Deck 13: The Double-Entry Accounting System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/167

Play

Full screen (f)

Deck 13: The Double-Entry Accounting System

1

Debits decrease asset accounts.

False

2

The type of transaction that would be represented by a debit to one asset and a credit to another asset is an asset source transaction.

False

3

The three primary asset use transactions are incurring expenses, accruing liabilities, and paying dividends.

False

4

The balance in Retained Earnings is decreased by debiting the account.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

5

The left side of a T-account is the debit side.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

6

The Dividends account normally has a credit balance.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

7

A company's general ledger provides a chronological record of its business transactions.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

8

When a company receives cash in advance from a customer, it should debit Cash and credit Accounts Receivable.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

9

The T-account format is also called the chart of accounts.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

10

The entry to record revenue earned on account includes a debit to accounts receivable and a credit to revenue.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

11

The general journal is a list of a business's accounts and their account numbers.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

12

A liability account normally has a credit balance.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

13

Source documents provide information that serves as the basis for entries into the accounting system. Examples of source documents include invoices and deposit tickets.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

14

At the end of its fiscal year, a company must adjust its accounting records for unrecorded accruals and deferrals before it can prepare financial statements.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

15

Generally accepted accounting principles require that a business's fiscal year must end on December 31.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

16

An increase to a liability account is recorded with a debit entry.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

17

Many companies choose to end their fiscal years during a part of the year when they expect low activity.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

18

To record an asset source transaction, an asset account would be debited and a liability or stockholders' equityaccount credited.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

19

To record the purchase of supplies on account, an accountant would credit Supplies.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

20

Double entry accounting requires that every entry must include at least one debit and at least one credit.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements regarding credit entries is true?

A)Credits decrease liability accounts.

B)Credits increase asset accounts.

C)Credits increase the common stock account.

D)Credits increase asset and common stock accounts and decrease liability accounts.

A)Credits decrease liability accounts.

B)Credits increase asset accounts.

C)Credits increase the common stock account.

D)Credits increase asset and common stock accounts and decrease liability accounts.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

22

Benson Company purchased land and paid the full purchase price in cash. Which of the following would be included in the journal entry necessary to record this event?

A)A debit to Land and a debit to Cash

B)A debit to Cash and a credit to Land

C)A credit to Land and a credit to Cash

D)A debit to Land and a credit to Cash

A)A debit to Land and a debit to Cash

B)A debit to Cash and a credit to Land

C)A credit to Land and a credit to Cash

D)A debit to Land and a credit to Cash

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

23

What is the term used to describe the right side of a T-account?

A)Credit Side

B)Claims Side

C)Debit Side

D)Equity Side

A)Credit Side

B)Claims Side

C)Debit Side

D)Equity Side

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

24

Journals are sometimes called books of original entry because transactions are recorded in journals before amounts are entered into the ledger.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

25

A business's chart of accounts is prepared to verify the equality of debits and credits.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

26

All of a company's temporary accounts appear on the income statement.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is decreased with a credit?

A)Assets

B)Liabilities

C)Stockholders' Equity

D)Net Income

A)Assets

B)Liabilities

C)Stockholders' Equity

D)Net Income

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

28

Posting is the process of determining the balance in an account by subtracting debits and credits.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

29

A trial balance can only be prepared at the end of the fiscal year, as part of the adjusting and closing processes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement.)

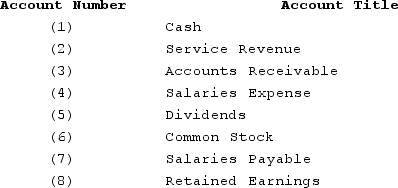

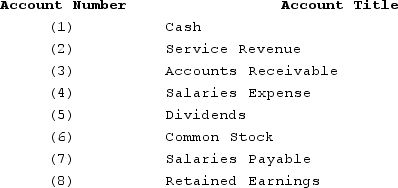

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement.)A)Account numbers 2, 4, and 5 will appear on the income statement.

B)Account numbers 1, 3, and 8 will appear on the balance sheet.

C)Account numbers 2, 5, and 8 will appear on the statement of cash flows.

D)Account numbers 4, 5, and 6 will appear on the statement of changes in stockholders' equity.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

31

Warren Company began the accounting period with a $32,000 debit balance in its accounts receivable account. During the accounting period, the company recorded revenue on account amounting to $88,000. The accounts receivable account at the end of the accounting period contained a $16,000 debit balance. Based on this information, what is the amount of cash collected from customers during the period?

A)$104,000

B)$40,000

C)$72,000

D)$84,000

A)$104,000

B)$40,000

C)$72,000

D)$84,000

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

32

A company's adjusted trial balance provides the information needed to prepare the balance sheet and income statement.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

33

What is the term that is used to describe the difference between the total debit and credit amounts in a T-account?

A)Net Income

B)Trial Balance

C)Equality

D)Account Balance

A)Net Income

B)Trial Balance

C)Equality

D)Account Balance

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

34

A trial balance can be in balance, even if there are errors in the accounting system.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following elements is increased with a debit?

A)Stockholders' Equity

B)Liabilities

C)Assets

D)None of these choices are increased with a debit

A)Stockholders' Equity

B)Liabilities

C)Assets

D)None of these choices are increased with a debit

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

36

Warren Company began the accounting period with a $48,000 debit balance in its accounts receivable account. During the accounting period, the company recorded revenue on account amounting to $108,000. The accounts receivable account at the end of the accounting period contained a $24,000 debit balance. Based on this information, what isthe amount of cash collected from customers during the period?

A)$90,000

B)$120,000

C)$132,000

D)$36,000

A)$90,000

B)$120,000

C)$132,000

D)$36,000

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

37

What is the term used to describe the left side of a T-account?

A)Equity Side

B)Debit Side

C)Credit Side

D)Claims Side

A)Equity Side

B)Debit Side

C)Credit Side

D)Claims Side

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that have debit balances on that particular financial statement).

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that have debit balances on that particular financial statement).A)Account numbers 1, 3, and 5 normally have debit balances.

B)Account numbers 2, 4, and 5 normally have debit balances.

C)Account numbers 2, 5, and 8 normally have debit balances.

D)Account numbers 4, 5, and 6 normally have debit balances.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

39

Closing entries move all current year data for revenues, expenses, and dividends into the retained earnings account.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements about debits is false?

A)Debits increase assets.

B)Debits decrease stockholders' equity.

C)Debits decrease liabilities.

D)Debits increase liabilities.

A)Debits increase assets.

B)Debits decrease stockholders' equity.

C)Debits decrease liabilities.

D)Debits increase liabilities.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

41

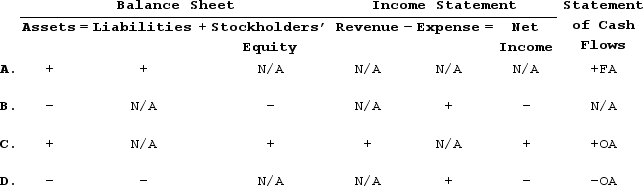

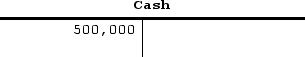

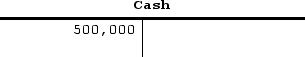

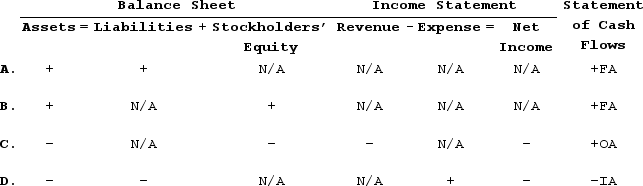

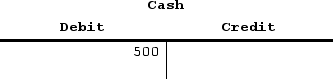

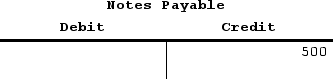

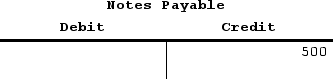

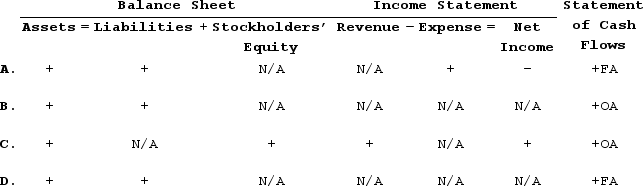

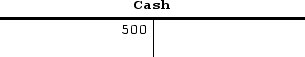

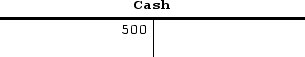

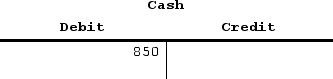

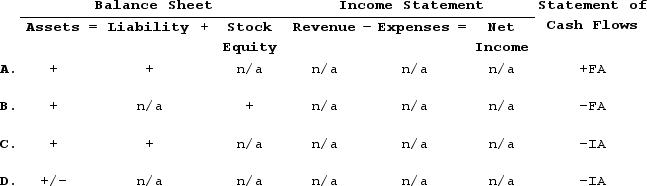

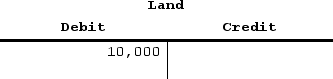

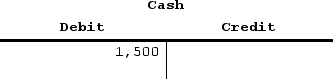

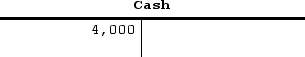

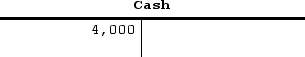

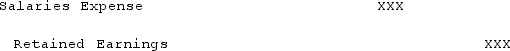

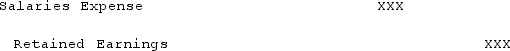

A transaction has been recorded in the T-accounts of Powell Corporation as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

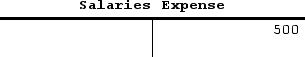

42

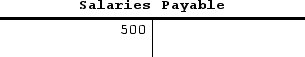

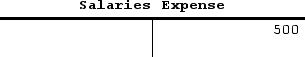

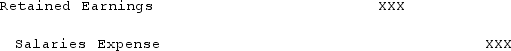

The employees of Able Company have worked the last two weeks of Year 1, but the employees' salaries have not been paid or recorded as of December 31, Year 1. The adjusting entry that Able should make to accrue these unpaid salaries on December 31, Year 1 is:

A)debit to Salaries Expense and credit to Cash.

B)debit to Salaries Expense and credit to Salaries Payable.

C)debit to Salaries Payable and credit to Salaries Expense.

D)no entry is required until the employee is paid next period.

A)debit to Salaries Expense and credit to Cash.

B)debit to Salaries Expense and credit to Salaries Payable.

C)debit to Salaries Payable and credit to Salaries Expense.

D)no entry is required until the employee is paid next period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

43

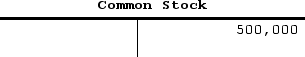

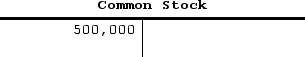

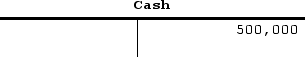

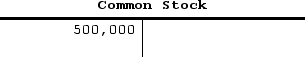

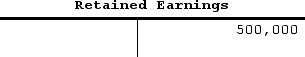

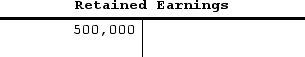

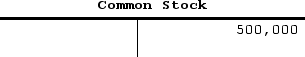

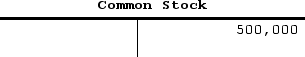

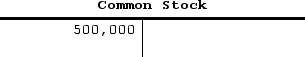

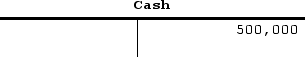

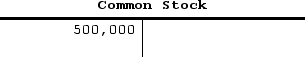

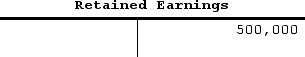

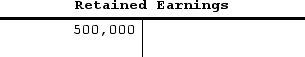

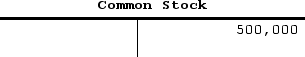

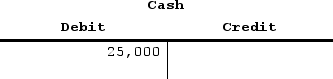

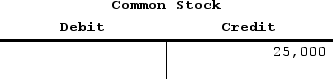

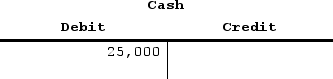

The Wagner Company acquired $500,000 cash from the issue of common stock. How would this transaction be recorded in the company's T-accounts?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

44

Why are adjusting entries recorded at the end of the accounting period?

A)The Cash account must be adjusted for the effects of the daily transactions with customers and creditors.

B)The company's accounts must be adjusted to ensure that debits are equal to credits prior to preparing the trial balance.

C)Unrecorded accruals and deferrals must be recognized before the financial statements can be prepared.

D)The data from the temporary accounts (revenues, expenses, and dividends)must be moved into the retained earnings account.

A)The Cash account must be adjusted for the effects of the daily transactions with customers and creditors.

B)The company's accounts must be adjusted to ensure that debits are equal to credits prior to preparing the trial balance.

C)Unrecorded accruals and deferrals must be recognized before the financial statements can be prepared.

D)The data from the temporary accounts (revenues, expenses, and dividends)must be moved into the retained earnings account.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

45

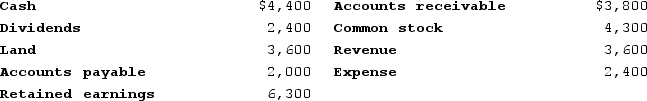

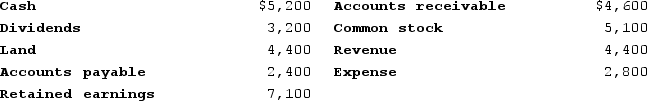

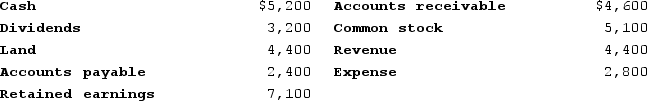

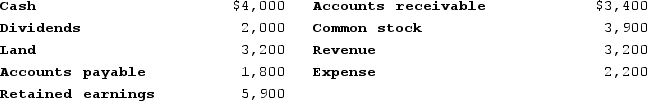

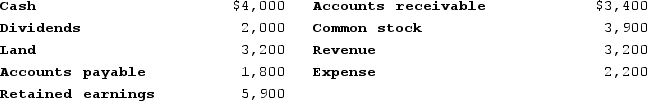

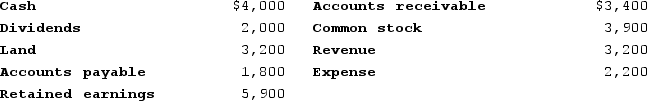

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

A)$11,800

B)$15,400

C)$8,000

D)$14,200

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?A)$11,800

B)$15,400

C)$8,000

D)$14,200

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

46

The Baker Company purchased $1,000 of supplies on account. How would this event be reflected in T-accounts?

A)On the right side of the Supplies T-account

B)On the left side of the Supplies T-account

C)On the left side of the Accounts Payable T-account

D)On the right side of the Cash T-account

A)On the right side of the Supplies T-account

B)On the left side of the Supplies T-account

C)On the left side of the Accounts Payable T-account

D)On the right side of the Cash T-account

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

47

If you debit an expense account, what impact does that have on stockholders' equity?

A)Decreases stockholders' equity

B)Increases stockholders' equity

C)There is no effect on stockholders' equity

D)Decreases net income but has no effect on stockholders' equity

A)Decreases stockholders' equity

B)Increases stockholders' equity

C)There is no effect on stockholders' equity

D)Decreases net income but has no effect on stockholders' equity

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

48

On November 1, Year 1, Shumate Company paid $1,200 in advance for an insurance policy that covered the company for six months. Which of the following will be included in the adjustment required on December 31, Year 1?

A)A debit to Prepaid Insurance for $400

B)A credit to Prepaid Insurance for $400

C)A debit to Insurance Expense for $1,200

D)A credit to Insurance Expense for $1,200

A)A debit to Prepaid Insurance for $400

B)A credit to Prepaid Insurance for $400

C)A debit to Insurance Expense for $1,200

D)A credit to Insurance Expense for $1,200

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

49

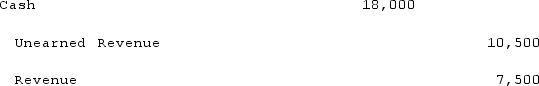

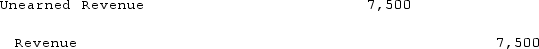

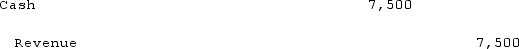

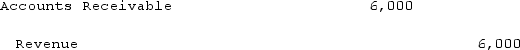

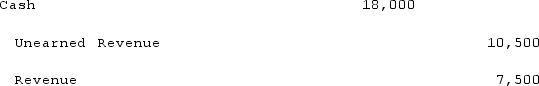

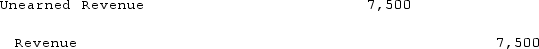

On August 1, Year 1, Benjamin and Associates collected $18,000 in advance for legal services to be rendered for one year. Which of the following entries reflect the end-of-the-year adjustment to reflect revenue earned?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

50

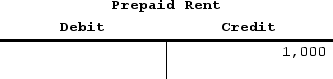

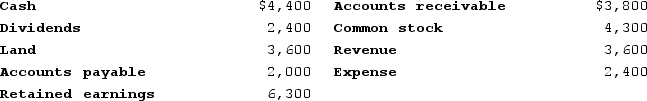

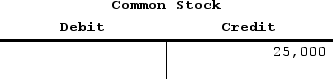

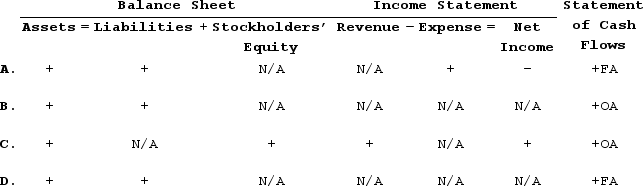

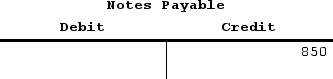

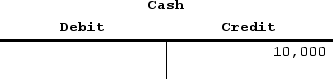

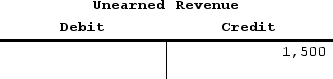

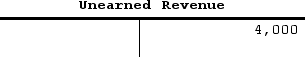

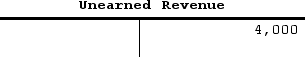

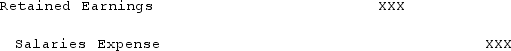

A transaction has been recorded in the T-accounts of Horowitz Corporation as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

51

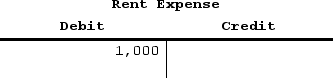

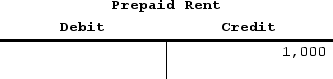

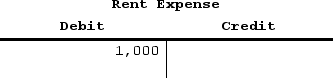

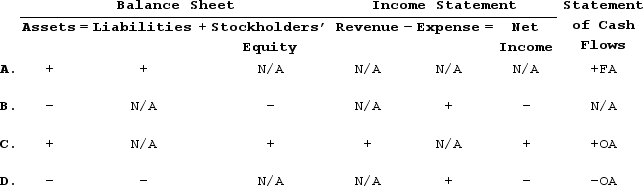

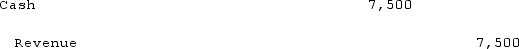

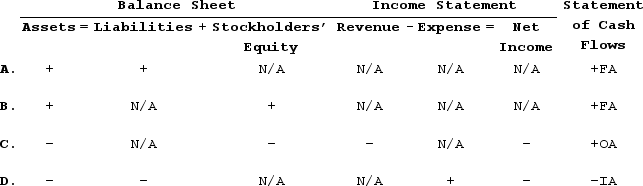

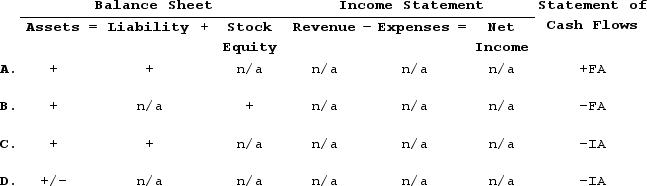

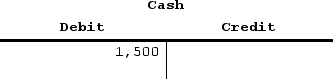

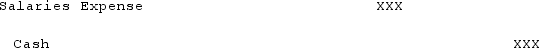

A transaction has been recorded in the T-accounts of Hough Company as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

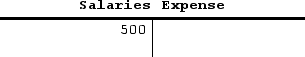

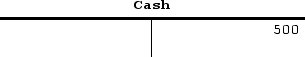

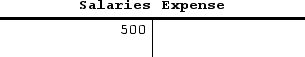

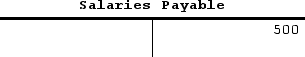

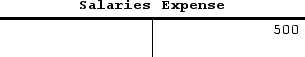

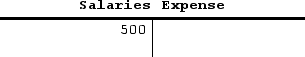

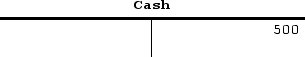

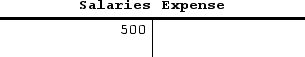

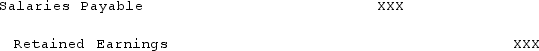

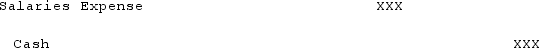

52

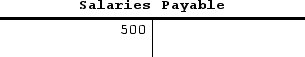

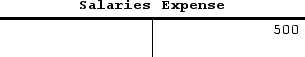

Fitzpatrick Company had $500 of accrued salary expenses that will be paid during the following accounting period. How would the related adjusting entry be recorded in the company's T-accounts?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

53

During a company's first yearof operations, the asset account, Office Supplies, was debited for $3,900 for the purchases of supplies. At year-end, a physical count of the supplies on hand revealed that $1,625 of unused supplies were available for future use. How will the related adjusting entry affect the company's financial statements?

A)Expenses will increase, and assets will decrease by $2,275.

B)Assets and expenses will both increase by $1,625.

C)Expenses and assetswill both increase by $2,275.

D)The related adjusting entry has no effect on net income or the accounting equation.

A)Expenses will increase, and assets will decrease by $2,275.

B)Assets and expenses will both increase by $1,625.

C)Expenses and assetswill both increase by $2,275.

D)The related adjusting entry has no effect on net income or the accounting equation.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

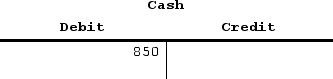

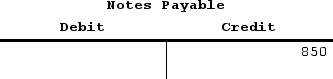

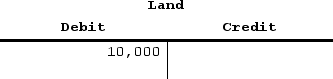

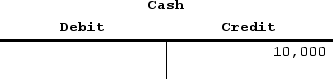

54

A transaction has been recorded in the T-accounts of Simpson Company as follows:

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?

A)The company borrowed $850.

B)The company loaned $850 to another company.

C)The company repaid a $850 debt.

D)Simpson acquired $850 cash from the issue of common stock.

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?A)The company borrowed $850.

B)The company loaned $850 to another company.

C)The company repaid a $850 debt.

D)Simpson acquired $850 cash from the issue of common stock.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

55

A transaction has been recorded in the T-accounts of Vernon Company as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

56

On October 1, Year 1, Senegal Company paid $1,200 in advance for rent of office space for one year and recorded a journal entry debiting Prepaid Rent and crediting Cash for $1,200. On December 31, Year 1, the required adjusting entry was recorded. What are the adjusted account balances at December 31, Year 1?

A)Prepaid Rent, $300; Rent Expense, $900

B)Prepaid Rent, $1,200; Rent Expense, $0

C)Prepaid Rent, $0; Rent Expense, $1,200

D)Prepaid Rent, $900; Rent Expense, $300

A)Prepaid Rent, $300; Rent Expense, $900

B)Prepaid Rent, $1,200; Rent Expense, $0

C)Prepaid Rent, $0; Rent Expense, $1,200

D)Prepaid Rent, $900; Rent Expense, $300

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

57

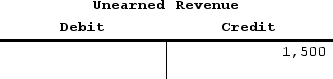

A transaction has been recorded in the T-accounts of Gibbs Company as follows:

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?

A)Cash has been paid out to a company that will provide future services to Gibbs Company.

B)Gibbs has completed services for which they had earlier received cash in advance.

C)Gibbs has provided services to a customer on account.

D)Gibbs has received cash for services to be provided in the future.

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?A)Cash has been paid out to a company that will provide future services to Gibbs Company.

B)Gibbs has completed services for which they had earlier received cash in advance.

C)Gibbs has provided services to a customer on account.

D)Gibbs has received cash for services to be provided in the future.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

58

During a company's first year of operations, the asset account, Office Supplies, was debited for $2,300 for the purchases of supplies. At year-end, a physical count of the supplies on hand revealed that $825 of unused supplies were available for future use. How will the related adjusting entry affect the company's financial statements?

A)Expenses will increase, and assets will decrease by $1,475.

B)Assets and expenses will both increase by $825.

C)Expenses and assets will both increase by $1,475.

D)The related adjusting entry has no effect on net income or the accounting equation.

A)Expenses will increase, and assets will decrease by $1,475.

B)Assets and expenses will both increase by $825.

C)Expenses and assets will both increase by $1,475.

D)The related adjusting entry has no effect on net income or the accounting equation.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

59

The closing entry for the Dividends account would involve which of the following?

A)A credit to Retained Earnings

B)A credit to Dividends

C)A credit to Common Stock

D)A credit to Cash

A)A credit to Retained Earnings

B)A credit to Dividends

C)A credit to Common Stock

D)A credit to Cash

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

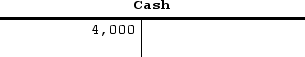

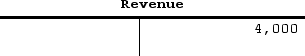

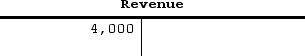

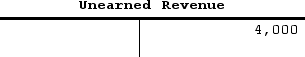

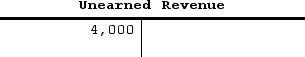

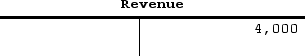

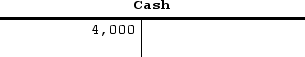

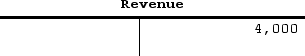

60

Bijan Corporation earned $4,000 of revenue that had been deferred. How would the related adjusting entry be recorded in the company's T-accounts?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is a (are)permanent account(s)?

A)The Retained Earnings account

B)All income statement accounts

C)The Dividend account

D)All balance sheet accounts and the Dividends account

A)The Retained Earnings account

B)All income statement accounts

C)The Dividend account

D)All balance sheet accounts and the Dividends account

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

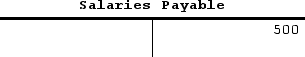

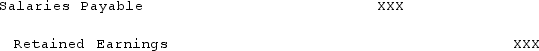

62

Which of the following journal entries would be required to close a salaries expense account?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is true?

A)Closing the revenue account increases retained earnings.

B)Closing expense accounts decreases retained earnings.

C)Closing the dividend account decreases retained earnings.

D)All of the statements are true.

A)Closing the revenue account increases retained earnings.

B)Closing expense accounts decreases retained earnings.

C)Closing the dividend account decreases retained earnings.

D)All of the statements are true.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is true regarding the trial balance?

A)Incorrectly recording a cash sale as a sale on account would not cause the trial balance to be out of balance.

B)The income statement is prepared using the post-closing trial balance.

C)A balance of debits and credits ensures that all transactions have been recorded correctly.

D)Trial balances are only prepared at the end of an accounting period.

A)Incorrectly recording a cash sale as a sale on account would not cause the trial balance to be out of balance.

B)The income statement is prepared using the post-closing trial balance.

C)A balance of debits and credits ensures that all transactions have been recorded correctly.

D)Trial balances are only prepared at the end of an accounting period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

65

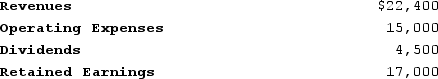

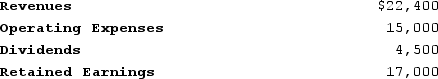

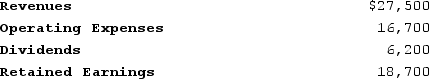

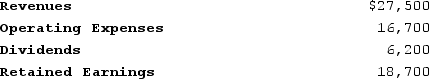

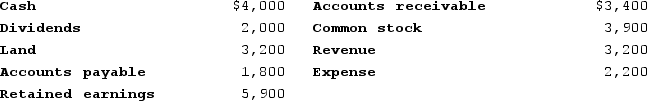

The following account balances were taken from the adjusted trial balance of Kendall Company:  What is the Retained Earnings account balance that will be included on the post-closing trial balance?

What is the Retained Earnings account balance that will be included on the post-closing trial balance?

A)$19,900

B)$7,400

C)$2,900

D)$24,400

What is the Retained Earnings account balance that will be included on the post-closing trial balance?

What is the Retained Earnings account balance that will be included on the post-closing trial balance?A)$19,900

B)$7,400

C)$2,900

D)$24,400

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

66

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  The amount of Carolina's retained earnings on December 31, Year 1 was:

The amount of Carolina's retained earnings on December 31, Year 1 was:

A)$9,600

B)$5,500

C)$5,100

D)$7,100

The amount of Carolina's retained earnings on December 31, Year 1 was:

The amount of Carolina's retained earnings on December 31, Year 1 was:A)$9,600

B)$5,500

C)$5,100

D)$7,100

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

67

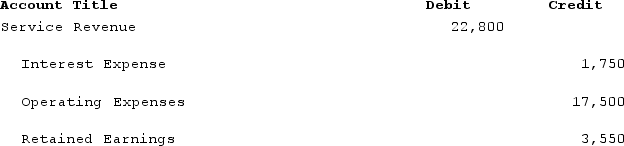

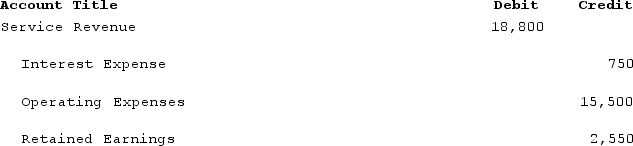

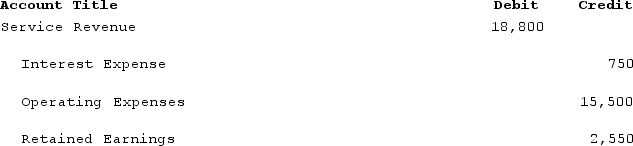

What effect will the following closing entry have on the retained earnings account?

A)Retained earnings will remain unchanged.

B)Retained earnings will decrease by $3,550.

C)Retained earnings will increase by $3,550.

D)Retained earnings will be transferred to the income statement.

A)Retained earnings will remain unchanged.

B)Retained earnings will decrease by $3,550.

C)Retained earnings will increase by $3,550.

D)Retained earnings will be transferred to the income statement.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

68

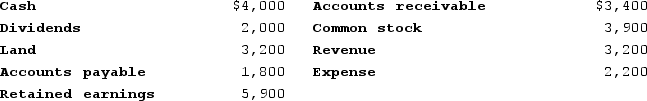

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  What is the amount of net income that will be reported on the Year 1 income statement?

What is the amount of net income that will be reported on the Year 1 income statement?

A)$2,200

B)$3,200

C)$1,000

D)$200

What is the amount of net income that will be reported on the Year 1 income statement?

What is the amount of net income that will be reported on the Year 1 income statement?A)$2,200

B)$3,200

C)$1,000

D)$200

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

69

The following account balances were taken from the adjusted trial balance of Kendall Company:  What is the Retained Earnings account balance that will be included on the post-closing trial balance?

What is the Retained Earnings account balance that will be included on the post-closing trial balance?

A)$23,300.

B)$10,800.

C)$4,600.

D)$29,500.

What is the Retained Earnings account balance that will be included on the post-closing trial balance?

What is the Retained Earnings account balance that will be included on the post-closing trial balance?A)$23,300.

B)$10,800.

C)$4,600.

D)$29,500.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

70

Valley Packaging Company's adjusted trial balance showed a zero balance in retained earnings. Which of the following is the most likely explanation for this?

A)Valley reported zero net income in the current year.

B)Valley's trial balance will be out of balance until closing entries are recorded.

C)The current year was Valley's first year in business.

D)An error must have been made in preparing Valley's trial balance.

A)Valley reported zero net income in the current year.

B)Valley's trial balance will be out of balance until closing entries are recorded.

C)The current year was Valley's first year in business.

D)An error must have been made in preparing Valley's trial balance.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

71

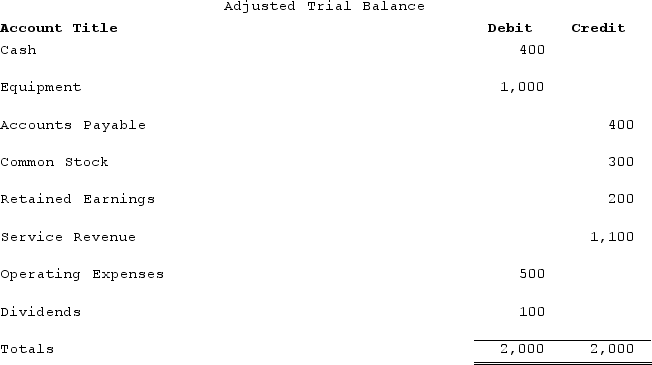

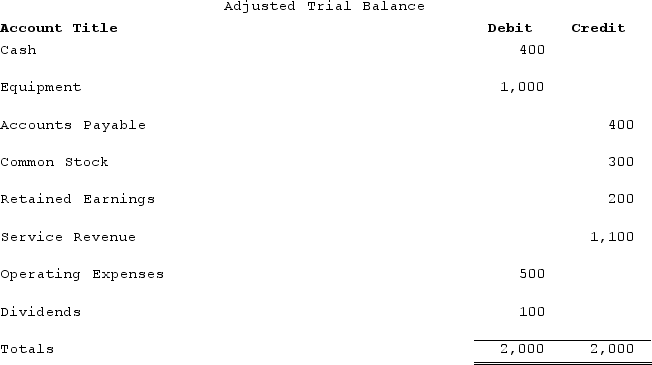

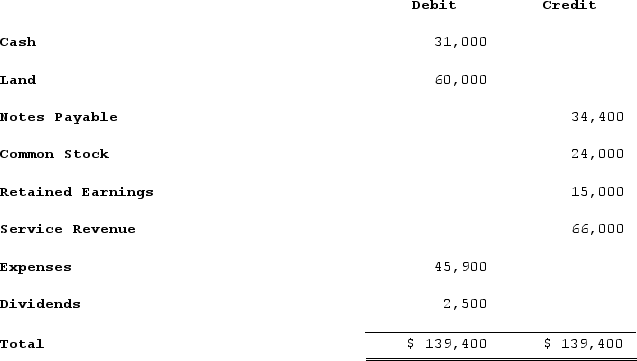

The following adjusted trial balance was drawn from the records of the Dakota Company .  Based on the information in the adjusted trial balance

Based on the information in the adjusted trial balance

A)the total of the debit column in the post-closing trial balance will be $1,400.

B)the total of the credit column in the post-closing trial balance will be $2,000.

C)the total of the debit column in the post-closing trial balance will be $2,000.

D)the total of the credit column in the post-closing trial balance will be $1,500.

Based on the information in the adjusted trial balance

Based on the information in the adjusted trial balanceA)the total of the debit column in the post-closing trial balance will be $1,400.

B)the total of the credit column in the post-closing trial balance will be $2,000.

C)the total of the debit column in the post-closing trial balance will be $2,000.

D)the total of the credit column in the post-closing trial balance will be $1,500.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is true?

A)Adjusting entries are recorded after the closing entries have been recorded.

B)Equal totals in a trial balance guarantees that no errors were made in the recording process.

C)Debits are equal to credits only after closing entries have been recorded.

D)The balance in the retained earnings account in the trial balance will equal the retained earnings balance on the balance sheet only after closing entries have been posted to the general ledger.

A)Adjusting entries are recorded after the closing entries have been recorded.

B)Equal totals in a trial balance guarantees that no errors were made in the recording process.

C)Debits are equal to credits only after closing entries have been recorded.

D)The balance in the retained earnings account in the trial balance will equal the retained earnings balance on the balance sheet only after closing entries have been posted to the general ledger.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

73

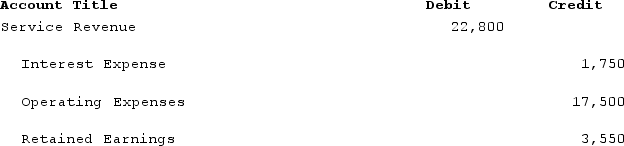

What effect will the following closing entry have on the retained earnings account?

A)Retained earnings will remain unchanged.

B)Retained earnings will decrease by $2,550.

C)Retained earnings will increase by $2,550.

D)Retained earnings will be transferred to the income statement.

A)Retained earnings will remain unchanged.

B)Retained earnings will decrease by $2,550.

C)Retained earnings will increase by $2,550.

D)Retained earnings will be transferred to the income statement.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

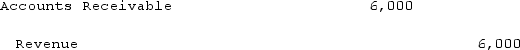

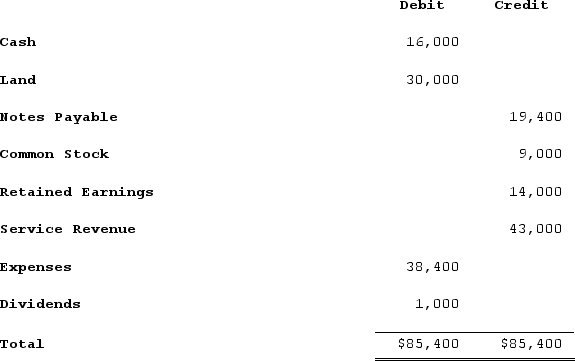

74

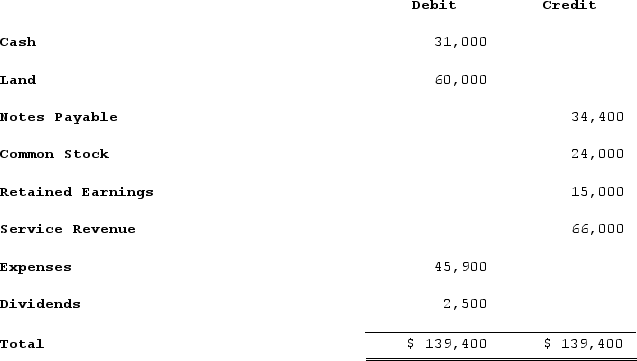

The trial balance of Barger Company at the end of the accounting period, immediately prior to recording closing entries, showed the following:  What will the balance of the retained earnings account be after the closing entries are recorded?

What will the balance of the retained earnings account be after the closing entries are recorded?

A)$17,600

B)$4,600

C)$18,600

D)$3,600

What will the balance of the retained earnings account be after the closing entries are recorded?

What will the balance of the retained earnings account be after the closing entries are recorded?A)$17,600

B)$4,600

C)$18,600

D)$3,600

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

75

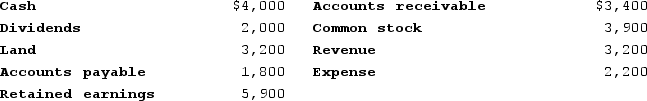

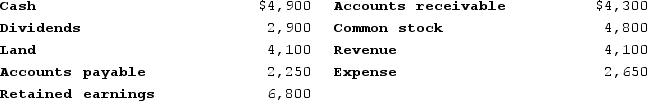

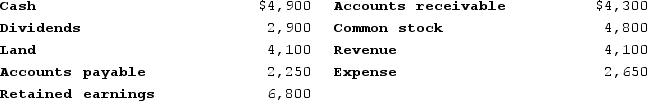

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  The amount of Carolina's retained earnings on December 31, Year 1 was:

The amount of Carolina's retained earnings on December 31, Year 1 was:

A)$5,900

B)$7,200

C)$3,900

D)$4,900

The amount of Carolina's retained earnings on December 31, Year 1 was:

The amount of Carolina's retained earnings on December 31, Year 1 was:A)$5,900

B)$7,200

C)$3,900

D)$4,900

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

76

The journal entry to close the revenue account would include which of the following?

A)A debit to both the revenue and the retained earnings account

B)A credit to both the revenue and the retained earnings account

C)A debit to the revenue account and a credit to the retained earnings account

D)A credit to the revenue account and a debit to the retained earnings account

A)A debit to both the revenue and the retained earnings account

B)A credit to both the revenue and the retained earnings account

C)A debit to the revenue account and a credit to the retained earnings account

D)A credit to the revenue account and a debit to the retained earnings account

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

77

Which one of the following would not be included in a closing entry?

A)A credit to Rent Expense

B)A debit to Unearned Revenue

C)A debit to Service Revenue

D)A credit to Dividends

A)A credit to Rent Expense

B)A debit to Unearned Revenue

C)A debit to Service Revenue

D)A credit to Dividends

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

78

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  What is the amount of net income that will be reported on the Year 1 income statement?

What is the amount of net income that will be reported on the Year 1 income statement?

A)$650

B)$2,650

C)$1,450

D)$4,100

What is the amount of net income that will be reported on the Year 1 income statement?

What is the amount of net income that will be reported on the Year 1 income statement?A)$650

B)$2,650

C)$1,450

D)$4,100

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

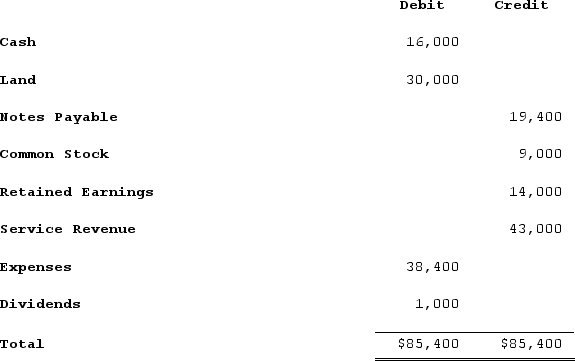

79

The trial balance of Barger Company at the end of the accounting period, immediately prior to recording closing entries, showed the following:  What will the balance of the retained earnings accountbe after the closing entries are recorded?

What will the balance of the retained earnings accountbe after the closing entries are recorded?

A)$17,600

B)$20,100

C)$32,600

D)$35,100

What will the balance of the retained earnings accountbe after the closing entries are recorded?

What will the balance of the retained earnings accountbe after the closing entries are recorded?A)$17,600

B)$20,100

C)$32,600

D)$35,100

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

80

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

A)$12,600

B)$13,800

C)$7,200

D)$10,600

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?

What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1?A)$12,600

B)$13,800

C)$7,200

D)$10,600

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck