Deck 16: Cost Accounting Systemsprocess Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/31

Play

Full screen (f)

Deck 16: Cost Accounting Systemsprocess Costing

1

In process costing, costs are generally accumulated by department rather than by product or job.

True

2

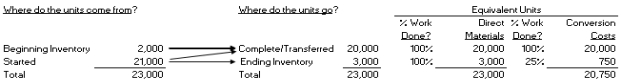

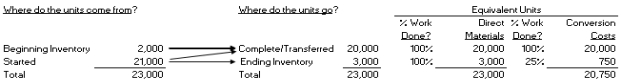

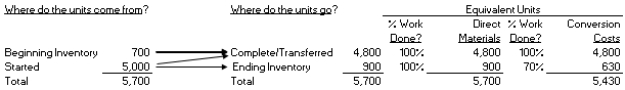

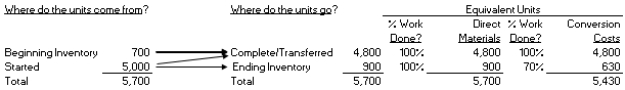

Use the following information :

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of May, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of materials during May for the Mixing Department.

A) 30,000

B) 32,000

C) 5,000

D) 38,000

E) 40,000

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of May, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of materials during May for the Mixing Department.

A) 30,000

B) 32,000

C) 5,000

D) 38,000

E) 40,000

40,000

3

Use the following information :

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of May, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of conversion costs during May for the Mixing Department.

A) 26,000

B) 33,800

C) 35,600

D) 38,000

E) 40,000

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of May, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of conversion costs during May for the Mixing Department.

A) 26,000

B) 33,800

C) 35,600

D) 38,000

E) 40,000

38,000

4

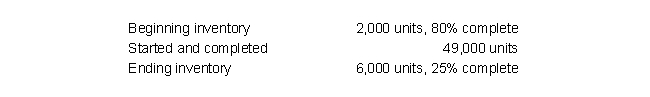

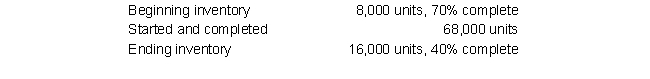

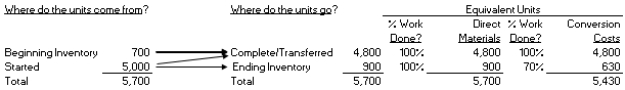

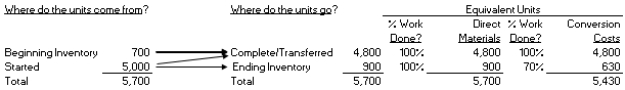

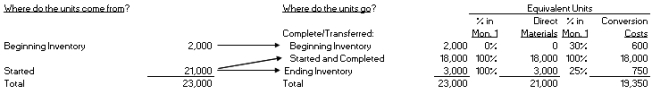

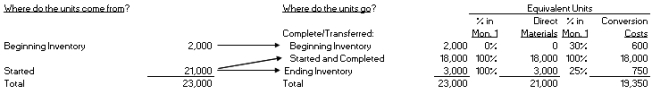

Use the following information for

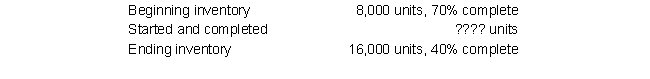

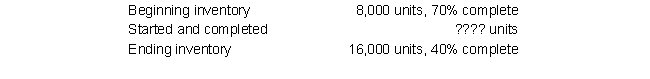

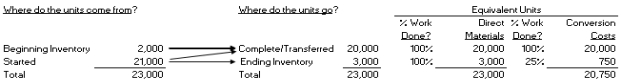

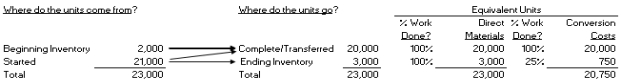

The following information summarizes the activities in the Mixing Department for the month of March.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to materials during the month of March using the .

A) 52,000

B) 52,500

C) 53,000

D) 57,000

E) 61,000

The following information summarizes the activities in the Mixing Department for the month of March.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to materials during the month of March using the .

A) 52,000

B) 52,500

C) 53,000

D) 57,000

E) 61,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

5

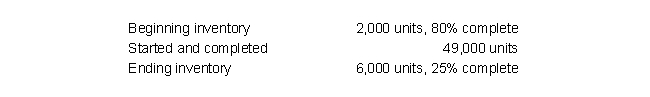

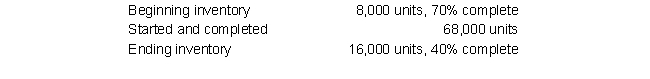

Use the following information for

The following information summarizes the activities in the Mixing Department for the month of March.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to conversion costs during the month of March using the .

A) 50,000

B) 52,000

C) 52,500

D) 57,000

E) 59,500

The following information summarizes the activities in the Mixing Department for the month of March.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to conversion costs during the month of March using the .

A) 50,000

B) 52,000

C) 52,500

D) 57,000

E) 59,500

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

6

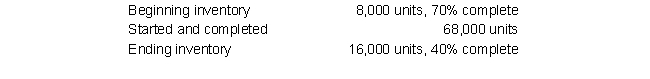

Use the following information :

The following information summarizes the activities in the Sewing Department for the month of October.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to materials during the month of October using the .

A) 82,400

B) 84,000

C) 92,000

D) 95,000

E) 96,000

The following information summarizes the activities in the Sewing Department for the month of October.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to materials during the month of October using the .

A) 82,400

B) 84,000

C) 92,000

D) 95,000

E) 96,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

7

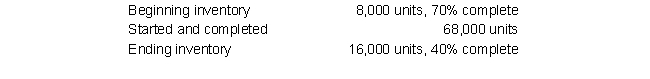

Use the following information :

The following information summarizes the activities in the Sewing Department for the month of October.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to conversion costs during the month of October using the .

A) 46,400

B) 80,400

C) 82,400

D) 91,200

E) 92,000

The following information summarizes the activities in the Sewing Department for the month of October.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to conversion costs during the month of October using the .

A) 46,400

B) 80,400

C) 82,400

D) 91,200

E) 92,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

8

The following information summarizes the activities in the Sewing Department for the month of October.

Assume that the company uses the and that during October, the equivalent units completed with respect to materials is 92,000, and the equivalent units completed with respect to conversion costs is 82,400.

Assume that the company uses the and that during October, the equivalent units completed with respect to materials is 92,000, and the equivalent units completed with respect to conversion costs is 82,400.

How many units were started and completed?

A) 68,000

B) 70,000

C) 76,000

D) 84,000

E) None of the above

Assume that the company uses the and that during October, the equivalent units completed with respect to materials is 92,000, and the equivalent units completed with respect to conversion costs is 82,400.

Assume that the company uses the and that during October, the equivalent units completed with respect to materials is 92,000, and the equivalent units completed with respect to conversion costs is 82,400.How many units were started and completed?

A) 68,000

B) 70,000

C) 76,000

D) 84,000

E) None of the above

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following information :

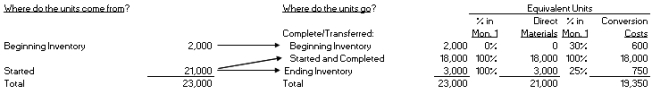

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

-Calculate the average cost per equivalent unit for materials for the month of November.

A) $0.13

B) $0.67

C) $6.85

D) $7.52

E) $8.34

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.-Calculate the average cost per equivalent unit for materials for the month of November.

A) $0.13

B) $0.67

C) $6.85

D) $7.52

E) $8.34

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following information :

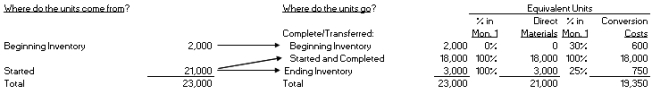

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

-Calculate the average cost per equivalent unit for conversion costs for the month of November.

A) $0.10

B) $0.46

C) $8.82

D) $9.32

E) $9.78

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,460 of materials and $193,335 of conversion costs.-Calculate the average cost per equivalent unit for conversion costs for the month of November.

A) $0.10

B) $0.46

C) $8.82

D) $9.32

E) $9.78

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information :

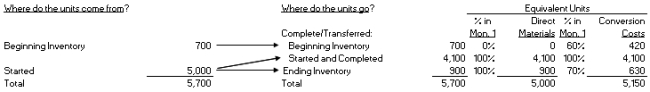

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department: Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

-Calculate the average cost per equivalent unit for materials costs for the month of July.

A) $0.15

B) $0.50

C) $6.14

D) $6.64

E) $6.97

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department:

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.-Calculate the average cost per equivalent unit for materials costs for the month of July.

A) $0.15

B) $0.50

C) $6.14

D) $6.64

E) $6.97

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information :

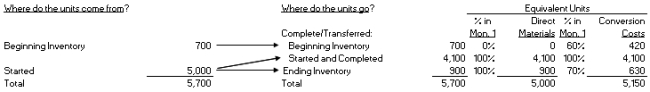

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department: Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

-Calculate the average cost per equivalent unit for conversion costs for the month of July.

A) $0.05

B) $1.46

C) $17.94

D) $18.48

E) $19.40

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department:

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $34,998 of materials and $97,412 of conversion costs.-Calculate the average cost per equivalent unit for conversion costs for the month of July.

A) $0.05

B) $1.46

C) $17.94

D) $18.48

E) $19.40

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following information :

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of March, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of materials during March for the Mixing Department.

A) 35,000

B) 35,900

C) 37,000

D) 37,900

E) 40,000

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of March, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of materials during March for the Mixing Department.

A) 35,000

B) 35,900

C) 37,000

D) 37,900

E) 40,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information :

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of March, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of conversion costs during March for the Mixing Department.

A) 35,000

B) 35,900

C) 37,000

D) 37,900

E) 40,000

Calegari Corporation makes cleaning products in two sequential departments, Mixing and Packaging. Materials are added at the beginning of the process in the Mixing Department. Conversion costs are added evenly throughout each process. Calegari uses the of process costing. In the Mixing Department for the month of March, beginning work in process was 3,000 pounds (70% processed), 37,000 pounds were started in process, 35,000 pounds transferred out, and ending work in process was 60% processed.

-Calculate equivalent units of conversion costs during March for the Mixing Department.

A) 35,000

B) 35,900

C) 37,000

D) 37,900

E) 40,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

15

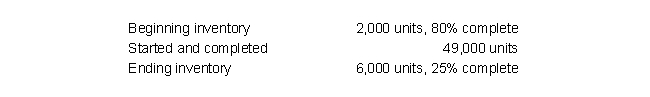

Use the following information :

The following information summarizes the activities in the Mixing Department for the month of August. Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to materials during the month of August using the .

A) 49,000

B) 50,500

C) 50,900

D) 55,000

E) 55,500

The following information summarizes the activities in the Mixing Department for the month of August.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to materials during the month of August using the .

A) 49,000

B) 50,500

C) 50,900

D) 55,000

E) 55,500

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

16

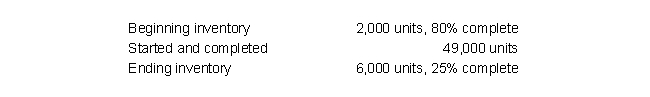

Use the following information :

The following information summarizes the activities in the Mixing Department for the month of August. Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to conversion costs during the month of August using the .

A) 44,900

B) 50,500

C) 50,900

D) 55,000

E) 55,500

The following information summarizes the activities in the Mixing Department for the month of August.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to conversion costs during the month of August using the .

A) 44,900

B) 50,500

C) 50,900

D) 55,000

E) 55,500

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information :

The following information summarizes the activities in the Sewing Department for the month of August. Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to materials during the month of August using the .

A) 68,000

B) 74,400

C) 76,800

D) 84,000

E) 86,000

The following information summarizes the activities in the Sewing Department for the month of August.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to materials during the month of August using the .

A) 68,000

B) 74,400

C) 76,800

D) 84,000

E) 86,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following information :

The following information summarizes the activities in the Sewing Department for the month of August. Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

-Calculate the equivalent units completed with respect to conversion costs during the month of August using the .

A) 65,000

B) 74,400

C) 76,800

D) 84,000

E) 86,000

The following information summarizes the activities in the Sewing Department for the month of August.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.-Calculate the equivalent units completed with respect to conversion costs during the month of August using the .

A) 65,000

B) 74,400

C) 76,800

D) 84,000

E) 86,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information :

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November: Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

-Calculate the average cost per equivalent unit for materials for the month of November.

A) $0.13

B) $0.74

C) $7.50

D) $8.24

E) $8.14

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.-Calculate the average cost per equivalent unit for materials for the month of November.

A) $0.13

B) $0.74

C) $7.50

D) $8.24

E) $8.14

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information :

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November: Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

-Calculate the average cost per equivalent unit for conversion costs for the month of November.

A) $0.10

B) $0.50

C) $9.21

D) $10.00

E) $10.49

Assume Eames Company uses a process costing system based on the . Eames' accountant produces the following equivalent unit calculations for the month of November:

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.

Also assume that the beginning inventory had accumulated $15,500 of materials and $9,600 of conversion costs in the previous month. During the month of November, current costs included $157,500 of materials and $193,500 of conversion costs.-Calculate the average cost per equivalent unit for conversion costs for the month of November.

A) $0.10

B) $0.50

C) $9.21

D) $10.00

E) $10.49

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

21

Use the following information :

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department: Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

-Calculate the average cost per equivalent unit for materials costs for the month of July.

A) $0.14

B) $0.57

C) $6.80

D) $7.57

E) $10.22

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department:

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.-Calculate the average cost per equivalent unit for materials costs for the month of July.

A) $0.14

B) $0.57

C) $6.80

D) $7.57

E) $10.22

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information :

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department: Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

-Calculate the average cost per equivalent unit for conversion costs for the month of July.

A) $0.05

B) $1.54

C) $15.40

D) $19.48

E) $20.45

Assume Towery Company uses a process costing system based on the . Towery's accountant produces the following equivalent unit calculations for the month of July for the first department:

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.

Also assume that the beginning inventory had accumulated $2,850 of materials and $7,930 of conversion costs in the previous month. During the month of July, current costs included $51,100 of materials and $79,310 of conversion costs.-Calculate the average cost per equivalent unit for conversion costs for the month of July.

A) $0.05

B) $1.54

C) $15.40

D) $19.48

E) $20.45

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

23

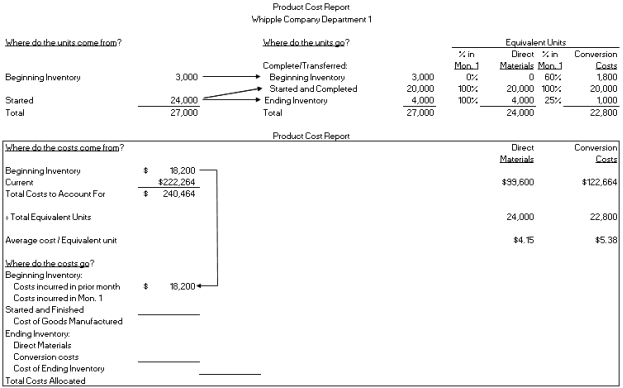

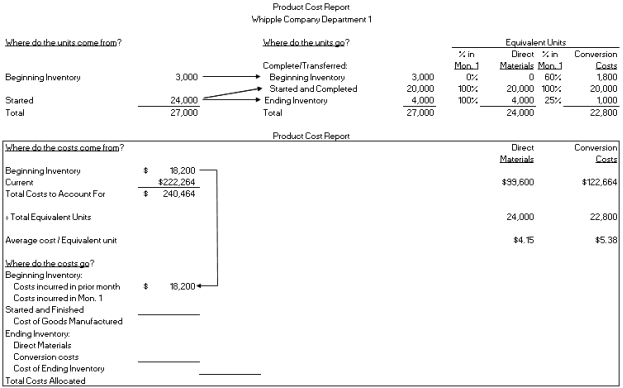

Assume Whipple Company's accountant began preparing the product cost report for Department 1 of a process used to produce a chemical compound for the month of August. However, she became ill and wasn't able to complete the report before being admitted to the hospital for an emergency appendectomy. Since she won't be back to work for at least a week, you have been asked to complete her work.

Assuming the company uses the , calculate cost of goods manufactured and ending inventory for this department for the month of August.

Assuming the company uses the , calculate cost of goods manufactured and ending inventory for this department for the month of August.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

24

How do the journal entries for Process Costing differ from those for Job-Order Costing?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

25

Safe Inc. is a service firm that sells home security systems, which it installs and maintains. After the sales force makes initial contact with a new customer and completes the sale, setting up the new service requires two processes: (1) a home visit where the equipment is physically installed, and (2) the remote connection from off-site at corporate headquarters. Given the different levels of skill and work required, Safe Inc. tracks costs separately for the Installation and Connection processes. Nevertheless, given the relative simplicity of these processes, Safe Inc. tracks them both on a single product cost report with one direct materials category for the equipment and two conversion cost categories for installation and connection services.

Assume that all home installations are completed the same day they are started. After installation, there is sometimes a delay of up to two days before the remote connection is completed. However, in the ideal situation, both the home installation and connection are completed on the same day.

•At the beginning of July, Safe Inc. had 190 incomplete sales contracts. Of these incomplete contracts, 184 were awaiting both installation and connection and 6 had been installed but were still awaiting connection.

•At the end of July, Safe Inc. had 240 incomplete sales contracts. Of these incomplete contracts, 228 jobs were awaiting both installation and connection and 12 jobs had been installed but were still awaiting connection.

•The sales team closed 4,100 new security contracts during July.

•Safe Inc. pays its suppliers $400, on average, to purchase one security system. However, the price experiences some variation due to fluctuations in suppliers cost of raw materials.

•On average, the installation of each system requires approximately 3 labor hours and establishing and testing the connection requires 2 labor hours. However, Safe Inc. does encounter some variation across employees.

•Labor and overhead costs for installation is approximately $20/hour.

•Labor and overhead costs for connection costs approximately $35/hour.

•Assume that the contracts outstanding at the beginning of July include $1,206 for equipment and $179 of installation costs.

•Also assume that Safe Inc. actually incurs $807,132 for new equipment installed during July plus $127,774 of installation costs and $148,230 of connection-related costs.

What is Safe Inc.'s ending Cost of Contracts Completed and Incomplete Contracts for July, assuming it uses the weighted average costing method?

Assume that all home installations are completed the same day they are started. After installation, there is sometimes a delay of up to two days before the remote connection is completed. However, in the ideal situation, both the home installation and connection are completed on the same day.

•At the beginning of July, Safe Inc. had 190 incomplete sales contracts. Of these incomplete contracts, 184 were awaiting both installation and connection and 6 had been installed but were still awaiting connection.

•At the end of July, Safe Inc. had 240 incomplete sales contracts. Of these incomplete contracts, 228 jobs were awaiting both installation and connection and 12 jobs had been installed but were still awaiting connection.

•The sales team closed 4,100 new security contracts during July.

•Safe Inc. pays its suppliers $400, on average, to purchase one security system. However, the price experiences some variation due to fluctuations in suppliers cost of raw materials.

•On average, the installation of each system requires approximately 3 labor hours and establishing and testing the connection requires 2 labor hours. However, Safe Inc. does encounter some variation across employees.

•Labor and overhead costs for installation is approximately $20/hour.

•Labor and overhead costs for connection costs approximately $35/hour.

•Assume that the contracts outstanding at the beginning of July include $1,206 for equipment and $179 of installation costs.

•Also assume that Safe Inc. actually incurs $807,132 for new equipment installed during July plus $127,774 of installation costs and $148,230 of connection-related costs.

What is Safe Inc.'s ending Cost of Contracts Completed and Incomplete Contracts for July, assuming it uses the weighted average costing method?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

26

Safe Inc. is a service firm that sells home security systems, which it installs and maintains. After the sales force makes initial contact with a new customer and completes the sale, setting up the new service requires two processes: (1) a home visit where the equipment is physically installed and (2) the remote connection from off-site at corporate headquarters. Given the different levels of skill and work required, Safe Inc. tracks costs separately for the Installation and Connection processes. Nevertheless, given the relative simplicity of these processes, Safe Inc. tracks them both on a single product cost report with one direct materials category for the equipment and two conversion cost categories for installation and connection services.

Assume that all home installations are completed the same day they are started. After installation, there is sometimes a delay of up to two days before the remote connection is completed. However, in the ideal situation, both the home installation and connection are completed on the same day.

•At the beginning of July, Safe Inc. had 190 incomplete sales contracts. Of these incomplete contracts, 184 were awaiting both installation and connection and 6 had been installed but were still awaiting connection.

•At the end of July, Safe Inc. had 240 incomplete sales contracts. Of these incomplete contracts, 228 jobs were awaiting both installation and connection and 12 jobs had been installed but were still awaiting connection.

•The sales team closed 4,100 new security contracts during July.

•Safe Inc. pays its suppliers $400, on average, to purchase one security system. However, the price experiences some variation due to fluctuations in suppliers cost of raw materials.

•On average, the installation of each system requires approximately 3 labor hours and establishing and testing the connection requires 2 labor hours. However, Safe Inc. does encounter some variation across employees.

•Labor and overhead costs for installation is approximately $20/hour.

•Labor and overhead costs for connection costs approximately $35/hour.

•Assume that the contracts outstanding at the beginning of July include $1,206 for equipment and $179 of installation costs.

•Also assume that Safe Inc. actually incurs $816,270 for new equipment installed during July plus $119,652 of installation costs and $147,825 of connection-related costs.

•Round calculations for equivalent units to whole numbers.

What is Safe Inc.'s ending Cost of Contracts Completed and Incomplete Contracts for July, assuming it uses the FIFO costing method?

Assume that all home installations are completed the same day they are started. After installation, there is sometimes a delay of up to two days before the remote connection is completed. However, in the ideal situation, both the home installation and connection are completed on the same day.

•At the beginning of July, Safe Inc. had 190 incomplete sales contracts. Of these incomplete contracts, 184 were awaiting both installation and connection and 6 had been installed but were still awaiting connection.

•At the end of July, Safe Inc. had 240 incomplete sales contracts. Of these incomplete contracts, 228 jobs were awaiting both installation and connection and 12 jobs had been installed but were still awaiting connection.

•The sales team closed 4,100 new security contracts during July.

•Safe Inc. pays its suppliers $400, on average, to purchase one security system. However, the price experiences some variation due to fluctuations in suppliers cost of raw materials.

•On average, the installation of each system requires approximately 3 labor hours and establishing and testing the connection requires 2 labor hours. However, Safe Inc. does encounter some variation across employees.

•Labor and overhead costs for installation is approximately $20/hour.

•Labor and overhead costs for connection costs approximately $35/hour.

•Assume that the contracts outstanding at the beginning of July include $1,206 for equipment and $179 of installation costs.

•Also assume that Safe Inc. actually incurs $816,270 for new equipment installed during July plus $119,652 of installation costs and $147,825 of connection-related costs.

•Round calculations for equivalent units to whole numbers.

What is Safe Inc.'s ending Cost of Contracts Completed and Incomplete Contracts for July, assuming it uses the FIFO costing method?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

27

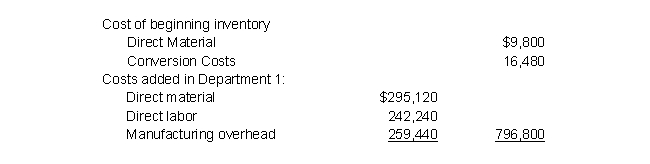

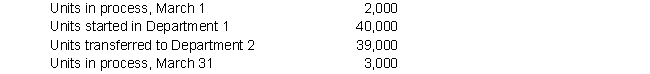

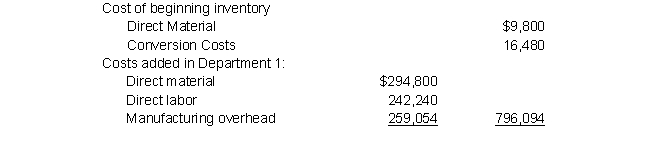

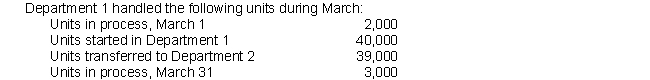

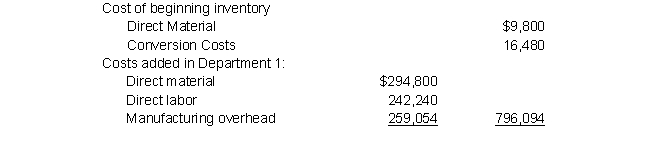

Matthews Manufacturing Corporation produces a sports injury ointment in three consecutive processes. The costs of Department 1 for March 20X5 were as follows:

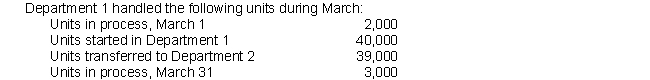

Department 1 handled the following units during March:

Department 1 handled the following units during March:

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

Prepare the product cost report for Department 1 for March.

Department 1 handled the following units during March:

Department 1 handled the following units during March: On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.Prepare the product cost report for Department 1 for March.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

28

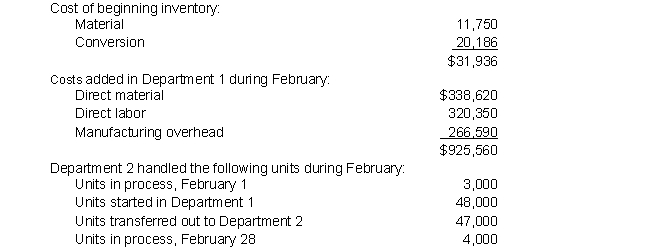

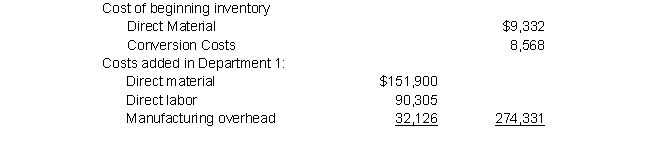

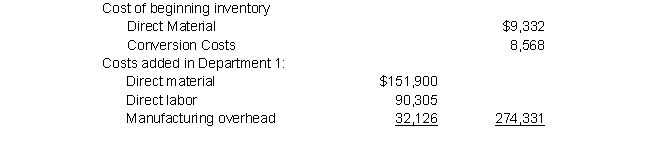

Chapman Manufacturing Company uses the for process costing. Chapman produces processed food products that pass through three sequential departments. The costs for Department 1 for February 20X5 were as follows:

On average, the February 1 units were 30% complete, and the February 28 units were 60% complete. Materials are added at the beginning of the process and conversion costs occur evenly throughout the process in Department 1.

On average, the February 1 units were 30% complete, and the February 28 units were 60% complete. Materials are added at the beginning of the process and conversion costs occur evenly throughout the process in Department 1.

Prepare the product cost report for February for Department 1.

On average, the February 1 units were 30% complete, and the February 28 units were 60% complete. Materials are added at the beginning of the process and conversion costs occur evenly throughout the process in Department 1.

On average, the February 1 units were 30% complete, and the February 28 units were 60% complete. Materials are added at the beginning of the process and conversion costs occur evenly throughout the process in Department 1.Prepare the product cost report for February for Department 1.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

29

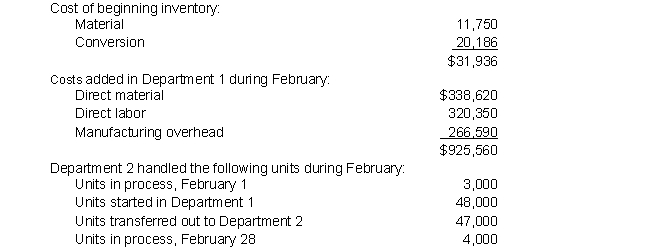

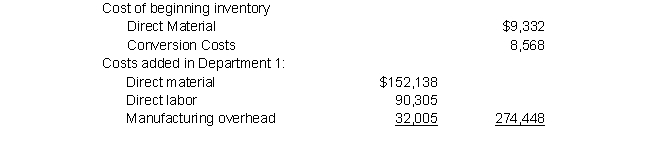

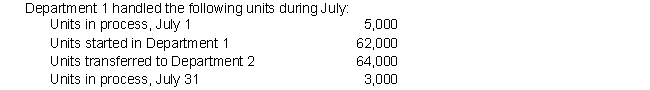

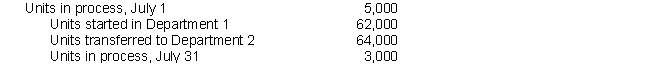

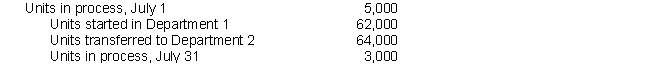

Heflin Manufacturing, Inc., operates a plant that produces artificial maple syrup. The syrup is produced in two processes, blending and bottling. In the Blending Department, all materials are added at the start of the process, and labor and overhead are incurred evenly throughout the process. Heflin uses the for process costing.

The following data relate to the Work in Process-Blending Department account for July 20X5:

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

Prepare the product cost report for Department 1 for July.

The following data relate to the Work in Process-Blending Department account for July 20X5:

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.Prepare the product cost report for Department 1 for July.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

30

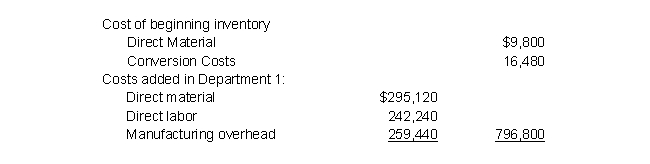

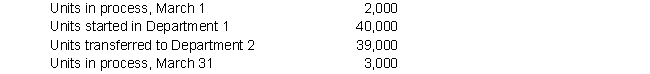

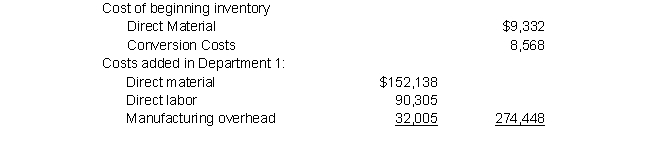

Matthews Manufacturing Corporation produces a sports injury ointment in three consecutive processes. The costs of Department 1 for March 20X5 were as follows:

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

Prepare the product cost report for Department 1 for March.

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.

On average, the March 1 units were 30% complete. The March 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Matthews uses the for process costing.Prepare the product cost report for Department 1 for March.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

31

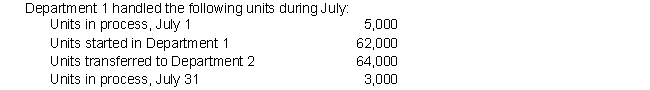

Heflin Manufacturing, Inc., operates a plant that produces artificial maple syrup. The syrup is produced in two processes, blending and bottling. In the Blending Department, all materials are added at the start of the process, and labor and overhead are incurred evenly throughout the process. Heflin uses the for process costing.

The following data relate to the Work in Process-Blending Department account for July 20X5:

Department 1 handled the following units during July:

Department 1 handled the following units during July:

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

Prepare the product cost report for Department 1 for July.

The following data relate to the Work in Process-Blending Department account for July 20X5:

Department 1 handled the following units during July:

Department 1 handled the following units during July: On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.

On average, the July 1 units were 40% complete. The July 31 units were 70% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Heflin uses the for process costing.Prepare the product cost report for Department 1 for July.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck