Deck 9: Decisions Under Risk and Uncertainty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 9: Decisions Under Risk and Uncertainty

1

Simulation techniques used in risk analysis are:

A) cheap to apply

B) widely used

C) mostly beneficial for large projects

D) limited by their inability to consider the probability distribution of the components of a project's cash flows

E) all of the above

A) cheap to apply

B) widely used

C) mostly beneficial for large projects

D) limited by their inability to consider the probability distribution of the components of a project's cash flows

E) all of the above

mostly beneficial for large projects

2

Which of the following statements concerning marginal utility is (are) true?

A) marginal utility measures the satisfaction the individual receives from a given incremental change in wealth

B) marginal utility is given by the reciprocal of the slope

C) a and b

D) none of the above

A) marginal utility measures the satisfaction the individual receives from a given incremental change in wealth

B) marginal utility is given by the reciprocal of the slope

C) a and b

D) none of the above

marginal utility measures the satisfaction the individual receives from a given incremental change in wealth

3

Diminishing marginal utility:

A) indicates that the slope of the utility function is increasing as wealth increases

B) means that, as one's wealth increases, the individual receives more additional satisfaction from each equal increment of wealth

C) a and b

D) none of the above

A) indicates that the slope of the utility function is increasing as wealth increases

B) means that, as one's wealth increases, the individual receives more additional satisfaction from each equal increment of wealth

C) a and b

D) none of the above

none of the above

4

For an individual having a utility function characterized by a(n) ____, the maximization of expected monetary value criterion will, in general, yield the same decisions as the maximization of expected utility criterion.

A) diminishing marginal utility for money

B) linear utility for money

C) increasing marginal utility for money

D) inverse marginal utility for money

E) converse marginal utility for money

A) diminishing marginal utility for money

B) linear utility for money

C) increasing marginal utility for money

D) inverse marginal utility for money

E) converse marginal utility for money

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

In the riskadjusted discount rate approach, the cash flows for each project are discounted at the:

A) risk-free rate

B) cost of capital

C) risk-adjusted discount rate

D) certainty-equivalent rate

E) none of the above

A) risk-free rate

B) cost of capital

C) risk-adjusted discount rate

D) certainty-equivalent rate

E) none of the above

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

A(n) ____ creates the legal obligation for the buyer (seller) to purchase (sell) a commodity specified in the contract at the agreed upon price at some future point in time.

A) futures contract

B) forward contract

C) option

D) a and b only

E) a, b, and c

A) futures contract

B) forward contract

C) option

D) a and b only

E) a, b, and c

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

A ____ is a transaction that limits the risk associated with market price fluctuations for a particular investment position.

A) minimax position

B) maximin position

C) hedge

D) fence

E) none of the above

A) minimax position

B) maximin position

C) hedge

D) fence

E) none of the above

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

The Economist Frank Knight and others sometimes make a distinction between risk and uncertainty:

A) Risk involves the huge volatility, whereas uncertainty is more like a feeling of queasiness.

B) Risk involves probabilities that are unknown and outcomes that are unknown, whereas uncertainty involves probabilities that are known and outcomes that are known.

C) Uncertainty uses standard deviations and expected values, whereas we can compute these in situations involving risk.

D) Uncertainty involves probabilities that are unknown and outcomes that are unknown, whereas risk involves probabilities that are known and outcomes that are known.

A) Risk involves the huge volatility, whereas uncertainty is more like a feeling of queasiness.

B) Risk involves probabilities that are unknown and outcomes that are unknown, whereas uncertainty involves probabilities that are known and outcomes that are known.

C) Uncertainty uses standard deviations and expected values, whereas we can compute these in situations involving risk.

D) Uncertainty involves probabilities that are unknown and outcomes that are unknown, whereas risk involves probabilities that are known and outcomes that are known.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

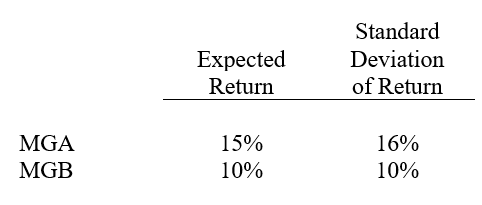

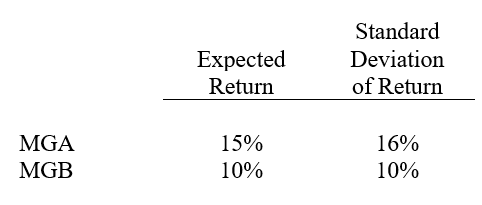

Consider the two following common stocks  The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.

The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.

(a)Determine the expected return for this portfolio.

(b)Determine the standard deviation of the portfolio's returns.

The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.

The correlation coefficient between the returns for the two common stocks is .50. An investor plans to put 60% of his wealth in MGA common stock and 40% in MGB common stock.(a)Determine the expected return for this portfolio.

(b)Determine the standard deviation of the portfolio's returns.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck