Deck 5: Accounting for Merchandising Operations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 5: Accounting for Merchandising Operations

1

If a firm using the periodic inventory system sells merchandise for $320,000 that originally cost $160,000, the firm will debit Sales Revenue for $320,000.

False

2

In specifying credit terms, 2/10, n/30 means that one-half of the invoice must be paid in 10 days, with the net balance due in 30 days.

False

3

The Purchases account normally has a debit balance.

True

4

All merchandise purchased for resale by a firm is initially recorded in the Purchases account when the firm uses the periodic inventory system.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

If merchandise is shipped F.O.B. destination, the seller ultimately bears the expense of transporting it.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not true for a retailer using perpetual inventory system?

A) When merchandise is purchased FOB shipping point, the buyer assumes the risk of any damage in transit.

B) After a physical inventory count, the retailer credits the Inventory account for any missing inventory.

C) When the retailer returns defective merchandise to the manufacturer, they credit Purchase Returns.

D) The Cost of Goods Sold account is closed at the end of the year with a debit to Income Summary.

A) When merchandise is purchased FOB shipping point, the buyer assumes the risk of any damage in transit.

B) After a physical inventory count, the retailer credits the Inventory account for any missing inventory.

C) When the retailer returns defective merchandise to the manufacturer, they credit Purchase Returns.

D) The Cost of Goods Sold account is closed at the end of the year with a debit to Income Summary.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Dells Company uses the periodic inventory system. Sales for 2019 were $1,410,000 while operating expenses were $525,000. Beginning and ending inventories for 2019 were $210,000 and $180,000, respectively. Net purchases were $540,000 while freight in was $45,000.

The net income or loss for 2019 was:

A) $270,000 net income

B) $ 90,000 net income

C) $ 30,000 net income

D) $ 90,000 net loss

The net income or loss for 2019 was:

A) $270,000 net income

B) $ 90,000 net income

C) $ 30,000 net income

D) $ 90,000 net loss

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

Illinois Company uses the periodic inventory system. Sales for 2019 were $1,880,000 while operating expenses were $700,000. Beginning and ending inventories for 2019 were $280,000 and $240,000, respectively. Net purchases were $720,000 while freight in was $60,000.

The net income or loss for 2019 was:

A) $360,000 net income

B) $120,000 net income

C) $ 40,000 net income

D) $120,000 net loss

The net income or loss for 2019 was:

A) $360,000 net income

B) $120,000 net income

C) $ 40,000 net income

D) $120,000 net loss

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

Charleston Company purchases $180,000 of inventory during the period and sells $54,000 of it for $90,000. Beginning of the period inventory was $9,000.

What is the company's inventory balance to be reported on its balance sheet at year end?

A) $ 54,000

B) $ 64,000

C) $135,000

D) $ 9,000

What is the company's inventory balance to be reported on its balance sheet at year end?

A) $ 54,000

B) $ 64,000

C) $135,000

D) $ 9,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

Oaks Company purchases $240,000 of inventory during the period and sells $72,000 of it for $120,000. Beginning of the period inventory was $12,000.

What is the company's inventory balance to be reported on its balance sheet at year end?

A) $ 72,000

B) $ 8,000

C) $180,000

D) $ 12,000

What is the company's inventory balance to be reported on its balance sheet at year end?

A) $ 72,000

B) $ 8,000

C) $180,000

D) $ 12,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

On August 1, Nevling Brothers bought goods with a list price of $14,400, terms 2/10, n/30. The firm records purchases at invoice price, using the periodic inventory system. On August 5, Nevling Brothers returned goods with a list price of $1,800 for credit.

If Nevling Brothers paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 14,400

Purchases Discounts 288

Cash 14,112

B) Accounts Payable 12,348

Cash 12,348

C) Accounts Payable 12,600

Purchases Discounts 252

Cash 12,348

D) Accounts Payable 12,600

Cash 12,600

If Nevling Brothers paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 14,400

Purchases Discounts 288

Cash 14,112

B) Accounts Payable 12,348

Cash 12,348

C) Accounts Payable 12,600

Purchases Discounts 252

Cash 12,348

D) Accounts Payable 12,600

Cash 12,600

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

On August 1, Baker Brothers bought goods with a list price of $19,200, terms 2/10, n/30. The firm records purchases at invoice price, using the periodic inventory system. On August 5, Baker Brothers returned goods with a list price of $2,400 for credit.

If Baker Brothers paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 19,200

Purchases Discounts 384

Cash 18,816

B) Accounts Payable 18,464

Cash 18,464

C) Accounts Payable 16,800

Purchases Discounts 336

Cash 16,464

D) Accounts Payable 16,800

Cash 16,800

If Baker Brothers paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 19,200

Purchases Discounts 384

Cash 18,816

B) Accounts Payable 18,464

Cash 18,464

C) Accounts Payable 16,800

Purchases Discounts 336

Cash 16,464

D) Accounts Payable 16,800

Cash 16,800

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

Lite Company records purchases at invoice price, using the periodic inventory system. On July 5, Lite returned $18,000 of goods purchased on account to the seller.

How would Lite record this transfer?

A) Accounts Payable 18,000

Purchases Returns and Allowances 18,000

B) Accounts Receivable 18,000

Purchases Returns and Allowances 18,000

C) Accounts Payable 18,000

Purchases 18,000

D) Cash 18,000

Purchases Returns and Allowances 18,000

How would Lite record this transfer?

A) Accounts Payable 18,000

Purchases Returns and Allowances 18,000

B) Accounts Receivable 18,000

Purchases Returns and Allowances 18,000

C) Accounts Payable 18,000

Purchases 18,000

D) Cash 18,000

Purchases Returns and Allowances 18,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

Lavinia Company records purchases at invoice price, using the periodic inventory system. On July 5, Lavinia returned $24,000 of goods purchased on account to the seller.

How would Lavinia record this transfer?

A) Accounts Payable 24,000

Purchases Returns and Allowances 24,000

B) Accounts Receivable 24,000

Purchases Returns and Allowances 24,000

C) Accounts Payable 24,000

Purchases 24,000

D) Cash 24,000

Purchases Returns and Allowances 24,000

How would Lavinia record this transfer?

A) Accounts Payable 24,000

Purchases Returns and Allowances 24,000

B) Accounts Receivable 24,000

Purchases Returns and Allowances 24,000

C) Accounts Payable 24,000

Purchases 24,000

D) Cash 24,000

Purchases Returns and Allowances 24,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

On August 1, Burkett Company bought goods with a list price of $7,200, terms 2/10, n/30. The firm records purchases at invoice price using the perpetual inventory system. On August 5, Burkett returned goods with a list price of $900 for credit.

If Burkett paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 7,200

Inventory 144

Cash 7,056

B) Accounts Payable 6,174

Cash 6,174

C) Accounts Payable 6,300

Inventory 126

Cash 6,174

D) Accounts Payable 6,300

Cash 6,300

If Burkett paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 7,200

Inventory 144

Cash 7,056

B) Accounts Payable 6,174

Cash 6,174

C) Accounts Payable 6,300

Inventory 126

Cash 6,174

D) Accounts Payable 6,300

Cash 6,300

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

On August 1, Trina Company bought goods with a list price of $9,600, terms 2/10, n/30. The firm records purchases at invoice price using the perpetual inventory system. On August 5, Trina returned goods with a list price of $1,200 for credit.

If Trina paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 9,600

Inventory 192

Cash 9,408

B) Accounts Payable 8,232

Cash 8,232

C) Accounts Payable 8,400

Inventory 168

Cash 8,232

D) Accounts Payable 8,400

Cash 8,400

If Trina paid the supplier the amount due on August 9, the appropriate entry would be:

A) Accounts Payable 9,600

Inventory 192

Cash 9,408

B) Accounts Payable 8,232

Cash 8,232

C) Accounts Payable 8,400

Inventory 168

Cash 8,232

D) Accounts Payable 8,400

Cash 8,400

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

Josiah records purchases at invoice price and uses the perpetual inventory system. On July 5, Josiah returned $9,000 of goods purchased on account to the seller.

How would Joshua record this transaction?

A) Accounts Payable 9,000

Inventory 9,000

B) Accounts Receivable 9,000

Inventory 9,000

C) Accounts Payable 9,000

Purchases 9,000

D) Cash 9,000

Purchases 9,000

How would Joshua record this transaction?

A) Accounts Payable 9,000

Inventory 9,000

B) Accounts Receivable 9,000

Inventory 9,000

C) Accounts Payable 9,000

Purchases 9,000

D) Cash 9,000

Purchases 9,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Bacerra records purchases at invoice price and uses the perpetual inventory system. On July 5, Bacerra returned $12,000 of goods purchased on account to the seller.

How would Bacerra record this transaction?

A) Accounts Payable 12,000

Inventory 12,000

B) Accounts Receivable 12,000

Inventory 12,000

C) Accounts Payable 12,000

Purchases 12,000

D) Cash 12,000

Purchases 12,000

How would Bacerra record this transaction?

A) Accounts Payable 12,000

Inventory 12,000

B) Accounts Receivable 12,000

Inventory 12,000

C) Accounts Payable 12,000

Purchases 12,000

D) Cash 12,000

Purchases 12,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

For a firm that uses the perpetual inventory system, the Sales Returns and Allowances account:

A) Is not a contra account

B) Has a normal credit balance

C) Is not used

D) Is debited by the firm receiving returned goods from a customer

A) Is not a contra account

B) Has a normal credit balance

C) Is not used

D) Is debited by the firm receiving returned goods from a customer

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

Using a periodic inventory system, the buyer's journal entry to record the return of merchandise purchased on account includes a:

A) Credit to Purchase Returns

B) Debit to Inventory

C) Credit to Accounts Payable

D) Debit to Cost of Goods Sold

A) Credit to Purchase Returns

B) Debit to Inventory

C) Credit to Accounts Payable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

Using a perpetual inventory system, the buyer's journal entry to record the freight costs includes a:

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

Using a periodic inventory system, the buyer's journal entry to record the freight costs includes a:

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

Using a perpetual inventory system, the buyer's journal entry to record the payment for merchandise within the discount period includes a:

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Accounts Payable

D) Debit to Cost of Goods Sold

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Accounts Payable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

Using a periodic inventory system, the buyer's journal entry to record the payment for merchandise within the discount period includes a:

A) Credit to Purchase Discounts

B) Debit to Inventory

C) Credit to Accounts Payable

D) Debit to Cost of Goods Sold

A) Credit to Purchase Discounts

B) Debit to Inventory

C) Credit to Accounts Payable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

Using a perpetual inventory system, the seller's journal entry to record the return, by the buyer, of merchandise purchased on account includes a:

A) Credit to Purchases Returns

B) Debit to Sales Returns and Allowances

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

A) Credit to Purchases Returns

B) Debit to Sales Returns and Allowances

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

Using a periodic inventory system, the seller's journal entry to record the return, by the buyer, of merchandise purchased on account includes a:

A) Credit to Purchases Returns

B) Debit to Sales Returns and Allowances

C) Debit to Accounts Receivable

D) Credit to Cost of Goods Sold

A) Credit to Purchases Returns

B) Debit to Sales Returns and Allowances

C) Debit to Accounts Receivable

D) Credit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

Using a perpetual inventory system, the seller's journal entry to record the payment for merchandise, received from the buyer, within the discount period includes a:

A) Debit to Sales Discounts

B) Credit to Sales Discounts

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

A) Debit to Sales Discounts

B) Credit to Sales Discounts

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

Using a periodic inventory system, the sellers journal entry to record the payment for merchandise, received from the buyer, within the discount period includes a:

A) Debit to Sales Discounts

B) Credit to Sales Discounts

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

A) Debit to Sales Discounts

B) Credit to Sales Discounts

C) Debit to Accounts Receivable

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

Using a perpetual inventory system, the buyer's journal entry to record the purchase of merchandise on credit includes a:

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

Using a periodic inventory system, the buyer's journal entry to record the purchase of merchandise on credit includes a:

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

A) Debit to Purchases

B) Debit to Inventory

C) Debit to Freight In

D) Debit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Using a perpetual inventory system, the seller's journal entry to record the sale of merchandise on account includes a:

A) Credit to Purchases

B) Debit to Inventory

C) Debit to Accounts Receivable

D) Credit to Cost of Goods Sold

A) Credit to Purchases

B) Debit to Inventory

C) Debit to Accounts Receivable

D) Credit to Cost of Goods Sold

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

San Jose Corporation uses the perpetual inventory method. On March 1, it purchased $90,000 of merchandise inventory, terms 2/10, n/30. On March 3, San Jose returned goods (not damaged) that cost $9,000.

On March 9, San Jose paid the supplier. On March 9, San Jose should credit:

A) Purchase discounts for $1,800

B) Inventory for $1,800

C) Purchase discounts for $1,620

D) Inventory for $1,620

On March 9, San Jose paid the supplier. On March 9, San Jose should credit:

A) Purchase discounts for $1,800

B) Inventory for $1,800

C) Purchase discounts for $1,620

D) Inventory for $1,620

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

Flagstaff Corporation uses the perpetual inventory method. On March 1, it purchased $120,000 of merchandise inventory, terms 2/10, n/30. On March 3, Flagstaff returned goods (not damaged) that cost $12,000. On March 9, Flagstaff paid the supplier.

On March 9, Flagstaff should credit:

A) Purchase discounts for $2,400

B) Inventory for $2,400

C) Purchase discounts for $2,160

D) Inventory for $2,160

On March 9, Flagstaff should credit:

A) Purchase discounts for $2,400

B) Inventory for $2,400

C) Purchase discounts for $2,160

D) Inventory for $2,160

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

Bosworth Company purchased $12,000 worth of merchandise, FOB shipping point. Transportation costs were an additional $1,050. The company later returned $2,250 worth of merchandise and paid the invoice within the 2% cash discount period.

The total amount paid for this merchandise is:

A) $10,605

B) $10,560

C) $12,789

D) $10,584

The total amount paid for this merchandise is:

A) $10,605

B) $10,560

C) $12,789

D) $10,584

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

Lizard Company purchased $16,000 worth of merchandise, FOB shipping point. Transportation costs were an additional $1,400. The company later returned $3,000 worth of merchandise and paid the invoice within the 2% cash discount period.

The total amount paid for this merchandise is:

A) $14,140

B) $14,080

C) $17,052

D) $14,112

The total amount paid for this merchandise is:

A) $14,140

B) $14,080

C) $17,052

D) $14,112

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

Vienna Stores recorded the following events involving a recent purchase of merchandise:

•Received goods for $60,000, terms 2/10, n/30.

•Returned $1,200 of the shipment for credit.

•Paid $300 freight on the shipment.

•Paid the invoice within the discount period.

As a combined result of these events, the company's inventory:

A) Increased by $57,624

B) Increased by $57,900

C) Increased by $57,918

D) Increased by $57,924

•Received goods for $60,000, terms 2/10, n/30.

•Returned $1,200 of the shipment for credit.

•Paid $300 freight on the shipment.

•Paid the invoice within the discount period.

As a combined result of these events, the company's inventory:

A) Increased by $57,624

B) Increased by $57,900

C) Increased by $57,918

D) Increased by $57,924

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

Clarksburg Stores recorded the following events involving a recent purchase of merchandise:

•Received goods for $80,000, terms 2/10, n/30.

•Returned $1,600 of the shipment for credit.

•Paid $400 freight on the shipment.

•Paid the invoice within the discount period.

As a combined result of these events, the company's inventory:

A) Increased by $76,832

B) Increased by $77,200

C) Increased by $77,224

D) Increased by $77,232

•Received goods for $80,000, terms 2/10, n/30.

•Returned $1,600 of the shipment for credit.

•Paid $400 freight on the shipment.

•Paid the invoice within the discount period.

As a combined result of these events, the company's inventory:

A) Increased by $76,832

B) Increased by $77,200

C) Increased by $77,224

D) Increased by $77,232

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

Gulliver's Groceries purchased milk cartons at an invoice price of $9,000 and terms of 2/10, n/30. On arrival of the goods, Gulliver's realized that half of the milk was past the expiration date, and returned them immediately to the supplier.

If Gulliver's pays the remaining amount of the invoice within the discount period, the amount paid should be:

A) $4,320

B) $8,820

C) $9,000

D) $4,410

If Gulliver's pays the remaining amount of the invoice within the discount period, the amount paid should be:

A) $4,320

B) $8,820

C) $9,000

D) $4,410

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

Javier's Groceries purchased milk cartons at an invoice price of $12,000 and terms of 2/10, n/30. On arrival of the goods, Javier's realized that half of the milk was past the expiration date, and returned them immediately to the supplier.

If Javier's pays the remaining amount of the invoice within the discount period, the amount paid should be:

A) $ 5,760

B) $11,760

C) $12,000

D) $ 5,880

If Javier's pays the remaining amount of the invoice within the discount period, the amount paid should be:

A) $ 5,760

B) $11,760

C) $12,000

D) $ 5,880

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Julissa Company sold merchandise in the amount of $17,400 to Nunez Company on September 1, with credit terms of 2/10, n/30. The cost of the merchandise is $7,200. On September 4, Nunez returns some of the merchandise, which was put back into Julissa's inventory. The selling price and the cost of the returned merchandise are $2,400 and $1,500, respectively.

Nunez Company's journal entry on September 8, when they pay the amount due, will include: (assume both companies use the perpetual inventory method)

A) Credit Purchase Discounts $300

B) Credit Cash $15,582

C) Debit Accounts Payable $15,000

D) Credit Sales Discounts $300

Nunez Company's journal entry on September 8, when they pay the amount due, will include: (assume both companies use the perpetual inventory method)

A) Credit Purchase Discounts $300

B) Credit Cash $15,582

C) Debit Accounts Payable $15,000

D) Credit Sales Discounts $300

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

Schulze Company sold merchandise in the amount of $23,200 to Edwardo Company on September 1, with credit terms of 2/10, n/30. The cost of the merchandise is $9,600. On September 4, Edwardo returns some of the merchandise, which was put back into Schulze's inventory. The selling price and the cost of the returned merchandise are $3,200 and $2,000, respectively.

Edwardo Company's journal entry on September 8, when they pay the amount due, will include: (assume both companies use the perpetual inventory method)

A) Credit Purchase Discounts $400

B) Credit Cash $20,776

C) Debit Accounts Payable $20,000

D) Credit Sales Discounts $400

Edwardo Company's journal entry on September 8, when they pay the amount due, will include: (assume both companies use the perpetual inventory method)

A) Credit Purchase Discounts $400

B) Credit Cash $20,776

C) Debit Accounts Payable $20,000

D) Credit Sales Discounts $400

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

On June 15, a food wholesaler sold 100 cases of canned soup to Juniper Foods for $90 per case with terms of 2/10, n/30. On June 17, Juniper returned 20 cases of damaged inventory (and received full credit), along with a check for the amount due for the purchase.

Given this information, the journal entry by Juniper Foods on June 17 will:

A) Debit Accounts Receivable for $9,000

B) Credit Cash for $8,820

C) Debit Cash for $7,056

D) Credit Inventory for $1,944

Given this information, the journal entry by Juniper Foods on June 17 will:

A) Debit Accounts Receivable for $9,000

B) Credit Cash for $8,820

C) Debit Cash for $7,056

D) Credit Inventory for $1,944

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

On June 15, a food wholesaler sold 100 cases of canned soup to Flavorful Foods for $120 per case with terms of 2/10, n/30. On June 17, Flavorful returned 20 cases of damaged inventory (and received full credit), along with a check for the amount due for the purchase.

Given this information, the journal entry by Flavorful Foods on June 17 will:

A) Debit Accounts Receivable for $12,000

B) Credit Cash for $11,760

C) Debit Cash for $9,408

D) Credit Inventory for $2,592

Given this information, the journal entry by Flavorful Foods on June 17 will:

A) Debit Accounts Receivable for $12,000

B) Credit Cash for $11,760

C) Debit Cash for $9,408

D) Credit Inventory for $2,592

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

When merchandise that was sold on account is returned, using the perpetual inventory system which accounts are affected in the books of the seller?

A) Cash, accounts receivable, cost of goods sold, and sales returns

B) Sales returns, accounts receivable, purchases, and cost of goods sold

C) Sales returns, accounts receivable, inventory, and cost of goods sold

D) Sales returns, accounts receivable, purchases, and inventory

A) Cash, accounts receivable, cost of goods sold, and sales returns

B) Sales returns, accounts receivable, purchases, and cost of goods sold

C) Sales returns, accounts receivable, inventory, and cost of goods sold

D) Sales returns, accounts receivable, purchases, and inventory

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

A manufacturing company sells goods to a merchandising company, which in turn, sells the goods to a retail customer. The Sales Discounts account is debited by the merchandising company when:

A) Defective merchandise is returned by the merchandiser to the manufacturer.

B) Defective merchandise is returned by the retail customer to the merchandiser.

C) Payment is made to the manufacturer within the discount period.

D) The retail customer pays the merchandising company within the discount period.

A) Defective merchandise is returned by the merchandiser to the manufacturer.

B) Defective merchandise is returned by the retail customer to the merchandiser.

C) Payment is made to the manufacturer within the discount period.

D) The retail customer pays the merchandising company within the discount period.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

Using a perpetual inventory system, the seller's journal entry to record the return of non-defective goods from a customer of merchandise sold on account includes a:

A) Credit to Sales Returns and Allowances

B) Debit to Cost of Goods Sold

C) Credit to Inventory

D) Debit to Inventory

A) Credit to Sales Returns and Allowances

B) Debit to Cost of Goods Sold

C) Credit to Inventory

D) Debit to Inventory

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Linus Van Pelt Company sold merchandise in the amount of $17,400 to Sally Brown Company on February 1, with credit terms of 2/10, n/30. The cost of the items sold is $7,200. On February 4, Sally Brown Company returns some of the merchandise, which was restored into Linus Van Pelt's inventory. The selling price and the cost of the returned merchandise are $2,400 and $1,500, respectively.

The entries that Linus Van Pelt Company must make on February 4 will not include: (assume both companies use the perpetual inventory method)

A) Credit to Cost of Goods Sold for $2,400

B) Debit to Inventory for $1,500

C) Debit to Sales Returns and Allowances for $2,400

D) Credit to Accounts Receivable for $2,400

The entries that Linus Van Pelt Company must make on February 4 will not include: (assume both companies use the perpetual inventory method)

A) Credit to Cost of Goods Sold for $2,400

B) Debit to Inventory for $1,500

C) Debit to Sales Returns and Allowances for $2,400

D) Credit to Accounts Receivable for $2,400

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

Tweetie Company sold merchandise in the amount of $23,200 to Sylvester Cat Company on February 1, with credit terms of 2/10, n/30. The cost of the items sold is $9,600. On February 4, Sylvester Cat Company returns some of the merchandise, which was restored into Tweetie's inventory. The selling price and the cost of the returned merchandise are $3,200 and $2,000, respectively.

The entries that Tweetie Company must make on February 4 will not include: (assume both companies use the perpetual inventory method)

A) Credit to Cost of Goods Sold for $3,200

B) Debit to Inventory for $2,000

C) Debit to Sales Returns and Allowances for $3,200

D) Credit to Accounts Receivable for $3,200

The entries that Tweetie Company must make on February 4 will not include: (assume both companies use the perpetual inventory method)

A) Credit to Cost of Goods Sold for $3,200

B) Debit to Inventory for $2,000

C) Debit to Sales Returns and Allowances for $3,200

D) Credit to Accounts Receivable for $3,200

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

Trefoil Company sold merchandise on account for $4,500 to GS Cookie Company with credit terms of 2/10, n/30. Five days later, GS Cookie Company returned $1,500 of merchandise that was damaged, along with a check to settle the account.

What entry does Trefoil Company make upon receipt of the check?

A) Cash 3,000

Accounts Receivable 3,000

B) Cash 2,940

Sales Returns and Allowances 1,560

Accounts Receivable 4,500

C) Cash 2,940

Sales Returns and Allowances 1,500

Sales Discounts 60

Accounts Receivable 4,500

D) Cash 4,410

Sales Discounts 90

Accounts Receivable 4,500

What entry does Trefoil Company make upon receipt of the check?

A) Cash 3,000

Accounts Receivable 3,000

B) Cash 2,940

Sales Returns and Allowances 1,560

Accounts Receivable 4,500

C) Cash 2,940

Sales Returns and Allowances 1,500

Sales Discounts 60

Accounts Receivable 4,500

D) Cash 4,410

Sales Discounts 90

Accounts Receivable 4,500

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Samores Company sold merchandise on account for $6,000 to DoSiDo Company with credit terms of 2/10, n/30. Five days later, DoSiDo Company returned $2,000 of merchandise that was damaged, along with a check to settle the account.

What entry does Samores Company make upon receipt of the check?

A) Cash 4,000

Accounts Receivable 4,000

B) Cash 3,920

Sales Returns and Allowances 2,080

Accounts Receivable 6,000

C) Cash 3,920

Sales Returns and Allowances 2,000

Sales Discounts 80

Accounts Receivable 6,000

D) Cash 5,880

Sales Discounts 120

Accounts Receivable 6,000

What entry does Samores Company make upon receipt of the check?

A) Cash 4,000

Accounts Receivable 4,000

B) Cash 3,920

Sales Returns and Allowances 2,080

Accounts Receivable 6,000

C) Cash 3,920

Sales Returns and Allowances 2,000

Sales Discounts 80

Accounts Receivable 6,000

D) Cash 5,880

Sales Discounts 120

Accounts Receivable 6,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

On January 5, Anka Brahtz Company purchased 11 all-terrain vehicles at a cost of $5,400 each. On February 12, they sold 8 vehicles for $6,900 per unit. If EGN uses a perpetual inventory system, the journal entry to record the sale on February 12th would include all of the following except:

A) A credit to Purchases for $43,200

B) A debit to the Cost of Goods Sold for $43,200

C) A credit to Sales Revenue for $55,200

D) A credit to Inventory for $43,200

A) A credit to Purchases for $43,200

B) A debit to the Cost of Goods Sold for $43,200

C) A credit to Sales Revenue for $55,200

D) A credit to Inventory for $43,200

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

On January 5, EMG Company purchased 11 all-terrain vehicles at a cost of $7,200 each. On February 12, they sold 8 vehicles for $9,200 per unit. If EMG uses a perpetual inventory system, the journal entry to record the sale on February 12th would include all of the following except:

A) A credit to Purchases for $57,600

B) A debit to the Cost of Goods Sold for $57,600

C) A credit to Sales Revenue for $73,600

D) A credit to Inventory for $57,600

A) A credit to Purchases for $57,600

B) A debit to the Cost of Goods Sold for $57,600

C) A credit to Sales Revenue for $73,600

D) A credit to Inventory for $57,600

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

Woofer Company sold $1,800,000 worth of merchandise, had $150,000 returned, and then the balance was received during the 2% discount period. What were the company's net sales?

A) $1,617,000

B) $1,350,000

C) $1,530,000

D) $1,320,000

A) $1,617,000

B) $1,350,000

C) $1,530,000

D) $1,320,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

Ribbitt Frog Company sold $2,400,000 worth of merchandise, had $200,000 returned, and then the balance was received during the 2% discount period. What were the company's net sales?

A) $2,156,000

B) $1,800,000

C) $2,040,000

D) $1,760,000

A) $2,156,000

B) $1,800,000

C) $2,040,000

D) $1,760,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

On June 1, Powell Book Company sold CNN's Bookstore $12,900 of books for cash. During the month, CNN's Bookstore returned books costing $1,500 to Powell for a cash refund. In the same month, CNN's sold the remaining books to their customers for a total of $15,300.

As a result of these transactions, at the end of the month, CNN's accounting equation will show a net:

A) Increase of Equity of $3,900

B) Increase of Assets of $15,300

C) Decrease of Assets of $11,400

D) Increase of Equity of $5,400

As a result of these transactions, at the end of the month, CNN's accounting equation will show a net:

A) Increase of Equity of $3,900

B) Increase of Assets of $15,300

C) Decrease of Assets of $11,400

D) Increase of Equity of $5,400

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

On June 1, Puzzling Puzzles Company sold Cari's Bookstore $17,200 of puzzles for cash. During the month, Cari's Bookstore returned puzzles costing $2,000 to Puzzling Puzzles for a cash refund. In the same month, Cari's sold the remaining puzzles to their customers for a total of $20,400.

As a result of these transactions, at the end of the month, Cari's accounting equation will show a net:

A) Increase of Equity of $5,200

B) Increase of Assets of $20,400

C) Decrease of Assets of $15,200

D) Increase of Equity of $7,200

As a result of these transactions, at the end of the month, Cari's accounting equation will show a net:

A) Increase of Equity of $5,200

B) Increase of Assets of $20,400

C) Decrease of Assets of $15,200

D) Increase of Equity of $7,200

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

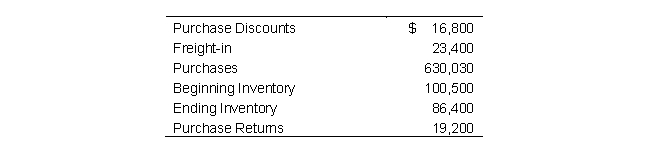

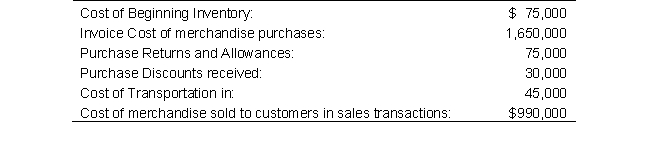

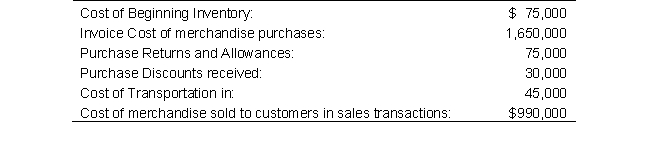

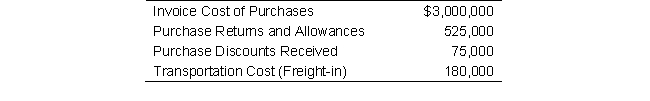

Better Gardens, Inc., which uses a periodic inventory system, shows the following on December 31, 2019.

The cost of goods sold for the year 2019 is:

The cost of goods sold for the year 2019 is:

A) $628,530

B) $596,730

C) $571,530

D) $631,530

The cost of goods sold for the year 2019 is:

The cost of goods sold for the year 2019 is:A) $628,530

B) $596,730

C) $571,530

D) $631,530

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

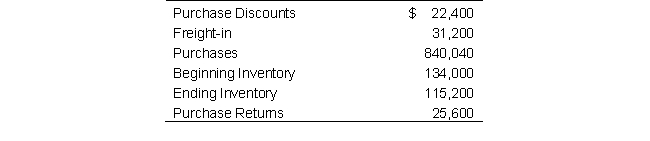

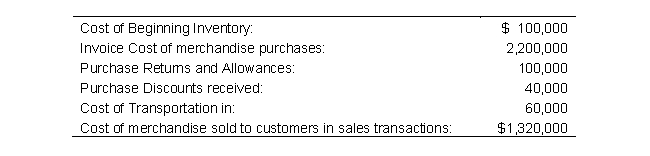

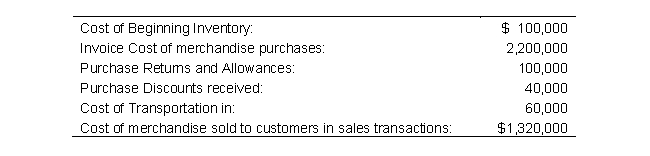

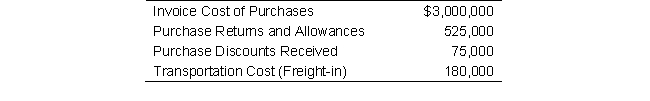

Building Supplies, Inc., which uses a periodic inventory system, shows the following on December 31, 2019.

The cost of goods sold for the year 2019 is:

The cost of goods sold for the year 2019 is:

A) $838,040

B) $795,640

C) $762,040

D) $842,040

The cost of goods sold for the year 2019 is:

The cost of goods sold for the year 2019 is:A) $838,040

B) $795,640

C) $762,040

D) $842,040

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

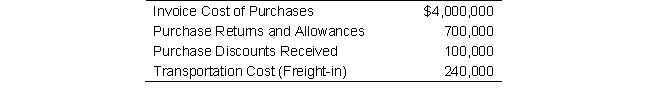

Fondant Company reported the following data for 2019:

Determine Fondant Company's Balance of Ending Inventory.

Determine Fondant Company's Balance of Ending Inventory.

A) $1,500,000

B) $1,560,000

C) $ 675,000

D) $ 660,000

Determine Fondant Company's Balance of Ending Inventory.

Determine Fondant Company's Balance of Ending Inventory.A) $1,500,000

B) $1,560,000

C) $ 675,000

D) $ 660,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

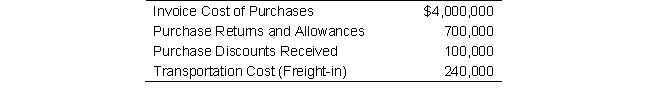

Honigkuchen Company reported the following data for 2019:

Determine Honigkuchen Company's Balance of Ending Inventory.

Determine Honigkuchen Company's Balance of Ending Inventory.

A) $2,000,000

B) $2,080,000

C) $ 900,000

D) $ 880,000

Determine Honigkuchen Company's Balance of Ending Inventory.

Determine Honigkuchen Company's Balance of Ending Inventory.A) $2,000,000

B) $2,080,000

C) $ 900,000

D) $ 880,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

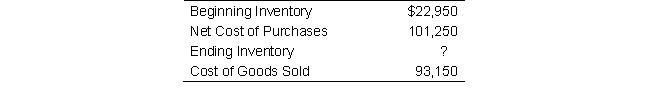

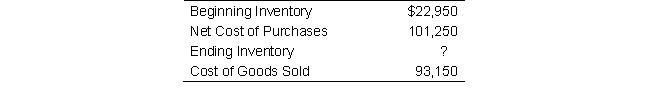

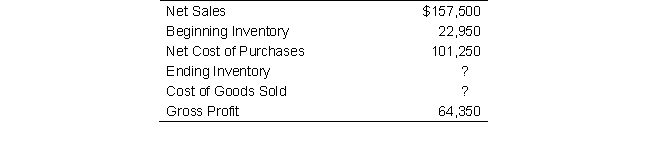

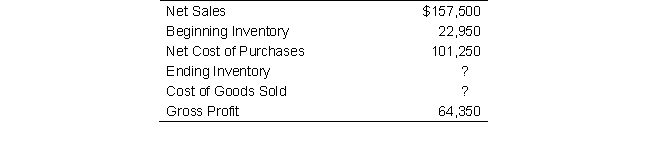

Sandpiper Company reported the following year-end amounts:

What is Sandpiper Company's Ending Inventory for the year?

What is Sandpiper Company's Ending Inventory for the year?

A) $22,950

B) $14,850

C) $31,050

D) $ 8,100

What is Sandpiper Company's Ending Inventory for the year?

What is Sandpiper Company's Ending Inventory for the year?A) $22,950

B) $14,850

C) $31,050

D) $ 8,100

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

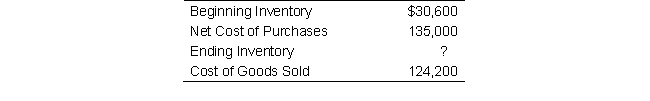

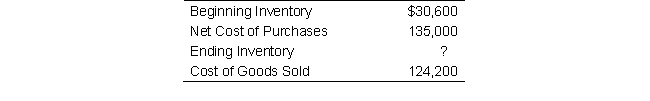

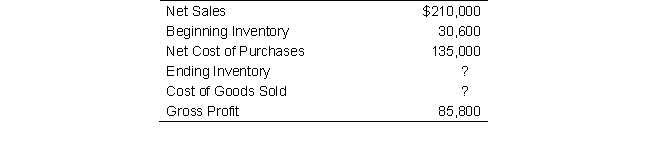

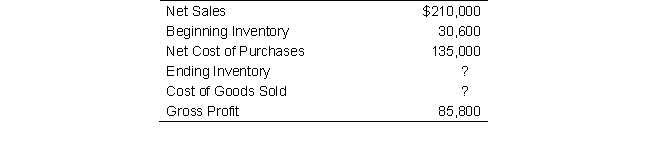

62

Hawk Company reported the following year-end amounts:

What is Hawk Company's Ending Inventory for the year?

What is Hawk Company's Ending Inventory for the year?

A) $30,600

B) $19,800

C) $41,400

D) $10,800

What is Hawk Company's Ending Inventory for the year?

What is Hawk Company's Ending Inventory for the year?A) $30,600

B) $19,800

C) $41,400

D) $10,800

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Emma-Eva Company reported the following balances:

What is the company's net cost of purchases?

What is the company's net cost of purchases?

A) $2,220,000

B) $2,580,000

C) $3,780,000

D) $2,400,000

What is the company's net cost of purchases?

What is the company's net cost of purchases?A) $2,220,000

B) $2,580,000

C) $3,780,000

D) $2,400,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Avery Street Company reported the following balances:

What is the company's net cost of purchases?

What is the company's net cost of purchases?

A) $2,960,000

B) $3,440,000

C) $5,040,000

D) $3,200,000

What is the company's net cost of purchases?

What is the company's net cost of purchases?A) $2,960,000

B) $3,440,000

C) $5,040,000

D) $3,200,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Holmes Company reported the following year-end amounts:

What is Holmes Company's Ending Inventory and Cost of Goods Sold for the year?

What is Holmes Company's Ending Inventory and Cost of Goods Sold for the year?

A) Ending Inventory = $31,050; Cost of Goods Sold = $93,150

B) Ending Inventory = $26,700; Cost of Goods Sold = $60,600

C) Ending Inventory = $14,850; Cost of Goods Sold = $93,150

D) Ending Inventory = $26,250; Cost of Goods Sold = $60,600

What is Holmes Company's Ending Inventory and Cost of Goods Sold for the year?

What is Holmes Company's Ending Inventory and Cost of Goods Sold for the year?A) Ending Inventory = $31,050; Cost of Goods Sold = $93,150

B) Ending Inventory = $26,700; Cost of Goods Sold = $60,600

C) Ending Inventory = $14,850; Cost of Goods Sold = $93,150

D) Ending Inventory = $26,250; Cost of Goods Sold = $60,600

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Maercker Company reported the following year-end amounts:

What is Maercker Company's Ending Inventory and Cost of Goods Sold for the year?

What is Maercker Company's Ending Inventory and Cost of Goods Sold for the year?

A) Ending Inventory = $35,600; Cost of Goods Sold = $ 80,800

B) Ending Inventory = $19,800; Cost of Goods Sold = $124,200

C) Ending Inventory = $35,000; Cost of Goods Sold = $ 80,800

What is Maercker Company's Ending Inventory and Cost of Goods Sold for the year?

What is Maercker Company's Ending Inventory and Cost of Goods Sold for the year?A) Ending Inventory = $35,600; Cost of Goods Sold = $ 80,800

B) Ending Inventory = $19,800; Cost of Goods Sold = $124,200

C) Ending Inventory = $35,000; Cost of Goods Sold = $ 80,800

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

In 2019, Bright Target Company earned a gross profit of $16,248 million on net sales of $58,966. What is Bright Target's gross profit percentage for 2019?

A) 268.3%

B) 58.4%

C) 27.6%

D) 181.5%

A) 268.3%

B) 58.4%

C) 27.6%

D) 181.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

In 2019, Blue Company earned a gross profit of $25,998 million on net sales of $67,390 million. What is Blue's gross profit percentage for 2019?

A) 311.1%

B) 67.9%

C) 38.6%

D) 211.1%

A) 311.1%

B) 67.9%

C) 38.6%

D) 211.1%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

In 2019, Wayfield Co. incurred cost of goods sold of $37,323 million on net sales of $56,228 million. What is Wayfield's gross profit percentage for 2019?

A) 33.6%

B) 115.3%

C) 43.4%

D) 31.4%

A) 33.6%

B) 115.3%

C) 43.4%

D) 31.4%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

In 2019, Shield Company incurred cost of goods sold of $59,716 million on net sales of $64,260 million. What is Shield's gross profit percentage for 2019?

A) 7.1%

B) 77.4%

C) 29.1%

D) 21.1%

A) 7.1%

B) 77.4%

C) 29.1%

D) 21.1%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

In 2019, Move It Company incurred cost of goods sold of $36,162 million on gross sales revenue of $76,643 million. Sales returns and allowances were $5,606 million and sales discounts were $1,314 million.

What is Move It's gross profit percentage for 2019?

A) 43.0%

B) 48.1%

C) 56.4%

D) 52.7%

What is Move It's gross profit percentage for 2019?

A) 43.0%

B) 48.1%

C) 56.4%

D) 52.7%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

In 2019, Intersection Company incurred cost of goods sold of $58,215 million on gross sales revenue of $87,592 million. Sales returns and allowances were $7,473 million and sales discounts were $1,752 million.

What is Intersection's gross profit percentage for 2019?

A) 34.4%

B) 25.7%

C) 37.6%

D) 35.1%

What is Intersection's gross profit percentage for 2019?

A) 34.4%

B) 25.7%

C) 37.6%

D) 35.1%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

In 2019, Arrow earned a net income of $22,614 million on net sales of $76,643 million. What was Arrow's return on sales ratio for 2019?

A) 29.5%

B) 249.2%

C) 56.2%

D) 163.4%

A) 29.5%

B) 249.2%

C) 56.2%

D) 163.4%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

In 2019, Farmer Co. earned a net income of $20,152 million on net sales of $87,592 million. What was Farmer's return on sales ratio for 2019?

A) 23.0%

B) 290.5%

C) 65.6%

D) 190.5%

A) 23.0%

B) 290.5%

C) 65.6%

D) 190.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

In 2019, Purple Eggplant incurred cost of goods sold of $59,823 million on net sales of $76,643 million. What was Purple Eggplant's return on sales ratio for 2019? (Assume no other expenses.)

A) 10.6%

B) 24.1%

C) 13.8%

D) 21.9%

A) 10.6%

B) 24.1%

C) 13.8%

D) 21.9%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

In 2019, Lemon Co. incurred cost of goods sold of $69,763 million on net sales of $87,592 million. What was Lemon's return on sales ratio for 2019? (Assume no other expenses.)

A) 4.3%

B) 9.8%

C) 5.6%

D) 20.4%

A) 4.3%

B) 9.8%

C) 5.6%

D) 20.4%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

In 2019, Arrow Co. incurred cost of goods sold of $56,073 million on gross sales revenue of $76,643 million. Sales returns and allowances were $5,606 million. What was Arrow Co.'s profit margin for 2019? (Assume no other expenses.)

A) 19.2%

B) 22.7%

C) 21.1%

D) 20.5%

A) 19.2%

B) 22.7%

C) 21.1%

D) 20.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

In 2019, Cumquat Co. incurred cost of goods sold of $74,763 million on gross sales revenue of $87,592 million. Sales returns and allowances were $10,473 million. What was Cumquat's profit margin for 2019? (Assume no other expenses.)

A) 6.1%

B) 7.2%

C) 3.1%

D) 6.5%

A) 6.1%

B) 7.2%

C) 3.1%

D) 6.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

During 2019, Reed Corporation sold merchandise for a total of $900,000. The cost of merchandise to Reed was $675,000. Reed offers credit terms of 1/10, n/30 to encourage early payment. At year-end, there are $22,500 of sales still eligible for the 1% discount. Reed believes that all of the companies will pay within the discount period to receive the 1% discount. Assume Reed's fiscal year is December 31.

Reed's adjusting journal entry will include:

A) A debit to Sales Discounts for $225

B) A credit to Allowance for Sales Discounts for $2,250

C) A debit to Sales Discounts for $2,050

D) A credit to Sales Discounts for $225

E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Reed's adjusting journal entry will include:

A) A debit to Sales Discounts for $225

B) A credit to Allowance for Sales Discounts for $2,250

C) A debit to Sales Discounts for $2,050

D) A credit to Sales Discounts for $225

E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

During 2019, Bava Technologies sold merchandise for a total of $800,000. The cost of merchandise to Bava was $560,000. Bava offers credit terms of 2/10, n/30 to encourage early payment. At year-end, there are $24,000 of sales still eligible for the 2% discount. Bava believes that all of the companies will pay within the discount period to receive the 2% discount. Assume Bava's fiscal year is December 31.

Bava's adjusting journal entry will include:

A) A debit to Sales Discounts for $480

B) A credit to Allowance for Sales Discounts for $4,800

C) A debit to Sales Discounts for $4,800

D) A credit to Sales Discounts for $480

E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Bava's adjusting journal entry will include:

A) A debit to Sales Discounts for $480

B) A credit to Allowance for Sales Discounts for $4,800

C) A debit to Sales Discounts for $4,800

D) A credit to Sales Discounts for $480

E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck