead rate = Actual total manufacturing overhead costs ÷ Estimated total units in the allocation base

D) Predetermined overhead rate = Estimated total manufacturing overhead costs ÷ Actual total units in the allocation base.

A) Predetermined overhead rate = Estimated total units in the allocation base ÷ Estimated total manufacturing overhead costs

B) Predetermined overhead rate = Estimated total manufacturing overhead costs ÷ Estimated total units in the allocation base

C) Predetermined overhead rate = Actual total manufacturing overhead costs ÷ Estimated total units in the allocation base

D) Predetermined overhead rate = Estimated total manufacturing overhead costs ÷ Actual total units in the allocation base.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

26

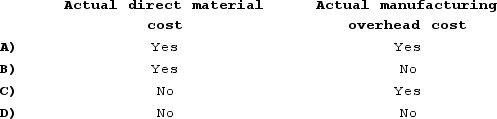

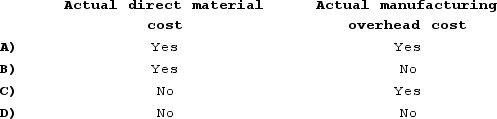

Which of the following would usually be found on a job cost sheet under a normal cost system?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

27

If the predetermined overhead rate is based on the estimated level of activity for the current period, then products will be charged only for the capacity that they use and will not be charged for the capacity they don't use.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

28

When the predetermined overhead rate is based on the level of activity at capacity, an item called the Cost of Unused Capacity may appear to be treated as a period expense on income statements prepared for internal management use.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

29

Dearden Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $144,000, variable manufacturing overhead of $2.00 per machine-hour, and 60,000 machine-hours. The predetermined overhead rate is closest to:

A) $2.40 per machine-hour

B) $6.40 per machine-hour

C) $4.40 per machine-hour

D) $2.00 per machine-hour

A) $2.40 per machine-hour

B) $6.40 per machine-hour

C) $4.40 per machine-hour

D) $2.00 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

30

Baj Corporation uses a predetermined overhead rate base on machine-hours that it recalculates at the beginning of each year. The company considers all of its manufacturing overhead costs to be fixed and it has provided the following data for the most recent year.  The predetermined overhead rate per machine-hour would be closest to:

The predetermined overhead rate per machine-hour would be closest to:

A) $17.80

B) $19.49

C) $16.23

D) $17.77

The predetermined overhead rate per machine-hour would be closest to:

The predetermined overhead rate per machine-hour would be closest to:A) $17.80

B) $19.49

C) $16.23

D) $17.77

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

31

Assigning manufacturing overhead to a specific job is complicated by all of the below except:

A) Manufacturing overhead is an indirect cost that is either impossible or difficult to trace to a particular job.

B) Manufacturing overhead is incurred only to support some jobs.

C) Manufacturing overhead consists of both variable and fixed costs.

D) The average cost of actual fixed manufacturing overhead expenses will vary depending on how many units are produced in a period.

A) Manufacturing overhead is an indirect cost that is either impossible or difficult to trace to a particular job.

B) Manufacturing overhead is incurred only to support some jobs.

C) Manufacturing overhead consists of both variable and fixed costs.

D) The average cost of actual fixed manufacturing overhead expenses will vary depending on how many units are produced in a period.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

32

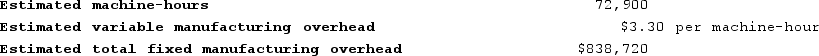

Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year appear below:  The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:

A) $8.69 per machine-hour

B) $9.90 per machine-hour

C) $6.75 per machine-hour

D) $14.81 per machine-hour

The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:A) $8.69 per machine-hour

B) $9.90 per machine-hour

C) $6.75 per machine-hour

D) $14.81 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

33

Gilchrist Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the machine-hours for the upcoming year at 79,000 machine-hours. The estimated variable manufacturing overhead was $7.38 per machine-hour and the estimated total fixed manufacturing overhead was $2,347,090. The predetermined overhead rate for the recently completed year was closest to:

A) $37.09 per machine-hour

B) $36.07 per machine-hour

C) $7.38 per machine-hour

D) $29.71 per machine-hour

A) $37.09 per machine-hour

B) $36.07 per machine-hour

C) $7.38 per machine-hour

D) $29.71 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

34

When the fixed costs of capacity are spread over the estimated activity of the period rather than the level of activity at capacity, the units that are produced must shoulder the costs of unused capacity.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

35

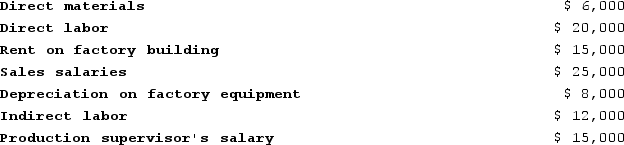

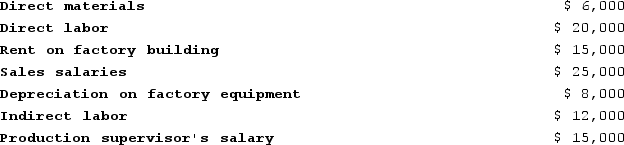

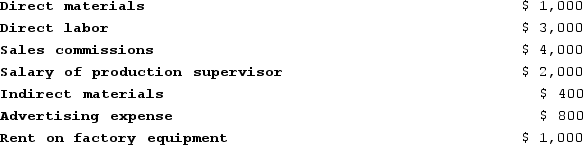

Johansen Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. The Corporation has provided the following estimated costs for the next year:  Jameson estimates that 20,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be:

Jameson estimates that 20,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be:

A) $2.50 per direct labor-hour

B) $2.79 per direct labor-hour

C) $3.00 per direct labor-hour

D) $4.00 per direct labor-hour

Jameson estimates that 20,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be:

Jameson estimates that 20,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be:A) $2.50 per direct labor-hour

B) $2.79 per direct labor-hour

C) $3.00 per direct labor-hour

D) $4.00 per direct labor-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

36

Purves Corporation is using a predetermined overhead rate that was based on estimated total fixed manufacturing overhead of $121,000 and 10,000 direct labor-hours for the period. The company incurred actual total fixed manufacturing overhead of $113,000 and 10,900 total direct labor-hours during the period. The predetermined overhead rate is closest to:

A) $10.37

B) $12.10

C) $11.10

D) $11.30

A) $10.37

B) $12.10

C) $11.10

D) $11.30

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

37

Longobardi Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 35,700 labor-hours. The estimated variable manufacturing overhead was $5.93 per labor-hour and the estimated total fixed manufacturing overhead was $805,392. The actual labor-hours for the year turned out to be 33,200 labor-hours. The predetermined overhead rate for the recently completed year was closest to:

A) $28.49 per labor-hour

B) $22.56 per labor-hour

C) $5.93 per labor-hour

D) $30.64 per labor-hour

A) $28.49 per labor-hour

B) $22.56 per labor-hour

C) $5.93 per labor-hour

D) $30.64 per labor-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

38

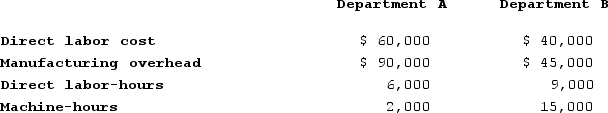

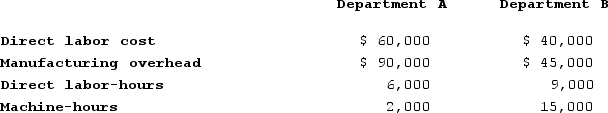

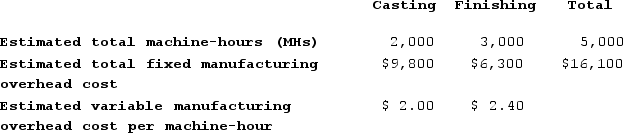

The Silver Corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. The predetermined overhead rate is based on labor cost in Department A and on machine-hours in Department B. At the beginning of the year, the Corporation made the following estimates:  What predetermined overhead rates would be used in Department A and Department B, respectively?

What predetermined overhead rates would be used in Department A and Department B, respectively?

A) 67% and $3.00

B) 150% and $5.00

C) 150% and $3.00

D) 67% and $5.00

What predetermined overhead rates would be used in Department A and Department B, respectively?

What predetermined overhead rates would be used in Department A and Department B, respectively?A) 67% and $3.00

B) 150% and $5.00

C) 150% and $3.00

D) 67% and $5.00

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is not correct concerning multiple overhead rate systems?

A) A multiple overhead rate system is more complex than a system based on a single plantwide overhead rate.

B) A multiple overhead rate system is usually more accurate than a system based on a single plantwide overhead rate.

C) A company may choose to create a separate overhead rate for each of its production departments.

D) In departments that are relatively labor-intensive, their overhead costs should be applied to jobs based on machine-hours rather than on direct labor-hours.

A) A multiple overhead rate system is more complex than a system based on a single plantwide overhead rate.

B) A multiple overhead rate system is usually more accurate than a system based on a single plantwide overhead rate.

C) A company may choose to create a separate overhead rate for each of its production departments.

D) In departments that are relatively labor-intensive, their overhead costs should be applied to jobs based on machine-hours rather than on direct labor-hours.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

40

Reamer Corporation uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The Corporation has provided the following estimated costs for next year:  Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

A) $6.80 per machine-hour

B) $6.00 per machine-hour

C) $3.00 per machine-hour

D) $3.40 per machine-hour

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:A) $6.80 per machine-hour

B) $6.00 per machine-hour

C) $3.00 per machine-hour

D) $3.40 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

41

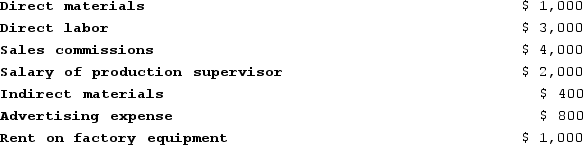

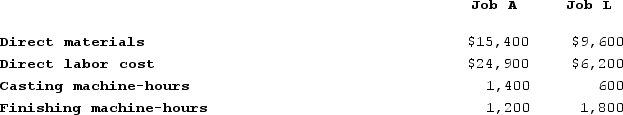

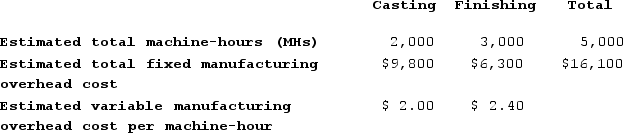

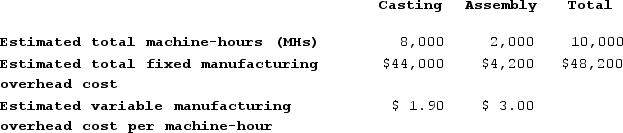

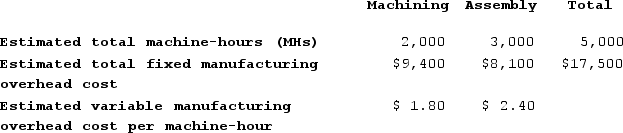

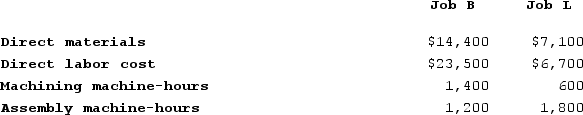

Pebbles Corporation has two manufacturing departments--Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job L. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $9,600

B) $6,200

C) $28,904

D) $13,104

During the most recent month, the company started and completed two jobs--Job A and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job L. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job L is closest to: (Round your intermediate calculations to 2 decimal places.)A) $9,600

B) $6,200

C) $28,904

D) $13,104

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

42

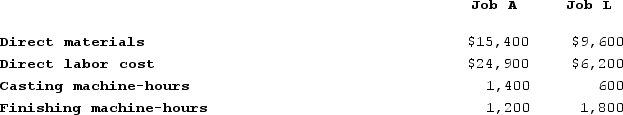

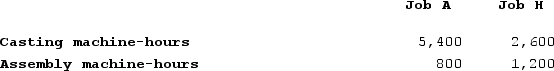

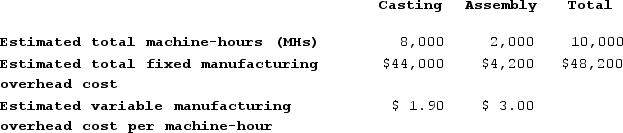

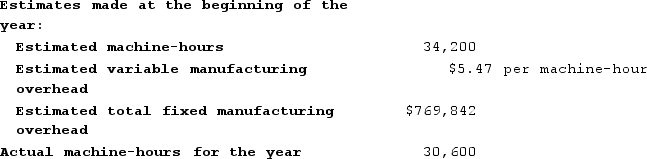

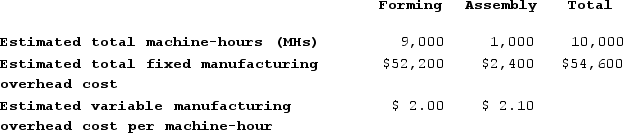

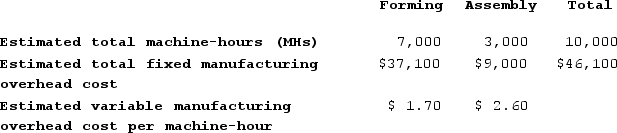

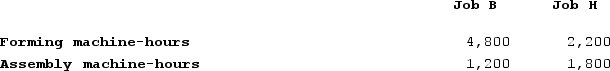

Parido Corporation has two manufacturing departments--Casting and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $8,328

B) $26,372

C) $18,316

D) $18,044

During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)A) $8,328

B) $26,372

C) $18,316

D) $18,044

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

43

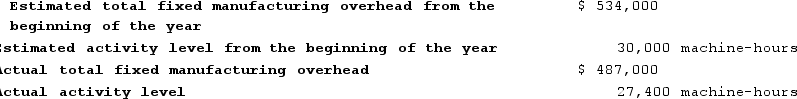

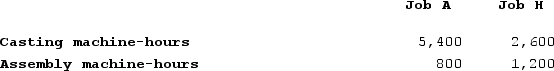

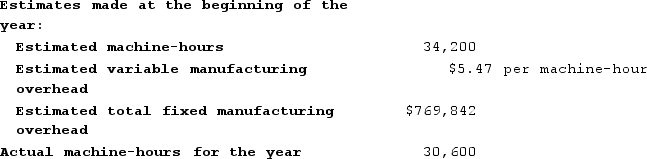

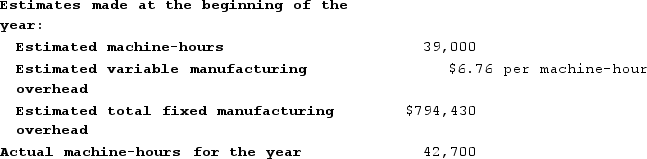

Brothern Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the most recently completed year appear below:  The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:

A) $27.40 per machine-hour

B) $27.98 per machine-hour

C) $5.47 per machine-hour

D) $22.51 per machine-hour

The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:A) $27.40 per machine-hour

B) $27.98 per machine-hour

C) $5.47 per machine-hour

D) $22.51 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

44

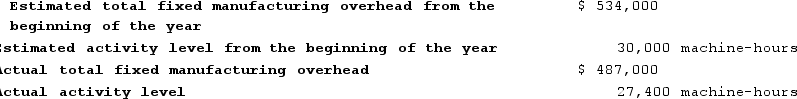

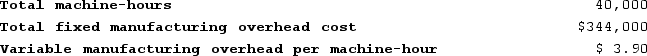

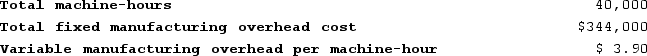

Brothern Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the most recently completed year appear below:  The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:

A) $25.37 per machine-hour

B) $27.13 per machine-hour

C) $6.76 per machine-hour

D) $20.37 per machine-hour

The predetermined overhead rate for the recently completed year was closest to:

The predetermined overhead rate for the recently completed year was closest to:A) $25.37 per machine-hour

B) $27.13 per machine-hour

C) $6.76 per machine-hour

D) $20.37 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

45

Beat Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M759 was completed. It required 60 machine-hours. The amount of overhead applied to Job M759 is closest to: (Round your intermediate calculations to 2 decimal places.)

Recently, Job M759 was completed. It required 60 machine-hours. The amount of overhead applied to Job M759 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $750

B) $516

C) $984

D) $234

Recently, Job M759 was completed. It required 60 machine-hours. The amount of overhead applied to Job M759 is closest to: (Round your intermediate calculations to 2 decimal places.)

Recently, Job M759 was completed. It required 60 machine-hours. The amount of overhead applied to Job M759 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $750

B) $516

C) $984

D) $234

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

46

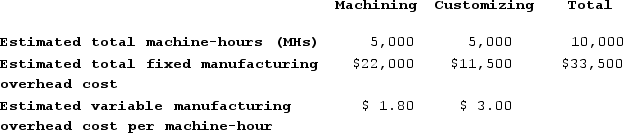

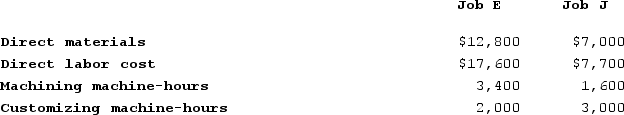

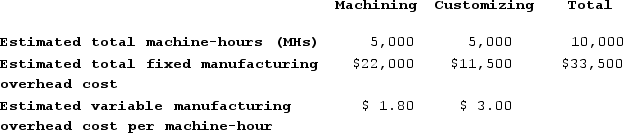

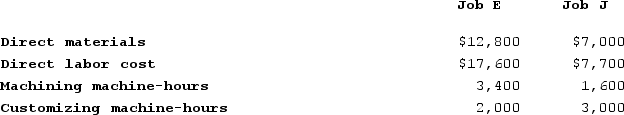

Tancredi Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job E and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job E and Job J. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs are sold during the month, the company's cost of goods sold for the month would be closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs are sold during the month, the company's cost of goods sold for the month would be closest to: (Round your intermediate calculations to 2 decimal places.)

A) $102,600

B) $61,450

C) $41,150

D) $110,808

During the most recent month, the company started and completed two jobs--Job E and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job E and Job J. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs are sold during the month, the company's cost of goods sold for the month would be closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. If both jobs are sold during the month, the company's cost of goods sold for the month would be closest to: (Round your intermediate calculations to 2 decimal places.)A) $102,600

B) $61,450

C) $41,150

D) $110,808

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

47

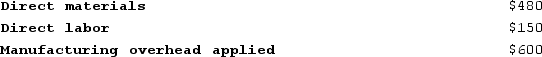

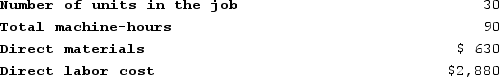

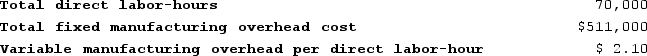

Juanita Corporation uses a job-order costing system and applies overhead on the basis of direct labor cost. At the end of October, Juanita had one job still in process. The job cost sheet for this job contained the following information:  An additional $100 of labor was needed in November to complete this job. For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?

An additional $100 of labor was needed in November to complete this job. For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?

A) $1,330

B) $500

C) $1,230

D) $1,730

An additional $100 of labor was needed in November to complete this job. For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?

An additional $100 of labor was needed in November to complete this job. For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?A) $1,330

B) $500

C) $1,230

D) $1,730

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

48

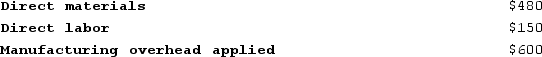

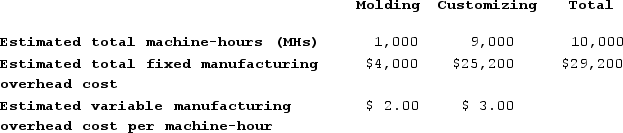

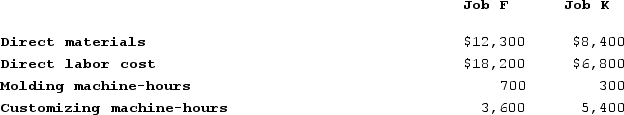

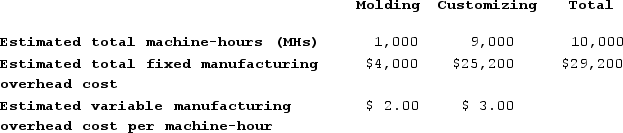

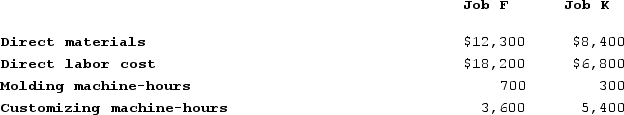

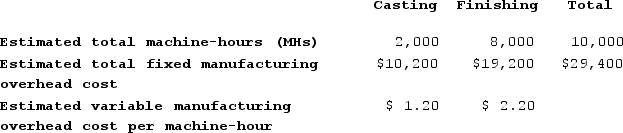

Koelsch Corporation has two manufacturing departments--Molding and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $72,561

B) $79,817

C) $24,187

D) $48,374

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job K is closest to: (Round your intermediate calculations to 2 decimal places.)A) $72,561

B) $79,817

C) $24,187

D) $48,374

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

49

Bernson Corporation is using a predetermined overhead rate that was based on estimated total fixed manufacturing overhead of $492,000 and 30,000 machine-hours for the period. The company incurred actual total fixed manufacturing overhead of $517,000 and 28,300 total machine-hours during the period. The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $464,120

B) $492,000

C) $487,703

D) $25,000

A) $464,120

B) $492,000

C) $487,703

D) $25,000

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

50

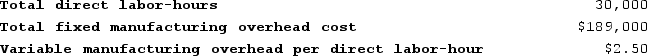

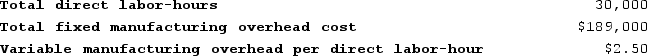

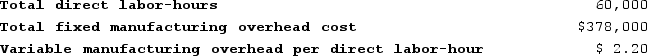

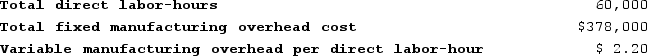

Helland Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

A) $2.50 per direct labor-hour

B) $11.30 per direct labor-hour

C) $6.30 per direct labor-hour

D) $8.80 per direct labor-hour

The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:A) $2.50 per direct labor-hour

B) $11.30 per direct labor-hour

C) $6.30 per direct labor-hour

D) $8.80 per direct labor-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

51

Valvano Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $440,000, variable manufacturing overhead of $2.20 per machine-hour, and 50,000 machine-hours. The estimated total manufacturing overhead is closest to:

A) $440,000

B) $110,000

C) $440,002

D) $550,000

A) $440,000

B) $110,000

C) $440,002

D) $550,000

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

52

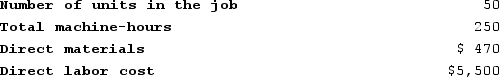

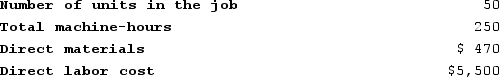

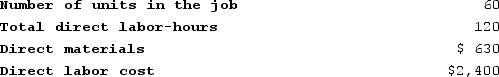

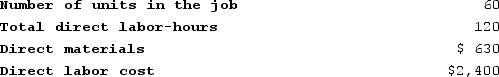

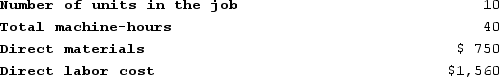

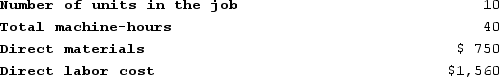

Thach Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $665,000, variable manufacturing overhead of $3.00 per machine-hour, and 70,000 machine-hours. Recently, Job T321 was completed with the following characteristics:  The unit product cost for Job T321 is closest to:

The unit product cost for Job T321 is closest to:

A) $117.00

B) $58.50

C) $154.50

D) $51.50

The unit product cost for Job T321 is closest to:

The unit product cost for Job T321 is closest to:A) $117.00

B) $58.50

C) $154.50

D) $51.50

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

53

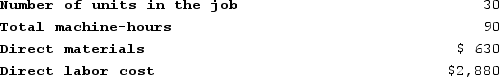

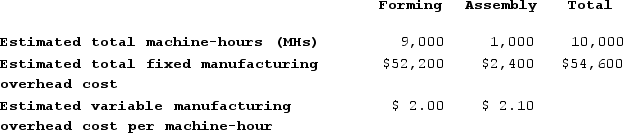

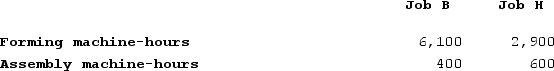

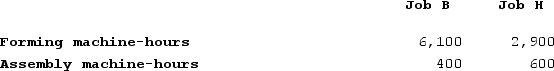

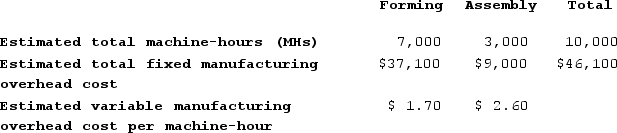

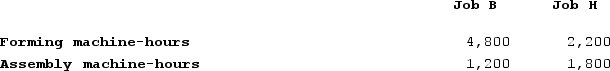

Mundorf Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to:

A) $48,555

B) $35,490

C) $2,988

D) $45,567

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to:A) $48,555

B) $35,490

C) $2,988

D) $45,567

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

54

Longobardi Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 46,000 labor-hours. The estimated variable manufacturing overhead was $6.25 per labor-hour and the estimated total fixed manufacturing overhead was $1,026,260. The actual labor-hours for the year turned out to be 41,200 labor-hours. The predetermined overhead rate for the recently completed year was closest to:

A) $28.56 per labor-hour

B) $22.31 per labor-hour

C) $6.25 per labor-hour

D) $31.16 per labor-hour

A) $28.56 per labor-hour

B) $22.31 per labor-hour

C) $6.25 per labor-hour

D) $31.16 per labor-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

55

Session Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K913 was completed with the following characteristics:

Recently, Job K913 was completed with the following characteristics:

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $6,060

B) $2,115

C) $6,765

D) $5,355

Recently, Job K913 was completed with the following characteristics:

Recently, Job K913 was completed with the following characteristics: The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job K913 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $6,060

B) $2,115

C) $6,765

D) $5,355

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

56

Steele Corporation uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. Steele Corporation has provided the following estimated costs for next year:  Steele estimates that 10,000 direct labor-hours and 16,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

Steele estimates that 10,000 direct labor-hours and 16,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

A) $4.25

B) $8.00

C) $9.00

D) $10.25

Steele estimates that 10,000 direct labor-hours and 16,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

Steele estimates that 10,000 direct labor-hours and 16,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:A) $4.25

B) $8.00

C) $9.00

D) $10.25

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

57

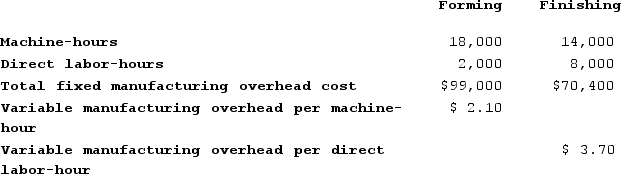

Almaraz Corporation has two manufacturing departments--Forming and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. That predetermined manufacturing overhead rate is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. That predetermined manufacturing overhead rate is closest to:

A) $6.62

B) $4.87

C) $4.10

D) $7.10

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. That predetermined manufacturing overhead rate is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. That predetermined manufacturing overhead rate is closest to:A) $6.62

B) $4.87

C) $4.10

D) $7.10

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

58

Fusaro Corporation uses a predetermined overhead rate base on machine-hours that it recalculates at the beginning of each year. The company has provided the following data for the most recent year.  The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $644,670

B) $684,000

C) $68,000

D) $580,580

The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to: (Round your intermediate calculations to 2 decimal places.)A) $644,670

B) $684,000

C) $68,000

D) $580,580

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

59

Carradine Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $105,000, variable manufacturing overhead of $3.00 per machine-hour, and 70,000 machine-hours. The company recently completed Job P233 which required 60 machine-hours. The amount of overhead applied to Job P233 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $90

B) $270

C) $450

D) $180

A) $90

B) $270

C) $450

D) $180

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

60

Laflame Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  The estimated total manufacturing overhead is closest to:

The estimated total manufacturing overhead is closest to:

A) $273,000

B) $630,000

C) $357,004

D) $357,000

The estimated total manufacturing overhead is closest to:

The estimated total manufacturing overhead is closest to:A) $273,000

B) $630,000

C) $357,004

D) $357,000

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

61

Columbo Corporation has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A948. The following data were recorded for this job:

During the current month the company started and finished Job A948. The following data were recorded for this job:

If the company marks up its manufacturing costs by 40% then the selling price for Job A948 would be closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its manufacturing costs by 40% then the selling price for Job A948 would be closest to: (Round your intermediate calculations to 2 decimal places.)

A) $6,197.80

B) $1,770.80

C) $4,427.00

D) $6,818.00

During the current month the company started and finished Job A948. The following data were recorded for this job:

During the current month the company started and finished Job A948. The following data were recorded for this job: If the company marks up its manufacturing costs by 40% then the selling price for Job A948 would be closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its manufacturing costs by 40% then the selling price for Job A948 would be closest to: (Round your intermediate calculations to 2 decimal places.)A) $6,197.80

B) $1,770.80

C) $4,427.00

D) $6,818.00

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

62

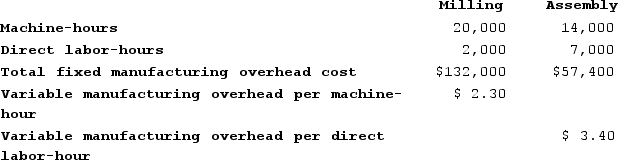

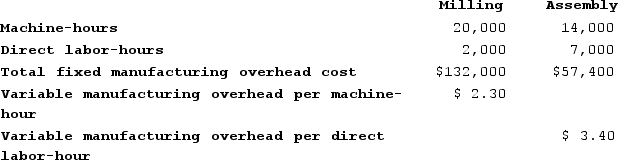

Bassett Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The predetermined overhead rate for the Milling Department is closest to:

The predetermined overhead rate for the Milling Department is closest to:

A) $19.00 per machine-hour

B) $2.10 per machine-hour

C) $9.50 per machine-hour

D) $7.40 per machine-hour

The predetermined overhead rate for the Milling Department is closest to:

The predetermined overhead rate for the Milling Department is closest to:A) $19.00 per machine-hour

B) $2.10 per machine-hour

C) $9.50 per machine-hour

D) $7.40 per machine-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

63

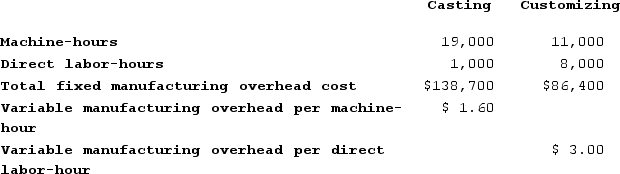

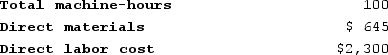

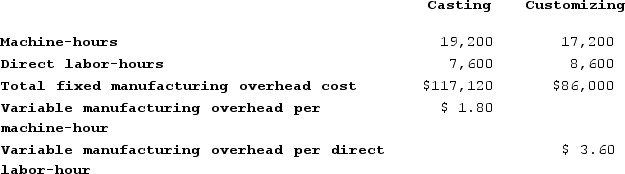

Swango Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The estimated total manufacturing overhead for the Customizing Department is closest to:

The estimated total manufacturing overhead for the Customizing Department is closest to:

A) $24,000

B) $110,400

C) $86,400

D) $60,379

The estimated total manufacturing overhead for the Customizing Department is closest to:

The estimated total manufacturing overhead for the Customizing Department is closest to:A) $24,000

B) $110,400

C) $86,400

D) $60,379

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

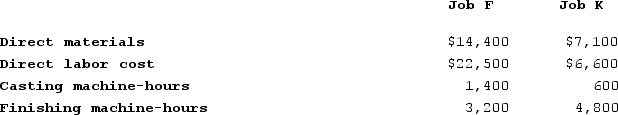

64

Lotz Corporation has two manufacturing departments--Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $30,220

B) $90,660

C) $60,440

D) $96,100

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)A) $30,220

B) $90,660

C) $60,440

D) $96,100

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

65

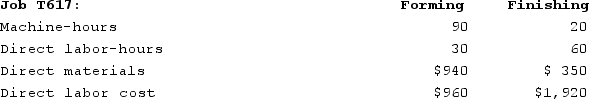

Tomey Corporation has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T617. The following data were recorded for this job:

During the current month the company started and finished Job T617. The following data were recorded for this job:

The total job cost for Job T617 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job T617 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $5,604

B) $2,584

C) $684

D) $3,020

During the current month the company started and finished Job T617. The following data were recorded for this job:

During the current month the company started and finished Job T617. The following data were recorded for this job: The total job cost for Job T617 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job T617 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $5,604

B) $2,584

C) $684

D) $3,020

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

66

Coates Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $249,000, variable manufacturing overhead of $3.80 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job X784 which was recently completed:  If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $253.87

B) $233.87

C) $53.97

D) $155.22

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $253.87

B) $233.87

C) $53.97

D) $155.22

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

67

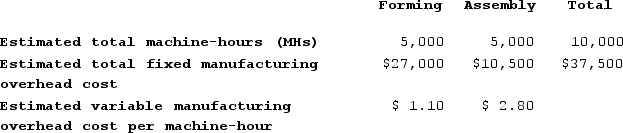

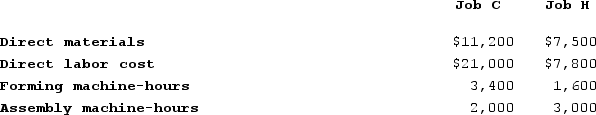

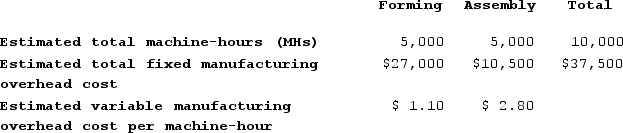

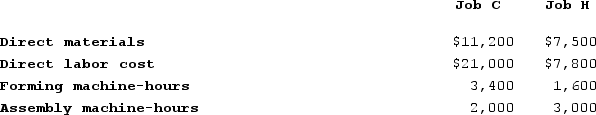

Stockmaster Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $96,989

B) $88,172

C) $25,192

D) $62,980

During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling price for Job C is closest to: (Round your intermediate calculations to 2 decimal places.)A) $96,989

B) $88,172

C) $25,192

D) $62,980

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

68

Doakes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M843 was completed with the following characteristics:

Recently, Job M843 was completed with the following characteristics:

The unit product cost for Job M843 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job M843 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $33.75

B) $67.50

C) $27.50

D) $50.50

Recently, Job M843 was completed with the following characteristics:

Recently, Job M843 was completed with the following characteristics: The unit product cost for Job M843 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job M843 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $33.75

B) $67.50

C) $27.50

D) $50.50

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

69

Sutter Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T369 was completed with the following characteristics:

Recently, Job T369 was completed with the following characteristics:

If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $324.56

B) $304.56

C) $277.20

D) $50.76

Recently, Job T369 was completed with the following characteristics:

Recently, Job T369 was completed with the following characteristics: If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $324.56

B) $304.56

C) $277.20

D) $50.76

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

70

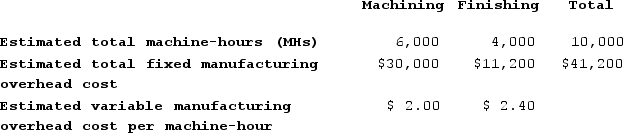

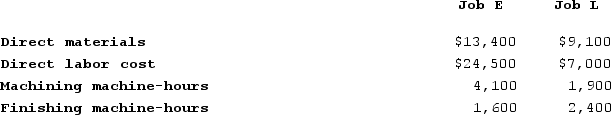

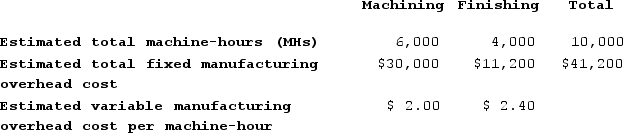

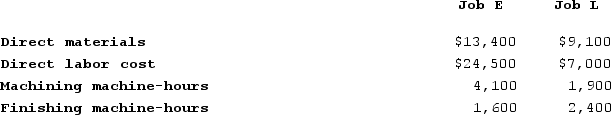

Atteberry Corporation has two manufacturing departments--Machining and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job E and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job E and Job L. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job E is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job E is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $24,500

B) $35,796

C) $13,400

D) $73,696

During the most recent month, the company started and completed two jobs--Job E and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job E and Job L. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job E is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The total manufacturing cost assigned to Job E is closest to: (Round your intermediate calculations to 2 decimal places.)A) $24,500

B) $35,796

C) $13,400

D) $73,696

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

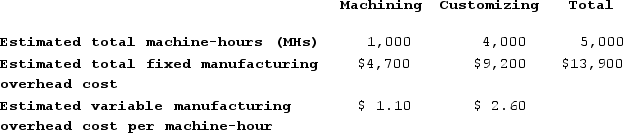

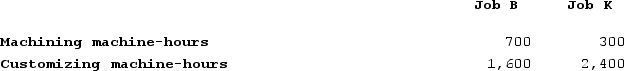

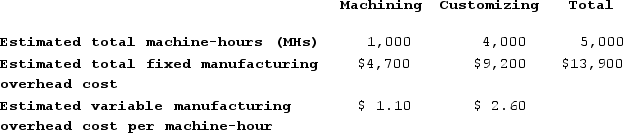

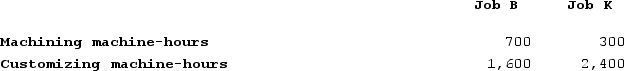

71

Ashe Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $11,760

B) $1,740

C) $13,716

D) $13,500

During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job K is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job K is closest to: (Round your intermediate calculations to 2 decimal places.)A) $11,760

B) $1,740

C) $13,716

D) $13,500

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

72

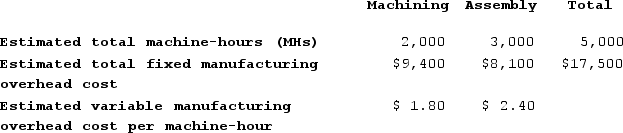

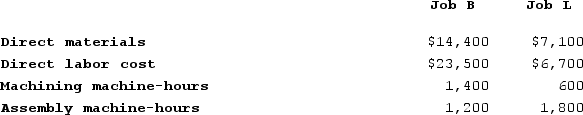

Molash Corporation has two manufacturing departments--Machining and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $40,320

B) $41,933

C) $13,440

D) $26,880

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job L is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job L is closest to: (Round your intermediate calculations to 2 decimal places.)A) $40,320

B) $41,933

C) $13,440

D) $26,880

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

73

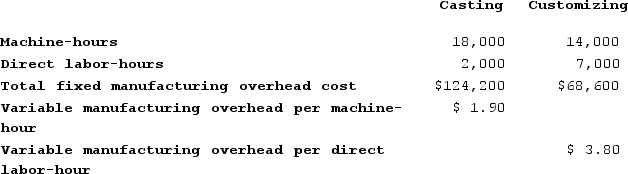

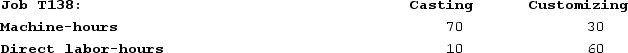

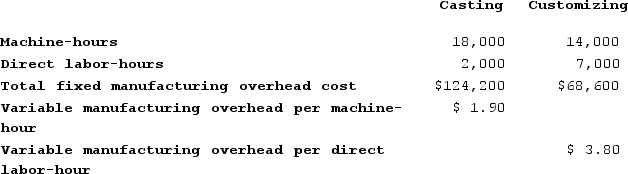

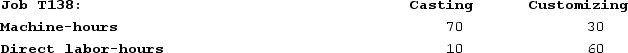

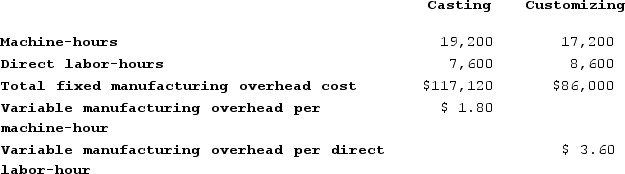

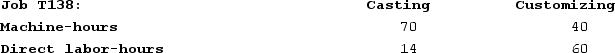

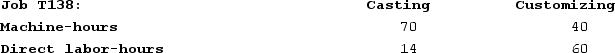

Mahon Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T138. The following data were recorded for this job:

During the current month the company started and finished Job T138. The following data were recorded for this job:

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $588.00

B) $95,200.00

C) $816.00

D) $228.00

During the current month the company started and finished Job T138. The following data were recorded for this job:

During the current month the company started and finished Job T138. The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $588.00

B) $95,200.00

C) $816.00

D) $228.00

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

74

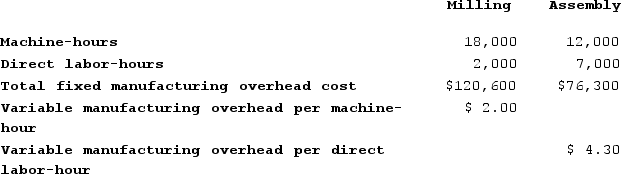

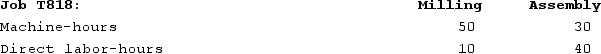

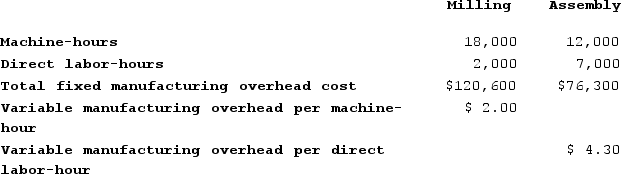

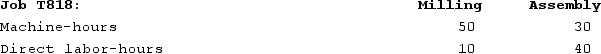

Boward Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T818. The following data were recorded for this job:

During the current month the company started and finished Job T818. The following data were recorded for this job:

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,651

B) $608

C) $435

D) $1,043

During the current month the company started and finished Job T818. The following data were recorded for this job:

During the current month the company started and finished Job T818. The following data were recorded for this job: The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total amount of overhead applied in both departments to Job T818 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $1,651

B) $608

C) $435

D) $1,043

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

75

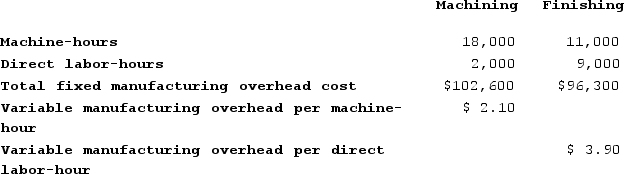

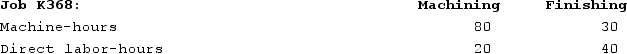

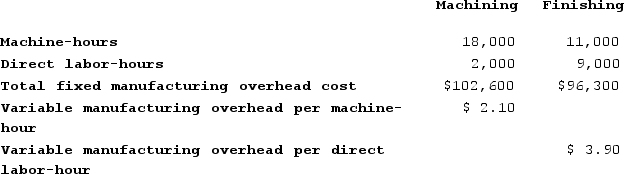

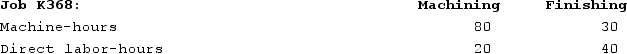

Malakan Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job K368. The following data were recorded for this job:

During the current month the company started and finished Job K368. The following data were recorded for this job:

The amount of overhead applied in the Machining Department to Job K368 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Machining Department to Job K368 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $856.00

B) $168.00

C) $624.00

D) $140,400.00

During the current month the company started and finished Job K368. The following data were recorded for this job:

During the current month the company started and finished Job K368. The following data were recorded for this job: The amount of overhead applied in the Machining Department to Job K368 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Machining Department to Job K368 is closest to: (Round your intermediate calculations to 2 decimal places.)A) $856.00

B) $168.00

C) $624.00

D) $140,400.00

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

76

Marioni Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $6,720

B) $33,600

C) $40,320

D) $39,480

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)A) $6,720

B) $33,600

C) $40,320

D) $39,480

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

77

Fatzinger Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The predetermined overhead rate for the Assembly Department is closest to:

The predetermined overhead rate for the Assembly Department is closest to:

A) $8.20 per direct labor-hour

B) $3.40 per direct labor-hour

C) $4.06 per direct labor-hour

D) $11.60 per direct labor-hour

The predetermined overhead rate for the Assembly Department is closest to:

The predetermined overhead rate for the Assembly Department is closest to:A) $8.20 per direct labor-hour

B) $3.40 per direct labor-hour

C) $4.06 per direct labor-hour

D) $11.60 per direct labor-hour

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

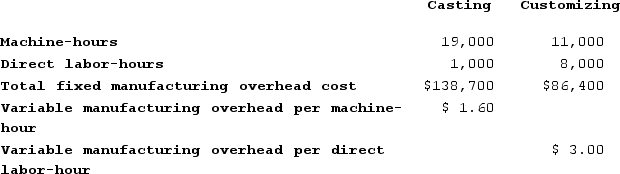

78

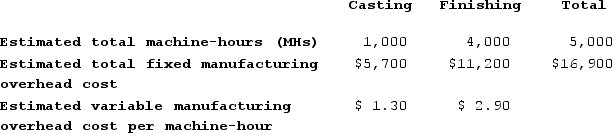

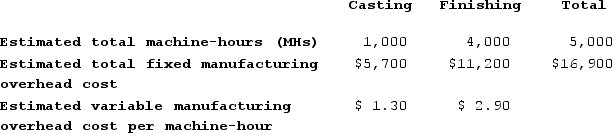

Tarrant Corporation has two manufacturing departments--Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Casting Department is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Casting Department is closest to:

A) $5.70

B) $1.30

C) $5.96

D) $7.00

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Casting Department is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Casting Department is closest to:A) $5.70

B) $1.30

C) $5.96

D) $7.00

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

79