Deck 4: Understanding the Importance of Management Accounting Reports and Off-Balance-Sheet Financing

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 4: Understanding the Importance of Management Accounting Reports and Off-Balance-Sheet Financing

1

In order to be useful to managers, management accounting reports:

A) Should be prepared according to the stated Institute of Management Accounting guidelines

B) Should be prepared according to Generally Accepted Accounting Principals

C) Should be prepared to meet the specific needs of decision makers

D) Should not be prepared prior to the end of a fiscal reporting period

A) Should be prepared according to the stated Institute of Management Accounting guidelines

B) Should be prepared according to Generally Accepted Accounting Principals

C) Should be prepared to meet the specific needs of decision makers

D) Should not be prepared prior to the end of a fiscal reporting period

Should be prepared to meet the specific needs of decision makers

2

To compete on the basis of price, the seller must most carefully manage:

A) Service

B) Product development

C) Cost

D) Quality

A) Service

B) Product development

C) Cost

D) Quality

Cost

3

Most analysts prefer to concentrate their attention on basic EPS, rather than the diluted EPS, because it is more useful.

False

4

Why might a company repurchase its own stock?

A) It feels that the market undervalues its shares

B) To offset dilutive effects of employee stock options

C) To increase the number of shares outstanding

D) A and B

A) It feels that the market undervalues its shares

B) To offset dilutive effects of employee stock options

C) To increase the number of shares outstanding

D) A and B

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

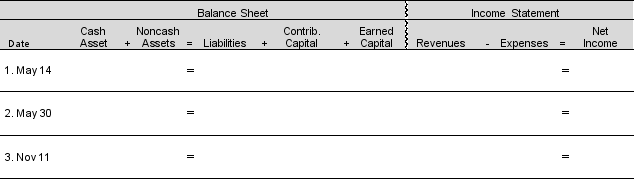

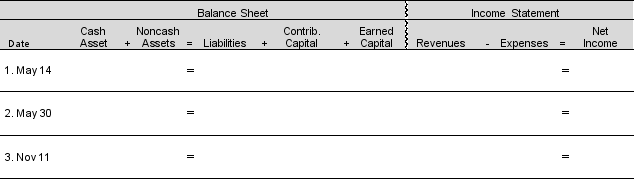

Following are selected stock transactions and information for Williams Materials, Inc.

•Authorization for initial public offering of 200,000 shares of common stock with par value of $0.02 to be issued at $50 per share

•Authorization for 10,000 shares of preferred stock with par value of $160 and 10%.

•Issued shares equal outstanding at time of offering.

1. May 14 200,000 common shares sold at $50 per share

2. May 30 1,000 shares of preferred stock sold at par

3. November 11 $80,000 for payment of cash dividends

A. Show the financial statement effects of the three equity transactions in the template.

B. How much was the per share cash dividend for common stock for the November 11 payment?

•Authorization for initial public offering of 200,000 shares of common stock with par value of $0.02 to be issued at $50 per share

•Authorization for 10,000 shares of preferred stock with par value of $160 and 10%.

•Issued shares equal outstanding at time of offering.

1. May 14 200,000 common shares sold at $50 per share

2. May 30 1,000 shares of preferred stock sold at par

3. November 11 $80,000 for payment of cash dividends

A. Show the financial statement effects of the three equity transactions in the template.

B. How much was the per share cash dividend for common stock for the November 11 payment?

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

Off-balance-sheet financing is the financing of investing activities where neither the accounts associated with the financing or investing are reported on the balance sheet.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

Which type of lease is considered a form of off-balance-sheet financing?

A) Capital lease

B) Deferred tax lease

C) Operating lease

D) Variable interest lease

A) Capital lease

B) Deferred tax lease

C) Operating lease

D) Variable interest lease

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck