Deck 8: Accounting for Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/118

Play

Full screen (f)

Deck 8: Accounting for Receivables

1

The direct write-off method of accounting for doubtful accounts mismatches revenue and expenses and overstates assets.

True

2

The direct write-off method of accounting for doubtful accounts follows the accrual concept of accounting more closely than does the allowance method of accounting for doubtful accounts.

False

3

The Allowance for Doubtful Accounts normally has a credit balance.

True

4

If the allowance method of recording doubtful accounts is used, the entry to write off an account does not affect net income or total assets.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

5

Interest at a rate of 8% on $9,000 for 120 days equals $240.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

6

At what amount will accounts receivable for Advantage Company be reported on the balance sheet if the gross receivable balance is $52,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables?

A) $52,960

B) $47,000

C) $49,920

D) $28,200

A) $52,960

B) $47,000

C) $49,920

D) $28,200

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

7

At what amount will accounts receivable for Horizon Company be reported on the balance sheet if the gross receivable balance is $156,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables?

A) $158,880

B) $141,000

C) $149,760

D) $ 84,600

A) $158,880

B) $141,000

C) $149,760

D) $ 84,600

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

8

Great Landscapes Company estimates its doubtful accounts by aging its accounts receivable and applying percentages to various aged categories of accounts. The Great Landscapes Company computes a total of $3,600 in estimated doubtful accounts as of December 31, 2019. Its Accounts Receivable account has a balance of $112,800 and its Allowance for Doubtful Accounts has a credit balance of $600 before adjustment at December 31, 2019.

How much bad debts expense will Great Escapes report in 2019?

A) $ 480

B) $3,840

C) $3,000

D) $3,360

How much bad debts expense will Great Escapes report in 2019?

A) $ 480

B) $3,840

C) $3,000

D) $3,360

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

9

Green Garden Company estimates its doubtful accounts by aging its accounts receivable and applying percentages to various aged categories of accounts. The Green Garden Company computes a total of $10,800 in estimated doubtful accounts as of December 31, 2019. Its Accounts Receivable account has a balance of $338,400 and its Allowance for Doubtful Accounts has a credit balance of $1,800 before adjustment at December 31, 2019.

How much bad debts expense will Green Garden report in 2019?

A) $ 1,440

B) $11,520

C) $ 9,000

D) $10,080

How much bad debts expense will Green Garden report in 2019?

A) $ 1,440

B) $11,520

C) $ 9,000

D) $10,080

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

10

A major shortcoming of the direct write-off method is that credit losses are:

A) Not matched with sales

B) Never recognized

C) Not shown in the subsidiary ledger

D) Sometimes collected at a future date

A) Not matched with sales

B) Never recognized

C) Not shown in the subsidiary ledger

D) Sometimes collected at a future date

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

11

In accounting for credit losses:

A) The allowance method matches losses with related sales better than the direct write-off method.

B) The direct write-off method involves estimating credit losses.

C) The direct write-off method consistently understates assets on the balance sheet.

D) Both (B) and (C)

A) The allowance method matches losses with related sales better than the direct write-off method.

B) The direct write-off method involves estimating credit losses.

C) The direct write-off method consistently understates assets on the balance sheet.

D) Both (B) and (C)

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

12

On December 31, 2019 before adjusting entries, Accounts Receivable for California Company had a debit balance of $200,000, and the Allowance for Doubtful Accounts had a credit balance of $6,000. Credit sales for the year were $1,600,000.

If credit losses are estimated at 1% of credit sales:

A) The balance of the Allowance for Doubtful Accounts will be $10,000 after adjustment.

B) The balance of the Allowance for Doubtful Accounts will be $22,000 after adjustment.

C) The balance of the Allowance for Doubtful Accounts will be $16,000 after adjustment.

D) Bad Debts Expense for the year will be $22,000.

If credit losses are estimated at 1% of credit sales:

A) The balance of the Allowance for Doubtful Accounts will be $10,000 after adjustment.

B) The balance of the Allowance for Doubtful Accounts will be $22,000 after adjustment.

C) The balance of the Allowance for Doubtful Accounts will be $16,000 after adjustment.

D) Bad Debts Expense for the year will be $22,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

13

On December 31, 2019 before adjusting entries, Accounts Receivable for Atlanta Company had a debit balance of $600,000, and the Allowance for Doubtful Accounts had a credit balance of $18,000. Credit sales for the year were $4,800,000.

If credit losses are estimated at 1% of credit sales:

A) The balance of the Allowance for Doubtful Accounts will be $30,000 after adjustment.

B) The balance of the Allowance for Doubtful Accounts will be $66,000 after adjustment.

C) The balance of the Allowance for Doubtful Accounts will be $48,000 after adjustment.

D) Bad Debts Expense for the year will be $66,000.

If credit losses are estimated at 1% of credit sales:

A) The balance of the Allowance for Doubtful Accounts will be $30,000 after adjustment.

B) The balance of the Allowance for Doubtful Accounts will be $66,000 after adjustment.

C) The balance of the Allowance for Doubtful Accounts will be $48,000 after adjustment.

D) Bad Debts Expense for the year will be $66,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

14

Under the allowance method of accounting for credit losses, the entry to write off a specific account:

A) Will increase total assets

B) Debits Bad Debts Expense and credits Allowance for Doubtful Accounts

C) Is the same as the entry to write off a specific account under the direct write-off method

D) Does not affect net income or total assets

A) Will increase total assets

B) Debits Bad Debts Expense and credits Allowance for Doubtful Accounts

C) Is the same as the entry to write off a specific account under the direct write-off method

D) Does not affect net income or total assets

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

15

Boulder Beaver Company had a $150,000 beginning balance in Accounts Receivable and a $6,000 credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $600,000 and customers' accounts collected were $590,000. Also, $4,000 in worthless accounts were written off.

What was the net amount of receivables included in the current assets at the end of the year, before any provision was made for doubtful accounts?

A) $130,000

B) $126,000

C) $154,000

D) $120,000

What was the net amount of receivables included in the current assets at the end of the year, before any provision was made for doubtful accounts?

A) $130,000

B) $126,000

C) $154,000

D) $120,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

16

John Den Bear Company had a $450,000 beginning balance in Accounts Receivable and a $18,000 credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $1,800,000 and customers' accounts collected were $1,770,000. Also, $12,000 in worthless accounts were written off.

What was the net amount of receivables included in the current assets at the end of the year, before any provision was made for doubtful accounts?

A) $390,000

B) $378,000

C) $462,000

D) $240,000

What was the net amount of receivables included in the current assets at the end of the year, before any provision was made for doubtful accounts?

A) $390,000

B) $378,000

C) $462,000

D) $240,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

17

The entry to record the write-off of Ward Company's account under the direct write-off method is:

A) Accounts Receivable--Ward Company

Allowance for Doubtful Accounts

B) Bad Debts Expense

Allowance for Doubtful Accounts

C) Allowance for Doubtful Accounts

Accounts Receivable--Ward Company

D) Bad Debts Expense

Accounts Receivable--Ward Company

A) Accounts Receivable--Ward Company

Allowance for Doubtful Accounts

B) Bad Debts Expense

Allowance for Doubtful Accounts

C) Allowance for Doubtful Accounts

Accounts Receivable--Ward Company

D) Bad Debts Expense

Accounts Receivable--Ward Company

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

18

The entry to record the write-off of Sepich, Inc.'s account using the allowance method is:

A) Bad Debts Expense

Allowance for Doubtful Accounts

B) Bad Debts Expense

Accounts Receivable--Sepich, Inc.

C) Allowance for Doubtful Accounts

Accounts Receivable--Sepich, Inc.

D) Accounts Receivable--Sepich, Inc.

Allowance for Doubtful Accounts

A) Bad Debts Expense

Allowance for Doubtful Accounts

B) Bad Debts Expense

Accounts Receivable--Sepich, Inc.

C) Allowance for Doubtful Accounts

Accounts Receivable--Sepich, Inc.

D) Accounts Receivable--Sepich, Inc.

Allowance for Doubtful Accounts

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

19

Assume the following unadjusted account balances at the end of the accounting period for Margarete Company: Accounts Receivable, $100,000; Allowance for Doubtful Accounts, $1,400 (debit balance); and Net sales, $1,200,000.

If Margarete's past experience indicates credit losses of 1% of net sales, the adjusting entry to estimate doubtful accounts is:

A) Bad Debts Expense 12,000

Accounts Receivable 12,000

B) Bad Debts Expense 10,600

Allowance for Doubtful Accounts 10,600

C) Bad Debts Expense 13,400

Allowance for Doubtful Accounts 13,400

D) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

If Margarete's past experience indicates credit losses of 1% of net sales, the adjusting entry to estimate doubtful accounts is:

A) Bad Debts Expense 12,000

Accounts Receivable 12,000

B) Bad Debts Expense 10,600

Allowance for Doubtful Accounts 10,600

C) Bad Debts Expense 13,400

Allowance for Doubtful Accounts 13,400

D) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

20

Assume the following unadjusted account balances at the end of the accounting period for Emmie Company: Accounts Receivable, $300,000; Allowance for Doubtful Accounts, $4,200 (debit balance); and Net sales, $3,600,000.

If Emmie's past experience indicates credit losses of 1% of net sales, the adjusting entry to estimate doubtful accounts is:

A) Bad Debts Expense 36,000

Accounts Receivable 36,000

B) Bad Debts Expense 31,800

Allowance for Doubtful Accounts 31,800

C) Bad Debts Expense 40,200

Allowance for Doubtful Accounts 40,200

D) Bad Debts Expense 36,000

Allowance for Doubtful Accounts 36,000

If Emmie's past experience indicates credit losses of 1% of net sales, the adjusting entry to estimate doubtful accounts is:

A) Bad Debts Expense 36,000

Accounts Receivable 36,000

B) Bad Debts Expense 31,800

Allowance for Doubtful Accounts 31,800

C) Bad Debts Expense 40,200

Allowance for Doubtful Accounts 40,200

D) Bad Debts Expense 36,000

Allowance for Doubtful Accounts 36,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

21

River Forest, Inc.'s $180,000 Accounts Receivable balance at December 31 consisted of $160,000 current balances and $20,000 past-due balances. At December 31, the Allowance for Doubtful Accounts had a credit balance of $1,600. River Forest estimated that 2% of current balances and 15% of past-due balances will prove uncollectible.

The adjusting entry to record credit losses is:

A) Bad Debts Expense 5,800

Allowance for Doubtful Accounts 5,800

B) Bad Debts Expense 4,600

Allowance for Doubtful Accounts 4,600

C) Bad Debts Expense 4,200

Accounts Receivable 4,200

D) Bad Debts Expense 7,400

Allowance for Doubtful Accounts 7,400

The adjusting entry to record credit losses is:

A) Bad Debts Expense 5,800

Allowance for Doubtful Accounts 5,800

B) Bad Debts Expense 4,600

Allowance for Doubtful Accounts 4,600

C) Bad Debts Expense 4,200

Accounts Receivable 4,200

D) Bad Debts Expense 7,400

Allowance for Doubtful Accounts 7,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

22

Hockey, Inc.'s $540,000 Accounts Receivable balance at December 31 consisted of $480,000 current balances and $60,000 past-due balances. At December 31, the Allowance for Doubtful Accounts had a credit balance of $4,800. Hockey, Inc. estimated that 2% of current balances and 15% of past-due balances will prove uncollectible.

The adjusting entry to record credit losses is:

A) Bad Debts Expense 17,400

Allowance for Doubtful Accounts 17,400

B) Bad Debts Expense 13,800

Allowance for Doubtful Accounts 13,800

C) Bad Debts Expense 12,600

Accounts Receivable 12,600

D) Bad Debts Expense 22,200

Allowance for Doubtful Accounts 22,200

The adjusting entry to record credit losses is:

A) Bad Debts Expense 17,400

Allowance for Doubtful Accounts 17,400

B) Bad Debts Expense 13,800

Allowance for Doubtful Accounts 13,800

C) Bad Debts Expense 12,600

Accounts Receivable 12,600

D) Bad Debts Expense 22,200

Allowance for Doubtful Accounts 22,200

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

23

Princess Company's Accounts Receivable balance at December 31 was $300,000 and there was a credit balance of $1,400 in the Allowance for Doubtful Accounts. The year's sales were $1,800,000. Princess estimates credit losses for the year at 1.5% of sales.

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $300,000

B) $271,600

C) $325,400

D) $277,400

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $300,000

B) $271,600

C) $325,400

D) $277,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

24

Mario Company's Accounts Receivable balance at December 31 was $900,000 and there was a credit balance of $4,200 in the Allowance for Doubtful Accounts. The year's sales were $5,400,000. Mario estimates credit losses for the year at 1.5% of sales.

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $900,000

B) $814,800

C) $976,305

D) $832,200

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $900,000

B) $814,800

C) $976,305

D) $832,200

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

25

McKinley Company's Accounts Receivable balance at December 31 was $200,000, and there was a debit balance of $1,200 in the Allowance for Doubtful Accounts. Mc Kinley estimates that 3% of the Accounts Receivable will prove to be uncollectible.

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $175,800

B) $173.400

C) $194,000

D) $180,000

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $175,800

B) $173.400

C) $194,000

D) $180,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

26

Vandy Company's Accounts Receivable balance at December 31 was $600,000, and there was a debit balance of $3,600 in the Allowance for Doubtful Accounts. Vandy estimates that 3% of the Accounts Receivable will prove to be uncollectible.

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $527,400

B) $520,200

C) $582,000

D) $540,000

After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end?

A) $527,400

B) $520,200

C) $582,000

D) $540,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

27

Assume the following unadjusted account balances at the end of the accounting period for Cottle Company: Accounts Receivable, $30,000; Allowances for Doubtful Accounts, $800 (debit balance); Net sales, $240,000.

If Cottle Company's past experience indicates credit losses of 2% of net sales, the adjusting entry to estimate uncollectible accounts is:

A) Bad Debts Expense 4,800

Allowance for Doubtful Accounts 4,800

B) Bad Debts Expense 5,600

Allowance for Doubtful Accounts 5,600

C) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

D) Bad Debts Expense 4,700

Accounts Receivable 4,700

If Cottle Company's past experience indicates credit losses of 2% of net sales, the adjusting entry to estimate uncollectible accounts is:

A) Bad Debts Expense 4,800

Allowance for Doubtful Accounts 4,800

B) Bad Debts Expense 5,600

Allowance for Doubtful Accounts 5,600

C) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

D) Bad Debts Expense 4,700

Accounts Receivable 4,700

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

28

Assume the following unadjusted account balances at the end of the accounting period for Jasek Company: Accounts Receivable, $90,000; Allowances for Doubtful Accounts, $2,400 (debit balance); Net sales, $720,000.

If Jaroslav Company's past experience indicates credit losses of 2% of net sales, the adjusting entry to estimate uncollectible accounts is:

A) Bad Debts Expense 14,400

Allowance for Doubtful Accounts 14,400

B) Bad Debts Expense 15,300

Allowance for Doubtful Accounts 15,300

C) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

D) Bad Debts Expense 14,400

Accounts Receivable 14,400

If Jaroslav Company's past experience indicates credit losses of 2% of net sales, the adjusting entry to estimate uncollectible accounts is:

A) Bad Debts Expense 14,400

Allowance for Doubtful Accounts 14,400

B) Bad Debts Expense 15,300

Allowance for Doubtful Accounts 15,300

C) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

D) Bad Debts Expense 14,400

Accounts Receivable 14,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

29

Assume the following unadjusted account balances at the end of the accounting period for Montana Hardware: Accounts Receivable, $80,000; Allowance for Doubtful Accounts, $1,600 (debit balance); Sales revenue, $900,000.

If Montana Hardware ages the accounts and determines that $4,000 of the receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

B) Bad Debts Expense 5,600

Allowance for Doubtful Accounts 5,600

C) Bad Debts Expense 2,400

Allowance for Doubtful Accounts 2,400

D) Bad Debts Expense 4,000

Accounts Receivable 4,000

If Montana Hardware ages the accounts and determines that $4,000 of the receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

B) Bad Debts Expense 5,600

Allowance for Doubtful Accounts 5,600

C) Bad Debts Expense 2,400

Allowance for Doubtful Accounts 2,400

D) Bad Debts Expense 4,000

Accounts Receivable 4,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

30

Assume the following unadjusted account balances at the end of the accounting period for Colorado Hardware: Accounts Receivable, $240,000; Allowance for Doubtful Accounts, $4,800 (debit balance); Sales revenue, $2,700,000.

If Colorado Hardware ages the accounts and determines that $12,000 of the receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

B) Bad Debts Expense 16,800

Allowance for Doubtful Accounts 16,800

C) Bad Debts Expense 7,200

Allowance for Doubtful Accounts 7,200

D) Bad Debts Expense 12,000

Accounts Receivable 12,000

If Colorado Hardware ages the accounts and determines that $12,000 of the receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

B) Bad Debts Expense 16,800

Allowance for Doubtful Accounts 16,800

C) Bad Debts Expense 7,200

Allowance for Doubtful Accounts 7,200

D) Bad Debts Expense 12,000

Accounts Receivable 12,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

31

Assume the following unadjusted account balances at the end of the accounting period for Candy Crunch Palace: Accounts Receivable, $90,000; Allowance for Doubtful Accounts, $1,000 (credit balance); and Sales revenue $600,000.

If Candy Crunch Palace ages the accounts and determines that $5,000 of receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 5,000

Accounts Receivable 5,000

B) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

C) Bad Debts Expense 3,000

Allowance for Doubtful Accounts 3,000

D) Bad Debts Expense 5,000

Allowance for Doubtful Accounts 5,000

If Candy Crunch Palace ages the accounts and determines that $5,000 of receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 5,000

Accounts Receivable 5,000

B) Bad Debts Expense 4,000

Allowance for Doubtful Accounts 4,000

C) Bad Debts Expense 3,000

Allowance for Doubtful Accounts 3,000

D) Bad Debts Expense 5,000

Allowance for Doubtful Accounts 5,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

32

Assume the following unadjusted account balances at the end of the accounting period for Guatemala Cafe: Accounts Receivable, $135,000; Allowance for Doubtful Accounts, $3,000 (credit balance); and Sales revenue $1,800,000.

If Guatemala ages the accounts and determines that $15,000 of receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 15,000

Accounts Receivable 15,000

B) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

C) Bad Debts Expense 9,000

Allowance for Doubtful Accounts 9,000

D) Bad Debts Expense 15,000

Allowance for Doubtful Accounts 15,000

If Guatemala ages the accounts and determines that $15,000 of receivables may be uncollectible, the adjusting entry should be:

A) Bad Debts Expense 15,000

Accounts Receivable 15,000

B) Bad Debts Expense 12,000

Allowance for Doubtful Accounts 12,000

C) Bad Debts Expense 9,000

Allowance for Doubtful Accounts 9,000

D) Bad Debts Expense 15,000

Allowance for Doubtful Accounts 15,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

33

New Zealand, Inc. had a $140,000 beginning balance in Accounts Receivable and a $5,000 credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $800,000 and customers' accounts collected were $810,000. Also, $4,000 in worthless accounts were written off. An aging of the accounts indicates that 5% of the end-of-the-year Accounts Receivable balance is doubtful for collection.

What amount of Bad Debts Expense should be provided at year-end?

A) $6,300

B) $7,300

C) $7,600

D) $5,300

What amount of Bad Debts Expense should be provided at year-end?

A) $6,300

B) $7,300

C) $7,600

D) $5,300

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

34

Monkey, Inc. had a $420,000 beginning balance in Accounts Receivable and a $15,000 credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $2,400,000 and customers' accounts collected were $2,430,000. Also, $12,000 in worthless accounts were written off. An aging of the accounts indicates that 5% of the end-of-the-year Accounts Receivable balance is doubtful for collection.

What amount of Bad Debts Expense should be provided at year-end?

A) $18.900

B) $21,900

C) $22,800

D) $15,900

What amount of Bad Debts Expense should be provided at year-end?

A) $18.900

B) $21,900

C) $22,800

D) $15,900

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

35

United Company uses the allowance method of recording credit losses. In November 2019, United wrote off the $1,800 account of Gamma Company. In January 2020, Gamma paid the $1,800.

The entry or entries to record the payment is/are:

A) Cash 1,800

Recoveries of Accounts Written Off 1,800

B) Accounts Receivable-Gamma Co. 1,800

Allowance for Doubtful Accounts 1,800

Cash 1,800

Accounts Receivable-Gamma Co. 1,800

C) Allowance for Doubtful Accounts 1,800

Accounts Receivable-Gamma Co. 1,800

D) Accounts Receivable-Gamma Co. 1,800

Bad Debts Expense 1,800

Cash 1,800

Accounts Receivable-Gamma Co. 1,800

The entry or entries to record the payment is/are:

A) Cash 1,800

Recoveries of Accounts Written Off 1,800

B) Accounts Receivable-Gamma Co. 1,800

Allowance for Doubtful Accounts 1,800

Cash 1,800

Accounts Receivable-Gamma Co. 1,800

C) Allowance for Doubtful Accounts 1,800

Accounts Receivable-Gamma Co. 1,800

D) Accounts Receivable-Gamma Co. 1,800

Bad Debts Expense 1,800

Cash 1,800

Accounts Receivable-Gamma Co. 1,800

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

36

Northwest Company uses the allowance method of recording credit losses. In November 2019, Northwest wrote off the $5,400 account of Delta Company.

In January 2020, Delta paid the $5,400. The entry or entries to record the payment is/are:

A) Cash 5,400

Recoveries of Accounts Written Off 5,400

B) Accounts Receivable-Delta Co. 5,400

Northwest Company uses the allowance method Allowance for Doubtful Accounts 5,400

Cash 5,400

Accounts Receivable-Delta Co. 5,400

C) Allowance for Doubtful Accounts 5,400

Accounts Receivable-Delta Co. 5,400

D) Accounts Receivable-Delta Co. 5,400

Bad Debts Expense 5,400

Cash 5,400

Accounts Receivable-Delta Co. 5,400

In January 2020, Delta paid the $5,400. The entry or entries to record the payment is/are:

A) Cash 5,400

Recoveries of Accounts Written Off 5,400

B) Accounts Receivable-Delta Co. 5,400

Northwest Company uses the allowance method Allowance for Doubtful Accounts 5,400

Cash 5,400

Accounts Receivable-Delta Co. 5,400

C) Allowance for Doubtful Accounts 5,400

Accounts Receivable-Delta Co. 5,400

D) Accounts Receivable-Delta Co. 5,400

Bad Debts Expense 5,400

Cash 5,400

Accounts Receivable-Delta Co. 5,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

37

Tiny Company uses the direct write-off method of recording credit losses. Tiny Company wrote off the $1,600 account of Tim Co. in October 2019. In February 2020, Tiny Company received a final $600 payment from Tim's trustee in bankruptcy.

Giant should make the following entry or entries to record the payment:

A) Cash 600

Allowance for Doubtful Accounts 600

B) Allowance for Doubtful Accounts 600

Bad Debts Expense 600

C) Accounts Receivable-Tim Co. 600

Allowance for Doubtful Accounts 600

D) Accounts Receivable-Tim Co. 600

Bad Debts Expense 600

Cash 600

Accounts Receivable-Tim Co. 600

Giant should make the following entry or entries to record the payment:

A) Cash 600

Allowance for Doubtful Accounts 600

B) Allowance for Doubtful Accounts 600

Bad Debts Expense 600

C) Accounts Receivable-Tim Co. 600

Allowance for Doubtful Accounts 600

D) Accounts Receivable-Tim Co. 600

Bad Debts Expense 600

Cash 600

Accounts Receivable-Tim Co. 600

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

38

Mercury Company uses the direct write-off method of recording credit losses. Mercury Company wrote off the $4,800 account of Venus Co. in October 2019. In February 2020, Mercury Company received a final $1,800 payment from Venus' trustee in bankruptcy.

Mercury should make the following entry or entries to record the payment:

A) Cash 1,800

Allowance for Doubtful Accounts 1,800

B) Allowance for Doubtful Accounts 1,800

Bad Debts Expense 1,800

C) Accounts Receivable - Venus Co. 1,800

Allowance for Doubtful Accounts 1,800

D) Accounts Receivable - Venus Co. 1,800

Bad Debts Expense 1,800

Cash 1,800

Accounts Receivable - Venus Co. 1,800

Mercury should make the following entry or entries to record the payment:

A) Cash 1,800

Allowance for Doubtful Accounts 1,800

B) Allowance for Doubtful Accounts 1,800

Bad Debts Expense 1,800

C) Accounts Receivable - Venus Co. 1,800

Allowance for Doubtful Accounts 1,800

D) Accounts Receivable - Venus Co. 1,800

Bad Debts Expense 1,800

Cash 1,800

Accounts Receivable - Venus Co. 1,800

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

39

After writing off a customer's account, a company using the allowance method subsequently collected the account in full. It should:

A) Debit Cash and credit Accounts Receivable

B) Debit Cash and credit Miscellaneous Income

C) Debit Accounts Receivable and credit Allowance for Doubtful Accounts

D) Both A) and C)

A) Debit Cash and credit Accounts Receivable

B) Debit Cash and credit Miscellaneous Income

C) Debit Accounts Receivable and credit Allowance for Doubtful Accounts

D) Both A) and C)

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

40

Robbie Company paid Hoover Company for merchandise with an $8,000, 60-day, 9% note dated April 1. If Robbie Company pays the note at maturity, what entry should Hoover make at that time?

A) Cash 8,720

Interest income 720

Notes receivable 8,000

B) Notes payable 8,000

Interest expense 720

Cash 8,720

C) Cash 8,120

Interest income 120

Notes receivable 8,000

D) Notes payable 7,880

Interest expense 120

Cash 8,000

A) Cash 8,720

Interest income 720

Notes receivable 8,000

B) Notes payable 8,000

Interest expense 720

Cash 8,720

C) Cash 8,120

Interest income 120

Notes receivable 8,000

D) Notes payable 7,880

Interest expense 120

Cash 8,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

41

Chopper Company paid Keith Company for merchandise with a $24,000, 60-day, 9% note dated April 1. If Chopper Company pays the note at maturity, what entry should Keith make at that time?

A) Cash 26,160

Interest income 2,160

Notes receivable 24,000

B) Notes payable 24,000

Interest expense 2,160

Cash 26,160

C) Cash 24,360

Interest income 360

Notes receivable 24,000

D) Notes payable 23,640

Interest expense 360

Cash 24,000

A) Cash 26,160

Interest income 2,160

Notes receivable 24,000

B) Notes payable 24,000

Interest expense 2,160

Cash 26,160

C) Cash 24,360

Interest income 360

Notes receivable 24,000

D) Notes payable 23,640

Interest expense 360

Cash 24,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

42

A $20,000, 3-month, 8% note is dated June 1, 2016. The maturity date and maturity value of the note are, respectively:

A) September 1, 2016; $20,400

B) August 29, 2016; $20,400

C) September 1, 2016; $400

D) August 29, 2016; $20,000

A) September 1, 2016; $20,400

B) August 29, 2016; $20,400

C) September 1, 2016; $400

D) August 29, 2016; $20,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

43

A $60,000, 3-month, 8% note is dated June 1, 2019. The maturity date and maturity value of the note are, respectively:

A) September 1, 2019; $61,200

B) August 29, 2019; $61,200

C) September 1, 2019; $1,200

D) August 29, 2019; $60,000

A) September 1, 2019; $61,200

B) August 29, 2019; $61,200

C) September 1, 2019; $1,200

D) August 29, 2019; $60,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

44

A $30,000, 120-day, 9% note is dated April 30, 2019. The maturity date and maturity value of the note are, respectively:

A) August 31, 2016; $32,960

B) August 28, 2016; $30,900

C) September 1, 2016; $32,960

D) August 28, 2016; $960

A) August 31, 2016; $32,960

B) August 28, 2016; $30,900

C) September 1, 2016; $32,960

D) August 28, 2016; $960

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

45

A $90,000, 120-day, 9% note is dated April 30, 2019. The maturity date and maturity value of the note are, respectively:

A) August 31, 2019; $99,880

B) August 28, 2019; $92,700

C) September 1, 2019; $98,880

D) August 28, 2019; $ 2,880

A) August 31, 2019; $99,880

B) August 28, 2019; $92,700

C) September 1, 2019; $98,880

D) August 28, 2019; $ 2,880

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

46

A note for $24,000 is dated May 3, 2019 and it matures on August 1, 2019. The note is a:

A) 3-month note

B) 90-day note

C) 91-day note

D) Both A and B

A) 3-month note

B) 90-day note

C) 91-day note

D) Both A and B

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

47

On December 11, 2019, Fred gave a $20,000, 60-day, 9% note to Barnie in payment of an account. On December 31, 2019, Barnie should record:

A) $100 interest income

B) $100 interest expense

C) $300 interest income

D) $300 interest expense

A) $100 interest income

B) $100 interest expense

C) $300 interest income

D) $300 interest expense

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

48

On December 11, 2019, Red gave a $60,000, 60-day, 9% note to Cardinal in payment of an account. On December 31, 2019, cardinal should record:

A) $300 interest income

B) $300 interest expense

C) $900 interest income

D) $900 interest expense

A) $300 interest income

B) $300 interest expense

C) $900 interest income

D) $900 interest expense

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

49

On November 16, 2019, Shoe Company borrowed $20,000 from Lace Company and gave a 90-day, 12% note.

On December 31, 2019 the end of the accounting period, Lace makes the following entry:

A) Notes receivable 300

Interest income 300

B) Interest receivable 600

Interest income 600

C) Cash 300

Interest income 300

D) Interest receivable 300

Interest income 300

On December 31, 2019 the end of the accounting period, Lace makes the following entry:

A) Notes receivable 300

Interest income 300

B) Interest receivable 600

Interest income 600

C) Cash 300

Interest income 300

D) Interest receivable 300

Interest income 300

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

50

On November 16, 2019, Pea Company borrowed $60,000 from Coat Company and gave a 90-day, 12% note.

On December 31, 2019 the end of the accounting period, Coat makes the following entry:

A) Notes receivable 900

Interest income 900

B) Interest receivable 1,800

Interest income 1,800

C) Cash 900

Interest income 900

D) Interest receivable 900

Interest income 900

On December 31, 2019 the end of the accounting period, Coat makes the following entry:

A) Notes receivable 900

Interest income 900

B) Interest receivable 1,800

Interest income 1,800

C) Cash 900

Interest income 900

D) Interest receivable 900

Interest income 900

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

51

Rain Company paid Drop Company for merchandise with a $9,000, 90-day, 10% note dated December 11, 2019.

What entry should Drop Company make in its books at the end of the accounting period on December 31, 2019?

A) Interest receivable 50

Interest income 50

B) Cash 50

Interest receivable 50

C) Interest income 50

Interest receivable 50

D) Cash 50

Interest income 50

What entry should Drop Company make in its books at the end of the accounting period on December 31, 2019?

A) Interest receivable 50

Interest income 50

B) Cash 50

Interest receivable 50

C) Interest income 50

Interest receivable 50

D) Cash 50

Interest income 50

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

52

Sun Company paid Shine Company for merchandise with a $27,000, 90-day, 10% note dated December 11, 2019.

What entry should Shine Company make in its books at the end of the accounting period on December 31, 2019?

A) Interest receivable 150

Interest income 150

B) Cash 150

Interest receivable 150

C) Interest income 150

Interest receivable 150

D) Cash 150

Interest income 150

What entry should Shine Company make in its books at the end of the accounting period on December 31, 2019?

A) Interest receivable 150

Interest income 150

B) Cash 150

Interest receivable 150

C) Interest income 150

Interest receivable 150

D) Cash 150

Interest income 150

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

53

Angela, Inc. received a $16,000 30-day, 9% note dated December 21, 2019 from Alyssa Company. On December 31, 2019, Angela made the necessary adjusting entry to accrue interest income on the note.

Angela's entry to record payment of the note on January 20, 2020 was:

A) Cash 16,120

Interest income 120

Notes receivable 16,000

B) Cash 16,040

Interest income 40

Notes receivable 16,000

C) Cash 16,120

Interest receivable 40

Interest income 80

Notes receivable 16,000

D) Cash 16,080

Interest income 80

Notes receivable 16,000

Angela's entry to record payment of the note on January 20, 2020 was:

A) Cash 16,120

Interest income 120

Notes receivable 16,000

B) Cash 16,040

Interest income 40

Notes receivable 16,000

C) Cash 16,120

Interest receivable 40

Interest income 80

Notes receivable 16,000

D) Cash 16,080

Interest income 80

Notes receivable 16,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

54

Balen, Inc. received a $48,000 30-day, 9% note dated December 21, 2019 from Vargas Company. On December 31, 2019, Balen made the necessary adjusting entry to accrue interest income on the note.

Balen's entry to record payment of the note on January 20, 2020 was:

A) Cash 48,360

Interest income 360

Notes receivable 48,000

B) Cash 48,120

Interest income 120

Notes receivable 48,000

C) Cash 48,360

Interest receivable 120

Interest income 240

Notes receivable 48,000

D) Cash 48,240

Interest income 240

Notes receivable 48,000

Balen's entry to record payment of the note on January 20, 2020 was:

A) Cash 48,360

Interest income 360

Notes receivable 48,000

B) Cash 48,120

Interest income 120

Notes receivable 48,000

C) Cash 48,360

Interest receivable 120

Interest income 240

Notes receivable 48,000

D) Cash 48,240

Interest income 240

Notes receivable 48,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

55

Percy, Inc. had net sales of $1,530,000 during 2019. On January 1, 2019, Percy's accounts receivable were $320,000. On December 31, 2019, Percy's accounts receivable were $400,000.

What was Annabeth's accounts receivable turnover for 2019?

A) 4.25

B) 3.03

C) 3.83

D) 4.78

What was Annabeth's accounts receivable turnover for 2019?

A) 4.25

B) 3.03

C) 3.83

D) 4.78

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

56

Tower, Inc. had net sales of $4,725,000 during 2019. On January 1, 2019, Tower's accounts receivable were $960,000. On December 31, 2019, Tower's accounts receivable were $1,200,000.

What was Tower's accounts receivable turnover for 2019?

A) 4.93

B) 4.38

C) 8.53

D) 2.78

What was Tower's accounts receivable turnover for 2019?

A) 4.93

B) 4.38

C) 8.53

D) 2.78

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

57

Percy, Inc. had net sales of $1,530,000 during 2019. On January 1, 2019, Percy's accounts receivable were $320,000. On December 31, 2019, Percy's accounts receivable were $400,000.

What was Percy's average collection period for 2019?

A) 85.9 days

B) 15.5 days

C) 95.4 days

D) 43.0 days

What was Percy's average collection period for 2019?

A) 85.9 days

B) 15.5 days

C) 95.4 days

D) 43.0 days

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

58

Tower, Inc. had net sales of $4,725,000 during 2019. On January 1, 2019, Tower's accounts receivable were $960,000. On December 31, 2019, Tower's accounts receivable were $1,200,000.

What was Tower's average collection period for 2019?

A) 83.4 days

B) 13.8 days

C) 96.2 days

D) 43.3 days

What was Tower's average collection period for 2019?

A) 83.4 days

B) 13.8 days

C) 96.2 days

D) 43.3 days

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

59

Storm Company has net credit sales of $1,800,000 for the year and it estimates that doubtful accounts will be 2% of sales.

If its Allowance for Doubtful Accounts has a credit balance of $6,000 prior to adjustment, its balance after adjustment will be a credit of:

A) $28,000

B) $42,000

C) $27,960

D) $26,000

If its Allowance for Doubtful Accounts has a credit balance of $6,000 prior to adjustment, its balance after adjustment will be a credit of:

A) $28,000

B) $42,000

C) $27,960

D) $26,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

60

Scorpion Company has net credit sales of $5,400,000 for the year and it estimates that doubtful accounts will be 2% of sales.

If its Allowance for Doubtful Accounts has a credit balance of $18,000 prior to adjustment, its balance after adjustment will be a credit of:

A) $ 84,000

B) $126,000

C) $ 83,880

D) $ 78,000

If its Allowance for Doubtful Accounts has a credit balance of $18,000 prior to adjustment, its balance after adjustment will be a credit of:

A) $ 84,000

B) $126,000

C) $ 83,880

D) $ 78,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

61

At the beginning of 2019, Page Company's allowance for doubtful accounts is $24,000. During 2019, $8,500 was written off as uncollectible. On December 31, 2019, Page Company used an aging schedule of accounts receivable and determined that $21,060 of the accounts receivable would probably be uncollectible.

What would be the bad debts expense that should be reported on Page Company's 2019 income statement?

A) $ 2,940

B) $53,560

C) $11,440

D) $ 5,560

What would be the bad debts expense that should be reported on Page Company's 2019 income statement?

A) $ 2,940

B) $53,560

C) $11,440

D) $ 5,560

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

62

At the beginning of 2019, Brown Company's allowance for doubtful accounts is $72,000. During 2019, $25,500 was written off as uncollectible. On December 31, 2019, Brown Company used an aging schedule of accounts receivable and determined that $63,180 of the accounts receivable would probably be uncollectible.

What would be the bad debts expense that should be reported on Brown Company's 2019 income statement?

A) $109,680

B) $160,680

C) $ 34,440

D) $ 16,680

What would be the bad debts expense that should be reported on Brown Company's 2019 income statement?

A) $109,680

B) $160,680

C) $ 34,440

D) $ 16,680

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

63

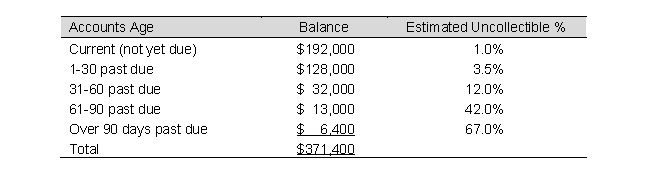

Losh Company has the following unadjusted account balances on December 31, 2019. The pre-adjustment balance of Allowance for Doubtful Accounts is $3,200 debit. This company uses the following aging of accounts receivable to estimate its bad debts.

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

A) $354,612

B) $391,925

C) $351,412

D) $348,212

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:A) $354,612

B) $391,925

C) $351,412

D) $348,212

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

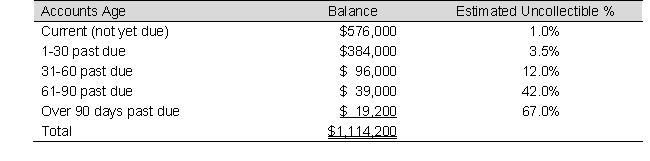

64

Pinata Company has the following unadjusted account balances on December 31, 2019. The pre-adjustment balance of Allowance for Doubtful Accounts is $9,600 debit. This company uses the following aging of accounts receivable to estimate its bad debts.

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

A) $1,063,836

B) $1,175,775

C) $1,054,236

D) $1,044,636

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:

The Net Realizable Value of Accounts Receivable reported on the year-end Balance Sheet will be:A) $1,063,836

B) $1,175,775

C) $1,054,236

D) $1,044,636

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

65

An aging of Bicycle Company's accounts receivable indicates that $20,000 is estimated to be uncollectible.

If Allowance for Doubtful Accounts has a $3,000 credit balance, the adjustment to record bad debts for the period will require a:

A) Debit to Bad Debts Expense for $20,000

B) Debit to Allowance for Doubtful Accounts for $17,000

C) Debit to Bad Debts Expense for $17,000

D) Credit to Allowance for Doubtful Accounts for $20,000

If Allowance for Doubtful Accounts has a $3,000 credit balance, the adjustment to record bad debts for the period will require a:

A) Debit to Bad Debts Expense for $20,000

B) Debit to Allowance for Doubtful Accounts for $17,000

C) Debit to Bad Debts Expense for $17,000

D) Credit to Allowance for Doubtful Accounts for $20,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

66

An aging of Coco Company's accounts receivable indicates that $60,000 is estimated to be uncollectible.

If Allowance for Doubtful Accounts has a $9,000 credit balance, the adjustment to record bad debts for the period will require a:

A) Debit to Bad Debts Expense for $60,000

B) Debit to Allowance for Doubtful Accounts for $51,000

C) Debit to Bad Debts Expense for $51,000

D) Credit to Allowance for Doubtful Accounts for $60,000

If Allowance for Doubtful Accounts has a $9,000 credit balance, the adjustment to record bad debts for the period will require a:

A) Debit to Bad Debts Expense for $60,000

B) Debit to Allowance for Doubtful Accounts for $51,000

C) Debit to Bad Debts Expense for $51,000

D) Credit to Allowance for Doubtful Accounts for $60,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

67

Cunningham Company's Accounts Receivable account has a balance of $644,000 and the Allowance for Doubtful Accounts has a debit balance of $1,700 at fiscal year-end prior to adjustment.

If the estimate based on the percentage of sales approach to estimating uncollectibles is $39,800, the net realizable value of accounts receivable reported on the balance sheet after adjustment is:

A) $604,200

B) $605,900

C) $602,500

D) $642,300

If the estimate based on the percentage of sales approach to estimating uncollectibles is $39,800, the net realizable value of accounts receivable reported on the balance sheet after adjustment is:

A) $604,200

B) $605,900

C) $602,500

D) $642,300

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

68

Johnnie Company's Accounts Receivable account has a balance of $1,932,000 and the Allowance for Doubtful Accounts has a debit balance of $5,100 at fiscal year-end prior to adjustment.

If the estimate based on the percentage of sales approach to estimating uncollectibles is $119,400, the net realizable value of accounts receivable reported on the balance sheet after adjustment is:

A) $1,812,600

B) $1,817,700

C) $1,807,500

D) $1,920,900

If the estimate based on the percentage of sales approach to estimating uncollectibles is $119,400, the net realizable value of accounts receivable reported on the balance sheet after adjustment is:

A) $1,812,600

B) $1,817,700

C) $1,807,500

D) $1,920,900

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

69

Cooper Company's net accounts receivable before write-offs is $1,690,000. What is the balance in net accounts receivable, if $39,600 in doubtful accounts are written off?

A) $1,646,000

B) $1,734,000

C) $1,690,000

D) Cannot be determined

A) $1,646,000

B) $1,734,000

C) $1,690,000

D) Cannot be determined

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

70

Spencer Company's net accounts receivable before write-offs is $5,070,000. What is the balance in net accounts receivable, if $118,800 in doubtful accounts are written off under the allowance method?

A) $4,938,000

B) $5,202,000

C) $5,070,000

D) Cannot be determined

A) $4,938,000

B) $5,202,000

C) $5,070,000

D) Cannot be determined

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

71

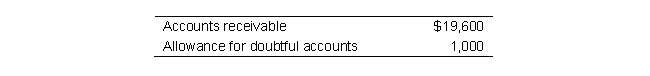

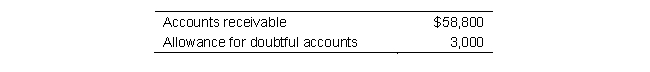

Prior to the write off of a $500 customer account, Parthenon Company had the following account balances:

The net realizable value of the Accounts Receivable before and after the write-off was:

The net realizable value of the Accounts Receivable before and after the write-off was:

Before After

A) $18,600 $18,600

B) $18,800 $18,600

C) $18,600 $18,400

D) $18,600 $18,300

The net realizable value of the Accounts Receivable before and after the write-off was:

The net realizable value of the Accounts Receivable before and after the write-off was:Before After

A) $18,600 $18,600

B) $18,800 $18,600

C) $18,600 $18,400

D) $18,600 $18,300

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

72

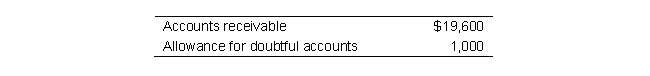

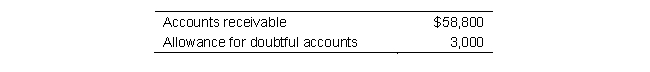

Prior to the write off of a $1,500 customer account, Betty Company had the following account balances:

The net realizable value of the Accounts Receivable before and after the write-off was:

The net realizable value of the Accounts Receivable before and after the write-off was:

The net realizable value of the Accounts Receivable before and after the write-off was:

The net realizable value of the Accounts Receivable before and after the write-off was:

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

73

Thor Company's Accounts Receivable account has a balance of $800,000 at the end of the year, and the company estimates the Net Realizable Value of Accounts Receivable to be $768,000. The Allowance for Doubtful Accounts has a credit balance of $18,000 at the beginning of the current year, and during the year, Thor wrote off $15,000 of accounts receivable.

The year-end adjusting entry would require a:

A) A credit to Allowance for Doubtful Accounts for $35,000

B) A debit to Bad Debts Expense for $14,000

C) A debit to Bad Debts Expense for $29,000

D) A credit to Allowance for Doubtful Accounts for $32,000

The year-end adjusting entry would require a:

A) A credit to Allowance for Doubtful Accounts for $35,000

B) A debit to Bad Debts Expense for $14,000

C) A debit to Bad Debts Expense for $29,000

D) A credit to Allowance for Doubtful Accounts for $32,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

74

Saturn Company's Accounts Receivable account has a balance of $2,400,000 at the end of the year, and the company estimates the Net Realizable Value of Accounts Receivable to be $2,304,000. The Allowance for Doubtful Accounts has a credit balance of $54,000 at the beginning of the current year, and during the year, Saturn wrote off $45,000 of accounts receivable.

The year-end adjusting entry would require a:

A) A credit to Allowance for Doubtful Accounts for $105,000

B) A debit to Bad Debts Expense for $42,000

C) A debit to Bad Debts Expense for $87,000

D) A credit to Allowance for Doubtful Accounts for $96,000

The year-end adjusting entry would require a:

A) A credit to Allowance for Doubtful Accounts for $105,000

B) A debit to Bad Debts Expense for $42,000

C) A debit to Bad Debts Expense for $87,000

D) A credit to Allowance for Doubtful Accounts for $96,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

75

Dahmen Company's Accounts Receivable Account has a debit balance of $1,800,000, and the Allowance for Doubtful Accounts has a debit balance of $4,000 at the end of the year before adjustment. An analysis of their customers' accounts estimates that 2% of year end account receivable will be uncollectible.

The adjusting journal entry for doubtful accounts will include:

A) Debit Bad Debts Expense $326,000

B) Credit Allowance for Doubtful Accounts, $36,000

C) Debit Bad Debts Expense $40,000

D) Credit Allowance for Doubtful Accounts, $32,000

The adjusting journal entry for doubtful accounts will include:

A) Debit Bad Debts Expense $326,000

B) Credit Allowance for Doubtful Accounts, $36,000

C) Debit Bad Debts Expense $40,000

D) Credit Allowance for Doubtful Accounts, $32,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

76

Gleeson Company's Accounts Receivable Account has a debit balance of $5,400,000, and the Allowance for Doubtful Accounts has a debit balance of $12,000 at the end of the year before adjustment. An analysis of their customers' accounts estimates that 2% of year end account receivable will be uncollectible.

The adjusting journal entry for doubtful accounts will include:

A) Debit Bad Debts Expense $978,000

B) Credit Allowance for Doubtful Accounts, $108,000

C) Debit Bad Debts Expense $120,000

D) Credit Allowance for Doubtful Accounts, $96,000

The adjusting journal entry for doubtful accounts will include:

A) Debit Bad Debts Expense $978,000

B) Credit Allowance for Doubtful Accounts, $108,000

C) Debit Bad Debts Expense $120,000

D) Credit Allowance for Doubtful Accounts, $96,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

77

On January 1, 2019, the accounts receivable balance for Hades Company was $14,000 and the balance in the allowance for doubtful accounts was $1,400. On that day, a $600 doubtful account was written-off.

The net realizable value of accounts receivable immediately after the write-off is:

A) $12,600

B) $13,600

C) $13,000

D) $12,200

The net realizable value of accounts receivable immediately after the write-off is:

A) $12,600

B) $13,600

C) $13,000

D) $12,200

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2019, the accounts receivable balance for Heaven Company was $42,000 and the balance in the allowance for doubtful accounts was $4,200. On that day, a $1,800 doubtful account was written-off.

The net realizable value of accounts receivable immediately after the write-off is:

A) $37,800

B) $40,800

C) $39,000

D) $36,300

The net realizable value of accounts receivable immediately after the write-off is:

A) $37,800

B) $40,800

C) $39,000

D) $36,300

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

79

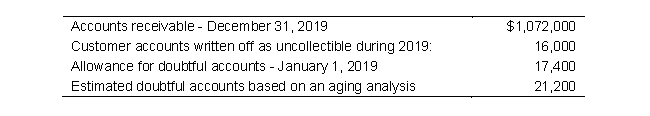

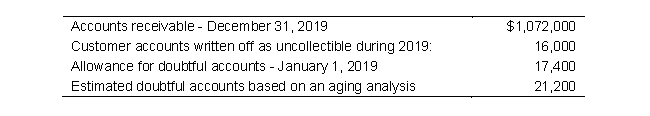

The data below is for Cronus Corporation for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

A) $16,000

B) $16,200

C) $17,400

D) $19,800

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.A) $16,000

B) $16,200

C) $17,400

D) $19,800

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

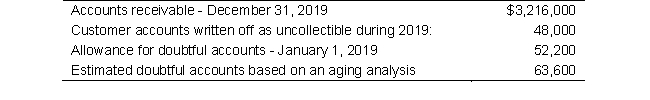

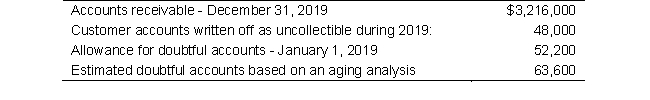

80

The data below is for Beta Corporation for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

A) $48,000

B) $48,600

C) $52,200

D) $59,400

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.

If the aging approach is used to estimate bad debts, determine the bad debt expense for 2019.A) $48,000

B) $48,600

C) $52,200

D) $59,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck