Deck 6: Accounting for Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/156

Play

Full screen (f)

Deck 6: Accounting for Inventory

1

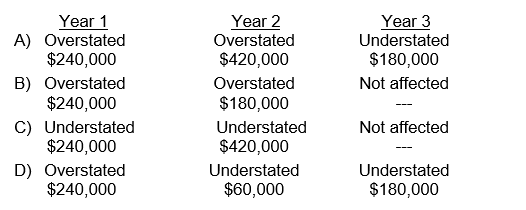

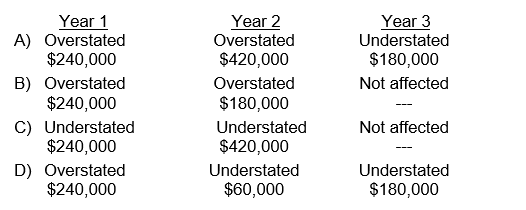

During its first and second years of operations, Lupin Company, a corporation using a periodic inventory system, made undiscovered errors in taking its year-end inventories that overstated year 1 ending inventory by $240,000 and overstated year 2 ending inventory by $180,000.

The combined effect of these errors on reported income is:

The combined effect of these errors on reported income is:

D

2

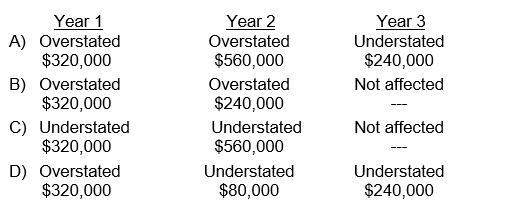

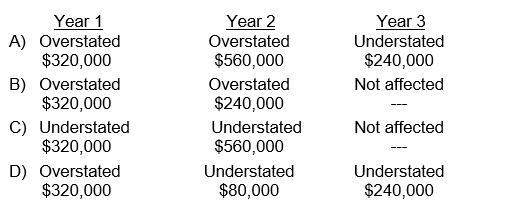

During its first and second years of operations, Clover Company, a corporation using a periodic inventory system, made undiscovered errors in taking its year-end inventories that overstated year 1 ending inventory by $320,000 and overstated year 2 ending inventory by $240,000.

The combined effect of these errors on reported income is:

The combined effect of these errors on reported income is:

D

3

The weighted-average cost method is used by Jose, Inc. Sales are $240,000, the number of units available for sale is 100, the number of units sold during the period is 75, and the weighted-average cost of the goods available for sale is $600 each.

How much is gross profit for the company?

A) $ 30,000

B) $ 45,000

C) $ 60,000

D) $195,000

How much is gross profit for the company?

A) $ 30,000

B) $ 45,000

C) $ 60,000

D) $195,000

$195,000

4

The weighted-average cost method is used by Hector, Inc. Sales are $320,000, the number of units available for sale is 100, the number of units sold during the period is 75, and the weighted-average cost of the goods available for sale is $800 each.

How much is gross profit for the company?

A) $ 40,000

B) $ 60,000

C) $ 80,000

D) $260,000

How much is gross profit for the company?

A) $ 40,000

B) $ 60,000

C) $ 80,000

D) $260,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

5

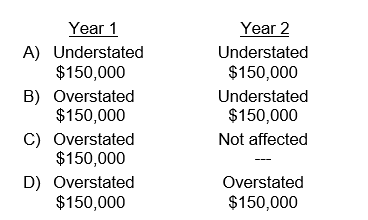

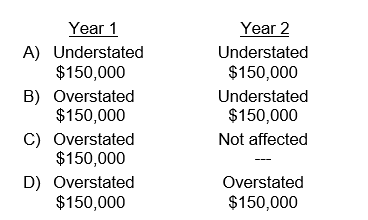

During its first year of operations, Richmond Company, using a periodic inventory system, made undiscovered errors in taking its year-end inventory that overstated Year 1 ending inventory by $150,000.

The effect of these errors on reported income is

The effect of these errors on reported income is

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

6

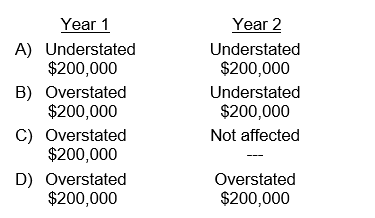

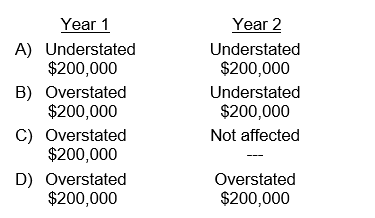

During its first year of operations, Oscar Company, using a periodic inventory system, made undiscovered errors in taking its year-end inventory that overstated Year 1 ending inventory by $200,000.

The effect of these errors on reported income is:

The effect of these errors on reported income is:

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

7

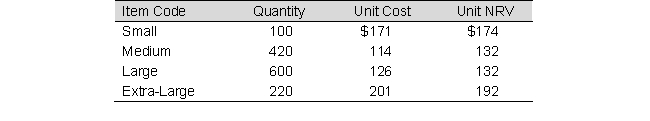

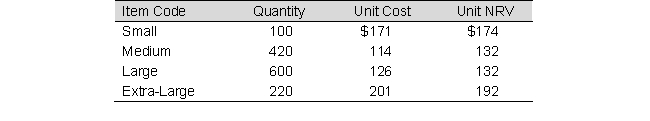

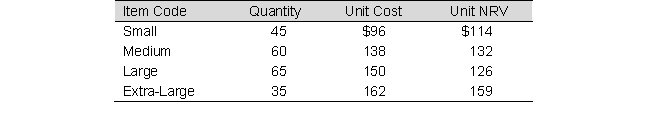

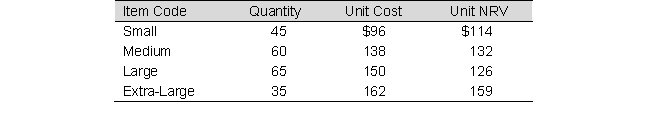

The following data refer to Coat Company's ending inventory:

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

A) $189,480

B) $182,820

C) $199,080

D) None of the above

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?A) $189,480

B) $182,820

C) $199,080

D) None of the above

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

8

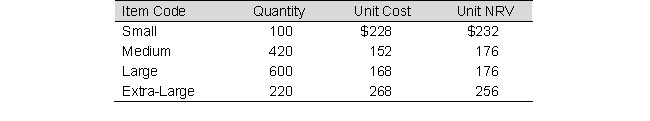

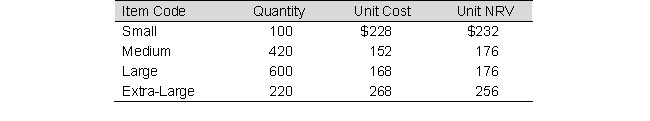

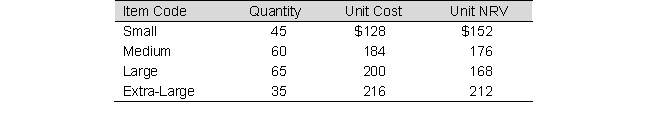

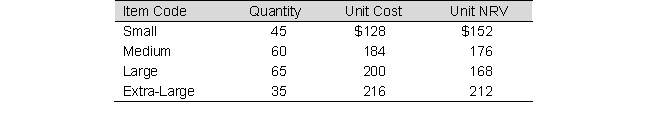

The following data refer to Lion Company's ending inventory:

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

A) $252,640

B) $243,760

C) $265,440

D) None of the above

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?

How much is the inventory if the lower-of-cost-or-net realizable value rule is applied to each item of inventory?A) $252,640

B) $243,760

C) $265,440

D) None of the above

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

9

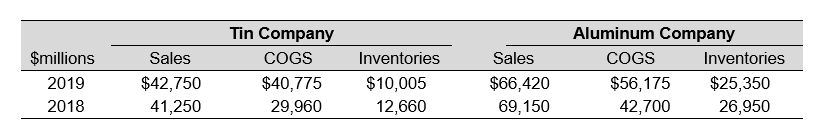

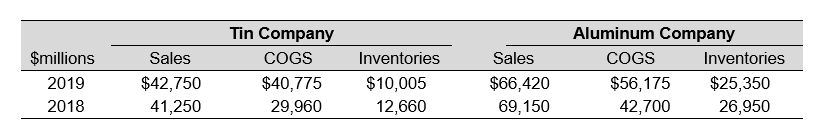

Tin Company and Aluminum Company reported the following information in their financial statements, prior to their merger:

To the closest hundredth, how much is the 2019 inventory turnover for Tin Company?

To the closest hundredth, how much is the 2019 inventory turnover for Tin Company?

A) 3.38

B) 2.82

C) 1.50

D) 3.60

To the closest hundredth, how much is the 2019 inventory turnover for Tin Company?

To the closest hundredth, how much is the 2019 inventory turnover for Tin Company?A) 3.38

B) 2.82

C) 1.50

D) 3.60

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

10

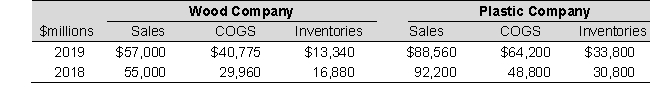

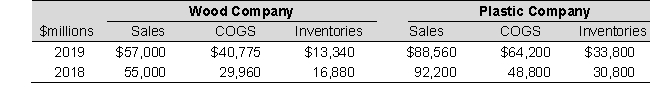

Wood Company and Plastic Company reported the following information in their financial statements, prior to their merger:

To the closest hundredth, how much is the 2019 inventory turnover for Wood Company?

To the closest hundredth, how much is the 2019 inventory turnover for Wood Company?

A) 3.06

B) 2.42

C) 1.28

D) 2.70

To the closest hundredth, how much is the 2019 inventory turnover for Wood Company?

To the closest hundredth, how much is the 2019 inventory turnover for Wood Company?A) 3.06

B) 2.42

C) 1.28

D) 2.70

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

11

The following data refer to Wards Company's ending inventory:

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

A) $26,805

B) $26,415

C) $26,436

D) $28,020

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?A) $26,805

B) $26,415

C) $26,436

D) $28,020

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

12

The following data refer to Montgomery Company's ending inventory:

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

A) $35,740

B) $35,220

C) $37,360

D) $35,256

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?

How much is ending inventory if the lower-of-cost-or-net realizable value rule is applied to the total inventory?A) $35,740

B) $35,220

C) $37,360

D) $35,256

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

13

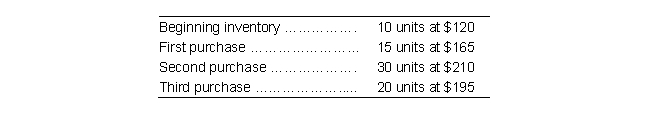

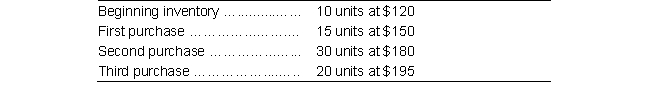

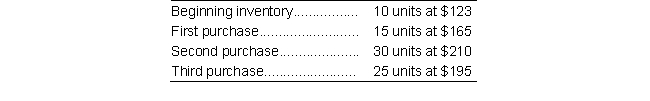

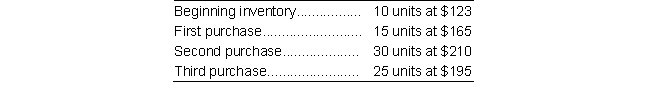

The following inventory was available for sale during the year for Dolphin Tools:

Dolphin has 25 units on hand at the end of the year.

Dolphin has 25 units on hand at the end of the year.

What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

A) $4,950

B) $8,925

C) $4,725

D) $5,850

Dolphin has 25 units on hand at the end of the year.

Dolphin has 25 units on hand at the end of the year.What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

A) $4,950

B) $8,925

C) $4,725

D) $5,850

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

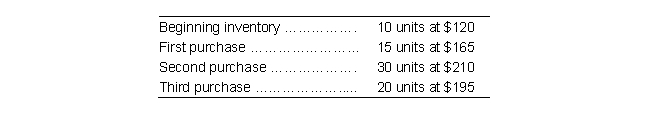

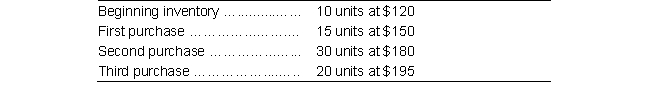

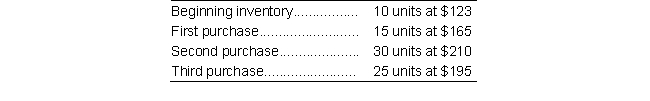

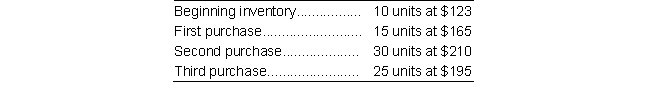

14

The following inventory was available for sale during the year for Tower Tools:

Tower Tools has 25 units on hand at the end of the year.

Tower Tools has 25 units on hand at the end of the year.

What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

A) $ 6,600

B) $11,900

C) $ 6,300

D) $ 7,800

Tower Tools has 25 units on hand at the end of the year.

Tower Tools has 25 units on hand at the end of the year.What is the dollar amount of inventory at the end of the year according to the first-in, first-out method?

A) $ 6,600

B) $11,900

C) $ 6,300

D) $ 7,800

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

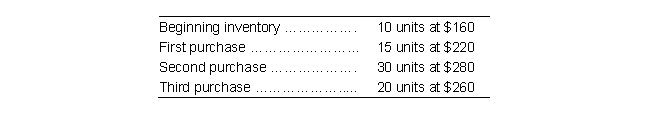

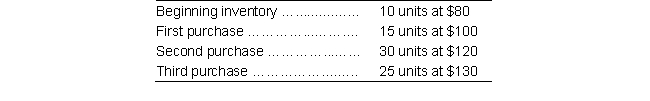

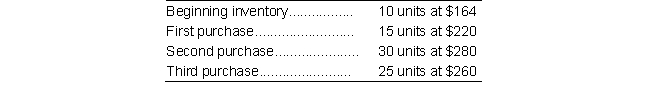

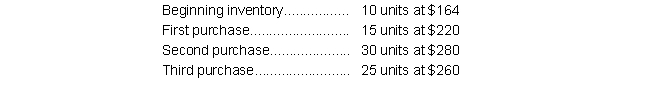

15

The following hammers were available for sale during the year for Helen Tools:

Helen has 25 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

Helen has 25 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

A) $5,925

B) $7,950

C) $4,725

D) $5,850

Helen has 25 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

Helen has 25 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?A) $5,925

B) $7,950

C) $4,725

D) $5,850

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

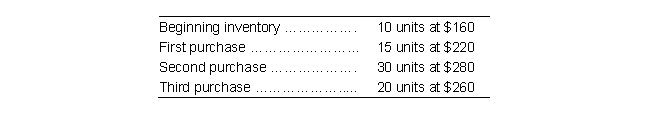

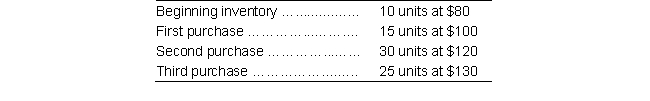

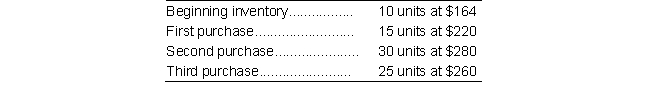

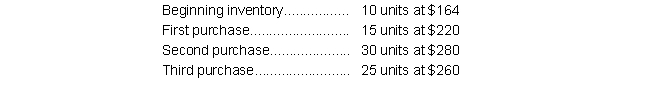

16

The following hammers were available for sale during the year for Albert's Tools:

Albert has 30 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

Albert has 30 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

A) $7,900

B) $5,300

C) $3,850

D) $7,800

Albert has 30 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?

Albert has 30 hammers on hand at the end of the year. What is the dollar amount of cost of goods sold for the year according to the first-in, first-out method?A) $7,900

B) $5,300

C) $3,850

D) $7,800

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

17

If inventory at the end of the year is understated by $105,000, what will this error cause?

A) An understatement of net income for the year by $105,000

B) An overstatement of gross profit for the year by $105,000

C) An overstatement of inventory for the year by $105,000

D) An understatement of cost of goods sold for the year by $105,000

A) An understatement of net income for the year by $105,000

B) An overstatement of gross profit for the year by $105,000

C) An overstatement of inventory for the year by $105,000

D) An understatement of cost of goods sold for the year by $105,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following information to answer:

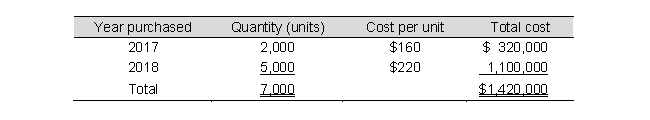

Timber Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Timber Company uses the LIFO inventory method. On January 1, 2019, Timber Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

-Assume that Timber Company makes no further purchases during 2019. Compute Timber Company's gross profit for 2019.

A) $ 321,800

B) $3,109,800

C) $3,741,000

D) $1,456,200

Timber Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Timber Company uses the LIFO inventory method. On January 1, 2019, Timber Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system-Assume that Timber Company makes no further purchases during 2019. Compute Timber Company's gross profit for 2019.

A) $ 321,800

B) $3,109,800

C) $3,741,000

D) $1,456,200

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information to answer:

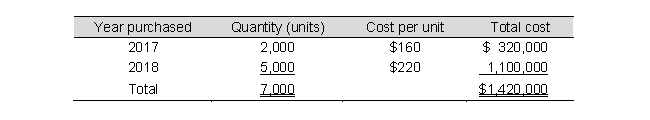

Timber Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Timber Company uses the LIFO inventory method. On January 1, 2019, Timber Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

-Assume that Timber Company purchases 11,400 more of the $240 units on December 31, 2019. Compute Timber Company's gross profit for 2019.

A) $2,736,000

B) $ 937,200

C) $3,109,800

D) $1,285,800

Timber Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Timber Company uses the LIFO inventory method. On January 1, 2019, Timber Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $240 per unit. Timber sold 14,200 units during 2019 at a price of $306 per unit, which significantly depleted its inventory. Timber Company uses a periodic inventory system-Assume that Timber Company purchases 11,400 more of the $240 units on December 31, 2019. Compute Timber Company's gross profit for 2019.

A) $2,736,000

B) $ 937,200

C) $3,109,800

D) $1,285,800

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer:

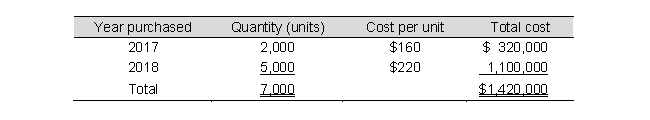

Northern Creations Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Northern Creations Company uses the LIFO inventory method. On January 1, 2019, Northern Creations Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

-Assume that Northern Creations Company makes no further purchases during 2019. Compute Nature Creations Company's gross profit for 2019.

A) $1,762,400

B) $4,146,400

C) $4,988,000

D) $1,941,600

Northern Creations Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Northern Creations Company uses the LIFO inventory method. On January 1, 2019, Northern Creations Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system-Assume that Northern Creations Company makes no further purchases during 2019. Compute Nature Creations Company's gross profit for 2019.

A) $1,762,400

B) $4,146,400

C) $4,988,000

D) $1,941,600

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

21

Use the following information to answer:

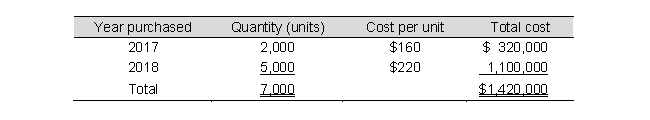

Northern Creations Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Northern Creations Company uses the LIFO inventory method. On January 1, 2019, Northern Creations Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

-Assume that Northern Creations Company purchases 11,400 more of the $320 units on December 31, 2019. Compute Northern Creations Company's gross profit for 2019.

A) $3,648,000

B) $1,249,600

C) $4,146,400

D) $1,714,400

Northern Creations Company imports and sells a product produced in Canada. In the summer of 2019, a natural disaster disrupted production, affecting its supply of product. Northern Creations Company uses the LIFO inventory method. On January 1, 2019, Northern Creations Company's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system

Through mid-December of 2019, purchases were limited to 8,000 units, because the cost had increased to $320 per unit. Northern Creations sold 14,200 units during 2019 at a price of $408 per unit, which significantly depleted its inventory. Northern Creations uses a periodic inventory system-Assume that Northern Creations Company purchases 11,400 more of the $320 units on December 31, 2019. Compute Northern Creations Company's gross profit for 2019.

A) $3,648,000

B) $1,249,600

C) $4,146,400

D) $1,714,400

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

22

The following amounts and costs of platters were available for sale by Cataling Ceramics during 2019:

Cataling Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?

Cataling Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?

A) $14,880

B) $ 9,300

C) $ 5,198

D) $ 6,510

Cataling Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?

Cataling Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year. What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?A) $14,880

B) $ 9,300

C) $ 5,198

D) $ 6,510

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

23

The following amounts and costs of platters were available for sale by Cibula Ceramics during 2019:

Cibula Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Cibula Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?

A) $19,840

B) $12,400

C) $ 6,930

D) $ 8,680

Cibula Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Cibula Ceramics, which uses a periodic inventory system, has 35 platters on hand at the end of the year.What is the dollar amount of inventory at the end of the year according to the weighted-average cost method?

A) $19,840

B) $12,400

C) $ 6,930

D) $ 8,680

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

24

The following amounts and costs of platters were available for sale by Southwest Pottery during 2019:

Southwest Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Southwest Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method?

A) $14,880

B) $ 5,580

C) $ 8,370

D) $ 5,198

Southwest Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Southwest Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method?

A) $14,880

B) $ 5,580

C) $ 8,370

D) $ 5,198

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

25

The following amounts and costs of platters were available for sale by Colorado Pottery during 2019:

Colorado Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Colorado Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method?

A) $19,840

B) $ 7,440

C) $11,160

D) $ 6,930

Colorado Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.

Colorado Pottery, which uses a periodic inventory system, has 35 platters on hand at the end of the year.How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method?

A) $19,840

B) $ 7,440

C) $11,160

D) $ 6,930

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following information to answer:

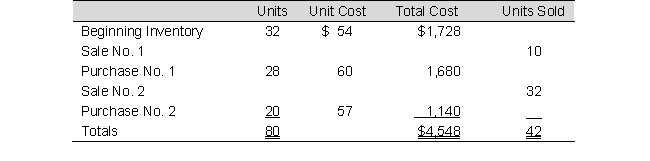

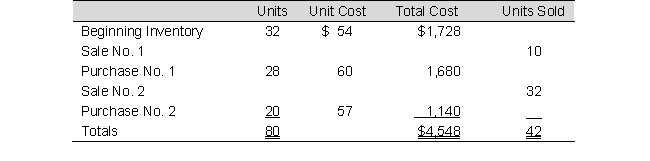

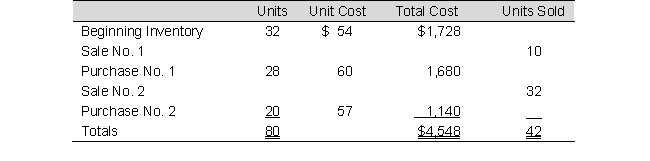

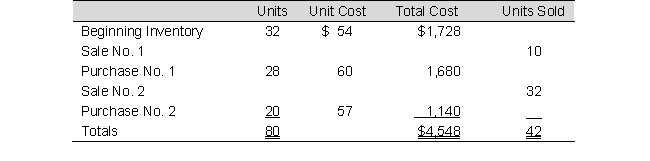

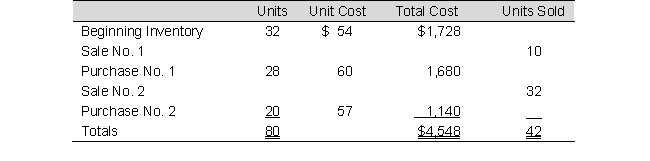

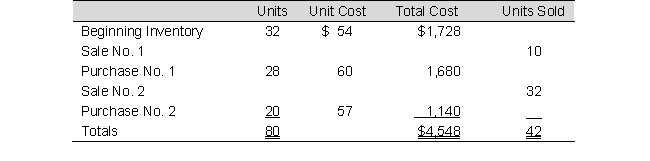

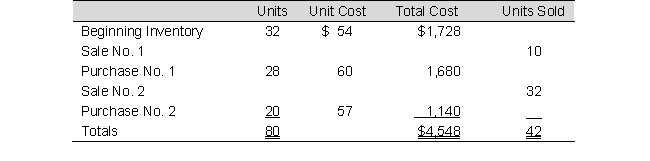

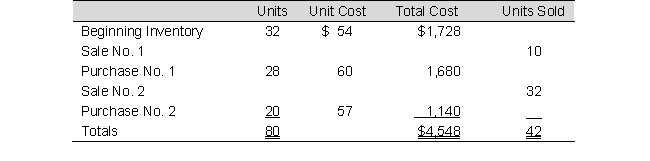

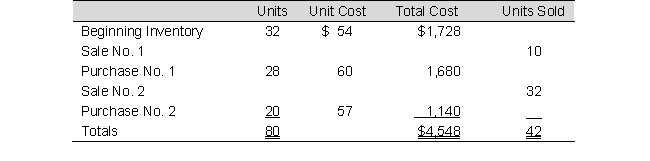

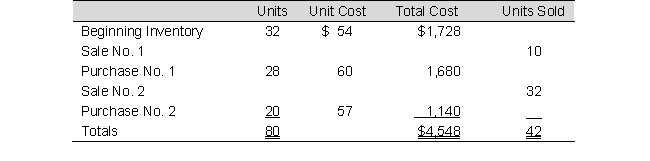

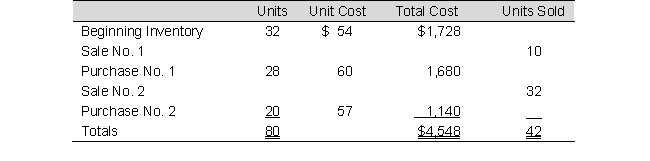

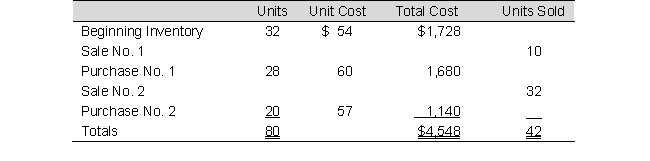

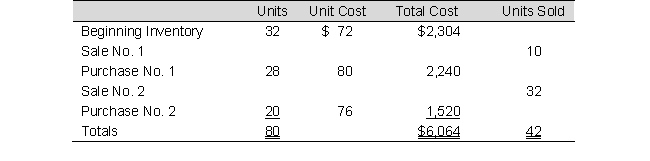

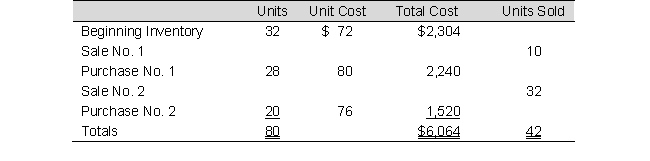

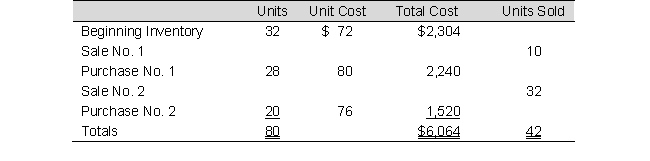

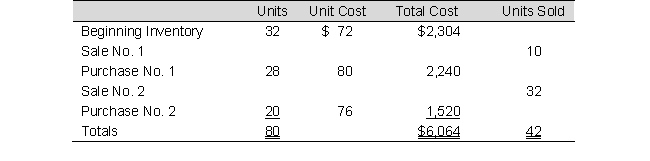

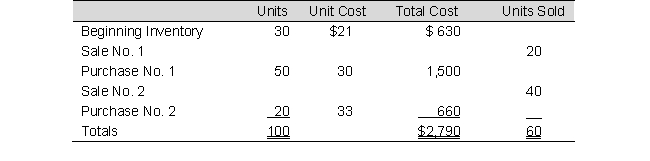

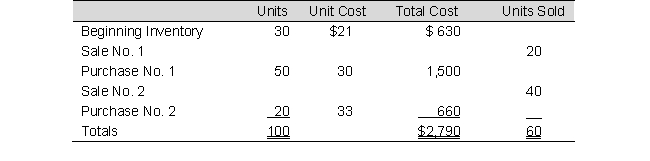

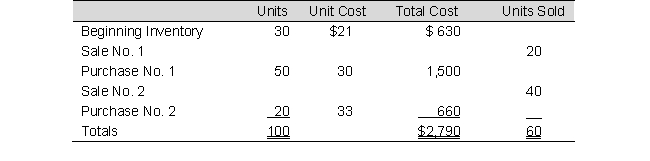

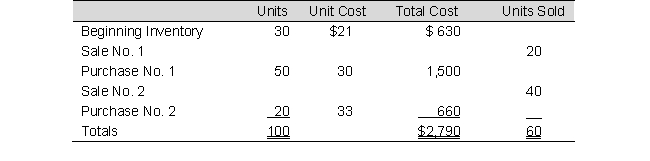

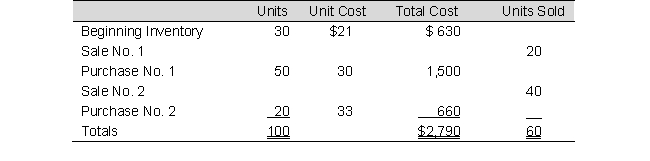

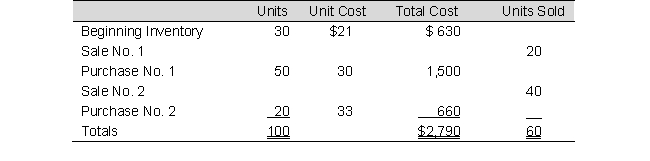

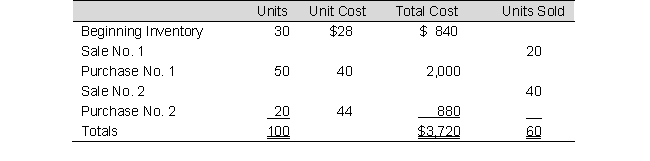

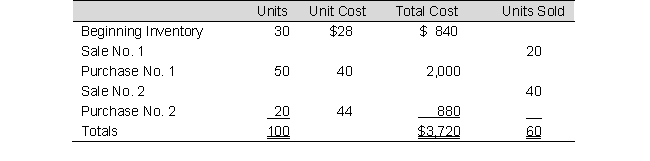

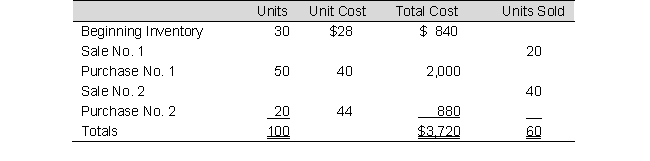

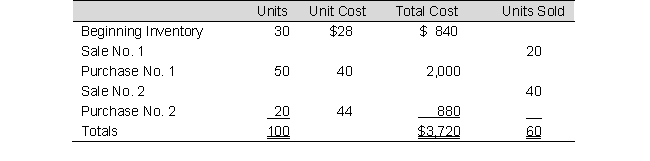

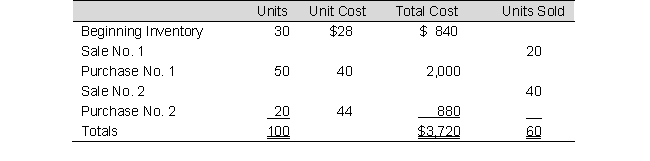

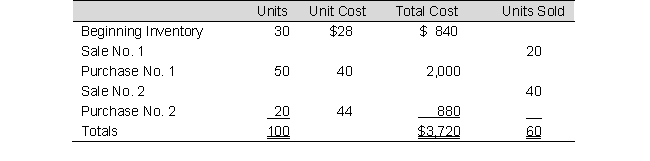

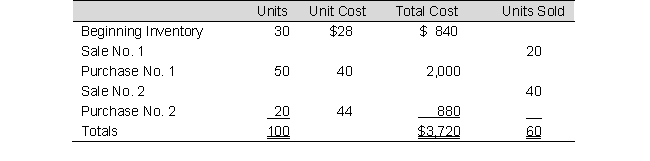

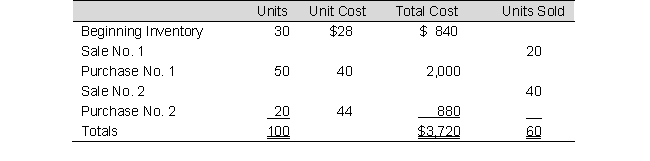

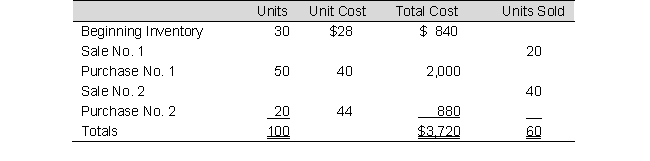

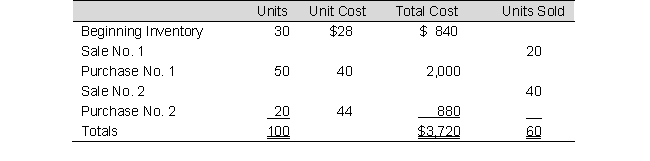

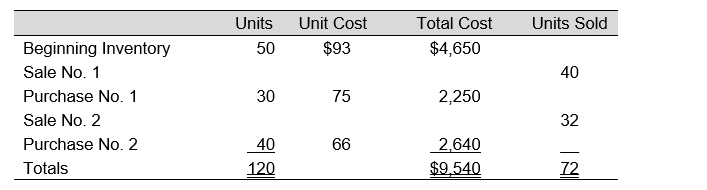

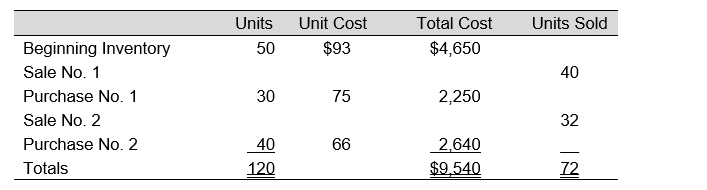

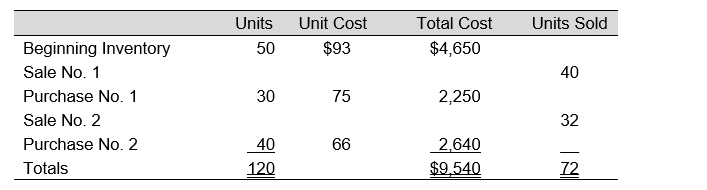

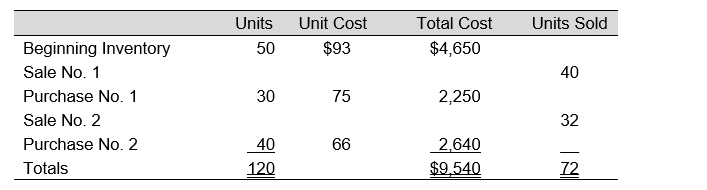

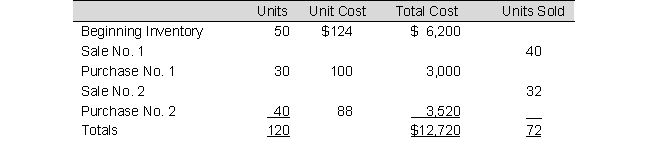

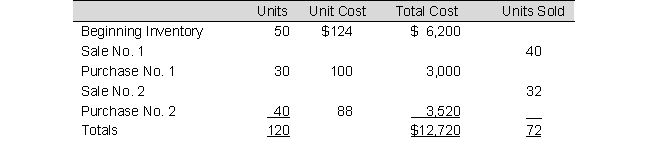

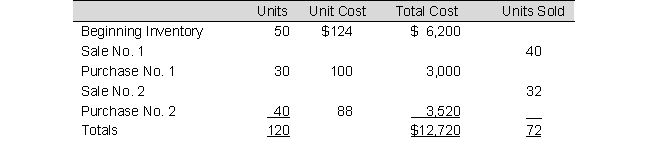

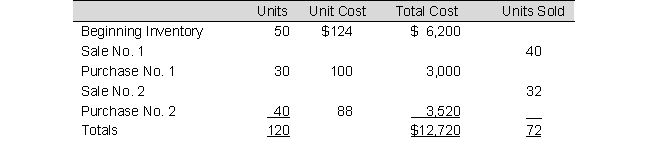

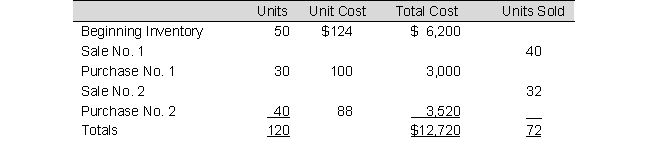

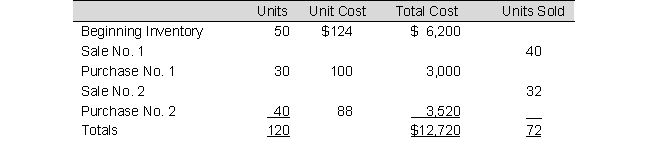

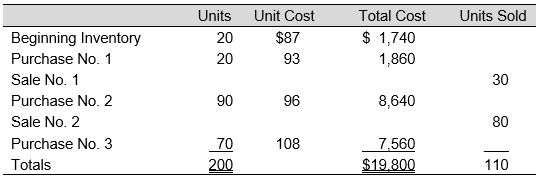

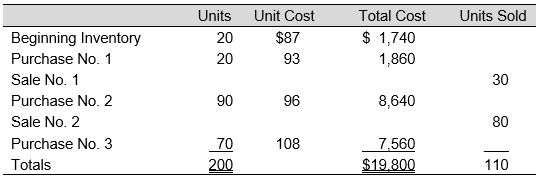

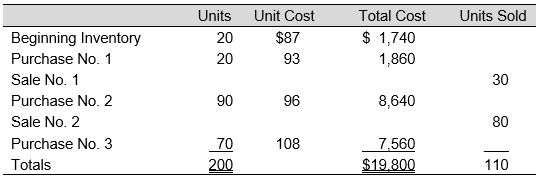

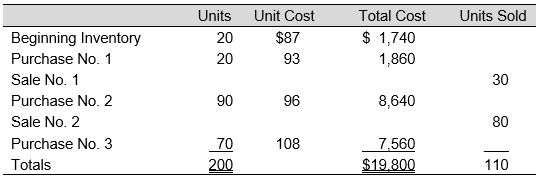

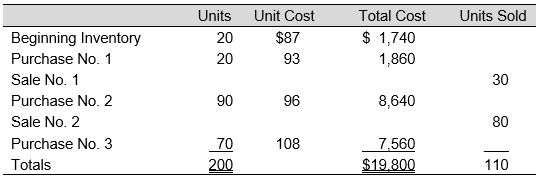

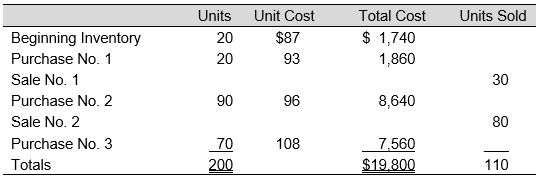

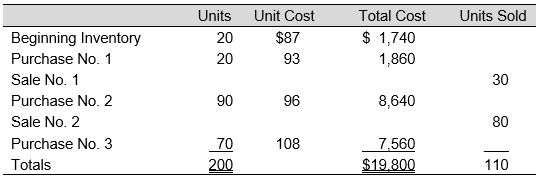

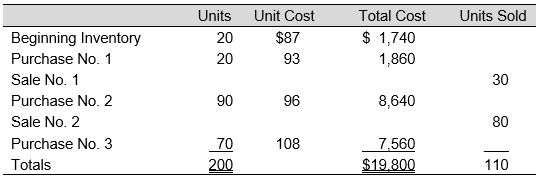

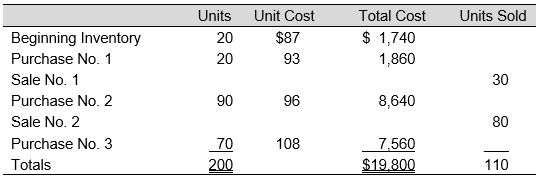

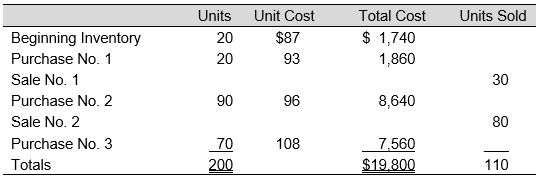

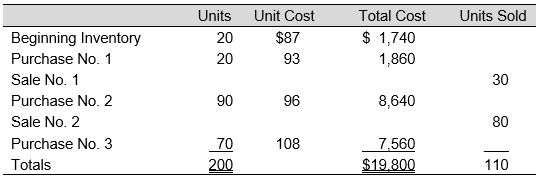

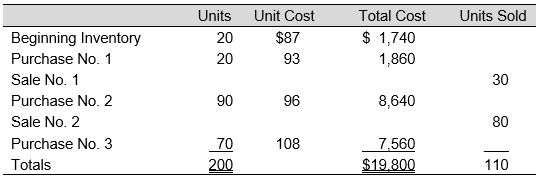

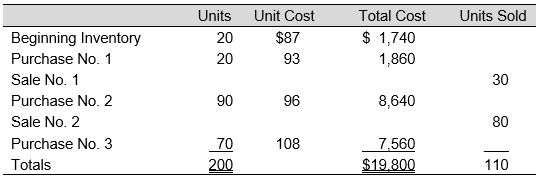

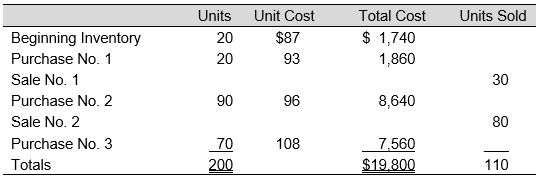

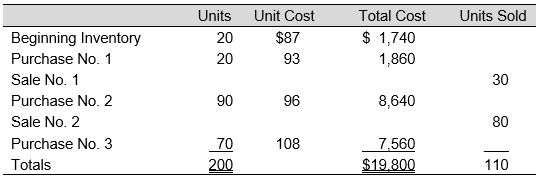

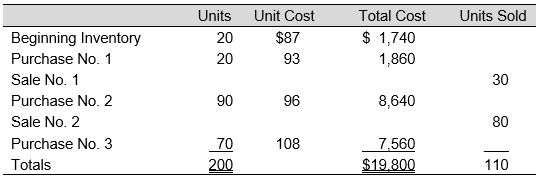

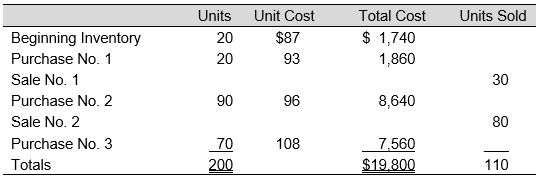

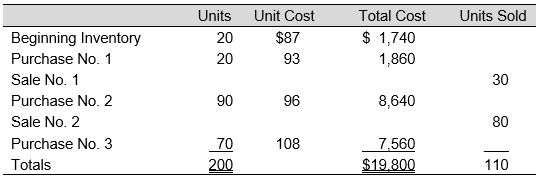

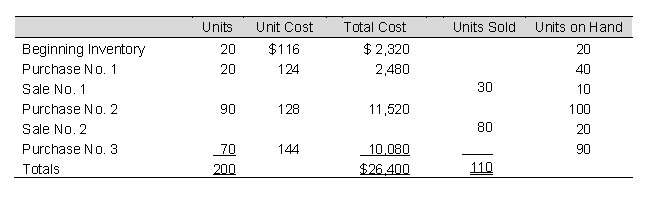

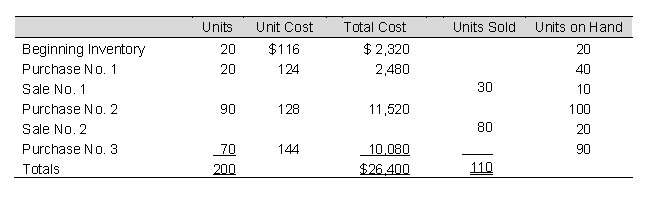

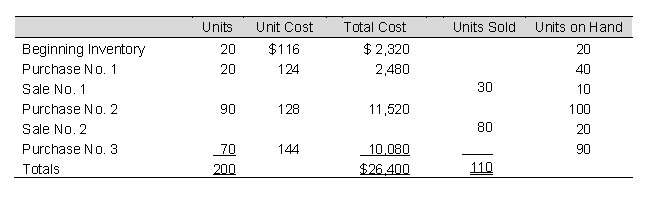

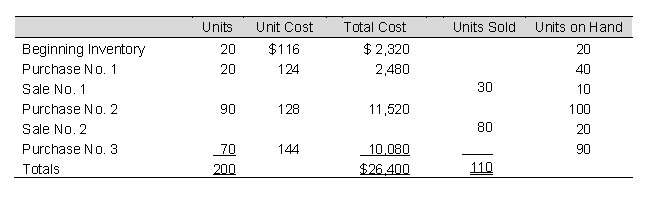

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $2,052

B) $2,088

C) $2,166

D) $2,220

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $2,052

B) $2,088

C) $2,166

D) $2,220

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

27

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $1,989

B) $2,088

C) $2,166

D) $2,220

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $1,989

B) $2,088

C) $2,166

D) $2,220

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

28

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $2,160.30

B) $2,163.00

C) $2,166.00

D) $2,392.20

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $2,160.30

B) $2,163.00

C) $2,166.00

D) $2,392.20

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses the FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,728

B) $1,788

C) $1,860

D) $1,896

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses the FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,728

B) $1,788

C) $1,860

D) $1,896

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses the LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,728

B) $1,788

C) $1,860

D) $1,896

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses the LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,728

B) $1,788

C) $1,860

D) $1,896

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods sold for:

A) $1,817.61

B) $1,824.00

C) $1,835.52

D) $1,819.20

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Quebec, Inc. for an operating period.

-Assuming Quebec, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods sold for:

A) $1,817.61

B) $1,824.00

C) $1,835.52

D) $1,819.20

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information to answer:

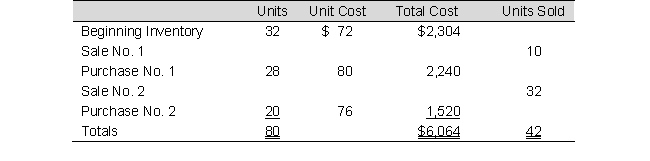

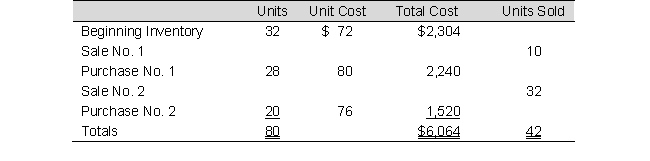

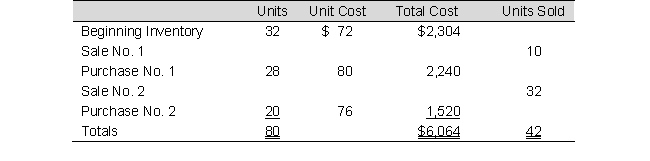

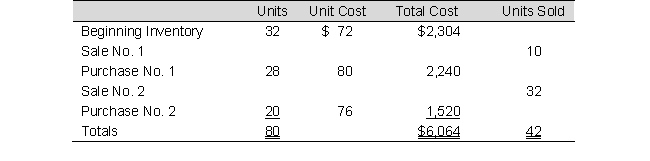

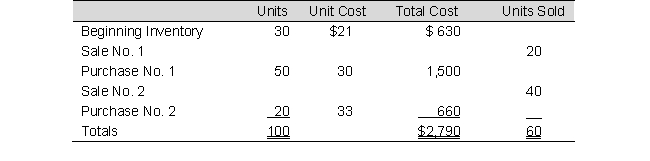

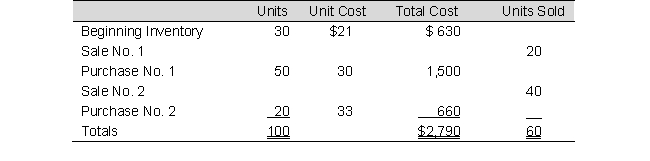

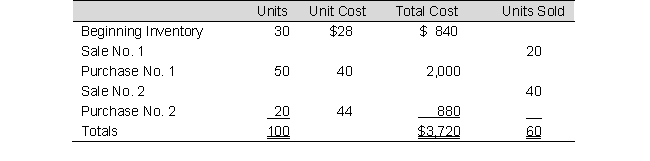

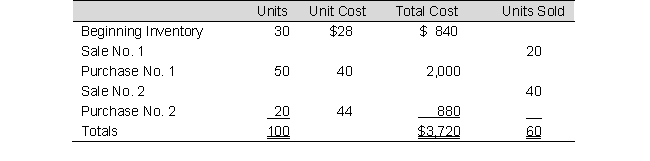

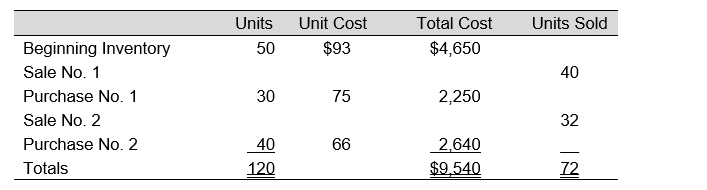

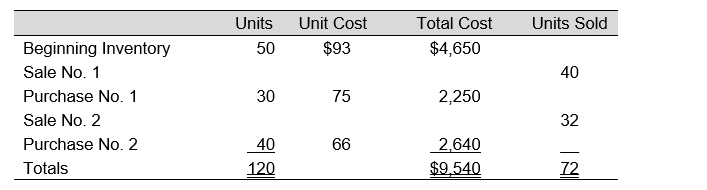

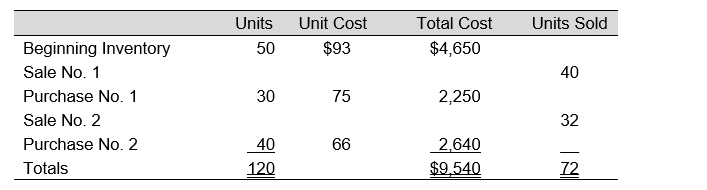

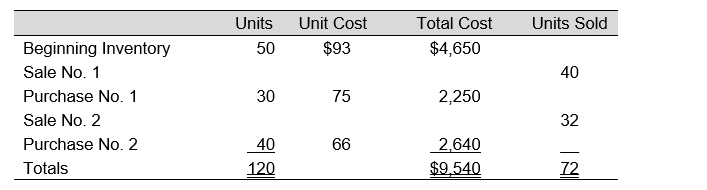

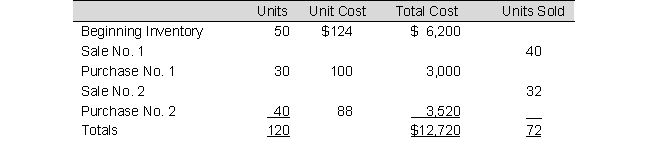

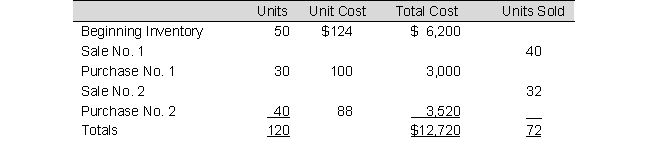

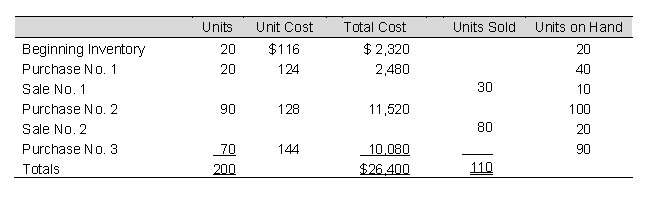

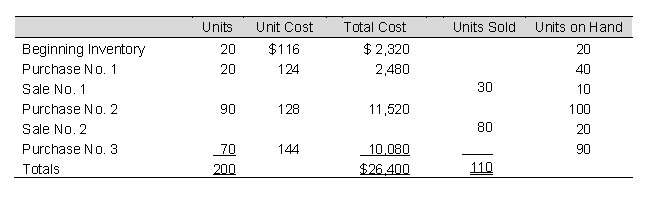

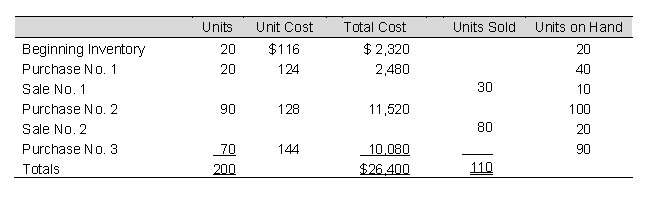

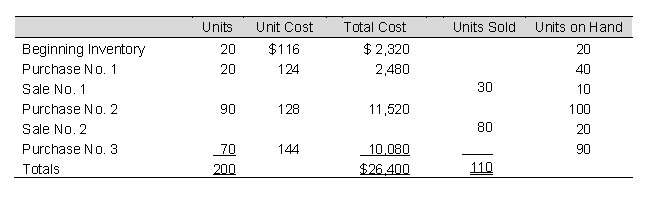

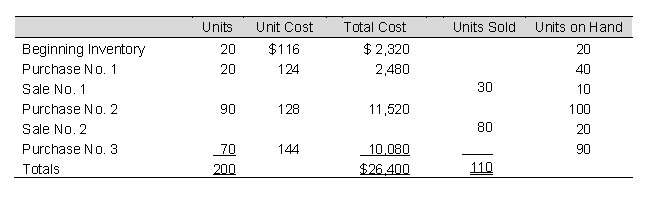

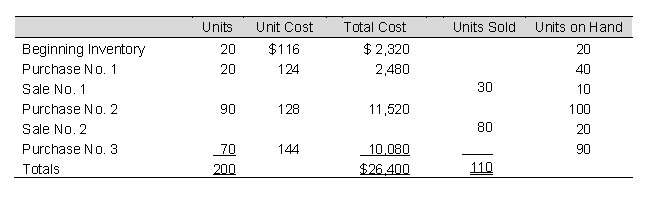

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $2,736

B) $2,784

C) $2,888

D) $2,960

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $2,736

B) $2,784

C) $2,888

D) $2,960

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $2,632

B) $2,784

C) $2,888

D) $2,360

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $2,632

B) $2,784

C) $2,888

D) $2,360

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $2,880.40

B) $2,884.00

C) $2,888.00

D) $3,189.60

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $2,880.40

B) $2,884.00

C) $2,888.00

D) $3,189.60

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses the FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $2,304

B) $2,384

C) $2,408

D) $2,528

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses the FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $2,304

B) $2,384

C) $2,408

D) $2,528

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses the LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $2,304

B) $2,384

C) $2,480

D) $2,528

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses the LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $2,304

B) $2,384

C) $2,480

D) $2,528

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods sold for:

A) $2,423.48

B) $2,432.00

C) $2,447.36

D) $2,425.60

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Sox, Inc. for an operating period.

-Assuming Sox, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods sold for:

A) $2,423.48

B) $2,432.00

C) $2,447.36

D) $2,425.60

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer:

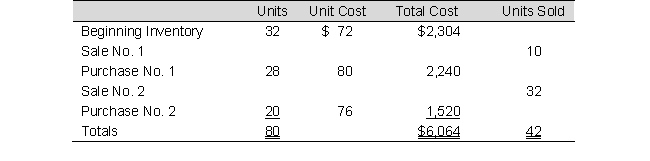

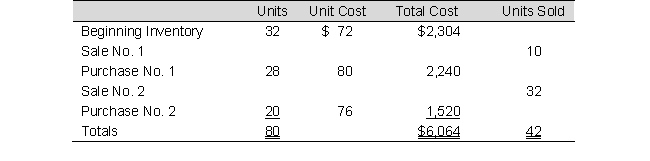

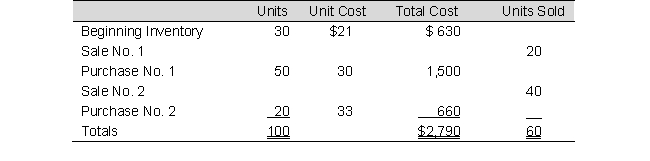

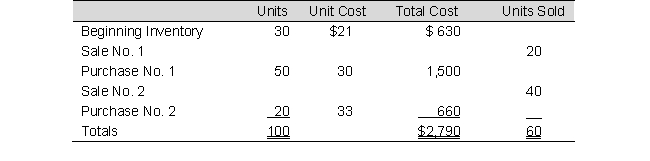

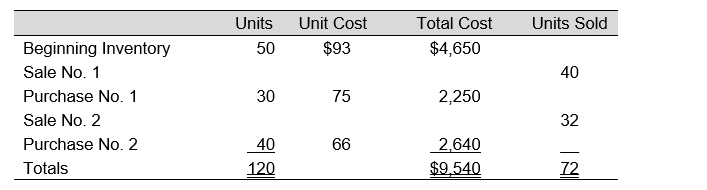

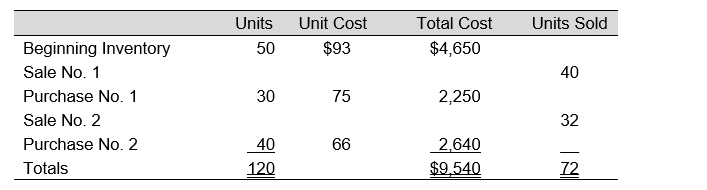

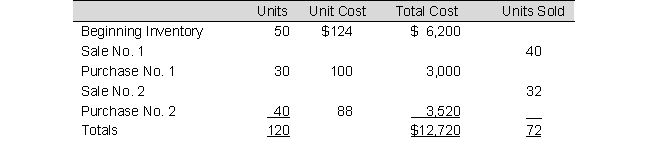

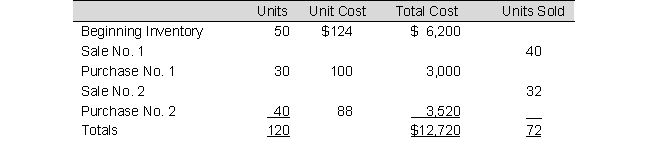

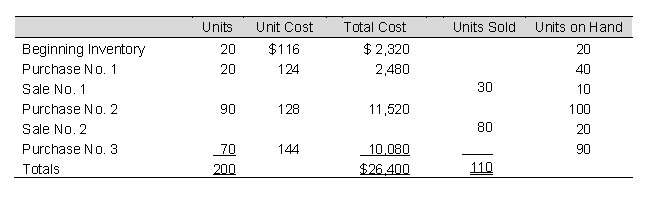

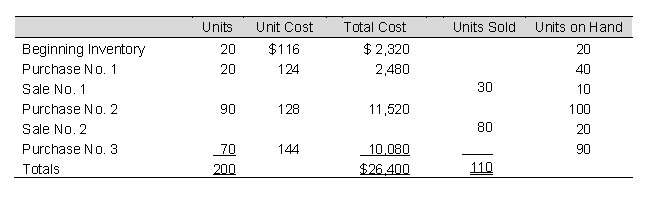

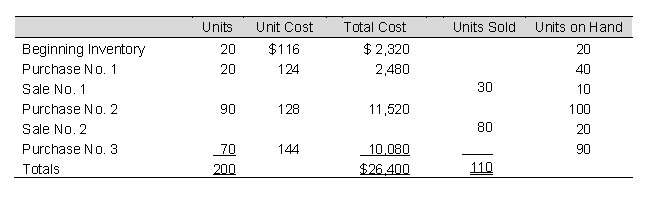

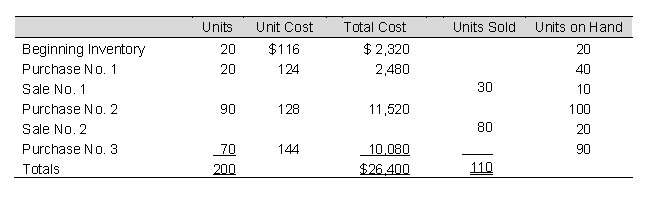

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $1,260

B) $1,320

C) $ 840

D) $ 930

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $1,260

B) $1,320

C) $ 840

D) $ 930

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $ 840

B) $1,260

C) $ 930

D) $1,320

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $ 840

B) $1,260

C) $ 930

D) $1,320

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $1,110

B) $1,116

C) $1,650

D) $1,140

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $1,110

B) $1,116

C) $1,650

D) $1,140

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,110

B) $1,200

C) $ 840

D) $1,260

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,110

B) $1,200

C) $ 840

D) $1,260

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $840

B) $1,200

C) $1,110

D) $1,320

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $840

B) $1,200

C) $1,110

D) $1,320

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,140

B) $1,116

C) $1,020

D) $1,065

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Ilse's Garden, Inc., for an operating period.

-Assuming Ilse's Garden, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,140

B) $1,116

C) $1,020

D) $1,065

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information to answer:

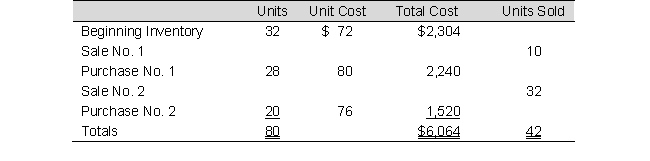

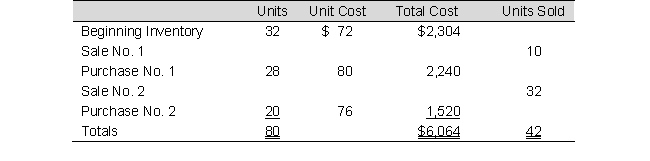

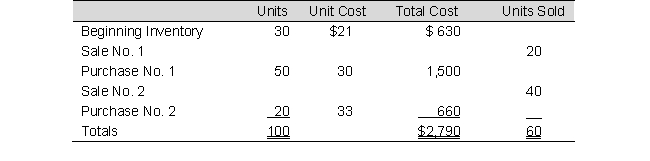

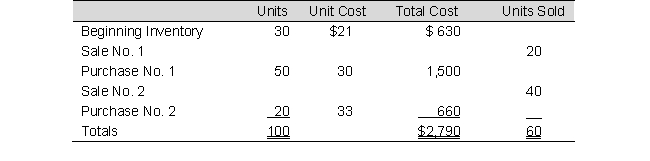

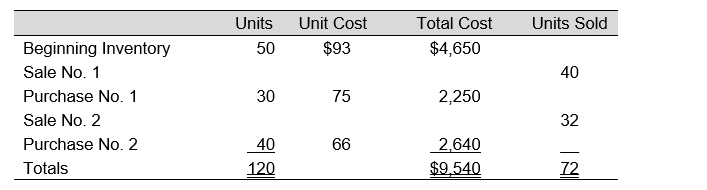

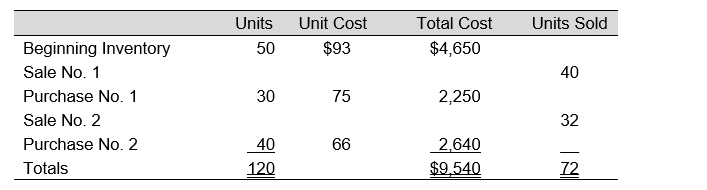

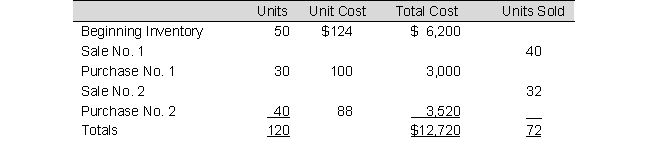

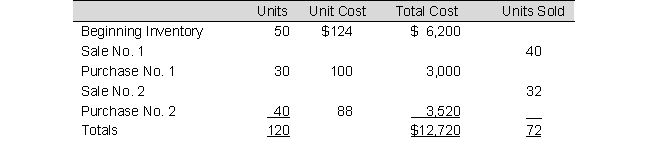

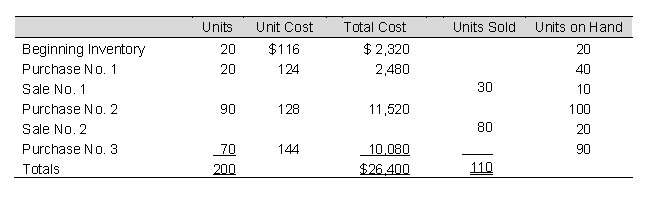

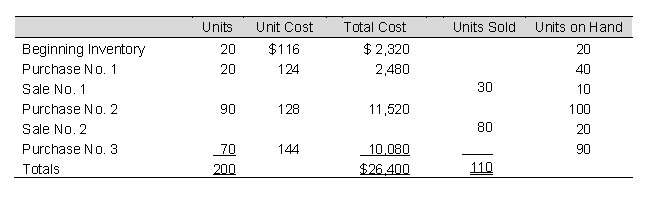

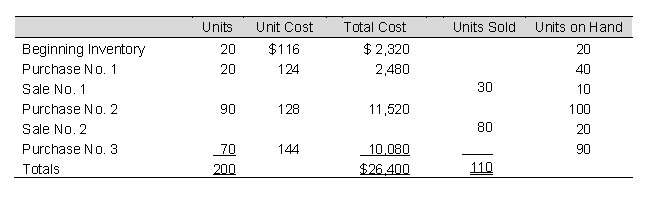

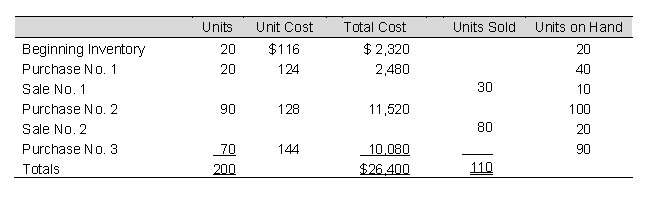

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $1,680

B) $1,760

C) $1,120

D) $1,240

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $1,680

B) $1,760

C) $1,120

D) $1,240

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $1,120

B) $1,680

C) $1,240

D) $1,760

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $1,120

B) $1,680

C) $1,240

D) $1,760

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $1,474

B) $1,488

C) $2,200

D) $1,520

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $1,474

B) $1,488

C) $2,200

D) $1,520

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,480

B) $1,600

C) $1,120

D) $1,680

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses FIFO perpetual inventory procedures, it records sale No. 2 as an entry to Cost of Goods Sold for:

A) $1,480

B) $1,600

C) $1,120

D) $1,680

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,120

B) $1,600

C) $1,480

D) $1,760

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,120

B) $1,600

C) $1,480

D) $1,760

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,520

B) $1,488

C) $1,360

D) $1,420

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Delacour, Inc. for an operating period.

-Assuming Delacour, Inc. uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $1,520

B) $1,488

C) $1,360

D) $1,420

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

50

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $3,240

B) $4,464

C) $3,168

D) $3,600

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $3,240

B) $4,464

C) $3,168

D) $3,600

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $3,168

B) $3,240

C) $3,816

D) $4,464

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $3,168

B) $3,240

C) $3,816

D) $4,464

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

52

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $3,276

B) $3,744

C) $3,816

D) $3,240

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $3,276

B) $3,744

C) $3,816

D) $3,240

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses FIFO perpetual inventory procedures, the ending inventory cost is:

A) $4,464

B) $3,240

C) $3,600

D) $3,168

E) None of the above

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses FIFO perpetual inventory procedures, the ending inventory cost is:

A) $4,464

B) $3,240

C) $3,600

D) $3,168

E) None of the above

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses LIFO perpetual inventory procedures, the ending inventory cost is:

A) $3,168

B) $3,240

C) $4,464

D) $3,384

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses LIFO perpetual inventory procedures, the ending inventory cost is:

A) $3,168

B) $3,240

C) $4,464

D) $3,384

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses weighted-average (perpetual) inventory procedures, the ending inventory cost is:

A) $3,744

B) $3,186

C) $3,384

D) $3,276

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Woof, Inc. for an operating period.

-Assuming Woof, Inc. uses weighted-average (perpetual) inventory procedures, the ending inventory cost is:

A) $3,744

B) $3,186

C) $3,384

D) $3,276

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $4,320

B) $5,952

C) $4,114

D) $4,800

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $4,320

B) $5,952

C) $4,114

D) $4,800

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $4,224

B) $4,320

C) $5,088

D) $5,952

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $4,224

B) $4,320

C) $5,088

D) $5,952

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $4,368

B) $4,992

C) $5,088

D) $4,320

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $4,368

B) $4,992

C) $5,088

D) $4,320

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses FIFO perpetual inventory procedures, the ending inventory cost is:

A) $5,952

B) $4,320

C) $4,800

D) $4,224

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses FIFO perpetual inventory procedures, the ending inventory cost is:

A) $5,952

B) $4,320

C) $4,800

D) $4,224

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses LIFO perpetual inventory procedures, the ending inventory cost is:

A) $4,224

B) $4,320

C) $5,952

D) $4,512

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses LIFO perpetual inventory procedures, the ending inventory cost is:

A) $4,224

B) $4,320

C) $5,952

D) $4,512

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information to answer:

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses weighted-average (perpetual) inventory procedures, the ending inventory cost is:

A) $4,992

B) $5,088

C) $4,512

D) $4,368

The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Purr-A-Lot, Inc. for an operating period.

-Assuming Purr-A-Lot, Inc. uses weighted-average (perpetual) inventory procedures, the ending inventory cost is:

A) $4,992

B) $5,088

C) $4,512

D) $4,368

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $9,720

B) $8,400

C) $9,480

D) $7,560

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $9,720

B) $8,400

C) $9,480

D) $7,560

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $7,380

B) $9,480

C) $9,390

D) $8,400

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $7,380

B) $9,480

C) $9,390

D) $8,400

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $ 8,910

B) $ 8,640

C) $ 9,468

D) $10,890

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $ 8,910

B) $ 8,640

C) $ 9,468

D) $10,890

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,700

B) $2,730

C) $2,670

D) $2,880

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,700

B) $2,730

C) $2,670

D) $2,880

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $7,632

B) $7,650

C) $7,680

D) $7,920

E) None of the above

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses FIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $7,632

B) $7,650

C) $7,680

D) $7,920

E) None of the above

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,730

B) $2,700

C) $2,670

D) $3,240

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,730

B) $2,700

C) $2,670

D) $3,240

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $8,640

B) $7,680

C) $7,650

D) $7,632

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $8,640

B) $7,680

C) $7,650

D) $7,632

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (perpetual) inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,790

B) $2,730

C) $2,700

D) $2,670

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (perpetual) inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $2,790

B) $2,730

C) $2,700

D) $2,670

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $7,632

B) $7,650

C) $7,680

D) $7,920

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Mullenax Company for an operating period.

-Assuming Mullenax Company uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $7,632

B) $7,650

C) $7,680

D) $7,920

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $12,960

B) $12,000

C) $12,640

D) $10,080

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO periodic inventory procedures, the ending inventory cost is:

A) $12,960

B) $12,000

C) $12,640

D) $10,080

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $10,440

B) $12,640

C) $12,520

D) $11,200

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO periodic inventory procedures, the ending inventory cost is:

A) $10,440

B) $12,640

C) $12,520

D) $11,200

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $11,880

B) $11,520

C) $12,624

D) $14,520

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (periodic) inventory procedures, the ending inventory cost is:

A) $11,880

B) $11,520

C) $12,624

D) $14,520

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

74

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,600

B) $3,640

C) $3,560

D) $3,840

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,600

B) $3,640

C) $3,560

D) $3,840

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $10,176

B) $10,200

C) $10,240

D) $10,560

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses FIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $10,176

B) $10,200

C) $10,240

D) $10,560

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,640

B) $3,600

C) $3,560

D) $4,320

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO perpetual inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,640

B) $3,600

C) $3,560

D) $4,320

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $11,520

B) $10,240

C) $10,200

D) $10,176

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses LIFO perpetual inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $11,520

B) $10,240

C) $10,200

D) $10,176

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (perpetual) inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,960

B) $3,640

C) $3,600

D) $3,560

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (perpetual) inventory procedures, sale No. 1 is recorded as an entry to Cost of Goods Sold for:

A) $3,960

B) $3,640

C) $3,600

D) $3,560

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following information to answer:

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $10,176

B) $10,200

C) $10,240

D) $10,560

The following data represent the beginning inventory and, in the order of occurrence, the purchases and sales of Tina Star Company for an operating period.

-Assuming Tina Star Company uses weighted-average (perpetual) inventory procedures, sale No. 2 is recorded as an entry to Cost of Goods Sold for:

A) $10,176

B) $10,200

C) $10,240

D) $10,560

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

80

At year-end, The Big Chill Shop has a freezer on hand that has been used as a demonstration model. The freezer cost $1,170 and sells for $2,250 when new. In its present condition, the freezer will be sold for $1,140.

Related selling costs are an estimated $60. At what amount should the freezer be carried in inventory?

A) $1,125

B) $1,140

C) $1,080

D) $1,200

Related selling costs are an estimated $60. At what amount should the freezer be carried in inventory?

A) $1,125

B) $1,140

C) $1,080

D) $1,200

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck