Deck 31: Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 31: Statement of Cash Flows

1

Which of the following is not a source of funds for a company?

A) Increases in loan balances.

B) The sale of a motor vehicle.

C) Decreases in trade receivables.

D) Decreases in current liabilities.

A) Increases in loan balances.

B) The sale of a motor vehicle.

C) Decreases in trade receivables.

D) Decreases in current liabilities.

Decreases in current liabilities.

2

Which of the following is not classed as cash from investing activities?

A) Cash advances to other parties (not banks)

B) Receipts from the sale of debentures held in other entities

C) Cash proceeds from the sale of property, plant and equipment

D) Payments on the redemption of loan stock

A) Cash advances to other parties (not banks)

B) Receipts from the sale of debentures held in other entities

C) Cash proceeds from the sale of property, plant and equipment

D) Payments on the redemption of loan stock

Payments on the redemption of loan stock

3

Which of the following is not classed as cash from financing activities?

A) Cash advances to other parties (not banks)

B) Cash repayments to banks

C) Cash receipts from the issue of equity shares

D) Payments on the redemption of loan stock

A) Cash advances to other parties (not banks)

B) Cash repayments to banks

C) Cash receipts from the issue of equity shares

D) Payments on the redemption of loan stock

Cash advances to other parties (not banks)

4

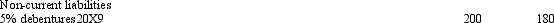

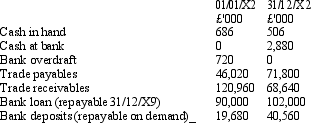

Which of the following best captures how this will be treated in the company's statement of cash flows?

An extract from a company's statement of financial position shows the following:

A) It will have no impact as there is no cash flow

B) It will disclose a receipt on the redemption of debentures of £20,000 under financing activities

C) It will disclose a payment on the redemption of debentures of £20,000 under financial activities

D) It will disclose a payment on the redemption of debentures of £20,000 under investing activities

An extract from a company's statement of financial position shows the following:

A) It will have no impact as there is no cash flow

B) It will disclose a receipt on the redemption of debentures of £20,000 under financing activities

C) It will disclose a payment on the redemption of debentures of £20,000 under financial activities

D) It will disclose a payment on the redemption of debentures of £20,000 under investing activities

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

A company has the following payments and receipts during its accounting period. Calculate

The 'financing' cash flow figure for its statement of cash flows, issue of shares £1,030,000, debenture repaid £400,000, proceeds of a rights issue £630,000, share premium received £460,000, and interest paid £230,000.

A) £1,720,000

B) £1,090,000

C) £1,490,000

D) £1,260,000

The 'financing' cash flow figure for its statement of cash flows, issue of shares £1,030,000, debenture repaid £400,000, proceeds of a rights issue £630,000, share premium received £460,000, and interest paid £230,000.

A) £1,720,000

B) £1,090,000

C) £1,490,000

D) £1,260,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

A company has the following non-current asset transactions. Non-current assets were sold for £25,000. Non-current assets purchased cost £600,000, part of these costs (£50,000) are unpaid at the year end. Non-current assets with a value of £250,000 are also leased. Depreciation for the period is £85,000. Calculate the 'Investment' cash flow.

A) £440,000

B) (£525,000)

C) (£550,000)

D) (£575,000)

A) £440,000

B) (£525,000)

C) (£550,000)

D) (£575,000)

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

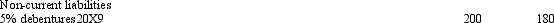

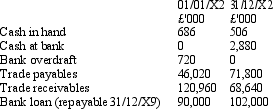

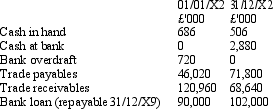

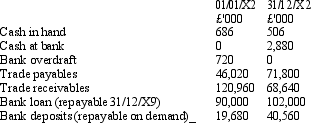

Bank deposits that are repayable on demand are considered to be cash equivalents.

What is the movement in cash and cash equivalents according to IAS 7 Statement of cash flows for the year ended 31/12/X2

Seamus Ltd has the following assets and liabilities at 01/01/X2 and 31/12/X2:

A) Decrease of £3,420

B) Increase of £3,420

C) Increase of £12,300

D) None of the above

What is the movement in cash and cash equivalents according to IAS 7 Statement of cash flows for the year ended 31/12/X2

Seamus Ltd has the following assets and liabilities at 01/01/X2 and 31/12/X2:

A) Decrease of £3,420

B) Increase of £3,420

C) Increase of £12,300

D) None of the above

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

Bank deposits that are repayable on demand are considered to be cash equivalents.

What is the movement in cash and cash equivalents according to IAS 7 Statement of cash flows for the year ended 31/12/X2

Seamus Ltd has the following assets and liabilities at 01/01/X2 and 31/12/X2:

A) Decrease of £3,420

B) Increase of £3,420

C) Increase of £12,300

D) Increase of £24,300

What is the movement in cash and cash equivalents according to IAS 7 Statement of cash flows for the year ended 31/12/X2

Seamus Ltd has the following assets and liabilities at 01/01/X2 and 31/12/X2:

A) Decrease of £3,420

B) Increase of £3,420

C) Increase of £12,300

D) Increase of £24,300

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

An entity can have a profit for the year but still experience a reduction in its cash. Which of the following might cause this to happen?

A) Depreciation

B) The sale of a non-current asset at a loss

C) The shortening of credit given to trade receivables

D) The shortening of credit received from trade suppliers

A) Depreciation

B) The sale of a non-current asset at a loss

C) The shortening of credit given to trade receivables

D) The shortening of credit received from trade suppliers

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

An entity can have a loss for the year but still experience an increase in its cash. Which of the following is most likely to cause this to happen?

A) The repayment of a loan

B) The purchase of an asset

C) The shortening of credit given to trade receivables

D) The shortening of credit received from trade suppliers

A) The repayment of a loan

B) The purchase of an asset

C) The shortening of credit given to trade receivables

D) The shortening of credit received from trade suppliers

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

In the cash flows from operating activities, profits are normally adjusted for non-cash items. Which of the following adjustments to profit is likely?

A) Depreciation is taken off

B) Purchases of motor vehicles is added back

C) Increases in the provision for doubtful debts is added back

D) The provision for discounts is added back

A) Depreciation is taken off

B) Purchases of motor vehicles is added back

C) Increases in the provision for doubtful debts is added back

D) The provision for discounts is added back

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

A company has the following payments and receipts during its accounting period. Calculate

The 'financing' cash flow figure for its statement of cash flows, issue of shares £530,000, debenture repaid £40,000, proceeds of a rights issue £130,000, share premium received £160,000, and interest paid £130,000.

A) £530,000

B) £650,000

C) £780,000

D) £820,000

The 'financing' cash flow figure for its statement of cash flows, issue of shares £530,000, debenture repaid £40,000, proceeds of a rights issue £130,000, share premium received £160,000, and interest paid £130,000.

A) £530,000

B) £650,000

C) £780,000

D) £820,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

A company has the following non-current asset transactions. Non-current assets were sold for £45,000. Non-current assets purchased cost £120,000, part of these costs (£20,000) are unpaid at the year end. Non-current assets with a value of £75,000 are also leased. Depreciation for the period is £25,000. Calculate the 'Investment' cash flow.

A) (£155,000)

B) (£130,000)

C) (£55,000)

D) (£75,000)

A) (£155,000)

B) (£130,000)

C) (£55,000)

D) (£75,000)

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

A statement of cash flows gives users an indication of:

A) The financial performance of the company

B) The financial position of the company

C) The financial adaptability of the company

D) The strategic management of the company

A) The financial performance of the company

B) The financial position of the company

C) The financial adaptability of the company

D) The strategic management of the company

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not categorised as a cash flow from a financial activity under IAS 7?

A) Cash payments on the capital portion of agreements

B) Loan repayments

C) Proceeds from the issue of debentures

D) The sale by an investor of company debentures held, for 50% more than they were purchased from the company for.

A) Cash payments on the capital portion of agreements

B) Loan repayments

C) Proceeds from the issue of debentures

D) The sale by an investor of company debentures held, for 50% more than they were purchased from the company for.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not regarded as a cash flow from operating activities?

A) Increases in inventories

B) Loss on the sale of a non-current asset

C) Increases in trade receivables

D) Increases in trade payables

A) Increases in inventories

B) Loss on the sale of a non-current asset

C) Increases in trade receivables

D) Increases in trade payables

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck