Deck 39: The Balance of Payments, Exchange Rates, and Trade Deficits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 39: The Balance of Payments, Exchange Rates, and Trade Deficits

1

Do all international financial transactions necessarily involve exchanging one nation's distinct currency for another? Explain. Could a nation that neither imports goods and services nor exports goods and services still engage in international financial transactions?

Yes , all international financial transactions necessarily involves exchanging one nation's currency for another, if by international, it is meant that the countries are using different currency.

For example , if France and Germany decided to trade, while they are two different countries, they will not need to exchange currencies first because they both use the euro. Therefore, an exchange of currency must first take place before any international financial transactions that involve different countries with different currencies.

Since there are two types of international financial transaction - one where goods and services are traded and one where people are trading assets for money - it is possible for a country that does not engage in trading goods and services to still be involved in international financial transaction.

For example , someone from this country may want to buy stocks of a foreign country. This will count as an international financial transaction that is not importing or exporting goods and services.

For example , if France and Germany decided to trade, while they are two different countries, they will not need to exchange currencies first because they both use the euro. Therefore, an exchange of currency must first take place before any international financial transactions that involve different countries with different currencies.

Since there are two types of international financial transaction - one where goods and services are traded and one where people are trading assets for money - it is possible for a country that does not engage in trading goods and services to still be involved in international financial transaction.

For example , someone from this country may want to buy stocks of a foreign country. This will count as an international financial transaction that is not importing or exporting goods and services.

2

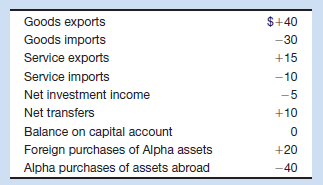

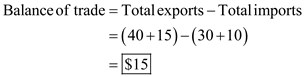

Alpha's balance-of-payments data for 2012 are shown beAll figures are in billions of dollars. What are the ( a ) balance on goods, ( b ) balance on goods and services, ( c ) balance on current account, and ( d ) balance on capital and financial account? Suppose Alpha sold $10 billion of official reserves abroad to balance the capital and financial account with the current account. Does Alpha have a balance-of-payments deficit or does it have a surplus?

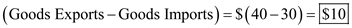

Balance of payments:

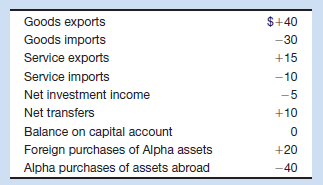

a. Company A has exported goods worth of $40 and imported $30.

Thus, the balance on goods is

.

.

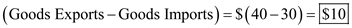

b. Company A has exported goods worth of $40 and imported $30, and exported service worth of $15 and imported $10.

c. In addition to the trade balance, the company's net transfer is $10 and net investment is $5.

c. In addition to the trade balance, the company's net transfer is $10 and net investment is $5.

Thus, the current account balance is given beThe company has foreign purchase of assets worth of $20, purchase of assets from abroad $40 and capital account balance is $0.

Thus the balance on capital and financial account is given bebalance on capital and financial account of -$20.

a. Company A has exported goods worth of $40 and imported $30.

Thus, the balance on goods is

.

.b. Company A has exported goods worth of $40 and imported $30, and exported service worth of $15 and imported $10.

c. In addition to the trade balance, the company's net transfer is $10 and net investment is $5.

c. In addition to the trade balance, the company's net transfer is $10 and net investment is $5.Thus, the current account balance is given beThe company has foreign purchase of assets worth of $20, purchase of assets from abroad $40 and capital account balance is $0.

Thus the balance on capital and financial account is given bebalance on capital and financial account of -$20.

3

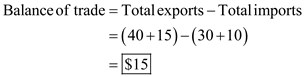

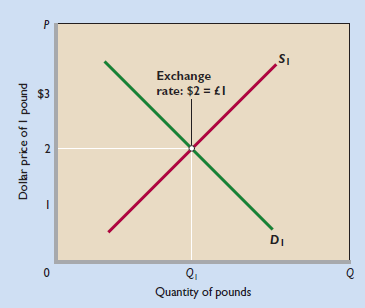

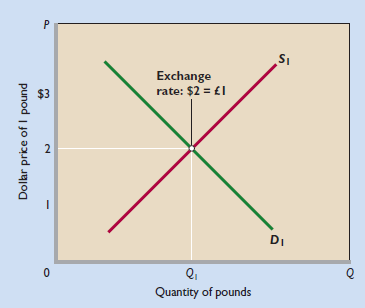

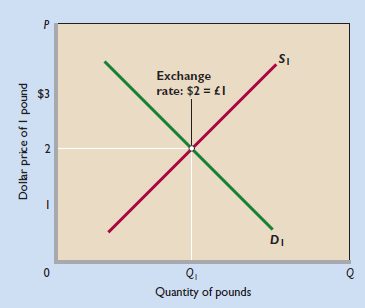

FIGURE 39.1 The market for foreign currency (pounds). The intersection of the demand-for-pounds curve D 1 and the supply-of-pounds curve S 1 determines the equilibrium dollar price of pounds, here, $2. That means that the exchange rate is $2 = £1. Not shown, an increase in demand for pounds or a decrease in supply of pounds will increase the dollar price of pounds and thus cause the pound to appreciate. Also not shown, a decrease in demand for pounds or an increase in the supply of pounds will reduce the dollar price of pounds, meaning that the pound has depreciated.

Which of the folstatements is true?

a. The quantity of pounds demanded falls when the dollar appreciates.

b. The quantity of pounds supplied declines as the dollar price of the pound rises.

c. At the equilibrium exchange rate, the pound price of $1 is £2.

d. The dollar appreciates if the demand for pounds increases.

Which of the folstatements is true?

a. The quantity of pounds demanded falls when the dollar appreciates.

b. The quantity of pounds supplied declines as the dollar price of the pound rises.

c. At the equilibrium exchange rate, the pound price of $1 is £2.

d. The dollar appreciates if the demand for pounds increases.

a)When the dollar appreciates, it means it has gained value against the pound. This makes domestically produced goods expensive while foreign goods become cheaper. This increases demand for imports, leading to an increase in demand for pounds, in order to purchase British goods.

Hence, the given statement is true.

b)When the dollar price of pound rises, it means pound has appreciated and gained value against the dollar. This makes British goods expensive and foreign goods cheaper. This increases supply of pounds in order to exchange it for more foreign currency and purchase imports.

Hence, the given statement is true.

c)As per the given graph, the equilibrium exchange rate is 2$ = 1E, or, 1$ = ½ E

This means the pound price of $1 is ½ pound.

Hence, the given statement is true.

d)When demand for pounds increases, it sifts out the demand curve for pounds. This leads to an appreciation of pounds and depreciation of dollar.

Hence, the given statement is true.

Hence, the given statement is true.

b)When the dollar price of pound rises, it means pound has appreciated and gained value against the dollar. This makes British goods expensive and foreign goods cheaper. This increases supply of pounds in order to exchange it for more foreign currency and purchase imports.

Hence, the given statement is true.

c)As per the given graph, the equilibrium exchange rate is 2$ = 1E, or, 1$ = ½ E

This means the pound price of $1 is ½ pound.

Hence, the given statement is true.

d)When demand for pounds increases, it sifts out the demand curve for pounds. This leads to an appreciation of pounds and depreciation of dollar.

Hence, the given statement is true.

4

An American company wants to buy a television from a Chinese company. The Chinese company sells its TVs for 1,200 yuan each. The current exchange rate between the U.S. dollar and the Chinese yuan is $1 5 6 yuan. How many dollars will the American company have to convert into yuan to pay for the television?

A) $7,200.

B) $1,200.

C) $200.

D) $100.

A) $7,200.

B) $1,200.

C) $200.

D) $100.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Explain: "U.S. exports earn supplies of foreign currencies that Americans can use to finance imports." Indicate whether each of the folcreates a demand for or a supply of European euros in foreign exchange markets;

a.A U.S. airline firm purchases several Airbus planes assembled in France.

b.A German automobile firm decides to build an assembly plant in South Carolina.

c.A U.S. college student decides to spend a year studying at the Sorbonne in Paris.

d.An Italian manufacturer ships machinery from one Italian port to another on a Liberian freighter.

e.The U.S. economy grows faster than the French economy.

f. A U.S. government bond held by a Spanish citizen matures, and the amount is paid back to that person.

g.It is widely expected that the euro will depreciate in the near future.

a.A U.S. airline firm purchases several Airbus planes assembled in France.

b.A German automobile firm decides to build an assembly plant in South Carolina.

c.A U.S. college student decides to spend a year studying at the Sorbonne in Paris.

d.An Italian manufacturer ships machinery from one Italian port to another on a Liberian freighter.

e.The U.S. economy grows faster than the French economy.

f. A U.S. government bond held by a Spanish citizen matures, and the amount is paid back to that person.

g.It is widely expected that the euro will depreciate in the near future.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

China had a $214 billion overall current account surplus in 2012. Assuming that China's net debt forgiveness was zero in 2012 (its capital account balance was zero), by how much did Chinese purchases of financial and real assets abroad exceed foreign purchases of Chinese financial and real assets?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

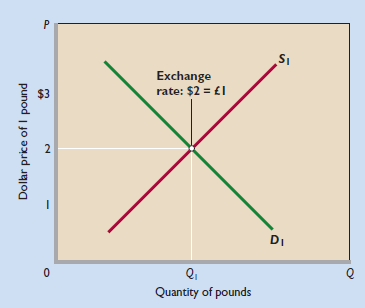

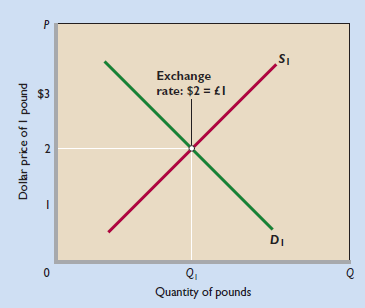

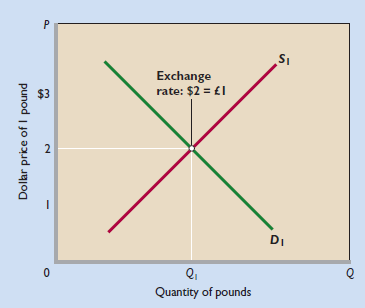

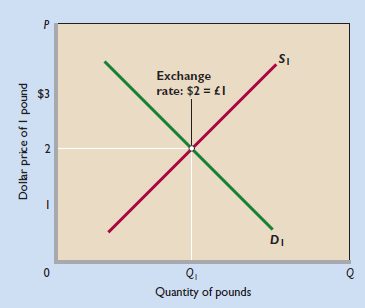

FIGURE 39.1 The market for foreign currency (pounds). The intersection of the demand-for-pounds curve D 1 and the supply-of-pounds curve S 1 determines the equilibrium dollar price of pounds, here, $2. That means that the exchange rate is $2 = £1. Not shown, an increase in demand for pounds or a decrease in supply of pounds will increase the dollar price of pounds and thus cause the pound to appreciate. Also not shown, a decrease in demand for pounds or an increase in the supply of pounds will reduce the dollar price of pounds, meaning that the pound has depreciated.

At the price of $2 for £1 in this figure:

a. the dollar-pound exchange rate is unstable.

b. the quantity of pounds supplied equals the quantity demanded.

c. the dollar price of £1 equals the pound price of $1.

d. U.S. goods exports to Britain must equal U.S. goods imports from Britain.

At the price of $2 for £1 in this figure:

a. the dollar-pound exchange rate is unstable.

b. the quantity of pounds supplied equals the quantity demanded.

c. the dollar price of £1 equals the pound price of $1.

d. U.S. goods exports to Britain must equal U.S. goods imports from Britain.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose that a country has a trade surplus of $50 billion, a balance on the capital account of $10 billion, and a balance on the current account of -$200 billion. The balance on the capital and financial account will be:

A) $10 billion.

B) $50 billion.

C) $200 billion.

D) -$200 billion.

A) $10 billion.

B) $50 billion.

C) $200 billion.

D) -$200 billion.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

What do the plus signs and negative signs signify in the U.S. balance-of-payments statement? Which of the folitems appear in the current account and which appear in the capital and financial account? U.S. purchases of assets abroad; U.S. services imports; foreign purchases of assets in the United States; U.S. good exports, U.S. net investment income. Why must the current account and the capital and financial account sum to zero?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

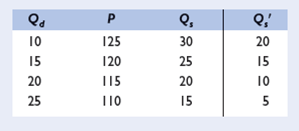

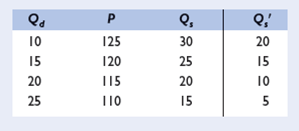

Refer to foltable, in which Qd is the quantity of yen demanded, P is the dollar price of yen, Qs is the quantity of yen supplied in year 1, and Qs ' is the quantity of yen supplied in year 2. All quantities are in billions and the dollar-yen exchange rate is fully flexible.

a. What is the equilibrium dollar price of yen in year 1?

b. What is the equilibrium dollar price of yen in year 2?

c. Did the yen appreciate or did it depreciate relative to the dollar between years 1 and 2?

d. Did the dollar appreciate or did it depreciate relative to the yen between years 1 and 2?

e. Which one of the folcould have caused the change in relative values of the dollar and yen between years 1 and 2: (1) More rapid inflation in the United States than in Japan; (2) an increase in the real interest rate in the United States but not in Japan; or (3) faster growth of income in the United States than in Japan.

a. What is the equilibrium dollar price of yen in year 1?

b. What is the equilibrium dollar price of yen in year 2?

c. Did the yen appreciate or did it depreciate relative to the dollar between years 1 and 2?

d. Did the dollar appreciate or did it depreciate relative to the yen between years 1 and 2?

e. Which one of the folcould have caused the change in relative values of the dollar and yen between years 1 and 2: (1) More rapid inflation in the United States than in Japan; (2) an increase in the real interest rate in the United States but not in Japan; or (3) faster growth of income in the United States than in Japan.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

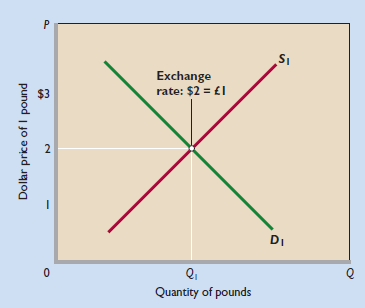

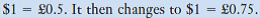

FIGURE 39.1 The market for foreign currency (pounds). The intersection of the demand-for-pounds curve D 1 and the supply-of-pounds curve S 1 determines the equilibrium dollar price of pounds, here, $2. That means that the exchange rate is $2 = £1. Not shown, an increase in demand for pounds or a decrease in supply of pounds will increase the dollar price of pounds and thus cause the pound to appreciate. Also not shown, a decrease in demand for pounds or an increase in the supply of pounds will reduce the dollar price of pounds, meaning that the pound has depreciated.

Other things equal, a leftward shift of the demand curve in this figure:

a. would depreciate the dollar.

b. would create a shortage of pounds at the previous price of $2 for £1.

c. might be caused by a major recession in the United States.

d. might be caused by a significant rise of real interest rates in Britain.

Other things equal, a leftward shift of the demand curve in this figure:

a. would depreciate the dollar.

b. would create a shortage of pounds at the previous price of $2 for £1.

c. might be caused by a major recession in the United States.

d. might be caused by a significant rise of real interest rates in Britain.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

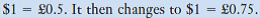

The exchange rate between the U.S. dollar and the British pound starts at

Given this change, we would say that the U.S. dollar has______ while the British pound has______.

Given this change, we would say that the U.S. dollar has______ while the British pound has______.

a. Depreciated; appreciated.

b. Depreciated; depreciated.

c. Appreciated; depreciated.

d. Appreciated; appreciated.

Given this change, we would say that the U.S. dollar has______ while the British pound has______.

Given this change, we would say that the U.S. dollar has______ while the British pound has______.a. Depreciated; appreciated.

b. Depreciated; depreciated.

c. Appreciated; depreciated.

d. Appreciated; appreciated.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

What are official reserves? How do net sales of official reserves to foreigners and net purchases of official reserves from foreigners relate to U.S. balance-of-payment deficits and surpluses? Explain why these deficits and surpluses are not actual deficits and surpluses in the overall balance-of-payments statement.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that the current Canadian dollar (CAD) to U.S. dollar exchange rate is $.85 CAD = $1 US and that the U.S. dollar price of an Apple iPhone is $300. What is the Canadian dollar price of an iPhone? Next, suppose that the CAD to U.S. dollar exchange rate moves to $.96 CAD = $1 Us What is the new Canadian dollar price of an iPhone? Other things equal, would you expect Canada to import more or fewer iPhones at the new exchange rate?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

FIGURE 39.1 The market for foreign currency (pounds). The intersection of the demand-for-pounds curve D 1 and the supply-of-pounds curve S 1 determines the equilibrium dollar price of pounds, here, $2. That means that the exchange rate is $2 = £1. Not shown, an increase in demand for pounds or a decrease in supply of pounds will increase the dollar price of pounds and thus cause the pound to appreciate. Also not shown, a decrease in demand for pounds or an increase in the supply of pounds will reduce the dollar price of pounds, meaning that the pound has depreciated.

Other things equal, a rightward shift of the supply curve in this figure would:

a. depreciate the dollar and might be caused by a significant rise of real interest rates in Britain.

b. depreciate the dollar and might be caused by a significant fall of real interest rates in Britain.

c. appreciate the dollar and might be caused by a significant rise of real interest rates in the United States.

d. appreciate the dollar and might be caused by a significant fall of real interest rates in the United States.

Other things equal, a rightward shift of the supply curve in this figure would:

a. depreciate the dollar and might be caused by a significant rise of real interest rates in Britain.

b. depreciate the dollar and might be caused by a significant fall of real interest rates in Britain.

c. appreciate the dollar and might be caused by a significant rise of real interest rates in the United States.

d. appreciate the dollar and might be caused by a significant fall of real interest rates in the United States.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

A meal at a McDonald's restaurant in New York costs $8. The identical meal at a McDonald's restaurant in costs £4. According to the purchasing-power-parity theory of exchange rates, the exchange rate between U.S. dollars and British pounds should tend to move toward:

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

Generally speaking, how is the dollar price of euros determined? Cite a factor that might increase the dollar price of euros. Cite a different factor that might decrease the dollar price of euros. Explain: "A rise in the dollar price of euros necessarily means a fall in the euro price of dollars." Illustrate and elaborate: "The dollar-euro exchange rate provides a direct link between the prices of goods and services produced in the Euro Zone and in the United States." Explain the purchasing-power-parity theory of exchange rates, using the euro-dollar exchange rate as an illustration.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

Return to problem 3 and assume the exchange rate is fixed against the dollar at the equilibrium exchange rate that occurs in year 1. Also suppose that Japan and the United States are the only two countries in the world. In year 2, what quantity of yen would the Japanese government have to buy or sell to balance its capital and financial account with its current account? In what specific account would this purchase or sale show up in Japan's balance-of- payments statement: Foreign purchases of assets in Japan or Japanese purchase of assets abroad? Would this transaction increase Japan's stock of official reserves or decrease its stock?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose that a country has a flexible exchange rate. Also suppose that at the current exchange rate, the country is experiencing a balance-of-payments deficit. Then would it be true or false that a sufficiently large depreciation of the currency could eliminate the balance-of-payments deficit.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose that a Swiss watchmaker imports watch components from Sweden and exports watches to the United States. Also suppose the dollar depreciates, and the Swedish krona appreciates, relative to the Swiss franc. Speculate as to how each would hurt the Swiss watchmaker.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

Diagram a market in which the equilibrium dollar price of 1 unit of fictitious currency zee (Z) is $5 (the exchange rate is $5 = Z1). Then show on your diagram a decline in the demand for zee.

a. Referring to your diagram, discuss the adjustment options the United States would have in maintaining the exchange rate at $5 = Z1 under a fixed-exchange-rate system.

b. How would the U.S. balance-of-payments surplus that is caused by the decline in demand be resolved under a system of flexible exchange rates?

a. Referring to your diagram, discuss the adjustment options the United States would have in maintaining the exchange rate at $5 = Z1 under a fixed-exchange-rate system.

b. How would the U.S. balance-of-payments surplus that is caused by the decline in demand be resolved under a system of flexible exchange rates?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Explain why the U.S. demand for Mexican pesos is downsand the supply of pesos to Americans is upsAssuming a system of flexible exchange rates between Mexico and the United States, indicate whether each of the folwould cause the Mexican peso to appreciate or depreciate, other things equal:

a. The United States unilaterally reduces tariffs on Mexican products.

b. Mexico encounters severe inflation.

c. Deteriorating political relations reduce American tourism in Mexico.

d. The U.S. economy moves into a severe recession.

e. The United States engages in a high-interest-rate monetary policy.

f. Mexican products become more fashionable to U.S. consumers.

g. The Mexican government encourages U.S. firms to invest in Mexican oil fields.

h. The rate of productivity growth in the United States diminishes sharply.

a. The United States unilaterally reduces tariffs on Mexican products.

b. Mexico encounters severe inflation.

c. Deteriorating political relations reduce American tourism in Mexico.

d. The U.S. economy moves into a severe recession.

e. The United States engages in a high-interest-rate monetary policy.

f. Mexican products become more fashionable to U.S. consumers.

g. The Mexican government encourages U.S. firms to invest in Mexican oil fields.

h. The rate of productivity growth in the United States diminishes sharply.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose that the government of China is currently fixing the exchange rate between the U.S. dollar and the Chinese yuan at a rate of $1 = 6 yuan. Also suppose that at this exchange rate, the people who want to convert dollars to yuan are asking to convert $10 billion per day of dollars into yuan, while the people who are wanting to convert yuan into dollars are asking to convert 36 billion yuan into dollars. What will happen to the size of China's official reserves of dollars?

A) Increase.

B) Decrease.

C) Stay the same.

A) Increase.

B) Decrease.

C) Stay the same.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Explain why you agree or disagree with the folstatements. Assume other things equal.

a. A country that grows faster than its major trading partners can expect the international value of its currency to depreciate.

b. A nation whose interest rate is rising more rapidly than interest rates in other nations can expect the international value of its currency to appreciate.

c. A country's currency will appreciate if its inflation rate is less than that of the rest of the world.

a. A country that grows faster than its major trading partners can expect the international value of its currency to depreciate.

b. A nation whose interest rate is rising more rapidly than interest rates in other nations can expect the international value of its currency to appreciate.

c. A country's currency will appreciate if its inflation rate is less than that of the rest of the world.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

Suppose that a country fola managed-fpolicy but that its exchange rate is currently ffreely. In addition, suppose that it has a massive current account deficit. Does it also necessarily have a balance-of-payments deficit? If it decides to engage in a currency intervention to reduce the size of its current account deficit, will it buy or sell its own currency? As it does so, will its official reserves of foreign currencies get larger or smaller? Would that outcome indicate a balance-of-payments deficit or a balance-of-payments surplus?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

"Exports pay for imports. Yet in 2012 the nations of the world exported about $540 billion more of goods and services to the United States than they imported from the United States." Resolve the apparent inconsistency of these two statements.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

If the economy booms in the United States while going into recession in other countries, the U.S. trade deficit will tend to_____________.

A) Increase.

B) Decrease.

C) Remain the same.

A) Increase.

B) Decrease.

C) Remain the same.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

What have been the major causes of the large U.S. trade deficits in recent years? What are the major benefits and costs associated with trade deficits? Explain: "A trade deficit means that a nation is receiving more goods and services from abroad than it is sending abroad." How can that be considered to be "unfavorable"?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

Other things equal, if the United States continually runs trade deficits, foreigners will own______ U.S. assets.

A) More and more.

B) Less and less.

C) The same amount of.

A) More and more.

B) Less and less.

C) The same amount of.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

LAST WORD Suppose Super D'Hiver-a hypothetical French snowboard retailer-wants to order 5000 snowboards made in the United States. The price per board is $200, the present exchange rate is 1 euro = $1, and payment is due in dollars when the boards are delivered in 3 months. Use a numerical example to explain why exchange-rate risk might make the French retailer hesitant to place the order. How might speculators absorb some of Super D'Hiver's risk?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck