Deck 6: Payroll

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

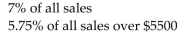

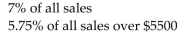

Question

Question

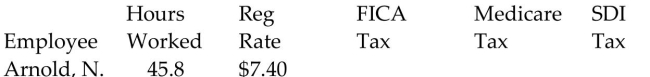

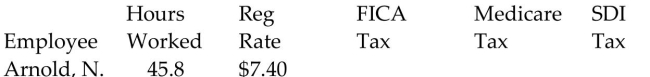

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 6: Payroll

1

Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Drew Laughlin, attorney, earned $53,081.59

A)$6,582.12, $1,539.37

B)$3,291.06, $1,539.37

C)$3,291.06, $769.68

D)$6,482.12, $1,439.37

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Drew Laughlin, attorney, earned $53,081.59

A)$6,582.12, $1,539.37

B)$3,291.06, $1,539.37

C)$3,291.06, $769.68

D)$6,482.12, $1,439.37

$6,582.12, $1,539.37

2

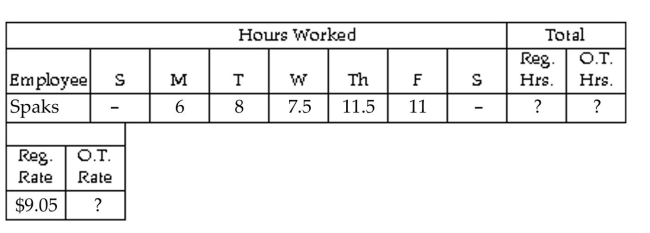

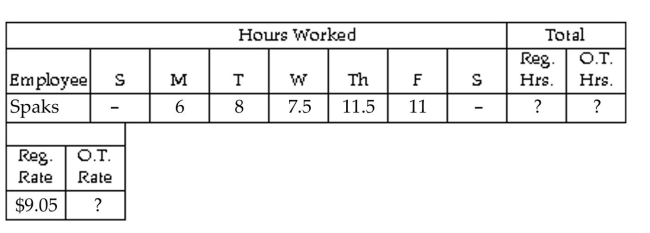

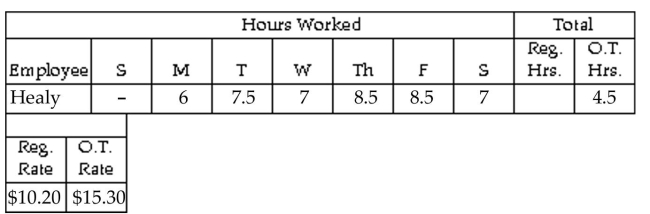

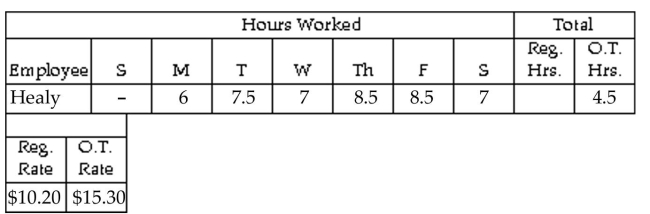

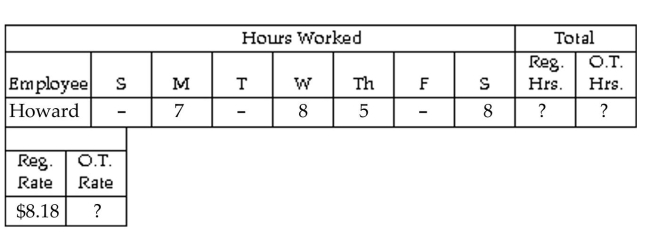

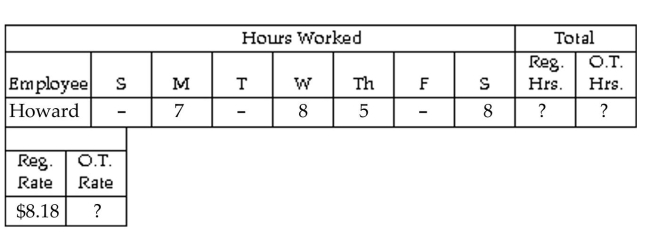

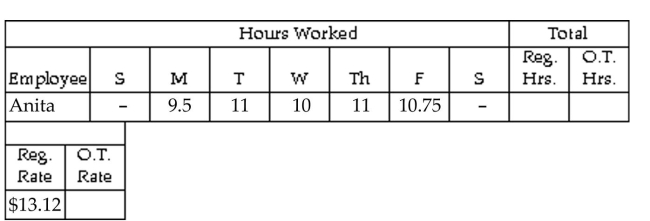

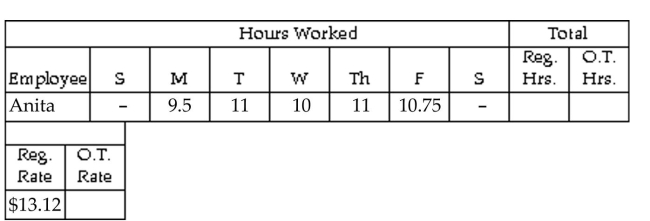

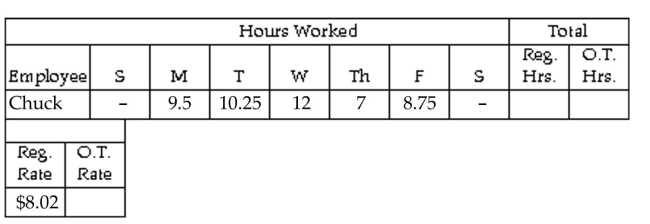

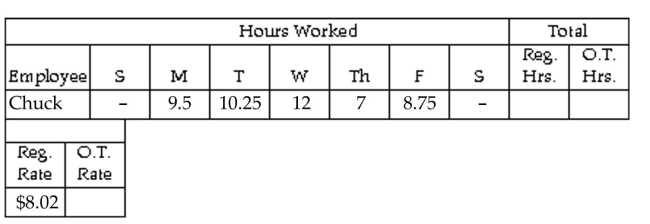

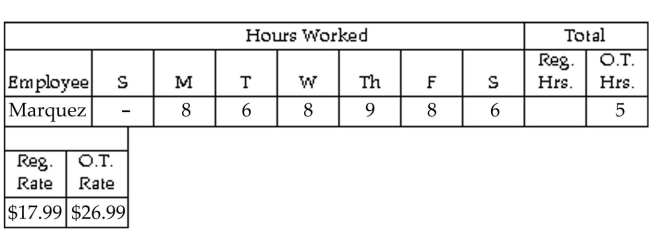

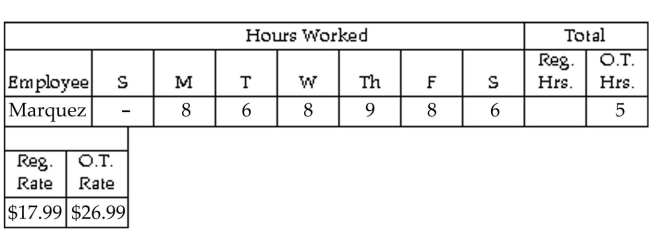

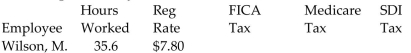

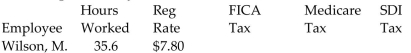

Find the hours, rate, or earnings as specified.

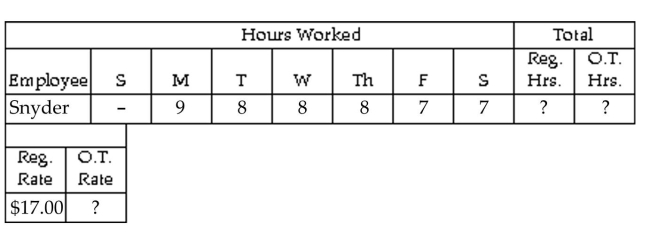

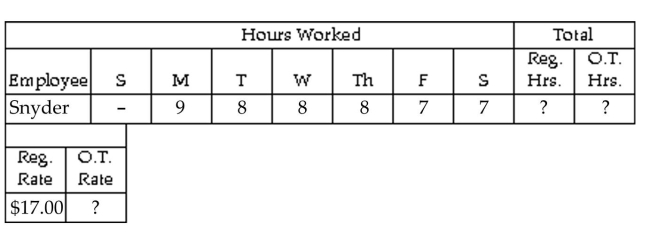

Find the number of regular hours, overtime hours (over 8 in a day), and overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 8 in a day), and overtime rate (time and a half).

A)36, 8, $18.10

B)37.5, 6.5, $18.10

C)44, 0, $13.58

D)37.5, 6.5, $13.58

Find the number of regular hours, overtime hours (over 8 in a day), and overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 8 in a day), and overtime rate (time and a half).A)36, 8, $18.10

B)37.5, 6.5, $18.10

C)44, 0, $13.58

D)37.5, 6.5, $13.58

37.5, 6.5, $13.58

3

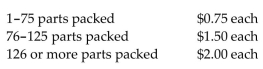

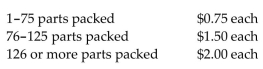

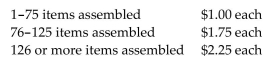

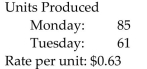

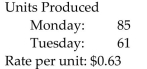

Solve the problem.

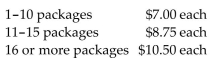

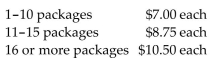

Suppose parts packers are paid as follows: If Sam packs 151 parts, what are his gross earnings?

If Sam packs 151 parts, what are his gross earnings?

A)$183.25

B)$145.75

C)$189.00

D)$226.50

Suppose parts packers are paid as follows:

If Sam packs 151 parts, what are his gross earnings?

If Sam packs 151 parts, what are his gross earnings?A)$183.25

B)$145.75

C)$189.00

D)$226.50

$183.25

4

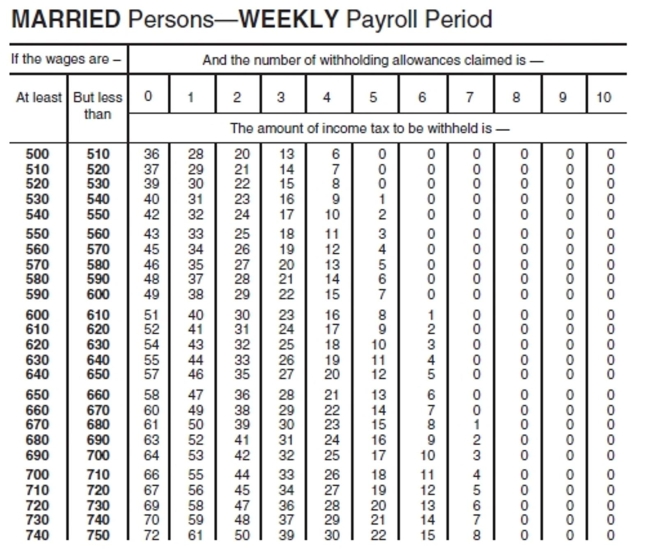

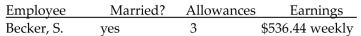

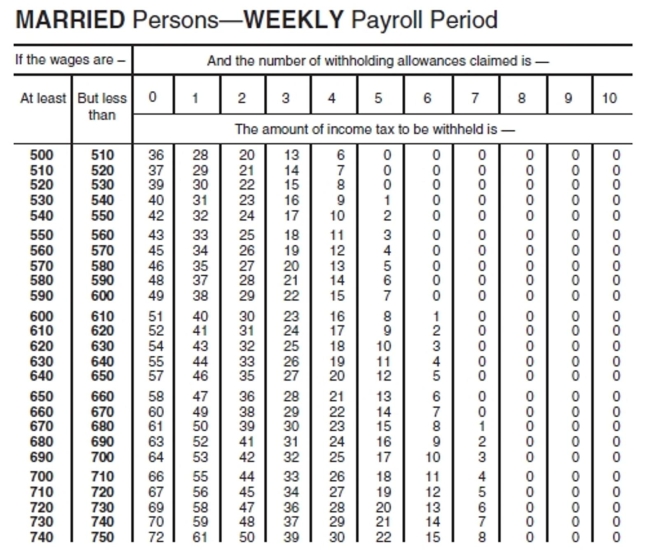

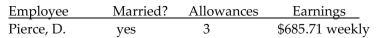

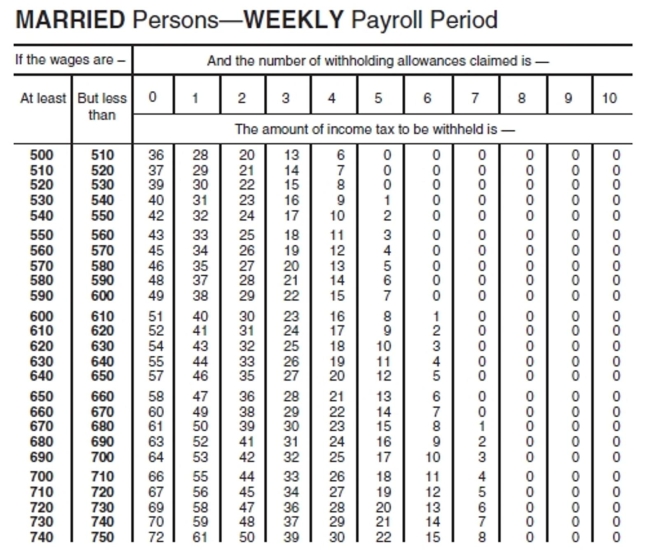

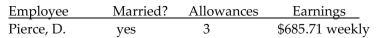

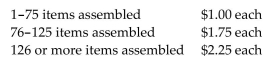

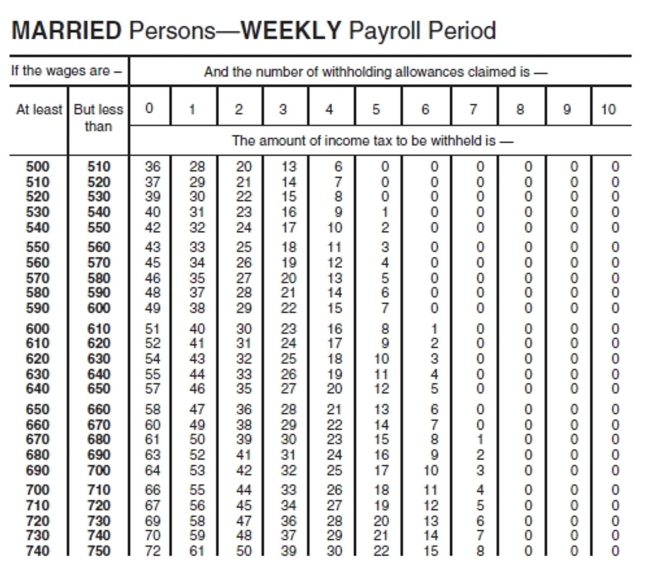

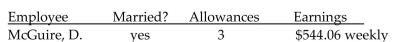

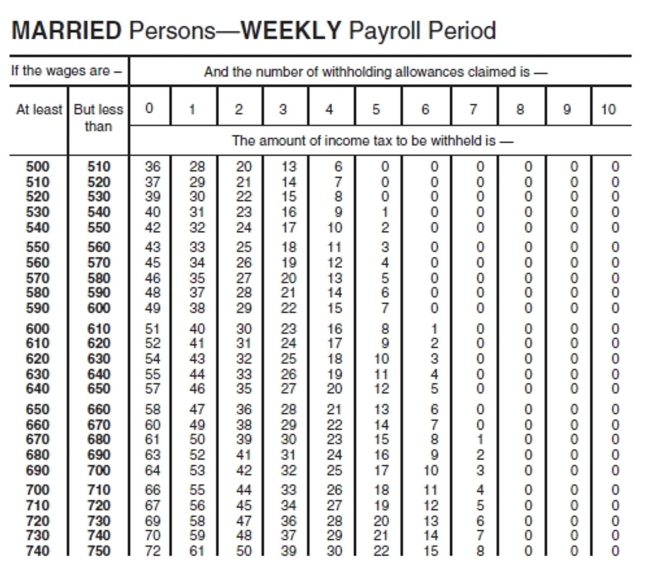

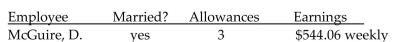

Find the federal withholding tax for the employee. Use the wage bracket method.

A)$18

B)$17

C)$15

D)$16

A)$18

B)$17

C)$15

D)$16

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

Solve the problem.

Chuck earns $11 per hour for a 40-hour work week and time-and-a-half for overtime. One week he worked 52 hours. Find his gross pay for the week.

A)$858.00

B)$572.00

C)$440.00

D)$638.00

Chuck earns $11 per hour for a 40-hour work week and time-and-a-half for overtime. One week he worked 52 hours. Find his gross pay for the week.

A)$858.00

B)$572.00

C)$440.00

D)$638.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

Find the federal withholding tax for the employee. Use the wage bracket method.

A)$29

B)$31

C)$30

D)$32

A)$29

B)$31

C)$30

D)$32

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

Solve the problem.

Acme Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Susan Jones, an employee of Acme Industries,

Makes $14.32 an hour as her regular rate of pay. Last week she worked 9 hours on Monday, 6.5

Hours on Tuesday, 10.25 hours on Wednesday, 7 hours on Thursday, and 12 hours on Friday. What

Were her gross earnings for the week?

A)$765.73

B)$692.73

C)$660.73

D)$643.73

Acme Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Susan Jones, an employee of Acme Industries,

Makes $14.32 an hour as her regular rate of pay. Last week she worked 9 hours on Monday, 6.5

Hours on Tuesday, 10.25 hours on Wednesday, 7 hours on Thursday, and 12 hours on Friday. What

Were her gross earnings for the week?

A)$765.73

B)$692.73

C)$660.73

D)$643.73

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

Solve the problem.

Acme Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Susan Jones is an employee of Acme Industries.

Last week she worked 10 hours on Monday, 6 hours on Tuesday, and 9 hours on Friday. Her gross

Earnings for the week were $263.56. What is her regular rate of pay?

A)$9.95

B)$11.71

C)$8.93

D)$13.52

Acme Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Susan Jones is an employee of Acme Industries.

Last week she worked 10 hours on Monday, 6 hours on Tuesday, and 9 hours on Friday. Her gross

Earnings for the week were $263.56. What is her regular rate of pay?

A)$9.95

B)$11.71

C)$8.93

D)$13.52

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

Solve the problem.

Barbara Smith is an employee of Allied Manufacturing Company. She has an 8-hr workday and each day is paid $0.60 for each unit produced or the hourly rate, whichever is greater. Her hourly

Rate is $7.15 per hour. Last week she produced 90 units on Monday, 111 units on Tuesday, 82 units

On Wednesday, 112 units on Thursday, and 98 units on Friday. What were her gross earnings for

The week?

A)$305.00

B)$294.00

C)$316.00

D)$307.00

Barbara Smith is an employee of Allied Manufacturing Company. She has an 8-hr workday and each day is paid $0.60 for each unit produced or the hourly rate, whichever is greater. Her hourly

Rate is $7.15 per hour. Last week she produced 90 units on Monday, 111 units on Tuesday, 82 units

On Wednesday, 112 units on Thursday, and 98 units on Friday. What were her gross earnings for

The week?

A)$305.00

B)$294.00

C)$316.00

D)$307.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

Find the Social Security and Medicare taxes on the gross earnings. Assume a 6.2% FICA rate and a 1.45% Medicare rate.

Round to the nearest cent.

$530.00

A)$33.86, $8.69

B)$32.86, $7.69

C)$3.29, $0.77

D)$328.60, $76.90

Round to the nearest cent.

$530.00

A)$33.86, $8.69

B)$32.86, $7.69

C)$3.29, $0.77

D)$328.60, $76.90

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

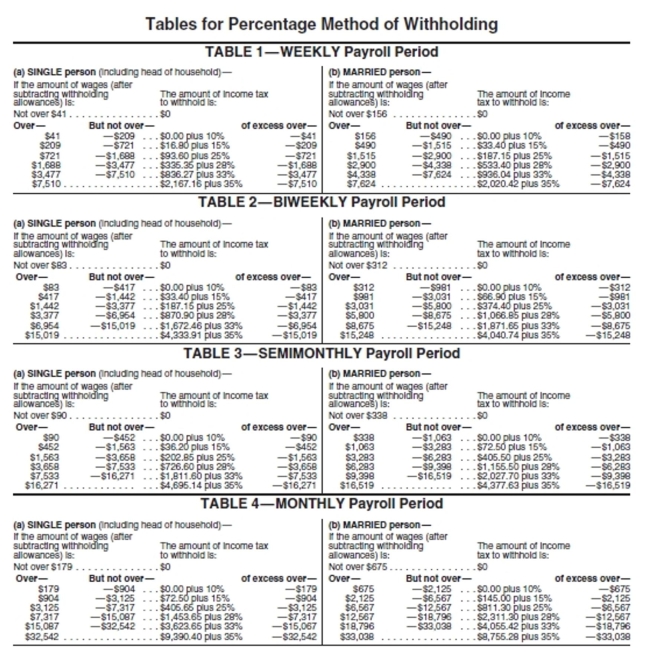

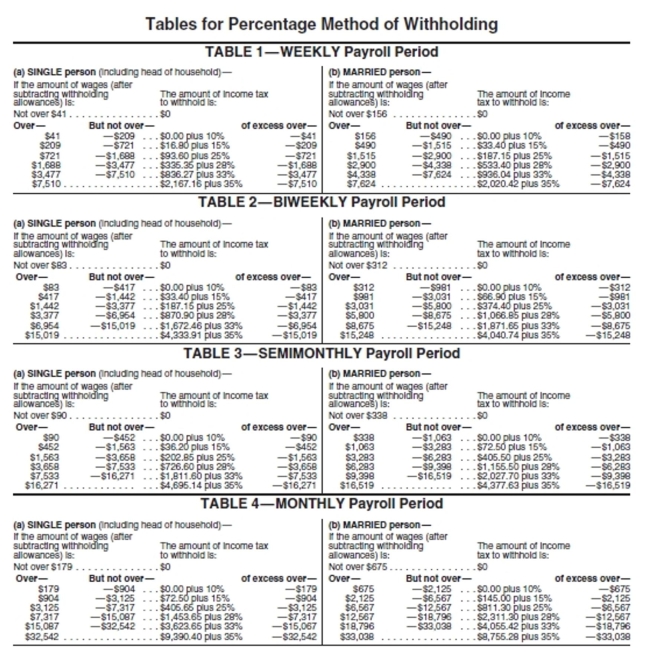

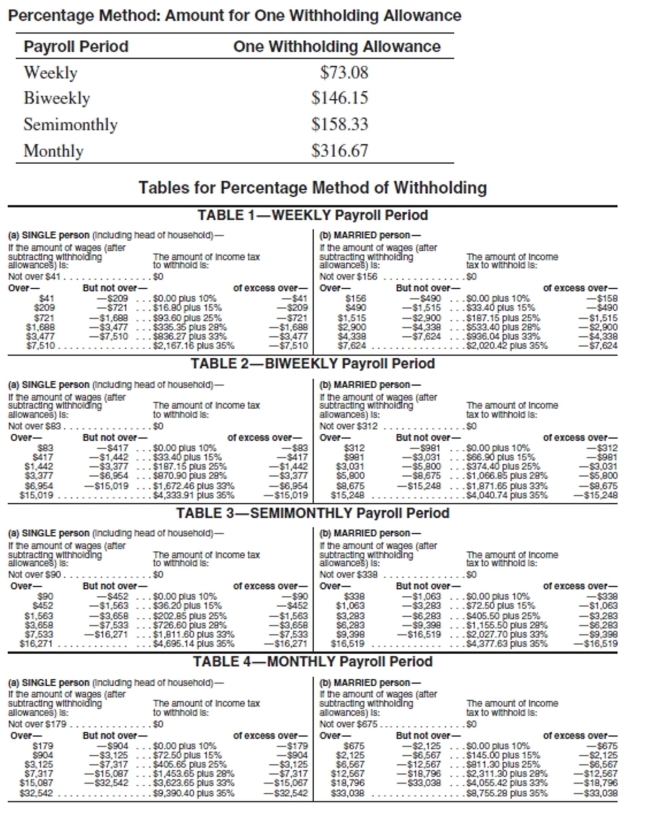

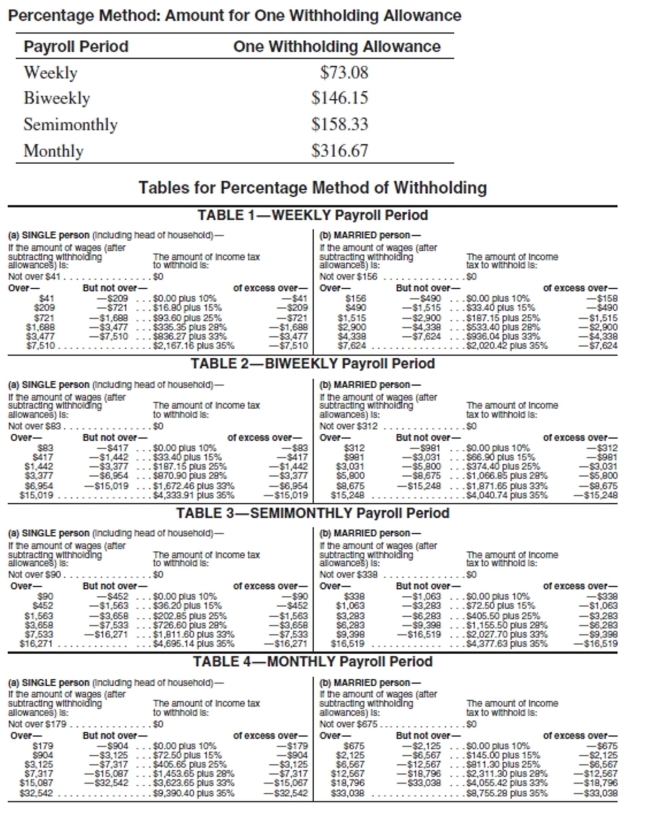

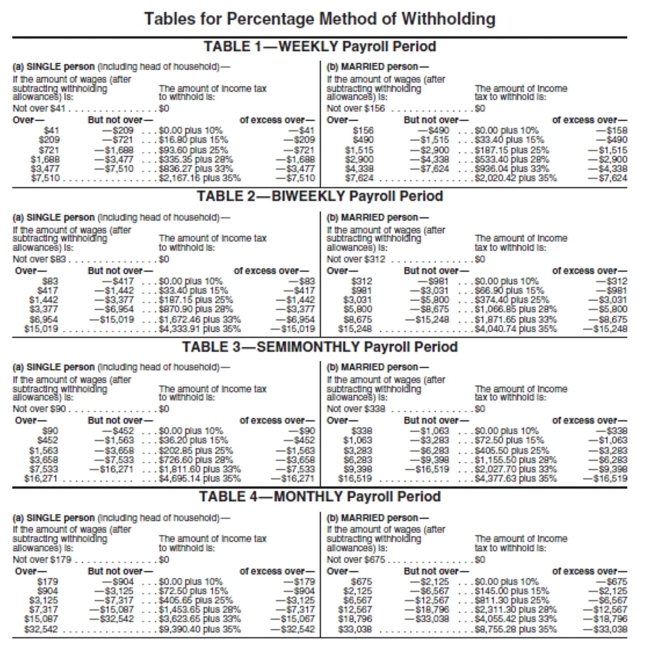

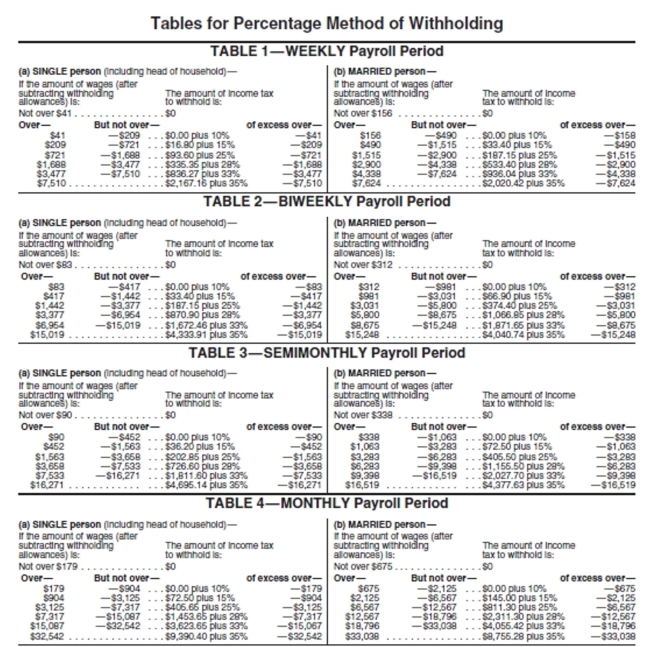

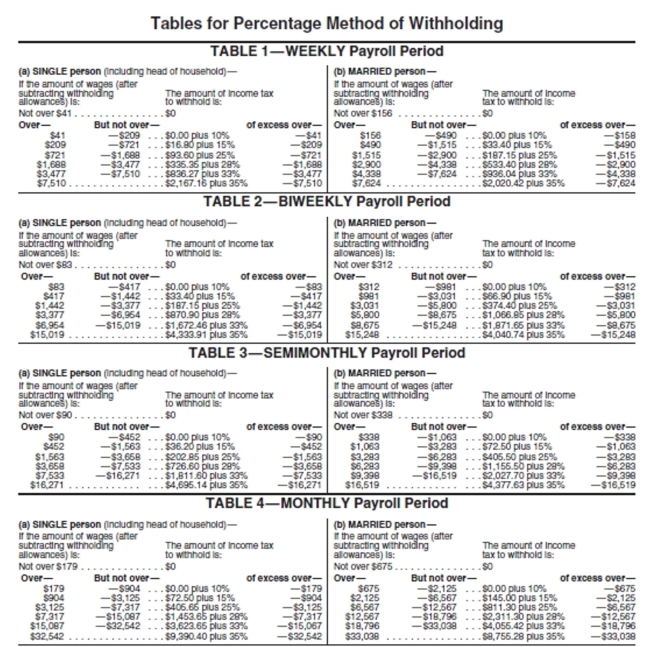

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Erika Du Mesnil has gross earnings of $7914.27 semimonthly. She is married and has 4 withholding allowances.

A)$7,308.83

B)$6,479.34

C)$5,873.90

D)$8,743.76

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Erika Du Mesnil has gross earnings of $7914.27 semimonthly. She is married and has 4 withholding allowances.

A)$7,308.83

B)$6,479.34

C)$5,873.90

D)$8,743.76

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

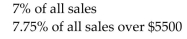

Motorville Auto Parts pays salespeople as follows: $488 per week plus a commission of 1.1% on sales above $15,000

through $25,000 with 1.4% paid on sales in excess of $25,000. Find the gross earnings of the salesperson. (No commission

is paid on the first $15,000 of sales.)

A)$704.70

B)$1,005.00

C)$51.70

D)$539.70

through $25,000 with 1.4% paid on sales in excess of $25,000. Find the gross earnings of the salesperson. (No commission

is paid on the first $15,000 of sales.)

A)$704.70

B)$1,005.00

C)$51.70

D)$539.70

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

Find the hours, rate, or earnings as specified.

Find the gross earnings for the week. Overtime hours are any hours over 40.

Find the gross earnings for the week. Overtime hours are any hours over 40.

A)$476.85

B)$657.90

C)$453.90

D)$680.85

Find the gross earnings for the week. Overtime hours are any hours over 40.

Find the gross earnings for the week. Overtime hours are any hours over 40.A)$476.85

B)$657.90

C)$453.90

D)$680.85

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

Find the equivalent earnings.

Chuck earns $363 a week. What is his yearly salary?

A)$3,630

B)$18,876

C)$18,150

D)$1,573

Chuck earns $363 a week. What is his yearly salary?

A)$3,630

B)$18,876

C)$18,150

D)$1,573

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

Find the gross earnings. Use the overtime premium method. Overtime is paid at time-and-a-half for all hours over 40.

A)$565.68

B)$496.72

C)$567.68

D)$745.08

A)$565.68

B)$496.72

C)$567.68

D)$745.08

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

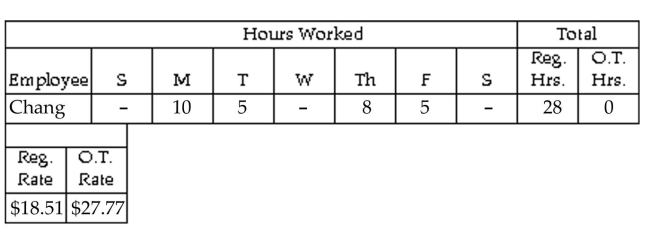

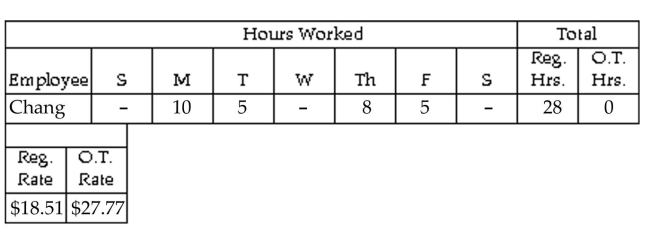

Find the hours, rate, or earnings as specified.

Find the number of regular hours, overtime hours (over 40), and the overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 40), and the overtime rate (time and a half).

A)28, 0, $16.36

B)15, 13, $16.36

C)28, 0, $12.27

D)20, 8, $12.27

Find the number of regular hours, overtime hours (over 40), and the overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 40), and the overtime rate (time and a half).A)28, 0, $16.36

B)15, 13, $16.36

C)28, 0, $12.27

D)20, 8, $12.27

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

Solve the problem.

Bob works for Allies Electronics making switches. He is paid $0.40 per switch. Last week he made 777 switches on regular time and 114 switches during overtime. Find his gross earnings for the

Week if time-and-a-half per switch is paid for overtime.

A)$367.80

B)$356.40

C)$390.60

D)$379.20

Bob works for Allies Electronics making switches. He is paid $0.40 per switch. Last week he made 777 switches on regular time and 114 switches during overtime. Find his gross earnings for the

Week if time-and-a-half per switch is paid for overtime.

A)$367.80

B)$356.40

C)$390.60

D)$379.20

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Carla LaFong has gross earnings of $3576.57 weekly. She is married and has 2 withholding allowances.

A)$2,621.05

B)$3,302.96

C)$2,894.66

D)$3,984.87

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Carla LaFong has gross earnings of $3576.57 weekly. She is married and has 2 withholding allowances.

A)$2,621.05

B)$3,302.96

C)$2,894.66

D)$3,984.87

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

Find the gross earnings for the employee.

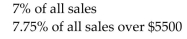

Westinghouse Paving pays its salespeople the following commissions.

A)$1,491.75

B)$74,150.00

C)$1,175.50

D)$741.50

Westinghouse Paving pays its salespeople the following commissions.

A)$1,491.75

B)$74,150.00

C)$1,175.50

D)$741.50

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

Solve the problem.

Allied Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Ken Warner, an employee of Allied Industries,

Makes $12.30 an hour as his regular rate of pay. Last week he worked 12 hours on Monday, 5.5

Hours on Thursday, and 8.75 hours on Friday. What were his gross earnings for the week?

A)$360.80

B)$352.09

C)$365.64

D)$317.07

Allied Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Ken Warner, an employee of Allied Industries,

Makes $12.30 an hour as his regular rate of pay. Last week he worked 12 hours on Monday, 5.5

Hours on Thursday, and 8.75 hours on Friday. What were his gross earnings for the week?

A)$360.80

B)$352.09

C)$365.64

D)$317.07

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

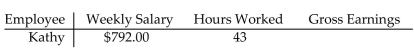

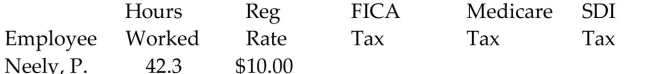

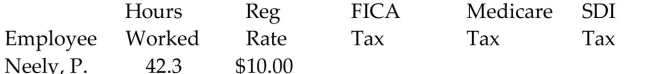

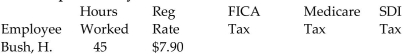

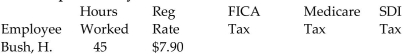

Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee.

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$21.01, $4.91, $3.39

B)$31.52, $7.37, $5.08

C)$22.34, $5.23, $3.60

D)$18.35, $4.29, $2.96

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$21.01, $4.91, $3.39

B)$31.52, $7.37, $5.08

C)$22.34, $5.23, $3.60

D)$18.35, $4.29, $2.96

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Ted Houston, accountant, earned $56,641.08

A)$6,923.49, $1,542.59

B)$3,511.75, $821.30

C)$3,511.75, $1,642.59

D)$7,023.49, $1,642.59

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Ted Houston, accountant, earned $56,641.08

A)$6,923.49, $1,542.59

B)$3,511.75, $821.30

C)$3,511.75, $1,642.59

D)$7,023.49, $1,642.59

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

Find the gross earnings. Use the overtime premium method. Overtime is paid at time-and-a-half for all hours over 40.

A)$685.52

B)$765.88

C)$1,028.28

D)$763.88

A)$685.52

B)$765.88

C)$1,028.28

D)$763.88

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

Find the hours, rate, or earnings as specified.

Find the gross earnings for the week.

Find the gross earnings for the week.

A)$46.51

B)$564.58

C)$777.56

D)$518.28

Find the gross earnings for the week.

Find the gross earnings for the week.A)$46.51

B)$564.58

C)$777.56

D)$518.28

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

Find the gross earnings. Use the overtime premium method. Overtime is paid at time-and-a-half for all hours over 40.

A)$411.03

B)$380.95

C)$571.43

D)$409.03

A)$411.03

B)$380.95

C)$571.43

D)$409.03

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Solve the problem.

Jennifer Jones is an employee of Acme Manufacturing Company. She has an 8-hr workday and each day is paid $0.75 for each unit produced or the hourly rate, whichever is greater. Her hourly

Rate is $8.40 per hour. Last week she produced 93 units on Monday, 107 units on Tuesday, 80 units

On Wednesday, 86 units on Thursday, and 103 units on Friday. What were her gross earnings for

The week?

A)$351.65

B)$357.65

C)$361.65

D)$370.45

Jennifer Jones is an employee of Acme Manufacturing Company. She has an 8-hr workday and each day is paid $0.75 for each unit produced or the hourly rate, whichever is greater. Her hourly

Rate is $8.40 per hour. Last week she produced 93 units on Monday, 107 units on Tuesday, 80 units

On Wednesday, 86 units on Thursday, and 103 units on Friday. What were her gross earnings for

The week?

A)$351.65

B)$357.65

C)$361.65

D)$370.45

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

Find the equivalent earnings.

Chuck earns $387 a week, but is paid semimonthly. How much is he paid at the end of a pay period?

A)$838.50

B)$774.00

C)$20,124.00

D)$1,677.00

Chuck earns $387 a week, but is paid semimonthly. How much is he paid at the end of a pay period?

A)$838.50

B)$774.00

C)$20,124.00

D)$1,677.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

Solve the problem.

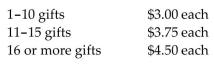

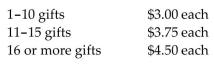

Brandy's Gift House pays employees for each gift they gift wrap. Assume they are paid as follows: If Lee wraps 13 gifts, what are her gross earnings?

If Lee wraps 13 gifts, what are her gross earnings?

A)$43.50

B)$41.25

C)$39.00

D)$48.75

Brandy's Gift House pays employees for each gift they gift wrap. Assume they are paid as follows:

If Lee wraps 13 gifts, what are her gross earnings?

If Lee wraps 13 gifts, what are her gross earnings?A)$43.50

B)$41.25

C)$39.00

D)$48.75

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

Solve the problem.

Suppose assembly line workers are paid as follows: If Jared assembles 80 items, what are his gross earnings?

If Jared assembles 80 items, what are his gross earnings?

A)$86.25

B)$83.75

C)$80.00

D)$140.00

Suppose assembly line workers are paid as follows:

If Jared assembles 80 items, what are his gross earnings?

If Jared assembles 80 items, what are his gross earnings?A)$86.25

B)$83.75

C)$80.00

D)$140.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

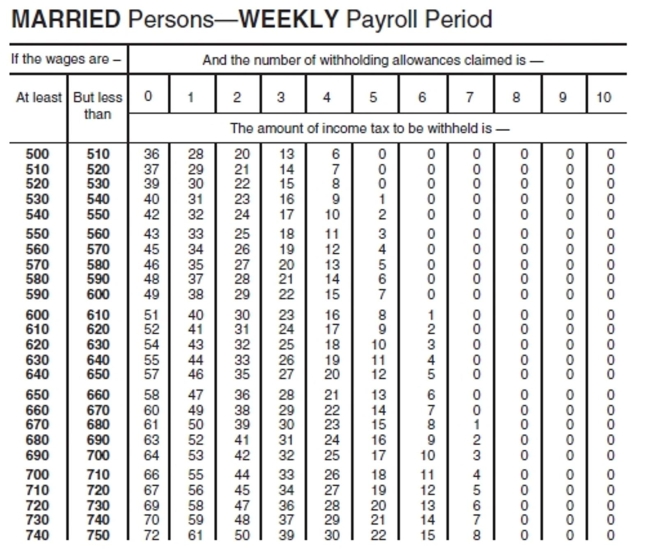

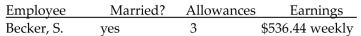

Find the federal withholding tax for the employee. Use the wage bracket method.

A)$16

B)$17

C)$18

D)$15

A)$16

B)$17

C)$18

D)$15

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

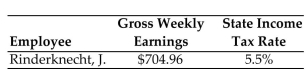

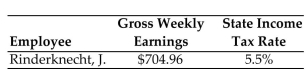

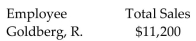

Use the state income tax rate given to find the state withholding tax for the following employee. Round to the nearest

cent.

A)$3,877.28

B)$38.77

C)$387.73

D)$0.01

cent.

A)$3,877.28

B)$38.77

C)$387.73

D)$0.01

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

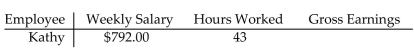

Find the weekly gross earnings. Overtime is paid at the time-and-a-half rate for hours over 40 per week.

A)$1,100.00

B)$1,131.00

C)$990.00

D)$1,072.50

A)$1,100.00

B)$1,131.00

C)$990.00

D)$1,072.50

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Bill Fox is paid 7% commission on sales. During a recent week, he had sales of $11,691.49 and allowances of $1,808. Find his Social Security tax, Medicare tax, and SDI deduction for the week.

A)$42.89, $10.03, $6.92

B)$58.59, $8.18, $9.45

C)$50.74, $11.87, $8.18

D)$42.46, $9.93, $6.85

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Bill Fox is paid 7% commission on sales. During a recent week, he had sales of $11,691.49 and allowances of $1,808. Find his Social Security tax, Medicare tax, and SDI deduction for the week.

A)$42.89, $10.03, $6.92

B)$58.59, $8.18, $9.45

C)$50.74, $11.87, $8.18

D)$42.46, $9.93, $6.85

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Thomas McKnight has gross earnings of $22,012.15 monthly. He is married and has 8 withholding allowances.

A)$24,608.96

B)$17,731.41

C)$16,047.48

D)$20,328.22

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Thomas McKnight has gross earnings of $22,012.15 monthly. He is married and has 8 withholding allowances.

A)$24,608.96

B)$17,731.41

C)$16,047.48

D)$20,328.22

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

Find the gross earnings for the employee.

Westinghouse Paving pays its salespeople the following commissions.

A)$4,417.50

B)$826.75

C)$1,225.75

D)$1,652.00

Westinghouse Paving pays its salespeople the following commissions.

A)$4,417.50

B)$826.75

C)$1,225.75

D)$1,652.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Kay McClain is paid 7% commission on sales. During a recent week, she had sales of $6,438.71 on Monday, $1,866.17 on Tuesday, and $1,952.16 on Thursday. Find her Social Security tax, Medicare

Tax, and SDI deduction for the week.

A)$27.94, $6.54, $4.51

B)$36.04, $4.51, $5.81

C)$36.42, $8.52, $5.87

D)$44.52, $10.41, $7.18

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Kay McClain is paid 7% commission on sales. During a recent week, she had sales of $6,438.71 on Monday, $1,866.17 on Tuesday, and $1,952.16 on Thursday. Find her Social Security tax, Medicare

Tax, and SDI deduction for the week.

A)$27.94, $6.54, $4.51

B)$36.04, $4.51, $5.81

C)$36.42, $8.52, $5.87

D)$44.52, $10.41, $7.18

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Solve the problem.

Tom Darcy makes $4.75 for each chimney he sweeps. Find his gross earnings if he sweeps 19 chimneys.

A)$80.75

B)$23.75

C)$99.75

D)$90.25

Tom Darcy makes $4.75 for each chimney he sweeps. Find his gross earnings if he sweeps 19 chimneys.

A)$80.75

B)$23.75

C)$99.75

D)$90.25

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

Find the weekly gross earnings. Overtime is paid at the time-and-a-half rate for hours over 40 per week.

A)$940.50

B)$836.60

C)$925.60

D)$881.10

A)$940.50

B)$836.60

C)$925.60

D)$881.10

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee.

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$39.34, $9.20, $6.35

B)$26.94, $6.30, $4.35

C)$26.23, $6.13, $4.23

D)$24.80, $5.80, $4.00

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$39.34, $9.20, $6.35

B)$26.94, $6.30, $4.35

C)$26.23, $6.13, $4.23

D)$24.80, $5.80, $4.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

Calculate the total amount due to the IRS from the firm.

Peter's Landscaping collected $933.83 FICA, $222.34 medicare, and $293.54 federal withholding from employees.

A)$2,899.42

B)$2,383.54

C)$1,672.05

D)$2,605.88

Peter's Landscaping collected $933.83 FICA, $222.34 medicare, and $293.54 federal withholding from employees.

A)$2,899.42

B)$2,383.54

C)$1,672.05

D)$2,605.88

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Donald Ruffano is paid a salary of $469 per week plus a commission of 2% on sales. During a recent week, he had sales of $11,040.34. Find his Social Security tax, Medicare tax, and SDI

Deduction for the week.

A)$42.77, $10.00, $6.90

B)$29.08, $6.80, $4.69

C)$13.11, $2.21, $2.11

D)$13.69, $3.20, $2.21

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Donald Ruffano is paid a salary of $469 per week plus a commission of 2% on sales. During a recent week, he had sales of $11,040.34. Find his Social Security tax, Medicare tax, and SDI

Deduction for the week.

A)$42.77, $10.00, $6.90

B)$29.08, $6.80, $4.69

C)$13.11, $2.21, $2.11

D)$13.69, $3.20, $2.21

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

Solve the problem.

Find the gross earnings.

A)$90.72

B)$93.24

C)$91.98

D)$106.58

Find the gross earnings.

A)$90.72

B)$93.24

C)$91.98

D)$106.58

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

Solve the problem.

Mike Penn is an employee of Acme Manufacturing Company. He has an 8-hr workday and each day is paid $0.30 for each unit produced or the hourly rate, whichever is greater. His hourly rate is

$6.50 per hour. Last week he produced 141 units on Monday, 167 units on Tuesday, 124 units on

Wednesday, 136 units on Thursday, and 147 units on Friday. What were his gross earnings for the

Week?

A)$296.50

B)$260.00

C)$243.25

D)$308.00

Mike Penn is an employee of Acme Manufacturing Company. He has an 8-hr workday and each day is paid $0.30 for each unit produced or the hourly rate, whichever is greater. His hourly rate is

$6.50 per hour. Last week he produced 141 units on Monday, 167 units on Tuesday, 124 units on

Wednesday, 136 units on Thursday, and 147 units on Friday. What were his gross earnings for the

Week?

A)$296.50

B)$260.00

C)$243.25

D)$308.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

Calculate the total amount due to the IRS from the firm.

Robinson Furnace Co. collected $2,800.09 FICA, $654.86 medicare, and $2,325.88 federal withholding tax from employees.

A)$8,580.92

B)$6,435.69

C)$5,780.83

D)$9,235.78

Robinson Furnace Co. collected $2,800.09 FICA, $654.86 medicare, and $2,325.88 federal withholding tax from employees.

A)$8,580.92

B)$6,435.69

C)$5,780.83

D)$9,235.78

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

Find the Social Security tax for the current pay period. Assume a 6.2% FICA rate up to a maximum of $115,000.

Gross Earnings This Year: $108,592.25 Current Period Earnings: $4,442.60

A)$13,587.28

B)$275.44

C)$285.44

D)$397.28

Gross Earnings This Year: $108,592.25 Current Period Earnings: $4,442.60

A)$13,587.28

B)$275.44

C)$285.44

D)$397.28

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Robert Stang has gross earnings of $603.16 weekly. He is married and has 4 withholding allowances.

A)$541.73

B)$587.88

C)$572.29

D)$557.01

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

Robert Stang has gross earnings of $603.16 weekly. He is married and has 4 withholding allowances.

A)$541.73

B)$587.88

C)$572.29

D)$557.01

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

Find the weekly gross earnings. Overtime is paid at the time-and-a-half rate for hours over 40 per week.

A)$902.50

B)$950.00

C)$997.50

D)$1,010.00

A)$902.50

B)$950.00

C)$997.50

D)$1,010.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

Solve the problem.

Al's Recycling Center pays local children $0.50 for each pound of aluminum cans they bring in. If Bobby brings in 9 pounds of cans, what are his gross earnings?

A)$9.50

B)$3.00

C)$6.00

D)$4.50

Al's Recycling Center pays local children $0.50 for each pound of aluminum cans they bring in. If Bobby brings in 9 pounds of cans, what are his gross earnings?

A)$9.50

B)$3.00

C)$6.00

D)$4.50

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Jessica Walker, physicist, earns $720 per week. She is married and claims 1 withholding allowance. Her deductions are FICA, Medicare, federal withholding, state disability insurance, state

Withholding, retirement contribution of $21.60, and a savings bond of $85. Find her net pay.

A)$554.70

B)$469.70

C)$454.64

D)$526.64

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Jessica Walker, physicist, earns $720 per week. She is married and claims 1 withholding allowance. Her deductions are FICA, Medicare, federal withholding, state disability insurance, state

Withholding, retirement contribution of $21.60, and a savings bond of $85. Find her net pay.

A)$554.70

B)$469.70

C)$454.64

D)$526.64

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

Find the weekly gross earnings. Overtime is paid at the time-and-a-half rate for hours over 40 per week.

A)$831.25

B)$778.75

C)$823.25

D)$689.75

A)$831.25

B)$778.75

C)$823.25

D)$689.75

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Frank Weller, surveyor, earned $25,118.67

A)$1,557.36, $728.44

B)$1,557.36, $364.22

C)$3,014.72, $628.44

D)$3,114.72, $728.44

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Frank Weller, surveyor, earned $25,118.67

A)$1,557.36, $728.44

B)$1,557.36, $364.22

C)$3,014.72, $628.44

D)$3,114.72, $728.44

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Charles Nave, bank teller, has weekly earnings of $610. He is married and claims 3 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance,

State withholding, and credit union savings of $50. Find his net pay.

A)$513.21

B)$425.49

C)$463.21

D)$453.51

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Charles Nave, bank teller, has weekly earnings of $610. He is married and claims 3 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance,

State withholding, and credit union savings of $50. Find his net pay.

A)$513.21

B)$425.49

C)$463.21

D)$453.51

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

Calculate the total amount due to the IRS from the firm.

The Book Mart collected $1,485.31 FICA, $347.37 medicare, and $1,806.33 federal withholding tax from employees.

A)$3,639.01

B)$5,124.32

C)$5,471.69

D)$3,986.38

The Book Mart collected $1,485.31 FICA, $347.37 medicare, and $1,806.33 federal withholding tax from employees.

A)$3,639.01

B)$5,124.32

C)$5,471.69

D)$3,986.38

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

Solve the problem.

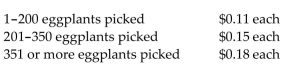

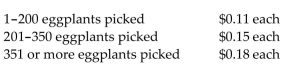

Suppose eggplant pickers are paid as follows: If Rachel picks 363 eggplants, what are her gross earnings?

If Rachel picks 363 eggplants, what are her gross earnings?

A)$40.84

B)$46.84

C)$39.93

D)$65.34

Suppose eggplant pickers are paid as follows:

If Rachel picks 363 eggplants, what are her gross earnings?

If Rachel picks 363 eggplants, what are her gross earnings?A)$40.84

B)$46.84

C)$39.93

D)$65.34

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

Find the Social Security and Medicare taxes on the gross earnings. Assume a 6.2% FICA rate and a 1.45% Medicare rate.

Round to the nearest cent.

$411.30

A)$255.00, $59.60

B)$2.55, $0.60

C)$26.50, $6.96

D)$25.50, $5.96

Round to the nearest cent.

$411.30

A)$255.00, $59.60

B)$2.55, $0.60

C)$26.50, $6.96

D)$25.50, $5.96

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

Solve the problem.

Stephen Rodrigues assembles and finishes wood products. He is paid $1.50 for a shelf, $0.90 for a picture frame, and $2.30 for a planter. One week he completed 41 shelves, 77 picture frames, and 37

Planters. Find his gross earnings.

A)$243.10

B)$219.10

C)$728.50

D)$215.90

Stephen Rodrigues assembles and finishes wood products. He is paid $1.50 for a shelf, $0.90 for a picture frame, and $2.30 for a planter. One week he completed 41 shelves, 77 picture frames, and 37

Planters. Find his gross earnings.

A)$243.10

B)$219.10

C)$728.50

D)$215.90

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Todd Bennett worked 41.5 hours last week at Eck Builders, a construction company. He is paid $ 11.27 per hour, plus time-and-a-half for overtime. Find his Social Security tax and Medicare tax

For the week.

A)$27.95, $6.54

B)$29.00, $6.78

C)$29.52, $6.90

D)$43.50, $10.17

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Todd Bennett worked 41.5 hours last week at Eck Builders, a construction company. He is paid $ 11.27 per hour, plus time-and-a-half for overtime. Find his Social Security tax and Medicare tax

For the week.

A)$27.95, $6.54

B)$29.00, $6.78

C)$29.52, $6.90

D)$43.50, $10.17

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

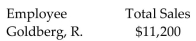

Find the gross earnings for the employee.

Westinghouse Paving pays its salespeople the following commissions.

A)$1,200.00

B)$810.00

C)$750.00

D)$60.00

Westinghouse Paving pays its salespeople the following commissions.

A)$1,200.00

B)$810.00

C)$750.00

D)$60.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate the total amount due to the IRS from the firm.

Northwest Auto Sales collected $3,087.89 FICA, $722.17 medicare, and $2,619.72 federal withholding tax from employees.

A)$7,151.95

B)$9,517.67

C)$10,239.84

D)$6,429.78

Northwest Auto Sales collected $3,087.89 FICA, $722.17 medicare, and $2,619.72 federal withholding tax from employees.

A)$7,151.95

B)$9,517.67

C)$10,239.84

D)$6,429.78

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

Find the Social Security tax for the current pay period. Assume a 6.2% FICA rate up to a maximum of $115,000.

Gross Earnings This Year: $110,965 45) Current Period Earnings: $5,636

A)$99.26

B)$243.97

C)$250.17

D)$349.43

Gross Earnings This Year: $110,965 45) Current Period Earnings: $5,636

A)$99.26

B)$243.97

C)$250.17

D)$349.43

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

Find the weekly gross earnings. Overtime is paid at the time-and-a-half rate for hours over 40 per week.

A)$458.35

B)$413.85

C)$502.85

D)$489.25

A)$458.35

B)$413.85

C)$502.85

D)$489.25

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Beth Conners worked 43.2 hours last week at Creative Kitchens. She is paid $6.58 per hour, plus time-and-a-half for overtime. Find her Social Security tax and Medicare tax for the week.

A)$26.43, $6.18

B)$18.28, $4.27

C)$17.62, $4.12

D)$16.32, $3.82

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Beth Conners worked 43.2 hours last week at Creative Kitchens. She is paid $6.58 per hour, plus time-and-a-half for overtime. Find her Social Security tax and Medicare tax for the week.

A)$26.43, $6.18

B)$18.28, $4.27

C)$17.62, $4.12

D)$16.32, $3.82

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Larry Calanan has earnings of $510 in a week. He is single and claims 2 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance, state

Withholding, union dues of $15, and charitable contributions of $21. Find his net pay.

A)$389.85

B)$361.54

C)$408.51

D)$372.51

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

Larry Calanan has earnings of $510 in a week. He is single and claims 2 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance, state

Withholding, union dues of $15, and charitable contributions of $21. Find his net pay.

A)$389.85

B)$361.54

C)$408.51

D)$372.51

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Solve the problem.

Anita's regular hourly rate is $14 for a 40-hour work week. She is paid time-and-a-half for each hour worked on weekends. One week Anita worked 40 hours from Monday through Friday and 8

Hours on Saturday. Find her gross pay for the week.

A)$728

B)$224

C)$672

D)$560

Anita's regular hourly rate is $14 for a 40-hour work week. She is paid time-and-a-half for each hour worked on weekends. One week Anita worked 40 hours from Monday through Friday and 8

Hours on Saturday. Find her gross pay for the week.

A)$728

B)$224

C)$672

D)$560

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

Solve the problem.

An entomologist pays Fred $0.15 for each butterfly he brings in. Find Fred's gross earnings if he brings in 75 butterflies.

A)$12.45

B)$75.15

C)$10.05

D)$11.25

An entomologist pays Fred $0.15 for each butterfly he brings in. Find Fred's gross earnings if he brings in 75 butterflies.

A)$12.45

B)$75.15

C)$10.05

D)$11.25

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

Solve the problem. Use a FICA rate of 6.2%, a Medicare rate of 1.45%, and an SDI rate of 1%. Assume the person's

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Lily Adams is paid 6% commission on sales. During a recent week, she had sales of $7,657.00 and returns of $162.05. Find her Social Security tax, Medicare tax, and SDI deduction for the week.

A)$27.88, $6.52, $4.50

B)$27.51, $6.43, $4.44

C)$28.48, $6.66, $4.59

D)$29.09, $4.59, $4.69

earnings will not exceed $31,800 for the year. Round to the nearest cent if needed.

Lily Adams is paid 6% commission on sales. During a recent week, she had sales of $7,657.00 and returns of $162.05. Find her Social Security tax, Medicare tax, and SDI deduction for the week.

A)$27.88, $6.52, $4.50

B)$27.51, $6.43, $4.44

C)$28.48, $6.66, $4.59

D)$29.09, $4.59, $4.69

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

Find the hours, rate, or earnings as specified.

Find the gross earnings for the week. Overtime hours are any hours over 40.

Find the gross earnings for the week. Overtime hours are any hours over 40.

A)$809.55

B)$854.55

C)$1,214.55

D)$1,169.55

Find the gross earnings for the week. Overtime hours are any hours over 40.

Find the gross earnings for the week. Overtime hours are any hours over 40.A)$809.55

B)$854.55

C)$1,214.55

D)$1,169.55

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

Find the Social Security tax for the current pay period. Assume a 6.2% FICA rate up to a maximum of $115,000.

Gross Earnings This Year: $113,089.05 Current Period Earnings: $4,442.38

A)$112.28

B)$118.48

C)$156.95

D)$275.43

Gross Earnings This Year: $113,089.05 Current Period Earnings: $4,442.38

A)$112.28

B)$118.48

C)$156.95

D)$275.43

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

Solve the problem.

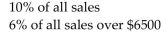

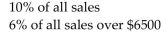

ACME package delivery pays employees for each package they deliver. They are paid as follows: If Joe delivers 22 packages, what are his gross earnings?

If Joe delivers 22 packages, what are his gross earnings?

A)$178.50

B)$154.00

C)$187.25

D)$231.00

ACME package delivery pays employees for each package they deliver. They are paid as follows:

If Joe delivers 22 packages, what are his gross earnings?

If Joe delivers 22 packages, what are his gross earnings?A)$178.50

B)$154.00

C)$187.25

D)$231.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Find the hours, rate, or earnings as specified.

Find the number of regular hours, overtime hours (over 40), and overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 40), and overtime rate (time and a half).

A)40, 7, $25.50

B)33, 14, $34.00

C)40, 7, $34.00

D)47, 0, $25.50

Find the number of regular hours, overtime hours (over 40), and overtime rate (time and a half).

Find the number of regular hours, overtime hours (over 40), and overtime rate (time and a half).A)40, 7, $25.50

B)33, 14, $34.00

C)40, 7, $34.00

D)47, 0, $25.50

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee.

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$23.27, $5.44, $3.75

B)$19.59, $4.58, $3.16

C)$22.04, $5.15, $3.56

D)$33.06, $7.73, $5.33

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$23.27, $5.44, $3.75

B)$19.59, $4.58, $3.16

C)$22.04, $5.15, $3.56

D)$33.06, $7.73, $5.33

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

Solve the problem.

Sue works for Acme Manufacturing Company packing boxes of staples. She is paid $0.15 per box packed. Last week she packed a total of 1,762 boxes, of which 103 were packed during overtime

Hours. What were her gross earnings for the week if time-and-a-half per box is paid for overtime?

A)$273.06

B)$282.33

C)$271.00

D)$272.03

Sue works for Acme Manufacturing Company packing boxes of staples. She is paid $0.15 per box packed. Last week she packed a total of 1,762 boxes, of which 103 were packed during overtime

Hours. What were her gross earnings for the week if time-and-a-half per box is paid for overtime?

A)$273.06

B)$282.33

C)$271.00

D)$272.03

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

Find the equivalent earnings.

Kathy earns $602 per biweekly pay period. How much does she earn in a month?

A)$1,304.33

B)$15,652.00

C)$301.00

D)$652.17

Kathy earns $602 per biweekly pay period. How much does she earn in a month?

A)$1,304.33

B)$15,652.00

C)$301.00

D)$652.17

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

Find the equivalent earnings.

Barbara's yearly salary is $17,212. What is her biweekly salary?

A)$662.00

B)$331

C)$717.17

D)$1,434.33

Barbara's yearly salary is $17,212. What is her biweekly salary?

A)$662.00

B)$331

C)$717.17

D)$1,434.33

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Solve the problem.

Allied Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Ken Warner, an employee of Allied Industries,

Makes $9.50 an hour as his regular rate of pay. Last week he worked 13 hours on Monday, 4 hours

On Tuesday, and 8 hours on Friday. What were his gross earnings for the week?

A)$271.45

B)$262.95

C)$261.25

D)$259.45

Allied Industries pays at the time-and-a-half rate for all time worked over 8 hours in any one day no matter how many hours are worked in a week. Ken Warner, an employee of Allied Industries,

Makes $9.50 an hour as his regular rate of pay. Last week he worked 13 hours on Monday, 4 hours

On Tuesday, and 8 hours on Friday. What were his gross earnings for the week?

A)$271.45

B)$262.95

C)$261.25

D)$259.45

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Roberta Beltman, freelance photographer, earned $30,199.36

A)$1,872.36, $875.78

B)$3,744.72, $875.78

C)$1,872.36, $437.89

D)$3,644.72, $775.78

self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.

Roberta Beltman, freelance photographer, earned $30,199.36

A)$1,872.36, $875.78

B)$3,744.72, $875.78

C)$1,872.36, $437.89

D)$3,644.72, $775.78

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee.

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$3.31, $0.77, $0.53

B)$25.82, $6.04, $4.17

C)$17.22, $4.03, $2.78

D)$19.99, $6.80, $5.55

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

A)$3.31, $0.77, $0.53

B)$25.82, $6.04, $4.17

C)$17.22, $4.03, $2.78

D)$19.99, $6.80, $5.55

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Find the equivalent earnings.

Arnold earns $19,656 a year. How much does he earn in a month?

A)$378.00

B)$1,965.60

C)$1,638.00

D)$819.00

Arnold earns $19,656 a year. How much does he earn in a month?

A)$378.00

B)$1,965.60

C)$1,638.00

D)$819.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Solve the problem.

Nancy earns $12.25 per hour. One week she worked 39.75 hours. Find her gross pay for the week.

A)$487.04

B)$486.84

C)$486.94

D)$486.95

Nancy earns $12.25 per hour. One week she worked 39.75 hours. Find her gross pay for the week.

A)$487.04

B)$486.84

C)$486.94

D)$486.95

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

Solve the problem.

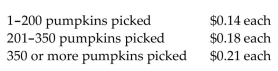

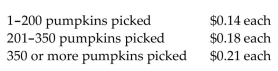

Suppose pumpkin pickers are paid as follows: If Nicole picks 267 pumpkins, what are her gross earnings?

If Nicole picks 267 pumpkins, what are her gross earnings?

A)$40.06

B)$48.06

C)$42.07

D)$37.38

Suppose pumpkin pickers are paid as follows:

If Nicole picks 267 pumpkins, what are her gross earnings?

If Nicole picks 267 pumpkins, what are her gross earnings?A)$40.06

B)$48.06

C)$42.07

D)$37.38

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck