Deck 6: Annual Cash Flow Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 6: Annual Cash Flow Analysis

1

Evaluate the value of A from the cash flows shown in table below using an interest rate of 7% compounded annually.

A) $734.63

B) $1,049.97

C) $955.11

D) $874.80

A) $734.63

B) $1,049.97

C) $955.11

D) $874.80

$955.11

2

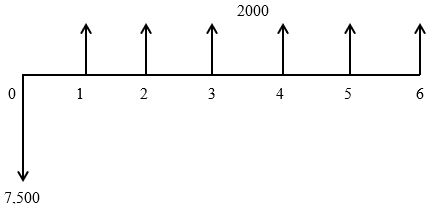

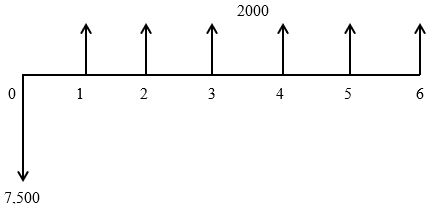

Determine the value of EUAW from the cash flow diagram shown below. i = 9%.

A) $328.25

B) $377.75

C) $569.75

D) $451.06

A) $328.25

B) $377.75

C) $569.75

D) $451.06

$328.25

3

Given: Cash flows for an investment.

Required: EUAC at 7% per year.

A) $674.63

B) $849.97

C) $925.68

D) $764.80

Required: EUAC at 7% per year.

A) $674.63

B) $849.97

C) $925.68

D) $764.80

$925.68

4

Jason bought a car for $40,000 upon graduation from college with an engineering degree and a very good job offer. A down payment of $5,000 was paid by his dad as graduation gift. The rest of the amount was financed with Generous Motors at 6% nominal interest with 60 monthly payments, the first payment which is to start at the end of 13th month. Determine his monthly payment.

A) $583.33

B) $717.38

C) $652.68

D) $752.67

A) $583.33

B) $717.38

C) $652.68

D) $752.67

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

An investment set up as a perpetual trust provides an annual disbursement of $25,000 for the first 20 years and an undetermined amount from year 21. If the trust is set up with $500,000, determine the disbursement that can be made from year 21 through infinity if the interest earned is 6% per year.

A) $41,031

B) $54,000

C) $60,090

D) $58,500

A) $41,031

B) $54,000

C) $60,090

D) $58,500

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

A couple, both engineering alums from a reputable engineering school has decided to set up an endowment to help pay for 4 engineering scholarships at the rate of $X per year starting year 21 perpetually. If $200,000 is invested in the trust today and if it earns a very good rate of return of 12% per year, what will the amount of each scholarship starting year 21?

A) $49,756.2

B) $57,876

C) $62,110.5

D) $41,932

A) $49,756.2

B) $57,876

C) $62,110.5

D) $41,932

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

Aaron invested on a corporate bond with a face value of $10,000 at a discounted price of $9,000. The bond pays a quarterly dividend. What is the quarterly dividend Aron should get if he hopes to get a 10% return on his investments? Assume the bond matures in 20 years.

A) $201

B) $221

C) $190

D) $152

A) $201

B) $221

C) $190

D) $152

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

For the cash flows given in the table below, evaluate the unknown value "A". Use an interest rate of 6%.

A) $1,982.57

B) $2,062.55

C) $1,862.55

D) $2,215.69

A) $1,982.57

B) $2,062.55

C) $1,862.55

D) $2,215.69

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

Choose the best alternative among the three alternatives given in the table below. Use of annual cash flow analysis is required.

A) A

B) B

C) C

A) A

B) B

C) C

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

The cost data for two equipment alternatives are given below.

Determine the better alternative using the annual cash flow analysis.

A) Machine X

B) Machine Y

Determine the better alternative using the annual cash flow analysis.

A) Machine X

B) Machine Y

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

Given the financial data for three mutually exclusive alternatives in the table below, determine the best alternative using the annual cash flow analysis for a MARR of 8%.

A) A

B) B

C) C

A) A

B) B

C) C

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

Equipment is being financed for 10 years by XYZ Corp. with monthly payments. The arrangement with the vendor worked out is as below.

The interest rate is ¾ % per month for the first 48 payments and for the remainder of the loan the interest rate would be 1 % per month.

The equipment cost $500,000.

-What is the monthly payment for the first 48 months?

The interest rate is ¾ % per month for the first 48 payments and for the remainder of the loan the interest rate would be 1 % per month.

The equipment cost $500,000.

-What is the monthly payment for the first 48 months?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

Equipment is being financed for 10 years by XYZ Corp. with monthly payments. The arrangement with the vendor worked out is as below.

The interest rate is ¾ % per month for the first 48 payments and for the remainder of the loan the interest rate would be 1 % per month.

The equipment cost $500,000.

-Determine the amount of 49-th monthly payment.

The interest rate is ¾ % per month for the first 48 payments and for the remainder of the loan the interest rate would be 1 % per month.

The equipment cost $500,000.

-Determine the amount of 49-th monthly payment.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

The equivalent uniform annual worth (EUAW) may be determined from net present worth from the equation, EUAW = PW (A/P, i, n).

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

The analysis period is the least common multiple of lives for evaluating mutually exclusive alternatives using the annual cash flow analysis.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

An endowment has been setup to fund ten engineering scholarships of $10,000 each every year in a state university in Tennessee starting year 11. If the endowment is expected an earn 8% rate of return, the endowment is worth $1,000,000.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

The best alternative among the four mutually exclusive alternatives in the table below is alternative A.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck