Deck 8: Product Costing: Absorption Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 8: Product Costing: Absorption Costing

1

Knowledge of costs = control

True

2

The costs of an organization are the only factor to consider when making selling price decisions.

False

3

Only the direct costs of providing a service or producing a product are taken into account when making decisions on the selling price to charge to customers.

False

4

Component ZVA sells for £200. This selling price is calculated by adding 25% to the total absorption cost of each component. Direct costs of production make up 60% of the total absorption cost of Component ZVA. Overhead is absorbed into each Component ZVA at the rate of £8 per labour hour. How many labour hours does each Component ZVA take to produce?

A) 7.5

B) 8

C) 10

D) 12

A) 7.5

B) 8

C) 10

D) 12

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

Production overheads at Zurich Manufacturing total up to £600,000. There are three support departments for the business, quality control, maintenance and warehousing. Quality control's total overheads are £100,000 per annum. 60% of quality control's time is spent on assessing the quality of Zurich Manufacturing's own production. The other 40% of quality control's time is spent on assessing the quality of production at other small businesses in the local area. Maintenance overheads total up to £144,000 per annum. 75% of the maintenance department's time is spent on servicing production machinery, 20% on servicing warehousing's fork lift trucks and 5% on servicing equipment used by the administration department. 80% of warehousing space is allocated to storing raw materials and finished goods for Zurich Manufacturing with the other 20% being rented out to other local businesses in the area. Warehousing costs total up to £151,200 for the year. Production department employees' normal working hours are 40,000 each year. During the current financial year, actual hours worked were 48,000. What is the hourly overhead recovery rate (correct to two decimal places) that will be applied to products produced in the production department?

A) £19.00

B) £22.22

C) £22.80

D) £24.88

A) £19.00

B) £22.22

C) £22.80

D) £24.88

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

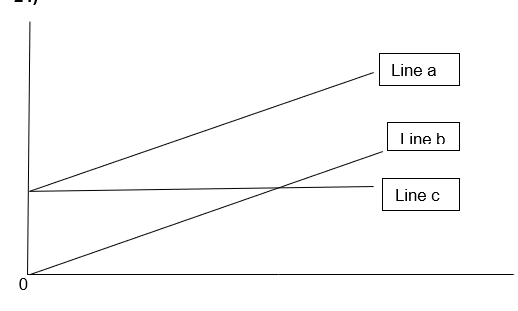

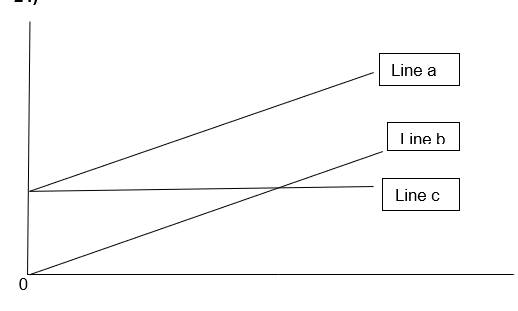

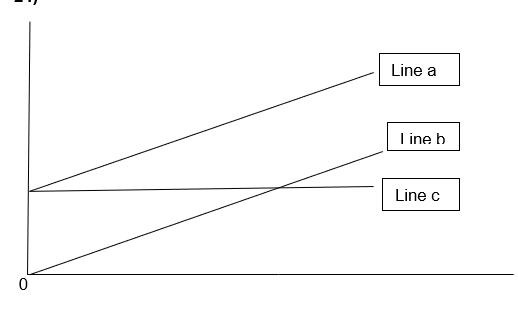

What does line a on the graph represent?

What does line a on the graph represent?A) Variable cost

B) Fixed cost

C) Total cost

D) Revenue

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

What does line b on the graph represent?

What does line b on the graph represent?A) Variable cost

B) Fixed cost

C) Total cost

D) Revenue

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

What does line c on the graph represent?

What does line c on the graph represent?A) Variable cost

B) Fixed cost

C) Total cost

D) Revenue

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

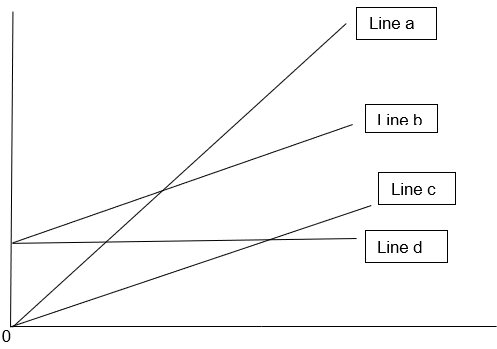

What does line a on the graph represent?

What does line a on the graph represent?A) Variable cost

B) Fixed cost

C) Total cost

D) Total revenue

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

10

Component QXP sells for £300. This selling price is calculated by adding 20% to the total absorption cost of each component. Overhead is absorbed into each unit of QXP at the rate of £8.75 per direct labour hour. Each unit of QXP takes 10 hours of direct labour to produce. What is the direct cost of each unit of component QXP?

A) £87.50

B) £152.50

C) £162.50

D) £212.50

A) £87.50

B) £152.50

C) £162.50

D) £212.50

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following are assumptions of costing? Please select all that apply.

A) Costs can be determined with the required precision

B) At a zero level of production, fixed costs = total costs

C) Fixed costs are fixed

D) Variable costs remain the same for all units of production

A) Costs can be determined with the required precision

B) At a zero level of production, fixed costs = total costs

C) Fixed costs are fixed

D) Variable costs remain the same for all units of production

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

12

Component TDQ sells for £325. This selling price is calculated by adding 30% to the total absorption cost of each component. Direct costs of production of each component are £160. Total overheads for the year are £500,000 and these are absorbed into products on a labour hour basis. During the year to 31 December 2021, 20,000 labour hours were worked but this is 20% lower than the expected level of labour hours that will be worked each year. How many labour hours does each Component TDQ take to produce?

A) 3.60

B) 4.50

C) 6.60

D) 8.25

A) 3.60

B) 4.50

C) 6.60

D) 8.25

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck