Deck 15: Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/176

Play

Full screen (f)

Deck 15: Monetary Policy

1

Which scenario best explains the Keynesian transmission mechanism when the money supply increases while the money market is in a liquidity trap?

A) The interest rate and investment are not affected; there is no shift in the AD curve.

B) The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C) The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D) The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

A) The interest rate and investment are not affected; there is no shift in the AD curve.

B) The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C) The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D) The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

A

2

According to the Keynesian transmission mechanism,an increase in the money supply will __________ the interest rate,causing a __________ in investment,which then __________ Real GDP.

A) raise; fall; raises

B) raise; rise; lowers

C) raise; fall; lowers

D) lower; fall; lowers

E) lower; rise; raises

A) raise; fall; raises

B) raise; rise; lowers

C) raise; fall; lowers

D) lower; fall; lowers

E) lower; rise; raises

E

3

If market interest rates increase,the prices of existing bonds will

A) decrease.

B) not change.

C) increase.

D) decrease if Real GDP decreases and increase if Real GDP increases.

A) decrease.

B) not change.

C) increase.

D) decrease if Real GDP decreases and increase if Real GDP increases.

A

4

If the interest rate increases,the opportunity cost of holding money __________,and the quantity demanded of money __________.

A) does not change; does not change

B) increases; also increases

C) decreases; increases

D) increases; decreases

E) decreases; also decreases

A) does not change; does not change

B) increases; also increases

C) decreases; increases

D) increases; decreases

E) decreases; also decreases

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

5

If the money market is in the liquidity trap,it is operating in the __________ segment of the __________ demand curve.

A) vertical; investment

B) vertical; money

C) horizontal; investment

D) horizontal; money

A) vertical; investment

B) vertical; money

C) horizontal; investment

D) horizontal; money

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

6

As the interest rate __________,the opportunity cost of holding money __________ and individuals choose to hold __________ money.

A) increases; increases; more

B) increases; decreases; more

C) increases; decreases; less

D) decreases; increases; more

E) decreases; decreases; more

A) increases; increases; more

B) increases; decreases; more

C) increases; decreases; less

D) decreases; increases; more

E) decreases; decreases; more

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

7

As the interest rate falls,the quantity

A) demanded of money falls.

B) demanded of money rises.

C) supplied of money rises.

D) supplied of money falls.

A) demanded of money falls.

B) demanded of money rises.

C) supplied of money rises.

D) supplied of money falls.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

8

Which scenario best explains the Keynesian transmission mechanism when the investment demand curve is vertical?

A) The interest rate falls, investment falls even more, the AD curve shifts rightward, but total expenditures do not change.

B) The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C) The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D) The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

A) The interest rate falls, investment falls even more, the AD curve shifts rightward, but total expenditures do not change.

B) The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C) The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D) The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

9

If the interest rate falls,the opportunity cost of holding money __________ and the quantity demanded of money __________.

A) rises, rises

B) rises, falls

C) falls, rises

D) falls, falls

A) rises, rises

B) rises, falls

C) falls, rises

D) falls, falls

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

10

What do Keynesians mean when they say that "you can't push on a string"?

A) An increase in the supply of goods does not really create its own demand.

B) If the government reduces taxes in an attempt to increase household consumption, it will not always work.

C) An increase in the money supply will not always stimulate the economy.

D) If the government wants to get something done, the best way is not to force the issue, but to offer incentives.

E) If the government puts too much expansionary pressure on the economy, it will probably "overheat."

A) An increase in the supply of goods does not really create its own demand.

B) If the government reduces taxes in an attempt to increase household consumption, it will not always work.

C) An increase in the money supply will not always stimulate the economy.

D) If the government wants to get something done, the best way is not to force the issue, but to offer incentives.

E) If the government puts too much expansionary pressure on the economy, it will probably "overheat."

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose the money market is in the liquidity trap and the Fed increases the supply of money.We expect that

A) people will end up willingly holding more money.

B) the excess money holdings will flow into the loanable funds market and there will be a decrease in interest rates.

C) interest rates will increase, since the demand curve for money is upward sloping in this case.

D) eventually, via the transmission mechanism, Real GDP will increase.

A) people will end up willingly holding more money.

B) the excess money holdings will flow into the loanable funds market and there will be a decrease in interest rates.

C) interest rates will increase, since the demand curve for money is upward sloping in this case.

D) eventually, via the transmission mechanism, Real GDP will increase.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

12

Compared to the Keynesian transmission mechanism,the monetarist transmission mechanism is

A) direct.

B) indirect.

C) inverse.

D) none of the above

A) direct.

B) indirect.

C) inverse.

D) none of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

13

The demand-for-money curve illustrates the __________ relationship between the quantity demanded of money and __________.

A) inverse; the interest rate

B) direct; GDP.

C) direct; the interest rate

D) inverse; GDP

A) inverse; the interest rate

B) direct; GDP.

C) direct; the interest rate

D) inverse; GDP

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

14

The Keynesian transmission mechanism might get blocked if

A) investment is insensitive to changes in interest rates.

B) the goods market is not in equilibrium.

C) the money supply increases too quickly.

D) interest rates are too high before they fall.

A) investment is insensitive to changes in interest rates.

B) the goods market is not in equilibrium.

C) the money supply increases too quickly.

D) interest rates are too high before they fall.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

15

The liquidity trap refers to the

A) assumption that the money supply curve is vertical as a result of the Fed's control.

B) problem that occurs when interest rates reach such high levels that no individuals want to hold their wealth in the form of money.

C) situation that occurs when an excess supply of money results in people holding more money than they desire.

D) possibility that interest rates drop so low that people willingly hold all the additions to the money supply, rather than use it to buy bonds.

A) assumption that the money supply curve is vertical as a result of the Fed's control.

B) problem that occurs when interest rates reach such high levels that no individuals want to hold their wealth in the form of money.

C) situation that occurs when an excess supply of money results in people holding more money than they desire.

D) possibility that interest rates drop so low that people willingly hold all the additions to the money supply, rather than use it to buy bonds.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

16

A general definition of the "transmission mechanism" is: the routes or channels that ripple effects created in the

A) market for goods and the services travel to affect the money market.

B) money market travel to affect the market for goods and services.

C) labor market travel to affect the market for goods and services.

D) market for goods and services travel to affect the labor market.

E) none of the above

A) market for goods and the services travel to affect the money market.

B) money market travel to affect the market for goods and services.

C) labor market travel to affect the market for goods and services.

D) market for goods and services travel to affect the labor market.

E) none of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

17

If the interest rate is below the equilibrium interest rate,then the quantity __________ of money exceeds the quantity __________ of money,and there is a __________ of money.

A) supplied; demanded; shortage

B) supplied; demanded; surplus

C) demanded; supplied; shortage

D) demanded; supplied; surplus

A) supplied; demanded; shortage

B) supplied; demanded; surplus

C) demanded; supplied; shortage

D) demanded; supplied; surplus

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

18

Which best describes the Keynesian transmission mechanism when the money supply increases?

A) The interest rate rises; this in turn reduces investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

B) The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve leftward.

C) The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

D) The interest rate falls; this in turn stimulates investment spending, which in turn lowers total expenditures and shifts the AD curve leftward.

A) The interest rate rises; this in turn reduces investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

B) The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve leftward.

C) The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

D) The interest rate falls; this in turn stimulates investment spending, which in turn lowers total expenditures and shifts the AD curve leftward.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose that one year ago you purchased a $100 bond with an interest payment of $5 per year and,at the time,the interest rate was 5 percent.One year later the interest rate has increased to 6.5 percent,and you still hold the bond.If you were to sell your bond now,the price that you could sell it for would be

A) higher than it was when you bought it.

B) lower than it was when you bought it.

C) the same as it was when you bought it, that is, $100.

D) More information is necessary to answer the question.

A) higher than it was when you bought it.

B) lower than it was when you bought it.

C) the same as it was when you bought it, that is, $100.

D) More information is necessary to answer the question.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

20

An individual buys a bond for $1,000 and sells it one year later for $1,050.What is the annual interest rate return that this individual has received on this bond?

A) 5.0 percent

B) 50.0 percent

C) 7.5 percent

D) 4.0 percent

E) 0.05 percent

A) 5.0 percent

B) 50.0 percent

C) 7.5 percent

D) 4.0 percent

E) 0.05 percent

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

21

A decrease in the money supply will shift the aggregate __________ curve to the __________.

A) supply; left

B) supply; right

C) demand; left

D) demand; right

A) supply; left

B) supply; right

C) demand; left

D) demand; right

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

22

Monetary policy refers to

A) actions taken by banks and other financial institutions regarding their approaches to lending, account management, etc.

B) changes in the money supply to achieve particular economic goals.

C) changes in government expenditures and taxation to achieve particular economic goals.

D) the change in private expenditures that occurs as a consequence of changes in the money supply.

A) actions taken by banks and other financial institutions regarding their approaches to lending, account management, etc.

B) changes in the money supply to achieve particular economic goals.

C) changes in government expenditures and taxation to achieve particular economic goals.

D) the change in private expenditures that occurs as a consequence of changes in the money supply.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

23

Monetarists believe that changes in the supply of money

A) do not affect aggregate demand.

B) affect aggregate demand through the loanable funds market only.

C) affect only the investment component of aggregate demand.

D) affect aggregate demand directly.

A) do not affect aggregate demand.

B) affect aggregate demand through the loanable funds market only.

C) affect only the investment component of aggregate demand.

D) affect aggregate demand directly.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

24

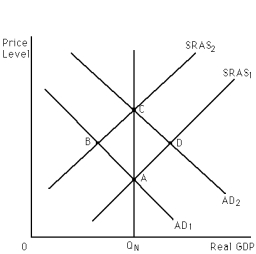

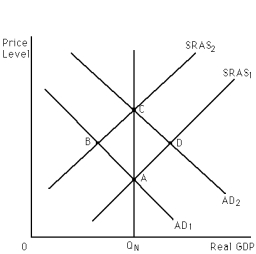

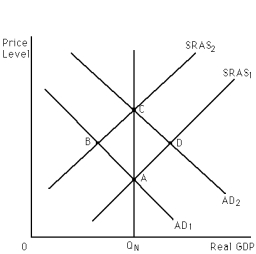

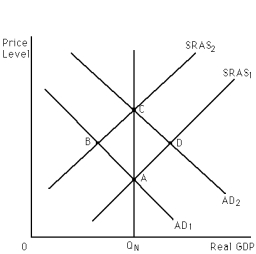

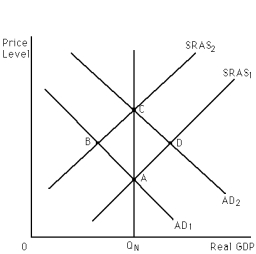

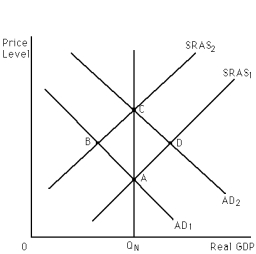

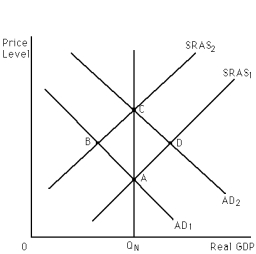

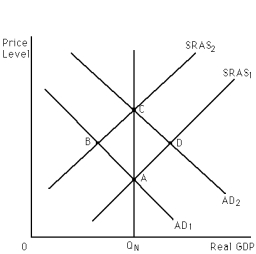

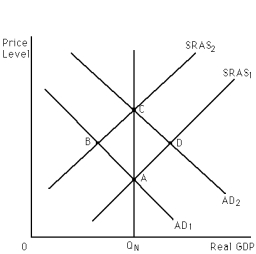

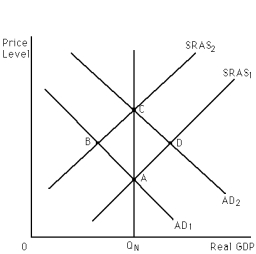

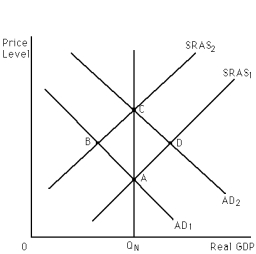

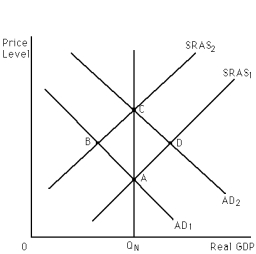

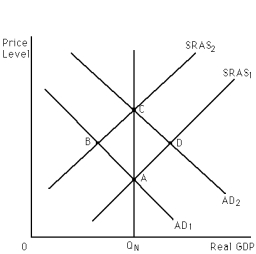

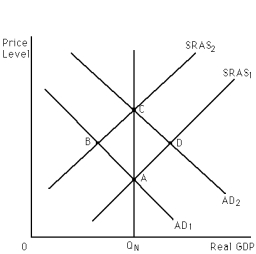

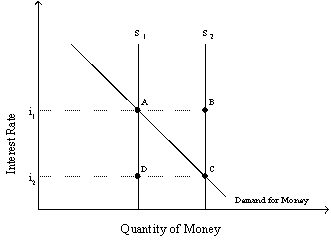

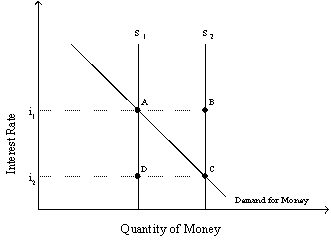

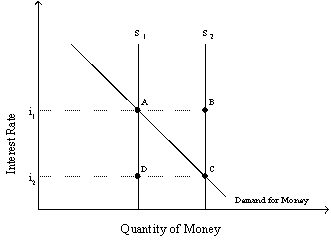

Exhibit 15-l

Refer to Exhibit 15-l.A Keynesian would say that natural market forces work so slowly in a recessionary gap in taking the economy between point __________ that an activist monetary policy is called for.

A) B and point D

B) B and point C

C) C and point B

D) B and point A

Refer to Exhibit 15-l.A Keynesian would say that natural market forces work so slowly in a recessionary gap in taking the economy between point __________ that an activist monetary policy is called for.

A) B and point D

B) B and point C

C) C and point B

D) B and point A

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is false?

A) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed that investment demand was interest-insensitive.

B) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed the money market was in the liquidity trap.

C) Keynesians would advocate an expansionary monetary policy to eliminate a recessionary gap if they believed investment spending was insensitive to changes in the interest rate.

D) Keynesians believe that money wages are inflexible in the downward direction.

A) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed that investment demand was interest-insensitive.

B) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed the money market was in the liquidity trap.

C) Keynesians would advocate an expansionary monetary policy to eliminate a recessionary gap if they believed investment spending was insensitive to changes in the interest rate.

D) Keynesians believe that money wages are inflexible in the downward direction.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

26

Persons who argue that monetary and fiscal policy should be deliberately used to smooth out the business cycle are called

A) activists.

B) disciples.

C) nonactivists.

D) controllers.

A) activists.

B) disciples.

C) nonactivists.

D) controllers.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit 15-l

Refer to Exhibit 15-l.A monetarist would claim that in a recessionary gap,the economy would move on its own from point

A) B to point C.

B) B to point A.

C) A to point B.

D) D to point C.

Refer to Exhibit 15-l.A monetarist would claim that in a recessionary gap,the economy would move on its own from point

A) B to point C.

B) B to point A.

C) A to point B.

D) D to point C.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit 15-l

Refer to Exhibit 15-l.A Keynesian monetary policy to eliminate a recessionary gap can be portrayed as a move between points

A) A and B.

B) B and C.

C) C and D.

D) D and A.

Refer to Exhibit 15-l.A Keynesian monetary policy to eliminate a recessionary gap can be portrayed as a move between points

A) A and B.

B) B and C.

C) C and D.

D) D and A.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 15-l

Refer to Exhibit 15-1.A Keynesian would say that market forces work more quickly in taking the economy from point______________ than from point _______________.

A) A to point D; D to point C

B) A to point D; A to point B

C) D to point C; B to point A

D) C to point D; C to point B

Refer to Exhibit 15-1.A Keynesian would say that market forces work more quickly in taking the economy from point______________ than from point _______________.

A) A to point D; D to point C

B) A to point D; A to point B

C) D to point C; B to point A

D) C to point D; C to point B

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is true?

A) In the monetarist transmission mechanism, changes in the money market directly affect aggregate demand.

B) In the monetarist transmission mechanism, there is no need for the money market to affect the loanable funds market or investment before aggregate demand is affected.

C) In the monetarist transmission mechanism, if individuals are faced with an excess supply of money, they spend that money on a wide variety of goods---not just bonds or other assets, as is the case in the Keynesian transmission mechanism.

D) a and b

E) a, b and c

A) In the monetarist transmission mechanism, changes in the money market directly affect aggregate demand.

B) In the monetarist transmission mechanism, there is no need for the money market to affect the loanable funds market or investment before aggregate demand is affected.

C) In the monetarist transmission mechanism, if individuals are faced with an excess supply of money, they spend that money on a wide variety of goods---not just bonds or other assets, as is the case in the Keynesian transmission mechanism.

D) a and b

E) a, b and c

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

31

If the money market is in the liquidity trap,then people

A) do not want to hold money because its value is at its lowest.

B) want to hold bonds because the interest rate is quite high.

C) do not want to hold bonds because their price is likely to decrease.

D) want to hold bonds because their price is high.

E) a, b and d

A) do not want to hold money because its value is at its lowest.

B) want to hold bonds because the interest rate is quite high.

C) do not want to hold bonds because their price is likely to decrease.

D) want to hold bonds because their price is high.

E) a, b and d

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose the money market is in the liquidity trap and that the economy is experiencing a recessionary gap.A Keynesian economist would most likely advocate

A) expansionary monetary policy.

B) contractionary monetary policy.

C) expansionary fiscal policy.

D) contractionary fiscal policy.

A) expansionary monetary policy.

B) contractionary monetary policy.

C) expansionary fiscal policy.

D) contractionary fiscal policy.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

33

If a liquidity trap exists,people are likely to be thinking that

A) bond prices are so low that they have nowhere to go but up; given this, now is a good time to be holding bonds.

B) bond prices are so high that they have nowhere to go but down; given this, it is better not to be holding bonds.

C) bond prices will soon rise so it is better to get out of bonds now.

D) interest rates will soon fall.

A) bond prices are so low that they have nowhere to go but up; given this, now is a good time to be holding bonds.

B) bond prices are so high that they have nowhere to go but down; given this, it is better not to be holding bonds.

C) bond prices will soon rise so it is better to get out of bonds now.

D) interest rates will soon fall.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

34

Keynesians are more likely to propose

A) contractionary monetary policy to eliminate an inflationary gap than expansionary monetary policy to eliminate a recessionary gap.

B) contractionary monetary policy to eliminate a recessionary gap than contractionary monetary policy to eliminate an inflationary gap.

C) expansionary monetary policy to eliminate a recessionary gap than contractionary monetary policy to eliminate an inflationary gap.

D) none of the above; instead, Keynesians are as likely to propose expansionary monetary policy to eliminate a recessionary gap as they are to propose contractionary monetary policy to eliminate an inflationary gap.

A) contractionary monetary policy to eliminate an inflationary gap than expansionary monetary policy to eliminate a recessionary gap.

B) contractionary monetary policy to eliminate a recessionary gap than contractionary monetary policy to eliminate an inflationary gap.

C) expansionary monetary policy to eliminate a recessionary gap than contractionary monetary policy to eliminate an inflationary gap.

D) none of the above; instead, Keynesians are as likely to propose expansionary monetary policy to eliminate a recessionary gap as they are to propose contractionary monetary policy to eliminate an inflationary gap.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

35

Exhibit 15-l

Refer to Exhibit 15-l.One argument against the use of activist monetary policy claims that it can destabilize the economy.For example,suppose we are in a recessionary gap.Expansionary monetary policy is implemented,but there are so many lags that by the time it has its effect,self-regulation has already closed the gap by itself.The end result is a movement from point

A) B to point D.

B) B to point C.

C) B to point A.

D) A to point C.

E) C to point B

Refer to Exhibit 15-l.One argument against the use of activist monetary policy claims that it can destabilize the economy.For example,suppose we are in a recessionary gap.Expansionary monetary policy is implemented,but there are so many lags that by the time it has its effect,self-regulation has already closed the gap by itself.The end result is a movement from point

A) B to point D.

B) B to point C.

C) B to point A.

D) A to point C.

E) C to point B

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

36

Compared to the Keynesian transmission mechanism,the monetarist transmission mechanism is

A) indirect and long.

B) direct and long.

C) direct and short.

D) indirect and short.

A) indirect and long.

B) direct and long.

C) direct and short.

D) indirect and short.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose the money market is in the liquidity trap and the Fed increases the supply of money.Individuals would rather hold __________ than __________ because they expect that bond prices can go no __________.

A) bonds; money; higher

B) bonds; money; lower

C) money; bonds; higher

D) money; bonds; lower

A) bonds; money; higher

B) bonds; money; lower

C) money; bonds; higher

D) money; bonds; lower

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

38

Exhibit 15-l

Refer to Exhibit 15-1.Keynesians are often accused of having an "inflationary bias." This is due at least in part to their advocacy of expansionary monetary policy when they believe it is needed to take the economy from point

A) B to point C.

B) B to point A.

C) D to point C.

D) A to point B.

Refer to Exhibit 15-1.Keynesians are often accused of having an "inflationary bias." This is due at least in part to their advocacy of expansionary monetary policy when they believe it is needed to take the economy from point

A) B to point C.

B) B to point A.

C) D to point C.

D) A to point B.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

39

Exhibit 15-l

Refer to Exhibit 15-l.A Keynesian monetary policy to eliminate an inflationary gap can be portrayed as a movement between point

A) A and point B.

B) B and point C.

C) C and point D.

D) D and point A.

Refer to Exhibit 15-l.A Keynesian monetary policy to eliminate an inflationary gap can be portrayed as a movement between point

A) A and point B.

B) B and point C.

C) C and point D.

D) D and point A.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

40

According to the monetarist transmission mechanism,a decrease in the supply of money will result in

A) individuals initially holding excess bonds.

B) individuals initially holding excess money.

C) a leftward shift in the aggregate demand curve.

D) a and c

A) individuals initially holding excess bonds.

B) individuals initially holding excess money.

C) a leftward shift in the aggregate demand curve.

D) a and c

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following may block the Keynesian transmission mechanism?

A) the loanable funds market

B) aggregate demand

C) interest-insensitive investment

D) the liquidity trap

E) c and d

A) the loanable funds market

B) aggregate demand

C) interest-insensitive investment

D) the liquidity trap

E) c and d

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

42

A person who opposes the deliberate use of fiscal and monetary policies is called a(n)

A) Keynesian.

B) fiscalist.

C) nonactivist.

D) activist.

A) Keynesian.

B) fiscalist.

C) nonactivist.

D) activist.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is false?

A) Activists are more likely to advocate fine-tuning the economy than nonactivists.

B) Activists believe that monetary and fiscal policies can be and should be deliberately used to smooth out the business cycle.

C) Nonactivists believe that monetary and fiscal policies cannot and should not be deliberately used to (try to) smooth out the business cycle.

D) Nonactivists favor rules-based monetary policy.

E) none of the above

A) Activists are more likely to advocate fine-tuning the economy than nonactivists.

B) Activists believe that monetary and fiscal policies can be and should be deliberately used to smooth out the business cycle.

C) Nonactivists believe that monetary and fiscal policies cannot and should not be deliberately used to (try to) smooth out the business cycle.

D) Nonactivists favor rules-based monetary policy.

E) none of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is likely to be made by an economist who believes in activist monetary policy? (1)The more closely monetary policy can be designed to meet the particulars of a given economic environment,the better.(2)Because of long and uncertain time lags,activist monetary policy may be destabilizing rather than stabilizing.(3)There is sufficient flexibility in wages and prices in modern economies to allow the economy to equilibrate in reasonable speed at the natural level of Real GDP.(4)The "same-for-all-seasons" monetary policy is the way to proceed.(5)There is evidence that monetary policy in the mid-1970s caused a recession.

A) (1), (2), and (3)

B) (1), (4), and (5)

C) (1) and (5)

D) (4) and (5)

E) (1), (3), and (4)

A) (1), (2), and (3)

B) (1), (4), and (5)

C) (1) and (5)

D) (4) and (5)

E) (1), (3), and (4)

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is likely to be made by an economist who does not believe in activist monetary policy? (1)The more closely monetary policy can he designed to meet the particulars of a given economic environment,the better.(2)Because of long and uncertain time lags,activist monetary policy may be destabilizing rather than stabilizing.(3)There is sufficient flexibility in wages and prices in modern economies to allow the economy to equilibrate in reasonable speed at the natural level of Real GDP,(4)The "same-for-all-seasons" monetary policy is the way to proceed.(5)There is evidence that monetary policy in the mid-1970s caused a recession.

A) (1), (2), and (3)

B) (1), (4), and (5)

C) (2), (3), and (4)

D) (3), (4), and (5)

E) (1) only

A) (1), (2), and (3)

B) (1), (4), and (5)

C) (2), (3), and (4)

D) (3), (4), and (5)

E) (1) only

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

46

Nonactivists favor

A) the use of fiscal policies to manage the economy.

B) the use of monetary polices to manage the economy.

C) fine-tuning.

D) rules for conducting monetary and fiscal policies.

A) the use of fiscal policies to manage the economy.

B) the use of monetary polices to manage the economy.

C) fine-tuning.

D) rules for conducting monetary and fiscal policies.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

47

Activists believe that

A) there is sufficient flexibility in wages and prices to allow the economy to equilibrate at full-employment Real GDP in a reasonable period of time.

B) discretionary fiscal policies do not work.

C) discretionary monetary policies do not work.

D) fine-tuning to smooth out the business cycle is feasible.

A) there is sufficient flexibility in wages and prices to allow the economy to equilibrate at full-employment Real GDP in a reasonable period of time.

B) discretionary fiscal policies do not work.

C) discretionary monetary policies do not work.

D) fine-tuning to smooth out the business cycle is feasible.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

48

Economist Smith favors an activist monetary policy.He says that if the economy is going to be stabilized over time,it is necessary to fine-tune the money supply to the particular economic conditions that exist.What would economist Jones,who favors rules-based monetary policy,say to economist Smith?

A) Because of long lags, activist monetary policy is likely to be destabilizing rather than stabilizing.

B) There have been times when activist monetary policy has worked well.

C) There have been times when a constant-money-growth-rate rule has worked poorly.

D) Flexibility is desirable when it comes to monetary policy.

A) Because of long lags, activist monetary policy is likely to be destabilizing rather than stabilizing.

B) There have been times when activist monetary policy has worked well.

C) There have been times when a constant-money-growth-rate rule has worked poorly.

D) Flexibility is desirable when it comes to monetary policy.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

49

Economist Jones favors a constant-money-growth-rate rule.She says that if the annual money supply growth rate each year is equal to the average annual growth rate in Real GDP,price stability will exist over time.What would economist Smith,who favors activist monetary policy,say to economist Jones?

A) Your analysis assumes that Real GDP is constant over time, and it is not.

B) Your analysis assumes that velocity is constant, and it is not.

C) Your analysis assumes that you can correctly define the money supply.

D) b and c

E) a, b and c

A) Your analysis assumes that Real GDP is constant over time, and it is not.

B) Your analysis assumes that velocity is constant, and it is not.

C) Your analysis assumes that you can correctly define the money supply.

D) b and c

E) a, b and c

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

50

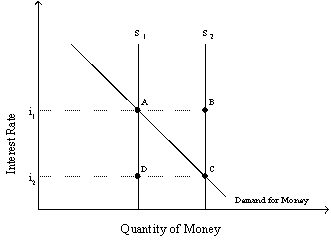

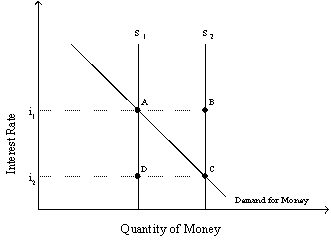

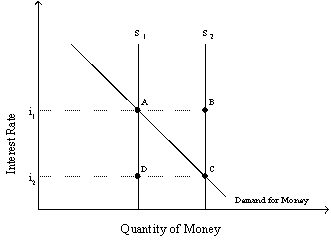

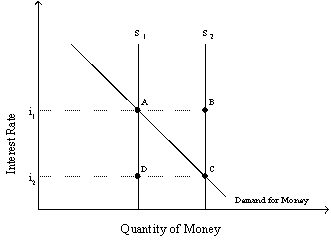

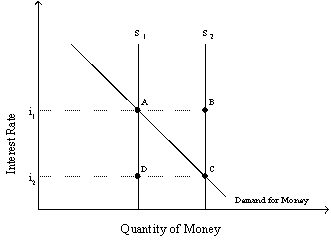

Exhibit 15-2

Refer to Exhibit 15-2.A(n)__________ in the money supply from S? to S? would have a tendency to __________ the amount of investment,assuming investment is sensitive to changes in the interest rate.

A) decrease; raise

B) decrease; lower

C) increase; raise

D) increase; lower

Refer to Exhibit 15-2.A(n)__________ in the money supply from S? to S? would have a tendency to __________ the amount of investment,assuming investment is sensitive to changes in the interest rate.

A) decrease; raise

B) decrease; lower

C) increase; raise

D) increase; lower

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

51

Exhibit 15-2

Refer to Exhibit 15-2. If the interest rate is i? and the relevant money supply curve is S?,then there is a

A) shortage of money between points B and A.

B) surplus of money between points B and A.

C) surplus of money between points C and D.

D) shortage of money between points C and D.

Refer to Exhibit 15-2. If the interest rate is i? and the relevant money supply curve is S?,then there is a

A) shortage of money between points B and A.

B) surplus of money between points B and A.

C) surplus of money between points C and D.

D) shortage of money between points C and D.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

52

The routes or channels that ripple effects created in the money market travel to impact the goods-and-services market are known as

A) the transmission lag.

B) monetary policy.

C) the liquidity trap.

D) the transmission mechanism.

A) the transmission lag.

B) monetary policy.

C) the liquidity trap.

D) the transmission mechanism.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

53

The rules-based monetary policy that some nonactivists have proposed to maintain price stability reads this way:

A) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP minus the growth rate in velocity.

B) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP plus the growth rate in velocity.

C) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP divided by the growth rate in velocity.

D) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP times the growth rate in velocity.

A) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP minus the growth rate in velocity.

B) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP plus the growth rate in velocity.

C) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP divided by the growth rate in velocity.

D) The annual growth rate in the money supply will equal the average annual growth rate in Real GDP times the growth rate in velocity.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

54

Activists believe that

A) monetary policy should not be used to smooth out the business cycle.

B) fiscal policy should not be used to smooth out the business cycle.

C) the frequent use of fiscal or monetary policy is called for to smooth out the business cycle.

D) rules should be established for the conduct of both monetary and fiscal policy.

A) monetary policy should not be used to smooth out the business cycle.

B) fiscal policy should not be used to smooth out the business cycle.

C) the frequent use of fiscal or monetary policy is called for to smooth out the business cycle.

D) rules should be established for the conduct of both monetary and fiscal policy.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

55

Exhibit 15-2

Refer to Exhibit 15-2. If the interest rate is i? and the relevant money supply curve is S?,then there is a

A) shortage of money between points B and A.

B) surplus of money between points B and A.

C) surplus of money between points C and D.

D) shortage of money between points C and D.

Refer to Exhibit 15-2. If the interest rate is i? and the relevant money supply curve is S?,then there is a

A) shortage of money between points B and A.

B) surplus of money between points B and A.

C) surplus of money between points C and D.

D) shortage of money between points C and D.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

56

A change in the money supply will change investment when

A) the money supply is a function of the price level.

B) investment is interest-sensitive.

C) investment depends only on the level of GDP.

D) investment is interest-insensitive.

E) the supply for money is a function of the interest rate.

A) the money supply is a function of the price level.

B) investment is interest-sensitive.

C) investment depends only on the level of GDP.

D) investment is interest-insensitive.

E) the supply for money is a function of the interest rate.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

57

Economists who propose a constant-money-growth-rate rule often argue that setting the annual growth rate in the money supply equal to the average annual growth rate in Real GDP

A) maintains price level stability over time.

B) is a way to raise Real GDP.

C) will cause the price level to fall over time.

D) a and b

E) a, b and c

A) maintains price level stability over time.

B) is a way to raise Real GDP.

C) will cause the price level to fall over time.

D) a and b

E) a, b and c

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

58

Economists who favor activist monetary policy often argue that

A) during the mid-1970s, money supply growth rates were nearly constant and still the economy went through a recession.

B) during the mid-1970s, activist monetary policy was applied and the economy was healthy and stable.

C) activist monetary policy is inflexible and this is one of its virtues; the money supply doesn't change every year in response to political considerations.

D) activist monetary policy is likely to be destabilizing most of the time, but still it is the better way to proceed.

A) during the mid-1970s, money supply growth rates were nearly constant and still the economy went through a recession.

B) during the mid-1970s, activist monetary policy was applied and the economy was healthy and stable.

C) activist monetary policy is inflexible and this is one of its virtues; the money supply doesn't change every year in response to political considerations.

D) activist monetary policy is likely to be destabilizing most of the time, but still it is the better way to proceed.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

59

Exhibit 15-2

Refer to Exhibit 15-2.A(n)__________ in the money supply from S? to S? would have a tendency to __________ the opportunity cost of holding money.

A) increase; raise

B) increase; lower

C) decrease; raise

D) decrease; lower

Refer to Exhibit 15-2.A(n)__________ in the money supply from S? to S? would have a tendency to __________ the opportunity cost of holding money.

A) increase; raise

B) increase; lower

C) decrease; raise

D) decrease; lower

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

60

Economists who favor activist monetary policy argue that

A) the economy does not always equilibrate quickly enough at the Natural Real GDP or full-employment output and therefore needs help.

B) activist monetary policy is effective at smoothing out the business cycle.

C) activist monetary policy is flexible and flexibility is a desirable quality in monetary policy.

D) a and b

E) a, b and c

A) the economy does not always equilibrate quickly enough at the Natural Real GDP or full-employment output and therefore needs help.

B) activist monetary policy is effective at smoothing out the business cycle.

C) activist monetary policy is flexible and flexibility is a desirable quality in monetary policy.

D) a and b

E) a, b and c

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

61

Activists hold that

A) activist monetary policy is flexible.

B) nonactivist monetary policy is inflexible.

C) the economy does not always return quickly enough to full-employment output.

D) a and b

E) all of the above

A) activist monetary policy is flexible.

B) nonactivist monetary policy is inflexible.

C) the economy does not always return quickly enough to full-employment output.

D) a and b

E) all of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

62

Under a constant growth rate of money rule of 4 percent in an economy in which Real GDP grows at an average rate of 3 percent and velocity is constant,the inflation rate is

A) 7 percent.

B) -7 percent.

C) 1 percent.

D) -1 percent.

E) constant at zero.

A) 7 percent.

B) -7 percent.

C) 1 percent.

D) -1 percent.

E) constant at zero.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

63

Monetary policy is

A) the policy concerning changes in the money supply that is pursued to achieve particular macroeconomic goals.

B) the expenditures and taxation policy that the government pursues to achieve particular macroeconomic goals.

C) the investment policy that businesses pursue to achieve particular macroeconomic goals.

D) the spending and saving policy that consumers pursue to achieve particular macroeconomic goals.

E) the spending policy that the Treasury pursues to achieve particular macroeconomic goals.

A) the policy concerning changes in the money supply that is pursued to achieve particular macroeconomic goals.

B) the expenditures and taxation policy that the government pursues to achieve particular macroeconomic goals.

C) the investment policy that businesses pursue to achieve particular macroeconomic goals.

D) the spending and saving policy that consumers pursue to achieve particular macroeconomic goals.

E) the spending policy that the Treasury pursues to achieve particular macroeconomic goals.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

64

According to the monetarist transmission mechanism,a decrease in the money supply __________ aggregate demand.

A) directly increases

B) indirectly increases

C) directly decreases

D) indirectly decreases

E) equals the increase in

A) directly increases

B) indirectly increases

C) directly decreases

D) indirectly decreases

E) equals the increase in

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

65

If the investment demand curve is vertical,a decrease in the interest rate will __________ investment,and therefore aggregate demand will __________.

A) increase; increase

B) decrease; increase

C) decrease; decrease

D) decrease; remain unchanged

E) not affect; remain unchanged

A) increase; increase

B) decrease; increase

C) decrease; decrease

D) decrease; remain unchanged

E) not affect; remain unchanged

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

66

The quantity supplied of money is assumed (in the textbook)to be

A) inversely related to the interest rate.

B) directly related to the interest rate.

C) independent of the interest rate.

D) determined exclusively by banks.

E) c and d

A) inversely related to the interest rate.

B) directly related to the interest rate.

C) independent of the interest rate.

D) determined exclusively by banks.

E) c and d

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

67

Under a constant growth rate of money rule of 5 percent in an economy in which Real GDP grows at an average rate of 5 percent and velocity is constant,the inflation rate is

A) 5 percent.

B) -5 percent.

C) 25 percent.

D) -25 percent.

E) constant at zero.

A) 5 percent.

B) -5 percent.

C) 25 percent.

D) -25 percent.

E) constant at zero.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

68

In the Keynesian transmission mechanism,if the money market is in the liquidity trap,an increase in the money supply will

A) cause total expenditures and aggregate demand to increase.

B) cause total expenditures and aggregate demand to decrease.

C) have no impact on total expenditures and aggregate demand.

D) cause total expenditures to increase and aggregate demand to decrease.

E) cause total expenditures to decrease and aggregate demand to increase.

A) cause total expenditures and aggregate demand to increase.

B) cause total expenditures and aggregate demand to decrease.

C) have no impact on total expenditures and aggregate demand.

D) cause total expenditures to increase and aggregate demand to decrease.

E) cause total expenditures to decrease and aggregate demand to increase.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

69

According to the Keynesian transmission mechanism,an increase in the money supply causes a(n)__________ in the interest rate and a(n)__________ in investment,which in turn causes a(n)__________ in total expenditures and aggregate demand.

A) increase; decrease; decrease

B) increase; increase; decrease

C) decrease; increase; increase

D) decrease; decrease; increase

A) increase; decrease; decrease

B) increase; increase; decrease

C) decrease; increase; increase

D) decrease; decrease; increase

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

70

The quantity demanded of money is

A) inversely related to the interest rate.

B) directly related to the interest rate.

C) inversely related to the general price level.

D) inversely related to GDP.

E) a, c, and d

A) inversely related to the interest rate.

B) directly related to the interest rate.

C) inversely related to the general price level.

D) inversely related to GDP.

E) a, c, and d

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

71

Persons who argue against the deliberate use of fiscal and monetary policies to smooth out the business cycle are referred to as

A) nonactivists.

B) fine-tuners.

C) activists.

D) b and c

E) none of the above

A) nonactivists.

B) fine-tuners.

C) activists.

D) b and c

E) none of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

72

In the Keynesian transmission mechanism,if investment is completely interest-insensitive,then an increase in the money supply will

A) cause total expenditures and aggregate demand to increase.

B) cause total expenditures and aggregate demand to decrease.

C) have no impact on total expenditures and aggregate demand.

D) cause total expenditures to increase and aggregate demand to decrease.

E) cause total expenditures to decrease and aggregate demand to increase.

A) cause total expenditures and aggregate demand to increase.

B) cause total expenditures and aggregate demand to decrease.

C) have no impact on total expenditures and aggregate demand.

D) cause total expenditures to increase and aggregate demand to decrease.

E) cause total expenditures to decrease and aggregate demand to increase.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

73

As the opportunity cost of holding money decreases,the quantity demanded of money

A) increases.

B) decreases.

C) remains unchanged.

D) increases, then decreases.

E) decreases, then increases.

A) increases.

B) decreases.

C) remains unchanged.

D) increases, then decreases.

E) decreases, then increases.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

74

To eliminate a recessionary gap the Fed typically uses __________ monetary policy,and to eliminate an inflationary gap the Fed typically uses __________ monetary policy.

A) expansionary; expansionary

B) expansionary; contractionary

C) contractionary; contractionary

D) contractionary; expansionary

A) expansionary; expansionary

B) expansionary; contractionary

C) contractionary; contractionary

D) contractionary; expansionary

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

75

Under conditions of a liquidity trap and interest-insensitive investment,Keynesians would be most likely to propose __________ policy to eliminate a recessionary gap.

A) expansionary fiscal

B) contractionary fiscal

C) expansionary monetary

D) contractionary monetary

A) expansionary fiscal

B) contractionary fiscal

C) expansionary monetary

D) contractionary monetary

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

76

The liquidity trap is the

A) vertical portion of the demand curve for money.

B) horizontal portion of the demand curve for money.

C) vertical portion of the supply curve of money.

D) horizontal portion of the supply curve of money.

E) vertical portion of the demand curve for investment.

A) vertical portion of the demand curve for money.

B) horizontal portion of the demand curve for money.

C) vertical portion of the supply curve of money.

D) horizontal portion of the supply curve of money.

E) vertical portion of the demand curve for investment.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

77

The monetary policy most likely to be favored by monetarists is

A) a constant (nongrowing) money supply.

B) frequent discretionary changes in the money growth rate.

C) a constant and slow rate of monetary growth.

D) vigorous monetary expansion during recessions.

E) a steadily increasing rate of monetary growth.

A) a constant (nongrowing) money supply.

B) frequent discretionary changes in the money growth rate.

C) a constant and slow rate of monetary growth.

D) vigorous monetary expansion during recessions.

E) a steadily increasing rate of monetary growth.

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

78

Nonactivists hold that

A) activist monetary policies are likely to be destabilizing rather than stabilizing.

B) economic fine-tuning is quite feasible.

C) flexibility in wages and prices is sufficient to allow the economy to return at a reasonable speed to full-employment output.

D) a and c

E) all of the above

A) activist monetary policies are likely to be destabilizing rather than stabilizing.

B) economic fine-tuning is quite feasible.

C) flexibility in wages and prices is sufficient to allow the economy to return at a reasonable speed to full-employment output.

D) a and c

E) all of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

79

To try to eliminate a recessionary gap the Fed typically__________ the money supply,and to try to eliminate an inflationary gap the Fed typically __________ the money supply.

A) increases; decreases

B) increases; increases

C) decreases; increases

D) decreases; decreases

A) increases; decreases

B) increases; increases

C) decreases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck

80

A rules-based monetary policy

A) is advocated by activists.

B) is advocated by nonactivists.

C) could involve a predetermined steady growth rate in the money supply.

D) b and c

E) all of the above

A) is advocated by activists.

B) is advocated by nonactivists.

C) could involve a predetermined steady growth rate in the money supply.

D) b and c

E) all of the above

Unlock Deck

Unlock for access to all 176 flashcards in this deck.

Unlock Deck

k this deck