Deck 17: International Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 17: International Finance

1

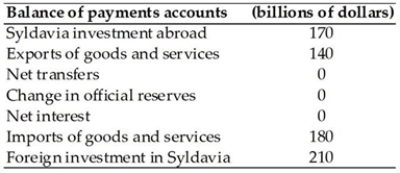

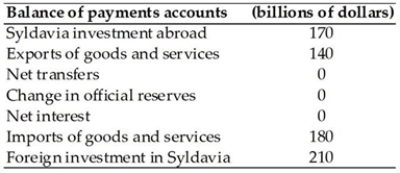

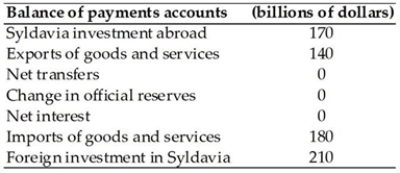

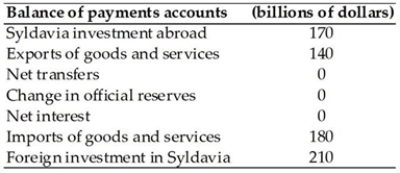

The table above gives data for the nation of Syldavia. The sum of the current account balance, capital and financial account balance, and the reserve assets account balances of Syldavia is equal to

A) $10 billion.

B) -$10 billion.

C) zero.

D) $30 billion.

E) $40 billion.

zero.

2

The reserve assets account is the record of

A) a nation's international trading, borrowing and lending.

B) exports of capital goods minus imports of capital goods.

C) changes in the government's holdings of foreign currency.

D) payments for imports, receipts for exports, net interest and net transfers.

E) foreign investment in the nation minus the nation's investment abroad.

A) a nation's international trading, borrowing and lending.

B) exports of capital goods minus imports of capital goods.

C) changes in the government's holdings of foreign currency.

D) payments for imports, receipts for exports, net interest and net transfers.

E) foreign investment in the nation minus the nation's investment abroad.

changes in the government's holdings of foreign currency.

3

When a German company purchases an Australian company for $20 million, in the balance of payments the value of that transaction is recorded in the

A) official purchases account.

B) capital and financial account.

C) purchases account.

D) investment account.

E) current account.

A) official purchases account.

B) capital and financial account.

C) purchases account.

D) investment account.

E) current account.

capital and financial account.

4

The table above gives data for the nation of Syldavia. The current account has a

A) $40 billion deficit.

B) $30 billion deficit.

C) $40 billion surplus.

D) $50 billion deficit.

E) balance of $320 billion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

When the Australian capital and financial account shows a positive balance, that is an indication of

A) foreigners investing more in Australia than Australia is investing abroad.

B) Australian industries becoming more competitive.

C) Australia acquiring more foreign reserves.

D) the value of Australian exports of capital goods exceeding the value of Australian imports of capital goods.

E) the value of all Australian exports exceeding the value of all Australian imports.

A) foreigners investing more in Australia than Australia is investing abroad.

B) Australian industries becoming more competitive.

C) Australia acquiring more foreign reserves.

D) the value of Australian exports of capital goods exceeding the value of Australian imports of capital goods.

E) the value of all Australian exports exceeding the value of all Australian imports.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose BHP Billiton purchases a gold mine in Canada. This purchase is entered into which of the balance of payments accounts?

A) The trade account.

B) The current account.

C) The purchases account.

D) The reserve assets account.

E) The capital and financial account.

A) The trade account.

B) The current account.

C) The purchases account.

D) The reserve assets account.

E) The capital and financial account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose that the Australian government acquires more foreign currency. How does this change affect the balance of payments accounts?

A) The capital and financial account is negative.

B) The reserve assets account balance is positive.

C) The capital and financial account is positive.

D) The balance of payments accounts sum to a positive number equal to the value of the additional foreign currency the government has obtained.

E) The reserve assets account balance is negative.

A) The capital and financial account is negative.

B) The reserve assets account balance is positive.

C) The capital and financial account is positive.

D) The balance of payments accounts sum to a positive number equal to the value of the additional foreign currency the government has obtained.

E) The reserve assets account balance is negative.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

Foreign investment in Australia and Australian investment abroad is recorded in the

A) investment account.

B) current account.

C) capital and financial account.

D) creditor/debtor account.

E) official settlements account.

A) investment account.

B) current account.

C) capital and financial account.

D) creditor/debtor account.

E) official settlements account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

The table above gives data for the nation of Syldavia. The capital and financial account has a

A) $40 billion deficit.

B) $30 billion deficit.

C) $40 billion surplus.

D) $50 billion deficit.

E) balance of $380 billion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

There are three balance of payments accounts. The sum of the balances on these three accounts will equal

A) the total amount of the nation's foreign borrowing.

B) zero.

C) the total amount of the nation's foreign lending.

D) the total amount of the nation's exports.

E) the total amount of the nation's imports.

A) the total amount of the nation's foreign borrowing.

B) zero.

C) the total amount of the nation's foreign lending.

D) the total amount of the nation's exports.

E) the total amount of the nation's imports.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

The trade between countries is recorded in accounts called the balance of

A) payments accounts.

B) Australian official trade accounts.

C) export and import accounts.

D) currency accounts.

E) international trade accounts.

A) payments accounts.

B) Australian official trade accounts.

C) export and import accounts.

D) currency accounts.

E) international trade accounts.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

The reserve assets account contains data on

A) official government complaints between countries.

B) capital imports and exports.

C) officials' expenses.

D) official reserves.

E) trade complaints that are officially settled.

A) official government complaints between countries.

B) capital imports and exports.

C) officials' expenses.

D) official reserves.

E) trade complaints that are officially settled.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

If the current account balance has a $70 million deficit and there was no change in official reserves during that year, then we know that

A) the capital and financial account balance must have a $70 million surplus.

B) the capital account balance must have a $70 million deficit.

C) net transfers were -$70 million.

D) the balance of payments must register a $70 million surplus.

E) the official settlements account balance must have a $70 million surplus.

A) the capital and financial account balance must have a $70 million surplus.

B) the capital account balance must have a $70 million deficit.

C) net transfers were -$70 million.

D) the balance of payments must register a $70 million surplus.

E) the official settlements account balance must have a $70 million surplus.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

Interest received from Australian holdings of foreign assets and interest paid to foreigners for Australian investment assets is recorded in the

A) official settlements account.

B) current account.

C) capital and financial account.

D) official reserves account.

E) official dollar account.

A) official settlements account.

B) current account.

C) capital and financial account.

D) official reserves account.

E) official dollar account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

The value of imports and exports is recorded in the

A) capital and financial account.

B) official settlements account.

C) official reserves account.

D) current account.

E) international trade account.

A) capital and financial account.

B) official settlements account.

C) official reserves account.

D) current account.

E) international trade account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

The table above gives data for the nation of Syldavia. The reserve assets settlements account has a

A) $40 billion deficit.

B) $30 billion deficit.

C) $40 billion surplus.

D) zero balance.

E) balance of $380 billion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

The capital and financial account is the record of

A) changes in the government's holdings of foreign currency.

B) foreign investment in the nation minus the nation's investment abroad.

C) a nation's international trading, borrowing and lending.

D) payments for imports, receipts for exports, net interest and net transfers.

E) the nation's imports and exports of capital goods.

A) changes in the government's holdings of foreign currency.

B) foreign investment in the nation minus the nation's investment abroad.

C) a nation's international trading, borrowing and lending.

D) payments for imports, receipts for exports, net interest and net transfers.

E) the nation's imports and exports of capital goods.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

If the current account balance is negative, net interest is $100 billion and net transfers are -$100 billion, then

A) imports exceed exports.

B) the official settlements account must be negative.

C) real GDP exceeds potential GDP.

D) the official settlements account must be positive.

E) exports exceed imports.

A) imports exceed exports.

B) the official settlements account must be negative.

C) real GDP exceeds potential GDP.

D) the official settlements account must be positive.

E) exports exceed imports.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is a balance of payments account?

i. The current account.

ii. The past account.

iii. The capital and financial account.

A) i only

B) ii only

C) iii only

D) i and iii

E) i, ii and iii

i. The current account.

ii. The past account.

iii. The capital and financial account.

A) i only

B) ii only

C) iii only

D) i and iii

E) i, ii and iii

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

When an Australian company makes a $200,000 donation to the International Red Cross to help the victims of an earthquake in India, the transaction is recorded in the

A) international help account.

B) capital and financial account.

C) official settlements account.

D) current account.

E) one-way donations account.

A) international help account.

B) capital and financial account.

C) official settlements account.

D) current account.

E) one-way donations account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

A nation that currently has a surplus in its capital account is called a

A) net lender.

B) current account surplus nation.

C) debtor nation.

D) net borrower.

E) creditor nation.

A) net lender.

B) current account surplus nation.

C) debtor nation.

D) net borrower.

E) creditor nation.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

A country has imports of goods and services at $2,000 billion. The interest paid to the rest of the world is $500 billion. The interest received from the rest of the world is $400 billion. The decrease in official reserves is $10 billion. The government sector balance is $200 billion, saving is $1,800 billion, investment is $2,000 billion, and net transfers is zero. Using this information, what is the capital account balance?

A) -$10 billion

B) $10 billion

C) $90 billion

D) -$200 billion

E) -$90 billion

A) -$10 billion

B) $10 billion

C) $90 billion

D) -$200 billion

E) -$90 billion

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

A country reports exports minus imports of $300 billion, net interest income of $30 billion, net transfers of $50 billion, and no change in official reserves. The country is a

A) net borrower.

B) net asset.

C) net liability.

D) debtor nation.

E) net lender.

A) net borrower.

B) net asset.

C) net liability.

D) debtor nation.

E) net lender.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

When a currency depreciates, its value has

A) fallen against another currency.

B) been fixed against the value of another country.

C) remained constant against that of another currency.

D) fluctuated around a particular value.

E) risen against another currency.

A) fallen against another currency.

B) been fixed against the value of another country.

C) remained constant against that of another currency.

D) fluctuated around a particular value.

E) risen against another currency.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

When a currency decreases in value relative to another currency, the currency has

A) decelerated.

B) appreciated.

C) depreciated.

D) declined.

E) accelerated.

A) decelerated.

B) appreciated.

C) depreciated.

D) declined.

E) accelerated.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

The government sector balance equals

A) net taxes minus government expenditures.

B) net taxes plus government expenditures.

C) saving plus investment.

D) saving minus investment.

E) government expenditures plus investment.

A) net taxes minus government expenditures.

B) net taxes plus government expenditures.

C) saving plus investment.

D) saving minus investment.

E) government expenditures plus investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

If the U.S. dollar falls from 1.25 euros to 1.00 euro, then the U.S. dollar has ________ and the euro has ________.

A) depreciated; appreciated

B) shrunk; grown

C) appreciated; depreciated

D) depreciated; depreciated

E) appreciated; appreciated

A) depreciated; appreciated

B) shrunk; grown

C) appreciated; depreciated

D) depreciated; depreciated

E) appreciated; appreciated

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

The current account balance equals

A) net exports + net transfers - net interest.

B) net exports + net transfers.

C) net exports - net transfers + net interest.

D) net exports + net transfers + net interest.

E) net exports - net transfers - net interest.

A) net exports + net transfers - net interest.

B) net exports + net transfers.

C) net exports - net transfers + net interest.

D) net exports + net transfers + net interest.

E) net exports - net transfers - net interest.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

The private sector balance is equal to savings ________ investment, and the government sector balance is equal to government expenditure ________ taxes. If there is a deficit in the private sector balance and a deficit in the government sector balance, then there must be a ________ in net exports.

A) plus; plus; surplus

B) minus; minus; surplus

C) plus; minus; surplus

D) minus; minus; deficit

E) plus; plus; deficit

A) plus; plus; surplus

B) minus; minus; surplus

C) plus; minus; surplus

D) minus; minus; deficit

E) plus; plus; deficit

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

When a Chinese company purchases Australian iron ore, the Chinese company pays for it with

A) euros or yen.

B) Australian dollars.

C) gold.

D) Chinese goods and services.

E) Chinese yuan.

A) euros or yen.

B) Australian dollars.

C) gold.

D) Chinese goods and services.

E) Chinese yuan.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

A country has imports of goods and services of $2,000 billion. The interest paid to the rest of the world is $500 billion. The interest received from the rest of the world is $400 billion. The decrease in official reserves is $10 billion. The government sector balance is $200 billion, saving is $1,800 billion, investment is $2,000 billion, and net transfers is zero. What is the current account balance?

A) -$100 billion

B) -$200 billion

C) -$10 billion

D) $100 billion

E) $200 billion

A) -$100 billion

B) -$200 billion

C) -$10 billion

D) $100 billion

E) $200 billion

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

If the exchange rate changes from 0.70 euros per dollar to 0.80 euros per dollar, the euro has

A) appreciated against the dollar.

B) appreciated against the euro.

C) fallen inversely in value.

D) depreciated against the euro.

E) depreciated against the dollar.

A) appreciated against the dollar.

B) appreciated against the euro.

C) fallen inversely in value.

D) depreciated against the euro.

E) depreciated against the dollar.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

When Australia exports goods and services to Japan, there is an increase in the

A) demand for Australian dollars.

B) supply of Australian dollars.

C) Australian reserve assets account balance.

D) supply of Japanese yen.

E) Australian capital account balance.

A) demand for Australian dollars.

B) supply of Australian dollars.

C) Australian reserve assets account balance.

D) supply of Japanese yen.

E) Australian capital account balance.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

In 2014, an Australian dollar could be traded for 100 yen and in 2015 an Australian dollar could be traded for 90 yen. Between these two years, the dollar has become ________ valuable and so the dollar has ________.

A) less; depreciated against the yen

B) more; appreciated against the yen

C) more; depreciated against the yen

D) less; appreciated against the yen

E) more; appreciated against the dollar

A) less; depreciated against the yen

B) more; appreciated against the yen

C) more; depreciated against the yen

D) less; appreciated against the yen

E) more; appreciated against the dollar

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

The private sector balance equals

A) net taxes plus government expenditures.

B) saving minus investment.

C) saving plus investment.

D) net taxes minus government expenditures.

E) investment minus saving.

A) net taxes plus government expenditures.

B) saving minus investment.

C) saving plus investment.

D) net taxes minus government expenditures.

E) investment minus saving.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Between 1983/84 and 2017/18, Australia

A) had a current account surplus or deficit that was almost equal to $0 every year.

B) some years had a deficit and some years had a surplus that totalled a surplus of $2.5 trillion.

C) had a current account deficit almost every year.

D) some years had a deficit and some years had a surplus that netted out to $0.

E) had a current account surplus almost every year.

A) had a current account surplus or deficit that was almost equal to $0 every year.

B) some years had a deficit and some years had a surplus that totalled a surplus of $2.5 trillion.

C) had a current account deficit almost every year.

D) some years had a deficit and some years had a surplus that netted out to $0.

E) had a current account surplus almost every year.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

Australia currently is

A) a creditor nation and has been since 1989.

B) neither a debtor nation nor a creditor nation.

C) a debtor nation and has been since the end of World War II in 1945.

D) a debtor nation and has been since 1989.

E) a creditor nation and has been since the end of World War II in 1945.

A) a creditor nation and has been since 1989.

B) neither a debtor nation nor a creditor nation.

C) a debtor nation and has been since the end of World War II in 1945.

D) a debtor nation and has been since 1989.

E) a creditor nation and has been since the end of World War II in 1945.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

During the last year, foreign investment in a country was $500 billion and the country's investment abroad was $600 billion. Which of the following statements is true?

A) The country has net lending of $100 billion.

B) The country has a current account deficit of $100 billion.

C) The country has a current account deficit of $1,100 billion.

D) The country has net borrowing of $100 billion.

E) The country has a capital and financial account deficit of $1,100 billion.

A) The country has net lending of $100 billion.

B) The country has a current account deficit of $100 billion.

C) The country has a current account deficit of $1,100 billion.

D) The country has net borrowing of $100 billion.

E) The country has a capital and financial account deficit of $1,100 billion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

The foreign exchange rate is defined as

A) the price at which one currency exchanges for another.

B) the rate or the speed with which the currencies of the worlds are traded.

C) equal to the amount of the current account deficit.

D) the volume of the world currencies traded.

E) equal to the amount of the capital account deficit.

A) the price at which one currency exchanges for another.

B) the rate or the speed with which the currencies of the worlds are traded.

C) equal to the amount of the current account deficit.

D) the volume of the world currencies traded.

E) equal to the amount of the capital account deficit.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

X = exports, M = imports, S = saving, I = investment, T = net taxes, and G = government expenditure. Which of the following formulas is correct?

A) X - M = S - I + T - G

B) X - M = S + I +T + G

C) X - M = S + I -T + G

D) X - M = S - I - T - G

E) X - M = S + I + T - G

A) X - M = S - I + T - G

B) X - M = S + I +T + G

C) X - M = S + I -T + G

D) X - M = S - I - T - G

E) X - M = S + I + T - G

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

The figure above shows demand curves for Australian dollars in the foreign exchange market.

The figure above shows demand curves for Australian dollars in the foreign exchange market.Based on the figure above, which of the following factors could lead the demand curve to shift leftward from D0 to D2?

A) A rise in the expected future Australian exchange rate.

B) A fall in foreign interest rates.

C) A rise in the Australian exchange rate.

D) A rise in the Australian interest rate.

E) A fall in the Australian exchange rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

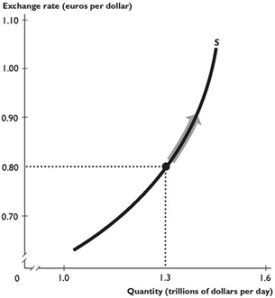

42

The figure above shows the supply curve of Australian dollars in the foreign exchange market.

The figure above shows the supply curve of Australian dollars in the foreign exchange market.If the exchange rate rises as shown by the arrow in the figure above, the price of imports coming into Australia will be ________, Australians will supply ________ dollars in order to get the foreign exchange to purchase ________ imported goods.

A) lower; fewer; fewer

B) higher; fewer; more

C) lower; more; more

D) lower; fewer; more

E) higher; more; more

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

In the foreign exchange market, the demand for dollars increases and the demand curve shifts if the

A) Australian exchange rate falls.

B) Australian interest rate differential decreases.

C) Australian interest rate differential increases.

D) expected future exchange rate falls.

E) Australian exchange rate rises.

A) Australian exchange rate falls.

B) Australian interest rate differential decreases.

C) Australian interest rate differential increases.

D) expected future exchange rate falls.

E) Australian exchange rate rises.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

If the exchange rate rises, the quantity of Australian dollars supplied

A) increases, and there is movement down along the supply curve.

B) does not change.

C) decreases, and there is movement down along the supply curve.

D) increases, and there is movement up along the supply curve of dollars.

E) increases with movement down along the supply curve.

A) increases, and there is movement down along the supply curve.

B) does not change.

C) decreases, and there is movement down along the supply curve.

D) increases, and there is movement up along the supply curve of dollars.

E) increases with movement down along the supply curve.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

If the Australian interest rate differential decreases, then in the foreign exchange market the

A) quantity demanded of dollars increases.

B) demand for dollars decreases.

C) demand for dollars increases.

D) quantity demanded of dollars decreases.

E) supply of dollars decreases.

A) quantity demanded of dollars increases.

B) demand for dollars decreases.

C) demand for dollars increases.

D) quantity demanded of dollars decreases.

E) supply of dollars decreases.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose interest rates in foreign countries increase relative to the Australian interest rate. As a result, there is ________ the demand curve for dollars.

A) a rightward shift of

B) a downward movement along

C) a leftward shift of

D) an upward movement along

E) neither a movement along nor a shift of

A) a rightward shift of

B) a downward movement along

C) a leftward shift of

D) an upward movement along

E) neither a movement along nor a shift of

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

On the foreign exchange market, an increase in a country's exchange rate

A) decreases the demand for its currency and shifts the demand curve rightward.

B) decreases the quantity demanded of its currency and leads to a movement up along the demand curve.

C) increases the quantity demanded of its currency and leads to a movement up along the demand curve.

D) decreases the demand for its currency and shifts the demand curve leftward.

E) increases the quantity demanded of its currency and leads to a movement down along the demand curve.

A) decreases the demand for its currency and shifts the demand curve rightward.

B) decreases the quantity demanded of its currency and leads to a movement up along the demand curve.

C) increases the quantity demanded of its currency and leads to a movement up along the demand curve.

D) decreases the demand for its currency and shifts the demand curve leftward.

E) increases the quantity demanded of its currency and leads to a movement down along the demand curve.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

The figure above shows demand curves for Australian dollars in the foreign exchange market.

The figure above shows demand curves for Australian dollars in the foreign exchange market.Based on the figure above, which of the following factors could lead the demand curve to shift leftward from D0 to D2?

A) A fall in the Australian exchange rate.

B) A rise in the Australian interest rate.

C) A rise in foreign interest rates.

D) A fall in the expected future Australian exchange rate.

E) A rise in the Australian exchange rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

The figure above shows supply curves of Australian dollars in the foreign exchange market.

The figure above shows supply curves of Australian dollars in the foreign exchange market.Based on the figure above, which of the following factors could lead the supply curve to shift rightward from S0 to S2?

A) A fall in the Australian exchange rate.

B) A rise in the Australian exchange rate.

C) A fall in the Australian interest rate.

D) A rise in the expected future Australian exchange rate.

E) A fall in foreign interest rates.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

When the Australian interest rate differential ________, the demand for dollars ________ and the demand curve for dollars shifts rightward.

A) rises; decreases

B) falls; increases

C) rises; increases

D) rises; does not change

E) falls; decreases

A) rises; decreases

B) falls; increases

C) rises; increases

D) rises; does not change

E) falls; decreases

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

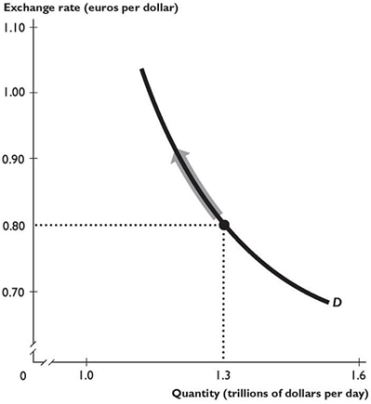

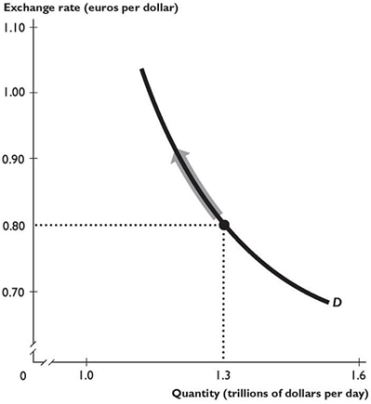

The figure above shows the demand curve for Australian dollars in the foreign exchange market.

The figure above shows the demand curve for Australian dollars in the foreign exchange market.Which of the following factors could lead to an upward movement along the demand curve as indicated by the arrow in the figure above?

i. An increase in the Australian interest rate.

ii. A decrease in the Australian interest rate.

iii. An increase in the expected future Australian exchange rate.

A) i and iii

B) i only

C) ii only

D) ii and iii

E) None of the factors listed could lead to the upward movement illustrated by the arrow.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

The figure above shows demand curves for Australian dollars in the foreign exchange market.

The figure above shows demand curves for Australian dollars in the foreign exchange market.Based on the figure above, which of the following factors could lead the demand curve to shift rightward from D0 to D1?

A) A fall in the Australian exchange rate.

B) A fall in the expected future Australian exchange rate.

C) A rise in the Australian interest rate.

D) A rise in foreign interest rates.

E) A rise in the Australian exchange rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

The figure above shows the demand curve for Australian dollars in the foreign exchange market.

The figure above shows the demand curve for Australian dollars in the foreign exchange market.If the exchange rate rises as shown by the arrow in the figure above, the price of Australian exports to foreigners will be ________, and foreign nations will demand ________ dollars in order to buy ________ Australian exports.

A) higher; fewer; fewer

B) cheaper; fewer; fewer

C) cheaper; fewer; more

D) cheaper; more; more

E) higher; more; more

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

If people expect the future exchange rate for dollars will be lower, then in the foreign exchange market the current

A) supply of dollars decreases.

B) demand for dollars increases.

C) demand for dollars decreases.

D) quantity demanded of dollars increases.

E) quantity demanded of dollars decreases.

A) supply of dollars decreases.

B) demand for dollars increases.

C) demand for dollars decreases.

D) quantity demanded of dollars increases.

E) quantity demanded of dollars decreases.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

In the foreign exchange market, which of the following shifts the demand curve for dollars rightward?

A) The expected future exchange rate falls.

B) The current exchange rate falls.

C) The expected future exchange rate rises.

D) The current exchange rate rises.

E) None of the above answers is correct.

A) The expected future exchange rate falls.

B) The current exchange rate falls.

C) The expected future exchange rate rises.

D) The current exchange rate rises.

E) None of the above answers is correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

If the expected future exchange rate decreases, then the supply of dollars ________ and the demand for dollars ________.

A) increases; decreases

B) decreases; increases

C) decreases; decreases

D) does not change; does not change

E) increases; increases

A) increases; decreases

B) decreases; increases

C) decreases; decreases

D) does not change; does not change

E) increases; increases

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

The figure above shows supply curves of Australian dollars in the foreign exchange market.

The figure above shows supply curves of Australian dollars in the foreign exchange market.Based on the figure above, which of the following factors could lead the supply curve to shift leftward from S0 to S1?

A) A rise in foreign interest rates.

B) A rise in the Australian exchange rate.

C) A fall in the Australian interest rate.

D) A rise in the expected future Australian exchange rate.

E) A fall in the Australian exchange rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

In the foreign exchange market, an increase in the supply of dollars could be the result of

A) an increase in the expected future exchange rate.

B) a decrease in the exchange rate.

C) a decrease in the Australian interest rate differential.

D) an increase in the exchange rate.

E) an increase in the Australian interest rate differential.

A) an increase in the expected future exchange rate.

B) a decrease in the exchange rate.

C) a decrease in the Australian interest rate differential.

D) an increase in the exchange rate.

E) an increase in the Australian interest rate differential.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

Other things remaining the same, as Australian imports increase, the quantity of

A) Australian dollars supplied decreases.

B) foreign currency demanded decreases.

C) Australian dollars demanded increases.

D) foreign currency demanded increases.

E) foreign currency supplied increases.

A) Australian dollars supplied decreases.

B) foreign currency demanded decreases.

C) Australian dollars demanded increases.

D) foreign currency demanded increases.

E) foreign currency supplied increases.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

As the exchange rate ________, the quantity supplied of Australian dollars ________.

A) rises; remains the same because it is the supply of Australian dollars that increases so the supply curve shifts rightward

B) falls; remains the same because it is the supply of Australian dollars that decreases so the supply curve shifts leftward

C) falls; increases

D) rises; increases

E) rises; decreases

A) rises; remains the same because it is the supply of Australian dollars that increases so the supply curve shifts rightward

B) falls; remains the same because it is the supply of Australian dollars that decreases so the supply curve shifts leftward

C) falls; increases

D) rises; increases

E) rises; decreases

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

The equilibrium exchange rate is 70 yen per Australian dollar. At this exchange rate, the quantity demanded equals the quantity supplied and is $1.3 billion a day. If the exchange rate is now 80 yen per Australian dollar, then

A) there is a surplus of dollars and the exchange rate rises.

B) there is no change.

C) there is a shortage of dollars and the exchange rate falls.

D) there is a shortage of dollars and the exchange rate rises.

E) there is a surplus of dollars and the exchange rate falls.

A) there is a surplus of dollars and the exchange rate rises.

B) there is no change.

C) there is a shortage of dollars and the exchange rate falls.

D) there is a shortage of dollars and the exchange rate rises.

E) there is a surplus of dollars and the exchange rate falls.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

Exchange rate changes are

A) very volatile because supply and demand changes reinforce each other.

B) not very volatile because of government intervention.

C) very volatile because of government intervention in the market.

D) not very volatile because of offsetting changes in demand and supply.

E) infrequent because the exchange rate rarely changes.

A) very volatile because supply and demand changes reinforce each other.

B) not very volatile because of government intervention.

C) very volatile because of government intervention in the market.

D) not very volatile because of offsetting changes in demand and supply.

E) infrequent because the exchange rate rarely changes.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

The exchange rate is volatile because

A) the demand curve and the supply curve are horizontal.

B) the demand curve is vertical.

C) when a relevant factor changes, demand and supply tend to change in the same direction.

D) the supply curve is vertical.

E) when a relevant factor changes, demand and supply tend to change in opposite directions.

A) the demand curve and the supply curve are horizontal.

B) the demand curve is vertical.

C) when a relevant factor changes, demand and supply tend to change in the same direction.

D) the supply curve is vertical.

E) when a relevant factor changes, demand and supply tend to change in opposite directions.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose the Reserve Bank wants to keep the Australian dollar at 0.80 cents per U.S. dollar. If the demand for Australian dollars increases,

A) the Reserve Bank conducts persistent intervention on one side of the market.

B) the Reserve Bank sells Australian dollars to increase the supply of dollars and maintain the exchange rate.

C) the Reserve Bank sells Australian dollars to decrease the supply of dollars and maintain the exchange rate.

D) the Reserve Bank buys Australian dollars to increase the supply of dollars and maintain the exchange rate.

E) the Reserve Bank buys Australian dollars to decrease the supply of dollars and maintain the exchange rate.

A) the Reserve Bank conducts persistent intervention on one side of the market.

B) the Reserve Bank sells Australian dollars to increase the supply of dollars and maintain the exchange rate.

C) the Reserve Bank sells Australian dollars to decrease the supply of dollars and maintain the exchange rate.

D) the Reserve Bank buys Australian dollars to increase the supply of dollars and maintain the exchange rate.

E) the Reserve Bank buys Australian dollars to decrease the supply of dollars and maintain the exchange rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

An increase in the Australian interest rate relative to other countries will lead to ________ in the supply of dollars and a ________ in the exchange rate.

A) a decrease; fall

B) a decrease; rise

C) an increase; fall

D) an increase; rise

E) no change; rise

A) a decrease; fall

B) a decrease; rise

C) an increase; fall

D) an increase; rise

E) no change; rise

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

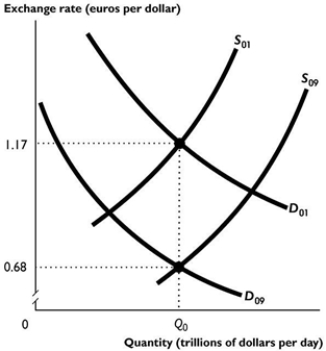

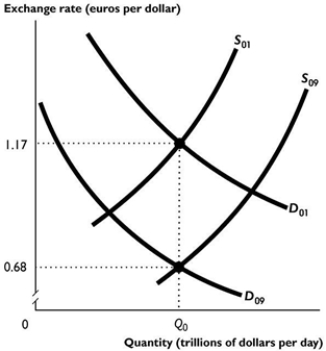

The figure above shows the Australian market for foreign exchange in 2001 and 2009.

The figure above shows the Australian market for foreign exchange in 2001 and 2009.Which of the following could have led to the shifts illustrated in the figure above?

i. The Australian exchange rate was expected to depreciate between 2001 and 2009.

ii. The Australian exchange rate was expected to appreciate between 2001 and 2009.

iii. The Australian interest rate rose relative to interest rates in other countries between 2001 and 2009.

A) i only

B) ii only

C) iii only

D) i and iii

E) ii and iii

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

A situation in which money buys the same amount of goods and services in different currencies is called

A) exchange rate surplus.

B) exchange rate equilibrium.

C) purchasing power parity.

D) a fixed exchange rate.

E) exchange rate balance.

A) exchange rate surplus.

B) exchange rate equilibrium.

C) purchasing power parity.

D) a fixed exchange rate.

E) exchange rate balance.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

Purchasing power parity determines the exchange rate in

A) the long run.

B) the short run.

C) the long run and the short run.

D) nations that do not allow their exchange rate to fluctuate.

E) theory only, but not in reality.

A) the long run.

B) the short run.

C) the long run and the short run.

D) nations that do not allow their exchange rate to fluctuate.

E) theory only, but not in reality.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

When the Australian interest rate rises, the demand for Australian dollars ________ and the exchange rate ________.

A) increases; rises

B) does not change; rises

C) increases; falls

D) decreases; rises

E) decreases; falls

A) increases; rises

B) does not change; rises

C) increases; falls

D) decreases; rises

E) decreases; falls

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

Yesterday, the Australian dollar was trading in the foreign exchange market at 80 cents per U.S. dollar. Today, the Australian dollar is trading at 90 cents per U.S. dollar. The dollar has ________ and a possible reason for the change is ________ in the expected future exchange rate.

A) depreciated; an increase

B) appreciated; that there has been no change

C) appreciated; an increase

D) depreciated; a decrease

E) appreciated; a decrease

A) depreciated; an increase

B) appreciated; that there has been no change

C) appreciated; an increase

D) depreciated; a decrease

E) appreciated; a decrease

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

If the interest rate on a bank deposit in Australia is 3 per cent while a similar deposit earns 6 per cent in Britain, then we could expect that deposits would flow to

A) Britain regardless of exchange rate expectations.

B) Britain if the pound is expected to depreciate more than 3 per cent.

C) Britain if the pound is expected to depreciate less than 3 per cent.

D) Australia regardless of exchange rate expectations.

E) Australia if the Australian dollar is expected to appreciate less than 3 per cent.

A) Britain regardless of exchange rate expectations.

B) Britain if the pound is expected to depreciate more than 3 per cent.

C) Britain if the pound is expected to depreciate less than 3 per cent.

D) Australia regardless of exchange rate expectations.

E) Australia if the Australian dollar is expected to appreciate less than 3 per cent.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose that a currency's value is found to be overvalued by using purchasing power parity. Then

A) the currency will depreciate in the future but we don't know when.

B) we know when and how much the currency will depreciate.

C) the interest rate in the country will change in order to restore purchasing power parity.

D) the currency will appreciate in the future but we don't know when.

E) we know when and how much the currency will appreciate.

A) the currency will depreciate in the future but we don't know when.

B) we know when and how much the currency will depreciate.

C) the interest rate in the country will change in order to restore purchasing power parity.

D) the currency will appreciate in the future but we don't know when.

E) we know when and how much the currency will appreciate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

If purchasing power parity exists and the exchange rate is 1.50 Australian dollars per British pound, then a latte that has a price of $4.00 in Sydney has a price of ________ in London, England.

A) 4.00 pounds

B) 2.67 pounds

C) 6.00 pounds

D) 8.00 pounds

E) 0.37 pounds

A) 4.00 pounds

B) 2.67 pounds

C) 6.00 pounds

D) 8.00 pounds

E) 0.37 pounds

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

The figure above shows the Australian market for foreign exchange in 2001 and 2009.

The figure above shows the Australian market for foreign exchange in 2001 and 2009.Which of the following could have led to the shifts illustrated in the figure above?

i. The Australian exchange rate was expected to depreciate between 2001 and 2009.

ii. The Australian exchange rate was expected to appreciate between 2001 and 2009.

iii. The Australian interest rate fell relative to interest rates in other countries between 2001 and 2009.

A) i only

B) ii only

C) iii only

D) i and iii

E) ii and iii

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck