Deck 18: Structuring Real Estate Investments: Organizational Forms and Joint Ventures

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/19

Play

Full screen (f)

Deck 18: Structuring Real Estate Investments: Organizational Forms and Joint Ventures

1

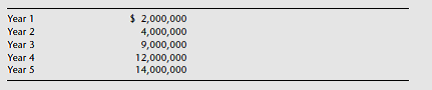

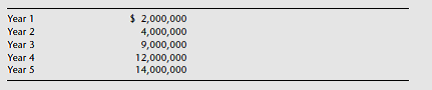

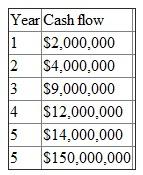

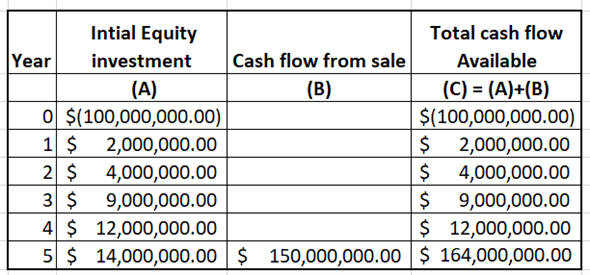

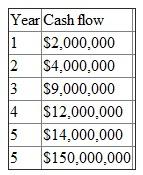

ABC Fund has decided to enter into a joint venture with Newtown Development Inc. to develop and operate an office building that will require an initial investment of $100 million to cover all the development costs (hard and soft costs). There will be no debt financing for the joint venture. Each party invests its capital at the beginning of the first year and cash flow from operations is projected as follows:

It is expected that the property will be sold at the end of year 5 for $150 million.

ABC Fund will invest $45 million and Newtown Development Inc. will invest the remaining $55 million needed for the development costs. The $50 million development costs already include a developer fee to Newtown Development Inc. and the cash flow projections for each year above are net of a property management fee being paid to Newtown Development Inc.

ABC Fund will receive a 5 percent operating return that is noncumulative. That is, any shortfall is not carried over to the next year but is paid before Newtown Development Inc. receives any cash from operations. After ABC Fund is paid its preferred return, Newtown Development Inc. will receive a 5 percent operating return on its contributed capital. This is also noncumulative. Any remaining cash flow from operations is split 50-50 to each party.

When the property is sold, proceeds from sale will be distributed as follows:

First, repay the initial capital investment by ABC Fund.

Next, repay the initial capital investment by Newtown Development Inc.

Next, pay ABC Fund an 11 percent IRR preference on its investment.

Thereafter, split all proceeds 50-50.

Use the above assumptions to calculate the cash flows that each party will receive and its expected IRR.

It is expected that the property will be sold at the end of year 5 for $150 million.

ABC Fund will invest $45 million and Newtown Development Inc. will invest the remaining $55 million needed for the development costs. The $50 million development costs already include a developer fee to Newtown Development Inc. and the cash flow projections for each year above are net of a property management fee being paid to Newtown Development Inc.

ABC Fund will receive a 5 percent operating return that is noncumulative. That is, any shortfall is not carried over to the next year but is paid before Newtown Development Inc. receives any cash from operations. After ABC Fund is paid its preferred return, Newtown Development Inc. will receive a 5 percent operating return on its contributed capital. This is also noncumulative. Any remaining cash flow from operations is split 50-50 to each party.

When the property is sold, proceeds from sale will be distributed as follows:

First, repay the initial capital investment by ABC Fund.

Next, repay the initial capital investment by Newtown Development Inc.

Next, pay ABC Fund an 11 percent IRR preference on its investment.

Thereafter, split all proceeds 50-50.

Use the above assumptions to calculate the cash flows that each party will receive and its expected IRR.

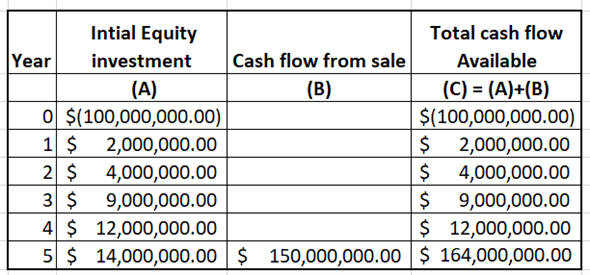

ABC fund and NDI industry comes together to make a joint venture for new project. The initial investment requires for the joint venture project is $100 million to cover all development cost. ABC fund contribute $55 million and NDI industry contribute remaining $45 million to construct the joint venture. From the cash flow first of all ABC fund receive 5% operating return and then BDI industry will receive 5% operating return. After distributing the operating return from the remaining cash flow both party distribute 50:50.

After 5 year the property will sold foe $150 million.

Cash flow from project is shown below in table:

As it is quoted that Investment of NDI is $55 million. Which include NDI fee of $50 million. Therefore, net investment by NDI is $55million - $50 Million = $5 million.

As it is quoted that Investment of NDI is $55 million. Which include NDI fee of $50 million. Therefore, net investment by NDI is $55million - $50 Million = $5 million.

First of all, ABC fund will get 5% operating return then NDI will get 5% operating return then remaining amount will be distributed in 50: 50 ratios.

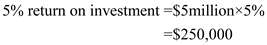

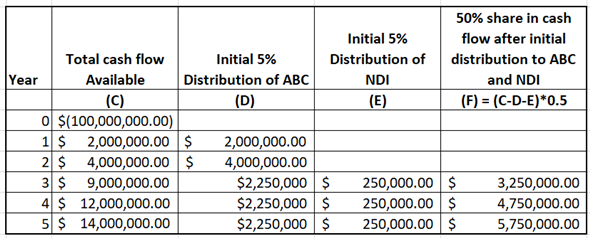

For the first year and second year NDI will not receive any cash flow. During year 3, total cash available to distribution increases the to $9,000,000. Therefore, ABC will receive 5% on its investment and NDI will also receive 5% return on its investment. The remining cash flow after distribution will be distributed in 50: 50 ratio. calculated as follows:

For the first year and second year NDI will not receive any cash flow. During year 3, total cash available to distribution increases the to $9,000,000. Therefore, ABC will receive 5% on its investment and NDI will also receive 5% return on its investment. The remining cash flow after distribution will be distributed in 50: 50 ratio. calculated as follows:

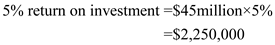

5% of ABC fund operating return is calculated below:

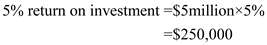

5% of NDI industry operating return is calculated below:

5% of NDI industry operating return is calculated below:

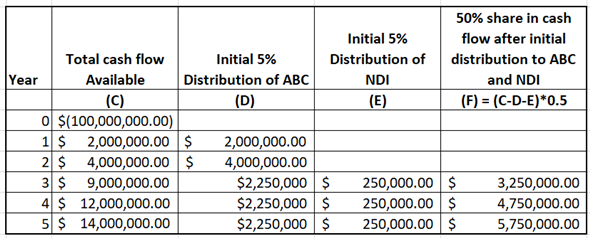

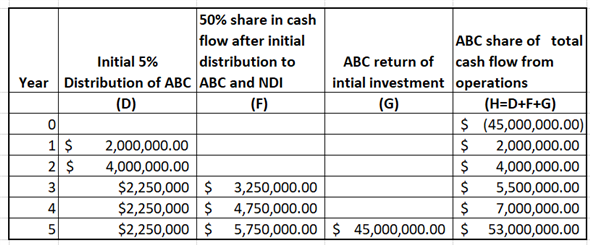

ABC share of cash flow from operation is shown below:

ABC share of cash flow from operation is shown below:

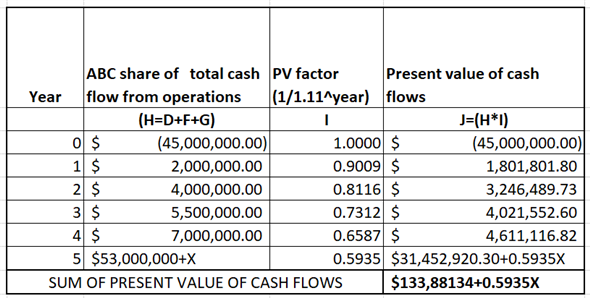

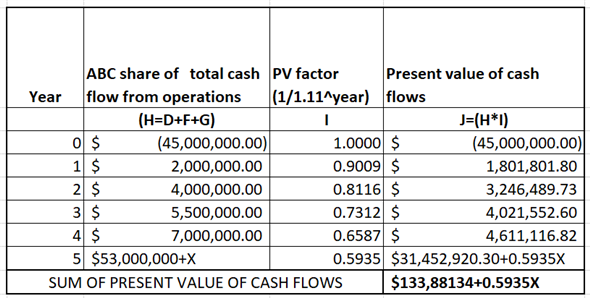

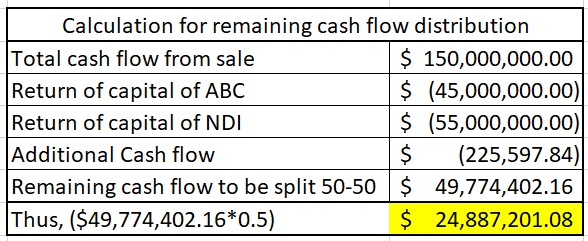

To achieve 11% IRR, calculate what amount of addition cash flow is required. Let X be the additional amount.

To achieve 11% IRR, calculate what amount of addition cash flow is required. Let X be the additional amount.

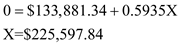

SUM of present value is equal to zero to get IRR of 11%. Calculate X as follows:

SUM of present value is equal to zero to get IRR of 11%. Calculate X as follows:

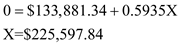

Thus, Additional amount of cash flow is $225,597.84.

Thus, Additional amount of cash flow is $225,597.84.

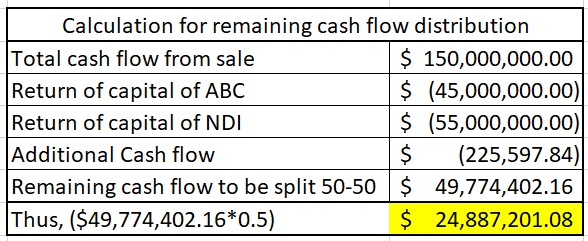

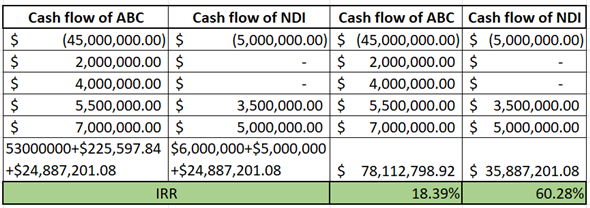

Cash flows of each party is shown below. Also, Expected IRR is calculated using IRR function of excel as follows:

Cash flows of each party is shown below. Also, Expected IRR is calculated using IRR function of excel as follows:

Thus, expected IRR of ABC is

Thus, expected IRR of ABC is

and NDI is

and NDI is

.

.

After 5 year the property will sold foe $150 million.

Cash flow from project is shown below in table:

As it is quoted that Investment of NDI is $55 million. Which include NDI fee of $50 million. Therefore, net investment by NDI is $55million - $50 Million = $5 million.

As it is quoted that Investment of NDI is $55 million. Which include NDI fee of $50 million. Therefore, net investment by NDI is $55million - $50 Million = $5 million. First of all, ABC fund will get 5% operating return then NDI will get 5% operating return then remaining amount will be distributed in 50: 50 ratios.

For the first year and second year NDI will not receive any cash flow. During year 3, total cash available to distribution increases the to $9,000,000. Therefore, ABC will receive 5% on its investment and NDI will also receive 5% return on its investment. The remining cash flow after distribution will be distributed in 50: 50 ratio. calculated as follows:

For the first year and second year NDI will not receive any cash flow. During year 3, total cash available to distribution increases the to $9,000,000. Therefore, ABC will receive 5% on its investment and NDI will also receive 5% return on its investment. The remining cash flow after distribution will be distributed in 50: 50 ratio. calculated as follows:5% of ABC fund operating return is calculated below:

5% of NDI industry operating return is calculated below:

5% of NDI industry operating return is calculated below:

ABC share of cash flow from operation is shown below:

ABC share of cash flow from operation is shown below: To achieve 11% IRR, calculate what amount of addition cash flow is required. Let X be the additional amount.

To achieve 11% IRR, calculate what amount of addition cash flow is required. Let X be the additional amount.  SUM of present value is equal to zero to get IRR of 11%. Calculate X as follows:

SUM of present value is equal to zero to get IRR of 11%. Calculate X as follows: Thus, Additional amount of cash flow is $225,597.84.

Thus, Additional amount of cash flow is $225,597.84. Cash flows of each party is shown below. Also, Expected IRR is calculated using IRR function of excel as follows:

Cash flows of each party is shown below. Also, Expected IRR is calculated using IRR function of excel as follows: Thus, expected IRR of ABC is

Thus, expected IRR of ABC is  and NDI is

and NDI is  .

. 2

What is the difference between an IRR preference and an IRR lookback

After a property is finally sold, cash distributions from available cash flows from sales are made after debt repayment. Investors are paid off initially an amount equal to the capital invested by them in the venture. Any remaining cash flows are then distributed in proportion of amount invested by each investor.

An IRR preference refers to the later part of cash distributions. Essentially it means that one or more investors will receive an amount which is sufficient to achieve the required IRR on equity invested for the entire investment period. This amount is received by investors after initial distributions are made. The additional cash flows available after distributing the IRR preference is then distributed among remaining partners in predetermined proportion for eg. 25% or 50% to each party.

IRR Lookback refers to cash distribution after the initial distributions to each partner in predetermined proportion subject to the condition that one or more investor must achieve a specified IRR. If this is not achieved then some of the cash which had been previously distributed to all partners must be redistributed so that partners who must earn an IRR lookback are able to achieve their specified return. (For deeper understanding, refer to the example given under textbook explanation of the above topic.)

An IRR preference refers to the later part of cash distributions. Essentially it means that one or more investors will receive an amount which is sufficient to achieve the required IRR on equity invested for the entire investment period. This amount is received by investors after initial distributions are made. The additional cash flows available after distributing the IRR preference is then distributed among remaining partners in predetermined proportion for eg. 25% or 50% to each party.

IRR Lookback refers to cash distribution after the initial distributions to each partner in predetermined proportion subject to the condition that one or more investor must achieve a specified IRR. If this is not achieved then some of the cash which had been previously distributed to all partners must be redistributed so that partners who must earn an IRR lookback are able to achieve their specified return. (For deeper understanding, refer to the example given under textbook explanation of the above topic.)

3

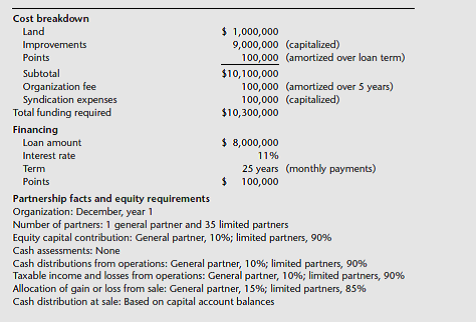

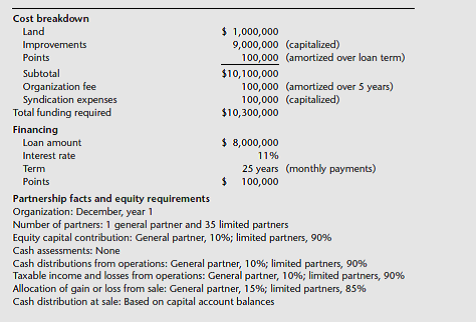

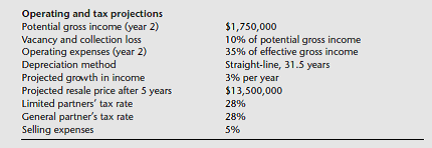

Venture Capital Limited has formed a private real estate syndication to acquire and operate the Tower Office Building. Venture will act as the general partner and will have 35 individual limited partners. The venture to be undertaken and relevant cost and financial data are summarized as follows:

a. Determine an estimated return ( ATIRR e) for a limited partner. ( Hint: Consider all 35 limited partners as a single investor.)

b. Determine an estimated return ( ATIRR e) for the general partner.

c. Why do the returns differ for the general and limited partners

a. Determine an estimated return ( ATIRR e) for a limited partner. ( Hint: Consider all 35 limited partners as a single investor.)

b. Determine an estimated return ( ATIRR e) for the general partner.

c. Why do the returns differ for the general and limited partners

a.

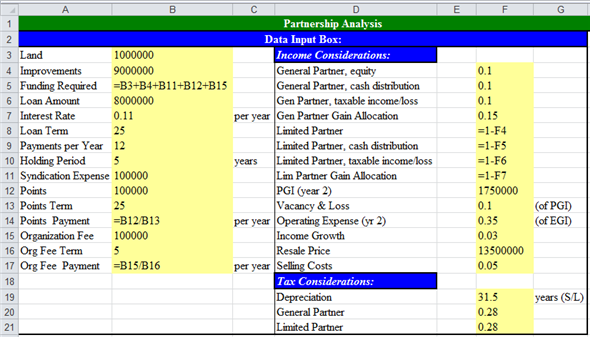

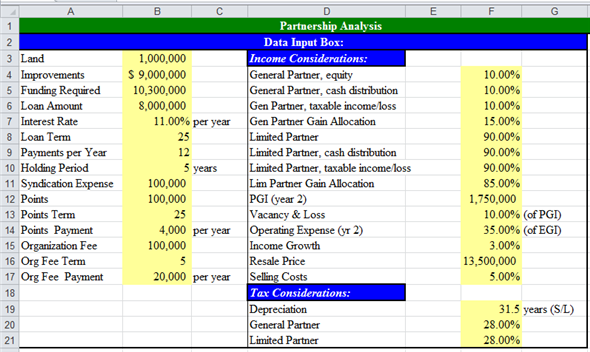

Compute ATIRR for Limited Partners in the following steps.

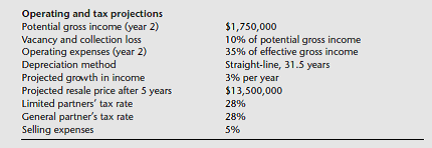

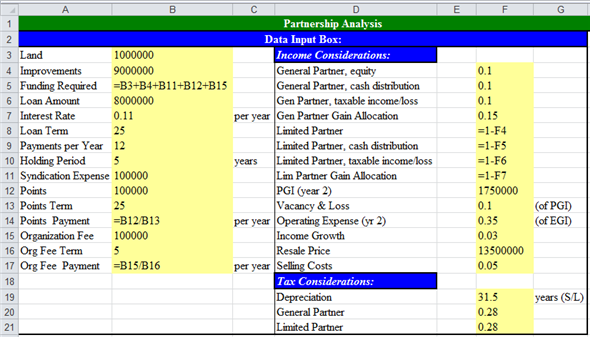

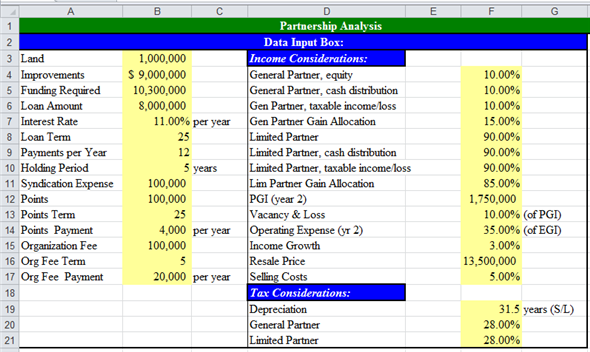

First step: Use spreadsheet for the required computations. Enter given values and formulas in spreadsheet to create input section as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

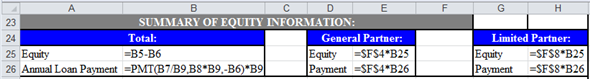

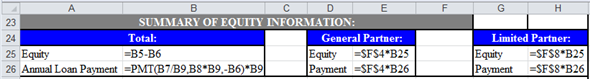

Second step: Prepare summary of equity information. Enter given values and formulas in spreadsheet as shown in the image below.

Second step: Prepare summary of equity information. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

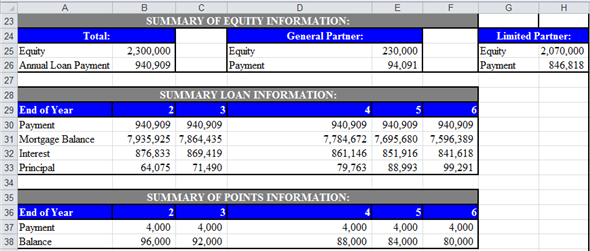

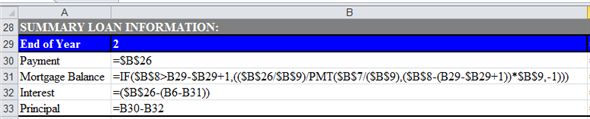

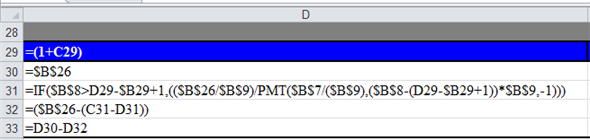

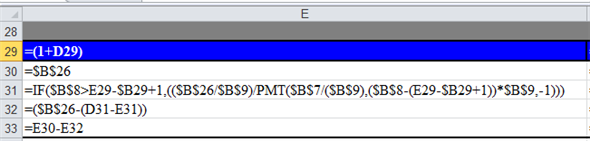

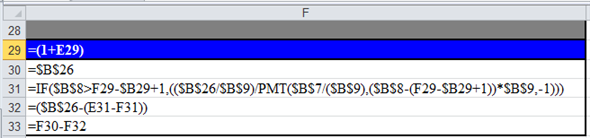

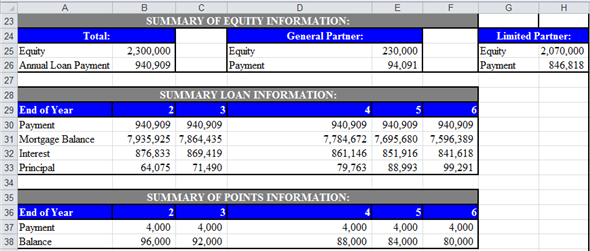

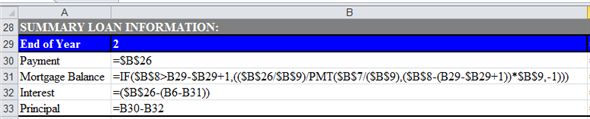

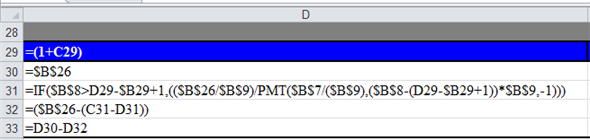

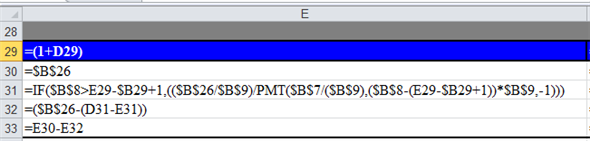

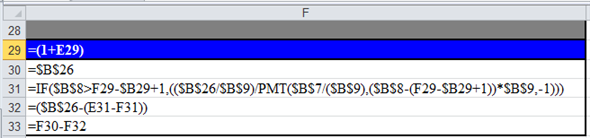

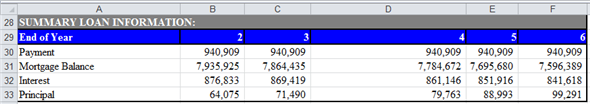

Third step: Prepare summary of loan information. Enter given values and formulas in spreadsheet (in Cells A28:F33) as shown in the image below.

Third step: Prepare summary of loan information. Enter given values and formulas in spreadsheet (in Cells A28:F33) as shown in the image below.

In Cells A28:B33

In Cells C28:C33

In Cells C28:C33

In Cells D28:D33

In Cells D28:D33

In Cells E28:E33

In Cells E28:E33

In Cells F28:F33

In Cells F28:F33

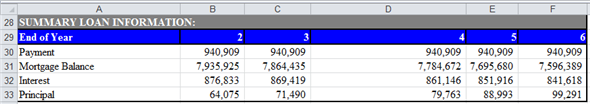

Obtained results are shown below.

Obtained results are shown below.

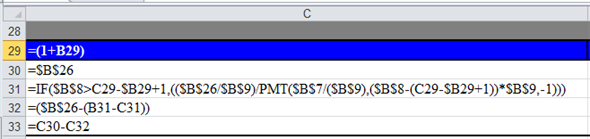

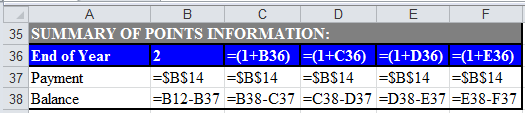

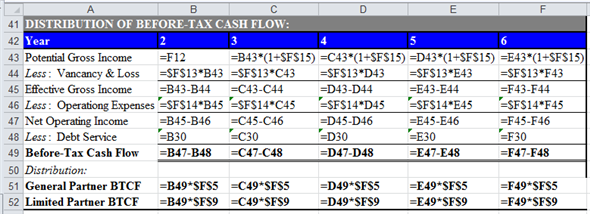

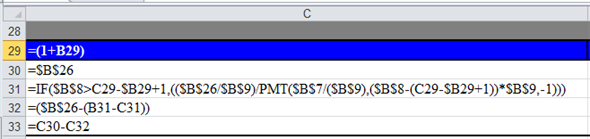

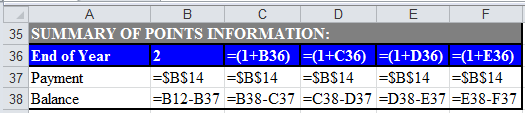

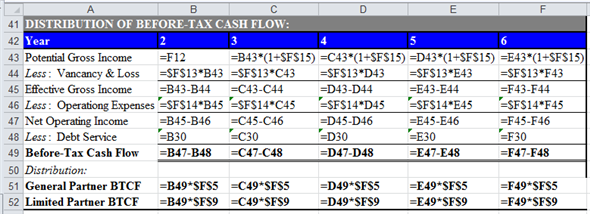

Fourth step: Prepare summary of points information. Enter given values and formulas in spreadsheet as shown in the image below.

Fourth step: Prepare summary of points information. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

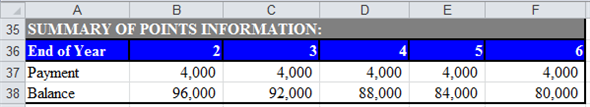

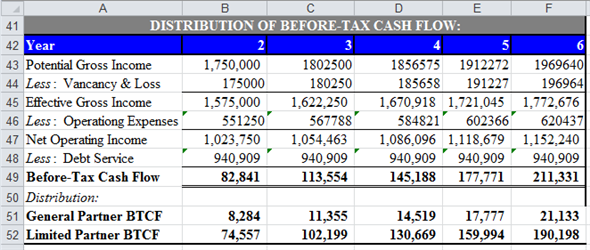

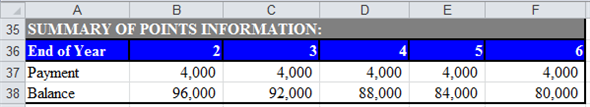

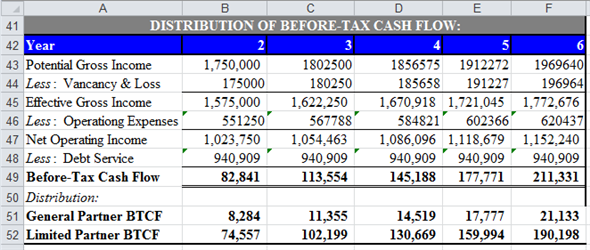

Fifth step: Prepare statement of distribution of cash flows. Enter given values and formulas in spreadsheet as shown in the image below.

Fifth step: Prepare statement of distribution of cash flows. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

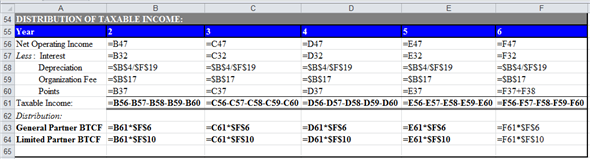

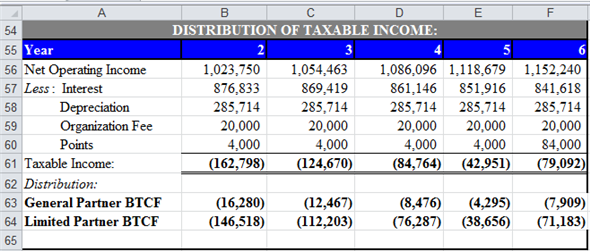

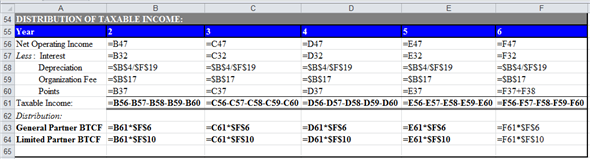

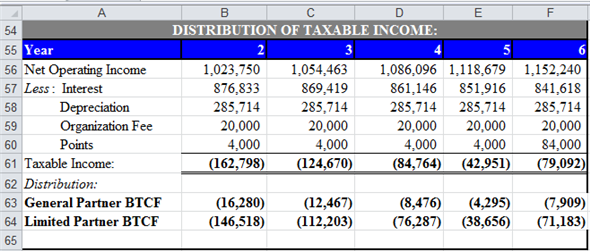

Sixth step: Prepare statement of distribution of taxable income. Enter given values and formulas in spreadsheet as shown in the image below.

Sixth step: Prepare statement of distribution of taxable income. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

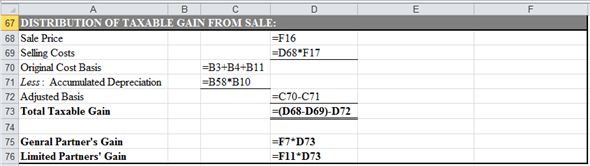

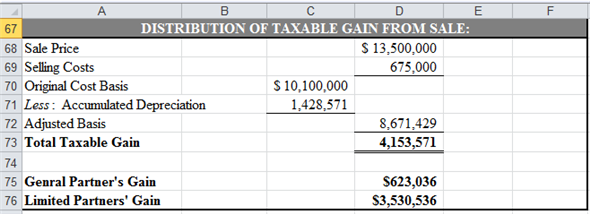

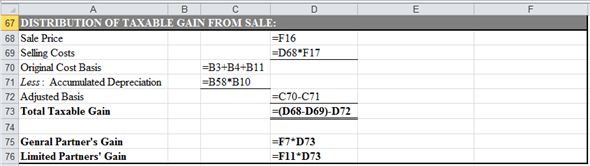

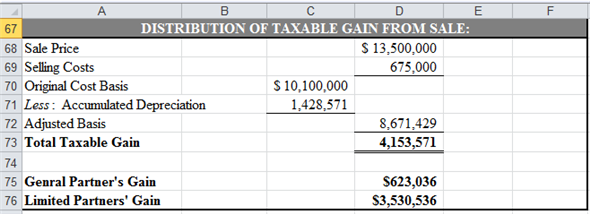

Seventh step: Prepare statement of distribution of taxable gain from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Seventh step: Prepare statement of distribution of taxable gain from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

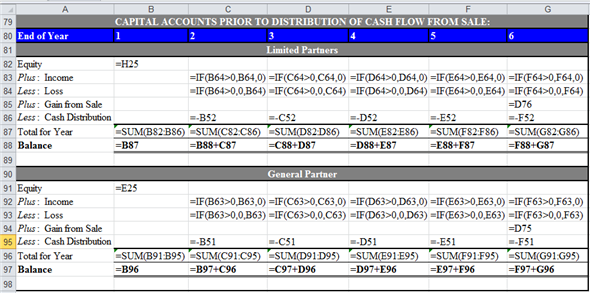

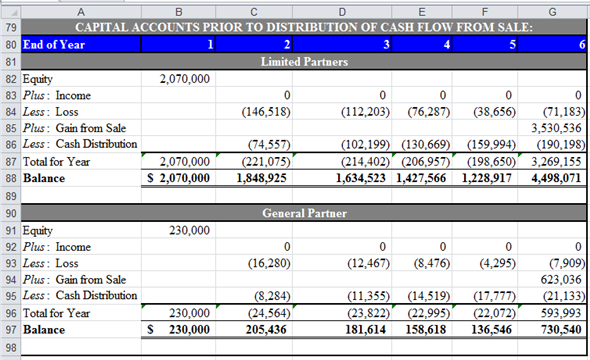

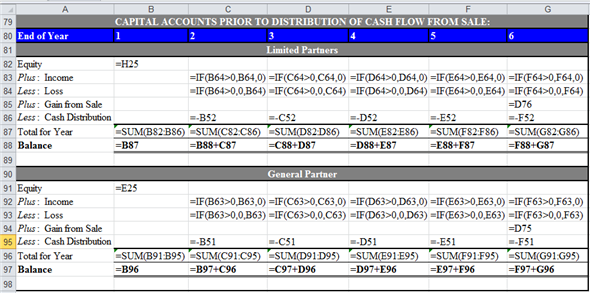

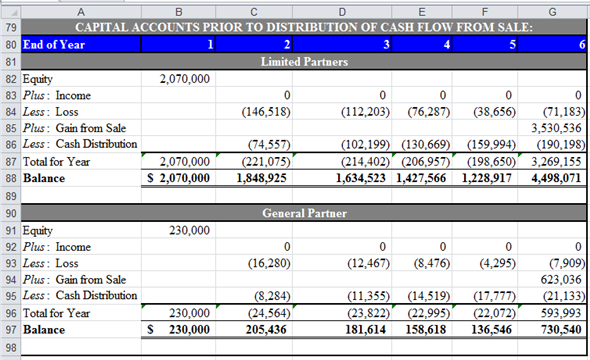

Eighth step: Prepare statement of capital accounts prior to distribution of cash flow from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Eighth step: Prepare statement of capital accounts prior to distribution of cash flow from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

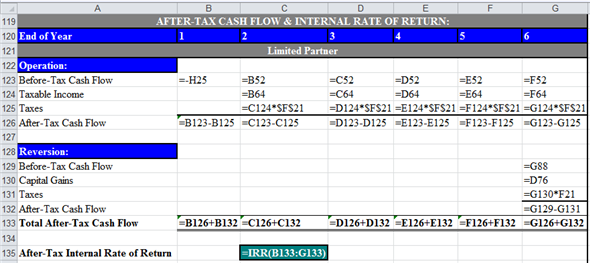

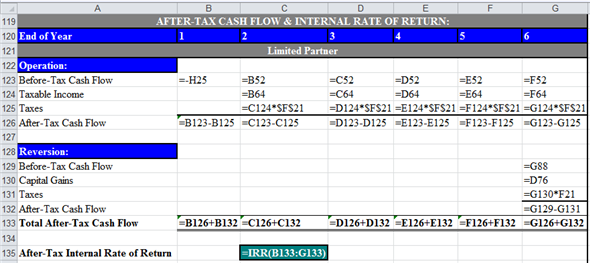

Final step: Compute ATIRR (after Tax Internal Rate of Return) for Limited Partner. Enter given values and formulas in spreadsheet as shown in the image below.

Final step: Compute ATIRR (after Tax Internal Rate of Return) for Limited Partner. Enter given values and formulas in spreadsheet as shown in the image below.

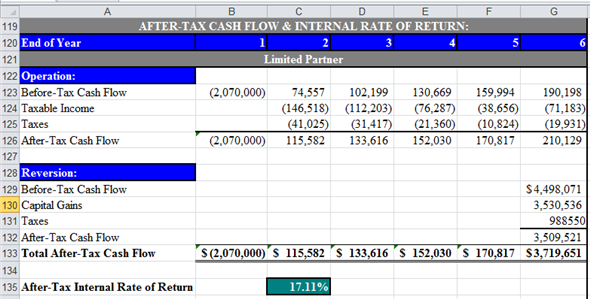

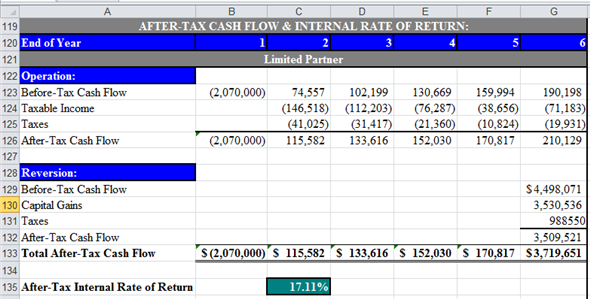

Obtained results are shown below.

Obtained results are shown below.

Thus, the ATIRR to Limited Partner is

Thus, the ATIRR to Limited Partner is

.

.

b.

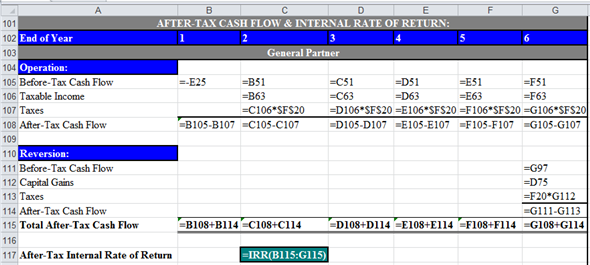

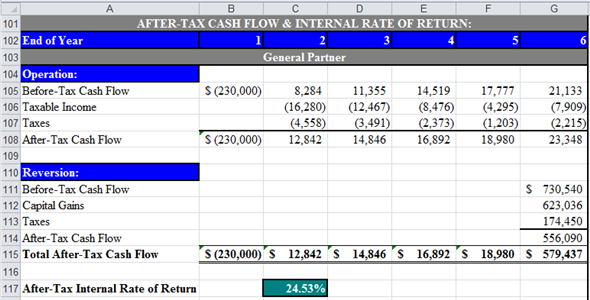

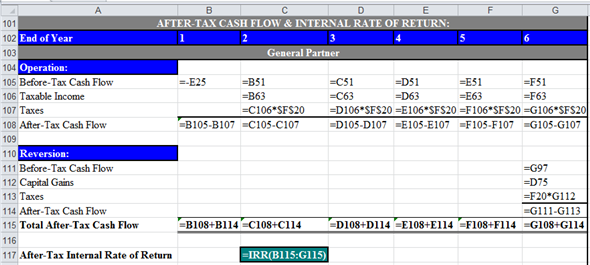

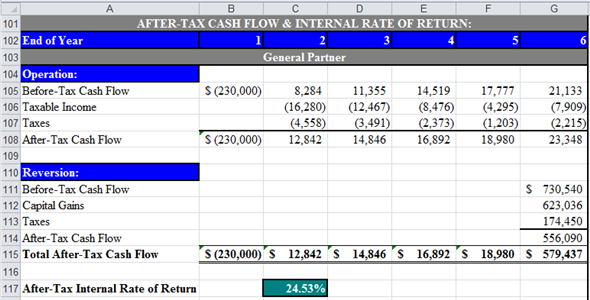

Compute ATIRR (after Tax Internal Rate of Return) for General Partners. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.

Thus, the ATIRR to General Partner is

Thus, the ATIRR to General Partner is

.

.

c.

The ATIRR for the General Partner is the highest. This difference has occurred due the higher percentage of allocation of gain from sale to General Partners'. If the percentage of allocation of gain from the sale would have been equal to the percentage of equity contribution, then the ATIRR would have been the same for both types of partners'.

Compute ATIRR for Limited Partners in the following steps.

First step: Use spreadsheet for the required computations. Enter given values and formulas in spreadsheet to create input section as shown in the image below.

Obtained results are shown below.

Obtained results are shown below. Second step: Prepare summary of equity information. Enter given values and formulas in spreadsheet as shown in the image below.

Second step: Prepare summary of equity information. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below. Third step: Prepare summary of loan information. Enter given values and formulas in spreadsheet (in Cells A28:F33) as shown in the image below.

Third step: Prepare summary of loan information. Enter given values and formulas in spreadsheet (in Cells A28:F33) as shown in the image below.In Cells A28:B33

In Cells C28:C33

In Cells C28:C33 In Cells D28:D33

In Cells D28:D33  In Cells E28:E33

In Cells E28:E33 In Cells F28:F33

In Cells F28:F33 Obtained results are shown below.

Obtained results are shown below. Fourth step: Prepare summary of points information. Enter given values and formulas in spreadsheet as shown in the image below.

Fourth step: Prepare summary of points information. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below. Fifth step: Prepare statement of distribution of cash flows. Enter given values and formulas in spreadsheet as shown in the image below.

Fifth step: Prepare statement of distribution of cash flows. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below. Sixth step: Prepare statement of distribution of taxable income. Enter given values and formulas in spreadsheet as shown in the image below.

Sixth step: Prepare statement of distribution of taxable income. Enter given values and formulas in spreadsheet as shown in the image below.  Obtained results are shown below.

Obtained results are shown below. Seventh step: Prepare statement of distribution of taxable gain from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Seventh step: Prepare statement of distribution of taxable gain from sale. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below. Eighth step: Prepare statement of capital accounts prior to distribution of cash flow from sale. Enter given values and formulas in spreadsheet as shown in the image below.

Eighth step: Prepare statement of capital accounts prior to distribution of cash flow from sale. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below.  Final step: Compute ATIRR (after Tax Internal Rate of Return) for Limited Partner. Enter given values and formulas in spreadsheet as shown in the image below.

Final step: Compute ATIRR (after Tax Internal Rate of Return) for Limited Partner. Enter given values and formulas in spreadsheet as shown in the image below. Obtained results are shown below.

Obtained results are shown below. Thus, the ATIRR to Limited Partner is

Thus, the ATIRR to Limited Partner is .

.b.

Compute ATIRR (after Tax Internal Rate of Return) for General Partners. Enter given values and formulas in spreadsheet as shown in the image below.

Obtained results are shown below.

Obtained results are shown below.  Thus, the ATIRR to General Partner is

Thus, the ATIRR to General Partner is .

.c.

The ATIRR for the General Partner is the highest. This difference has occurred due the higher percentage of allocation of gain from sale to General Partners'. If the percentage of allocation of gain from the sale would have been equal to the percentage of equity contribution, then the ATIRR would have been the same for both types of partners'.

4

What is the advantage of the limited partnership ownership form for real estate syndications

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

5

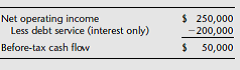

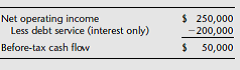

A and B form a partnership where A, the limited partner, contributes $500,000 and B, the general partner, contributes no cash. The partnership secures a $2 million (10 percent interest only) nonrecourse loan and acquires AB Apartments for $2.5 million. Assume that the results from the first year of operations of AB Apartments are as follows:

Assume that tax depreciation the first year is $250,000.

The partnership agreement provides that 90 percent of all taxable income, loss, and cash flow from operations is to be allocated to A and 10 percent to B. At resale, taxable gains or losses are to be split 50-50 between A and B, and cash proceeds are distributed first to A in an amount equal to his original investment less any cash distributions previously received, and then split 50-50 between A and B.

a. What are the capital account balances for A and B after one year

b. Assume that AB Apartments is sold after year 1 for $3 million with no expenses of sale. How much cash is available (before tax) from sale

c. How much cash would be distributed to A and B upon sale of the property

d. How much capital gain would be allocated to A and B upon sale of the property

e. Calculate the capital account balances for A and B after sale.

Assume that tax depreciation the first year is $250,000.

The partnership agreement provides that 90 percent of all taxable income, loss, and cash flow from operations is to be allocated to A and 10 percent to B. At resale, taxable gains or losses are to be split 50-50 between A and B, and cash proceeds are distributed first to A in an amount equal to his original investment less any cash distributions previously received, and then split 50-50 between A and B.

a. What are the capital account balances for A and B after one year

b. Assume that AB Apartments is sold after year 1 for $3 million with no expenses of sale. How much cash is available (before tax) from sale

c. How much cash would be distributed to A and B upon sale of the property

d. How much capital gain would be allocated to A and B upon sale of the property

e. Calculate the capital account balances for A and B after sale.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

6

How can the general partner-syndicator structure the partnership to offer incentives to limited partners

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

7

Excel. Refer to the "Ch18 Partner" tab in the Excel Workbook provided on the Web site. Suppose the split between the limited and general partner is 99 percent for the limited partner and 1 percent for the general partner for equity contributions, income, and allocation of gain. How does this change the expected return to each partner

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

8

Why is the Internal Revenue Service concerned with how partnership agreements in real estate are structured

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

9

What is the main difference between the way a partnership is taxed versus the way a corporation is taxed

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

10

What are special allocations

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

11

What causes the after-tax IRR (ATIRR e ) for the general partner to differ from that of the limited partner

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

12

What is the significance of capital accounts What causes the balance in a capital account to change each year

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

13

How does the risk associated with investment in a partnership differ for the general partner versus a limited partner

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

14

What are the different ways that the general partner is compensated

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

15

Why do you think the Tax Reform Act of 1986 affected the desirability of investing in real estate syndications

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

16

What concerns should an investor in a real estate syndication have regarding general partners

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

17

Differentiate between public and private syndications What is an accredited investor Why is the distinction used

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

18

How are general partners usually compensated in a syndication What major concerns should investors consider when making an investment with a syndication

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

19

What is the main difference between organizing a real estate venture a corporation versus a general partnership How does a limited partnership have some of the characteristics of both

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck