Deck 5: Cost-Volume-Profit Relationships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/396

Play

Full screen (f)

Deck 5: Cost-Volume-Profit Relationships

1

An increase in the number of units sold will decrease a company's break-even point.

False

2

The break-even point can be determined by simply adding together all of the expenses from the income statement.

False

3

The smaller the contribution margin ratio, the smaller the amount of sales required to cover a given amount of fixed expenses.

False

4

To estimate what the profit will be at various levels of sales volume, multiply the number of units to be sold above or below the break-even point by the unit contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

5

If the variable expense per unit decreases, and all other factors remain the same, the contribution margin ratio will increase.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

6

In a Cost-Volume-Profit graph, the anticipated profit or loss at any given level of sales is measured by the vertical distance between the total revenue line (sales) and the total fixed expense line.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

7

When expressed on a per unit basis, fixed costs can mislead decision makers into thinking of them as variable costs.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

8

If fixed expenses increase by $10,000 per year, then the sales needed to break even will generally increase by more than $10,000.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

9

The break-even point in units can be obtained by dividing total fixed expenses by the unit contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

10

A shift in the sales mix from low-margin items to high-margin items will decrease total profits even though total sales increase.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

11

In two companies making the same product and with the same total sales and total expenses, the contribution margin ratio will be lower in the company with a higher proportion of fixed expenses in its cost structure.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

12

Two companies with the same margin of safety in dollars will also have the same total contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

13

For a capital intensive, automated company the break-even point will tend to be higher and the margin of safety will be lower than for a less capital intensive company with the same sales.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

14

Fawn Company's margin of safety is $90,000. If the company's sales drop by $80,000, it will still have positive net operating income.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

15

For a given level of sales, a low contribution margin ratio will produce more net operating income than a high contribution margin ratio.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

16

In a Cost-Volume-Profit graph (sometimes called a break-even chart), unit volume is represented on the horizontal (X) axis and dollars on the vertical (Y) axis.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

17

On a Cost-Volume-Profit graph for a profitable company, the total expense line will be steeper than the total revenue line.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

18

A shift in the sales mix from high-margin items to low-margin items can cause total profits to decrease even though total sales may increase.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

19

The total volume in sales dollars that would be required to attain a given target profit is determined by dividing the target profit by the contribution margin ratio.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

20

A decrease in the number of units sold will decrease the break-even point.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

21

A major advantage of the high-low method of cost estimation is that it omits all data from the analysis other than the lowest and highest costs.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

22

A company with high operating leverage will experience a larger reduction in net operating income in a period of declining salesvolume than a company with low operating leverage.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

23

The degree of operating leverage in a company is smallest at the break-even point and increases as salesvolumes rise.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

24

The R 2 (i.e., R-squared) varies from 0% to 100%, and the lower the percentage, the better the fit of the data to a straight line.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

25

Managers can use a variety of methods to estimate the fixed and variable components of a mixed cost. In account analysis, an account is classified as either variable or fixed based on the analyst's prior knowledge of how the cost in the account behaves.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

26

The highest and lowest costs are always used to analyze a mixed cost under the high-low method.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

27

Least-squares regression selects the values for the intercept and slope of a straight line that minimize the sum of the errors.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

28

A quick look at a scattergraph of cost versus activity can reveal that there is little relation between the cost and the activity or that the relation is something other than a simple straight line. In such cases, least square regression is highly recommended for estimating fixed and variable costs.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

29

In a scattergraph of cost and activity, activity is the independent variable because it causes variations in the cost.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is true regarding the contribution margin ratio of a company that produces only a single product?

A) As fixed expenses decrease, the contribution margin ratio increases.

B) The contribution margin ratio multiplied by the selling price per unit equals the contribution margin per unit.

C) The contribution margin ratio will decline as unit sales decline.

D) The contribution margin ratio equals the selling price per unit less the variable expense ratio.

A) As fixed expenses decrease, the contribution margin ratio increases.

B) The contribution margin ratio multiplied by the selling price per unit equals the contribution margin per unit.

C) The contribution margin ratio will decline as unit sales decline.

D) The contribution margin ratio equals the selling price per unit less the variable expense ratio.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

31

The least-squares regression method computes the regression line that minimizes the sum of the squared deviations from the plotted points to the line.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

32

The margin of safety is the amount by which sales can decrease before losses are incurred by the company.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

33

The margin of safety percentage is equal to the margin of safety in dollars divided by total contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

34

The high and low points used in the high-low method tend to be unusual and therefore the cost formula for the mixed cost may not accurately represent all of the data.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

35

The engineering approach to the analysis of mixed costs involves a detailed statistical analysis of cost behavior using methods that minimize the squared errors.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is correct with regard to a Cost-Volume-Profit graph?

A) A Cost-Volume-Profit graph shows the maximum possible profit.

B) A Cost-Volume-Profit graph shows the break-even point as the intersection of the total sales revenue line and the total expense line.

C) A Cost-Volume-Profit graph assumes that total expense varies in direct proportion to unit sales.

D) A Cost-Volume-Profit graph shows the operating leverage as the gap between total sales revenue and total expense at the actual level of sales.

A) A Cost-Volume-Profit graph shows the maximum possible profit.

B) A Cost-Volume-Profit graph shows the break-even point as the intersection of the total sales revenue line and the total expense line.

C) A Cost-Volume-Profit graph assumes that total expense varies in direct proportion to unit sales.

D) A Cost-Volume-Profit graph shows the operating leverage as the gap between total sales revenue and total expense at the actual level of sales.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is correct? The break-even point occurs on the Cost-Volume-Profit graph where:

A) total profit equals total expenses.

B) total profit equals total fixed expenses.

C) total contribution margin equals total fixed expenses.

D) total variable expenses equal total contribution margin.

A) total profit equals total expenses.

B) total profit equals total fixed expenses.

C) total contribution margin equals total fixed expenses.

D) total variable expenses equal total contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

38

The degree of operating leverage is computed by dividing sales by the contribution margin.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

39

A shift in the sales mix from products with high contribution margin ratios toward products with low contribution margin ratios will raise the break-even point for the company as a whole.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

40

The R 2 (i.e., R-squared) tells us the percentage of the variation in the dependent variable (cost) that is explained by variation in the independent variable (activity).

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

41

Break-even analysis assumes that:

A) Total revenue is constant.

B) Unit variable expense is constant.

C) Unit fixed expense is constant.

D) Selling prices must fall in order to generate more revenue.

A) Total revenue is constant.

B) Unit variable expense is constant.

C) Unit fixed expense is constant.

D) Selling prices must fall in order to generate more revenue.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

42

If a company increases its selling price by $2 per unit due to an increase in its variable labor cost of $2 per unit, the break-even point in units will:

A) decrease.

B) increase.

C) not change.

D) change but direction cannot be determined.

A) decrease.

B) increase.

C) not change.

D) change but direction cannot be determined.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

43

If sales volume increases and all other factors remain constant, then the:

A) contribution margin ratio will increase.

B) break-even point will decrease.

C) margin of safety will increase.

D) net operating income will decrease.

A) contribution margin ratio will increase.

B) break-even point will decrease.

C) margin of safety will increase.

D) net operating income will decrease.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

44

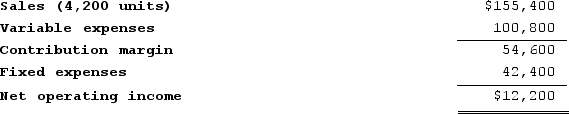

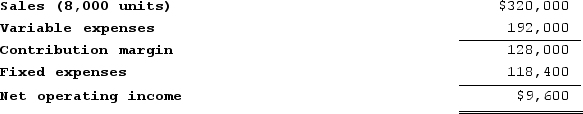

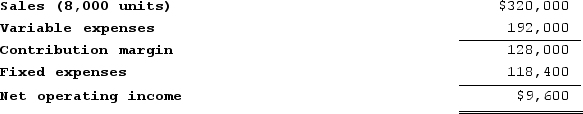

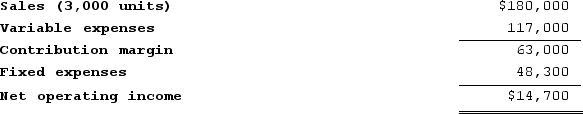

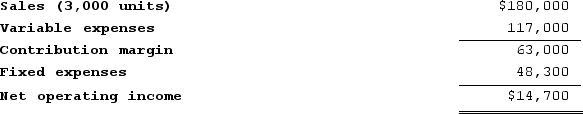

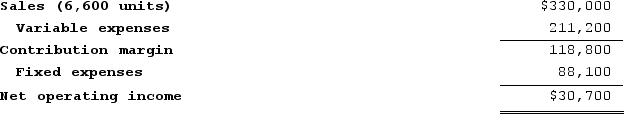

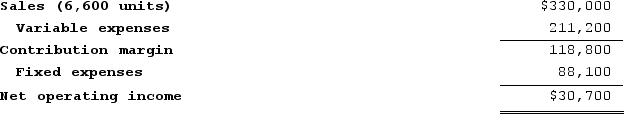

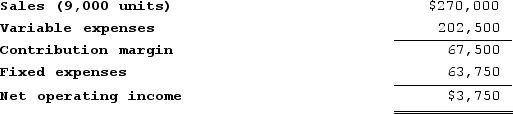

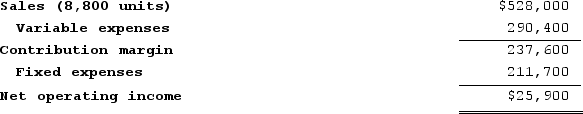

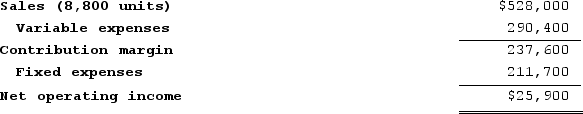

Sorin Incorporated, a company that produces and sells a single product, has provided its contribution format income statement for January.  If the company sells 4,600 units, its total contribution margin should be closest to:

If the company sells 4,600 units, its total contribution margin should be closest to:

A) $54,600

B) $59,800

C) $69,400

D) $13,362

If the company sells 4,600 units, its total contribution margin should be closest to:

If the company sells 4,600 units, its total contribution margin should be closest to:A) $54,600

B) $59,800

C) $69,400

D) $13,362

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

45

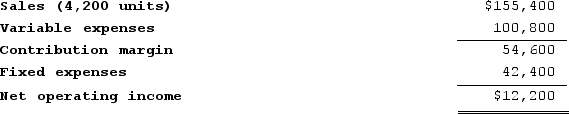

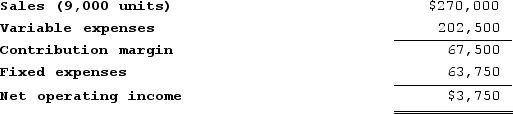

Sorin Incorporated, a company that produces and sells a single product, has provided its contribution format income statement for January.  If the company sells 4,100 units, its total contribution margin should be closest to: (Do not round intermediate calculations.)

If the company sells 4,100 units, its total contribution margin should be closest to: (Do not round intermediate calculations.)

A) $46,656

B) $53,136

C) $81,300

D) $10,655

If the company sells 4,100 units, its total contribution margin should be closest to: (Do not round intermediate calculations.)

If the company sells 4,100 units, its total contribution margin should be closest to: (Do not round intermediate calculations.)A) $46,656

B) $53,136

C) $81,300

D) $10,655

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

46

To obtain the dollar sales volume necessary to attain a given target profit, which of the following formulas should be used?

A) (Fixed expenses + Target net profit)/Total contribution margin

B) (Fixed expenses + Target net profit)/Contribution margin ratio

C) Fixed expenses/Contribution margin per unit

D) Target net profit/Contribution margin ratio

A) (Fixed expenses + Target net profit)/Total contribution margin

B) (Fixed expenses + Target net profit)/Contribution margin ratio

C) Fixed expenses/Contribution margin per unit

D) Target net profit/Contribution margin ratio

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

47

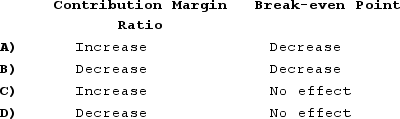

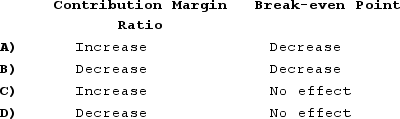

Mossfeet Shoe Corporation is a single product firm. The company is predicting that a price increase next year will not cause unit sales to decrease. What effect would this price increase have on the following items for next year?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

48

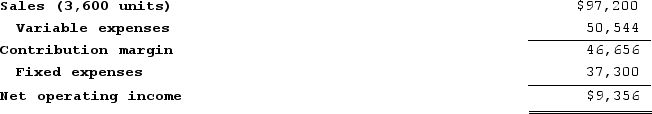

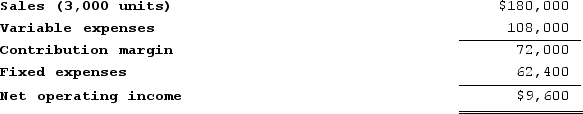

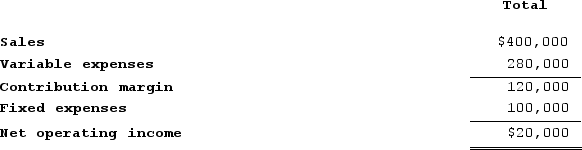

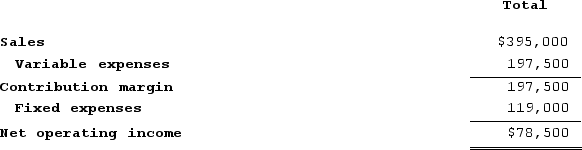

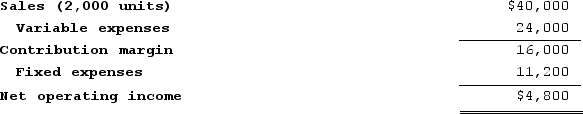

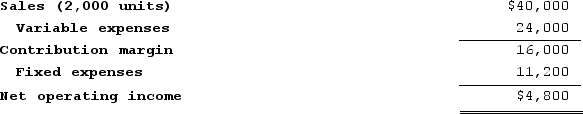

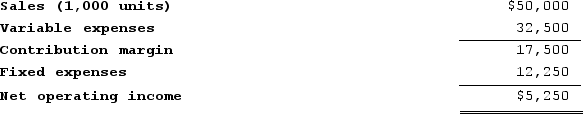

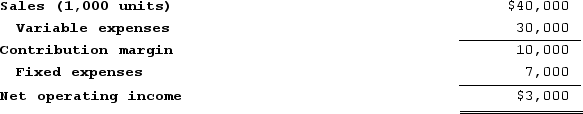

Kelchner Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The contribution margin ratio is closest to:

The contribution margin ratio is closest to:

A) 67%

B) 40%

C) 33%

D) 60%

The contribution margin ratio is closest to:

The contribution margin ratio is closest to:A) 67%

B) 40%

C) 33%

D) 60%

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

49

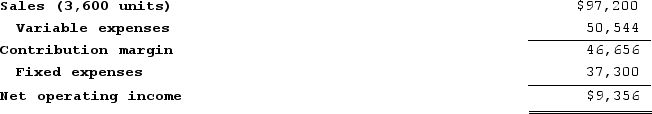

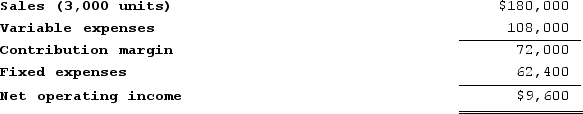

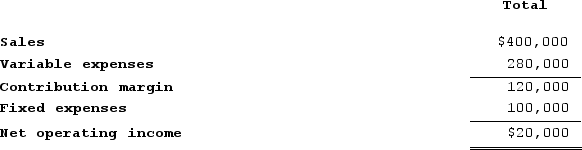

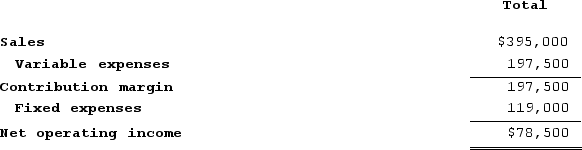

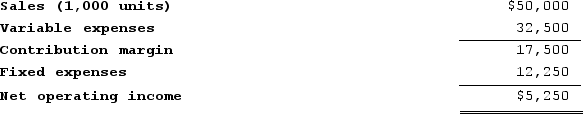

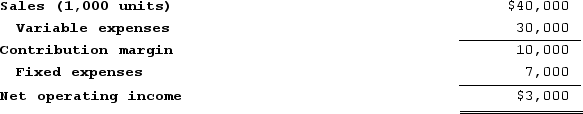

Stauffer Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The variable expense ratio is closest to:

The variable expense ratio is closest to:

A) 60%

B) 40%

C) 67%

D) 33%

The variable expense ratio is closest to:

The variable expense ratio is closest to:A) 60%

B) 40%

C) 67%

D) 33%

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

50

A $2.00 increase in a product's variable expense per unit accompanied by a $2.00 increase in its selling price per unit will:

A) decrease the degree of operating leverage.

B) decrease the contribution margin.

C) have no effect on the break-even volume.

D) have no effect on the contribution margin ratio.

A) decrease the degree of operating leverage.

B) decrease the contribution margin.

C) have no effect on the break-even volume.

D) have no effect on the contribution margin ratio.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

51

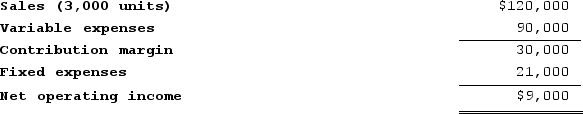

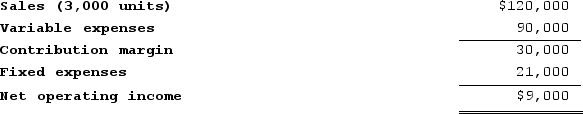

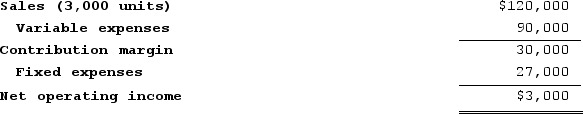

Nocum Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  If salesvolumes decline to 2,900 units, the net operating income would be closest to:

If salesvolumes decline to 2,900 units, the net operating income would be closest to:

A) $29,000

B) $1,000

C) $8,700

D) $8,000

If salesvolumes decline to 2,900 units, the net operating income would be closest to:

If salesvolumes decline to 2,900 units, the net operating income would be closest to:A) $29,000

B) $1,000

C) $8,700

D) $8,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

52

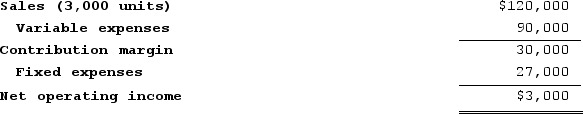

Coultrap Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The contribution margin per unit is closest to:

The contribution margin per unit is closest to:

A) $21.00

B) $60.00

C) $39.00

D) $4.90

The contribution margin per unit is closest to:

The contribution margin per unit is closest to:A) $21.00

B) $60.00

C) $39.00

D) $4.90

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

53

If the degree of operating leverage is 4, then a one percent change in quantity sold should result in a four percent change in:

A) unit contribution margin.

B) revenue.

C) variable expense.

D) net operating income.

A) unit contribution margin.

B) revenue.

C) variable expense.

D) net operating income.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

54

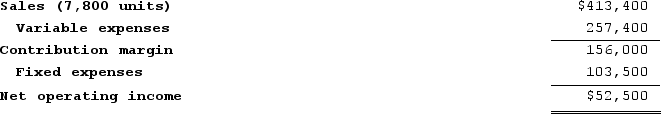

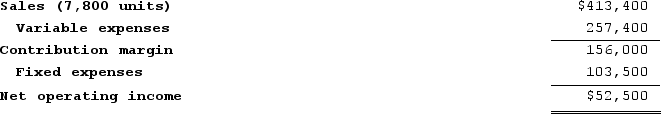

Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November.  If the company sells 7,700 units, its net operating income should be closest to: (Do not round intermediate calculations.)

If the company sells 7,700 units, its net operating income should be closest to: (Do not round intermediate calculations.)

A) $51,979

B) $50,500

C) $52,500

D) $48,000

If the company sells 7,700 units, its net operating income should be closest to: (Do not round intermediate calculations.)

If the company sells 7,700 units, its net operating income should be closest to: (Do not round intermediate calculations.)A) $51,979

B) $50,500

C) $52,500

D) $48,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

55

Carver Corporation produces a product which sells for $40. Variable manufacturing costs are $18 per unit. Fixed manufacturing costs are $5 per unit based on the current level of sales volume, and fixed selling and administrative costs are $4 per unit. A selling commission of 15% of the selling price is paid on each unit sold. The contribution margin per unit is:

A) $7

B) $17

C) $22

D) $16

A) $7

B) $17

C) $22

D) $16

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

56

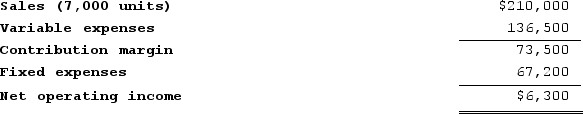

Schister Systems uses the following data in its Cost-Volume-Profit analyses:  What is total contribution margin if sales volume increases by 20%?

What is total contribution margin if sales volume increases by 20%?

A) $80,000

B) $158,400

C) $200,000

D) $144,000

What is total contribution margin if sales volume increases by 20%?

What is total contribution margin if sales volume increases by 20%?A) $80,000

B) $158,400

C) $200,000

D) $144,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

57

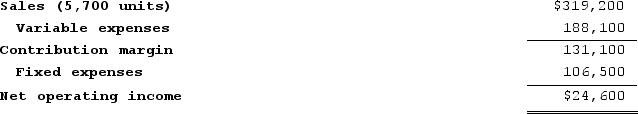

Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November.  If the company sells 5,300 units, its net operating income should be closest to:

If the company sells 5,300 units, its net operating income should be closest to:

A) $24,600

B) $2,200

C) $22,874

D) $15,400

If the company sells 5,300 units, its net operating income should be closest to:

If the company sells 5,300 units, its net operating income should be closest to:A) $24,600

B) $2,200

C) $22,874

D) $15,400

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is an assumption underlying standard CVP analysis?

A) In multiproduct companies, the sales mix is constant.

B) In manufacturing companies, inventories always change.

C) The price of a product or service is expected to change as volume changes.

D) Fixed expenses will change as volume increases.

A) In multiproduct companies, the sales mix is constant.

B) In manufacturing companies, inventories always change.

C) The price of a product or service is expected to change as volume changes.

D) Fixed expenses will change as volume increases.

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following would not affect the break-even point?

A) number of units sold

B) variable expense per unit

C) total fixed expense

D) selling price per unit

A) number of units sold

B) variable expense per unit

C) total fixed expense

D) selling price per unit

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

60

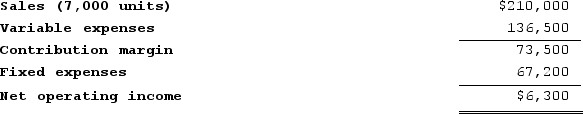

Schister Systems uses the following data in its Cost-Volume-Profit analyses:  What is total contribution margin if sales volume increases by 20%?

What is total contribution margin if sales volume increases by 20%?

A) $197,500

B) $94,200

C) $237,000

D) $62,800

What is total contribution margin if sales volume increases by 20%?

What is total contribution margin if sales volume increases by 20%?A) $197,500

B) $94,200

C) $237,000

D) $62,800

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

61

Warrix Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  If salesvolumes increase to 3,020 units, the increase in net operating income would be closest to:

If salesvolumes increase to 3,020 units, the increase in net operating income would be closest to:

A) $800.00

B) $20.00

C) $600.00

D) $200.00

If salesvolumes increase to 3,020 units, the increase in net operating income would be closest to:

If salesvolumes increase to 3,020 units, the increase in net operating income would be closest to:A) $800.00

B) $20.00

C) $600.00

D) $200.00

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

62

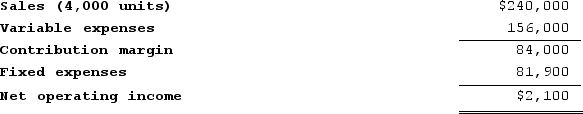

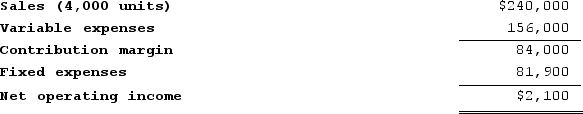

Decaprio Incorporated produces and sells a single product. The company has provided its contribution format income statement for June.  If the company sells 6,800 units, its net operating income should be closest to: (Do not round intermediate calculations.)

If the company sells 6,800 units, its net operating income should be closest to: (Do not round intermediate calculations.)

A) $34,300

B) $30,700

C) $40,700

D) $31,630

If the company sells 6,800 units, its net operating income should be closest to: (Do not round intermediate calculations.)

If the company sells 6,800 units, its net operating income should be closest to: (Do not round intermediate calculations.)A) $34,300

B) $30,700

C) $40,700

D) $31,630

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

63

Northern Pacific Fixtures Corporation sells a single product for $28 per unit. If variable expenses are 65% of sales and fixed expenses total $9,800, the break-even point is: (Round your intermediate calculations to 2 decimal places.)

A) $15,077

B) $18,200

C) $9,800

D) $28,000

A) $15,077

B) $18,200

C) $9,800

D) $28,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

64

Creswell Corporation's fixed monthly expenses are $29,000 and its contribution margin ratio is 56%. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $95,000?

A) $12,800

B) $24,200

C) $53,200

D) $66,000

A) $12,800

B) $24,200

C) $53,200

D) $66,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

65

Duve Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:

If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:

A) $7,200

B) $12,800

C) $10,400

D) $11,520

If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:

If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:A) $7,200

B) $12,800

C) $10,400

D) $11,520

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

66

Goodman Corporation has sales volumes of 3,000 units at $80 per unit. Variable costs are 35% of the sales price. If total fixed costs are $66,000, the degree of operating leverage is:

A) 0.79

B) 0.93

C) 2.67

D) 1.73

A) 0.79

B) 0.93

C) 2.67

D) 1.73

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

67

Hedman Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The margin of safety percentage is closest to:

The margin of safety percentage is closest to:

A) 75%

B) 1%

C) 6%

D) 24%

The margin of safety percentage is closest to:

The margin of safety percentage is closest to:A) 75%

B) 1%

C) 6%

D) 24%

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

68

Mishoe Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The break-even point in unit sales is closest to: (Round your intermediate calculations to 2 decimal places.)

The break-even point in unit sales is closest to: (Round your intermediate calculations to 2 decimal places.)

A) 0 units

B) 895 units

C) 700 units

D) 650 units

The break-even point in unit sales is closest to: (Round your intermediate calculations to 2 decimal places.)

The break-even point in unit sales is closest to: (Round your intermediate calculations to 2 decimal places.)A) 0 units

B) 895 units

C) 700 units

D) 650 units

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

69

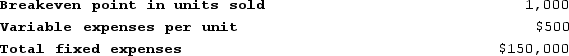

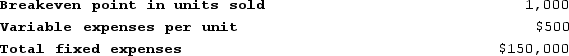

The following information pertains to Nova Co.'s cost-volume-profit relationships:  How much will be contributed to net operating income by the 1,001st unit sold?

How much will be contributed to net operating income by the 1,001st unit sold?

A) $650

B) $500

C) $150

D) $0

How much will be contributed to net operating income by the 1,001st unit sold?

How much will be contributed to net operating income by the 1,001st unit sold?A) $650

B) $500

C) $150

D) $0

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

70

Gayne Corporation's contribution margin ratio is 16% and its fixed monthly expenses are $45,500. If the company's sales for a month are $302,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change.

A) $208,180

B) $2,820

C) $256,500

D) $48,320

A) $208,180

B) $2,820

C) $256,500

D) $48,320

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

71

Jilk Incorporated's contribution margin ratio is 58% and its fixed monthly expenses are $36,000. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $103,000?

A) $23,740

B) $59,740

C) $67,000

D) $7,260

A) $23,740

B) $59,740

C) $67,000

D) $7,260

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

72

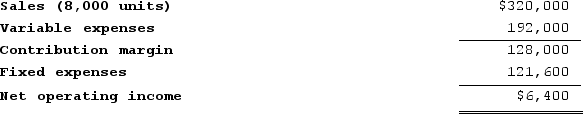

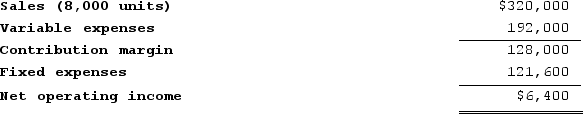

Stockmaster Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The margin of safety in dollars is closest to:

The margin of safety in dollars is closest to:

A) $6,400

B) $16,000

C) $121,600

D) $128,000

The margin of safety in dollars is closest to:

The margin of safety in dollars is closest to:A) $6,400

B) $16,000

C) $121,600

D) $128,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

73

Jilk Incorporated's contribution margin ratio is 61% and its fixed monthly expenses are $43,000. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $128,000?

A) $78,080

B) $6,920

C) $35,080

D) $85,000

A) $78,080

B) $6,920

C) $35,080

D) $85,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

74

Thomason Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  If the variable cost per unit increases by $1, spending on advertising increases by $2,000, and unit sales increase by 50 units, the net operating income would be closest to:

If the variable cost per unit increases by $1, spending on advertising increases by $2,000, and unit sales increase by 50 units, the net operating income would be closest to:

A) $450

B) $1,000

C) $2,150

D) $9,450

If the variable cost per unit increases by $1, spending on advertising increases by $2,000, and unit sales increase by 50 units, the net operating income would be closest to:

If the variable cost per unit increases by $1, spending on advertising increases by $2,000, and unit sales increase by 50 units, the net operating income would be closest to:A) $450

B) $1,000

C) $2,150

D) $9,450

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

75

Cassius Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The number of units that must be sold to achieve a target profit of $31,500 is closest to:

The number of units that must be sold to achieve a target profit of $31,500 is closest to:

A) 42,000 units

B) 16,400 units

C) 35,000 units

D) 9,400 units

The number of units that must be sold to achieve a target profit of $31,500 is closest to:

The number of units that must be sold to achieve a target profit of $31,500 is closest to:A) 42,000 units

B) 16,400 units

C) 35,000 units

D) 9,400 units

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

76

Decaprio Incorporated produces and sells a single product. The company has provided its contribution format income statement for June.  If the company sells 9,200 units, its net operating income should be closest to:

If the company sells 9,200 units, its net operating income should be closest to:

A) $27,077

B) $49,900

C) $36,700

D) $25,900

If the company sells 9,200 units, its net operating income should be closest to:

If the company sells 9,200 units, its net operating income should be closest to:A) $27,077

B) $49,900

C) $36,700

D) $25,900

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

77

Creswell Corporation's fixed monthly expenses are $30,000 and its contribution margin ratio is 63%. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $92,000?

A) $4,040

B) $57,960

C) $27,960

D) $62,000

A) $4,040

B) $57,960

C) $27,960

D) $62,000

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

78

Ploeger Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range.  The break-even point in dollar sales is closest to:

The break-even point in dollar sales is closest to:

A) $234,000

B) $237,900

C) $156,000

D) $0

The break-even point in dollar sales is closest to:

The break-even point in dollar sales is closest to:A) $234,000

B) $237,900

C) $156,000

D) $0

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

79

Gayne Corporation's contribution margin ratio is 12% and its fixed monthly expenses are $84,000. If the company's sales for a month are $738,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change.

A) $565,440

B) $654,000

C) $88,560

D) $4,560

A) $565,440

B) $654,000

C) $88,560

D) $4,560

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck

80

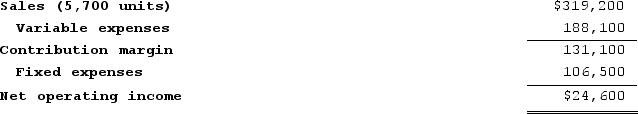

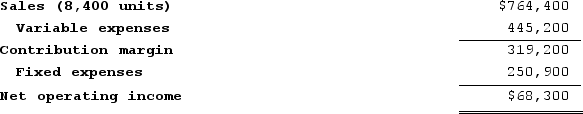

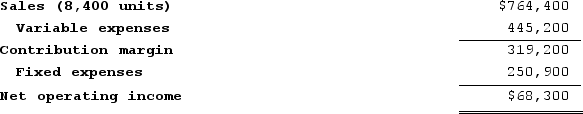

Escareno Corporation has provided its contribution format income statement for June. The company produces and sells a single product.  If the company sells 8,200 units, its total contribution margin should be closest to:

If the company sells 8,200 units, its total contribution margin should be closest to:

A) $301,000

B) $311,600

C) $319,200

D) $66,674

If the company sells 8,200 units, its total contribution margin should be closest to:

If the company sells 8,200 units, its total contribution margin should be closest to:A) $301,000

B) $311,600

C) $319,200

D) $66,674

Unlock Deck

Unlock for access to all 396 flashcards in this deck.

Unlock Deck

k this deck