Deck 14: Yield Curve Strategies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 14: Yield Curve Strategies

1

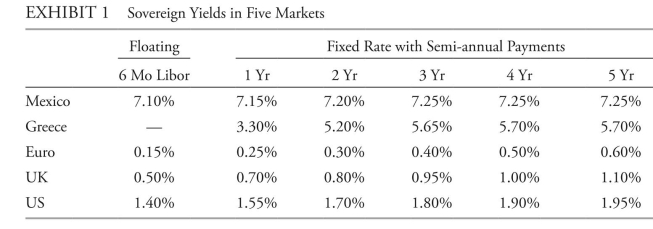

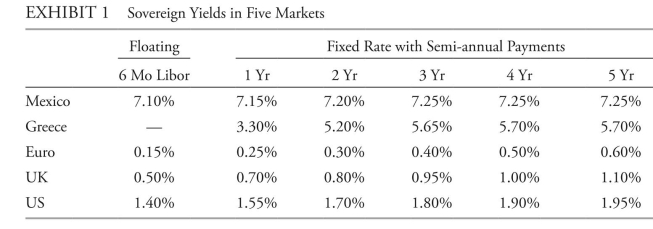

The following information relates to Questions

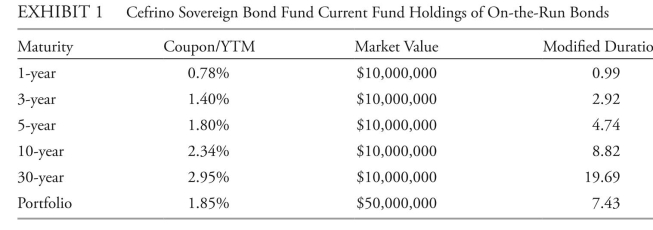

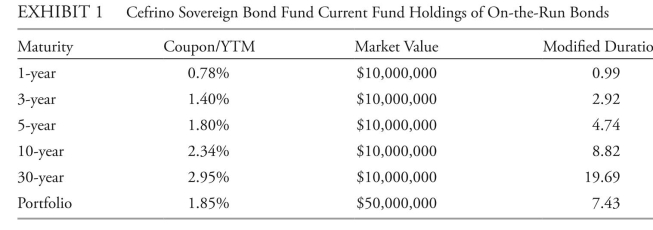

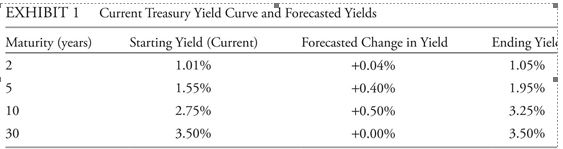

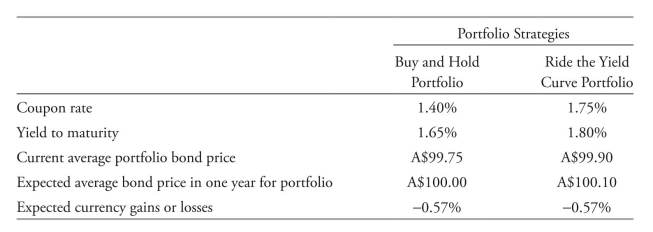

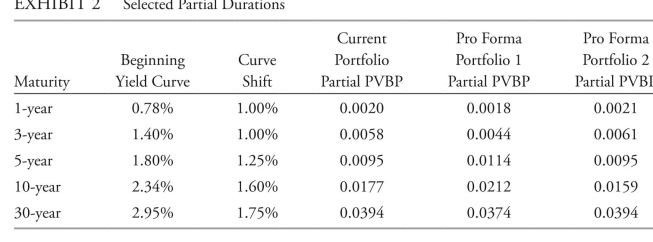

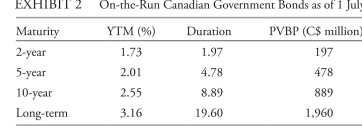

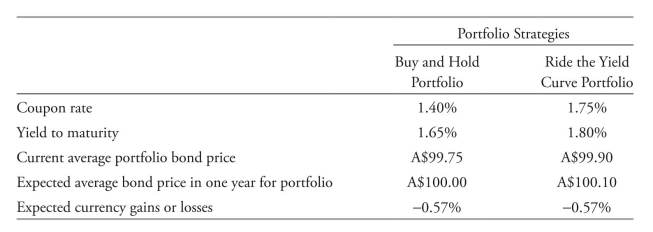

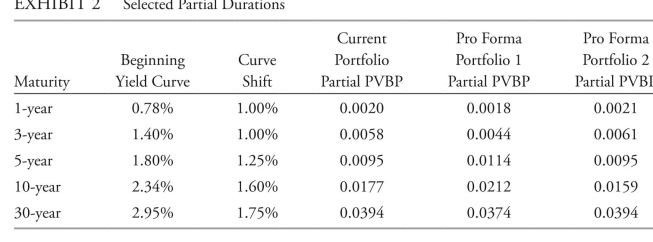

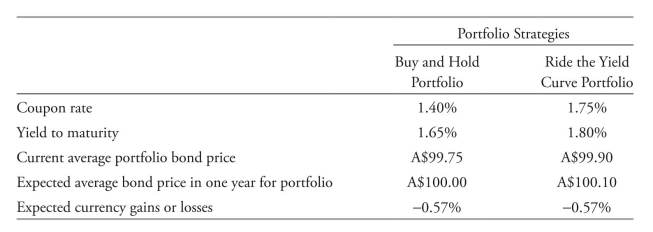

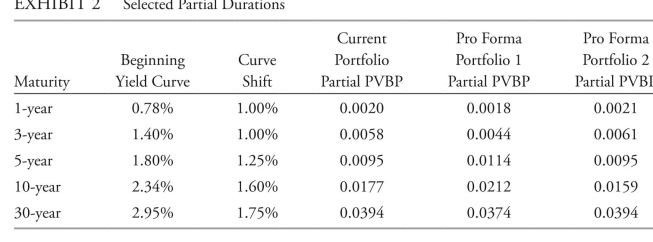

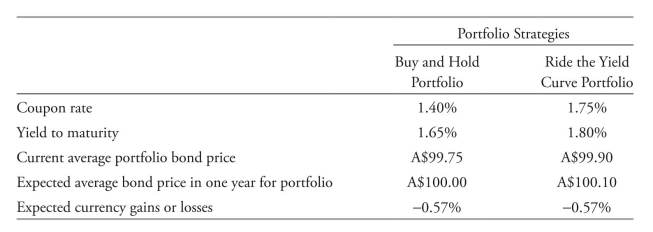

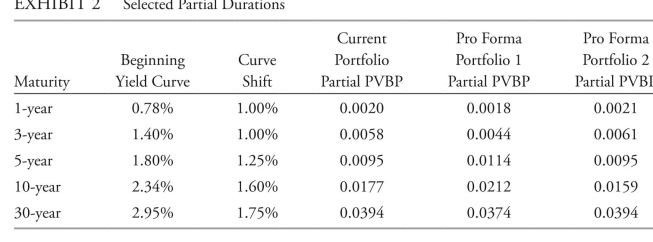

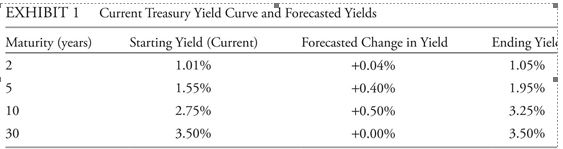

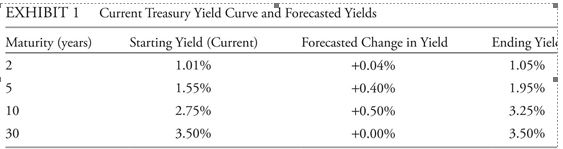

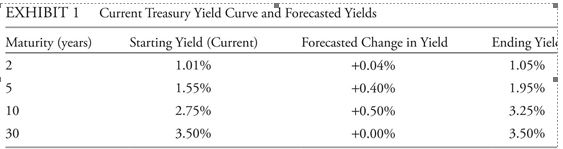

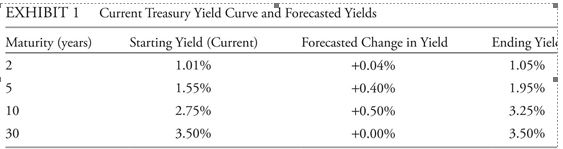

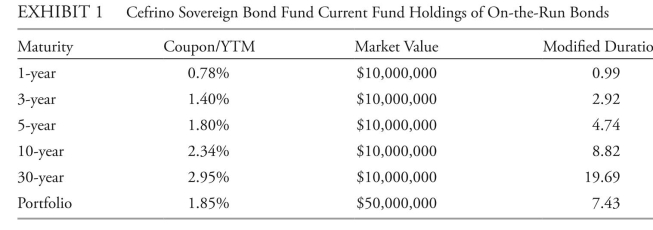

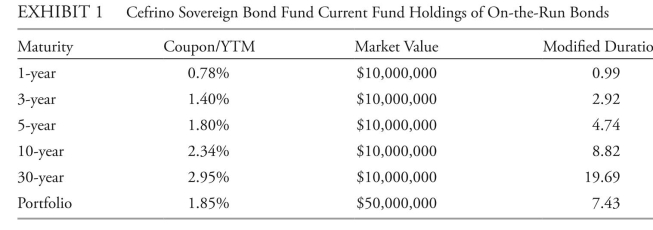

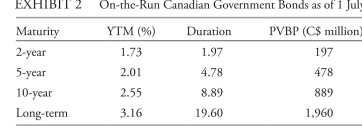

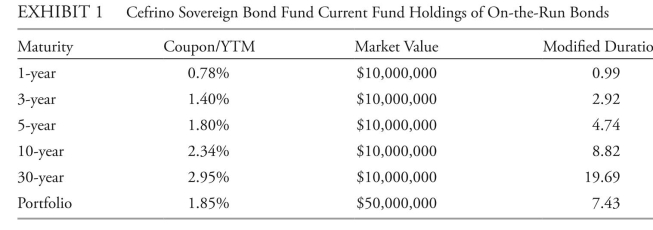

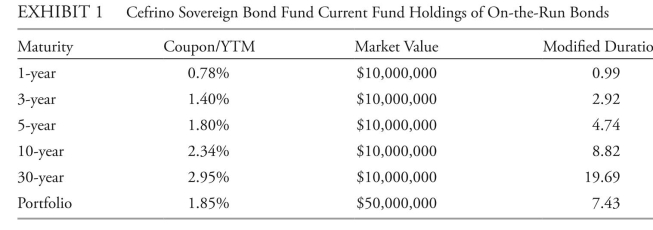

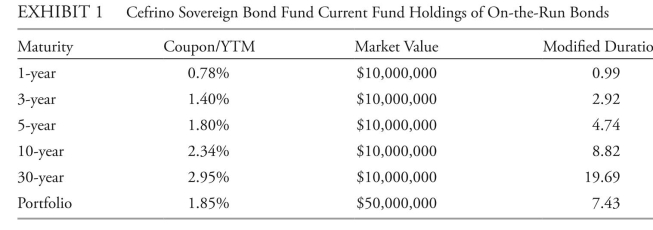

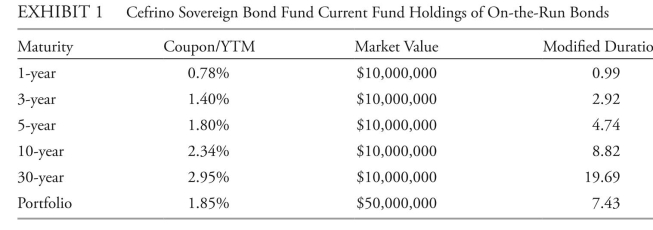

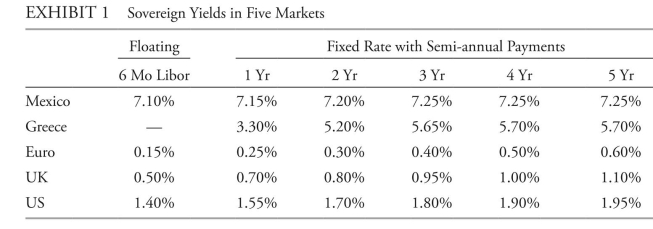

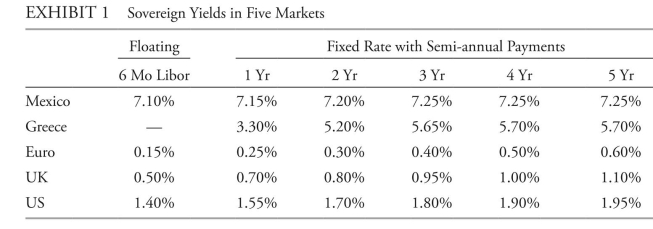

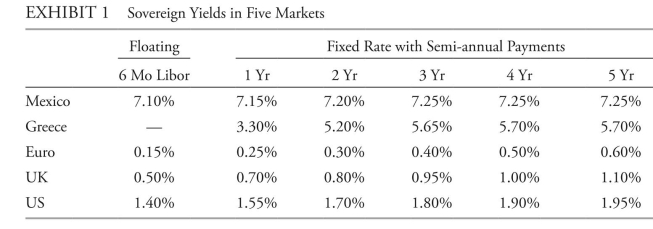

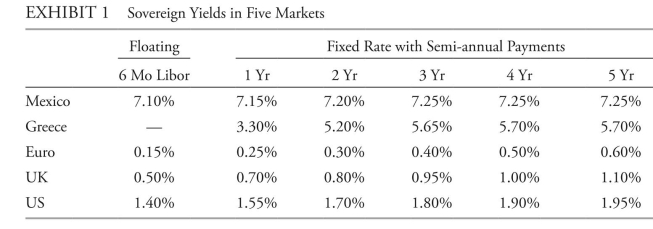

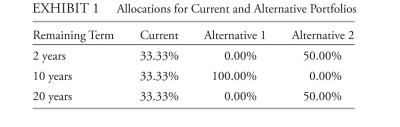

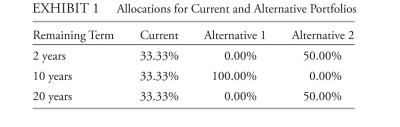

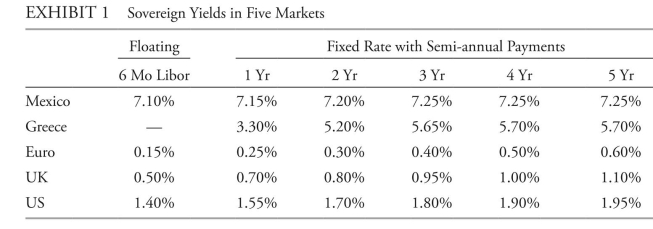

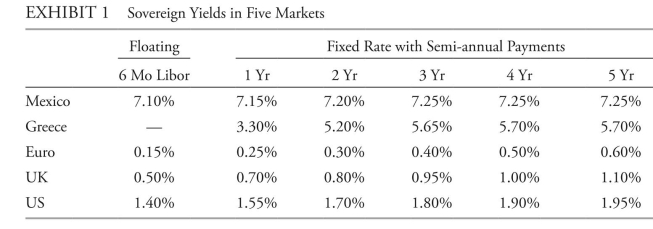

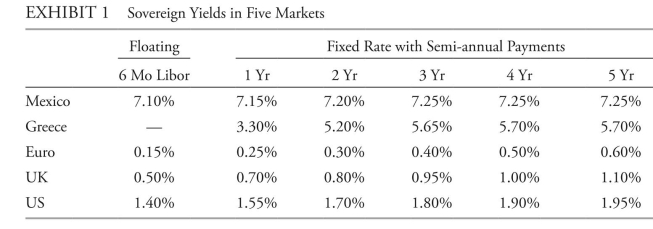

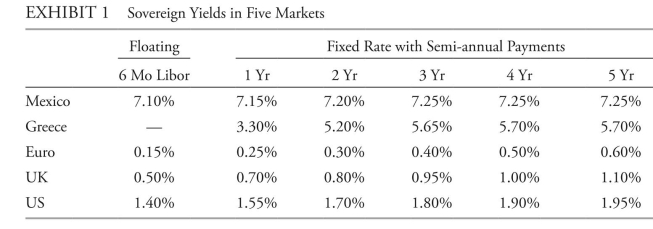

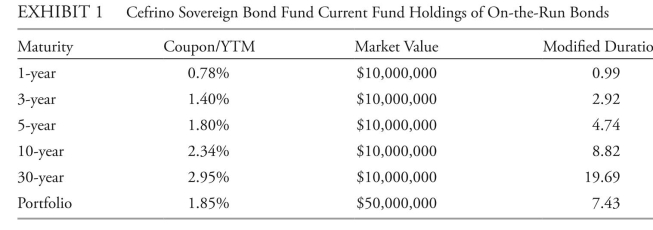

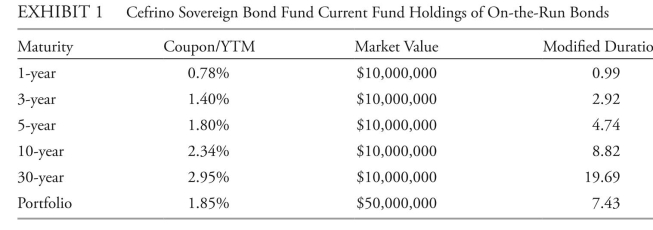

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

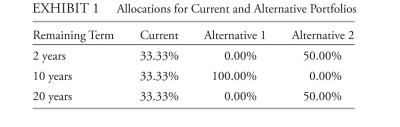

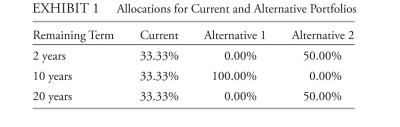

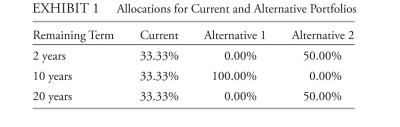

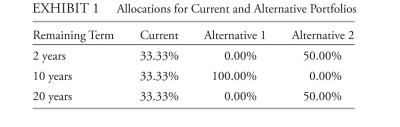

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

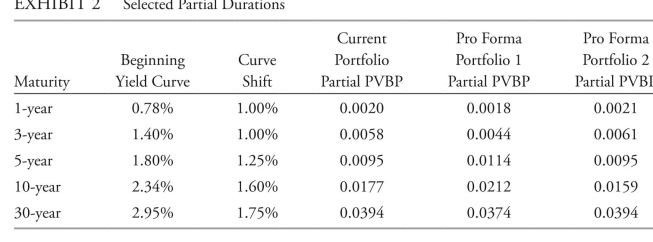

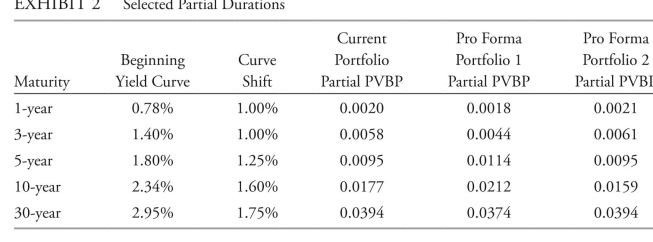

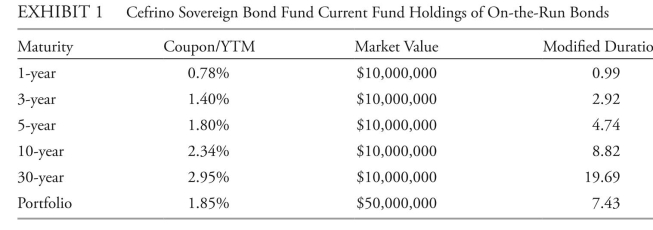

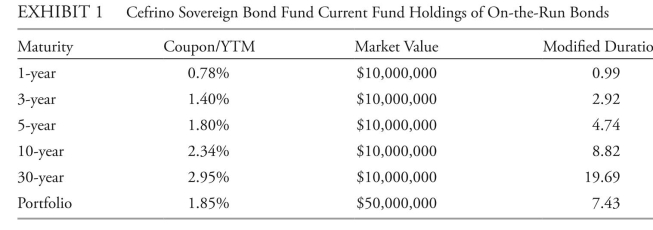

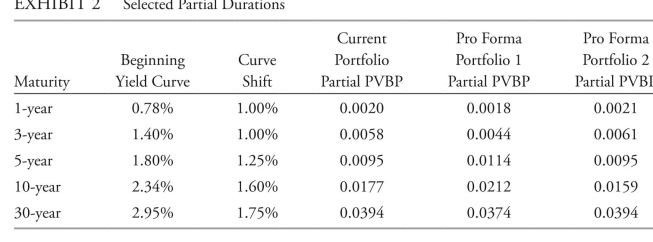

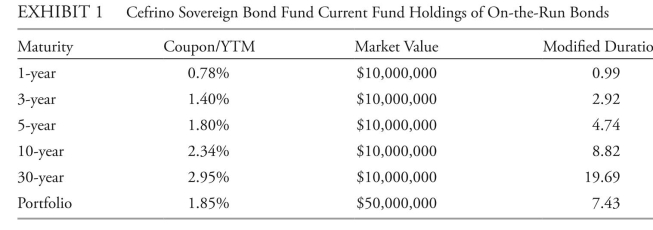

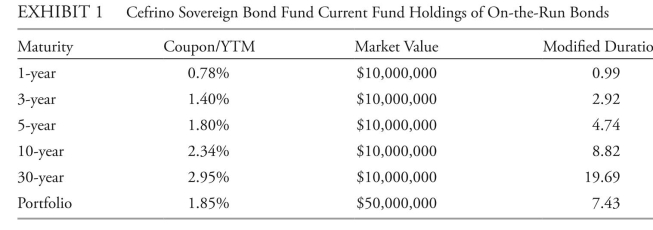

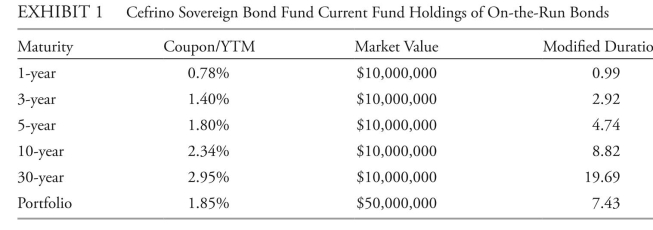

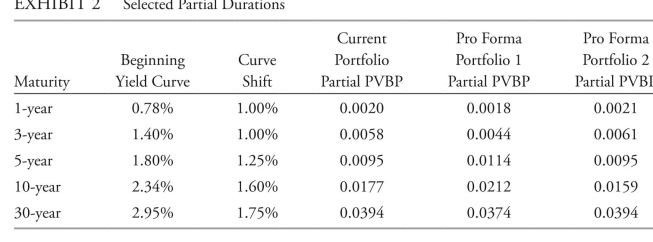

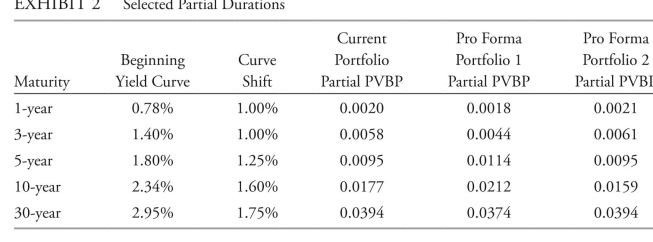

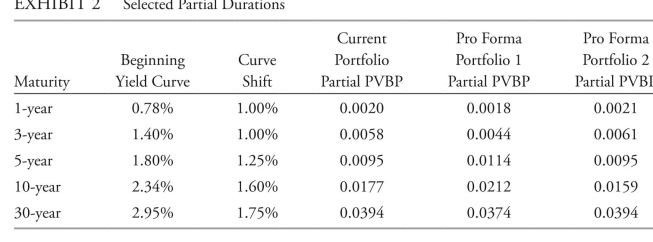

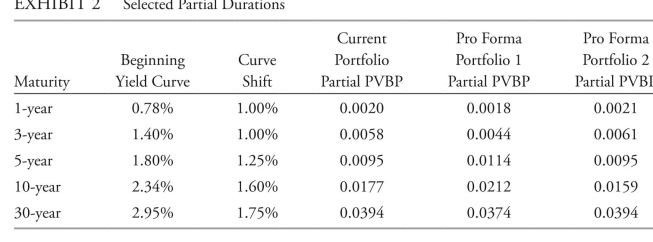

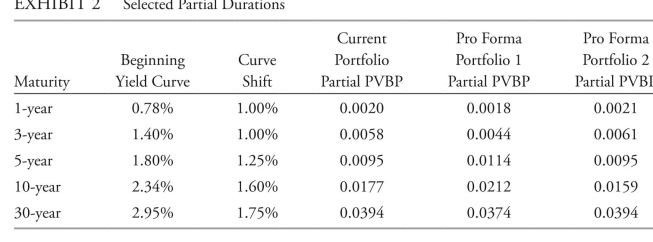

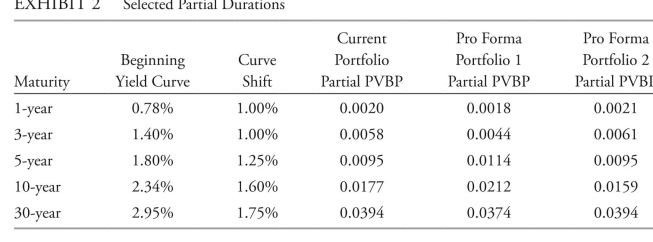

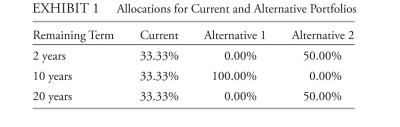

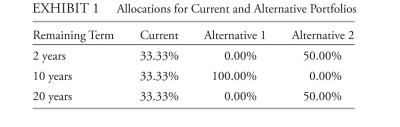

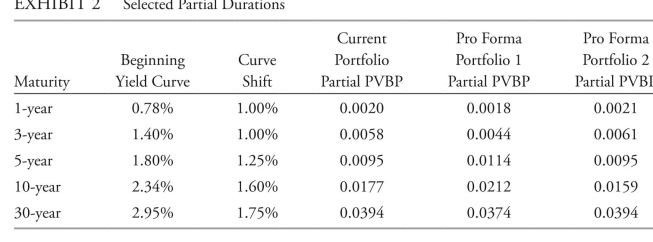

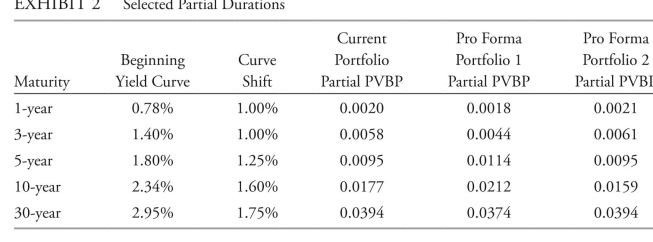

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

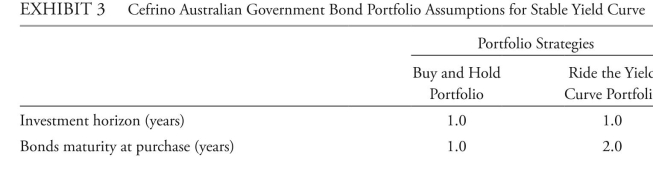

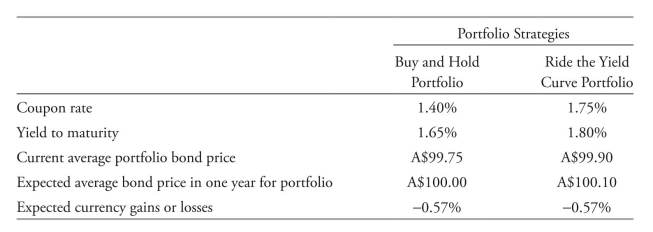

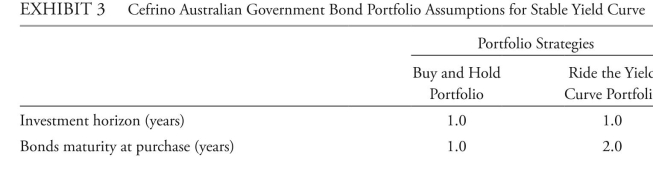

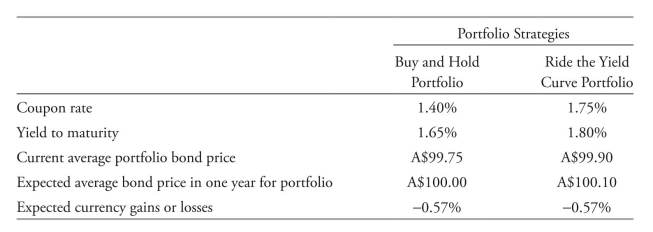

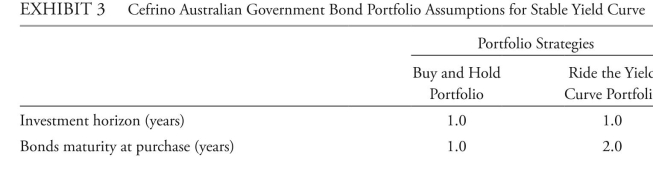

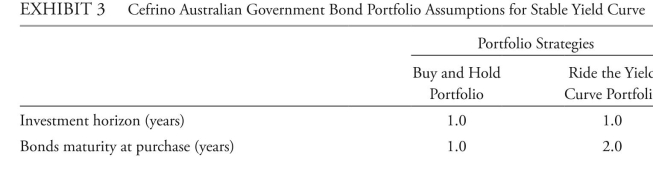

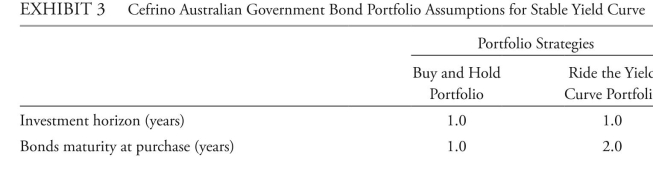

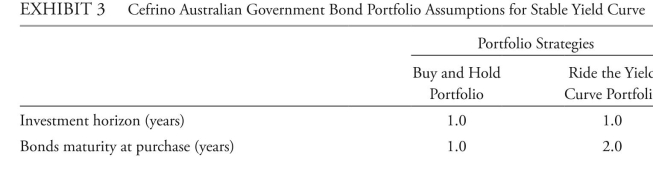

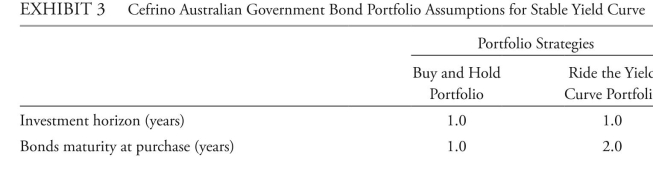

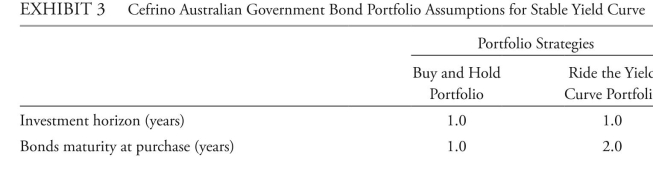

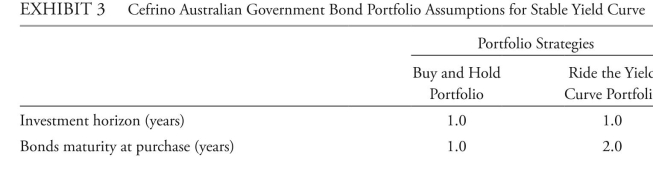

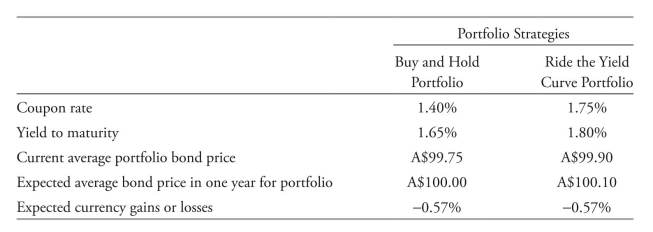

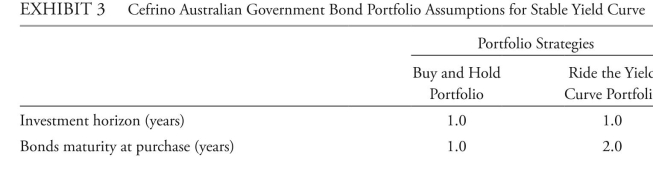

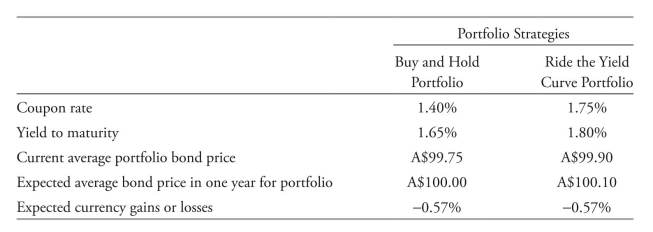

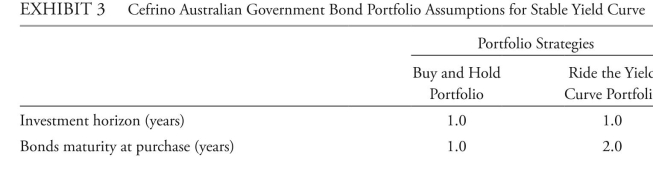

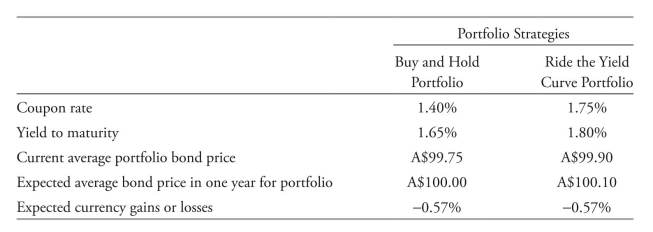

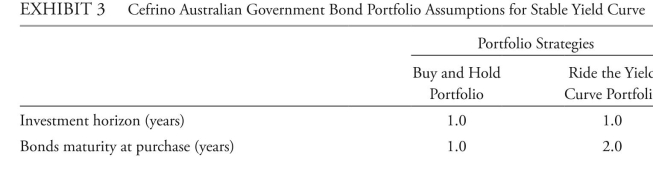

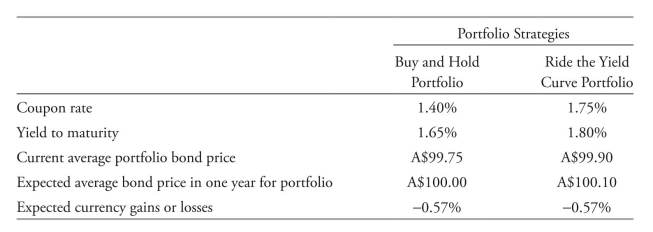

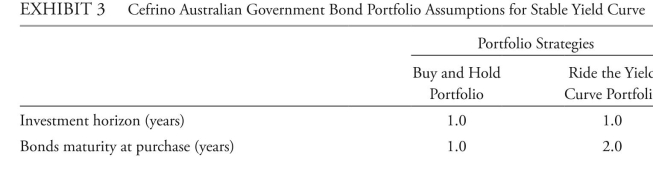

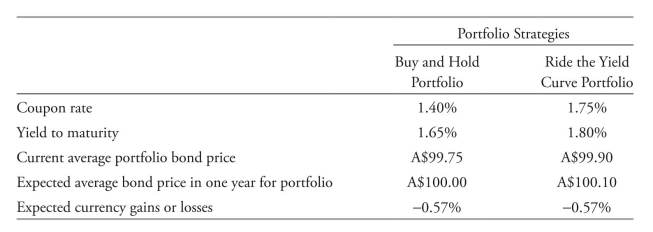

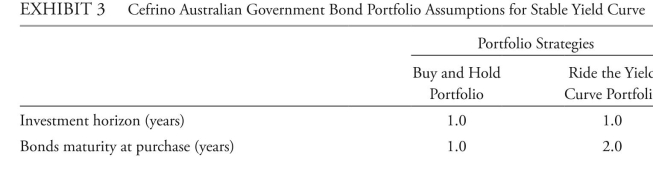

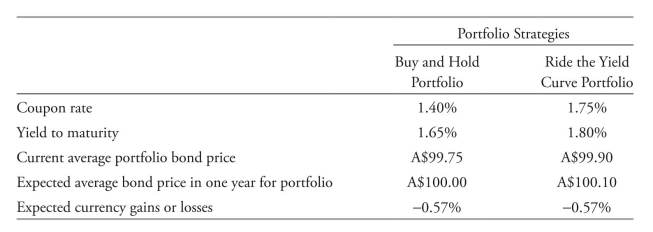

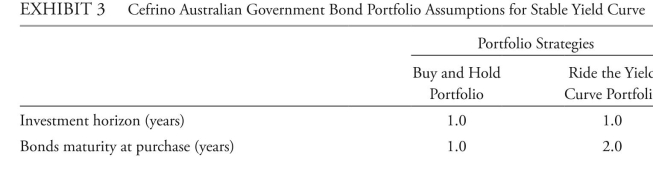

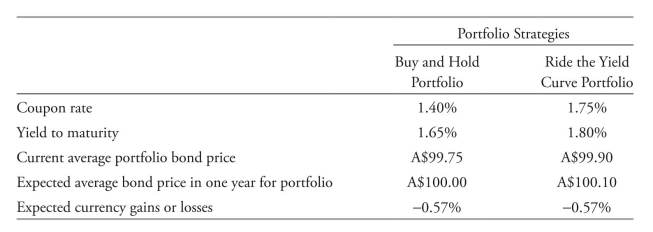

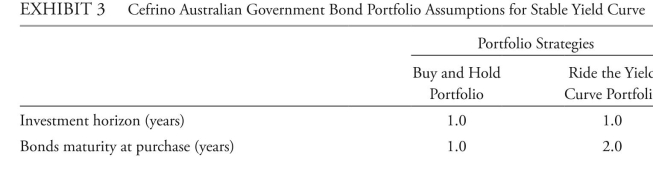

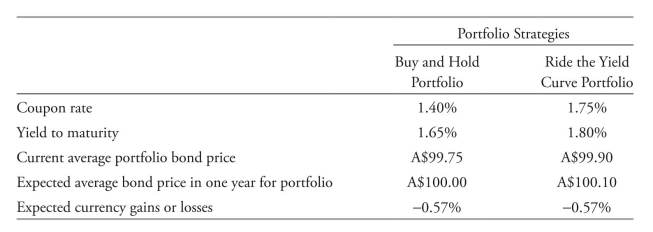

portfolios, which are summarized in exhibit 2: last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

government bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to the

Fund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibit 1 and abram's expectation for the yield curve over the next 12 months, the strategy most likely to improve the Fund's return relative to the benchmark is to:

A) buy and hold.

B) increase convexity.

C) ride the yield curve.

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2:

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australiangovernment bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to theFund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibit 1 and abram's expectation for the yield curve over the next 12 months, the strategy most likely to improve the Fund's return relative to the benchmark is to:

A) buy and hold.

B) increase convexity.

C) ride the yield curve.

C

2

The following information relates to Questions

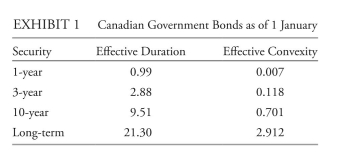

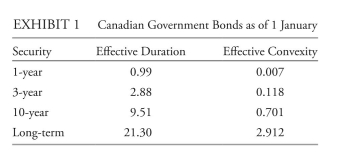

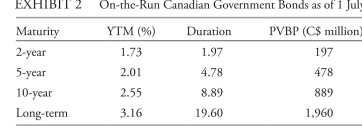

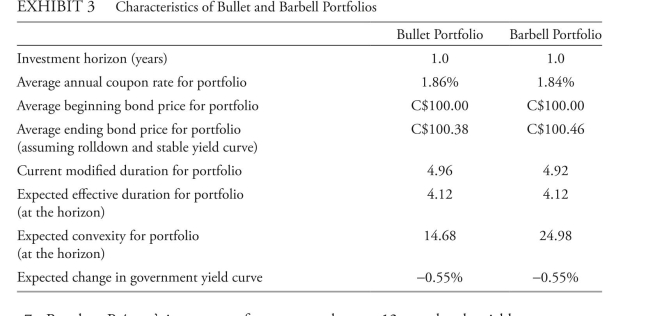

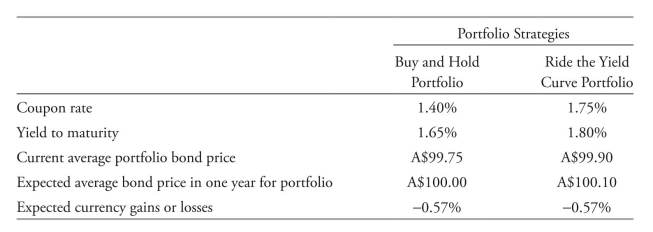

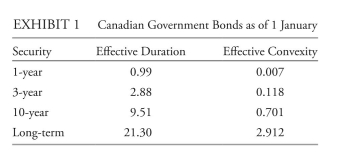

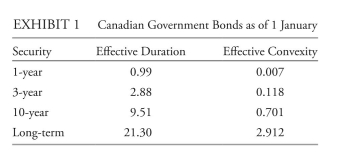

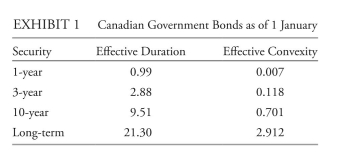

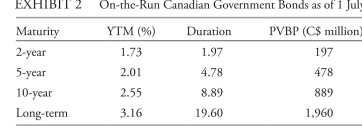

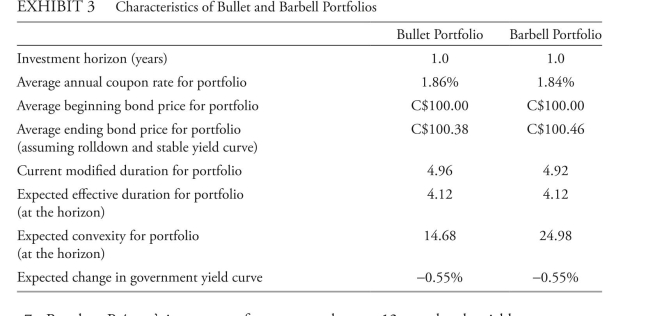

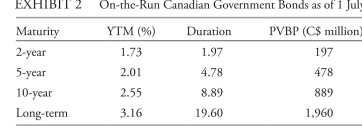

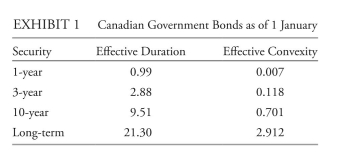

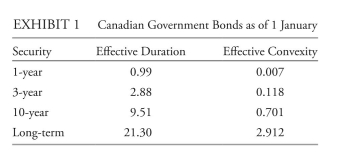

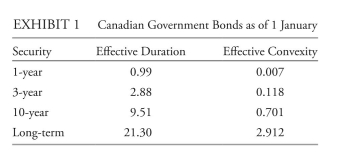

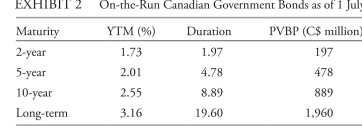

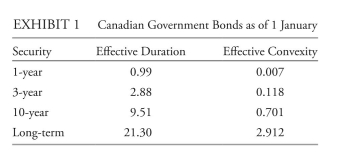

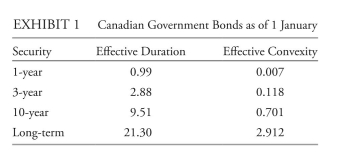

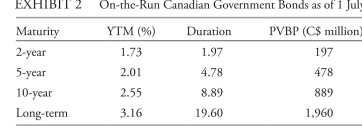

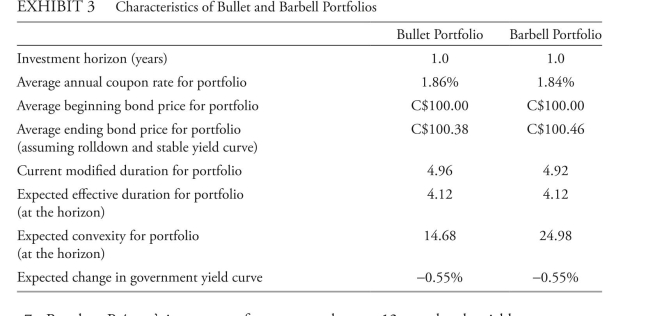

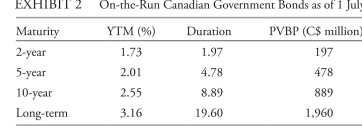

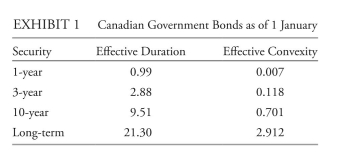

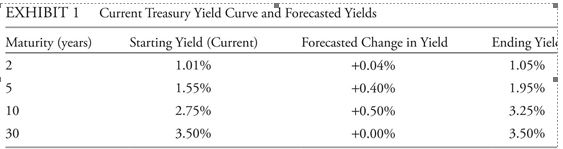

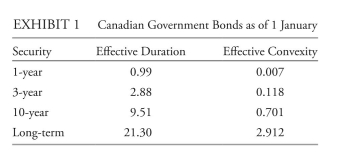

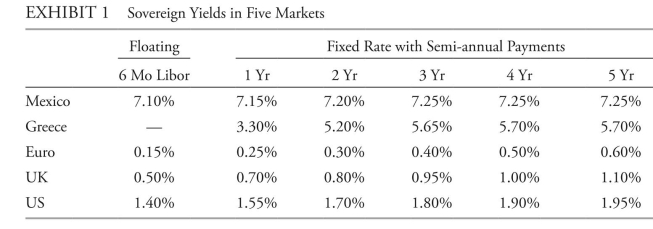

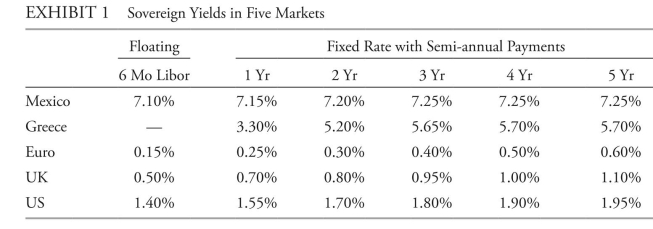

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1. * There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers are

presented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

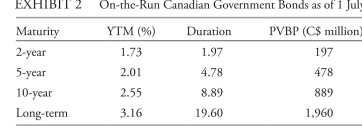

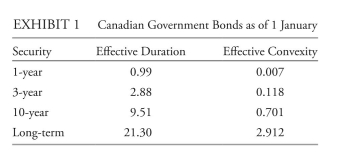

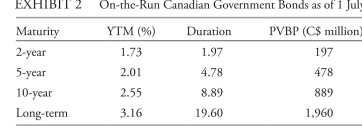

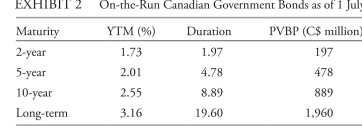

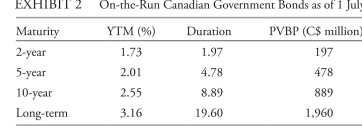

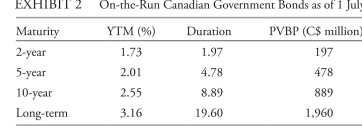

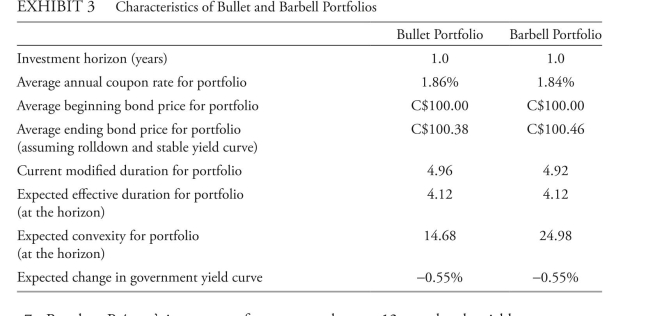

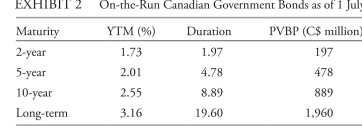

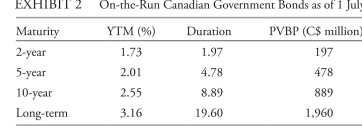

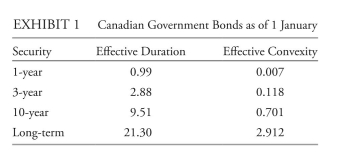

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2. hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

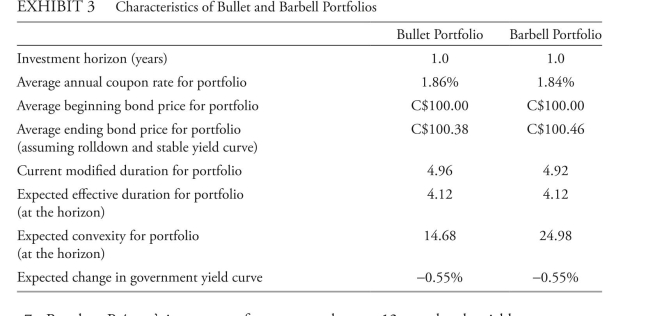

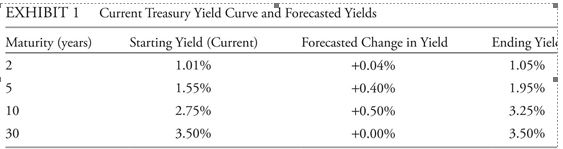

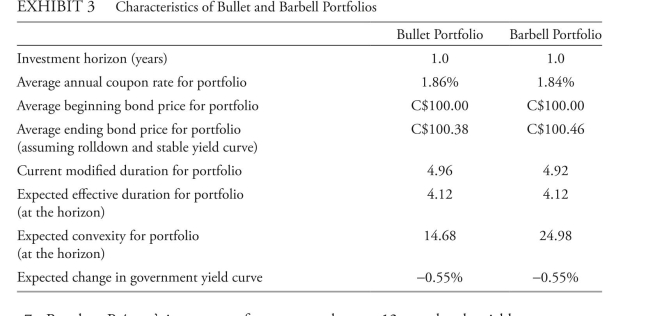

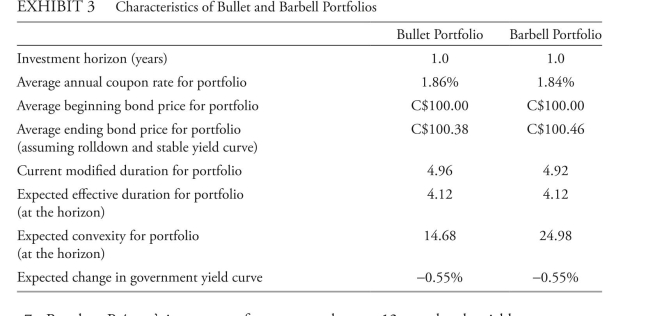

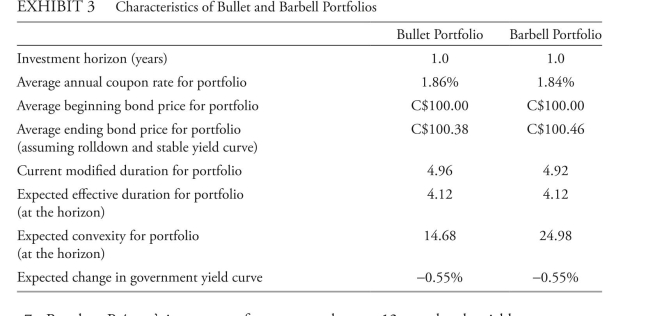

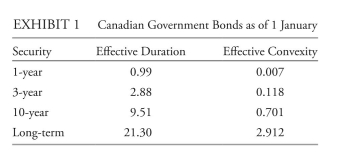

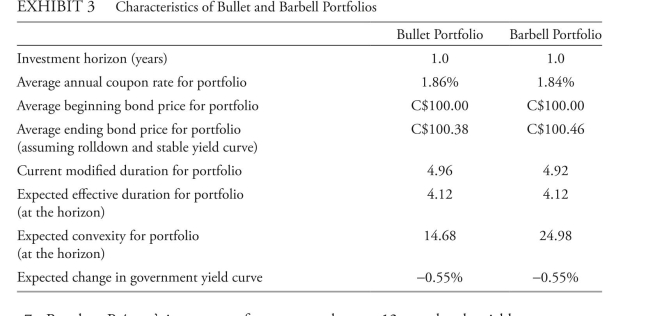

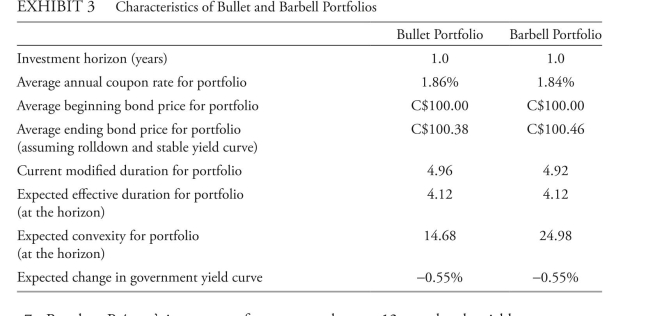

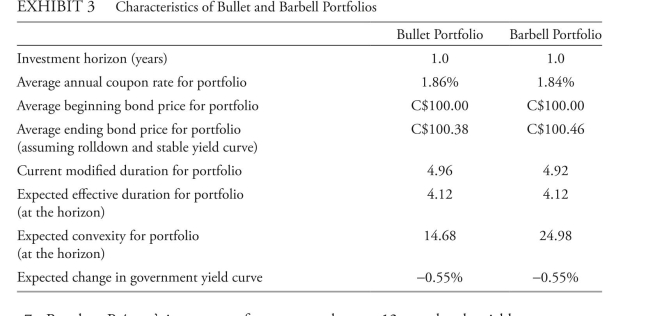

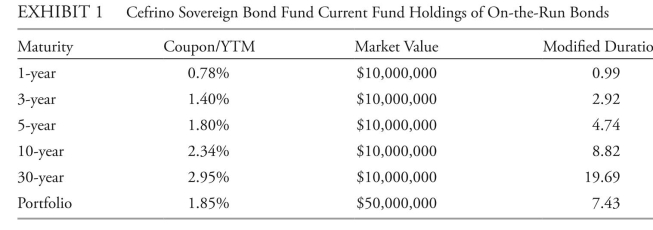

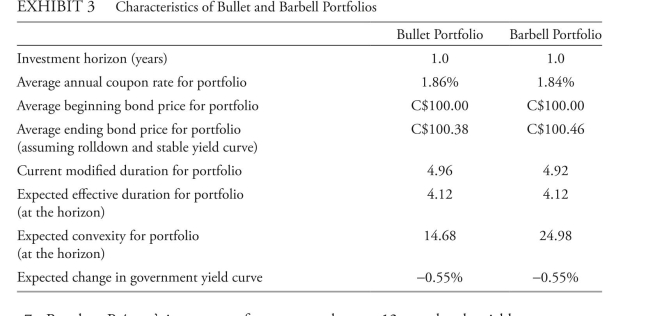

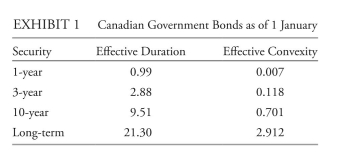

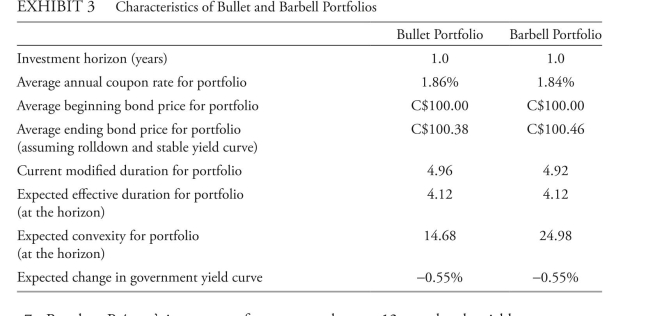

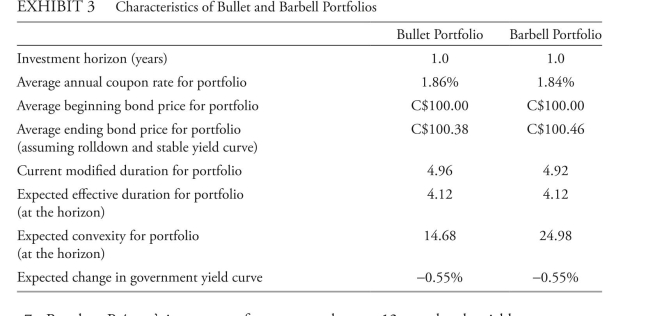

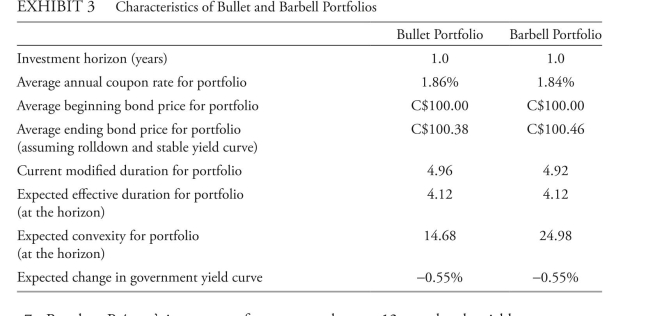

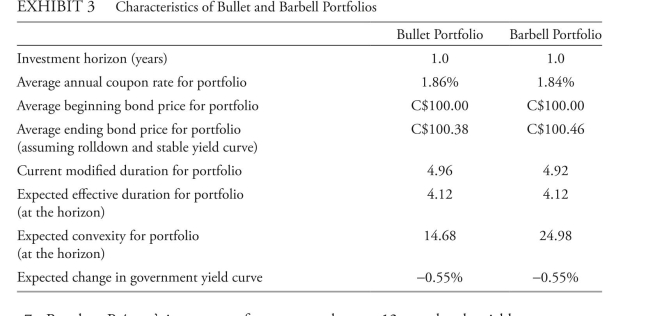

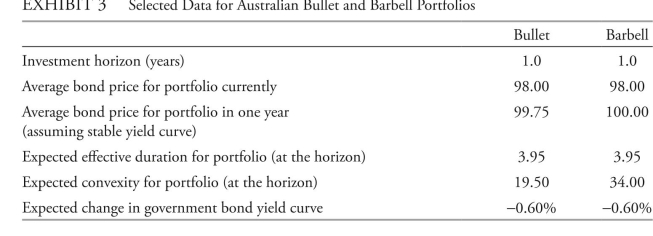

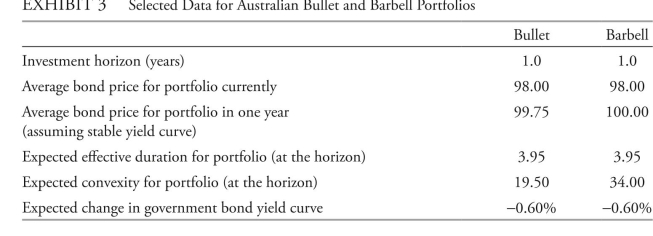

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 2, the amount that hirji should allocate to the 2-year bond position is closest to:

A) c$331 million.

B) c$615 million.

C) c$1,492 million.

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1.

* There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers arepresented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2.

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 2, the amount that hirji should allocate to the 2-year bond position is closest to:

A) c$331 million.

B) c$615 million.

C) c$1,492 million.

C

3

The following information relates to Questions

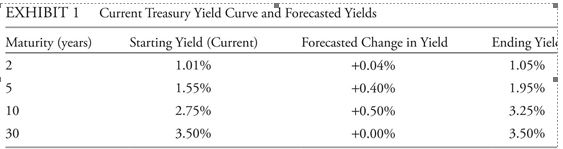

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

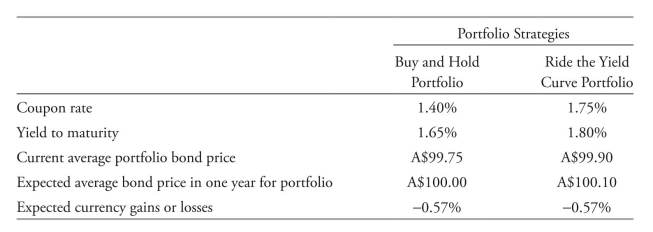

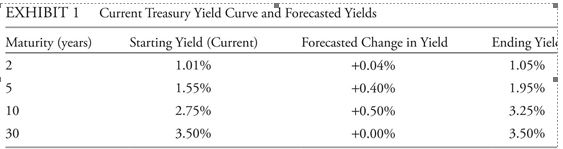

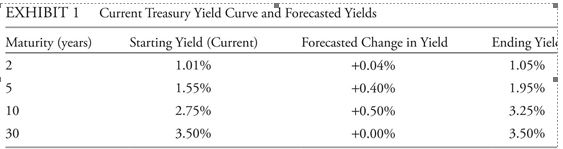

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

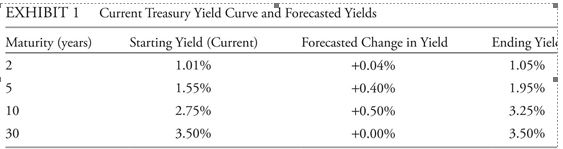

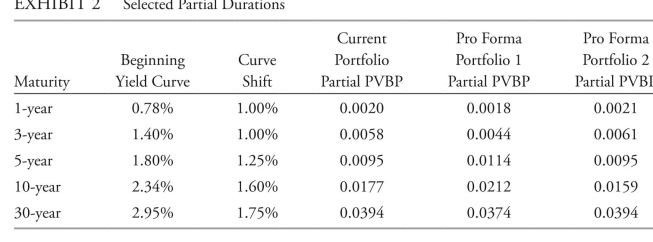

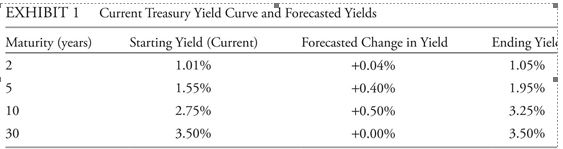

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

The portfolio strategy implemented by Mclaughlin last year is mostly likely to be described as:

A) a carry trade.

B) a barbell structure.

C) riding the yield curve.

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

The portfolio strategy implemented by Mclaughlin last year is mostly likely to be described as:

A) a carry trade.

B) a barbell structure.

C) riding the yield curve.

C

4

The following information relates to Questions

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

at the start of last year, the expected return on the portfolio strategy implemented by Mclaughlin was closest to:

A) 9.61%.

B) 9.68%.

C) 12.61%.

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

at the start of last year, the expected return on the portfolio strategy implemented by Mclaughlin was closest to:

A) 9.61%.

B) 9.68%.

C) 12.61%.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

The following information relates to Questions

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

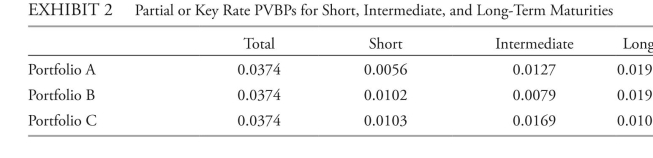

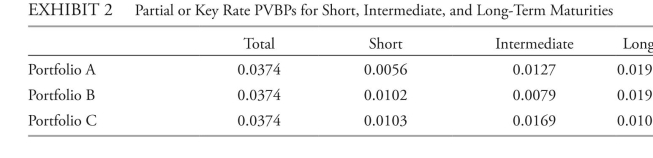

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2: last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

government bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to the

Fund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibits 1 and 2, which of the following portfolios is most likely to have the best performance given edgarton's yield curve expectations?

A) current Portfolio

B) Pro Forma Portfolio 1

C) Pro Forma Portfolio 2

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2:

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australiangovernment bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to theFund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibits 1 and 2, which of the following portfolios is most likely to have the best performance given edgarton's yield curve expectations?

A) current Portfolio

B) Pro Forma Portfolio 1

C) Pro Forma Portfolio 2

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

The following information relates to Questions

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1. * There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers are

presented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2. hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 1, the gain in convexity from hirji's suggestion is closest to:

A) 0.423.

B) 1.124.

C) 1.205.

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1.

* There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers arepresented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2.

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 1, the gain in convexity from hirji's suggestion is closest to:

A) 0.423.

B) 1.124.

C) 1.205.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

The following information relates to Questions

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1. * There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers are

presented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2. hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 3, the total expected return of hirji's barbell portfolio is closest to:

A) −2.30%.

B) 0.07%.

C) 4.60%.

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1.

* There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers arepresented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2.

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

based on exhibit 3, the total expected return of hirji's barbell portfolio is closest to:

A) −2.30%.

B) 0.07%.

C) 4.60%.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

The following information relates to Questions

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1. * There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers are

presented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2. hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

Which yield curve forecast will most likely result in the highest profit for hirji's proposed duration-neutral trades?

A) increase in curvature

B) decrease in curvature

C) Parallel downward shift

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1.

* There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers arepresented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2.

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

Which yield curve forecast will most likely result in the highest profit for hirji's proposed duration-neutral trades?

A) increase in curvature

B) decrease in curvature

C) Parallel downward shift

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

The following information relates to Questions

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1. * There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers are

presented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2. hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

relative to the canadian government bond index, the portfolio that hirji proposes for the Malaysian client will most likely:

A) underperform.

B) remain stable.

C) outperform.

Sanober hirji is a junior analyst with Northco Securities, which is based in canada. The

institutional clients of Northco are active investors in canadian coupon-bearing government

bonds. client portfolios are benchmarked to a canadian government bond index, which is a

diverse maturity index portfolio. after reviewing the portfolio of a French institutional client,

hirji evaluates yield curve strategies for canadian government bond portfolios under various interest rate scenarios. hirji's supervisor, Éliane Prégent, forecasts that canadian long-term

rates will rise and short-term rates will fall over the next 12 months.

Northco's chief economist forecasts that canadian interest rates will increase or decrease

by 100 basis points over the next 12 months. based on the chief economist's forecast, hirji

suggests increasing the convexity of the French institutional client's portfolio by selling 10-

year bonds and investing the proceeds in a duration-matched barbell position of canadian

government 3-year and long-term bonds. She notes that the duration of the 10-year bonds,

along with the durations of the other portfolio bonds, aligns the portfolio's effective duration

with that of the benchmark. Selected data on canadian government bonds are presented in

exhibit 1.

* There is no single convention for how convexity numbers are

* There is no single convention for how convexity numbers arepresented; for example, bloomberg has historically followed a

convention of dividing the "raw" convexity number by 100

(as presented here). however, it is important to use the raw

convexity number when estimating returns.

hirji then considers a strategy to sell some long-term bonds from the French institutional

client's portfolio and purchase short maturity at-the-money options on long-term bond fu-

tures. The portfolio's duration would remain unchanged. Prégent asks:

"how would portfolio performance be affected by this strategy if the yield curve were

to remain stable?"

hirji also proposes the following duration-neutral trades for the French institutional client:

• long/short trade on 1-year and 3-year canadian government bonds

• Short/long trade on 10-year and long-term canadian government bonds

Six months later, hirji reviews canadian government bonds for a Malaysian institutional

client. Prégent and hirji expect changes in the curvature of the yield curve but are not sure

whether curvature will increase or decrease. hirji first analyzes positions that would profit from

an increase in the curvature of the yield curve. The positions must be duration neutral, and the

maximum position that the Malaysian client can take in long-term bonds is c$150 million.

hirji notes that interest rates have increased by 100 basis points over the past six months. Se-

lected data for on-the-run canadian government bonds are shown in exhibit 2.

hirji then considers the scenario where the yield curve will lose curvature for the Malay-

hirji then considers the scenario where the yield curve will lose curvature for the Malay-sian institutional client. She notes that a 7-year canadian government bond is also available

in the market. hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds

and 53% in 7-year bonds.

Finally, hirji uses the components of expected returns to compare the performance of a

bullet portfolio and a barbell portfolio for a british institutional client. characteristics of these

portfolios are shown in exhibit 3.

relative to the canadian government bond index, the portfolio that hirji proposes for the Malaysian client will most likely:

A) underperform.

B) remain stable.

C) outperform.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

The following information relates to Questions

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2: last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

government bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to the

Fund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

The yield curve expectation that abram's supervisor targets with Scenario 1 is most likely a:

A) flattening yield curve.

B) reduction in yield curve curvature.

C) 100 bps parallel shift downward of the yield curve.

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2:

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australiangovernment bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to theFund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

The yield curve expectation that abram's supervisor targets with Scenario 1 is most likely a:

A) flattening yield curve.

B) reduction in yield curve curvature.

C) 100 bps parallel shift downward of the yield curve.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

The following information relates to Questions

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2: last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

government bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to the

Fund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibit 1, which short position is most likely to be included in the condor out-lined in Scenario 2?

A) 1-year $338 million

B) 5-year $71 million

C) 10-year $38 million

Silvia abram and Walter edgarton are analysts with cefrino investments, which sponsors

the cefrino Sovereign bond Fund (the Fund). abram and edgarton recently attended an

investment committee meeting where interest rate expectations for the next 12 months were

discussed. The Fund's mandate allows its duration to fluctuate ±0.30 per year from the bench-

mark duration. The Fund's duration is currently equal to its benchmark. although the Fund is

presently invested entirely in annual coupon sovereign bonds, its investment policy also allows

investments in mortgage-backed securities (MbS) and call options on government bond fu-

tures. The Fund's current holdings of on-the-run bonds are presented in exhibit 1.

over the next 12 months, abram expects a stable yield curve; however, edgarton expects

a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising

by more than 1.00%.

two alternative portfolio scenarios based on her own yield curve outlook:

Scenario 1 Sell all bonds in the Fund except the 2-year and 30-year bonds, and increase

positions in these two bonds while keeping duration neutral to the benchmark.

Scenario 2 construct a condor to benefit from less curvature in the 5-year to 10-year area

of the yield curve. The condor will utilize the same 1-year, 5-year, 10-year, and

30-year bonds held in the Fund. The maximum allowable position in the 30-year

bond in the condor is $17 million, and the bonds must have equal (absolute

value) money duration.

edgarton evaluates the Fund's positions from exhibit 1 along with two of his pro forma

portfolios, which are summarized in exhibit 2:

last, edgarton reviews a separate account for cefrino's uS clients that invest in australian

last, edgarton reviews a separate account for cefrino's uS clients that invest in australiangovernment bonds. he expects a stable australian yield curve over the next 12 months. he

evaluates the return from buying and holding a 1-year australian government bond versus

buying the 2-year australian government bond and selling it in one year.

based on her yield curve forecast, abram recommends to her supervisor changes to the

based on her yield curve forecast, abram recommends to her supervisor changes to theFund's holdings using the following three strategies:

Strategy 1 Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2 Sell the 5-year bonds, and use the proceeds to buy 30-year MbS with an

effective duration of 4.75.

Strategy 3 Sell the 10-year bonds, and buy call options on 10-year government bond

futures.

abram's supervisor disagrees with abram's yield curve outlook. The supervisor develops

based on exhibit 1, which short position is most likely to be included in the condor out-lined in Scenario 2?

A) 1-year $338 million

B) 5-year $71 million

C) 10-year $38 million

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

The following information relates to Questions

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

given Mclaughlin's interest rate expectations over the next 12 months, which long/short structure would be most appropriate?

A) condor: short wings, long body

B) butterfly: short barbell, long bullet

C) butterfly: long barbell, short bullet

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

given Mclaughlin's interest rate expectations over the next 12 months, which long/short structure would be most appropriate?

A) condor: short wings, long body

B) butterfly: short barbell, long bullet

C) butterfly: long barbell, short bullet

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

The following information relates to Questions

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

using the yield curve forecast shown in exhibit 1, which portfolio strategy should don- aldson recommend for the year ahead?

A) The bullet portfolio

B) The barbell portfolio

C) The laddered portfolio

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

using the yield curve forecast shown in exhibit 1, which portfolio strategy should don- aldson recommend for the year ahead?

A) The bullet portfolio

B) The barbell portfolio

C) The laddered portfolio

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

The following information relates to Questions

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.

Mclaughlin and Michaela donaldson, a junior analyst at delphi, are now discussing how

to reposition the portfolio in light of Mclaughlin's expectations about interest rates over the

next 12 months. She expects interest rate volatility to be high and the yield curve to experience

an increase in the 2s/10s/30s butterfly spread, with the 30-year yield remaining unchanged.

Selected yields on the treasury yield curve, and Mclaughlin's expected changes in yields over

the next 12 months, are presented in exhibit 1.

Which of donaldson's statements is correct?

A) only Statement 1

B) only Statement 2

C) both Statements 1 and 2

amy Mclaughlin is a fixed-income portfolio manager at uK-based delphi investments. one

year ago, given her expectations of a stable yield curve over the coming 12 months and noting

that the yield curve was upward sloping, Mclaughlin elected to position her portfolio solely

in 20-year uS treasury bonds with a coupon rate of 4% and a price of 101.7593, with the

expectation of selling the bonds in one year at a price of 109.0629. Mclaughlin expected the

uS dollar to depreciate relative to the british pound by 1.50% during the year. Mclaughlin

chose the 20-year treasury bonds because they were on the steepest part of the yield curve.