Deck 23: Flexible Budgets, Segment Analysis, and Performance Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 23: Flexible Budgets, Segment Analysis, and Performance Reporting

1

The flexible budget variance is equal to the sum of the price and efficiency variances.

True

2

The Return on Sales is a measure of profitability relative to the level of operations.

True

3

HSS Company provides security services to senior executives of prominent corporations when they travel outside the United States. HSS applies both fixed and variable overhead using direct labor hours. The annual budget for one if its customers is as follows:

During the year, HSS had the following activity related to this customer:

During the year, HSS had the following activity related to this customer:

• Actual hours were 850 at a total cost of $44,200.

• Actual fixed overhead was $12,750.

• Actual variable overhead was $22,950.

What is the overall Static Budget Variance?

A) $850 favorable

B) $850 unfavorable

C) $3,900 favorable

D) $3,900 unfavorable

E) None of the above

During the year, HSS had the following activity related to this customer:

During the year, HSS had the following activity related to this customer:• Actual hours were 850 at a total cost of $44,200.

• Actual fixed overhead was $12,750.

• Actual variable overhead was $22,950.

What is the overall Static Budget Variance?

A) $850 favorable

B) $850 unfavorable

C) $3,900 favorable

D) $3,900 unfavorable

E) None of the above

$3,900 unfavorable

4

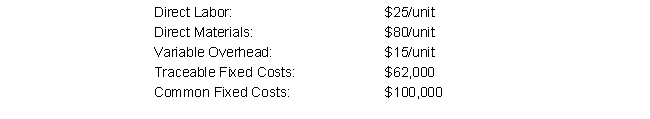

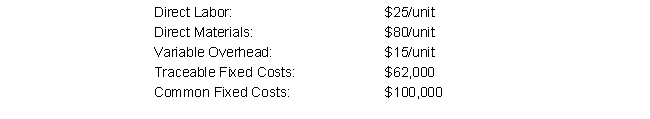

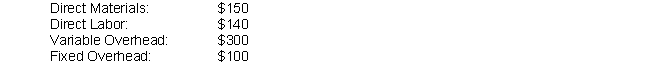

Mangum Co. is a large company that segments its business into cost and profit centers. The Cost center for the manufacture of Product M2T incurred the following costs in October:

Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000.

Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000.

By how much did the department margin increase or decrease in October?

A) $100,000 decrease

B) $18,000 increase

C) $82,000 decrease

D) $118,000 increase

E) None of the above

Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000.

Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000.By how much did the department margin increase or decrease in October?

A) $100,000 decrease

B) $18,000 increase

C) $82,000 decrease

D) $118,000 increase

E) None of the above

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

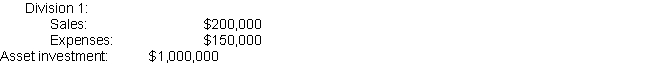

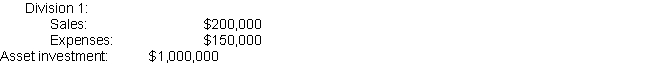

Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows:

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Which division has a higher efficiency in the use of assets to generate sales?

A) Division 1

B) Division 2

C) Both divisions have the same asset utilization ratio

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.Which division has a higher efficiency in the use of assets to generate sales?

A) Division 1

B) Division 2

C) Both divisions have the same asset utilization ratio

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows:

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Which division generates greater profitability per sales dollar?

A) Division 1

B) Division 2

C) Both divisions have the same return on sales ratio

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.

Management discovers that the ROI is the same for both divisions, and wants a deeper evaluation.Which division generates greater profitability per sales dollar?

A) Division 1

B) Division 2

C) Both divisions have the same return on sales ratio

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows:

Based on ROI, which division is more profitable?

Based on ROI, which division is more profitable?

A) Division 1

B) Division 2

C) Both divisions have the same return on investment ratio

Based on ROI, which division is more profitable?

Based on ROI, which division is more profitable?A) Division 1

B) Division 2

C) Both divisions have the same return on investment ratio

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows:

Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"?

Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"?

A) Division 1

B) Division 2

C) Both divisions have the same return on investment ratio

Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"?

Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"?A) Division 1

B) Division 2

C) Both divisions have the same return on investment ratio

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

Bagley & Daughters is a baked-goods manufacturing firm. Bagley has two main divisions: Packaged Mixes and Finished Desserts. The Finished Desserts division is considering purchasing the mix for its cakes from an outside supplier.

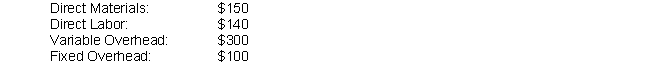

The Packaged Mixes department incurs the following costs for each batch of cake mix:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $50 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $200: this is the price at which Bagley can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $400.

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $50 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $200: this is the price at which Bagley can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $400.

Based on the decision that will maximize the overall benefit to Bagley & Daughters, what is the contribution margin per batch that can be realized by the Finished Desserts department?

A) $50

B) $40

C) $116

D) $276

E) None of the above

The Packaged Mixes department incurs the following costs for each batch of cake mix:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes: Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $50 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $200: this is the price at which Bagley can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $400.

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $50 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $200: this is the price at which Bagley can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $400.Based on the decision that will maximize the overall benefit to Bagley & Daughters, what is the contribution margin per batch that can be realized by the Finished Desserts department?

A) $50

B) $40

C) $116

D) $276

E) None of the above

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

Sanchez & Sons is a Mexican baked-goods manufacturing firm. Sanchez has two main divisions: Packaged Mixes and Finished Products. The Finished Products division is considering purchasing the mix for its churros from an outside supplier.

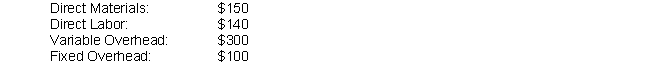

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

The current market price from an outside supplier for the quantity of mix needed by the Finished Products department is $800. The finished churros from each batch of mix will sell for $1,500.

The current market price from an outside supplier for the quantity of mix needed by the Finished Products department is $800. The finished churros from each batch of mix will sell for $1,500.

What is the range of transfer prices within which the two departments could agree on a price to maximize Sanchez & Sons' profit?

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros: The current market price from an outside supplier for the quantity of mix needed by the Finished Products department is $800. The finished churros from each batch of mix will sell for $1,500.

The current market price from an outside supplier for the quantity of mix needed by the Finished Products department is $800. The finished churros from each batch of mix will sell for $1,500.What is the range of transfer prices within which the two departments could agree on a price to maximize Sanchez & Sons' profit?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

Sanchez & Sons is a Mexican baked-goods manufacturing firm. Sanchez has two main divisions: Packaged Mixes and Finished Products. The Finished Products division is considering purchasing the mix for its churros from an outside supplier.

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

Currently, the Packaged Mixes department has excess capacity. Sanchez currently sells the mix for $1,000 per batch. The Finished Products department is able to purchase the mix for $650 from an outside supplier. The finished churros from each batch will sell for a total of $1,500.

Currently, the Packaged Mixes department has excess capacity. Sanchez currently sells the mix for $1,000 per batch. The Finished Products department is able to purchase the mix for $650 from an outside supplier. The finished churros from each batch will sell for a total of $1,500.

Based on the decision that will maximize the overall benefit to Sanchez & Sons, what is the contribution margin per batch that can be realized by the Finished Products department?

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished Products Department would incur the following costs for each batch of churros: Currently, the Packaged Mixes department has excess capacity. Sanchez currently sells the mix for $1,000 per batch. The Finished Products department is able to purchase the mix for $650 from an outside supplier. The finished churros from each batch will sell for a total of $1,500.

Currently, the Packaged Mixes department has excess capacity. Sanchez currently sells the mix for $1,000 per batch. The Finished Products department is able to purchase the mix for $650 from an outside supplier. The finished churros from each batch will sell for a total of $1,500.Based on the decision that will maximize the overall benefit to Sanchez & Sons, what is the contribution margin per batch that can be realized by the Finished Products department?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

Sanchez & Sons is a Mexican baked-goods manufacturing firm. Sanchez has two main divisions: Packaged Mixes and Finished Products. The Finished Products division is considering purchasing the mix for its churros from an outside supplier.

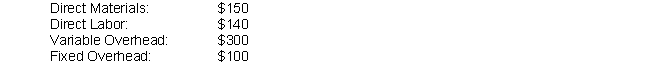

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished churros Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished churros Products Department would incur the following costs for each batch of churros:

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide churro mix to the Finished Products department. Management estimates that $180 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Products department is $800: this is the price at which Sanchez can purchase the mix from an outside supplier. The finished churros from each batch will sell for $1,500.

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide churro mix to the Finished Products department. Management estimates that $180 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Products department is $800: this is the price at which Sanchez can purchase the mix from an outside supplier. The finished churros from each batch will sell for $1,500.

Based on the decision that will maximize the overall benefit to Sanchez & Sons, what is the contribution margin per batch that can be realized by the Finished Products department?

The Packaged Mixes department incurs the following costs for each batch of churros mix:

In addition to the cost of the churros mix, the Finished churros Products Department would incur the following costs for each batch of churros:

In addition to the cost of the churros mix, the Finished churros Products Department would incur the following costs for each batch of churros: Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide churro mix to the Finished Products department. Management estimates that $180 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Products department is $800: this is the price at which Sanchez can purchase the mix from an outside supplier. The finished churros from each batch will sell for $1,500.

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide churro mix to the Finished Products department. Management estimates that $180 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Products department is $800: this is the price at which Sanchez can purchase the mix from an outside supplier. The finished churros from each batch will sell for $1,500.Based on the decision that will maximize the overall benefit to Sanchez & Sons, what is the contribution margin per batch that can be realized by the Finished Products department?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

Bored Boards (BB) is a plywood manufacturing company. BB has two main divisions of product types: Construction Plywood (a rougher product with more knots and blemishes) and Project Plywood (sold for constructing cabinetry and other finished products). The Project Plywood division has the option to purchase the needed panels from the Construction Plywood department or to choose an outside supplier (depending on the agreed-upon transfer price). Extra demand for the following month is projected to be 300 panels of Project Plywood. However, the Construction Plywood department is already producing at full capacity: to meet this demand, the Construction Plywood department would need to shift production from current projects, and management estimates that $30,000 in contribution margin would be lost as a result.

The following are the expected costs for the extra production in the Construction Plywood department:

An outside supplier has offered to produce the needed panels for $200/panel.

An outside supplier has offered to produce the needed panels for $200/panel.

Should the Project Plywood department purchase the panels from the Construction Plywood department or from the outside supplier?

The following are the expected costs for the extra production in the Construction Plywood department:

An outside supplier has offered to produce the needed panels for $200/panel.

An outside supplier has offered to produce the needed panels for $200/panel.Should the Project Plywood department purchase the panels from the Construction Plywood department or from the outside supplier?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

What is the responsibility of an investment center manager?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

Conceptually, what is residual income?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck