Deck 20: International Issues in Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Match between columns

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 20: International Issues in Taxation

1

Summarize the taxation of the income of controlled and non-controlled foreign affiliates.

Controlled Foreign Affiliates - Whether the resident Canadian shareholder is an individual or a corporation, Foreign Accrual Property Income (FAPI)that is earned by a Controlled Foreign Affiliate must be included in income on an accrual basis as it is earned. When these amounts are subsequently paid out as dividends they will be included in the income of the Canadian shareholder but will be eligible for an offsetting deduction to recognize the fact that the amount was previously taxed as FAPI. If the dividend is paid from non-FAPI sources of income, it will be included in income, but, in the case of Canadian corporate shareholders, may be completely or partially offset by the ITA 113(1)deduction from Taxable Income depending upon whether Canada has entered into a tax treaty or Tax Exchange Information Agreement (TEIA)with the source country. Canadian individual shareholders would obtain partial relief through the foreign tax credit system only, since they are not entitled to the ITA 113(1)deduction. This generally encourages individuals to hold shares in foreign corporations through a resident Canadian corporation.

Non-Controlled Foreign Affiliates - The income of Foreign Affiliates that are not controlled will not be accrued as it is earned. Rather, it is included in income when dividends are received from the Foreign Affiliate. If the dividend is paid from active business income earned in a country with which Canada has a tax treaty or TEIA, it will be eliminated by the ITA 113(1)deduction in the calculation of Taxable Income. In addition, dividends paid out of the non-taxable portion of some types of capital gains, or the full amount of capital gains resulting from dispositions of property used in an active business in a country with which Canada has a tax treaty or TEIA, are deductible under ITA 113(1). When the ITA 113(1)deduction is available, no credit can be taken for any foreign taxes paid.

Alternatively, i f the dividend is paid out of passive income, or earned in a non-treaty/non-TEIA country, it will be included in income and only be eligible for deductions under ITA 113 to the extent income taxes or withholding taxes have been paid on the amounts distributed.

Non-Controlled Foreign Affiliates - The income of Foreign Affiliates that are not controlled will not be accrued as it is earned. Rather, it is included in income when dividends are received from the Foreign Affiliate. If the dividend is paid from active business income earned in a country with which Canada has a tax treaty or TEIA, it will be eliminated by the ITA 113(1)deduction in the calculation of Taxable Income. In addition, dividends paid out of the non-taxable portion of some types of capital gains, or the full amount of capital gains resulting from dispositions of property used in an active business in a country with which Canada has a tax treaty or TEIA, are deductible under ITA 113(1). When the ITA 113(1)deduction is available, no credit can be taken for any foreign taxes paid.

Alternatively, i f the dividend is paid out of passive income, or earned in a non-treaty/non-TEIA country, it will be included in income and only be eligible for deductions under ITA 113 to the extent income taxes or withholding taxes have been paid on the amounts distributed.

2

The Canada/U.S. tax treaty allows Canada to tax the business income of U.S. residents, provided that business is operated in Canada through a permanent establishment.

True

3

If there is a conflict between the Canadian Income Tax Act and the Canada/U.S. tax treaty, the provisions of the treaty must be used.

True

4

Indicate the types of income on which non-residents are subject Canadian Part I taxes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

If a non-resident is required to pay Part XIII tax in Canada, they will have to file a Canadian tax return.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

John Barth has $20,000 of foreign source business income, from which the government in the foreign jurisdiction has withheld $2,000. Briefly describe the treatment of the withholding amount in determining John Barth's Canadian Tax Payable.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Clarkson Equipment Ltd. is a manufacturer of construction equipment that is used throughout the world. The factory is located in Windsor, Ontario and the majority of its manufacturing operations take place at that location. In the current year, the Company negotiated a very significant contract with an African country with which Canada has a comprehensive tax treaty. The contract requires not only the provision of the Company's equipment, but instruction and training of the operators as well. Given the magnitude of this contract, Clarkson is considering establishing a subsidiary in the African country to carry out the terms of the agreement. Compare the Canadian tax treatment of income earned if the contract was handled through the Canadian head office with the tax treatment if a non-resident subsidiary is used to carry out the contract.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Provide two examples of the type of income on which Part XIII tax is assessed.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

In general, employment income earned in Canada is subject to Part I tax. However, the Canada/U.S. tax treaty provides exceptions to this general rule. Describe these exceptions.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Explain why dividends received by individuals from non-resident corporations do not usually receive the same gross up and tax credit treatment that is accorded to dividends received from taxable Canadian corporations.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

If a non-resident individual has Part I Tax Payable and is required to file a Canadian tax return, he will not be eligible for any of the usual credits against the total amount payable.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

If a U.S. resident receives interest on Canadian participating debt, she will be required to pay Part XIII tax on the amounts received.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

List two objectives that are served by international tax treaties.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

An individual emigrates from Canada at a time when he owns shares in a private company with a fair market value of $500,000 and an adjusted cost base of $300,000. Two years later, he decides to return to Canada. At this time he still owns the shares. What are the tax consequences of his departure from Canada and his return to Canada.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

If an individual resident of Canada emigrates to the U.S., he will have a deemed disposition at fair market value of the assets in his brokerage accounts and his RRSP.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

A non-resident individual owns a rental property in Canada. While her rental revenues would be subject to Part XIII tax, as an alternative, she can elect to pay taxes under Part I, rather than Part XIII. Why might she wish to make this election?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

The Canada/U.S. tax treaty permits Canadian taxation of business income earned by a U.S. business that has a "permanent establishment" in Canada. The treaty also indicates that, in some situations, an individual can be considered to be a permanent establishment for the purposes of this rule. Describe these situations.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

When a person emigrates from Canada, there is no deemed disposition/reacquisition of their Canadian real estate holdings. However, ITA 128.1(4)(d)allows a taxpayer to elect to have a deemed disposition/reacquisition of real estate at the time of their departure. Why would an individual wish to make this election? Briefly explain your conclusion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

When an individual immigrates to Canada, there is a deemed disposition/reacquisition at fair market value of most of their capital property. Briefly explain why this is an important provision for most individuals.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

If a U.S. resident earns less than $10,000 in Canadian employment income, the employment income will not be taxed in Canada even if the income is paid by a Canadian business that deducts the payments.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

All Canadian interest that is earned by non-residents is subject to Part XIII tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

A non-resident earning rental income on property in Canada can either pay Part XIII tax or, alternatively, elect to be taxed under Part I.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

In the Canada/U.S. tax treaty, the definition of a permanent establishment does not include:

A)an oil well.

B)a storage facility.

C)a factory.

D)a mine.

A)an oil well.

B)a storage facility.

C)a factory.

D)a mine.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

In general, if a non-resident individual earns employment income in Canada, he will be subject to Canadian taxation on that income.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

An entity would be a controlled foreign affiliate of a Canadian taxpayer if it is a foreign affiliate of the taxpayer that would, at that time, be controlled by the taxpayer if the taxpayer owned all of the shares of the capital stock of the foreign affiliate that are owned at that time by persons who do not deal at arm's length with the taxpayer.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

In which of the following cases, where a U.S. resident disposes of a property, is the gain taxable in Canada?

A)Joelle Elfassy sells 100 shares in a widely held Canadian public company that has over 10 million shares issued.

B)Ku Jung owns a rental property in downtown Vancouver. Ku has owned the property for 3 years and has never lived in it. The property is sold for a substantial gain.

C)Danyal Sigindere incorporated a private company in Canada 10 years ago. The company rents space and operates a retail clothing store. Danyal sells the shares for a gain of $1,000.

D)Ariella Incorporated sells its list of Canadian customers to a Canadian business.

A)Joelle Elfassy sells 100 shares in a widely held Canadian public company that has over 10 million shares issued.

B)Ku Jung owns a rental property in downtown Vancouver. Ku has owned the property for 3 years and has never lived in it. The property is sold for a substantial gain.

C)Danyal Sigindere incorporated a private company in Canada 10 years ago. The company rents space and operates a retail clothing store. Danyal sells the shares for a gain of $1,000.

D)Ariella Incorporated sells its list of Canadian customers to a Canadian business.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Darren Brock, a non-resident, borrows $422,000 and invests it in a Canadian rental property which produces gross annual rental income of $72,000. The interest costs on the loan total $6,000, and other expenses of operating the property, including maximum CCA, total $20,000. Which of the following sets of numbers represents first, the amount that would be taxable to Mr. Brock if he reports his rental income under Part I, and second, if he reports his rental income under Part XIII?

A)$72,000; $46,000

B)$46,000; $52,000

C)$72,000; $66,000

D)$46,000; $72,000

A)$72,000; $46,000

B)$46,000; $52,000

C)$72,000; $66,000

D)$46,000; $72,000

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

In general, if a non-resident earns income from mining in Canada, it is not subject to taxation in Canada.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Under the Canada/U.S. tax treaty, if a Canadian resident earns employment income in the U.S. that is $10,000 or less in U.S. dollars, then the income is taxable only in Canada.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

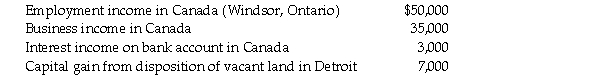

Kenichi Takahawa is a resident of the United States, living in Detroit, Michigan. He works and earns income for the year as follows:  What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

A)$50,000

B)$85,000

C)$88,000

D)$91,500

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?A)$50,000

B)$85,000

C)$88,000

D)$91,500

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

If a U.S. corporation owns a storage facility in Canada, this will be considered a permanent establishment for purposes of determining which country will tax business income.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

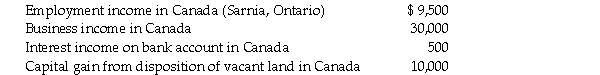

Fahad Lodhi is a resident of the United States, living in Port Huron, Michigan. He works and earns income in Canada all year as follows:  What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

A)$30,000

B)$35,000

C)$45,000

D)$44,500

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?A)$30,000

B)$35,000

C)$45,000

D)$44,500

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Many types of income are subject to withholding tax under Part XIII of the Income Tax Act. Which of the following would NOT be subject to this withholding tax when paid to a non-resident individual? Ignore any tax treaty provisions that might be applicable.

A)A withdrawal from a RRIF by a former resident of Canada.

B)A deferred bonus from a former employer who is resident in Canada.

C)Interest on Government of Canada bonds.

D)Dividends received from a CCPC.

A)A withdrawal from a RRIF by a former resident of Canada.

B)A deferred bonus from a former employer who is resident in Canada.

C)Interest on Government of Canada bonds.

D)Dividends received from a CCPC.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

Merivale is an American corporation with operations throughout the United States. In addition to its U.S. operations, it has a sales office in Calgary. Canadian employees who work out of this sales office take orders for the company's products. The orders are filled from a warehouse in Montana.

A)Merivale is not subject to Canadian tax because it is not incorporated in Canada.

B)Merivale is not subject to Canadian tax because the orders are not filled from a Canadian warehouse.

C)Merivale is not subject to Canadian tax because the mind and management of the company is not in Canada.

D)Merivale is subject to Canadian tax on the income that is earned by the Calgary office.

A)Merivale is not subject to Canadian tax because it is not incorporated in Canada.

B)Merivale is not subject to Canadian tax because the orders are not filled from a Canadian warehouse.

C)Merivale is not subject to Canadian tax because the mind and management of the company is not in Canada.

D)Merivale is subject to Canadian tax on the income that is earned by the Calgary office.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following businesses will be subject to Part I tax in Canada?

A)A U.S. company that receives dividends from its Canadian subsidiary.

B)A U.S. company that stores its inventory in a Canadian warehouse.

C)A multinational manufacturing business that has a factory in Canada.

D)A U.S. company that has a temporary office in Canada while searching for a site for its planned Canadian manufacturing plant.

A)A U.S. company that receives dividends from its Canadian subsidiary.

B)A U.S. company that stores its inventory in a Canadian warehouse.

C)A multinational manufacturing business that has a factory in Canada.

D)A U.S. company that has a temporary office in Canada while searching for a site for its planned Canadian manufacturing plant.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Under ITA 2(3), gains resulting from the disposition of any capital property in Canada by a non-resident will be subject to Canadian income tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

When an individual immigrates to Canada, there is a deemed disposition/reacquisition at fair market value of most of their capital property.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

While Canadian dividends paid to U.S. residents are subject to Part XIII tax, the Canada/U.S. tax treaty serves to reduce this rate from the statutory rate of 25 percent.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Under ITA 115(2)certain non-resident individuals will be deemed to be employed in Canada even when they are not working in Canada. Which of the following non-resident individuals would be deemed to be employed in Canada?

A)Marcel is employed by a Canadian resident company in a foreign country. The tax treaty with the foreign country subjects his employment income to taxation in that jurisdiction.

B)Anita was previously a Canadian resident. She is currently employed by a non-resident company in a foreign country, but receives pension income from a Canadian resident company.

C)Johann receives a signing bonus from a non-resident company. His services will be provided in Canada.

D)Helen is employed by a Canadian resident company in a foreign country. The tax treaty with the foreign country exempts her employment income from taxation.

A)Marcel is employed by a Canadian resident company in a foreign country. The tax treaty with the foreign country subjects his employment income to taxation in that jurisdiction.

B)Anita was previously a Canadian resident. She is currently employed by a non-resident company in a foreign country, but receives pension income from a Canadian resident company.

C)Johann receives a signing bonus from a non-resident company. His services will be provided in Canada.

D)Helen is employed by a Canadian resident company in a foreign country. The tax treaty with the foreign country exempts her employment income from taxation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Mike O'Shea, a resident of Ireland, has owned a Canadian rental property for several years. The property is located in Alberta and, during the current year, it was sold for an amount that resulted in a significant capital gain. Which of the following statements is correct with respect to the gain?

A)Mr. O'Shea is not a Canadian resident and, as a consequence, will not be taxed on this gain.

B)Mr.O'Shea will be assessed for a withholding tax under Part XIII of the Income Tax Act.

C)Mr. O'Shea will be subject to Canadian Part I tax.

D)Mr. O'Shea will be subject to Canadian Part I tax as well as Part XIII tax.

A)Mr. O'Shea is not a Canadian resident and, as a consequence, will not be taxed on this gain.

B)Mr.O'Shea will be assessed for a withholding tax under Part XIII of the Income Tax Act.

C)Mr. O'Shea will be subject to Canadian Part I tax.

D)Mr. O'Shea will be subject to Canadian Part I tax as well as Part XIII tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

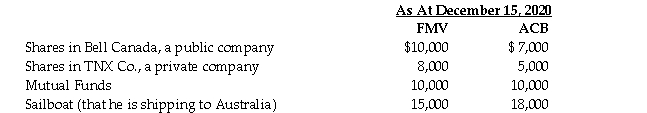

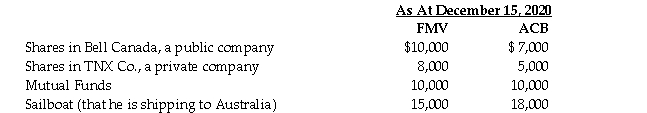

Mr. Winsome is a Canadian citizen and has been resident in Canada for the past 35 years. His company has offered him a position with its Australian branch, which Mr. Winsome has accepted. The position is a transfer and Mr. Winsome plans to remain in Australia for the rest of his life. Given the temperate climate in Australia, he thinks it will be a good country to retire in. Mr. Winsome has the following assets in Canada on December 15, 2020, the date of his departure from Canada:  He sold all of his other assets. Which of the following is correct?

He sold all of his other assets. Which of the following is correct?

A)Mr.Winsome will be deemed to have disposed of his mutual funds, sailboat, TNX Co. shares and Bell Canada shares on December 15, 2020.

B)Mr.Winsome can elect to defer the gain on the Bell Canada shares until they are sold, only if security acceptable to the CRA is provided.

C)Mr. Winsome can elect to have a deemed disposition of the Bell Canada shares on December 15, 2020, only if security acceptable to the CRA is provided.

D)None of the above.

He sold all of his other assets. Which of the following is correct?

He sold all of his other assets. Which of the following is correct?A)Mr.Winsome will be deemed to have disposed of his mutual funds, sailboat, TNX Co. shares and Bell Canada shares on December 15, 2020.

B)Mr.Winsome can elect to defer the gain on the Bell Canada shares until they are sold, only if security acceptable to the CRA is provided.

C)Mr. Winsome can elect to have a deemed disposition of the Bell Canada shares on December 15, 2020, only if security acceptable to the CRA is provided.

D)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Because of his distaste for Canadian winters, Rob Johnston has emigrated from Canada to Florida. At the time of his departure, his RRSP held assets with a fair market value of $1,500,000. Which of the following statements is correct?

A)There will be a deemed disposition of all of these assets at the time of Rob's departure from Canada.

B)There will be no tax consequences at the time of departure. However, any withdrawals from the plan after his departure will be subject to Canadian Part I tax.

C)There will be no tax consequences at the time of departure. However, any withdrawals from the plan after his departure will be subject to Canadian Part XIII tax.

D)Part XIII tax will have to be paid at the time of departure, but there will be no further taxation assessed on withdrawals from the plan.

A)There will be a deemed disposition of all of these assets at the time of Rob's departure from Canada.

B)There will be no tax consequences at the time of departure. However, any withdrawals from the plan after his departure will be subject to Canadian Part I tax.

C)There will be no tax consequences at the time of departure. However, any withdrawals from the plan after his departure will be subject to Canadian Part XIII tax.

D)Part XIII tax will have to be paid at the time of departure, but there will be no further taxation assessed on withdrawals from the plan.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

In each of the following Cases, determine whether Rawlings Inc., a non-resident U.S. corporation, is taxable in Canada:

Case 1 - Rawlings is the parent company of Delma Ltd., a company incorporated in British Columbia. Rawlings produces and sells small construction equipment, while Delma produces and sells hand tools. Rawlings sells pieces of equipment to Delma, who in turn sells them in Canada.

Case 2 - Rawlings manufactures small construction equipment in the U.S. Rawlings ships pieces of equipment to a warehouse located in Winnipeg that is rented on a seven year lease. Rawlings has employed an individual in Winnipeg to sell the equipment throughout central Canada. The employee is not allowed to conclude contracts without approval by the U.S. office.

Case 3 - Assume the same facts as in Case 2, except that the employee has the authority to conclude contracts on behalf of the employer.

Case 1 - Rawlings is the parent company of Delma Ltd., a company incorporated in British Columbia. Rawlings produces and sells small construction equipment, while Delma produces and sells hand tools. Rawlings sells pieces of equipment to Delma, who in turn sells them in Canada.

Case 2 - Rawlings manufactures small construction equipment in the U.S. Rawlings ships pieces of equipment to a warehouse located in Winnipeg that is rented on a seven year lease. Rawlings has employed an individual in Winnipeg to sell the equipment throughout central Canada. The employee is not allowed to conclude contracts without approval by the U.S. office.

Case 3 - Assume the same facts as in Case 2, except that the employee has the authority to conclude contracts on behalf of the employer.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

In each of the following Cases, determine whether the employment income is taxable in Canada:

Case 1 - John lives in Blaine, Washington and is a U.S. citizen. However, he is employed by a business in Chilliwack, British Columbia. His salary for 2020 is $72,000. As he is able to do some of his work in his home office in Blaine, he commutes to Chilliwack for 150 days during 2020.

Case 2 - Martin is a U.S. citizen who lives in Vermont. He is employed by a U.S. business that does not have a permanent establishment in Canada. During the period March 1, 2020 through June 30, 2020, Martin is required to work in Montreal. His $5,000 per month salary is paid by his U.S. employer.

Case 3 - Assume the same facts as in Case 2 except that his U.S. employer has a subsidiary in Montreal. During the period that he is working in Montreal, his salary is paid by the Montreal subsidiary.

Case 1 - John lives in Blaine, Washington and is a U.S. citizen. However, he is employed by a business in Chilliwack, British Columbia. His salary for 2020 is $72,000. As he is able to do some of his work in his home office in Blaine, he commutes to Chilliwack for 150 days during 2020.

Case 2 - Martin is a U.S. citizen who lives in Vermont. He is employed by a U.S. business that does not have a permanent establishment in Canada. During the period March 1, 2020 through June 30, 2020, Martin is required to work in Montreal. His $5,000 per month salary is paid by his U.S. employer.

Case 3 - Assume the same facts as in Case 2 except that his U.S. employer has a subsidiary in Montreal. During the period that he is working in Montreal, his salary is paid by the Montreal subsidiary.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Certain types of Canadian income earned by non-residents are not taxed under Part I of the Income Tax Act. Which of the following types of income would be eligible for this treatment? Ignore any tax treaty implications that might be applicable.

A)Income from the sale of Canadian real estate.

B)Interest on a GIC issued by a Canadian bank.

C)Income resulting from the exercise of options on the stock of a Canadian public company.

D)Recapture resulting from the sale of a Canadian business property.

A)Income from the sale of Canadian real estate.

B)Interest on a GIC issued by a Canadian bank.

C)Income resulting from the exercise of options on the stock of a Canadian public company.

D)Recapture resulting from the sale of a Canadian business property.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

A non-resident individual owns a rental property in Canada. Which of the following statements is correct?

A)The gross rents are subject to withholding under Part XIII of the Income Tax Act. However, the taxpayer can elect to file a Canadian tax return which will include the net rental income.

B)The net rental income is subject to withholding under Part XIII of the Income Tax Act. However, the taxpayer can elect to file a Canadian tax return which will include the gross rents.

C)The taxpayer must file a Canadian tax return which includes the net rental income.

D)The net rents are subject to withholding under Part XIII of the Income Tax Act.

A)The gross rents are subject to withholding under Part XIII of the Income Tax Act. However, the taxpayer can elect to file a Canadian tax return which will include the net rental income.

B)The net rental income is subject to withholding under Part XIII of the Income Tax Act. However, the taxpayer can elect to file a Canadian tax return which will include the gross rents.

C)The taxpayer must file a Canadian tax return which includes the net rental income.

D)The net rents are subject to withholding under Part XIII of the Income Tax Act.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

In each of the following Cases, determine whether the interest payments made to non-residents are subject to Part XIII withholding tax.

Case 1 - Phillip, a resident of Montana, earned interest of $2,250 on Canada Savings Bonds in 2020.

Case 2 - Marsha, a resident of Halifax, acquired a vacation property in California for personal purposes. The property is mortgaged with a U.S. bank. Marsha paid $16,500 in interest to the U.S. bank in 2020.

Case 3 - Assume the same facts as in Case 2, except that Marsha had acquired the California condo in 2014 for cash. In 2020, she mortgages the property with a U.S. bank and uses the money to support a business she carries on in Halifax.

Case 1 - Phillip, a resident of Montana, earned interest of $2,250 on Canada Savings Bonds in 2020.

Case 2 - Marsha, a resident of Halifax, acquired a vacation property in California for personal purposes. The property is mortgaged with a U.S. bank. Marsha paid $16,500 in interest to the U.S. bank in 2020.

Case 3 - Assume the same facts as in Case 2, except that Marsha had acquired the California condo in 2014 for cash. In 2020, she mortgages the property with a U.S. bank and uses the money to support a business she carries on in Halifax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

Mrs. Lorna Rand owns a rental property in Calgary, Alberta with a cost of $175,000 and a fair market value of $315,000. The land values included in these figures are $52,000 and $70,000, respectively. The UCC of the building is $91,400. During the current year, Mrs. Rand permanently departs from Canada. What are the current and possible future tax consequences of her departure with respect to this rental property?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

In each of the following Cases, determine how the rental payments made to non-residents will be taxed by Canada.

Case 1 - Carco is a U.S. corporation with worldwide rental facilities dedicated to automobile rentals. Carco has offices in New Brunswick, where it rents out small and medium sized vehicles.

Case 2 - In 2017, Danielle Clark, a U.S. resident, acquired several cottages in Manitoba that she rents out. In 2020, she rented the cottages to Canadian residents exclusively. Danielle received $46,000 in gross rents and estimates that expenses, including CCA, totaled $17,500.

Case 3 - Assume the same facts as in Case 2, with one additional consideration. Danielle acquired four all terrain vehicles in 2018, which she rented to guests of the cottages for an additional cost. In 2020, she received $4,000 in gross rents and estimates all terrain vehicle related expenses of $2,500.

Case 1 - Carco is a U.S. corporation with worldwide rental facilities dedicated to automobile rentals. Carco has offices in New Brunswick, where it rents out small and medium sized vehicles.

Case 2 - In 2017, Danielle Clark, a U.S. resident, acquired several cottages in Manitoba that she rents out. In 2020, she rented the cottages to Canadian residents exclusively. Danielle received $46,000 in gross rents and estimates that expenses, including CCA, totaled $17,500.

Case 3 - Assume the same facts as in Case 2, with one additional consideration. Danielle acquired four all terrain vehicles in 2018, which she rented to guests of the cottages for an additional cost. In 2020, she received $4,000 in gross rents and estimates all terrain vehicle related expenses of $2,500.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

In each of the following Cases, determine whether the employment income is taxable in Canada:

Case 1 - Mary resides in the state of Maine. She accepted temporary employment as a personal trainer with a Canadian company for clients in New Brunswick beginning August 1, 2020 and ending on December 31, 2020. The Canadian employer agreed to pay her $2,660 Canadian per month. Mary remained a non-resident of Canada throughout her Canadian employment.

Case 2 - Assume the same facts as in Case 1, except the employer was resident in Maine and did not have a permanent establishment in Canada.

Case 3 - Bill resides in Watertown, New York and has commuted daily to a full-time job in Kingston, Ontario for the last five years. In 2020, he spent 217 days at his job in Canada. He works for the municipality of Kingston and earned $53,000 Canadian in employment income. Bill is a U.S. resident throughout the year.

Case 1 - Mary resides in the state of Maine. She accepted temporary employment as a personal trainer with a Canadian company for clients in New Brunswick beginning August 1, 2020 and ending on December 31, 2020. The Canadian employer agreed to pay her $2,660 Canadian per month. Mary remained a non-resident of Canada throughout her Canadian employment.

Case 2 - Assume the same facts as in Case 1, except the employer was resident in Maine and did not have a permanent establishment in Canada.

Case 3 - Bill resides in Watertown, New York and has commuted daily to a full-time job in Kingston, Ontario for the last five years. In 2020, he spent 217 days at his job in Canada. He works for the municipality of Kingston and earned $53,000 Canadian in employment income. Bill is a U.S. resident throughout the year.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

In which of the following cases would the interest payment made to a non-resident be subject to Part XIII withholding tax?

A)Ling, a resident of a country that does not have a tax treaty with Canada, earns interest of $5,000 from a Canadian term deposit.

B)Jin, a resident of a country that does not have a tax treaty with Canada, earns interest of $15,000 on a Canadian government bond.

C)Dou, a U.S. resident, earns interest of $42,000 on a loan to Moon Limited, a CCPC. Dou owns 51% of the shares in the company.

D)Ying, a resident of a country that does not have a tax treaty with Canada, earns $25,000 on a loan to Sun Enterprises Limited, a CCPC. Ying owns 40% of the shares in the company.

A)Ling, a resident of a country that does not have a tax treaty with Canada, earns interest of $5,000 from a Canadian term deposit.

B)Jin, a resident of a country that does not have a tax treaty with Canada, earns interest of $15,000 on a Canadian government bond.

C)Dou, a U.S. resident, earns interest of $42,000 on a loan to Moon Limited, a CCPC. Dou owns 51% of the shares in the company.

D)Ying, a resident of a country that does not have a tax treaty with Canada, earns $25,000 on a loan to Sun Enterprises Limited, a CCPC. Ying owns 40% of the shares in the company.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following types of payment is NOT subject to Part XIII Canadian withholding tax when paid to a non-resident?

A)Dividends

B)Pension benefits

C)Interest paid to an arm's length party

D)Registered retirement savings fund payments

A)Dividends

B)Pension benefits

C)Interest paid to an arm's length party

D)Registered retirement savings fund payments

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

In each of the following Cases, determine whether the U.S. resident who is disposing of property is taxable under Part I in Canada on any gain resulting from the disposition.

Case 1 - In 2015, Anne Mason acquired a condo in Canmore, Alberta that she rented to Canadian residents. She sold the condo in 2020 at a considerable gain. Anne never occupied the condo.

Case 2 - Assume the same facts as in Case 1, except that Anne incorporates a private corporation under Alberta legislation which acquires the condo. Anne sells the shares of the private company at a later point for a considerable gain.

Case 3 - Assume the same facts as in Case 2, except the corporation is created under Oregon state legislation.

Case 1 - In 2015, Anne Mason acquired a condo in Canmore, Alberta that she rented to Canadian residents. She sold the condo in 2020 at a considerable gain. Anne never occupied the condo.

Case 2 - Assume the same facts as in Case 1, except that Anne incorporates a private corporation under Alberta legislation which acquires the condo. Anne sells the shares of the private company at a later point for a considerable gain.

Case 3 - Assume the same facts as in Case 2, except the corporation is created under Oregon state legislation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

Ms. Michelle Walker, a U.S. citizen, has Canadian employment income of $22,000 and U.S.employment income of $40,000 Canadian for the current year. The Canadian employment income is from a British Columbia company that can deduct the payments in its Canadian tax return. She lives in Seattle, Washington and is a resident of the United States for the entire year. Ms. Walker does not believe that she is subject to taxation in Canada. Is she correct? Explain your conclusion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

When an individual departs from Canada, there is a deemed disposition of most types of capital property. However, certain items are exempted from this deemed disposition rule. Which of the following items would be among these exemptions?

A)An extremely valuable coin collection.

B)A 72 foot sea-going yacht.

C)Shares of a CCPC that primarily provides nursing services.

D)Shares of a CCPC that primarily owns rental properties for resale.

A)An extremely valuable coin collection.

B)A 72 foot sea-going yacht.

C)Shares of a CCPC that primarily provides nursing services.

D)Shares of a CCPC that primarily owns rental properties for resale.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Joan Bias, a U.S. citizen, established Canadian residency in 2018. At the time she entered Canada, she owned shares in a U.S. company that had an adjusted cost base of $150,000 and a fair market value $210,000. During 2020, she sold these shares for $170,000. Which of the following reflects the tax consequence of this sale?

A)There would be a taxable capital gain of $20,000.

B)There would be an allowable capital loss of $20,000.

C)There would be a taxable capital gain of $10,000.

D)There would be a business investment loss of $40,000.

A)There would be a taxable capital gain of $20,000.

B)There would be an allowable capital loss of $20,000.

C)There would be a taxable capital gain of $10,000.

D)There would be a business investment loss of $40,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

During 2020, Barton Ferris is entitled to $50,000 in dividends from a publicly listed foreign corporation in which he owns shares. The foreign jurisdiction withholds $10,000 (20%), providing a net receipt of $40,000. In addition to the dividend, Barton has Canadian source rental income of $130,000. He has no tax credits other than his basic personal credit and any credits related to foreign taxes withheld. He has no deductions from Net Income For Tax Purposes in determining Taxable Income. What is the amount of his 2020 Taxable Income?

A)$170,000.

B)$177,500.

C)$180,000.

D)$199,000.

A)$170,000.

B)$177,500.

C)$180,000.

D)$199,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Mr. Ryan Marchand owns publicly traded securities with an adjusted cost base of $30,000 and a fair market value of $56,000. During the current year, he permanently departs from Canada still owning the shares. What would be the tax consequences of his departure, if any, with respect to these securities?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Which type of income is not taxable in the hands of non-residents under either Part I or Part XIII?

A)Rental income from a property situated in Canada.

B)Pension benefits from a Canadian employer.

C)Dividend income from a Canadian corporation.

D)Interest paid on a savings account at a Canadian bank branch located in Canada.

A)Rental income from a property situated in Canada.

B)Pension benefits from a Canadian employer.

C)Dividend income from a Canadian corporation.

D)Interest paid on a savings account at a Canadian bank branch located in Canada.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following conditions must be met in order for a resident Canadian corporation to be able to deduct dividends from a non-resident corporation?

A)The dividend must be paid out of active business income.

B)The active business income must be earned in a country with which Canada has a tax treaty or has entered into a tax exchange information agreement.

C)The non-resident corporation must be a foreign affiliate.

D)All of the above.

A)The dividend must be paid out of active business income.

B)The active business income must be earned in a country with which Canada has a tax treaty or has entered into a tax exchange information agreement.

C)The non-resident corporation must be a foreign affiliate.

D)All of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Match between columns

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Mr. Jordan Koch owns shares in a Canadian private company with an adjusted cost base of $115,000 and a fair market value of $240,000. In addition, he owns a rental property with a fair market value of $105,000 ($27,000 of this can be attributed to the land)and a cost of$200,000 ($55,000 of this can be attributed to the land). The UCC of the building is $121,000. During the current year, Mr. Koch permanently departs from Canada.

Calculate the minimum and maximum Net Income For Tax Purposes that could result from his departure.

Calculate the minimum and maximum Net Income For Tax Purposes that could result from his departure.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Subco is a 100 percent owned foreign subsidiary of Parco, a resident Canadian company. During 2020, Subco earns $250,000 of investment income and pays 15 percent tax on this income in the foreign jurisdiction. None of the after tax income is paid out as dividends. What is the effect of this information on Parco's 2020 Net Income For Tax Purposes?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Match between columns

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

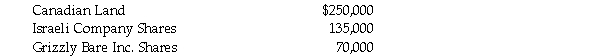

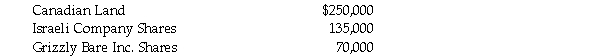

For many years, Dakota Fox was a resident of Israel. However, in 2019, she concludes that she would like to move to an area with a cooler climate and accepts an employment position in Canada. At this time, her capital assets consist of a tract of Canadian land which she purchased on a previous visit to research living in Canada, and shares in an Israeli utility company. The land has an adjusted cost base of $125,000 and a fair market value of $200,000. The shares have an adjusted cost base of $85,000 and a fair market value of $115,000.

While she is in Canada, she acquires shares of a Canadian company, Grizzly Bare Inc. for $55,000. In 2021, after finding Canadian winters to be too severe, she decides to move back to Israel. At this time the values of her assets are as follows: What are the tax consequences of Dakota's emigration from Canada?

What are the tax consequences of Dakota's emigration from Canada?

While she is in Canada, she acquires shares of a Canadian company, Grizzly Bare Inc. for $55,000. In 2021, after finding Canadian winters to be too severe, she decides to move back to Israel. At this time the values of her assets are as follows:

What are the tax consequences of Dakota's emigration from Canada?

What are the tax consequences of Dakota's emigration from Canada?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Shelley Burns is a Canadian resident living in Sudbury, Ontario. During 2020, she earns $23,000 of business income through a permanent establishment located in a foreign country. Income taxes of $2,300 were assessed and withheld at the source on that income. All amounts are in Canadian dollars. Assume that her marginal combined federal/provincial tax rate is 42 percent and that the foreign tax credit is equal to the tax withheld. Determine her after tax retention and overall tax rate on her foreign source business income.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck