Deck 12: State and Local Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 12: State and Local Taxes

1

Nondomiciliary businesses are subject to tax everywhere they do business.

True

2

Use tax liability accrues in the state where taxable purchased property will be used when the seller of the property is not required to collect sales tax.

False

3

Purchases of inventory for resale are typically exempt from sales and use taxes.

True

4

All states employ some combination of sales and use tax, income or franchise tax, or property tax to fund their government operations.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

Businesses engaged in interstate commerce are subject to income tax in every state in which they operate.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

The Wayfair decision held that an out-of-state mail-order company did not have sales tax collection responsibility because it lacked physical presence.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

Businesses subject to income tax in more than one jurisdiction have the right to apportionment.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Business income is allocated to the state of commercial domicile.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

Commercial domicile is the location where a business is headquartered and from whence it directs its operations.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

The sales and use tax base varies from state to state.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

Businesses must collect sales tax only in states where they have sales tax nexus.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

The Wayfair decision reversed the Quill decision, which had affirmed that out-of-state businesses must have physical presence within a state before the state may require the collection of sales taxes from in-state customers.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

State tax law is comprised solely of legislative authority.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

All 50 states impose a sales and use tax system.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

The state tax base is computed by making adjustments to federal taxable income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

Many states are either starting to or are in the process of expanding the types of services subject to sales tax.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

Economic presence always creates sales tax nexus.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

Failure by a seller to collect and remit sales taxes often results in a larger tax liability than failure to pay income taxes.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

Businesses must pay income tax in their state of commercial domicile.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

Wyoming imposes an income tax on corporations.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Public Law 86-272 was a congressional response to Northwestern States Portland Cement.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

Immaterial violations of the solicitation rules automatically create income tax nexus.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

A state's apportionment formula divides nonbusiness income among the states where income tax nexus exists.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

A state's apportionment formula usually is applied using some variation of sales, payroll, and property factors.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

Public Law 86-272 protects certain business activities from creating income tax nexus.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Separate-return states require each member of a consolidated group with income tax nexus to file their own state income tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

The throwback rule requires a company, for apportionment purposes, to include all sales of inventory sold into a state without income tax nexus rather than from the state from where the inventory was shipped.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

Business income includes all income earned in the ordinary course of business.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Most state tax laws adopt the federal tax law as of a specific date in time.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Delivery of tangible personal property through common carrier is a protected activity.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

A unitary-return group includes only companies included in the federal consolidated tax return filing.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

Giving samples and promotional materials without charge is a protected solicitation activity.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

The Mobil decision identified three factors to determine whether a group of companies are unitary.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

Public Law 86-272 protects only companies selling tangible personal property.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

The Wrigley case held that the sale of intangibles is protected by Public Law 86-272.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

Federal/state adjustments correct for differences between two states' tax laws.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

Several states are now moving from a strict physical presence test toward an economic presence test for income taxes.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

In Complete Auto Transit the U.S. Supreme Court determined eight criteria for determining whether a state can tax a nondomiciliary company.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

The trade show rule allows businesses to maintain a sample room for up to four weeks per year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Sales personnel investigating a potential customer's creditworthiness generally are deemed to exceed protected boundaries of solicitation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

The property factor is generally calculated as being the average of the beginning and ending property values.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

Most states have shifted away from an equally weighted three-factor to a heavily weighted sales apportionment formula.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not a primary revenue source for most states?

A) Income or franchise taxes

B) Sales or use taxes

C) Severance taxes

D) Property taxes

A) Income or franchise taxes

B) Sales or use taxes

C) Severance taxes

D) Property taxes

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

Rental income is allocated to the state of commercial domicile.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following sales is likely subject to sales and use tax in a state that assesses a sales and use tax?

A) Tax preparation services

B) Automobiles

C) Inventory

D) Food

A) Tax preparation services

B) Automobiles

C) Inventory

D) Food

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following regarding the state tax base is incorrect?

A) It is computed by making adjustments to federal taxable income.

B) It is divided into business and nonbusiness income.

C) It is a necessary step in the state income tax process.

D) It applies only to interstate businesses.

A) It is computed by making adjustments to federal taxable income.

B) It is divided into business and nonbusiness income.

C) It is a necessary step in the state income tax process.

D) It applies only to interstate businesses.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

In recent years, states are weighting the sales factor because it is easier to calculate.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

Interest and dividends are allocated to the state of commercial domicile.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Mighty Manny, Incorporated manufactures ice scrapers and distributes them across the midwestern United States. Mighty Manny is incorporated and headquartered in Michigan. It has product sales to customers in Illinois, Indiana, Michigan, Minnesota, Wisconsin, and Wyoming. It has sales personnel only in the states discussed and all these states have adopted Wayfair legislation. Determine the state in which Mighty Manny does not have sales tax nexus given the following scenarios:

A) Mighty Manny has sales personnel that visit Minnesota. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to Michigan for acceptance. The goods are shipped by FedEx into Minnesota.

B) Mighty Manny's trucks drive through Nebraska to deliver goods to Mighty Manny's customers in other states, but the company has no Nebraska sales.

C) Mighty Manny provides design services to another manufacturer located in Wisconsin. While the services are performed in Michigan, Mighty Manny's designers visit Wisconsin at least quarterly to deliver the new designs and receive feedback.

D) Mighty Manny receives online orders from its Illinois client. Because the orders are so large, the goods are delivered weekly on Mighty Manny's trucks.

A) Mighty Manny has sales personnel that visit Minnesota. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to Michigan for acceptance. The goods are shipped by FedEx into Minnesota.

B) Mighty Manny's trucks drive through Nebraska to deliver goods to Mighty Manny's customers in other states, but the company has no Nebraska sales.

C) Mighty Manny provides design services to another manufacturer located in Wisconsin. While the services are performed in Michigan, Mighty Manny's designers visit Wisconsin at least quarterly to deliver the new designs and receive feedback.

D) Mighty Manny receives online orders from its Illinois client. Because the orders are so large, the goods are delivered weekly on Mighty Manny's trucks.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following activities will create sales tax nexus?

A) Advertising using television commercials.

B) Salespeople physically located in a state from which they only take orders.

C) Delivery of sales by UPS.

D) $90,000 of sales on 190 online sales transactions.

A) Advertising using television commercials.

B) Salespeople physically located in a state from which they only take orders.

C) Delivery of sales by UPS.

D) $90,000 of sales on 190 online sales transactions.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

Most services are sourced to the state where the services were performed.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

The annual value of rented property is not included in the property factor.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

Mighty Manny, Incorporated manufactures ice scrapers and distributes them across the midwestern United States. Mighty Manny is incorporated and headquartered in Michigan. It has product sales to customers in Illinois, Indiana, Michigan, Minnesota, and Wisconsin. It has sales personnel only in the states discussed and all these states have adopted Wayfair legislation. Determine the state in which Mighty Manny does not have sales and nexus given the following scenarios:

A) Mighty Manny is incorporated and headquartered in Michigan. It also has property, employees, sales personnel, and intangibles in Michigan.

B) Mighty Manny has a warehouse in Illinois.

C) Mighty Manny has independent sales representatives in Minnesota that make $150,000 of sales on 100 transactions. The representatives distribute ice scraper-related items for over a dozen companies.

D) Mighty Manny has two customers in Wisconsin. Mighty Manny receives $50,000 on 20 orders over the phone and ships goods to its customers using FedEx.

A) Mighty Manny is incorporated and headquartered in Michigan. It also has property, employees, sales personnel, and intangibles in Michigan.

B) Mighty Manny has a warehouse in Illinois.

C) Mighty Manny has independent sales representatives in Minnesota that make $150,000 of sales on 100 transactions. The representatives distribute ice scraper-related items for over a dozen companies.

D) Mighty Manny has two customers in Wisconsin. Mighty Manny receives $50,000 on 20 orders over the phone and ships goods to its customers using FedEx.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements regarding income tax commercial domicile is incorrect?

A) The location where a business is headquartered.

B) The location where a business is incorporated.

C) The location from which a business directs its operations.

D) None of the choices are correct.

A) The location where a business is headquartered.

B) The location where a business is incorporated.

C) The location from which a business directs its operations.

D) None of the choices are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

All of the following are false regarding apportionment except?

A) Applies to only business income.

B) Applies to only nonbusiness income.

C) Applies to both business and nonbusiness income.

D) Investment income is subject to apportionment.

A) Applies to only business income.

B) Applies to only nonbusiness income.

C) Applies to both business and nonbusiness income.

D) Investment income is subject to apportionment.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following law types is not a primary authority source?

A) Legislative

B) Administrative

C) Judicial

D) Treatises

A) Legislative

B) Administrative

C) Judicial

D) Treatises

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is incorrect regarding nondomiciliary businesses?

A) Subject to tax only where income tax nexus exists.

B) A business cannot be nondomiciliary where it is headquartered.

C) A business can be nondomiciliary in only one jurisdiction.

D) Subject to tax only where a sufficient connection exists.

A) Subject to tax only where income tax nexus exists.

B) A business cannot be nondomiciliary where it is headquartered.

C) A business can be nondomiciliary in only one jurisdiction.

D) Subject to tax only where a sufficient connection exists.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

The payroll factor includes payments to independent contractors.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following businesses is likely to have taxable sales for purposes of sales and use tax?

A) Campus bookstore selling textbooks and university apparel.

B) An online retailer of textbooks with less than $100,000 in sales on 150 transactions.

C) A local accounting firm.

D) Mail-order clothing company.

A) Campus bookstore selling textbooks and university apparel.

B) An online retailer of textbooks with less than $100,000 in sales on 150 transactions.

C) A local accounting firm.

D) Mail-order clothing company.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the items is correct regarding a use tax?

A) Use taxes are imposed by every state.

B) Use taxes only apply when the seller is not required to collect the sales tax.

C) Amazon collects use taxes on behalf of all its resellers.

D) States choose to implement either a sales tax or a use tax but not both.

A) Use taxes are imposed by every state.

B) Use taxes only apply when the seller is not required to collect the sales tax.

C) Amazon collects use taxes on behalf of all its resellers.

D) States choose to implement either a sales tax or a use tax but not both.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

What was the Supreme Court's holding in National Bellas Hess?

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reaffirmed that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reaffirmed that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

On which of the following transactions should sales tax generally be collected?

A) Architecture plans delivered out of state through the mail.

B) Sales of woolen goods to a state without economic sales tax nexus delivered through common carrier.

C) Accounting services provided in Alaska.

D) Meal purchased at McDonald's.

A) Architecture plans delivered out of state through the mail.

B) Sales of woolen goods to a state without economic sales tax nexus delivered through common carrier.

C) Accounting services provided in Alaska.

D) Meal purchased at McDonald's.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following isn't a typical federal/state adjustment?

A) Dividends received deduction

B) Depreciation

C) Meals

D) U.S. obligation interest income

A) Dividends received deduction

B) Depreciation

C) Meals

D) U.S. obligation interest income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

Public Law 86-272 protects a taxpayer from which of the following taxes?

A) Texas Margin Tax (a tax with net income, gross receipts, and capital worth components).

B) Washington Business & Occupation Tax (a gross receipts tax).

C) Ohio Commercial Activity Tax (an excise tax with a gross receipts base).

D) California Franchise Tax (a net income tax).

A) Texas Margin Tax (a tax with net income, gross receipts, and capital worth components).

B) Washington Business & Occupation Tax (a gross receipts tax).

C) Ohio Commercial Activity Tax (an excise tax with a gross receipts base).

D) California Franchise Tax (a net income tax).

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

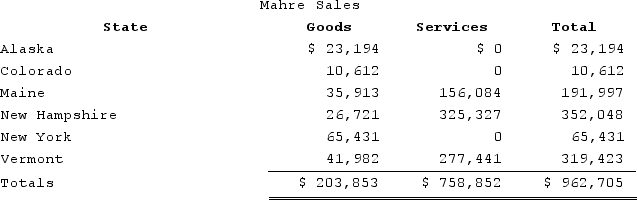

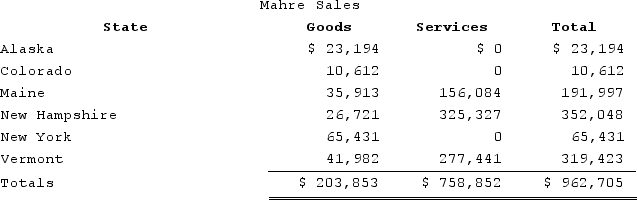

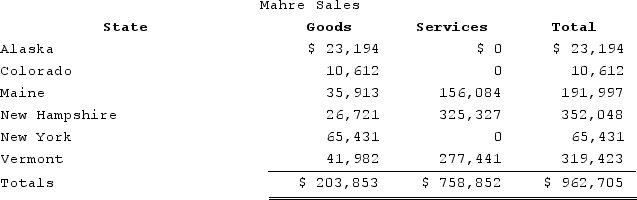

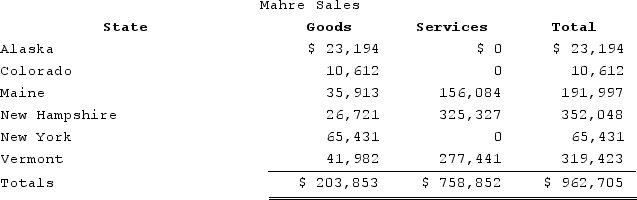

Mahre, Incorporated, a New York corporation, runs ski tours in several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

A) $0

B) $3,053

C) $13,267

D) $16,319

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?A) $0

B) $3,053

C) $13,267

D) $16,319

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

What was the Supreme Court's holding in Wayfair?

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reversed the Quill decision that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reversed the Quill decision that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

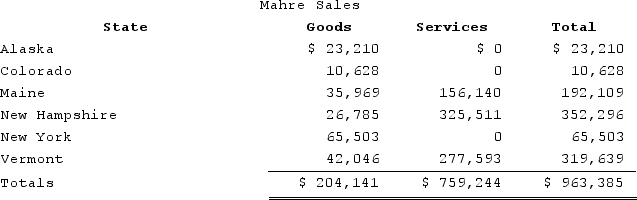

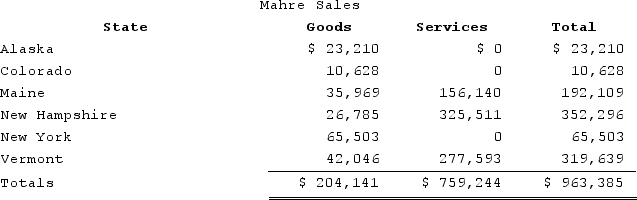

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

A) $10,400

B) $14,470

C) $26,749

D) $61,305

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?A) $10,400

B) $14,470

C) $26,749

D) $61,305

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

In which of the following state cases did the state not assert economicincome tax nexus?

A) South Dakota with the Wayfair rule.

B) South Carolina in the Geoffrey case.

C) West Virginia in the MBNA case.

D) Wisconsin in Wrigley.

A) South Dakota with the Wayfair rule.

B) South Carolina in the Geoffrey case.

C) West Virginia in the MBNA case.

D) Wisconsin in Wrigley.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $1,500 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation?

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following isn't a requirement of Public Law 86-272?

A) The tax is based on net income.

B) The taxpayer sells only tangible personal property.

C) The taxpayer is an intrastate business.

D) The taxpayer is nondomiciliary.

A) The tax is based on net income.

B) The taxpayer sells only tangible personal property.

C) The taxpayer is an intrastate business.

D) The taxpayer is nondomiciliary.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Bethesda Corporation is unprotected from income tax by Public Law 86-272. Which of the following characteristics likely creates a problem for Bethesda in states other than Maryland?

A) Bethesda does business in Maryland and five other states.

B) Bethesda sells copier equipment and copy center services.

C) All orders are approved in Maryland.

D) All in-state services are limited to solicitation in states other than Maryland.

A) Bethesda does business in Maryland and five other states.

B) Bethesda sells copier equipment and copy center services.

C) All orders are approved in Maryland.

D) All in-state services are limited to solicitation in states other than Maryland.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following isn't a criterion used to determine whether a unitary relationship exists?

A) Functional integration

B) Centralized management

C) Economies of scale

D) Consolidated return status

A) Functional integration

B) Centralized management

C) Economies of scale

D) Consolidated return status

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is not one of the Complete Auto Transit's criteria for whether a state can tax nondomiciliary companies?

A) Protected activities are exempt.

B) A sufficient connection exists.

C) Only a fair portion of income can be taxed.

D) Tax cannot discriminate against nondomiciliary businesses.

A) Protected activities are exempt.

B) A sufficient connection exists.

C) Only a fair portion of income can be taxed.

D) Tax cannot discriminate against nondomiciliary businesses.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

Roxy operates a dress shop in Arlington, Virginia. Roxy also ships dresses nationwide upon request. Roxy's Virginia sales are $1,900,000 and out-of-state sales are $218,000. Assuming that Virginia's sales tax rate is 5 percent, what is Roxy's Virginia sales and use tax collection obligation?

A) $0

B) $10,900

C) $95,000

D) $105,900

A) $0

B) $10,900

C) $95,000

D) $105,900

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?A) $10,386

B) $14,543

C) $26,733

D) $61,289

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $1,500 dress that is shipped to her Maryland residence using a common carrier. Roxy's total Maryland sales are $20,000 on 15 transactions. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 7 percent, what is Roxy's sales and use tax collection obligation?

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

Public Law 86-272 protects solicitation from income taxation. Which of the following activities exceeds the solicitation threshold?

A) Any form of advertising.

B) Distribution of samples without charge.

C) Accepting a down payment.

D) Checking a customer's inventory.

A) Any form of advertising.

B) Distribution of samples without charge.

C) Accepting a down payment.

D) Checking a customer's inventory.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $3,100 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation?

A) $0

B) $155 to Virginia

C) $155 sales tax to Virginia and $31 use tax to Maryland

D) $186 to Maryland

A) $0

B) $155 to Virginia

C) $155 sales tax to Virginia and $31 use tax to Maryland

D) $186 to Maryland

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $2,600 dress that is shipped to her Maryland residence using a common carrier. Roxy's total Maryland sales are $33,800 on 15 transactions. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 7 percent, what is Roxy's sales and use tax collection obligation?

A) $0

B) $130 to Virginia

C) $130 sales tax to Virginia and $52 use tax to Maryland

D) $182 to Maryland

A) $0

B) $130 to Virginia

C) $130 sales tax to Virginia and $52 use tax to Maryland

D) $182 to Maryland

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

Roxy operates a dress shop in Arlington, Virginia. Roxy also ships dresses nationwide upon request. Roxy's Virginia sales are $1,000,000 and out-of-state sales are $200,000. Assuming that Virginia's sales tax rate is 5 percent, what is Roxy's Virginia sales and use tax collection obligation?

A) $0

B) $10,000

C) $50,000

D) $60,000

A) $0

B) $10,000

C) $50,000

D) $60,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck