Deck 3: Accounting for Deferrals

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

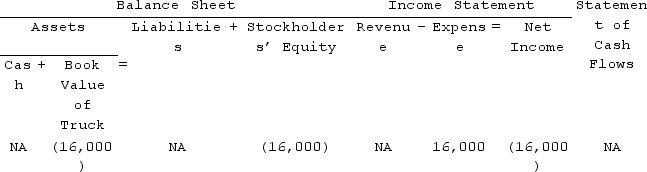

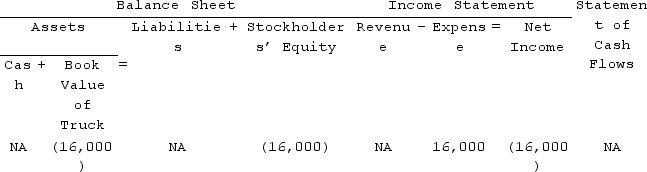

Question

Question

Question

Question

Question

Question

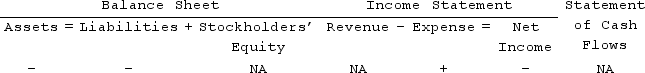

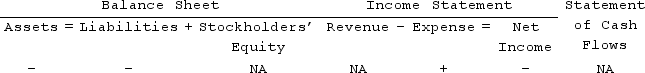

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/136

Play

Full screen (f)

Deck 3: Accounting for Deferrals

1

Purchasing a truck for $50,000 cash with a four-year useful life and $6,000 salvage value is an example of a deferred expense.

True

2

Calculating the debt-to-assets ratio measures how efficiently a company is using its assets in the normal scope of business.

False

3

Recognition of depreciation expense is an asset use transaction.

True

4

Recognition of depreciation expense on equipment decreases the accumulated depreciation on the equipment.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

5

Accumulated depreciation is reported on the income statement.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

6

The carrying value of an asset is the expected selling price of an asset at the end of its useful life.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

7

Sometimes the recognition of revenue is accompanied by an increase in liabilities.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

8

Asset use transactions always involve the payment of cash.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

9

An adjusting entry that decreases unearned revenue and increases service revenue is a claims exchange transaction.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

10

A cost may be recorded as an expense or as an asset purchase.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

11

Purchasing supplies for cash is an asset exchange transaction.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

12

Recognizing an expense may be accompanied by which of the following?

A)A decrease in liabilities

B)An increase in assets

C)A decrease in revenue

D)A decrease in assets

A)A decrease in liabilities

B)An increase in assets

C)A decrease in revenue

D)A decrease in assets

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

13

During Bruce Company's first year of operations, the company purchased $2,600 of supplies. At year-end, a physical count of the supplies on hand revealed that $975 of unused supplies were available for future use. How will the related adjusting entry affect the company's financial statements?

A)Expenses will increase and assets will decrease by $1,625.

B)Assets and expenses will both increase by $975.

C)Expenses and assetswill both increase by $1,625.

D)The related adjusting entry has no effect on net income or the accounting equation.

A)Expenses will increase and assets will decrease by $1,625.

B)Assets and expenses will both increase by $975.

C)Expenses and assetswill both increase by $1,625.

D)The related adjusting entry has no effect on net income or the accounting equation.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

14

Unearned revenue is reported on the income statement by subtracting it from revenue.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

15

When a company purchases a depreciable asset, it must estimate the asset's useful life and salvage value.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

16

The financial statement ratio that may be of greatest interest to a company's stockholders is the amount of its return-on-assets ratio.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

17

A company may recognize a revenue or expense without a corresponding cash collection or payment in the same accounting period.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

18

During Bruce Company's first year of operations, the company purchased $2,300 of supplies. At year-end, a physical count of the supplies on hand revealed that $825 of unused supplies were available for future use. How will the related adjusting entry affect the company's financial statements?

A)Expenses will increase and assets will decrease by $1,475.

B)Assets and expenses will both increase by $825.

C)Expenses and assets will both increase by $1,475.

D)The related adjusting entry has no effect on net income or the accounting equation.

A)Expenses will increase and assets will decrease by $1,475.

B)Assets and expenses will both increase by $825.

C)Expenses and assets will both increase by $1,475.

D)The related adjusting entry has no effect on net income or the accounting equation.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

19

A high debt-to-asset ratio may indicate that a company has a high level of debt risk.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

20

An increase in revenue may be accompanied by a decrease in a liability.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

21

On September 1, Year 1, Gomez Company collected $9,000 in advance from a customer for services to be provided over a one-year period beginning on that date. How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31, Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A)$3,000; $3,000

B)$9,000; $9,000

C)$3,000; $9,000

D)$0; $9,000

A)$3,000; $3,000

B)$9,000; $9,000

C)$3,000; $9,000

D)$0; $9,000

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following accounts would not appear on a balance sheet?

A)Service Revenue

B)Supplies

C)Unearned Revenue

D)Prepaid Rent

A)Service Revenue

B)Supplies

C)Unearned Revenue

D)Prepaid Rent

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

23

On December 1, Year 1, Jack's Snow Removal Company received $6,000 of cash in advance from a customer and promised to provide services for that customer during the months of December, January, and February. How will the Year 1 year-end adjustment to recognize the partial expiration of the contract impact the financial statements?

A)Total assets will increase by $2,000.

B)Stockholders' Equity will increase by $2,000.

C)Total liabilities will increase by $2,000.

D)Total assets will increase by $2,000 and stockholders' equity will increase by $2,000.

A)Total assets will increase by $2,000.

B)Stockholders' Equity will increase by $2,000.

C)Total liabilities will increase by $2,000.

D)Total assets will increase by $2,000 and stockholders' equity will increase by $2,000.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following shows how the year-end adjustment to recognize supplies expense will affect a company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following shows how receiving cash for services that will be performed in the future affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following events would require a year-end adjusting entry?

A)Purchasing supplies for cash during the year.

B)Purchasing land for cash during the year.

C)Providing services on account during the year.

D)Each of these events would require a year-end adjusting entry.

A)Purchasing supplies for cash during the year.

B)Purchasing land for cash during the year.

C)Providing services on account during the year.

D)Each of these events would require a year-end adjusting entry.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

27

Recognition of revenue may be accompanied by which of the following?

A)A decrease in a liability

B)An increase in a liability

C)An increase in an asset

D)An increase in an asset or a decrease in a liability

A)A decrease in a liability

B)An increase in a liability

C)An increase in an asset

D)An increase in an asset or a decrease in a liability

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

28

How wouldan advance payment for rent be classified?

A)Asset source transaction

B)Asset use transaction

C)Asset exchange transaction

D)Claims exchange transaction

A)Asset source transaction

B)Asset use transaction

C)Asset exchange transaction

D)Claims exchange transaction

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

29

How does the adjusting entry to recognize the portion of the unearned revenue that a company earned during the accounting period affect the financial statements?

A)An increase in assets and a decrease in liabilities.

B)An increase in liabilities and a decrease instockholders' equity.

C)A decrease in liabilities and an increase instockholders' equity.

D)A decrease in assets and a decrease in liabilities.

A)An increase in assets and a decrease in liabilities.

B)An increase in liabilities and a decrease instockholders' equity.

C)A decrease in liabilities and an increase instockholders' equity.

D)A decrease in assets and a decrease in liabilities.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following would cause net income on the accrual basis to be different from (either higher or lower than)"cash provided by operating activities" on the statement of cash flows?

A)Purchased land for cash

B)Purchased supplies for cash

C)Paid rent expense

D)Paid dividends to stockholder

A)Purchased land for cash

B)Purchased supplies for cash

C)Paid rent expense

D)Paid dividends to stockholder

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

31

What is the purpose of the accrual basis of accounting?

A)Recognize revenue when it is collected from customers.

B)Match assets with liabilities during the proper accounting period.

C)Recognize expenses when cash disbursements are made.

D)Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

A)Recognize revenue when it is collected from customers.

B)Match assets with liabilities during the proper accounting period.

C)Recognize expenses when cash disbursements are made.

D)Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

32

Duluth Company collected a $6,000 cash advance from a customer on November 1, Year 1 for services to be provided over a six-month period beginning on that date. If the year-end adjustment is properly recorded, what will be the effect of the adjusting entry on Duluth's Year 1 financial statements?

A)Increase assets and decrease liabilities

B)Increase assets and increase revenues

C)Decrease liabilities and increase revenues

D)No effect

A)Increase assets and decrease liabilities

B)Increase assets and increase revenues

C)Decrease liabilities and increase revenues

D)No effect

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

33

On January 1, Year 2, the Supplies account of Sheldon Company had a balance of $1,200. During the year, the company purchased $3,400 of supplies on account and made partial payments totaling $3,000 on those accounts. On December 31, Year 2, Sheldon determined that there were $1,400 of supplies on hand. Which of the following would be reported on Sheldon's Year 2 financial statements?

A)$1,600 of supplies; $200 of supplies expense

B)$1,400 of supplies; $2,000 of supplies expense

C)$1,400 of supplies; $3,200 of supplies expense

D)$1,600 of supplies; $3,400 of supplies expense

A)$1,600 of supplies; $200 of supplies expense

B)$1,400 of supplies; $2,000 of supplies expense

C)$1,400 of supplies; $3,200 of supplies expense

D)$1,600 of supplies; $3,400 of supplies expense

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following shows how purchasing supplies for cash will affect a company's financial statements at the date of purchase?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

35

On October 1, Year 1 Allen Company paid $24,000 cash to lease office space for one year beginning immediately. How would the adjustment on December 31, Year 1 to recognize rent expense affect the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following shows how paying cash to lease office space for one year affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

37

Allen Company received $12,000 cash from Gerry Corporation for cleaning services that Allen agrees to perform over a one year period beginning on June 1, Year 1. How would the adjustment on December 31, Year 1 to recognize the portion of the revenue that Allen earned during Year 1 affect Allen company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

38

On October 1, Year 1, Jason Company paid $7,200 to lease office space for one year beginning immediately. What is the amount of rent expense that will be reported on the Year 1 income statement and what is the cash outflow for rent that would be reported on the Year 1 statement of cash flows?

A)$7,200; $7,200

B)$1,800; $1,800

C)$1,800; $7,200

D)$1,200; $7,200

A)$7,200; $7,200

B)$1,800; $1,800

C)$1,800; $7,200

D)$1,200; $7,200

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

39

When a revenue or an expense event is recognized after cash has been exchanged it is referred to as

A)an accrual

B)a deferral

C)either an accrual or deferral

D)neither of these terms describe this event

A)an accrual

B)a deferral

C)either an accrual or deferral

D)neither of these terms describe this event

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is true regarding accrual accounting?

A)Revenue is recorded only when cash is collected.

B)Expenses are recorded when they are incurred.

C)Revenue is recorded in the period when it is earned.

D)Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

A)Revenue is recorded only when cash is collected.

B)Expenses are recorded when they are incurred.

C)Revenue is recorded in the period when it is earned.

D)Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

41

On January 1, Year 1, Alabama Company purchased a machine for $26,000. The machine has an estimated useful life of 4 years and an estimated salvage value of $6,000. What is the book value of the machine reported on Alabama's balance sheet as of December 31, Year 1?

A)$26,000

B)$19,500

C)$21,000

D)$15,000

A)$26,000

B)$19,500

C)$21,000

D)$15,000

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

42

When a company purchases supplies on account

A)Cash flow from financing activities decreases

B)Total assets decrease

C)Expenses increase

D)Liabilities increase

A)Cash flow from financing activities decreases

B)Total assets decrease

C)Expenses increase

D)Liabilities increase

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

43

Hawk Company purchased $800 of supplies on account. Which of the following shows how this purchase will affect Hawk's balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is false?

A)Prepaid insurance is a liability reported on the balance sheet.

B)Prepaid insurance indicates that a company has already paid cash for insurance coverage that protects the company for some future time period.

C)Prepaid insurance is a deferred expense.

D)Prepaid insurance represents a future economic benefit.

A)Prepaid insurance is a liability reported on the balance sheet.

B)Prepaid insurance indicates that a company has already paid cash for insurance coverage that protects the company for some future time period.

C)Prepaid insurance is a deferred expense.

D)Prepaid insurance represents a future economic benefit.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following events involves a deferral?

A)Recording interest that has been earned but not received.

B)Recording revenue that has been earned but not yet collected in cash.

C)Recording supplies that have been purchased with cash but not yet used.

D)Recording salaries owed to employees at the end of the year that will be paid during the following year.

A)Recording interest that has been earned but not received.

B)Recording revenue that has been earned but not yet collected in cash.

C)Recording supplies that have been purchased with cash but not yet used.

D)Recording salaries owed to employees at the end of the year that will be paid during the following year.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

46

Consider how each of the transactions listed below affect net income reported on the income statement and the net cash flows from operating activities reported on the statement of cash flows. Which transaction(s)would affect the income statement in a different period from the statement of cash flows?

A)Recognized depreciation expense on equipment.

B)Incurred operating expenses on account.

C)Paid interest that was accrued in a prior year.

D)All of these answer choices would affect the income statement in a different period from the statement of cash flows.

A)Recognized depreciation expense on equipment.

B)Incurred operating expenses on account.

C)Paid interest that was accrued in a prior year.

D)All of these answer choices would affect the income statement in a different period from the statement of cash flows.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following shows how adjusting the accounts to recognize supplies expense will affect a company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

48

The entry to recognize depreciation expense incurred on equipment involves which of the following?

A)A decrease in assets

B)An increase in liabilities

C)An increase in assets

D)A decrease in liabilities

A)A decrease in assets

B)An increase in liabilities

C)An increase in assets

D)A decrease in liabilities

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

49

Joseph Company purchased a delivery van on January 1, Year 1 for $35,000. The van is estimated to have a 5-year useful life and a $5,000 salvage value. How much expense should Joseph recognize in Year 1 related to the use of the van?

A)$6,000

B)$7,000

C)$30,000

D)$5,000

A)$6,000

B)$7,000

C)$30,000

D)$5,000

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, Year 1, Marino Moving Company paid $68,000 cash to purchase a truck. The truck was expected to have a four-year useful life and a $4,000 salvage value. If Marino uses the straight-line method, which of the following shows how the adjusting entry to recognize depreciation expense at the end of Year 3 will affect the Company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following shows how paying cash to purchase supplies will affect a company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

52

The following accounts and balances were obtained from the records of Barnes Company:  Based on this information alone the amount of Barnes's retained earnings is:

Based on this information alone the amount of Barnes's retained earnings is:

A)$11,600.

B)$17,200.

C)$5,200.

D)None of these answers is correct.

Based on this information alone the amount of Barnes's retained earnings is:

Based on this information alone the amount of Barnes's retained earnings is:A)$11,600.

B)$17,200.

C)$5,200.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

53

On January 1, Year 1, Marino Moving Company paid $35,000 cash to purchase a truck. The truck was expected to have a four-year useful life and a $3,000 salvage value. If Marino uses the straight-line method, which of the following shows how the adjusting entry to recognize depreciation expense at the end of Year 3 will affect the Company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

54

A deferral exists when a company pays cash

A)at the same time the associated expense is recognized.

B)after recognizing the associated expense.

C)before recognizing the associated expense.

D)None of these answer choices are correct.

A)at the same time the associated expense is recognized.

B)after recognizing the associated expense.

C)before recognizing the associated expense.

D)None of these answer choices are correct.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is an asset use transaction?

A)Purchased land for cash

B)Recorded rent expense at the end of the period

C)Borrowed cash from the bank

D)Accrued salary expense at the end of the period

A)Purchased land for cash

B)Recorded rent expense at the end of the period

C)Borrowed cash from the bank

D)Accrued salary expense at the end of the period

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

56

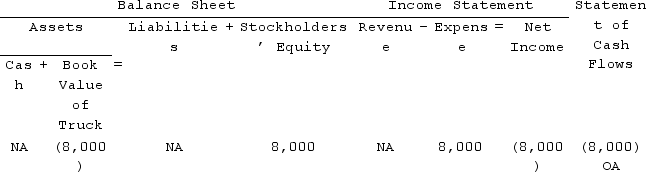

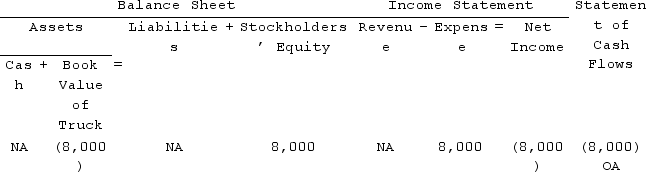

Pizitz Company experienced a business event that affected its financial statements as indicated below.  Which of the following events could have caused these effects?

Which of the following events could have caused these effects?

A)Paid cash to reduce supplies payable

B)Recognized supplies expense

C)Paid cash to purchase supplies

D)Purchased supplies on account

Which of the following events could have caused these effects?

Which of the following events could have caused these effects?A)Paid cash to reduce supplies payable

B)Recognized supplies expense

C)Paid cash to purchase supplies

D)Purchased supplies on account

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

57

Knoll Company started Year 2 with a $1,000 balance in its Cash account, a $200 balance in its Supplies account and a $1,200 balance in its common stock account. During Year 2, the company experienced the following events:(1)Paid $600 cash to purchase supplies.(2)Physical count revealed $50 of supplies on hand at the end of Year 2.Based on this information the amount of supplies expense reported on the Year 2 income statement is

A)$600

B)$750

C)$800

D)$850

A)$600

B)$750

C)$800

D)$850

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is a claims exchange transaction?

A)Recognized revenue earned on a contract where the cash had been collected at an earlier date

B)Issued common stock

C)Provided services on account

D)Purchased land for cash

A)Recognized revenue earned on a contract where the cash had been collected at an earlier date

B)Issued common stock

C)Provided services on account

D)Purchased land for cash

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

59

Chester Company started Year 2 with a $2,000 balance in its Cash account, a $500 balance in its Supplies account, and a $2,500 balance in its Common Stock account. During Year 2, the company experienced the following events:(1)Paid $1,400 cash to purchase supplies.(2)Physical count revealed $300 of supplies on hand at the end of Year 2.Based on this information, which of the following shows how the year-end adjusting entry required to recognize supplies expense would affect Chester's account balances?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

60

On May 1, Year 2, Cole Company paid $12,000 cash for supplies. The Year 2 adjusting entry to recognize the amount of supplies used during Year 2

A)increases the amount of supplies expense recognized in Year 2.

B)decreases the amount of liabilities shown on the Year 2 balance sheet.

C)increases the amount of liabilities shown on the Year 2 balance sheet.

D)decreases the amount of supplies expense recognized in Year 2.

A)increases the amount of supplies expense recognized in Year 2.

B)decreases the amount of liabilities shown on the Year 2 balance sheet.

C)increases the amount of liabilities shown on the Year 2 balance sheet.

D)decreases the amount of supplies expense recognized in Year 2.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following shows how the adjusting entry to recognize services provided to a client who paid for the services prior to the work being performed?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

62

Hans Company's December 31, Year 1, balance sheet showed $800 cash, $500 supplies, $400 accounts payable, $300 common stock, and $600 retained earnings. The company experienced the following events during year 2.(1)Purchased $1,000 of supplies on account(2)Earned $2,000 cash revenue(3)Paid $1,200 cash to reduce accounts payable created in Event 1 above(4)Physical count revealed $300 of supplies on hand at the end of Year 2Based on this information, the company would report

A)a $200 balance in the accounts payable account on the Year 2 balance sheet.

B)a $800 net cash inflow from operating activities on the Year 2 statement of cash flows.

C)a $1,200 supplies expense on the Year 2 income statement.

D)All of the answers are correct.

A)a $200 balance in the accounts payable account on the Year 2 balance sheet.

B)a $800 net cash inflow from operating activities on the Year 2 statement of cash flows.

C)a $1,200 supplies expense on the Year 2 income statement.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

63

On June 1, Year 1, Maverick Company paid $1,200 cash for an insurance policy that would protect the company for one year. The company's fiscal year ends on December 31. Based on this information, the amount of insurance expense and the cash flow from operating activities shown on the Year 1 financial statements would be

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

64

On August 1, Year 1, Lace Company paid $2,400 cash for an insurance policy that would provide protection for a one-year term. Which of the following shows how the required adjustment on December 31, Year 1, will affect Lace Company's balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

65

On November 1, Year 1, Falloch, Incorporated paid $3,600 cash for a contract allowing the company to use office space for one year. The company's fiscal year ends on December 31. Based on this information, the amount of cash flow from operating activities appearing on the Year 1 statement of cash flows would be

A)$2,100

B)$3,000

C)$3,300

D)$3,600

A)$2,100

B)$3,000

C)$3,300

D)$3,600

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

66

On June 1, Year 1, Jack Associates collected $48,000 cash for consulting services to be provided for one year beginning immediately. Based on this information, which of the following shows how the required adjustment on December 31, Year 1, would affect Jack's balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

67

On March 1, Year 1, Presco Enterprises paid $1,200 cash for an insurance policy that would provide protection for a one-year term. The company's fiscal year ends on December 31. Based on this information, the amount of insurance expense appearing on the Year 1 income statement would be

A)$200

B)$500

C)$1,000

D)$1,200

A)$200

B)$500

C)$1,000

D)$1,200

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

68

Foster Company's December 31, Year 1, balance sheet showed $2,700 cash, $1,000 common stock, and $1,700 retained earnings. The company experienced the following event during Year 2. On October 1, collected $12,000 in advance for an agreement to provide office space for one year beginning immediately. Based on this information alone,

A)the Year 3 income statement would show $9,000 of rent revenue.

B)the Year 3 balance sheet would show $9,000 of rent revenue.

C)the Year 2 income statement would show $3,000 of unearned rent revenue.

D)the Year 2 balance sheet would show $3,000 of unearned rent revenue.

A)the Year 3 income statement would show $9,000 of rent revenue.

B)the Year 3 balance sheet would show $9,000 of rent revenue.

C)the Year 2 income statement would show $3,000 of unearned rent revenue.

D)the Year 2 balance sheet would show $3,000 of unearned rent revenue.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

69

On October 1, Year 1, Wilson Company paid cash for an insurance policy that would provide protection for a one-year term. Which of the following shows how the required adjusting entry on December 31, Year 1 will affect Wilson's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

70

Langley Incorporated accepted a $24,000 retainer for which the company agreed to provide services in the future. Recognizing this event would

A)defer the recognition of revenue.

B)increase the balance in the company's cash account.

C)cause the company's liabilities to increase.

D)All of the answers are correct.

A)defer the recognition of revenue.

B)increase the balance in the company's cash account.

C)cause the company's liabilities to increase.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

71

On October 1, Year 1, Gomez Company collected $24,000 in advance from a customer for services to be provided over a one-year period beginning on that date. How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31, Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A)$6,000; $6,000

B)$24,000; $24,000

C)$6,000; $24,000

D)$0; $24,000

A)$6,000; $6,000

B)$24,000; $24,000

C)$6,000; $24,000

D)$0; $24,000

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

72

On August 1, Year 1, Carson Company collected $84,000 for services to be provided for one year beginning immediately. The company's fiscal year ends on December 31. Based on this information, the amount of service revenue and the cash flow from operating activities shown on the Year 1 financial statements would be

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following shows how the event "collected cash for services to be rendered in the future" affects a company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

74

On February 1, Year 1, Cora Company collected $60,000 cash for consulting services to be provided for one year beginning immediately. The company's fiscal year ends on December 31. Based on this information, the amount of unearned revenue appearing on the December 31, Year 2 balance sheet would be

A)$60,000

B)$55,000

C)$5,000

D)zero

A)$60,000

B)$55,000

C)$5,000

D)zero

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

75

On October 1, Year 1, Gomez Company collected $18,600 in advance from a customer for services to be provided over a one-year period beginning on that date. How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31, Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A)$4,650; $4,650

B)$18,600; $18,600

C)$4,650; $18,600

D)$0; $18,600

A)$4,650; $4,650

B)$18,600; $18,600

C)$4,650; $18,600

D)$0; $18,600

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

76

Bates Company paid $1,600 cash for the right to use office space during the coming year. Which of the following shows how this event would affect Bates' balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following shows how paying cash to lease an office building for the upcoming year affects a company's financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

78

On September 1, Year 1, Zelda Company collected $120,000 cash for services to be provided for one year beginning immediately. The company's fiscal year ends on December 31. Based on this information, the amount of revenue appearing on the Year 1 income statement would be

A)$30,000

B)$40,000

C)$80,000

D)$120,000

A)$30,000

B)$40,000

C)$80,000

D)$120,000

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

79

A deferral exists when a company receives cash

A)after recognizing the associated revenue.

B)at the same time the associated revenue is recognized.

C)before recognizing the associated revenue.

D)either before or after recognizing the associated revenue.

A)after recognizing the associated revenue.

B)at the same time the associated revenue is recognized.

C)before recognizing the associated revenue.

D)either before or after recognizing the associated revenue.

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck

80

Amelia Consulting Services collected $12,000 cash for services to be provided in the future. Which of the following shows how recognizing the cash receipt will affect the company's balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 136 flashcards in this deck.

Unlock Deck

k this deck